Market Overview:

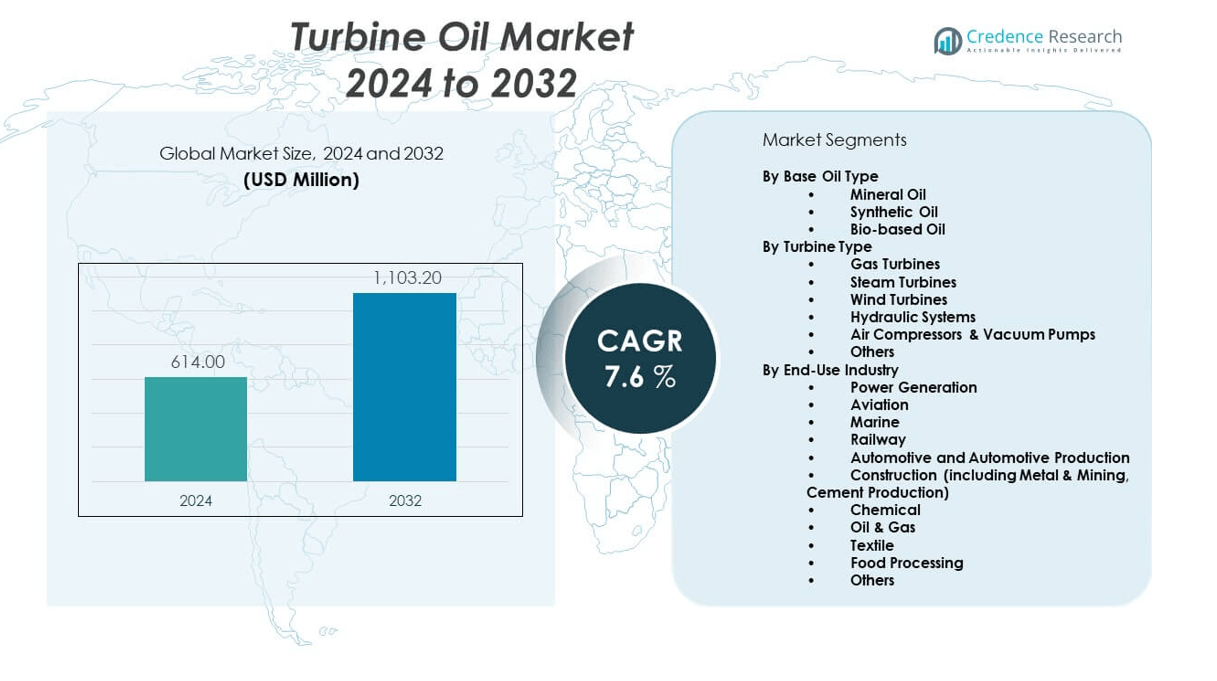

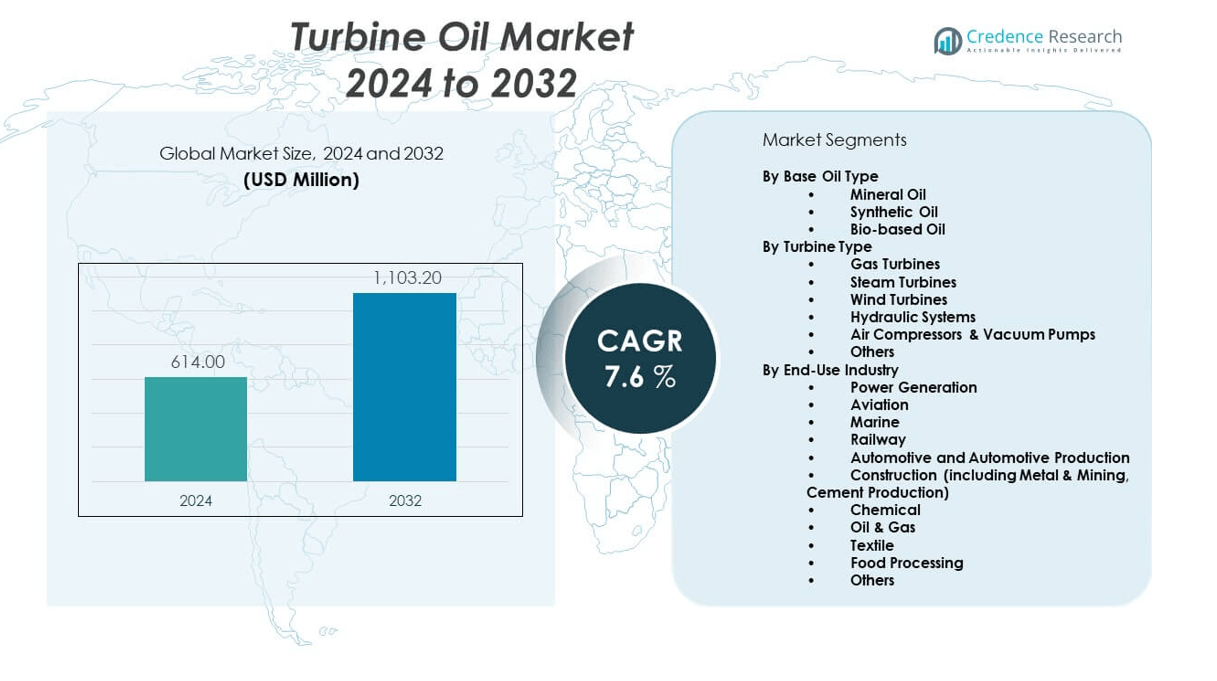

The Turbine oil market is projected to grow from USD 614 million in 2024 to an estimated USD 1,103.2 million by 2032, with a compound annual growth rate (CAGR) of 7.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turbine Oil Market Size 2024 |

USD 614 million |

| Turbine Oil Market, CAGR |

7.6% |

| Turbine Oil Market Size 2032 |

USD 1,103.2 million |

The turbine oil market is expanding due to rising demand for efficient turbine operation across thermal, hydro, and gas power plants. Industries require high-performance oils to ensure thermal stability, oxidation resistance, and minimal deposit formation, which enhance equipment life and reduce maintenance costs. Growing investments in energy infrastructure, particularly in developing regions, support turbine deployment, which directly drives lubricant demand. The emphasis on energy efficiency and equipment reliability in large-scale manufacturing, aviation, and marine sectors continues to reinforce the need for advanced turbine oil formulations.

Asia-Pacific dominates the turbine oil market due to rapid industrial growth, increasing power generation capacity, and ongoing energy infrastructure expansion, especially in China, India, and Southeast Asia. North America shows strong demand driven by modernization of thermal plants and industrial operations. Europe maintains a steady share, supported by energy transition initiatives and sustainable equipment maintenance. Latin America, the Middle East, and Africa are emerging markets due to growing investments in oil, gas, and power sectors.

Market Insights:

- The Turbine oil market was valued at USD 614 million in 2024 and is projected to reach USD 1,103.2 million by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising demand for efficient turbine operation in power generation, aviation, and industrial sectors is driving the market forward.

- Increased investments in infrastructure, especially in developing economies, support higher turbine deployment and lubricant demand.

- High-performance oils that offer oxidation resistance and thermal stability are increasingly preferred for reducing maintenance costs.

- Price volatility of base oils and dependency on petrochemical supply chains act as key restraints for market stability.

- Asia-Pacific dominates the turbine oil market due to rapid industrialization and power sector growth, particularly in China and India.

- North America and Europe follow, supported by modernization of thermal plants and regulatory emphasis on energy efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Efficient Lubrication in Power Generation Systems:

The turbine oil market is driven by the growing need for reliable lubrication in gas, steam, and hydro turbines. Power generation facilities operate continuously under high temperatures and load conditions, requiring lubricants that ensure long service life and thermal stability. Turbine oils minimize friction, resist oxidation, and reduce component wear, making them critical for uninterrupted energy supply. Utilities prioritize cost-effective operation and long maintenance intervals, which depend heavily on high-performance oils. Renewable energy projects also rely on lubrication systems for grid reliability. The global push for energy efficiency is prompting upgrades of legacy systems with advanced lubrication solutions. It reflects a shift toward proactive maintenance practices in both conventional and renewable energy assets. The turbine oil market supports these evolving needs with specialized formulations and long-drain interval oils.

- For instance, ExxonMobil’s Mobil DTE 700 Series turbine oil, introduced in 2023, is formulated to achieve up to 10,000 hours of oxidation stability in gas turbines, reducing scheduled oil changes by over 60% in Fast Power plant operations, as documented by field trials with Wärtsilä Energy. Similarly, Shell’s Turbo T oils have been deployed in more than 30% of combined-cycle power plants in North America, demonstrating intervals of up to 16,000 operating hours before requiring replacement, according to Shell technical case studies.

Expanding Industrial Infrastructure and Manufacturing Activities Worldwide:

Ongoing industrialization and growth in heavy manufacturing sectors directly influence demand in the turbine oil market. Industrial turbines power large-scale operations in sectors such as cement, chemicals, metallurgy, and paper production. These facilities operate equipment under extreme mechanical and thermal stress, requiring reliable turbine oils for system longevity and stable output. Investments in industrial automation and energy-efficient systems reinforce lubricant consumption. Countries expanding their industrial bases allocate capital to ensure equipment uptime and operational safety. Turbine oil usage rises in tandem with new facility installations and the modernization of existing plants. The market benefits from this infrastructure growth, particularly in Asia-Pacific and the Middle East. It responds with product innovations that cater to regional climate, load profiles, and usage cycles.

- For instance, FUCHS Lubritech supplies its RENOLIN ETERNA turbine oils to over 700 heavy industry plants worldwide, supporting uninterrupted operation of turbines in 24/7 paper mills and steel factories. In India, Indian Oil Corp. reported the supply of more than 12 million liters of Servo Prime turbine oil to newly commissioned cement and power plants in 2023, ensuring continuous operation during two-month peak demand cycles.

Increasing Focus on Operational Reliability and Asset Lifecycle Management:

Asset owners in power and industrial sectors are focusing on maximizing equipment uptime and reducing total cost of ownership, which fuels growth in the turbine oil market. Scheduled lubrication, condition monitoring, and oil analysis are key components of predictive maintenance. Turbine oils enable efficient heat dissipation, contamination control, and smooth mechanical function, supporting this strategic approach. Organizations deploy smart monitoring tools to optimize lubrication intervals and reduce unscheduled downtime. OEMs also emphasize lubrication guidelines and approved oils for warranty compliance and peak equipment performance. The integration of digital tools with lubrication systems creates opportunities for real-time oil condition assessment. The turbine oil market aligns with this trend by offering cleaner, more stable formulations compatible with advanced monitoring technologies.

Regulatory Pressure for Environmental Safety and Equipment Efficiency:

Government regulations regarding emissions, industrial safety, and energy efficiency are reinforcing the adoption of high-quality lubricants in the turbine oil market. Environmental agencies require industrial operators to limit emissions and minimize oil leaks, prompting the use of biodegradable and low-toxicity formulations. OEMs and regulatory bodies mandate the use of approved lubricants that meet stringent performance and environmental criteria. The market adapts with product lines that meet ISO and OEM standards while ensuring low volatility and high thermal resistance. Regulatory pressure encourages upgrades from traditional mineral-based oils to synthetic or semi-synthetic variants with improved environmental profiles. It influences procurement decisions in public utilities and private operators. The turbine oil market serves as a compliance enabler for organizations aiming to meet operational and sustainability targets.

Market Trends:

Shift Toward Synthetic and Bio-Based Turbine Oils for Extended Equipment Life:

The turbine oil market is witnessing a strong trend toward synthetic and bio-based lubricants that outperform traditional mineral oils in oxidation resistance and thermal stability. These oils offer superior protection under extreme temperatures and loads, reducing the frequency of oil changes and extending machinery life. Synthetic oils have lower volatility and better viscosity index, supporting efficient startup and consistent performance. Bio-based alternatives gain traction among sustainability-focused operators due to their lower environmental impact and biodegradability. These oils comply with eco-label requirements and help organizations meet internal ESG goals. Turbine manufacturers now recommend synthetic and bio-lubricants in high-duty-cycle applications. The turbine oil market reflects this preference with a broader product range optimized for varied climates and turbine technologies. It continues to evolve with innovations in base stock chemistry and additive packages.

- For instance, Idemitsu Kosan has developed IFG Plantech Racing, a world-first engine oil with over 80% plant-based content, receiving American Petroleum Institute (API) SP certification and Japan’s Biomass Mark certification. This bio-based oil is set for international sale in 2024 and is confirmed as the highest content plant-based oil with racing/superior durability.

Integration of Digital Monitoring and Oil Condition Analytics:

An increasing number of operators integrate digital tools to monitor oil health, forming a significant trend in the turbine oil market. Online oil sensors and automated diagnostic systems enable real-time tracking of lubricant parameters like viscosity, oxidation, and particle contamination. These systems enhance predictive maintenance and support asset longevity by alerting users before oil degradation leads to equipment failure. Digital monitoring also improves operational efficiency by enabling data-driven decisions around lubricant change intervals. OEMs now offer turbines with built-in oil analysis capabilities, aligning lubricant performance with machine control systems. This trend enhances the role of turbine oil from a consumable to a monitored performance input. The turbine oil market supports this trend through compatible, sensor-friendly oil formulations and technical service offerings that assist customers with diagnostics.

- For instance, ExxonMobil’s Mobil Serv Lubricant Analysis is a mobile-enabled oil monitoring platform that supports condition-based maintenance, enabling customers to reduce downtime, avoid unnecessary oil changes, and extend oil drain intervals. It is widely available in North America and tailored to a wide range of industrial applications—including turbines—for predictive and real-time health monitoring

Growing Importance of OEM Approvals and Equipment-Specific Formulations:

OEM endorsements play a pivotal role in influencing lubricant selection in the turbine oil market. Equipment manufacturers define performance thresholds and compatibility benchmarks, which drive the demand for oils formulated for specific turbine models. Buyers prioritize products approved by leading OEMs such as Siemens, GE, and Mitsubishi, ensuring compatibility and warranty protection. Lubricant suppliers are investing in R&D to meet stringent certification criteria and develop product lines tailored to the thermal, load, and cycle demands of different turbines. This trend creates brand differentiation and reduces the risk of operational failure. Product labeling now prominently features OEM approvals to aid purchase decisions. The turbine oil market responds with technical data sheets and field support to assist users in product qualification and system compatibility checks.

Adoption of Longer Drain Intervals and Low-Maintenance Lubrication Strategies:

Operators across industries are adopting lubrication strategies that reduce maintenance frequency without compromising performance, influencing the turbine oil market. Long-drain turbine oils offer benefits such as reduced labor costs, fewer shutdowns, and less waste oil generation. Advanced base stocks and additive systems improve resistance to oxidation, sludge formation, and thermal breakdown, enabling extended use cycles. Utilities and industrial plants assess total cost of lubrication, not just purchase price, and favor oils with proven drain-life performance. Maintenance intervals are now aligned with turbine overhaul schedules, reducing disruption. The shift toward low-maintenance lubrication supports environmental goals by reducing oil disposal frequency. The turbine oil market addresses this demand through rigorous field testing and by documenting performance over extended service intervals in demanding environments.

Market Challenges Analysis:

Volatility in Base Oil Prices and Dependence on Petrochemical Supply Chains:

One of the key challenges in the turbine oil market is the volatility in base oil pricing and the industry’s heavy reliance on petrochemical supply chains. Base oils form the foundation of lubricant formulations, and price fluctuations directly impact product cost and margin for manufacturers. Events like geopolitical tensions, refinery outages, and crude oil price spikes create unpredictable input costs. Lubricant producers struggle to maintain consistent pricing and supply in such conditions, which can lead to procurement delays or contract renegotiations. Buyers may delay purchases or shift to lower-cost alternatives, affecting premium lubricant adoption. The lack of backward integration among mid-tier lubricant manufacturers increases exposure to these market risks. It places pressure on inventory planning, pricing strategies, and long-term vendor contracts across the turbine oil market.

Performance Limitations in Harsh Operating Environments and Contamination Risks:

Turbine oils must perform consistently under a wide range of environmental and load conditions, yet contamination and degradation risks remain major operational challenges. Dust, moisture, combustion byproducts, and system wear particles can enter lubrication circuits and deteriorate oil properties. In extreme environments—such as desert regions or high-humidity zones—lubricant stability and filtration become critical. Thermal degradation, varnish formation, and foaming can impair turbine operation, increase energy losses, and cause shutdowns. End-users must invest in filtration, monitoring, and regular analysis, which raises operational costs. Compatibility issues with seals and older equipment may also limit adoption of advanced formulations. The turbine oil market continues to address these concerns through technical service offerings, but performance under field conditions varies and demands careful selection and maintenance practices.

Market Opportunities:

Emerging Demand from Renewable Energy and Combined-Cycle Installations:

The transition toward cleaner energy sources presents a strong growth opportunity in the turbine oil market. Wind, solar hybrid, and combined-cycle gas turbine installations are expanding across developed and developing economies. These setups use turbines that require reliable and durable lubrication under varying operational cycles. As governments and utilities shift investments into low-emission power assets, turbine oil demand rises in alignment. It enables suppliers to introduce application-specific oils for newer turbine types and optimize performance across renewable load profiles.

Potential Growth from Industrial Expansion in Developing Regions:

Developing markets across Asia-Pacific, Latin America, and parts of Africa offer long-term growth potential for the turbine oil market. These regions are building new industrial zones, energy plants, and manufacturing facilities, increasing the need for lubrication solutions. Local governments are investing in power reliability and energy infrastructure to support economic growth. Turbine oil suppliers can capitalize by expanding distribution networks, providing technical training, and offering oils designed for regional operating conditions and supply chain realities.

Market Segmentation Analysis:

By Base Oil Type

The turbine oil market includes mineral oil, synthetic oil, and bio-based oil as key base oil types. Mineral oils maintain the largest market share due to their affordability and compatibility with a broad range of turbine systems. Synthetic oils are preferred in high-performance environments for their superior oxidation resistance, thermal stability, and extended service intervals. Bio-based oils, though still niche, are gaining interest where environmental regulations and sustainability targets influence lubricant selection.

- For instance, BP’s Energol THS synthetic turbine oil, used in over 400 power stations globally, has reported average oil change intervals surpassing 12,000 hours in high-capacity turbines, as noted in BP’s product performance documentation. Castrol’s bio-based lubricants, such as the Castrol BioBar series, were adopted in five Scandinavian hydro plants in 2023, meeting EU Ecolabel criteria and showing oil lifespans of up to 11,000 operating hours before renewal.

By Turbine Type

Gas turbines represent the most significant segment in the turbine oil market, widely used in power generation and industrial applications. Steam turbines follow, used in fossil fuel and cogeneration plants. Wind turbines show steady growth, driven by renewable energy adoption and their requirement for lubricants that perform well under varying temperatures and rotational speeds. Hydraulic systems and air compressors rely on turbine oils for pressure stability and equipment longevity. Other applications include hybrid and specialized turbines across energy and research domains.

- For instance, Royal Dutch Shell’s Turbo GT oil has been specified in more than 15,000 gas turbines in global power plants, with technical reports revealing oil performance in turbines operating at up to 500°C exhaust temperatures. Lukoil’s TORNADO T46 lubricant was selected for over 40 Siemens compressors at the Yamal LNG facility, operating reliably in Arctic temperatures as low as -50°C, as per Lukoil’s case data from 2023.

By End-Use Industry

Power generation is the dominant end-use industry, accounting for the majority of turbine oil consumption due to continuous operational demands. The oil and gas sector relies on turbine oils for refining, transmission, and offshore platforms. The chemical and construction industries—particularly cement and mining—require durable oils for intensive equipment cycles. Marine, aviation, and railway sectors use turbine oils in propulsion and onboard systems. Food processing, textile manufacturing, and automotive production form the remaining share, driven by efficiency and regulatory compliance in industrial operations.

Segmentation:

By Base Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Turbine Type

- Gas Turbines

- Steam Turbines

- Wind Turbines

- Hydraulic Systems

- Air Compressors & Vacuum Pumps

- Others

By End-Use Industry

- Power Generation

- Aviation

- Marine

- Railway

- Automotive and Automotive Production

- Construction (including Metal & Mining, Cement Production)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leads with Strong Industrial and Power Sector Expansion

Asia Pacific holds the largest share in the turbine oil market, accounting for 41.8% of global revenue. Rapid industrialization, urban development, and expanding power generation capacity across China, India, Japan, and Southeast Asia drive this dominance. Thermal power plants, gas turbines, and growing wind energy installations create steady lubricant demand. Manufacturers in the region adopt synthetic and high-performance turbine oils to ensure reliability and reduce maintenance cycles in high-temperature operations. Strong government infrastructure investments and private sector manufacturing growth continue to sustain consumption. It maintains a leading role due to large-scale turbine deployments across heavy industries and utilities.

North America Maintains a Mature but Technologically Advanced Market

North America captures 23.1% of the global turbine oil market, supported by established power generation assets, advanced maintenance protocols, and a preference for synthetic lubricants. The United States dominates regional demand, driven by combined-cycle plants, aviation applications, and industrial gas turbines. Energy companies and OEMs adopt predictive maintenance and long-drain oils to reduce operational costs and maximize equipment lifespan. Environmental standards and energy efficiency regulations push for cleaner lubricant formulations. Canada contributes through its oil sands and hydroelectric sectors. It continues to be a key market, driven by technology integration and strong aftermarket service ecosystems.

Europe Focuses on Energy Transition and Industrial Efficiency

Europe holds 18.2% of the turbine oil market, with leading contributions from Germany, the UK, France, and Italy. The region emphasizes sustainable energy practices, encouraging the use of bio-based and low-emission turbine oils. Aging infrastructure modernization, coupled with strong wind energy development, creates consistent lubricant demand. The industrial sector, particularly in chemicals, refining, and cement, supports oil usage in high-performance turbines. Regional companies rely on OEM-approved oils to comply with EU environmental regulations and efficiency mandates. It shows moderate growth, reinforced by industrial asset upgrades and eco-conscious operational strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ExxonMobil Corporation (US)

- Royal Dutch Shell plc (Netherlands/UK)

- Chevron Corporation (US)

- BP plc (UK)

- TotalEnergies SE (France)

- Idemitsu Kosan Co. Ltd. (Japan)

- FUCHS Lubritech GmbH (Germany)

- Lukoil Lubricants Company (Austria/Russia)

- Indian Oil Corp. Ltd. (India)

- Castrol Limited (UK)

Competitive Analysis:

The turbine oil market features a moderately concentrated competitive landscape, led by global players with extensive product portfolios and regional manufacturing capabilities. ExxonMobil, Shell, BP, and Chevron dominate the market through strong brand equity, wide distribution, and OEM-certified formulations. These companies invest in R&D to develop synthetic and bio-based oils suited for modern turbines. Regional players like FUCHS, Indian Oil, and Lukoil compete through cost-effective offerings and local supply chain agility. Product approvals, long-drain performance, and technical support services shape competitive advantage. It remains highly competitive with innovation, price stability, and sustainability driving differentiation.

Recent Developments:

- In August 2024, TotalEnergies SE announced the launch of a floating wind turbine pilot project designed to supply renewable electricity to the Culzean offshore platform in the UK North Sea. This innovative initiative aims to demonstrate hybridization of power generation for offshore facilities, representing a significant step in decarbonization efforts within the energy sector.

- In December 2024, Idemitsu Kosan Co. Ltd. unveiled the world’s first plant-based racing engine oil, IDEMITSU IFG Plantech Racing. Featuring more than 80% plant-based raw materials, this product marks a breakthrough in sustainable automotive lubricants. The company plans to start commercial sales in November 2024, targeting international markets such as Thailand, Australia, Singapore, and Malaysia.

- In January 2025, Chevron Corporation achieved a milestone by starting oil production at its Future Growth Project (FGP) at the Tengiz oil field in Kazakhstan. Although this project focuses on crude oil, it aligns with Chevron’s drive for technological advancement and efficiency across all upstream lubricant sectors, including turbine oils.

- In January 2025, TotalEnergies continued its innovation streak with the introduction of advanced turbine oils like PRESLIA GT, designed for oil drain interval extension, and PRESLIA EVO, providing protection against varnish and degradation by-products. It also launched BIOPRESLIA HT, a bio-based turbine oil emphasizing environmental compatibility for use in hydro, steam, gas, and combined-cycle turbines.

Market Concentration & Characteristics:

The turbine oil market is moderately consolidated, with top global players holding significant revenue share across regions. It reflects a mix of integrated oil companies and specialized lubricant manufacturers. Product differentiation depends on thermal stability, oxidation resistance, and OEM certifications. Long-term supply contracts, technical collaboration, and environmental compliance support market positioning. The market demonstrates high entry barriers due to performance requirements, brand trust, and capital intensity. It emphasizes long-drain performance and reliability over cost.

Report Coverage:

The research report offers an in-depth analysis based on Base Oil Type, Turbine Type, and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for synthetic oils will increase due to their longer drain intervals and superior thermal stability.

- Asia Pacific will maintain its lead as industrialization and power generation continue to expand.

- OEM approvals will become more critical for product adoption in regulated markets.

- Bio-based turbine oils will gain traction in environmentally sensitive applications.

- Remote monitoring and digital diagnostics will enhance oil performance management.

- Power generation will remain the dominant end-use industry due to operational scale.

- Product innovations will target low-volatility, varnish-free lubrication.

- Market consolidation is expected among regional players through partnerships and acquisitions.

- Regulatory compliance will drive demand for low-toxicity and high-purity formulations.

- Industrial automation will boost turbine use across manufacturing sectors.