Market Overview

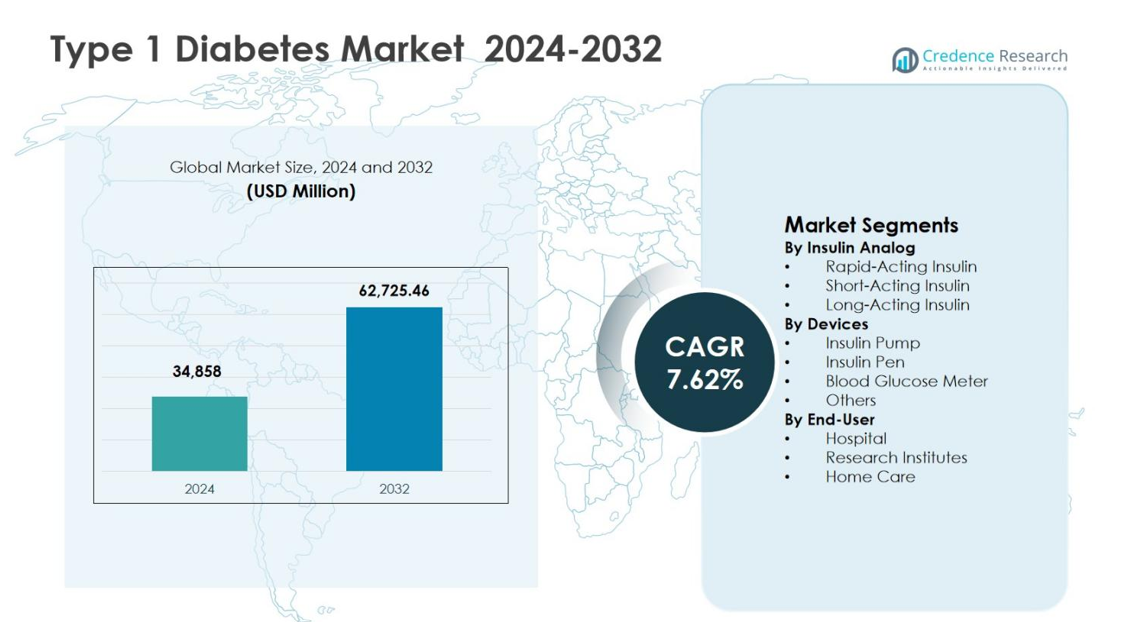

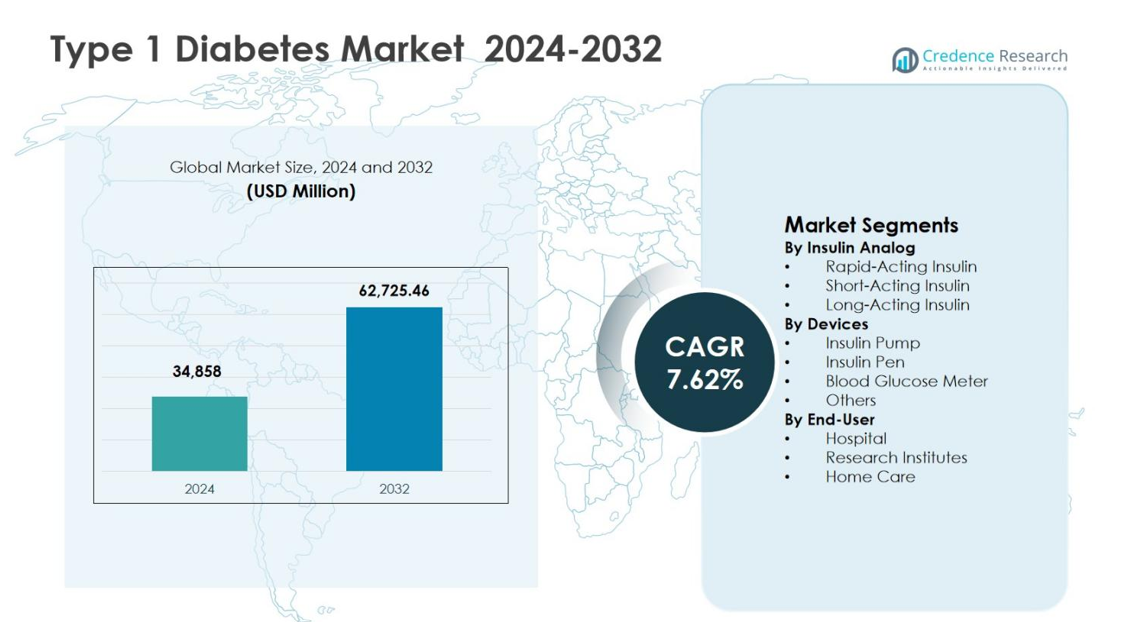

The Type 1 Diabetes Market size was valued at USD 34,858 million in 2024 and is anticipated to reach USD 62,725.46 million by 2032, expanding at a CAGR of 7.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Type 1 Diabetes Market Size 2024 |

USD 34,858 million |

| Type 1 Diabetes Market, CAGR |

7.62% |

| Type 1 Diabetes Market Size 2032 |

USD 62,725.46 million |

The Type 1 Diabetes Market is driven by the strong presence of leading pharmaceutical and medical device companies such as Sanofi S.A., Novo Nordisk A/S, Eli Lilly and Company, Abbott Laboratories, Medtronic plc, Dexcom, Inc., and Roche Holding AG, which focus on advanced insulin analogs, delivery systems, and glucose monitoring technologies. These players emphasize innovation, portfolio expansion, and digital integration to improve glycemic control and patient outcomes. Regionally, North America led the Type 1 Diabetes Market with a 38.4% share in 2024, supported by high disease prevalence, advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of insulin pumps and continuous glucose monitoring systems, reinforcing the region’s dominance in overall market revenue.

Market Insights

- The Type 1 Diabetes Market was valued at USD 34,858 million in 2024 and is projected to reach USD 62,725.46 million by 2032, growing at a CAGR of 7.62% during the forecast period, driven by sustained demand for insulin therapies and diabetes management devices.

- Growth in the Type 1 Diabetes Market is supported by rising global prevalence, early diagnosis rates, and continuous dependence on lifelong insulin therapy, increasing demand across insulin analogs, devices, and monitoring solutions.

- Key trends in the Type 1 Diabetes Market include higher adoption of long-acting insulin, which held a 48.6% segment share in 2024, and increasing use of insulin pens with a 42.9% share, driven by convenience, accuracy, and home-based care preference.

- The market landscape is shaped by established players focusing on insulin innovation, automated delivery systems, and glucose monitoring technologies, while high treatment costs and long-term therapy adherence challenges act as major restraints.

- Regionally, North America led the Type 1 Diabetes Market with a 38.4% share in 2024, followed by Europe at 27.1% and Asia Pacific at 22.8%, reflecting strong healthcare access and rising adoption of advanced diabetes care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Insulin Analog:

The Type 1 Diabetes Market by insulin analog is led by Long-Acting Insulin, which accounted for 48.6% market share in 2024, driven by its ability to provide stable basal insulin coverage and reduce the risk of hypoglycemia. Rapid-acting insulin followed with strong adoption due to its effectiveness in postprandial glucose control, particularly among intensive insulin therapy patients. Growth in this segment is supported by rising global prevalence of type 1 diabetes, increasing preference for advanced insulin regimens, and continuous product innovations aimed at improving glycemic stability and patient adherence.

- For instance, Eli Lilly’s insulin lispro enabled reduced postprandial excursions and similar or improved HbA1c with lower severe hypoglycemia risk versus regular insulin across pediatric type 1 groups.

By Devices:

Within the devices segment, Insulin Pens dominated the Type 1 Diabetes Market with a 42.9% share in 2024, supported by ease of use, dosing accuracy, portability, and high patient acceptance in home-care settings. Insulin pumps are gaining traction due to improved glucose control and integration with continuous glucose monitoring systems, while blood glucose meters maintain steady demand for routine monitoring. Key growth drivers include rising adoption of self-management devices, increasing awareness of diabetes care technologies, and favorable reimbursement policies across developed healthcare systems.

- For instance, Medtronic’s MiniMed 780G insulin pump, approved for type 1 diabetes patients aged 7 and above, automatically adjusts insulin delivery every 5 minutes based on CGM data, achieving up to 80% Time in Range in real-world adult studies without increasing hypoglycemia.

By End-User:

The Home Care segment emerged as the dominant end-user, capturing 54.3% of the Type 1 Diabetes Market share in 2024, driven by the chronic nature of the disease and the growing preference for self-administered insulin therapies. Hospitals continue to play a critical role in diagnosis and acute management, while research institutes contribute to clinical trials and therapeutic advancements. Expansion of home-based diabetes management programs, increasing availability of user-friendly devices, and rising healthcare cost optimization initiatives are key drivers supporting sustained growth in this segment.

Key Growth Drivers

Rising Global Prevalence of Type 1 Diabetes

The increasing incidence of type 1 diabetes across both pediatric and adult populations remains a primary growth driver for the Type 1 Diabetes Market. Improved diagnostic capabilities, expanding screening programs, and better disease awareness have led to higher identification rates worldwide. Lifestyle changes, genetic predisposition, and environmental triggers continue to contribute to disease onset. This expanding patient pool directly increases long-term demand for insulin analogs, monitoring devices, and supportive care solutions, sustaining consistent market expansion across developed and emerging healthcare systems.

- For instance, Abbott’s FreeStyle Libre sensor-based glucose monitoring system has shown in large real‑world studies in France and Sweden that wider use in people with type 1 diabetes is associated with significant HbA1c reductions and fewer hospitalizations, supporting sustained uptake of CGM in routine care.

Technological Advancements in Insulin Delivery and Monitoring

Rapid innovation in insulin delivery systems and glucose monitoring technologies significantly accelerates market growth. Advanced insulin pumps, smart insulin pens, and integrated continuous glucose monitoring systems enable precise dosing, improved glycemic control, and reduced complication risks. These innovations enhance patient convenience and treatment outcomes, driving higher adoption rates. Ongoing digital integration, including data-driven insulin management platforms and mobile health applications, further strengthens patient engagement and supports personalized diabetes management, boosting overall market penetration.

- For instance, Dexcom’s G7 continuous glucose monitor delivers real-time interstitial glucose readings every 5 minutes to smartphones or receivers, with a 10-day waterproof sensor/transmitter.

Favorable Healthcare Policies and Reimbursement Support

Supportive healthcare policies and expanding reimbursement frameworks play a critical role in driving the Type 1 Diabetes Market. Governments and private insurers increasingly recognize the long-term cost benefits of effective diabetes management, leading to broader coverage for insulin therapies and diabetes devices. Improved access to advanced treatments reduces financial barriers for patients and encourages early adoption. Additionally, public health initiatives promoting diabetes care infrastructure and access to essential medicines continue to strengthen market growth globally.

Key Trends & Opportunities

Shift Toward Home-Based and Self-Managed Care

A strong shift toward home-based diabetes management represents a major trend in the Type 1 Diabetes Market. Patients increasingly prefer self-administered insulin therapies supported by easy-to-use devices and remote monitoring solutions. This trend improves treatment adherence, reduces hospital visits, and lowers overall healthcare costs. The growing availability of compact insulin pens, portable pumps, and digital monitoring tools creates significant opportunities for manufacturers to develop patient-centric solutions tailored to long-term home care needs.

- For instance, Insulet’s Omnipod 5 tubeless pump delivers automated insulin via a wearable pod controlled by smartphone, enabling discreet home wear nearly anywhere an injection occurs.

Advancements in Disease-Modifying and Adjunct Therapies

Ongoing research into disease-modifying therapies and adjunct treatments presents significant growth opportunities. Innovations targeting immune modulation, beta-cell preservation, and improved insulin sensitivity aim to complement traditional insulin therapy. These advancements have the potential to improve long-term outcomes and reduce complications. Increasing clinical trial activity and investment in next-generation biologics and combination therapies position the market for long-term innovation-driven expansion beyond conventional insulin-based treatment approaches.

- For instance, Provention Bio’s teplizumab, an anti-CD3 monoclonal antibody, delayed the onset of clinical type 1 diabetes by a median of two years in high-risk individuals in the TN-10 trial. Treated participants showed preserved C-peptide levels, indicating sustained beta-cell function, compared to placebo.

Key Challenges

High Treatment Costs and Affordability Constraints

The high cost of insulin therapies and advanced diabetes devices remains a significant challenge for the Type 1 Diabetes Market. Despite reimbursement support in certain regions, many patients face financial strain due to long-term treatment requirements. Price disparities across regions limit access in low- and middle-income countries, slowing adoption of innovative therapies. Persistent affordability concerns continue to create barriers to equitable healthcare access and restrain overall market growth potential.

Risk of Complications and Therapy Adherence Issues

Maintaining consistent therapy adherence remains a major challenge in managing type 1 diabetes. Complex insulin regimens, fear of hypoglycemia, and lifestyle-related factors can hinder proper disease management. Poor adherence increases the risk of long-term complications, including cardiovascular and renal conditions, leading to higher healthcare burdens. Addressing these challenges requires continuous patient education, simplified treatment protocols, and improved device usability to ensure sustained treatment effectiveness.

Regional Analysis

North America

North America dominated the Type 1 Diabetes Market with a 38.4% market share in 2024, supported by high disease prevalence, advanced healthcare infrastructure, and strong adoption of innovative insulin therapies and devices. The United States represents the largest contributor due to widespread use of long-acting insulin, insulin pumps, and continuous glucose monitoring systems. Favorable reimbursement frameworks, strong presence of leading pharmaceutical and medical device companies, and high patient awareness levels continue to drive treatment adherence. Ongoing investments in digital diabetes management platforms further strengthen the region’s leadership position.

Europe

Europe accounted for a 27.1% share of the Type 1 Diabetes Market in 2024, driven by well-established public healthcare systems and strong government support for chronic disease management. Countries such as Germany, the United Kingdom, and France contribute significantly through broad access to insulin analogs and advanced delivery devices. Rising pediatric diabetes cases and growing adoption of home-based insulin administration continue to support demand. Regulatory emphasis on early diagnosis, structured diabetes care programs, and increasing clinical research activity further enhance regional market stability and long-term growth prospects.

Asia Pacific

Asia Pacific held a 22.8% market share in 2024, reflecting rapid growth fueled by increasing diagnosis rates, improving healthcare access, and expanding urban populations. Countries including China, India, and Japan are witnessing rising awareness of type 1 diabetes management and gradual adoption of modern insulin therapies. Government initiatives aimed at strengthening diabetes care infrastructure and expanding insurance coverage support market expansion. The growing availability of affordable insulin products and portable monitoring devices is accelerating penetration across both urban and semi-urban healthcare settings.

Latin America

Latin America captured a 6.9% share of the Type 1 Diabetes Market in 2024, supported by gradual improvements in healthcare access and increasing focus on chronic disease management. Brazil and Mexico represent the primary contributors, driven by rising patient awareness and expanding public healthcare programs. Demand for insulin pens and blood glucose monitoring devices continues to grow as self-care adoption increases. However, cost sensitivity and uneven reimbursement coverage remain key factors influencing therapy access and treatment adoption across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4.8% market share in 2024, driven by improving diagnostic capabilities and expanding healthcare investments in key countries. Saudi Arabia, the United Arab Emirates, and South Africa lead regional demand due to growing diabetes awareness and modernization of healthcare infrastructure. Increasing government initiatives to improve access to essential insulin therapies and diabetes education programs support market growth. Despite progress, limited access in rural areas and affordability constraints continue to shape regional market dynamics.

Market Segmentations:

By Insulin Analog

- Rapid-Acting Insulin

- Short-Acting Insulin

- Long-Acting Insulin

By Devices

- Insulin Pump

- Insulin Pen

- Blood Glucose Meter

- Others

By End-User

- Hospital

- Research Institutes

- Home Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Type 1 Diabetes Market is characterized by strong competition among established pharmaceutical and medical device companies, with Sanofi S.A. and Novo Nordisk A/S leading through extensive insulin analog portfolios and global distribution networks. Eli Lilly and Company continues to strengthen its position with advancements in rapid- and long-acting insulin therapies, while Abbott Laboratories, Dexcom, Inc., and Roche Holding AG drive innovation in blood glucose monitoring and integrated diabetes management solutions. Device-focused players such as Medtronic plc, Insulet Corporation, and Tandem Diabetes Care enhance market dynamics through advanced insulin pumps and automated delivery systems. Strategic investments in research, digital health integration, and geographic expansion enable these companies to strengthen market presence and sustain long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanofi S.A.

- AstraZeneca PLC

- Novartis AG

- Pfizer Inc.

- Macrogenics, Inc.

- DiaVacs, Inc.

- Biodel, Inc.

- Boehringer Ingelheim GmbH

- Mannkind Corporation

- Abbott Laboratories

Recent Developments

- In September 2025, Medtronic plc received expanded FDA clearance for its MiniMed 780G system to integrate with Abbott’s glucose sensors, enhancing automated insulin delivery capabilities.

- In September 2025, Sanofi received approval from China’s National Medical Products Administration for Tzield (teplizumab), the first disease-modifying therapy to delay stage 3 type 1 diabetes onset in adult and pediatric patients aged eight and older with stage 2 T1D.

- In July 2025, Sequel Med Tech launched its twiist automated insulin delivery system, initially compatible with Abbott’s FreeStyle Libre 3 Plus CGM, offering personalized management for type 1 diabetes patients aged six and up with features like iiSure technology for accurate delivery

Report Coverage

The research report offers an in-depth analysis based on Insulin Analog, Devices, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Type 1 Diabetes Market will continue to expand due to rising global diagnosis rates across pediatric and adult populations.

- Advancements in long-acting and ultra-rapid insulin analogs will improve glycemic control and patient adherence.

- Adoption of automated insulin delivery systems integrated with continuous glucose monitoring will increase steadily.

- Home-based and self-managed diabetes care will gain further traction, reducing dependence on hospital-based treatment.

- Digital health platforms and data-driven insulin management tools will enhance personalized therapy approaches.

- Ongoing research into disease-modifying and adjunct therapies will reshape long-term treatment strategies.

- Emerging markets will experience faster adoption of insulin therapies supported by improving healthcare access.

- Strategic collaborations between pharmaceutical and device manufacturers will accelerate innovation.

- Regulatory support and expanding reimbursement coverage will improve access to advanced diabetes treatments.

- Focus on patient-centric device design and education will strengthen long-term treatment outcomes.