Market Overview:

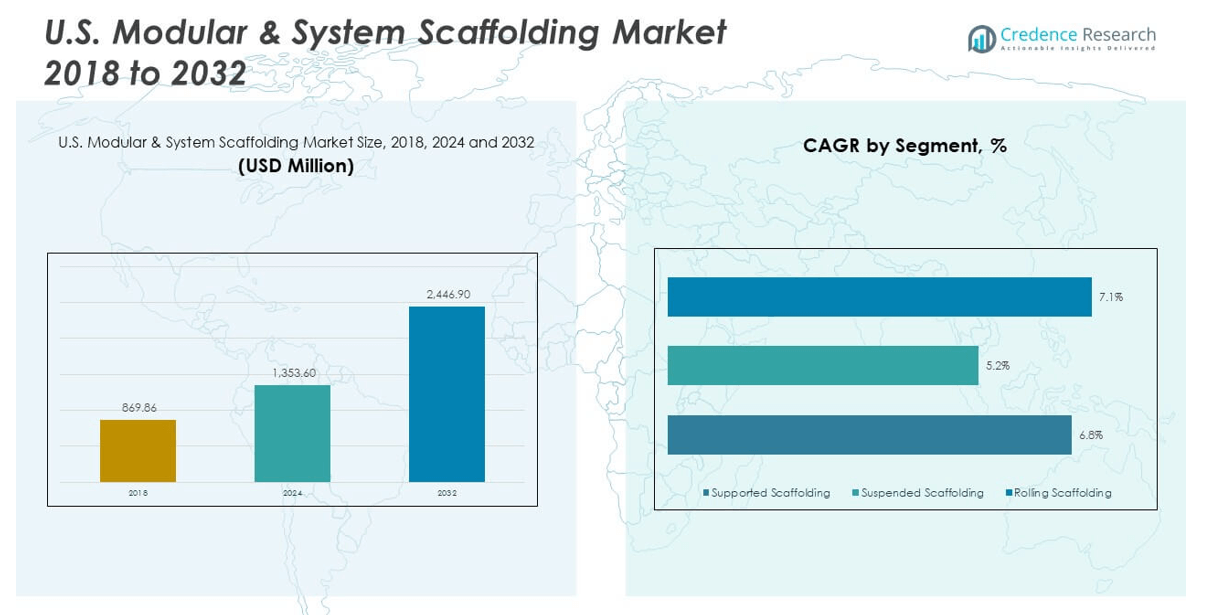

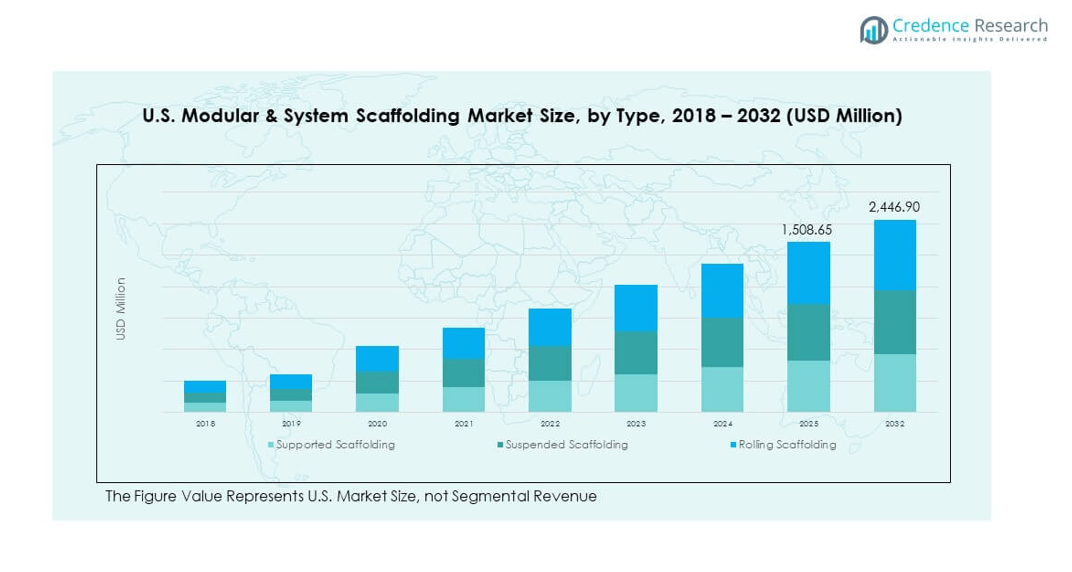

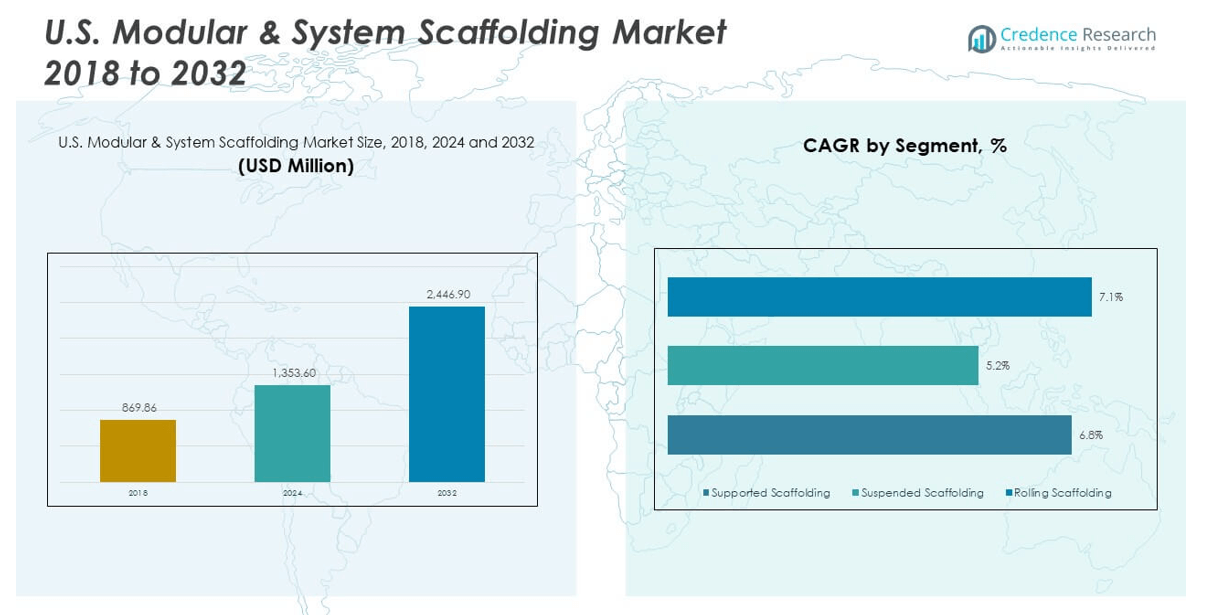

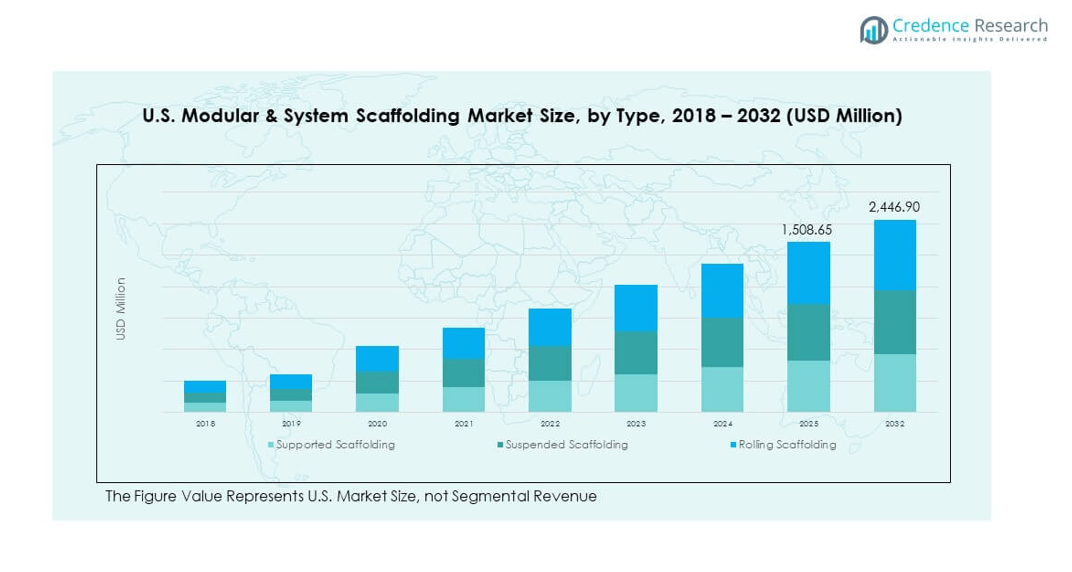

The U.S. Modular & System Scaffolding Market size was valued at USD 869.86 million in 2018 to USD 1353.4 million in 2024 and is anticipated to reach USD 2446.9 million by 2032, at a CAGR of 7.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Modular & System Scaffolding Market Size 2024 |

USD 1353.4 million |

| U.S. Modular & System Scaffolding Market, CAGR |

7.68% |

| U.S. Modular & System Scaffolding Market Size 2032 |

USD 2446.9 million |

The market is driven by rising construction and infrastructure development activities across commercial, industrial, and residential sectors. Increased emphasis on worker safety, coupled with stringent regulatory compliance, has fueled the demand for modular and system scaffolding solutions. The U.S. market benefits from rapid urbanization and public-private partnerships that accelerate large-scale infrastructure projects. Furthermore, the adoption of modular scaffolding systems, which offer superior flexibility, time efficiency, and reusability, continues to gain traction, especially in high-rise construction and renovation works.

Regionally, the market experiences strong dominance from urban and industrial hubs across the Northeastern and Western U.S., including states like New York, California, and Texas, driven by large-scale commercial and infrastructure developments. Emerging regions such as the Midwest and Southeast are also witnessing growing scaffolding demand due to increased investment in housing and transport infrastructure. These trends highlight a balanced expansion pattern across both mature and developing construction zones, contributing to nationwide market growth.

Market Insights:

- The U.S. Modular & System Scaffolding Market was valued at USD 1353.4 million in 2024 and is projected to reach USD 2446.9 million by 2032, growing at a CAGR of 7.68%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Expanding infrastructure and urban redevelopment projects are significantly driving demand for modular scaffolding solutions.

- Increasing emphasis on worker safety and strict OSHA compliance requirements continues to accelerate scaffold system adoption.

- High initial investment and cost concerns among small contractors remain a restraint to wider modular scaffolding uptake.

- The Western region led the market in 2024 with a 31.2% share due to active construction across California and urban centers.

- Steel remains the preferred material segment, while aluminum is gaining popularity for lightweight applications.

- Residential renovations and event-based applications are emerging as growth areas alongside traditional construction sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surging Infrastructure Modernization Initiatives Across Urban and Industrial Zones

The U.S. Modular & System Scaffolding Market is benefiting from nationwide infrastructure upgrades across highways, bridges, commercial buildings, and public facilities. The federal government’s push to revitalize aging infrastructure has led to increased construction activity, thereby driving scaffolding demand. Public-private partnerships are facilitating capital-intensive projects with compressed timelines, where modular scaffolding offers speed and efficiency. Contractors are increasingly opting for system scaffolds due to their adaptability and rapid assembly features. These structures support tight project deadlines without compromising on safety. State-level infrastructure programs, particularly in California, Texas, and New York, are amplifying scaffold requirements. This surge in infrastructure development directly boosts the revenue potential for modular scaffold providers.

Emphasis on Worker Safety and Regulatory Compliance in Construction

Stringent occupational safety norms by OSHA and other federal agencies have reinforced the integration of certified scaffolding systems in construction sites. The U.S. Modular & System Scaffolding Market benefits from a regulatory climate that prioritizes worker protection and risk mitigation. Companies are investing in advanced scaffolding systems to ensure compliance with safety codes. System scaffolds with enhanced load-bearing capacity and anti-slip features have become industry standard. These structures minimize workplace injuries and contribute to maintaining a safe working environment. Frequent audits and inspections reinforce the need for high-quality modular scaffold systems. Compliance-driven adoption ensures consistent demand, particularly in high-risk sectors like oil & gas and heavy industrial manufacturing.

- For instance, BrandSafway’s SafMax Frame System includes integral guardrail systems, ladder access hatches, and flush decking designed to address safety risks like falls in industrial environments.

Growth of Urban Redevelopment and Retrofitting Projects Across Cities

Urban revitalization efforts in the U.S. have created a steady pipeline of redevelopment and retrofitting projects. Aging commercial and residential buildings in metropolitan areas require upgrades that depend heavily on safe and scalable scaffolding. The U.S. Modular & System Scaffolding Market gains traction as contractors prefer reusable and easy-to-install solutions for interior and exterior refurbishments. These scaffolds simplify complex access requirements during façade repairs, electrical rewiring, or HVAC upgrades. The modular format supports non-disruptive operations in occupied spaces, which is critical in urban settings. Retrofits often involve tight spatial constraints, favoring adjustable system scaffolds. Local governments continue to invest in neighborhood improvement schemes, further fueling demand for efficient scaffolding systems.

Rising Construction Activity in Residential and Commercial Sectors

New construction projects in housing developments, offices, retail complexes, and educational institutions are accelerating scaffold demand. The U.S. Modular & System Scaffolding Market responds to these sectoral investments with scalable solutions that suit multiple elevations and layouts. Construction firms are adopting modular scaffolds for their reduced labor dependency and flexibility. High-rise developments in metropolitan cities create complex elevation challenges, addressed effectively with system scaffolds. Real estate developers seek scaffolds that ensure precision, speed, and cost-efficiency. Increasing use of Building Information Modeling (BIM) helps integrate scaffolding design during early project planning. This collaboration between scaffolding providers and construction firms fosters deeper market penetration.

- For example, ULMA Construction offers MEGAFRAME shoring and scaffold systems galvanized, high-strength frame solutions designed for heavy-duty applications with simplified jet-lock assembly.

Market Trends:

Adoption of Digital Scaffolding Management and Smart Monitoring Systems

Contractors in the U.S. Modular & System Scaffolding Market are increasingly implementing digital scaffolding design and planning software. This trend enhances accuracy and planning efficiency across construction projects. Digital tools allow real-time site visualization, enabling faster setup and dismantling. RFID and IoT-enabled scaffolding elements support inventory tracking, usage monitoring, and safety checks. These systems reduce human error and streamline scaffold logistics across large-scale operations. Remote inspection tools also allow compliance verification from a centralized dashboard. The integration of these technologies is improving operational workflows. Companies are investing in digital scaffolding platforms to reduce delays and optimize manpower allocation.

- For instance, Avontus pioneered VR/AR visualization for scaffold design through its Avontus Viewer app, enabling immersive walkthroughs in both 3D and augmented reality to improve planning and client communication.

Shift Toward Sustainable and Recyclable Scaffold Materials in Construction

Environmental regulations and green building certifications are pushing the adoption of recyclable scaffolding materials. The U.S. Modular & System Scaffolding Market is witnessing a move from traditional steel-only systems to aluminum and hybrid scaffolds. These lightweight alternatives reduce carbon footprints during transport and assembly. Contractors prefer materials that comply with LEED and other environmental standards. Recyclable materials reduce disposal costs post-project, enhancing profitability. Manufacturers are also innovating with corrosion-resistant coatings that extend product life. This trend supports sustainability goals without compromising structural integrity. Clients increasingly seek scaffolding providers with environmental credentials, fostering market differentiation.

- For example, Nanjing Tuopeng Construction Technology Co., Ltd. supplies OEM‑customizable scaffolding systems including ringlock, frame, cuplock, and kwikstage types to clients in more than 50 countries

Increased Use of Modular Scaffolds in Entertainment, Events, and Temporary Structures

Beyond construction, the U.S. Modular & System Scaffolding Market is expanding into events, entertainment, and temporary installations. Concerts, festivals, and sports venues use modular scaffolds for stage setups, lighting rigs, and seating platforms. These non-traditional applications require fast assembly, high load capacity, and customizable configurations. Modular systems provide the versatility and safety needed in public-facing structures. Event organizers prefer scaffolds that can be transported and installed quickly without heavy machinery. This trend diversifies market revenue streams and attracts clients outside core construction industries. Seasonal demand patterns support steady equipment rentals and reuse opportunities.

Contractor Preference for Pre-Engineered Scaffolding Systems in Tight Schedules

Contractors facing compressed construction timelines are selecting pre-engineered scaffolding solutions for improved efficiency. The U.S. Modular & System Scaffolding Market supports this trend by offering plug-and-play systems that minimize on-site fabrication. These systems reduce erection times by up to 40% compared to traditional tube-and-coupler setups. Pre-engineered components come with built-in safety features and are often compatible with digital modeling tools. Contractors benefit from faster approvals during safety audits. Repeatability and modular design simplify usage across multiple sites. This preference is reshaping procurement strategies and driving innovation in scaffold design. Suppliers are responding with customizable kits tailored to project specifications.

Market Challenges Analysis:

High Initial Investment and Cost Sensitivity Among Small Contractors

One of the primary barriers in the U.S. Modular & System Scaffolding Market is the high upfront investment required to procure advanced modular systems. While these systems offer long-term value and reusability, small and mid-sized contractors often struggle with initial capital allocation. Budget limitations restrict access to premium scaffolds, pushing some firms toward substandard or rental alternatives. This hesitancy hampers broader market adoption, especially in fragmented or regional construction segments. Equipment maintenance and transportation costs further strain operating margins. The price sensitivity often leads to trade-offs in safety and durability, impacting overall project quality. Small players may also lack access to training for proper scaffold assembly, raising compliance concerns.

Complex Regulatory Landscape Across States and Jurisdictions

The U.S. Modular & System Scaffolding Market is impacted by diverse regulatory frameworks across states, municipalities, and industry sectors. Scaffold providers must navigate a complex mix of local building codes, labor regulations, and OSHA standards. Variations in inspection protocols and permit requirements lead to project delays and added administrative costs. Compliance tracking becomes difficult for multi-state operators and national scaffold suppliers. Any misstep in meeting state-specific guidelines could result in heavy fines or operational shutdowns. These inconsistencies slow innovation and hinder seamless product standardization. Companies must invest in localized compliance expertise, adding overhead to project budgets.

Market Opportunities:

Growing Demand for Rental-Based Scaffold Solutions Across Urban Projects

The rental model is gaining popularity across the U.S. Modular & System Scaffolding Market due to its cost-effectiveness and operational flexibility. Construction companies increasingly prefer short-term rentals over full ownership to minimize capital expenditure. This shift creates growth opportunities for rental service providers offering modular scaffolds on flexible terms. Urban contractors working on multiple small-scale renovations and maintenance tasks benefit from renting instead of investing in storage and logistics. The rental approach supports recurring revenue streams and allows faster market expansion for providers.

Emerging Role of Modular Scaffolds in Renewable Energy and Utility Sectors

Renewable energy installations, especially solar farms and wind turbine projects, are creating new demand channels for modular scaffolding. The U.S. Modular & System Scaffolding Market is poised to benefit as scaffolds enable access during turbine erection, panel maintenance, and infrastructure upgrades. Utility providers also require scaffold systems for substation construction and repair. These emerging sectors value modularity, safety, and ease of deployment. Scaffold suppliers who align with energy and utility contractors gain a competitive edge and long-term project pipelines.

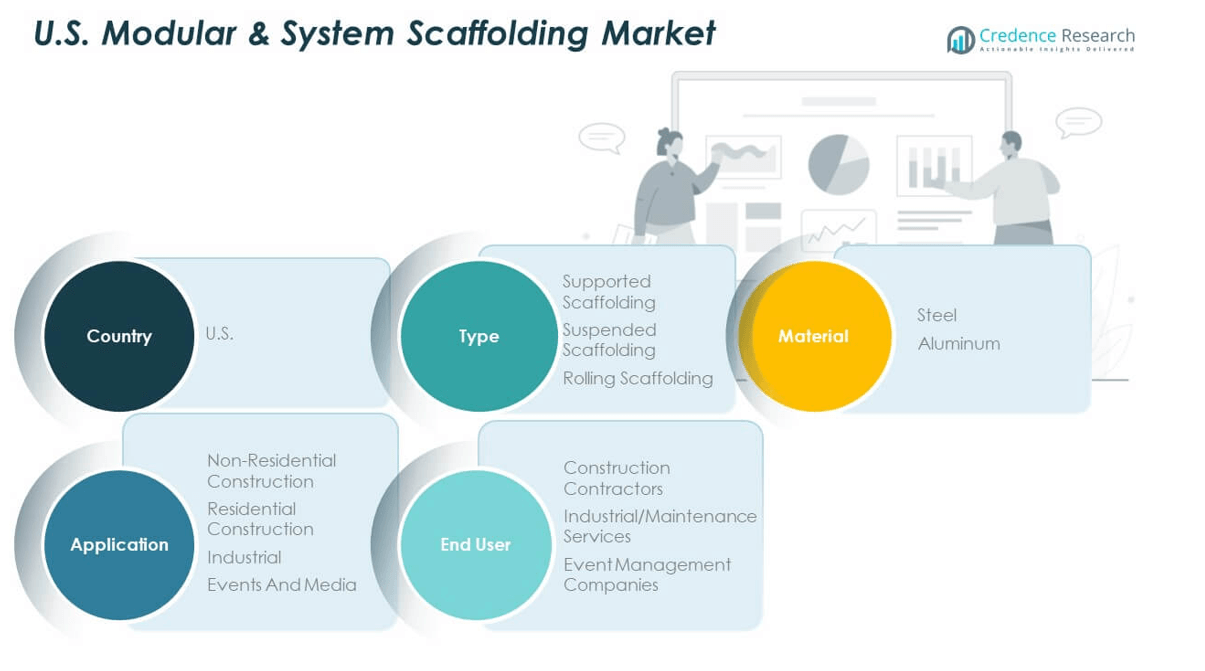

Market Segmentation Analysis:

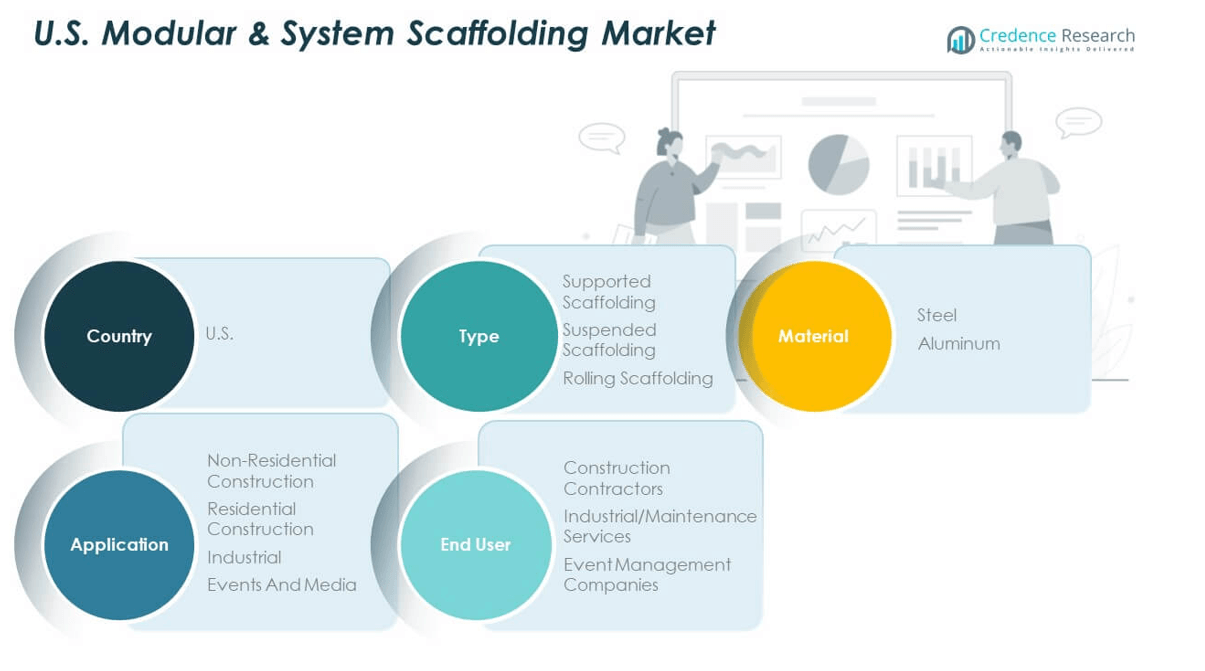

The U.S. Modular & System Scaffolding Market demonstrates strong performance across varied segmentations, reflecting the diversity of end-use demands and structural requirements.

By type, supported scaffolding leads the market due to its stability and widespread use in large-scale construction. Suspended scaffolding follows, favored for projects requiring elevated access without ground support. Rolling scaffolding gains traction in maintenance and indoor tasks for its mobility and ease of use.

- For example, BrandSafway’s CupLok® scaffolding system is a fully galvanized modular solution designed for industrial and infrastructure projects, compliant with ANSI and BS/EN standards. BrandSafway’s Infrastructure Services Group has supported major bridge projects—including the Governor Mario M. Cuomo Bridge (formerly Tappan Zee Bridge)—providing access platforms, formwork, and scaffolding services.

By material, steel dominates due to its superior strength, durability, and suitability for heavy-duty operations. Aluminum is gaining ground in the U.S. Modular & System Scaffolding Market, driven by demand for lightweight, corrosion-resistant alternatives ideal for fast-paced installations and relocation.

By Application, non-residential construction forms the largest application segment, fueled by commercial buildings, infrastructure upgrades, and public sector investments. Residential construction also contributes significantly, particularly in urban renovation projects. The industrial segment demands custom scaffolding for facility maintenance and equipment access. Events and media applications are growing steadily, with modular systems used for stage setups and temporary structures.

- For example, BrandSafway supported ExxonMobil’s Baton Rouge refinery during a turnaround cycle providing comprehensive services including scaffolding, access systems, insulation, fireproofing, and safety support. The project received recognition from industry bodies, underscoring its operational integration and safety performance.

By end users, construction contractors account for the largest share, leveraging scaffolding in diverse new-build and retrofitting projects. Industrial and maintenance service providers use modular scaffolding for repairs, inspections, and shutdowns in plants and factories. Event management companies represent a niche but expanding user group, requiring safe and reusable systems for temporary event infrastructure.

Segmentation:

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

By Application

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

Regional Analysis:

The Western region holds the largest share of the U.S. Modular & System Scaffolding Market, accounting for 31.2% in 2024. California, in particular, drives this dominance through large-scale infrastructure, real estate, and urban redevelopment projects. High-rise commercial and residential construction activities across Los Angeles and San Francisco demand extensive use of system scaffolding. The market also benefits from strong environmental regulations encouraging the use of advanced, recyclable scaffold systems. The presence of several major scaffolding providers and rental firms further strengthens market growth in the West. Ongoing investments in public infrastructure continue to sustain demand across the region.

The Southern region captures 26.8% of the U.S. Modular & System Scaffolding Market in 2024, driven by rapid urbanization and industrial expansion in Texas and Florida. Strong construction activity in the oil and gas, petrochemical, and manufacturing sectors supports scaffold deployment in both temporary and permanent settings. Metropolitan cities like Houston, Dallas, and Miami have seen rising high-density residential projects that utilize modular scaffolding for safety and efficiency. Favorable state policies, coupled with a growing skilled labor force, contribute to rising scaffold installations. The region is also witnessing an increase in public-private construction partnerships, creating scalable opportunities for scaffold providers.

The Midwest and Northeast regions represent 21.5% and 20.5% of the U.S. Modular & System Scaffolding Market respectively in 2024. The Midwest benefits from investments in transport infrastructure, educational institutions, and healthcare facilities, which drive scaffold demand across various states including Illinois, Ohio, and Michigan. The Northeast, anchored by New York and Massachusetts, sees demand from dense urban construction zones and retrofit projects in aging buildings. Both regions face challenges related to seasonal construction limitations but make up for it through higher productivity during active quarters. Demand in these areas is also supported by stringent safety codes and advanced compliance standards, encouraging use of premium scaffolding systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BrandSafway

- Safway Atlantic

- PERI USA (part of PERI Group)

- Layher

- The Brock Group

- Mattison Scaffolding Ltd

- Brand Industrial Services, Inc.

- ULMA Construction (U.S. operations)

- Sunbelt Rentals

- Atlantic Pacific Equipment (AT-PAC)

Competitive Analysis:

The U.S. Modular & System Scaffolding Market features a competitive landscape with a mix of multinational corporations and regional players. Key companies such as PERI Group, Layher Inc., Safway Group, BrandSafway, and Waco International dominate through extensive distribution networks and product portfolios. These firms focus on innovation, rental services, and integrated digital scaffold design tools to strengthen their market positions. Strategic partnerships with construction contractors and government infrastructure agencies help them secure long-term projects. Smaller regional players compete through pricing, localized services, and niche project execution. The market sees moderate consolidation with frequent mergers and acquisitions aimed at expanding geographic reach and technical capabilities. Product reliability, compliance with OSHA standards, and efficient logistics remain core differentiators. Competitive dynamics continue to evolve with rising demand from industrial maintenance, renewable energy, and retrofitting sectors.

Recent Developments:

- In May 2025, PERI USA’s parent company, Perion, completed the acquisition of Greenbids, a cutting-edge AI technology firm, to accelerate market share expansion and enhance its pioneering solutions. During the same period, Perion also established a key integration partnership with The Trade Desk, boosting industry interoperability and value for clients.

- In April 2025, Layher opened a new scaffolding materials and support facility in Baltimore County, Maryland, underscoring its commitment to expanding distribution and support operations in the U.S. This move allows Layher to scale up engineering, assembly, and support activities to serve the growing demand for system scaffolding in the region

- In January 2025, BrandSafway showcased a full suite of innovative access and scaffolding solutions at World of Concrete 2025, reinforcing its leading market role. Just a few months earlier, in September 2024, the company expanded its service portfolio through the acquisition of Covan’s Insulation Company, strengthening its position in the industrial insulation sector, especially across the Carolinas and eastern Georgia.

Market Concentration & Characteristics:

The U.S. Modular & System Scaffolding Market is moderately concentrated, with leading players accounting for a substantial share of national revenue. It exhibits characteristics of a service-driven ecosystem, where product availability, rental flexibility, and technical support significantly influence buyer decisions. The market relies heavily on safety certifications and regulatory compliance, especially in high-risk construction zones. Regional demand fluctuations impact inventory cycles and equipment utilization rates. Standardization of scaffold components enhances interoperability, helping large firms scale operations across states. Rapid project turnaround expectations drive the adoption of modular solutions with plug-and-play configurations. It remains sensitive to labor availability and weather-dependent construction schedules.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing infrastructure investments will continue to generate strong demand across commercial and public sector projects.

- Rising adoption of modular scaffolds in retrofitting and renovation will support long-term market expansion.

- Increasing preference for rental-based scaffolding services will reshape business models and improve accessibility.

- Integration of digital design and inventory tracking tools will enhance project planning and operational efficiency.

- Expansion into non-construction sectors like events, media, and industrial maintenance will diversify revenue streams.

- Stringent safety regulations will drive continued demand for certified, high-performance scaffolding systems.

- Sustainable and lightweight scaffold materials will gain traction amid growing environmental compliance.

- Technological innovation in pre-engineered components will reduce installation time and labor costs.

- Collaborative partnerships with construction firms and public agencies will strengthen market penetration.

- Urban redevelopment and smart city projects will unlock new opportunities across densely populated states.