Table of Content

1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Market Introduction

2. Executive Summary

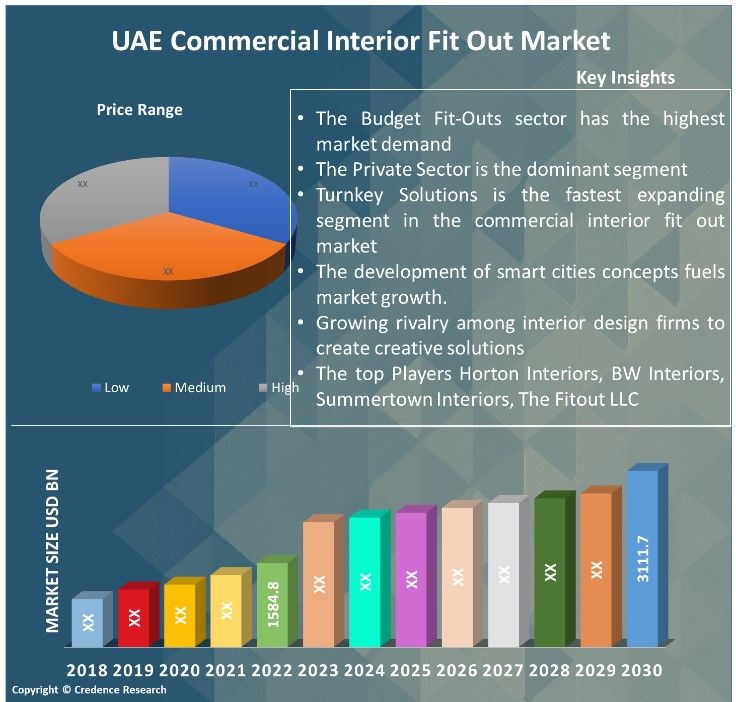

2.1. Market Snapshot: UAE Commercial Interior Fit Out Market

2.1.1. UAE Commercial Interior Fit Out Market, By Type of Commercial Space

2.1.2. UAE Commercial Interior Fit Out Market, By Scope of Services

2.1.3. UAE Commercial Interior Fit Out Market, By End Users

2.1.4. UAE Commercial Interior Fit Out Market, By Style and Aesthetics

2.1.5. UAE Commercial Interior Fit Out Market, By Budget and Scale

2.1.6. UAE Commercial Interior Fit Out Market, By Specialty and Niche Segments

2.1.7. UAE Commercial Interior Fit Out Market, By Region

2.2. Insights from Primary Respondents

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. UAE Commercial Interior Fit Out Market Value, 2017-2030, (US$ Mn)

3.1.2. Y-o-Y Growth Trend Analysis

3.2. Market Dynamics

3.2.1. UAE Commercial Interior Fit Out Market Drivers

3.2.2. UAE Commercial Interior Fit Out Market Restraints

3.2.3. UAE Commercial Interior Fit Out Market Opportunities

3.2.4. Major UAE Commercial Interior Fit Out Industry Challenges

3.3. Growth and Development Patterns

3.4. Investment Feasibility Analysis

3.5. Market Opportunity Analysis

3.5.1. Type of Commercial Space

3.5.2. Scope of Services

3.5.3. End Users

3.5.4. Style and Aesthetics

3.5.5. Budget and Scale

3.5.6. Specialty and Niche Segments

3.5.7. Geography

4. Market Competitive Landscape Analysis

4.1. Company Market Share Analysis, 2022

4.1.1. UAE Commercial Interior Fit Out Market: Company Market Share, Value 2022

4.1.2. UAE Commercial Interior Fit Out Market: Top 6 Company Market Share, Value 2022

4.1.3. UAE Commercial Interior Fit Out Market: Top 3 Company Market Share, Value 2022

4.2. UAE Commercial Interior Fit Out Market: Company Revenue Share Analysis, 2022

4.3. Company Assessment Metrics, 2022

4.3.1. Stars

4.3.2. Emerging Leaders

4.3.3. Pervasive Players

4.3.4. Participants

4.4. Startups/ SMEs Assessment Metrics, 2022

4.4.1. Progressive Companies

4.4.2. Responsive Companies

4.4.3. Dynamic Companies

4.4.4. Starting Blocks

4.5. Strategic Development

4.5.1. Acquisition and Mergers

4.5.2. New Scope of Services Launch

4.5.3. Regional Expansion

4.5.4. Partnerships

4.6. Key Player Scope of Services Matrix

4.7. Potential for New Players in the UAE Commercial Interior Fit Out Market

5. Premium Insights

5.1. STAR (Situation, Task, Action, Results) Analysis

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of New Entrants

5.2.2. Bargaining Power of Buyers/Consumers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of Substitute Type of Commercial Spaces

5.2.5. Intensity of Competitive Rivalry

5.3. PESTEL Analysis

5.3.1. Political Factors

5.3.2. Economic Factors

5.3.3. Social Factors

5.3.4. Technological Factors

5.3.5. Environmental Factors

5.3.6. Legal Factors

5.4. Key Market Trends

5.4.1. Demand Side Trends

5.4.2. Supply Side Trends

5.5. Value Chain Analysis

5.6. Technology Analysis

5.6.1. Research and development in the market

5.6.2. Patent Analysis

5.6.3. Emerging technologies and their potential disruption to the market

5.7. Consumer Behaviour Analysis

5.7.1. Consumer Preferences and Expectations

5.7.2. Factors Influencing Consumer Buying Decisions

5.7.3. Consumer Pain Points

5.8. Analysis and Recommendations

5.9. Adjacent Market Analysis

6. Market Positioning of Key Players, 2022

6.1. Company market share of key players, 2022

6.2. Competitive Benchmarking

6.3. Market Positioning of Key Vendors

6.4. Geographical Presence Analysis

6.5. Major Strategies Adopted by Key Players

6.5.1. Key Strategies Analysis

6.5.2. Mergers and Acquisitions

6.5.3. Partnerships

6.5.4. Scope of Services Launch

6.5.5. Geographical Expansion

6.5.6. Others

7. Impact Analysis of COVID 19 and Russia – Ukraine War on UAE Commercial Interior Fit Out Market

7.1. Ukraine-Russia War Impact

7.1.1. Uncertainty and Economic Instability

7.1.2. Supply chain disruptions

7.1.3. Regional market shifts

7.1.4. Shift in government priorities

7.2. COVID-19 Impact Analysis

7.2.1. Supply Chain Disruptions

7.2.2. Demand Fluctuations

7.2.3. Shift in Scope of Services Mix

7.2.4. Reduced Industrial Activity

8. UAE Commercial Interior Fit Out Market, By Type of Commercial Space

8.1. UAE Commercial Interior Fit Out Market Overview, by Type of Commercial Space

8.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By Type of Commercial Space, 2022 Vs 2030 (in %)

8.2. Office Interiors

8.2.1. UAE Commercial Interior Fit Out Market, By OFFICE INTERIORS, By Region, 2017-2030 (US$ Mn)

8.2.2. Market Dynamics for OFFICE INTERIORS

8.2.2.1. Drivers

8.2.2.2. Restraints

8.2.2.3. Opportunities

8.2.2.4. Trends

8.3. Retail Interiors

8.3.1. UAE Commercial Interior Fit Out Market, By RETAIL INTERIORS, By Region, 2017-2030 (US$ Mn)

8.3.2. Market Dynamics for RETAIL INTERIORS

8.3.2.1. Drivers

8.3.2.2. Restraints

8.3.2.3. Opportunities

8.3.2.4. Trends

8.4. Hospitality Interiors

8.4.1. UAE Commercial Interior Fit Out Market, By Hospitality Interiors, By Region, 2017-2030 (US$ Mn)

8.4.2. Market Dynamics for Hospitality Interiors

8.4.2.1. Drivers

8.4.2.2. Restraints

8.4.2.3. Opportunities

8.4.2.4. Trends

8.5. Healthcare Interiors

8.5.1. UAE Commercial Interior Fit Out Market, By Healthcare Interiors, By Region, 2017-2030 (US$ Mn)

8.5.2. Market Dynamics for Healthcare Interiors

8.5.2.1. Drivers

8.5.2.2. Restraints

8.5.2.3. Opportunities

8.5.2.4. Trends

8.6. Education Interiors

8.6.1. UAE Commercial Interior Fit Out Market, By Education Interiors, By Region, 2017-2030 (US$ Mn)

8.6.2. Market Dynamics for Education Interiors

8.6.2.1. Drivers

8.6.2.2. Restraints

8.6.2.3. Opportunities

8.6.2.4. Trends

8.7. Government and Public Sector Interiors

8.7.1. UAE Commercial Interior Fit Out Market, By Government and Public Sector Interiors, By Region, 2017-2030 (US$ Mn)

8.7.2. Market Dynamics for Government and Public Sector Interiors

8.7.2.1. Drivers

8.7.2.2. Restraints

8.7.2.3. Opportunities

8.7.2.4. Trends

9. UAE Commercial Interior Fit Out Market, By Scope of Services

9.1. UAE Commercial Interior Fit Out Market Overview, By Scope of Services

9.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By Scope of Services, 2022 Vs 2030 (in %)

9.2. Design Services

9.2.1. UAE Commercial Interior Fit Out Market, By Design Services, By Region, 2017-2030 (US$ Mn)

9.2.2. Market Dynamics for Design Services

9.2.2.1. Drivers

9.2.2.2. Restraints

9.2.2.3. Opportunities

9.2.2.4. Trends

9.3. Fit-Out Services

9.3.1. UAE Commercial Interior Fit Out Market, By Fit-Out Services, By Region, 2017-2030 (US$ Mn)

9.3.2. Market Dynamics for Fit-Out Services

9.3.2.1. Drivers

9.3.2.2. Restraints

9.3.2.3. Opportunities

9.3.2.4. Trends

9.4. Furniture and Fixture Installation

9.4.1. UAE Commercial Interior Fit Out Market, By Furniture and Fixture Installation, By Region, 2017-2030 (US$ Mn)

9.4.2. Market Dynamics for Furniture and Fixture Installation

9.4.2.1. Drivers

9.4.2.2. Restraints

9.4.2.3. Opportunities

9.4.2.4. Trends

9.5. Project Management

9.5.1. UAE Commercial Interior Fit Out Market, By Project Management, By Region, 2017-2030 (US$ Mn)

9.5.2. Market Dynamics for Project Management

9.5.2.1. Drivers

9.5.2.2. Restraints

9.5.2.3. Opportunities

9.5.2.4. Trends

9.6. Turnkey Solutions

9.6.1. UAE Commercial Interior Fit Out Market, By Turnkey Solutions, By Region, 2017-2030 (US$ Mn)

9.6.2. Market Dynamics for Turnkey Solutions

9.6.2.1. Drivers

9.6.2.2. Restraints

9.6.2.3. Opportunities

9.6.2.4. Trends

9.7. Renovation and Refurbishment

9.7.1. UAE Commercial Interior Fit Out Market, By Renovation and Refurbishment, By Region, 2017-2030 (US$ Mn)

9.7.2. Market Dynamics for Renovation and Refurbishment

9.7.2.1. Drivers

9.7.2.2. Restraints

9.7.2.3. Opportunities

9.7.2.4. Trends

10. UAE Commercial Interior Fit Out Market, By End Users

10.1. UAE Commercial Interior Fit Out Market Overview, by End Users

10.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By End Users, 2022 Vs 2030 (in %)

10.2. Private Sector

10.2.1. UAE Commercial Interior Fit Out Market, By Private Sector, By Region, 2017-2030 (US$ Mn)

10.2.2. Market Dynamics for Private Sector

10.2.2.1. Drivers

10.2.2.2. Restraints

10.2.2.3. Opportunities

10.2.2.4. Trends

10.3. Public Sector

10.3.1. UAE Commercial Interior Fit Out Market, By Public Sector, By Region, 2017-2030 (US$ Mn)

10.3.2. Market Dynamics for Public Sector

10.3.2.1. Drivers

10.3.2.2. Restraints

10.3.2.3. Opportunities

10.3.2.4. Trends

10.4. Small and Medium Enterprises (SMEs)

10.4.1. UAE Commercial Interior Fit Out Market, By Small and Medium Enterprises (SMEs), By Region, 2017-2030 (US$ Mn)

10.4.2. Market Dynamics for Small and Medium Enterprises (SMEs)

10.4.2.1. Drivers

10.4.2.2. Restraints

10.4.2.3. Opportunities

10.4.2.4. Trends

10.5. Large Enterprises

10.5.1. UAE Commercial Interior Fit Out Market, By Large Enterprises, By Region, 2017-2030 (US$ Mn)

10.5.2. Market Dynamics for Large Enterprises

10.5.2.1. Drivers

10.5.2.2. Restraints

10.5.2.3. Opportunities

10.5.2.4. Trends

10.6. Hospitality and Retail Chains

10.6.1. UAE Commercial Interior Fit Out Market, By Hospitality and Retail Chains, By Region, 2017-2030 (US$ Mn)

10.6.2. Market Dynamics for Hospitality and Retail Chains

10.6.2.1. Drivers

10.6.2.2. Restraints

10.6.2.3. Opportunities

10.6.2.4. Trends

11. UAE Commercial Interior Fit Out Market, By Style and Aesthetics

11.1. UAE Commercial Interior Fit Out Market Overview, by Style and Aesthetics

11.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By Style and Aesthetics, 2022 Vs 2030 (in %)

11.2. Modern and Contemporary

11.2.1. UAE Commercial Interior Fit Out Market, By Modern and Contemporary, By Region, 2017-2030 (US$ Mn)

11.2.2. Market Dynamics for Modern and Contemporary

11.2.2.1. Drivers

11.2.2.2. Restraints

11.2.2.3. Opportunities

11.2.2.4. Trends

11.3. Traditional and Classic

11.3.1. UAE Commercial Interior Fit Out Market, By Traditional and Classic, By Region, 2017-2030 (US$ Mn)

11.3.2. Market Dynamics for Traditional and Classic

11.3.2.1. Drivers

11.3.2.2. Restraints

11.3.2.3. Opportunities

11.3.2.4. Trends

11.4. Minimalist and Industrial

11.4.1. UAE Commercial Interior Fit Out Market, By Minimalist and Industrial, By Region, 2017-2030 (US$ Mn)

11.4.2. Market Dynamics for Minimalist and Industrial

11.4.2.1. Drivers

11.4.2.2. Restraints

11.4.2.3. Opportunities

11.4.2.4. Trends

11.5. Eco-Friendly and Sustainable

11.5.1. UAE Commercial Interior Fit Out Market, By Eco-Friendly and Sustainable, By Region, 2017-2030 (US$ Mn)

11.5.2. Market Dynamics for Eco-Friendly and Sustainable

11.5.2.1. Drivers

11.5.2.2. Restraints

11.5.2.3. Opportunities

11.5.2.4. Trends

11.6. High-Tech and Futuristic

11.6.1. UAE Commercial Interior Fit Out Market, By High-Tech and Futuristic, By Region, 2017-2030 (US$ Mn)

11.6.2. Market Dynamics for High-Tech and Futuristic

11.6.2.1. Drivers

11.6.2.2. Restraints

11.6.2.3. Opportunities

11.6.2.4. Trends

12. UAE Commercial Interior Fit Out Market, By Budget and Scale

12.1. UAE Commercial Interior Fit Out Market Overview, by Budget and Scale

12.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By Budget and Scale, 2022 Vs 2030 (in %)

12.2. Budget Fit-Outs

12.2.1. UAE Commercial Interior Fit Out Market, By Budget Fit-Outs, By Region, 2017-2030 (US$ Mn)

12.2.2. Market Dynamics for Budget Fit-Outs

12.2.2.1. Drivers

12.2.2.2. Restraints

12.2.2.3. Opportunities

12.2.2.4. Trends

12.3. High-End and Luxury Fit-Outs

12.3.1. UAE Commercial Interior Fit Out Market, By High-End and Luxury Fit-Outs, By Region, 2017-2030 (US$ Mn)

12.3.2. Market Dynamics for High-End and Luxury Fit-Outs

12.3.2.1. Drivers

12.3.2.2. Restraints

12.3.2.3. Opportunities

12.3.2.4. Trends

12.4. Medium-Scale Fit-Outs

12.4.1. UAE Commercial Interior Fit Out Market, By Medium-Scale Fit-Outs, By Region, 2017-2030 (US$ Mn)

12.4.2. Market Dynamics for Medium-Scale Fit-Outs

12.4.2.1. Drivers

12.4.2.2. Restraints

12.4.2.3. Opportunities

12.4.2.4. Trends

13. UAE Commercial Interior Fit Out Market, By Specialty and Niche Segments

13.1. UAE Commercial Interior Fit Out Market Overview, by Specialty and Niche Segments

13.1.1. UAE Commercial Interior Fit Out Market Revenue Share, By Specialty and Niche Segments, 2022 Vs 2030 (in %)

13.2. Exhibition and Event Space

13.2.1. UAE Commercial Interior Fit Out Market, By Exhibition and Event Space, By Region, 2017-2030 (US$ Mn)

13.2.2. Market Dynamics for Exhibition and Event Space

13.2.2.1. Drivers

13.2.2.2. Restraints

13.2.2.3. Opportunities

13.2.2.4. Trends

13.3. Data Centers

13.3.1. UAE Commercial Interior Fit Out Market, By Data Centers, By Region, 2017-2030 (US$ Mn)

13.3.2. Market Dynamics for Data Centers

13.3.2.1. Drivers

13.3.2.2. Restraints

13.3.2.3. Opportunities

13.3.2.4. Trends

13.4. Laboratories

13.4.1. UAE Commercial Interior Fit Out Market, By Laboratories, By Region, 2017-2030 (US$ Mn)

13.4.2. Market Dynamics for Laboratories

13.4.2.1. Drivers

13.4.2.2. Restraints

13.4.2.3. Opportunities

13.4.2.4. Trends

13.5. Specialized Healthcare Facilities

13.5.1. UAE Commercial Interior Fit Out Market, By Specialized Healthcare Facilities, By Region, 2017-2030 (US$ Mn)

13.5.2. Market Dynamics for Specialized Healthcare Facilities

13.5.2.1. Drivers

13.5.2.2. Restraints

13.5.2.3. Opportunities

13.5.2.4. Trends

13.6. Gyms and Fitness Centers

13.6.1. UAE Commercial Interior Fit Out Market, By Gyms and Fitness Centers, By Region, 2017-2030 (US$ Mn)

13.6.2. Market Dynamics for Gyms and Fitness Centers

13.6.2.1. Drivers

13.6.2.2. Restraints

13.6.2.3. Opportunities

13.6.2.4. Trends

14. UAE Commercial Interior Fit Out Market, By Region

14.1. UAE Commercial Interior Fit Out Market Overview, by Region

14.1.1. UAE Commercial Interior Fit Out Market, By Region, 2022 vs 2030 (in%)

14.2. Type of Commercial Space

14.2.1. UAE Commercial Interior Fit Out Market, By Type of Commercial Space, 2017-2030 (US$ Mn)

14.3. Scope of Services

14.3.1. UAE Commercial Interior Fit Out Market, By Scope of Services, 2017-2030 (US$ Mn)

14.4. End Users

14.4.1. UAE Commercial Interior Fit Out Market, By End Users, 2017-2030 (US$ Mn)

14.5. Style and Aesthetics

14.5.1. UAE Commercial Interior Fit Out Market, By Style and Aesthetics, 2017-2030 (US$ Mn)

14.6. Budget and Scale

14.6.1. UAE Commercial Interior Fit Out Market, By Budget and Scale, 2017-2030 (US$ Mn)

14.7. Specialty and Niche Segments

14.7.1. UAE Commercial Interior Fit Out Market, By Specialty and Niche Segments, 2017-2030 (US$ Mn)

15. Company Profiles

15.1. A & T Group Interiors

15.1.1. Company Overview

15.1.2. Scope of Servicess/Services Portfolio

15.1.3. Geographical Presence

15.1.4. SWOT Analysis

15.1.5. Financial Summary

15.1.5.1. Market Revenue and Net Profit (2019-2022)

15.1.5.2. Business Segment Revenue Analysis

15.1.5.3. Geographical Revenue Analysis

15.2. Al Tayer Stacks LLC

15.3. Horton Interiors

15.4. BW Interiors

15.5. Summertown Interiors

15.6. The Fitout LLC

15.7. ARKI Group Design LLC

15.8. Al Shirawi Contracting Company LLC

15.9. Xworks Interior LLC

15.10. Depa Plc

16. Research Methodology

16.1. Research Methodology

16.2. Phase I – Secondary Research

16.3. Phase II – Data Modelling

16.3.1. Company Share Analysis Model

16.3.2. Revenue Based Modelling

16.4. Phase III – Primary Research

16.5. Research Limitations

16.5.1. Assumptions

List of Figures

FIG. 1 UAE Commercial Interior Fit Out Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 UAE Commercial Interior Fit Out Market Segmentation

FIG. 4 UAE Commercial Interior Fit Out Market, by Type of Commercial Space, 2022 (US$ Mn)

FIG. 5 UAE Commercial Interior Fit Out Market, By Scope of Services, 2022 (US$ Mn)

FIG. 6 UAE Commercial Interior Fit Out Market, by End Users, 2022 (US$ Mn)

FIG. 7 UAE Commercial Interior Fit Out Market, by Data Trasnfer Speed, 2022 (US$ Mn)

FIG. 8 UAE Commercial Interior Fit Out Market, by Budget and Scale, 2022 (US$ Mn)

FIG. 9 UAE Commercial Interior Fit Out Market, by Specialty and Niche Segments, 2022 (US$ Mn)

FIG. 10 UAE Commercial Interior Fit Out Market, by Geography, 2022 (US$ Mn)

FIG. 11 Attractive Investment Proposition, by Type of Commercial Space, 2022

FIG. 12 Attractive Investment Proposition, By Scope of Services, 2022

FIG. 13 Attractive Investment Proposition, by End Users, 2022

FIG. 14 Attractive Investment Proposition, by Style and Aesthetics, 2022

FIG. 15 Attractive Investment Proposition, by Budget and Scale, 2022

FIG. 16 Attractive Investment Proposition, by Specialty and Niche Segments, 2022

FIG. 17 Attractive Investment Proposition, by Geography, 2022

FIG. 18 Market Share Analysis of Key UAE Commercial Interior Fit Out Market Manufacturers, 2022

FIG. 19 Market Positioning of Key UAE Commercial Interior Fit Out Market Manufacturers, 2022

FIG. 20 UAE Commercial Interior Fit Out Market Value Contribution, By Type of Commercial Space, 2022 & 2030 (Value %)

FIG. 21 UAE Commercial Interior Fit Out Market, by OFFICE INTERIORS, Value, 2017-2030 (US$ Mn)

FIG. 22 UAE Commercial Interior Fit Out Market, by RETAIL INTERIORS, Value, 2017-2030 (US$ Mn)

FIG. 23 UAE Commercial Interior Fit Out Market, by Hospitality Interiors, Value, 2017-2030 (US$ Mn)

FIG. 24 UAE Commercial Interior Fit Out Market, by Healthcare Interiors, Value, 2017-2030 (US$ Mn)

FIG. 25 UAE Commercial Interior Fit Out Market, by Education Interiors, Value, 2017-2030 (US$ Mn)

FIG. 26 UAE Commercial Interior Fit Out Market, by Government and Public Sector Interiors, Value, 2017-2030 (US$ Mn)

FIG. 27 UAE Commercial Interior Fit Out Market Value Contribution, By Scope of Services, 2022 & 2030 (Value %)

FIG. 28 UAE Commercial Interior Fit Out Market, by Design Services, Value, 2017-2030 (US$ Mn)

FIG. 29 UAE Commercial Interior Fit Out Market, by Fit-Out Services, Value, 2017-2030 (US$ Mn)

FIG. 30 UAE Commercial Interior Fit Out Market, by Furniture and Fixture Installation, Value, 2017-2030 (US$ Mn)

FIG. 31 UAE Commercial Interior Fit Out Market, by Project Management, Value, 2017-2030 (US$ Mn)

FIG. 32 UAE Commercial Interior Fit Out Market, by Turnkey Solutions, Value, 2017-2030 (US$ Mn)

FIG. 33 UAE Commercial Interior Fit Out Market, by Renovation and Refurbishment, Value, 2017-2030 (US$ Mn)

FIG. 34 UAE Commercial Interior Fit Out Market Value Contribution, By End Users, 2022 & 2030 (Value %)

FIG. 35 UAE Commercial Interior Fit Out Market, by Private Sector, Value, 2017-2030 (US$ Mn)

FIG. 36 UAE Commercial Interior Fit Out Market, by Fit-Out Services, Value, 2017-2030 (US$ Mn)

FIG. 37 UAE Commercial Interior Fit Out Market, by Small and Medium Enterprises (SMEs), Value, 2017-2030 (US$ Mn)

FIG. 38 UAE Commercial Interior Fit Out Market, by Large Enterprises, Value, 2017-2030 (US$ Mn)

FIG. 39 UAE Commercial Interior Fit Out Market, by Hospitality and Retail Chains, Value, 2017-2030 (US$ Mn)

FIG. 40 UAE Commercial Interior Fit Out Market Value Contribution, By Style and Aesthetics, 2022 & 2030 (Value %)

FIG. 41 UAE Commercial Interior Fit Out Market, by Modern and Contemporary, Value, 2017-2030 (US$ Mn)

FIG. 42 UAE Commercial Interior Fit Out Market, by Traditional and Classic, Value, 2017-2030 (US$ Mn)

FIG. 43 UAE Commercial Interior Fit Out Market, by Minimalist and Industrial, Value, 2017-2030 (US$ Mn)

FIG. 44 UAE Commercial Interior Fit Out Market, by Eco-Friendly and Sustainable, Value, 2017-2030 (US$ Mn)

FIG. 45 UAE Commercial Interior Fit Out Market, by High-Tech and Futuristic, Value, 2017-2030 (US$ Mn)

FIG. 46 UAE Commercial Interior Fit Out Market Value Contribution, By Budget and Scale, 2022 & 2030 (Value %)

FIG. 47 UAE Commercial Interior Fit Out Market, by Budget Fit-Outs, Value, 2017-2030 (US$ Mn)

FIG. 48 UAE Commercial Interior Fit Out Market, by High-End and Luxury Fit-Outs, Value, 2017-2030 (US$ Mn)

FIG. 49 UAE Commercial Interior Fit Out Market, by Medium-Scale Fit-Outs, Value, 2017-2030 (US$ Mn)

FIG. 50 UAE Commercial Interior Fit Out Market Value Contribution, By Specialty and Niche Segments, 2022 & 2030 (Value %)

FIG. 51 UAE Commercial Interior Fit Out Market, by Exhibition and Event Space, Value, 2017-2030 (US$ Mn)

FIG. 52 UAE Commercial Interior Fit Out Market, by Data Centers, Value, 2017-2030 (US$ Mn)

FIG. 53 UAE Commercial Interior Fit Out Market, by Laboratories, Value, 2017-2030 (US$ Mn)

FIG. 54 UAE Commercial Interior Fit Out Market, by Specialized Healthcare Facilities, Value, 2017-2030 (US$ Mn)

FIG. 55 UAE Commercial Interior Fit Out Market, by Gyms and Fitness Centers, Value, 2017-2030 (US$ Mn)

List of Tables

TABLE 1 Market Snapshot: UAE Commercial Interior Fit Out Market

TABLE 2 UAE Commercial Interior Fit Out Market: Market Drivers Impact Analysis

TABLE 3 UAE Commercial Interior Fit Out Market: Market Restraints Impact Analysis

TABLE 4 UAE Commercial Interior Fit Out Market, by Competitive Benchmarking, 2022

TABLE 5 UAE Commercial Interior Fit Out Market, by Geographical Presence Analysis, 2022

TABLE 6 UAE Commercial Interior Fit Out Market, by Key Strategies Analysis, 2022

TABLE 7 UAE Commercial Interior Fit Out Market, by Office Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 8 UAE Commercial Interior Fit Out Market, by Office Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 9 UAE Commercial Interior Fit Out Market, by Retail Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 10 UAE Commercial Interior Fit Out Market, by Retail Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 11 UAE Commercial Interior Fit Out Market, by Hospitality Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 12 UAE Commercial Interior Fit Out Market, by Hospitality Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 13 UAE Commercial Interior Fit Out Market, by Hospitality Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 14 UAE Commercial Interior Fit Out Market, by Hospitality Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 15 UAE Commercial Interior Fit Out Market, by Education Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 16 UAE Commercial Interior Fit Out Market, by Education Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 17 UAE Commercial Interior Fit Out Market, by Government and Public Sector Interiors, By Region, 2017-2022 (US$ Mn)

TABLE 18 UAE Commercial Interior Fit Out Market, by Government and Public Sector Interiors, By Region, 2023-2030 (US$ Mn)

TABLE 19 UAE Commercial Interior Fit Out Market, by Design Services, By Region, 2017-2022 (US$ Mn)

TABLE 20 UAE Commercial Interior Fit Out Market, by Design Services, By Region, 2023-2030 (US$ Mn)

TABLE 21 UAE Commercial Interior Fit Out Market, by Fit-Out Services, By Region, 2017-2022 (US$ Mn)

TABLE 22 UAE Commercial Interior Fit Out Market, by Fit-Out Services, By Region, 2023-2030 (US$ Mn)

TABLE 23 UAE Commercial Interior Fit Out Market, by Furniture and Fixture Installation, By Region, 2017-2022 (US$ Mn)

TABLE 24 UAE Commercial Interior Fit Out Market, by Furniture and Fixture Installation, By Region, 2023-2030 (US$ Mn)

TABLE 25 UAE Commercial Interior Fit Out Market, by Project Management, By Region, 2017-2022 (US$ Mn)

TABLE 26 UAE Commercial Interior Fit Out Market, by Project Management, By Region, 2023-2030 (US$ Mn)

TABLE 27 UAE Commercial Interior Fit Out Market, by Turnkey Solutions, By Region, 2017-2022 (US$ Mn)

TABLE 28 UAE Commercial Interior Fit Out Market, by Turnkey Solutions, By Region, 2023-2030 (US$ Mn)

TABLE 29 UAE Commercial Interior Fit Out Market, by Renovation and Refurbishment, By Region, 2017-2022 (US$ Mn)

TABLE 30 UAE Commercial Interior Fit Out Market, by Renovation and Refurbishment, By Region, 2023-2030 (US$ Mn)

TABLE 31 UAE Commercial Interior Fit Out Market, by Private Sector, By Region, 2017-2022 (US$ Mn)

TABLE 32 UAE Commercial Interior Fit Out Market, by Private Sector, By Region, 2023-2030 (US$ Mn)

TABLE 33 UAE Commercial Interior Fit Out Market, by Public Sector, By Region, 2017-2022 (US$ Mn)

TABLE 34 UAE Commercial Interior Fit Out Market, by Public Sector, By Region, 2023-2030 (US$ Mn)

TABLE 35 UAE Commercial Interior Fit Out Market, by Small and Medium Enterprises (SMEs), By Region, 2017-2022 (US$ Mn)

TABLE 36 UAE Commercial Interior Fit Out Market, by Small and Medium Enterprises (SMEs), By Region, 2023-2030 (US$ Mn)

TABLE 37 UAE Commercial Interior Fit Out Market, by Modern and Contemporary, By Region, 2017-2022 (US$ Mn)

TABLE 38 UAE Commercial Interior Fit Out Market, by Modern and Contemporary, By Region, 2023-2030 (US$ Mn)

TABLE 39 UAE Commercial Interior Fit Out Market, by Traditional and Classic, By Region, 2017-2022 (US$ Mn)

TABLE 40 UAE Commercial Interior Fit Out Market, by Traditional and Classic, By Region, 2023-2030 (US$ Mn)

TABLE 41 UAE Commercial Interior Fit Out Market, by Minimalist and Industrial, By Region, 2017-2022 (US$ Mn)

TABLE 42 UAE Commercial Interior Fit Out Market, by Minimalist and Industrial, By Region, 2023-2030 (US$ Mn)

TABLE 43 UAE Commercial Interior Fit Out Market, by Eco-Friendly and Sustainable, By Region, 2017-2022 (US$ Mn)

TABLE 44 UAE Commercial Interior Fit Out Market, by Eco-Friendly and Sustainable, By Region, 2023-2030 (US$ Mn)

TABLE 45 UAE Commercial Interior Fit Out Market, by High-Tech and Futuristic, By Region, 2017-2022 (US$ Mn)

TABLE 46 UAE Commercial Interior Fit Out Market, by High-Tech and Futuristic, By Region, 2023-2030 (US$ Mn)

TABLE 47 UAE Commercial Interior Fit Out Market, by Budget Fit-Outs, By Region, 2023-2030 (US$ Mn)

TABLE 48 UAE Commercial Interior Fit Out Market, by Budget Fit-Outs, By Region, 2017-2022 (US$ Mn)

TABLE 49 UAE Commercial Interior Fit Out Market, by High-End and Luxury Fit-Outs, By Region, 2023-2030 (US$ Mn)

TABLE 50 UAE Commercial Interior Fit Out Market, by High-End and Luxury Fit-Outs, By Region, 2017-2022 (US$ Mn)

TABLE 51 UAE Commercial Interior Fit Out Market, by Medium-Scale Fit-Outs, By Region, 2023-2030 (US$ Mn)

TABLE 52 UAE Commercial Interior Fit Out Market, by Medium-Scale Fit-Outs, By Region, 2017-2022 (US$ Mn)

TABLE 53 UAE Commercial Interior Fit Out Market, by Exhibition and Event Space, By Region, 2017-2022 (US$ Mn)

TABLE 54 UAE Commercial Interior Fit Out Market, by Exhibition and Event Space, By Region, 2023-2030 (US$ Mn)

TABLE 55 UAE Commercial Interior Fit Out Market, by Data Centers, By Region, 2017-2022 (US$ Mn)

TABLE 56 UAE Commercial Interior Fit Out Market, by Data Centers, By Region, 2023-2030 (US$ Mn)

TABLE 57 UAE Commercial Interior Fit Out Market, by Laboratories, By Region, 2017-2022 (US$ Mn)

TABLE 58 UAE Commercial Interior Fit Out Market, by Laboratories, By Region, 2023-2030 (US$ Mn)

TABLE 59 UAE Commercial Interior Fit Out Market, by Specialized Healthcare Facilities, By Region, 2017-2022 (US$ Mn)

TABLE 60 UAE Commercial Interior Fit Out Market, by Specialized Healthcare Facilities, By Region, 2023-2030 (US$ Mn)

TABLE 61 UAE Commercial Interior Fit Out Market, by Gyms and Fitness Centers, By Region, 2017-2022 (US$ Mn)

TABLE 62 UAE Commercial Interior Fit Out Market, by Gyms and Fitness Centers, By Region, 2023-2030 (US$ Mn)

TABLE 63 UAE Commercial Interior Fit Out Market, by Type of Commercial Space, 2017-2022 (US$ Mn)

TABLE 64 UAE Commercial Interior Fit Out Market, by Type of Commercial Space, 2023-2030 (US$ Mn)

TABLE 65 UAE Commercial Interior Fit Out Market, By Scope of Services, 2017-2022 (US$ Mn)

TABLE 66 UAE Commercial Interior Fit Out Market, By Scope of Services, 2023-2030 (US$ Mn)

TABLE 67 UAE Commercial Interior Fit Out Market, by End Users, 2017-2022 (US$ Mn)

TABLE 68 UAE Commercial Interior Fit Out Market, by End Users, 2023-2030 (US$ Mn)

TABLE 69 UAE Commercial Interior Fit Out Market, by Style and Aesthetics, By Region, 2017-2022 (US$ Mn)

TABLE 70 UAE Commercial Interior Fit Out Market, by Style and Aesthetics, By Region, 2023-2030 (US$ Mn)

TABLE 71 UAE Commercial Interior Fit Out Market, by Budget and Scale, 2017-2022 (US$ Mn)

TABLE 72 UAE Commercial Interior Fit Out Market, by Budget and Scale, 2023-2030 (US$ Mn)

TABLE 73 UAE Commercial Interior Fit Out Market, by Specialty and Niche Segments, 2017-2022 (US$ Mn)

TABLE 74 UAE Commercial Interior Fit Out Market, by Specialty and Niche Segments, 2023-2030 (US$ Mn)

TABLE 75 UAE Commercial Interior Fit Out Market, by Region, 2017-2022 (US$ Mn)

TABLE 76 UAE Commercial Interior Fit Out Market, by Region, 2023-2030 (US$ Mn)