Market Overview:

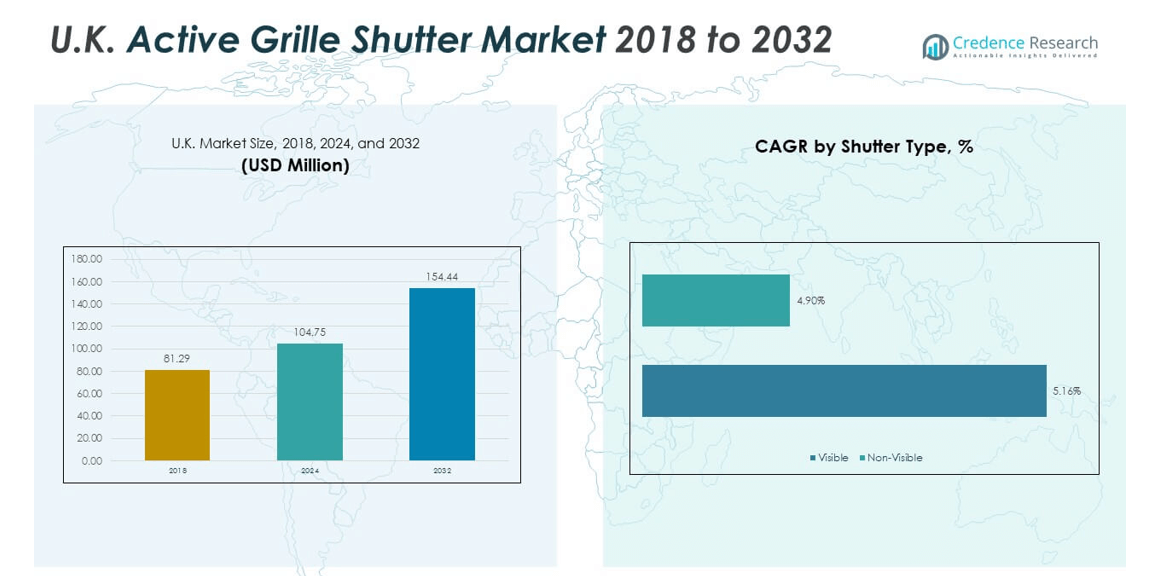

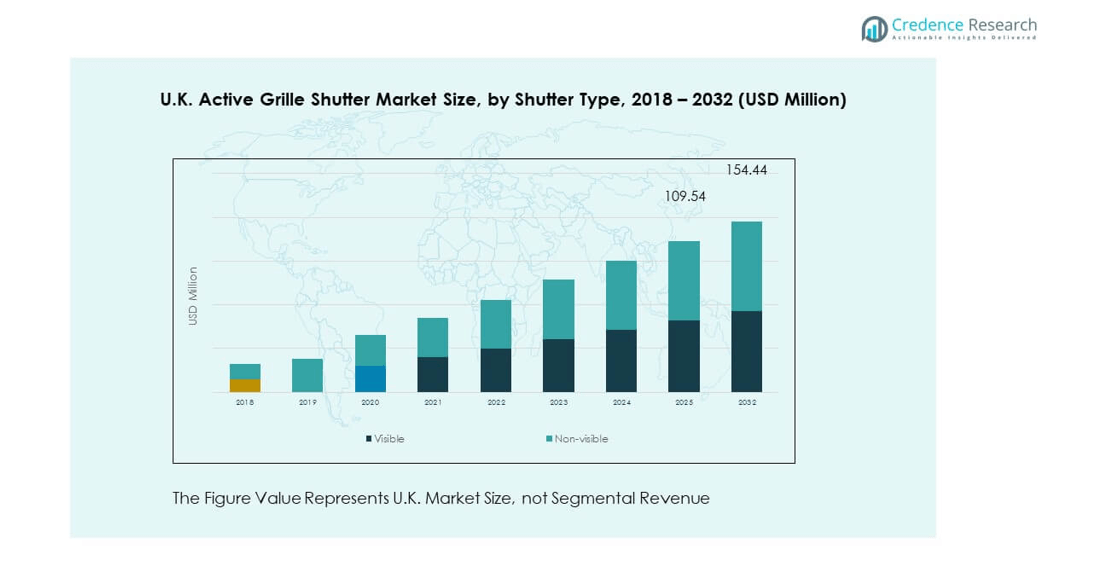

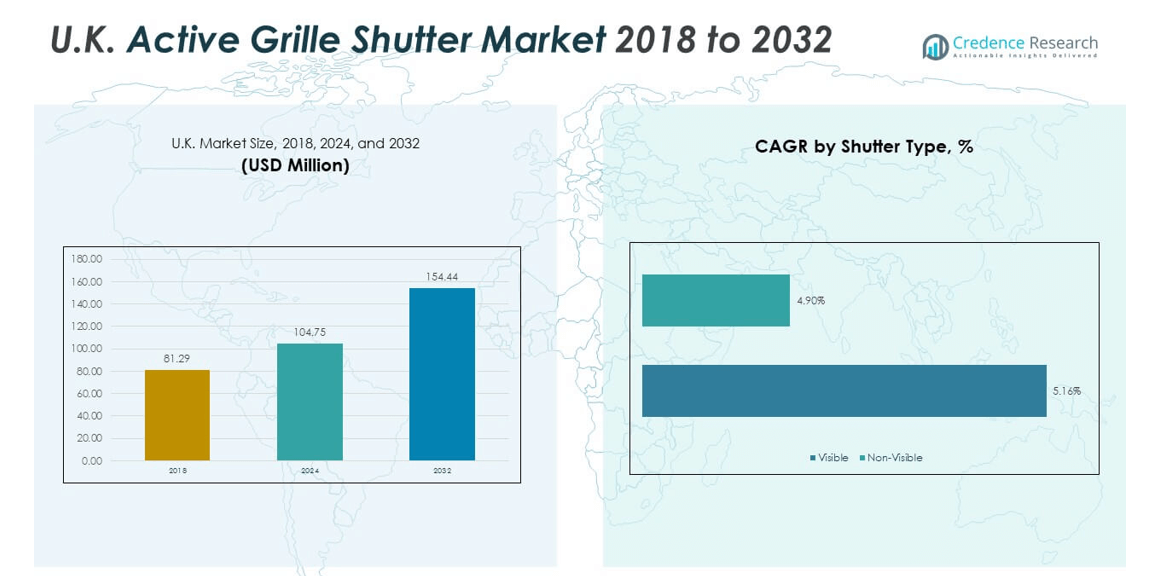

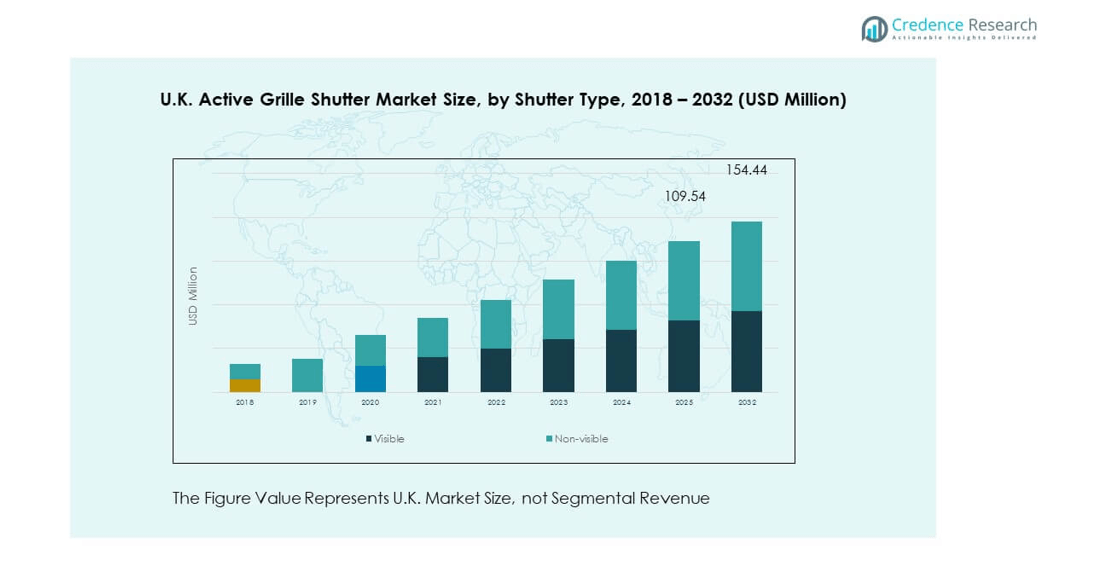

The U.K. Active Grille Shutter Market size was valued at USD 81.29 million in 2018 to USD 104.75 million in 2024 and is anticipated to reach USD 154.44 million by 2032, at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Active Grille Shutter Market Size 2024 |

USD 104.75 million |

| U.K. Active Grille Shutter Market, CAGR |

5.0% |

| U.K. Active Grille Shutter Market Size 2032 |

USD 154.44 million |

The market is being driven by rising adoption of energy-efficient automotive technologies and stricter emission standards. Active grille shutters help reduce drag, improve aerodynamics, and enhance fuel efficiency, aligning with the U.K.’s push toward cleaner mobility. Automakers are increasingly integrating these systems into both conventional and electric vehicles to optimize performance, reduce carbon emissions, and meet regulatory targets. Growing consumer preference for advanced automotive features also supports demand.

Within the regional landscape, Western Europe, particularly the U.K., plays a central role due to its strong automotive industry and early adoption of emission reduction technologies. Germany and France remain influential with established OEMs integrating advanced aerodynamic solutions. Meanwhile, Eastern European markets are emerging as production hubs, driven by cost advantages and expanding automotive manufacturing capabilities. This dynamic mix highlights the U.K.’s leadership while underlining growth potential across Europe.

Market Insights:

- The U.K. Active Grille Shutter Market was valued at USD 81.29 million in 2018, reached USD 104.75 million in 2024, and is projected to hit USD 154.44 million by 2032, registering a CAGR of 5.0%.

- England held the largest share at 62% due to its strong automotive clusters, Scotland followed with 18% supported by sustainability policies, and Wales captured 12% backed by component investments.

- Northern Ireland, with an 8% share, is the fastest-growing region, supported by its role as a trade hub and rising adoption of imported vehicles.

- In 2024, non-visible shutters accounted for 61% of the market share, driven by cost-effectiveness and widespread use across mass-market vehicles.

- Visible shutters held 39% share, with higher adoption in premium and luxury vehicles due to their aesthetic and aerodynamic value.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need for Aerodynamic Efficiency and Reduced Vehicle Emissions

The U.K. Active Grille Shutter Market is driven by the country’s regulatory push for lower emissions and better fuel economy. Government authorities have tightened carbon dioxide targets, which compels manufacturers to integrate advanced airflow management systems. Active grille shutters reduce aerodynamic drag, helping vehicles meet stringent standards. Consumers also demand fuel-efficient cars, encouraging automakers to adopt these technologies across mid-range and premium segments. It also aids in reducing warm-up times, which improves engine performance. Rising awareness of environmental sustainability adds further pressure on the industry. Automotive OEMs now view grille shutters as vital for compliance and competitiveness. The market benefits from a combination of regulations, consumer behavior, and technological value.

- For instance, Ford Motor Company implemented active grille shutters on its Focus model in the U.K., resulting in a reduction of aerodynamic drag coefficient by up to 025and improved combined fuel efficiency by 5% compared to previous versions without active grille shutters.

Increasing Integration of Advanced Thermal Management Solutions in Automobiles

The rising adoption of advanced thermal management systems fuels demand for active grille shutters in the U.K. market. Automakers seek to maintain optimal engine and battery performance in varying conditions. Active grille shutters support faster engine warm-up and controlled cooling, which extends vehicle life. Electric and hybrid models also benefit from this integration, as controlled airflow aids in preserving battery efficiency. It allows manufacturers to market vehicles with longer durability and lower maintenance requirements. The U.K. Active Grille Shutter Market reflects this trend as local and global OEMs expand offerings. Growing use of composite materials also makes shutters lighter, supporting vehicle efficiency. The integration of thermal management with aerodynamic functions highlights a strong driver for adoption.

Rising Adoption of Lightweight Materials and Cost Reduction Strategies

Lightweight vehicle construction continues to drive active grille shutter adoption in the U.K. market. Automakers reduce vehicle weight to meet efficiency targets without compromising performance. Composite and polymer-based shutter systems offer significant weight reduction compared to traditional metal units. It helps improve vehicle handling and lowers overall energy consumption. Cost optimization strategies by automakers also push suppliers to deliver advanced but affordable grille systems. Suppliers integrate automation and modular designs to lower production costs and expand adoption. The U.K. Active Grille Shutter Market benefits from these dynamics as OEMs prioritize efficiency and competitiveness. The focus on sustainability and affordability ensures steady growth for the segment.

- For instance, Magna International developed active grille shutter systems using glass-fiber-reinforced polypropylene, achieving a weight reduction of up to 28% compared to traditional ABS plastic designs, while maintaining durability and aerodynamic performance.

Rising Demand for Aerodynamic Enhancements in Electric and Hybrid Vehicles

The shift toward electric and hybrid vehicles increases demand for grille shutter technologies. These systems help extend vehicle range by reducing drag and improving aerodynamic flow. Electric models rely on efficient cooling, and grille shutters provide effective airflow control. It also improves battery protection under demanding driving conditions. Automakers competing in the U.K. market prioritize these features to attract eco-conscious consumers. The U.K. Active Grille Shutter Market reflects this driver as both local and international brands target efficiency improvements. Growing adoption of EVs accelerates the need for advanced airflow management systems. The convergence of sustainability goals and technology makes grille shutters essential for next-generation mobility.

Market Trends:

Expansion of Smart and Digitally Controlled Grille Shutter Systems

Smart technologies shape the direction of the U.K. Active Grille Shutter Market. Manufacturers increasingly adopt digital sensors and electronic actuators for precise airflow control. These systems adjust in milliseconds to match speed, climate, and driving conditions. It enhances thermal management while reducing aerodynamic drag more efficiently than mechanical versions. The integration with vehicle diagnostics provides real-time data to improve maintenance schedules. Automakers in the U.K. now incorporate predictive maintenance functions supported by these shutters. The adoption of digitally controlled solutions represents a shift toward connected and intelligent automotive systems. This trend enhances consumer trust and supports long-term performance.

- For instance, Valeo’s active grille shutter systems, as detailed in their latest technical catalogue, link real-time airflow adjustment to vehicle ECUs via digital communication interfaces, enabling verified fuel savings of up to 2–5 grams CO₂/km and a specific drag coefficient reduction of 4.8% on recent vehicle models.

Rising Focus on Integration with Vehicle Aesthetic and Brand Identity

Manufacturers emphasize design integration of grille shutters to align with brand identity. The U.K. Active Grille Shutter Market reflects growing consumer preference for premium styling features. Automakers now design shutters that remain visible and enhance vehicle aesthetics while performing functional roles. It creates a balance between performance and visual appeal. Luxury vehicle brands adopt this approach to differentiate their models. The combination of aerodynamic benefits and design value boosts acceptance across high-end segments. The trend shows that grille shutters are no longer just functional components. Instead, they evolve into design-linked features with significant marketing value.

- For instance, BMW integrates visible active grille shutters on the 7 Series, designed with vertical slats that enhance aerodynamics while preserving the vehicle’s signature styling.

Expansion of EV-Centric Grille Shutter Solutions for Thermal and Aerodynamic Balance

Electric vehicle adoption drives new grille shutter designs suited for battery cooling and drag reduction. The U.K. Active Grille Shutter Market reflects strong alignment with EV innovation. Suppliers develop compact, lightweight shutters tailored for EV platforms. It ensures thermal balance without unnecessary energy losses. Manufacturers also use shutters to achieve longer driving ranges by minimizing resistance. Growing competition among EV producers pushes suppliers to create highly efficient models. Integration with smart battery management systems further enhances performance benefits. This trend highlights the vital role shutters play in supporting EV growth.

Adoption of Modular and Scalable Grille Shutter Designs for Mass Production

Automakers focus on modular grille shutter designs to support multiple vehicle platforms. The U.K. Active Grille Shutter Market benefits from scalable solutions that lower development costs. Suppliers create shutters adaptable to compact cars, SUVs, and luxury sedans. It reduces production complexity and accelerates deployment across different vehicle categories. Modular designs also allow automakers to standardize quality and reliability. Suppliers in the U.K. increasingly adopt automated manufacturing for these solutions. The trend reflects the industry’s push for efficiency and broader application. Standardization ensures that shutters become a common feature across varied automotive classes.

Market Challenges Analysis:

High Production Costs and Supply Chain Constraints in Automotive Manufacturing

The U.K. Active Grille Shutter Market faces challenges linked to cost and supply chain management. High-grade composites and electronic components raise production expenses for suppliers. Automakers expect affordable yet advanced solutions, creating pressure on margins. It drives the need for efficient production systems and reliable supplier networks. Supply chain disruptions in Europe also impact component availability and delivery timelines. Global crises and raw material shortages increase risk factors for manufacturers. The industry must overcome these hurdles to ensure consistent production and adoption. OEMs demand scalability, and suppliers must balance cost with quality. Addressing these constraints is critical to long-term growth.

Limited Consumer Awareness and Aftermarket Adoption in Developing Segments

A significant challenge involves limited consumer awareness about grille shutter benefits in mid-range vehicle categories. Many buyers focus on immediate cost rather than long-term efficiency gains. The U.K. Active Grille Shutter Market reflects this challenge across less premium segments. It creates slower adoption rates compared to luxury and EV categories. Aftermarket demand also remains limited due to low replacement awareness. Automakers and suppliers must invest in consumer education and marketing strategies. Without strong awareness, adoption will remain concentrated in top-tier models. Building consumer trust is vital for broader market penetration.

Market Opportunities:

Integration of Grille Shutters into Expanding Electric Vehicle Segment

The U.K. Active Grille Shutter Market offers opportunities within the growing EV segment. Automakers seek advanced thermal and aerodynamic systems to optimize vehicle range. It positions grille shutters as a crucial feature in EV adoption. Suppliers can capitalize by designing compact, lightweight, and energy-efficient shutters. Partnerships with EV producers create growth prospects. It opens opportunities for suppliers to differentiate with innovative technologies. Consumer preference for eco-friendly mobility strengthens this potential.

Leveraging Advanced Materials and Smart Controls for Future Growth

The adoption of smart technologies and advanced composites presents new opportunities for suppliers. The U.K. Active Grille Shutter Market reflects strong demand for intelligent, digitally controlled systems. It allows for precise control, real-time diagnostics, and predictive maintenance. Lightweight polymers and reinforced composites provide cost and performance advantages. Suppliers investing in such innovations gain a competitive edge. It also enables alignment with global sustainability targets. Market growth will rely on suppliers combining material science and digital innovation.

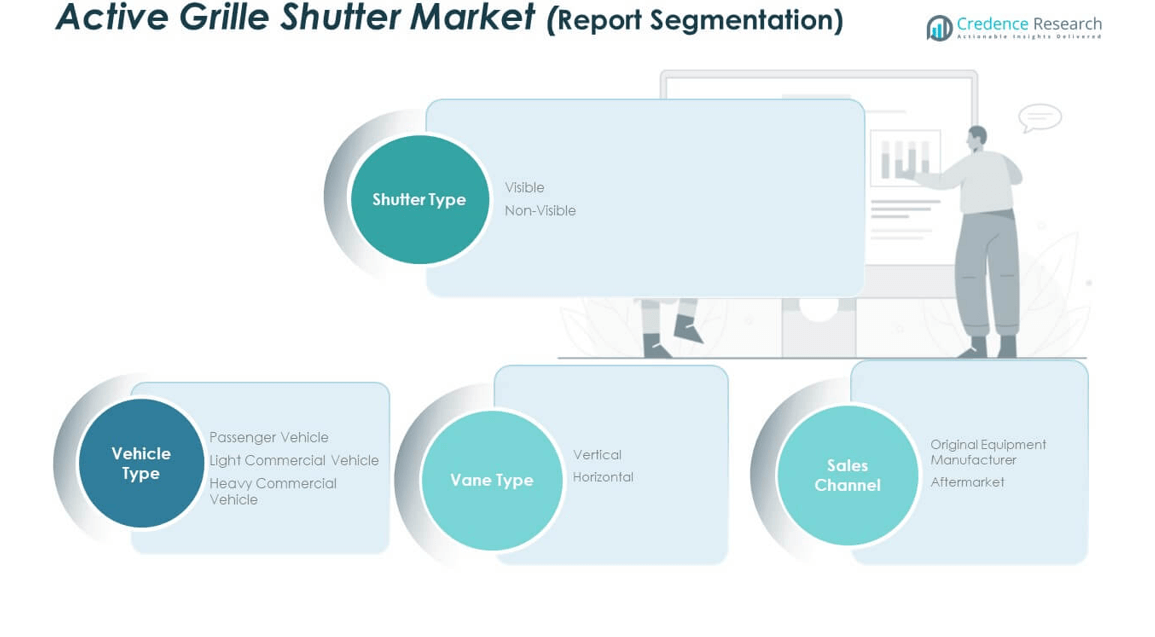

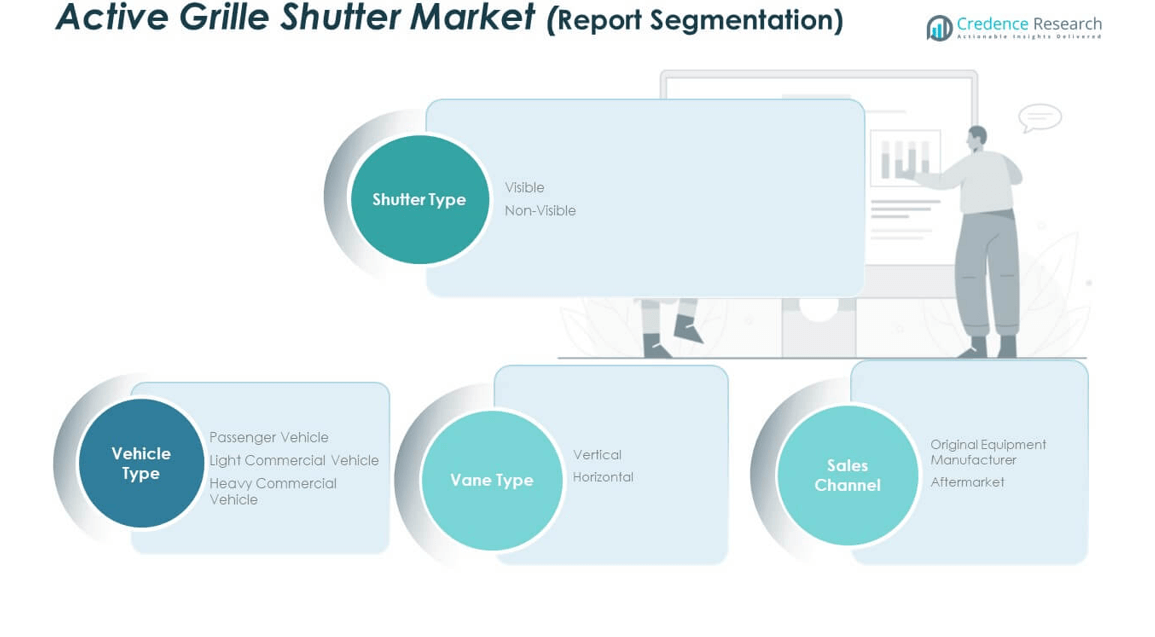

Market Segmentation Analysis:

By shutter type, the U.K. Active Grille Shutter Market is divided into visible and non-visible systems. Visible shutters are gaining traction in premium vehicles due to their blend of functionality and design appeal, offering aerodynamic efficiency while enhancing brand aesthetics. Non-visible shutters dominate mass-market and utility vehicles, providing cost-effective solutions for reducing drag and improving fuel efficiency. It reflects the balance between performance-oriented design and widespread adoption across varied price segments.

- For instance, the Chevrolet Malibu (General Motors) has used a visible active grille shutter system, mounted in the front grille, since at least the 2013 model year to enhance aerodynamics.

By vehicle type, passenger vehicles hold the largest share due to high production volumes and strong consumer demand for fuel-efficient models. Light commercial vehicles also contribute significantly, with fleet operators adopting grille shutters to improve operational efficiency. Heavy commercial vehicles remain a smaller but growing category, as manufacturers integrate aerodynamic technologies to reduce emissions and comply with tightening standards. The U.K. Active Grille Shutter Market benefits from adoption across both consumer and commercial sectors.

- For instance, the Toyota Camry integrates active grille shutters as standard equipment on recent models, particularly hybrids, to improve aerodynamics and fuel efficiency.

By vane type, vertical shutters are increasingly integrated into high-performance and luxury cars, offering optimized airflow and enhanced aesthetics. Horizontal shutters maintain strong adoption in mainstream vehicle categories due to their simpler design and cost benefits. It indicates a clear segmentation where vane orientation is tied closely to vehicle class and positioning strategies.

By sales channel, OEMs dominate the market, driven by automaker-led integration during production. The aftermarket remains limited but is gradually expanding as awareness of performance and efficiency benefits increases. It provides an emerging opportunity for suppliers seeking to reach beyond initial manufacturing channels.

Segmentation:

By Shutter Type

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Vane Type

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Regional Analysis:

England dominates the U.K. Active Grille Shutter Market with a market share of 62%, supported by its strong automotive manufacturing base and high concentration of premium vehicle production. Leading OEMs and suppliers invest in advanced aerodynamic solutions to meet consumer demand and regulatory standards. It benefits from the presence of established automotive clusters in the Midlands and North West. Increasing adoption of electric vehicles further strengthens the demand for grille shutters, particularly in luxury and performance models. The combination of industrial strength, innovation, and consumer demand secures England’s leading position.

Scotland accounts for 18% of the market, supported by its growing focus on sustainable mobility and the import of advanced vehicle technologies. While Scotland lacks large-scale automotive manufacturing, it sees demand from rising adoption of fuel-efficient and electric cars. It relies on imports and partnerships with England-based suppliers for technological integration. Government policies encouraging greener transportation foster adoption across both passenger and light commercial vehicles. Scotland’s contribution reflects steady growth potential, especially as electrification accelerates.

Wales and Northern Ireland collectively represent 20% of the market, with Wales holding 12% and Northern Ireland accounting for 8%. Wales benefits from a modest but expanding automotive supply chain, supported by investment in advanced components and vehicle assembly. Northern Ireland plays a role as a trade and distribution hub, serving both local and export markets. It shows gradual adoption of grille shutter technologies, driven by the replacement of older fleets and increasing availability of imported vehicles. While smaller in scale, both regions contribute to a balanced geographic spread within the U.K. Active Grille Shutter Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Röchling SE & Co. KG

- Valeo

- Magna International Inc.

- SRG U.K.

- Batz Group

- Standard Motor Products, Inc.

- Techniplas LLC

- Brose Fahrzeugteile GmbH & Co. KG, Coburg

- Yacenter Electric Co., Ltd.

- Keboda

- Starlite

- Aisin Corporation

Competitive Analysis:

The U.K. Active Grille Shutter Market features a competitive landscape shaped by global and regional players focusing on innovation, cost efficiency, and strategic partnerships. Leading companies such as Röchling SE & Co. KG, Valeo, and Magna International Inc. dominate with strong portfolios and advanced product lines. It emphasizes aerodynamics, lightweight materials, and integration of smart control systems to meet evolving consumer and regulatory demands. These players leverage established relationships with OEMs, ensuring consistent revenue streams and long-term contracts. Mid-tier participants, including SRG U.K., Batz Group, and Standard Motor Products, Inc., focus on niche offerings and regional supply agreements. They strengthen competitiveness by targeting specific vehicle categories, offering flexible design solutions, and aligning with OEM cost-reduction strategies. Emerging players such as Yacenter Electric Co., Keboda, and Starlite concentrate on technological differentiation, particularly in EV-compatible shutter systems. The U.K. Active Grille Shutter Market shows a clear trend toward consolidation, where established companies acquire or partner with smaller innovators to enhance product capabilities. Competitive intensity remains high, driven by pressure to reduce costs while maintaining performance and quality.

Recent Developments:

- In November 2024, Continental Automotive Systems Inc. released a new line of Active Grille Shutters for key Ford and Chrysler models. The launch covers popular vehicles like the Chrysler 200, Ford Focus, Escape, Mustang, Explorer, F-150, Fusion, and Lincoln MKZ. Designed to reduce aerodynamic drag and regulate engine cooling, these shutters remain closed during the engine warm-up phase to warm up quickly, then open at lower speeds for cooling and close again at higher speeds to lower drag.

Report Coverage:

The research report offers an in-depth analysis based on shutter type, vehicle type, vane type, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for fuel-efficient and low-emission vehicles will continue to support adoption.

- Integration of active grille shutters into electric vehicles will expand with rising EV penetration.

- Visible grille shutters will gain wider use in premium and luxury models to enhance aesthetics.

- Non-visible grille shutters will dominate mainstream categories due to affordability and efficiency benefits.

- Vertical vane designs will see rising traction in high-performance vehicles, driven by aerodynamic advantages.

- OEM channels will remain the primary contributor, supported by strong automaker partnerships.

- Aftermarket opportunities will grow steadily as consumer awareness of replacement and efficiency benefits increases.

- Technological advancements such as smart sensors and predictive maintenance will improve product value.

- Consolidation and partnerships among suppliers and OEMs will shape competitive dynamics.

- Expansion of lightweight materials and modular designs will create opportunities for scalable production.