Market Overview:

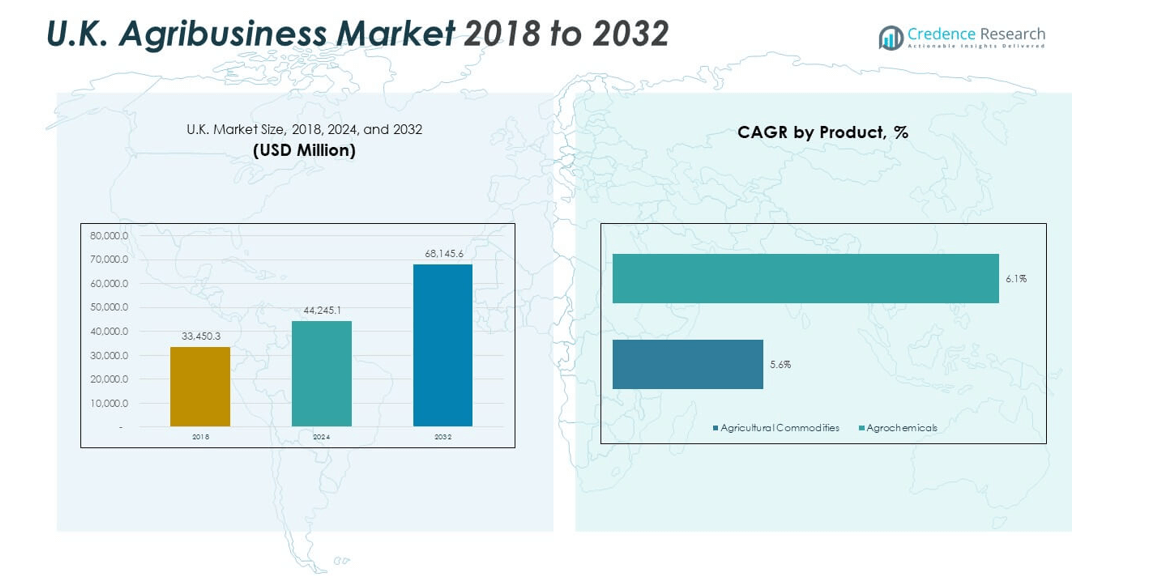

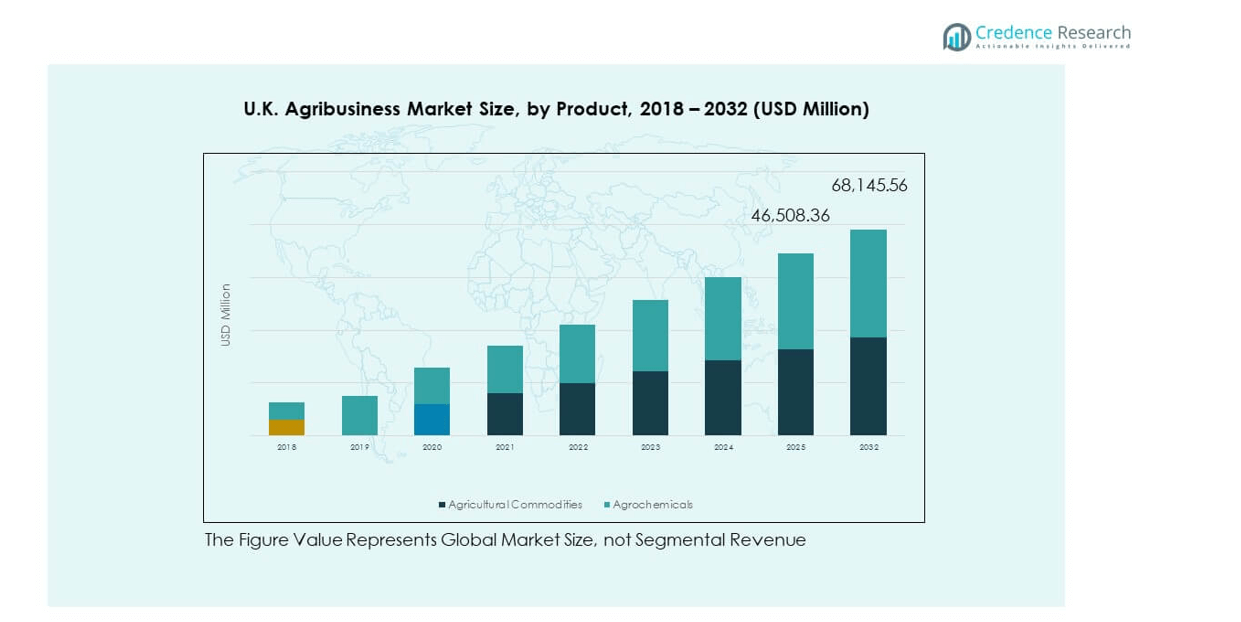

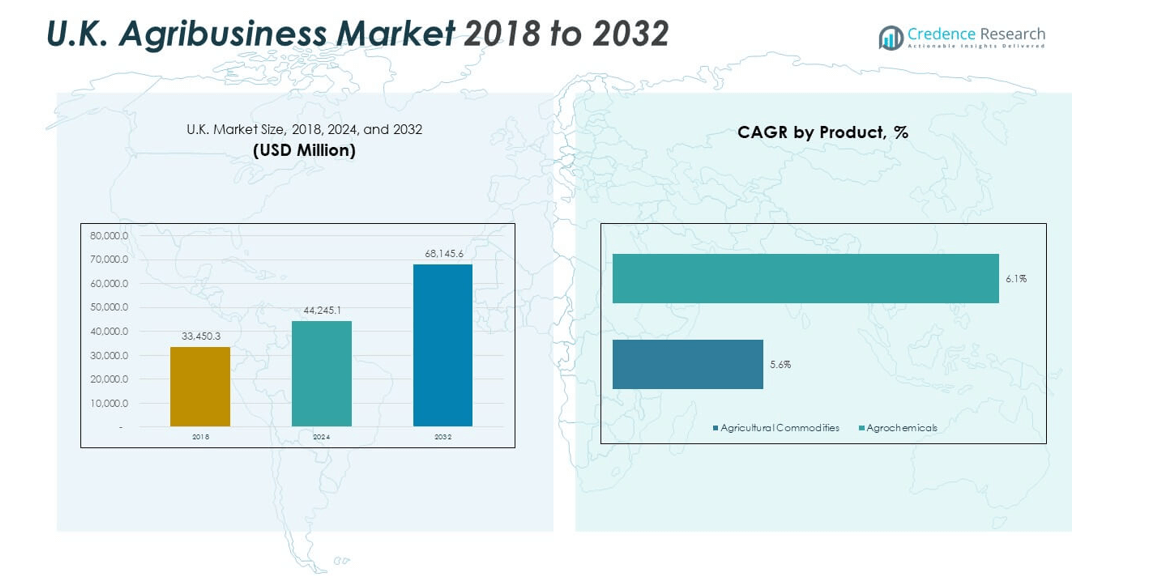

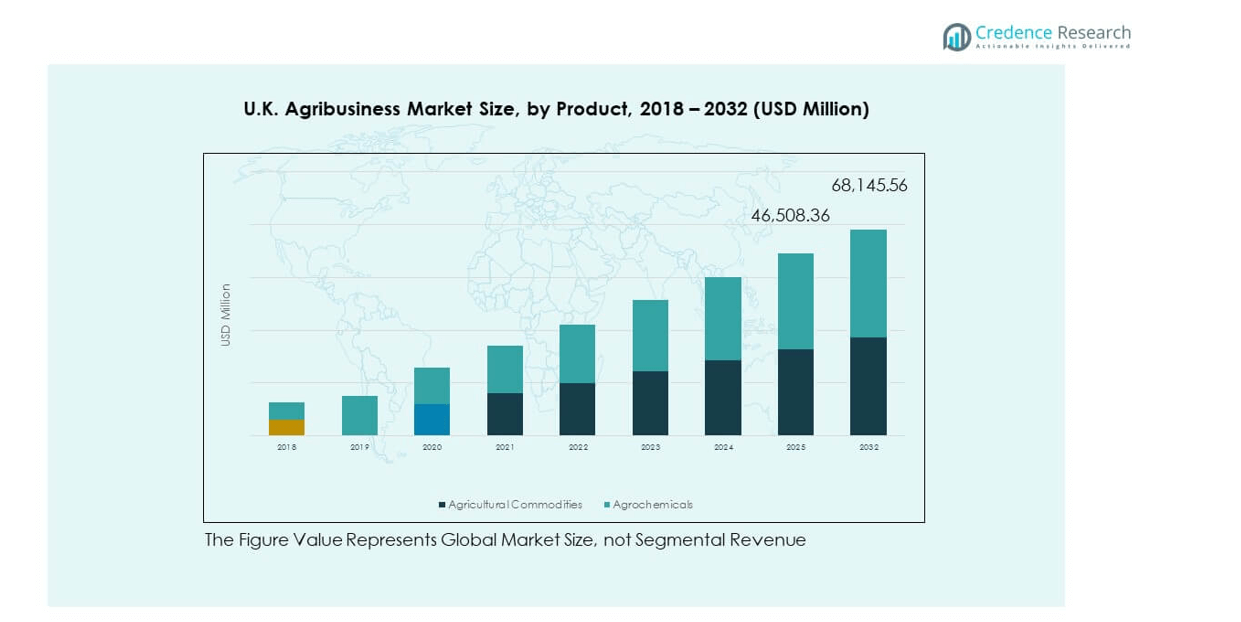

The U.K. Agribusiness Market size was valued at USD 33,450.30 million in 2018 to USD 44,245.10 million in 2024 and is anticipated to reach USD 68,145.60 million by 2032, at a CAGR of 5.61% during the forecast period. This growth reflects the sector’s capacity to adapt to evolving consumer demands, sustainability imperatives, and technological innovations, positioning it as a key contributor to the national economy.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Agribusiness Market Size 2024 |

USD 44,245.10 million |

| U.K. Agribusiness Market, CAGR |

5.61% |

| U.K. Agribusiness Market Size 2032 |

USD 68,145.60 million |

The market growth is driven by increasing demand for sustainable food production, advanced farming techniques, and improved supply chain efficiencies. Rising consumer preference for organic and locally sourced produce is encouraging investments in high-value crops and modern agricultural practices. Government initiatives supporting precision agriculture, climate-smart farming, and renewable energy integration in agribusiness are strengthening the industry’s growth trajectory. Moreover, the adoption of digital farming technologies, including AI-powered crop monitoring and automation, is enhancing productivity and reducing operational costs across farms and agribusiness enterprises.

The U.K. agribusiness sector exhibits strong regional variation, with England leading due to advanced infrastructure, a well-established farming network, and significant investment in agricultural innovation. Scotland and Wales are emerging as important players, particularly in organic farming and niche agricultural products, driven by growing domestic and export markets. Northern Ireland benefits from strong trade connections with both the U.K. and the European Union, enabling expansion in livestock and dairy production. These geographic distinctions create a diversified market landscape, enhancing the sector’s resilience and capacity for long-term growth.

Market Insights:

- The U.K. Agribusiness Market was valued at USD 44,245.10 million in 2024 and is projected to reach USD 68,145.60 million by 2032, growing at a CAGR of 5.61%.

- Growth is driven by increasing demand for sustainable farming practices, organic produce, and advanced agricultural technologies.

- Precision agriculture and smart farming solutions are enhancing productivity and reducing operational costs across the sector.

- Rising input costs for fertilizers, feed, and energy are creating pressure on profitability for producers.

- England holds the largest market share at 56%, supported by advanced infrastructure and strong export capabilities.

- Scotland’s share of 22% is bolstered by premium livestock production and barley cultivation for brewing and distilling industries.

- Wales and Northern Ireland, together holding 22%, are leveraging niche crop production, livestock farming, and improved trade connectivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Sustainable and Organic Farming Practices

The U.K. Agribusiness Market benefits from rising consumer awareness toward health, nutrition, and environmental sustainability. Demand for organic produce is expanding across urban and semi-urban areas, supported by premium pricing and higher profit margins for farmers. Government support for environmentally friendly practices is motivating farmers to adopt soil-friendly cultivation techniques and crop rotation strategies. Retailers are prioritizing local sourcing agreements, ensuring reduced carbon emissions from transportation. Farmers are leveraging organic certifications to access export markets with stricter quality standards. This transition to sustainability aligns with the U.K.’s broader climate targets and net-zero ambitions. The sector’s emphasis on transparency and traceability is also attracting health-conscious consumers. It continues to foster an agricultural ecosystem where quality, sustainability, and profitability coexist.

- For instance, Tolhurst Organic, recognized as the UK’s largest vegan and organic farm, has maintained organic certification for over 30 years and operates with a carbon footprint of around eight tonnes comparable to that of an average UK household.

Advancement of Precision Agriculture and Smart Farming Technologies

echnological adoption in the U.K. Agribusiness Market is accelerating through precision agriculture and smart farming tools. Farmers are using GPS-enabled equipment, drones, and AI-powered crop monitoring systems to improve yields and reduce waste. Digital soil mapping and automated irrigation systems are enabling more targeted use of water and fertilizers, cutting operational costs. Big data analytics is helping predict weather patterns and optimize planting schedules. Agricultural robots are assisting in harvesting, planting, and field monitoring, improving efficiency. Start-ups and established agritech companies are collaborating to develop affordable precision farming solutions for small and medium farms. Integration of blockchain is enhancing transparency across the supply chain. It is making farm operations more productive while meeting consumer demand for ethically sourced produce.

Government Policies and Financial Incentives Supporting Agriculture

The U.K. government is actively supporting agribusiness through subsidies, grants, and tax relief programs aimed at improving farm infrastructure and production efficiency. Funding is directed toward sustainable farming projects, rural development, and innovation in agriculture. Policies are encouraging diversification into alternative crops and livestock breeds that meet evolving market demands. The post-Brexit trade framework is opening new export opportunities while also requiring domestic self-reliance in food production. Local councils are working with farmers to preserve agricultural land and promote climate-friendly farming methods. The sector is benefiting from public-private partnerships aimed at improving research and technology transfer. It is creating a stable policy environment that encourages both domestic investment and foreign collaboration in the U.K. Agribusiness Market.

Expanding Global Export Potential for High-Quality British Produce

British agricultural products enjoy a strong reputation for quality, safety, and compliance with international standards, making them attractive in global markets. Demand for premium meat, dairy, cereals, and specialty crops is growing in regions such as the Middle East and Asia. Strategic trade agreements are enabling exporters to access high-value markets with reduced tariffs. Enhanced cold chain logistics and packaging innovations are ensuring extended shelf life for perishable goods. Producers are focusing on niche segments such as heritage breeds, artisanal dairy, and organic grains to differentiate in competitive export markets. Marketing campaigns are reinforcing the “British quality” brand internationally. It is helping agribusinesses secure long-term contracts with international buyers and expand their footprint beyond Europe.

- For instance, according to Food and Drinks Federation data, milk and cream exports from the UK reached £569.4million for January–June 2023, while cheese exports totaled £397.3million in the same period.

Market Trends

Rising Adoption of Vertical and Urban Farming Solutions

Urban farming and vertical agriculture are emerging as transformative trends in the U.K. Agribusiness Market. Growing population density in cities is creating demand for locally grown produce with minimal transportation time. Hydroponic and aeroponic systems are enabling year-round cultivation of leafy greens and herbs in controlled environments. Start-ups are converting unused urban spaces, including warehouses and rooftops, into productive farms. Integration of LED lighting and climate-control systems is improving yields while reducing resource consumption. Retail chains and restaurants are sourcing directly from urban farms to meet sustainability goals. This trend is fostering a shift toward decentralizing food production closer to consumption hubs. It is providing a scalable model to address food security challenges in densely populated areas.

- For example, Infarm operates modular vertical farms inside UK supermarkets and urban grocery outlets, leveraging an AI-powered, cloud-based farm management platform to monitor and optimize plant growth remotely. These systems support local production that significantly reduces transport emissions and water usage compared to conventional farming methods, while also eliminating chemical pesticides.

Integration of Renewable Energy into Agricultural Operations

Farmers are increasingly investing in renewable energy solutions such as solar panels, wind turbines, and biomass systems to power agricultural facilities. The U.K. Agribusiness Market is witnessing a shift toward energy self-sufficiency, reducing dependence on fossil fuels. Renewable-powered irrigation, heating, and storage systems are lowering long-term operational expenses. Government incentives and carbon reduction targets are encouraging adoption. Bioenergy from crop residues and animal waste is gaining traction, offering both waste management and power generation benefits. Farmers adopting green energy are gaining a competitive advantage in sustainability-focused export markets. It is positioning the agricultural sector as a proactive contributor to the U.K.’s clean energy transition.

- For example, Farmonaut, a leading UK agri-tech company, provides satellite-based advisory tools that assist farmers in optimizing the placement of solar photovoltaic systems and anaerobic digestion units. The platform also includes carbon footprint monitoring features to help assess and improve sustainability performance.

Growing Focus on Functional and Nutrient-Dense Crops

Consumer interest in functional foods with health-enhancing properties is influencing crop choices in the U.K. Agribusiness Market. Producers are expanding into nutrient-rich varieties such as high-protein pulses, omega-3-rich seeds, and antioxidant-packed berries. Food manufacturers are sourcing these ingredients to meet demand for health-focused packaged goods. Research institutions are collaborating with farmers to develop biofortified crops that address nutritional deficiencies. Marketing campaigns highlight health benefits to differentiate products in a competitive retail environment. Specialty crop cultivation is enabling farmers to capture premium market segments. It is driving innovation in breeding programs and seed technology to support nutritional diversity in agricultural output.

Expansion of Direct-to-Consumer and Digital Sales Channels

E-commerce platforms and farm-to-door delivery services are reshaping how agricultural products reach consumers. The U.K. Agribusiness Market is experiencing growth in subscription-based produce boxes, online marketplaces, and mobile ordering apps. Farmers are building direct relationships with customers through digital platforms, increasing brand loyalty. Cold chain logistics for home delivery are improving freshness and customer satisfaction. Social media marketing is helping producers showcase product origin stories and sustainable practices. Digital payment solutions are streamlining transactions for both domestic and export sales. It is allowing small and medium farms to compete effectively with larger agribusinesses by bypassing traditional retail channels.

Market Challenges Analysis

Impact of Climate Variability and Environmental Risks

Climate change poses significant risks to the U.K. Agribusiness Market through unpredictable weather patterns, increased flooding, and prolonged droughts. Extreme temperature shifts affect crop yields and livestock health. Farmers face difficulties in adapting planting and harvesting schedules to changing climatic conditions. Soil degradation and declining biodiversity are reducing long-term productivity. Water scarcity in certain regions is adding pressure to adopt efficient irrigation systems. Compliance with evolving environmental regulations requires financial and operational adjustments. It is forcing the industry to balance productivity goals with sustainability imperatives in an increasingly volatile climate environment.

Rising Input Costs and Supply Chain Disruptions

The sector is experiencing sharp increases in costs for fertilizers, feed, machinery, and energy, impacting profitability. Post-Brexit trade barriers have added complexity to importing agricultural inputs and exporting produce. Global supply chain disruptions from geopolitical tensions and pandemics have delayed critical shipments. Transportation bottlenecks are affecting perishable goods, leading to potential losses. Limited access to skilled labor in farming and processing is constraining operational capacity. Farmers are under pressure to pass on higher costs to consumers, risking reduced demand. It is compelling agribusinesses to seek cost-optimization strategies while maintaining product quality and market competitiveness.

Market Opportunities

Emergence of High-Value Crop and Specialty Product Segments

Opportunities in the U.K. Agribusiness Market are expanding through diversification into high-value crops such as medicinal herbs, exotic fruits, and specialty grains. Producers are targeting niche markets with tailored offerings to meet growing consumer interest in unique and premium food products. Collaborations with research institutions are enabling the development of climate-resilient crop varieties. Branding and certification programs are supporting higher export premiums. It is positioning farmers to capture demand in both domestic and high-income international markets.

Strengthening Export Capacity Through Trade Partnerships

New and expanded trade agreements are creating avenues for British agricultural products to access lucrative global markets. Focus on building logistics infrastructure, including cold storage and efficient freight services, is enhancing export reliability. Producers are leveraging digital tools to streamline compliance with international quality and safety standards. Government-led promotion of British produce is strengthening global brand recognition. It is enabling agribusinesses to secure long-term contracts and increase market share in competitive global trade environments.

Market Segmentation Analysis:

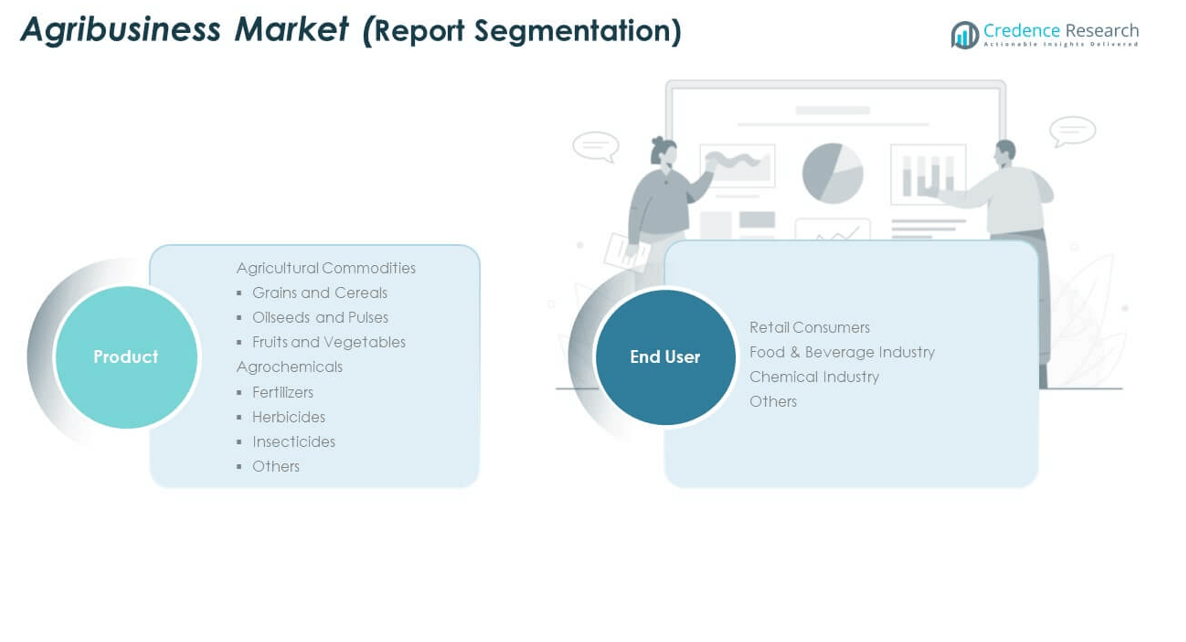

By product type, the U.K. Agribusiness Market is divided into agricultural commodities and agrochemicals. Agricultural commodities hold a substantial share, with grains and cereals serving as the backbone of domestic food supply and export potential. Oilseeds and pulses are gaining traction due to rising demand for plant-based proteins and healthier cooking oils. Fruits and vegetables maintain steady growth, supported by consumer preference for fresh produce and the expansion of greenhouse farming. Agrochemicals form a critical segment, with fertilizers driving crop yield improvements. Herbicides and insecticides remain essential for pest and weed management, while other agrochemical products cater to specialized crop protection and soil enhancement needs.

- For instance, United Oilseeds, a national cooperative, trades more than 450,000 tonnes of break crops including oilseed rape, pulses, and beans on behalf of over 4,500 farmer-members.

By end user, the market caters to retail consumers, the food and beverage industry, the chemical industry, and other segments. Retail consumers contribute strongly, driven by demand for fresh, organic, and traceable products. The food and beverage industry relies heavily on agricultural inputs for processed foods, beverages, and packaged goods. The chemical industry utilizes agro-based raw materials for biofuels, bioplastics, and other industrial applications. Other end users include exporters, institutional buyers, and niche food producers who seek quality, variety, and compliance with sustainability standards. It demonstrates a diverse consumption landscape that supports stable demand and creates opportunities for both large-scale and specialty producers.

- For instance, Langridge Organic Products is acknowledged as the UK’s leading wholesaler of local and seasonal organic produce. The business operates from a purpose-built, 20,000 sq ft facility in Feltham, West London, where it receives direct farm deliveries nightly and serves a wide network of independent retailers, foodservice clients, and schools.

Segmentation:

By Product Type

- Agricultural Commodities

- Grains and Cereals

- Oilseeds and Pulses

- Fruits and Vegetables

- Agrochemicals

- Fertilizers

- Herbicides

- Insecticides

- Others

By End User

- Retail Consumers

- Food & Beverage Industry

- Chemical Industry

- Others

Regional Analysis:

England holds the largest share of the U.K. Agribusiness Market at 56%, driven by advanced infrastructure, high investment in agritech, and a diverse agricultural base. The region benefits from fertile land, established farming cooperatives, and strong domestic and export channels. Major production areas include grains, vegetables, dairy, and livestock, supported by advanced processing and distribution networks. Investment in precision farming and sustainable practices is accelerating output efficiency. England also leads in integrating renewable energy solutions into agricultural operations, reinforcing its position as a market leader. It continues to attract both domestic and foreign investors seeking high-return agricultural ventures.

Scotland accounts for 22% of the market, with a strong focus on livestock, barley, and high-quality dairy products. Its favorable climate supports grass-fed beef and lamb production, while the barley segment benefits from demand in the brewing and distilling industries. The region is investing in sustainable farming, organic production, and environmentally conscious land management. Geographic advantages allow Scotland to access both domestic markets and premium export destinations. Emerging innovation hubs are fostering collaboration between farmers, research institutions, and agribusiness companies. It is positioning itself as a key supplier of premium agricultural goods with a focus on sustainability and traceability.

Wales and Northern Ireland together represent 22% of the U.K. Agribusiness Market, with shares of 12% and 10% respectively. Wales is known for sheep farming, dairy production, and niche horticulture, supported by rural development programs and cooperative farming initiatives. Northern Ireland benefits from strong trade links with both the U.K. and the EU, enabling steady growth in livestock and dairy exports. Both regions are adopting renewable energy solutions and diversifying into high-value crops. Government-led programs are improving infrastructure, logistics, and market access for rural producers. It reflects a balanced mix of traditional farming strengths and modern agribusiness practices to sustain growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Agrivi

- Gentle Farming Ltd.

- Farming Dynamics

- Fischer Farms

- Tropic Biosciences

- GrowUp Farms

- ABBEY FRUIT & VEG LTD

- AB Agri

- Frontier Agriculture

- Dewhirst Farming Group

- Other Key Players

Competitive Analysis:

The U.K. Agribusiness Market features a mix of established corporations, specialized producers, and innovative start-ups. Key players such as Agrivi, Gentle Farming Ltd., Fischer Farms, Tropic Biosciences, and AB Agri dominate through diversified product portfolios and strategic partnerships. Competition is driven by product quality, supply chain efficiency, and technological adoption. Companies are investing in precision farming, vertical agriculture, and renewable energy integration to gain a competitive edge. Export-oriented firms focus on compliance with international quality standards to access premium markets. Market leaders are expanding their reach through acquisitions, collaborations, and targeted marketing strategies. It reflects a competitive landscape where innovation, sustainability, and brand strength define market positioning.

Recent Developments:

- In August 2025, Eat Just, known for its popular plant-based egg substitute, officially launched Just Egg in the UK. This was made possible through a significant £11.5 million investment and marks an important expansion of plant-based food options for UK consumers. The move reflects the increasing consumer demand for sustainable and innovative food alternatives in the UK agribusiness landscape.

- In June 2025, Agrivi announced a major partnership with Podravka, one of Europe’s leading food processing companies. This collaboration will see Agrivi’s farm management software integrated into Podravka’s agricultural operations, accelerating the company’s digital transformation efforts in sustainable agriculture and enhancing traceability and operational efficiency across its supply chain.

- In April 2025, plant-based food company THIS™ launched its new Super Superfood product line in UK supermarkets. This marks a strategic shift from their traditional focus on meat alternatives to more holistic, whole-food protein products. The new lineup debuted with products such as the Super Block and Marinated Pieces, both rich in protein and nutrients, and are available in leading retailers like Tesco and Ocado.

Market Concentration & Characteristics:

The U.K. Agribusiness Market is moderately concentrated, with leading players holding significant influence over supply chains and pricing structures. It is characterized by strong vertical integration, from primary production to processing and distribution. The sector demonstrates high entry barriers due to regulatory compliance, capital requirements, and the need for advanced technology adoption. While large-scale enterprises dominate core segments, niche and specialty producers are gaining visibility through direct-to-consumer channels and premium product positioning. Innovation in sustainable farming practices and value-added processing is reshaping competitive dynamics. It is fostering a market environment where adaptability and technological advancement are critical for long-term success.

Report Coverage:

The research report offers an in-depth analysis based on product and end User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.K. Agribusiness Market will expand its adoption of precision agriculture, improving efficiency and reducing resource wastage across farms.

- Vertical farming and controlled-environment agriculture will gain momentum to address urban demand and limited arable land availability.

- Demand for organic and sustainably sourced products will drive investments in eco-friendly cultivation and supply chain transparency.

- Technological integration, including AI-powered crop monitoring and automation, will enhance yield forecasting and operational decision-making.

- Renewable energy adoption within farms will strengthen cost efficiency and support national carbon reduction targets.

- Expansion into high-value crops and specialty produce will open new domestic and export market opportunities.

- Strengthened trade partnerships will diversify export destinations and reduce dependence on limited market channels.

- Digital platforms will enable direct-to-consumer models, enhancing profitability for small and medium-sized producers.

- Climate resilience strategies, including drought-resistant crops, will mitigate environmental risks and stabilize production.

- Collaboration between agritech firms, research institutions, and producers will accelerate innovation and market competitiveness.