Market Overview

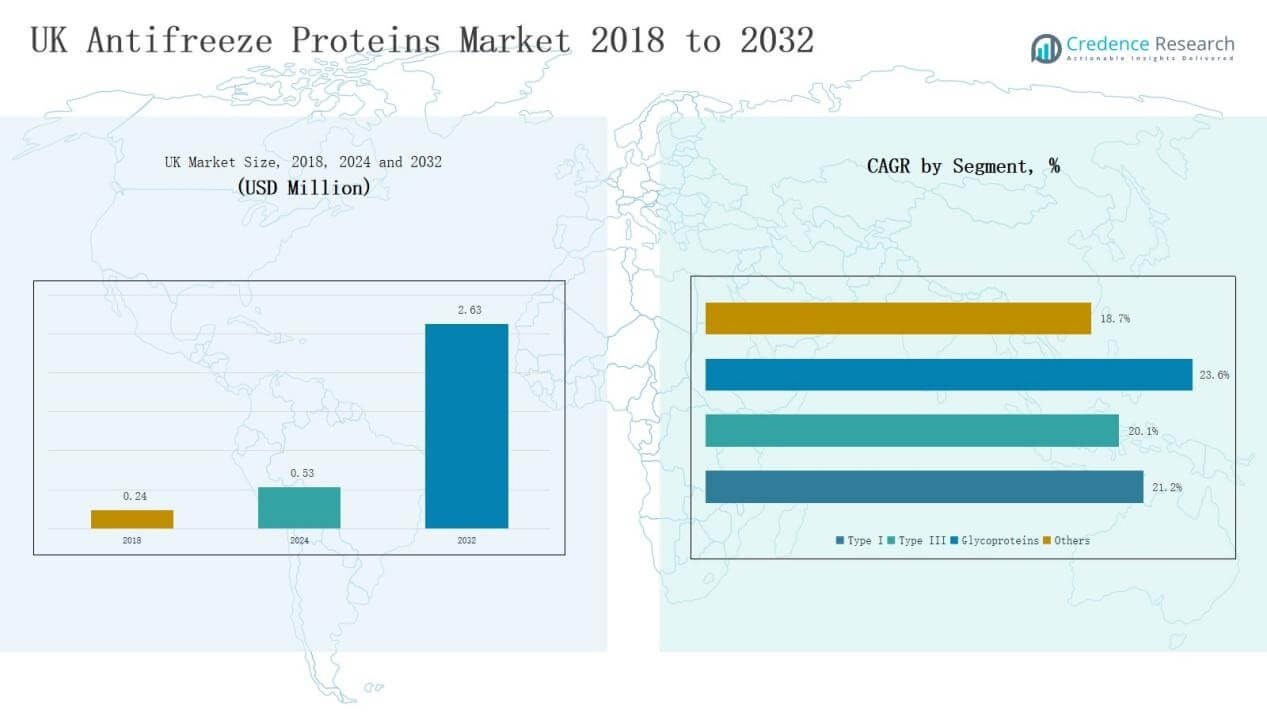

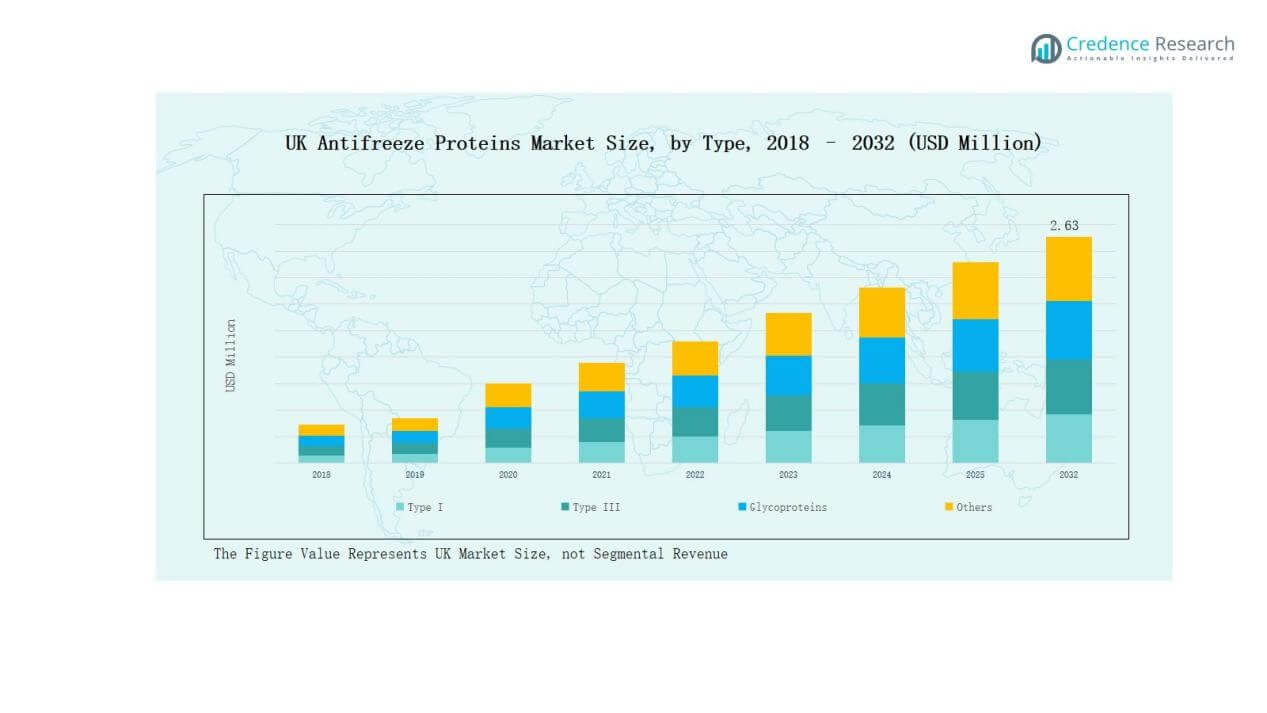

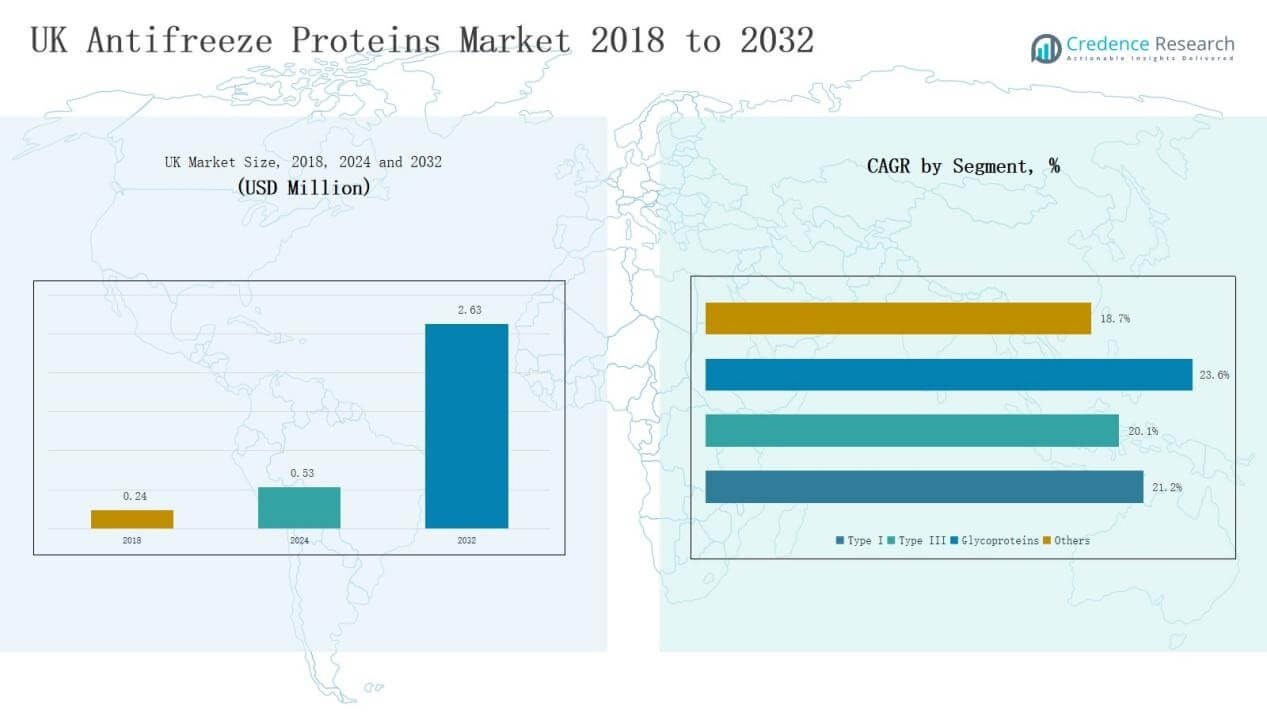

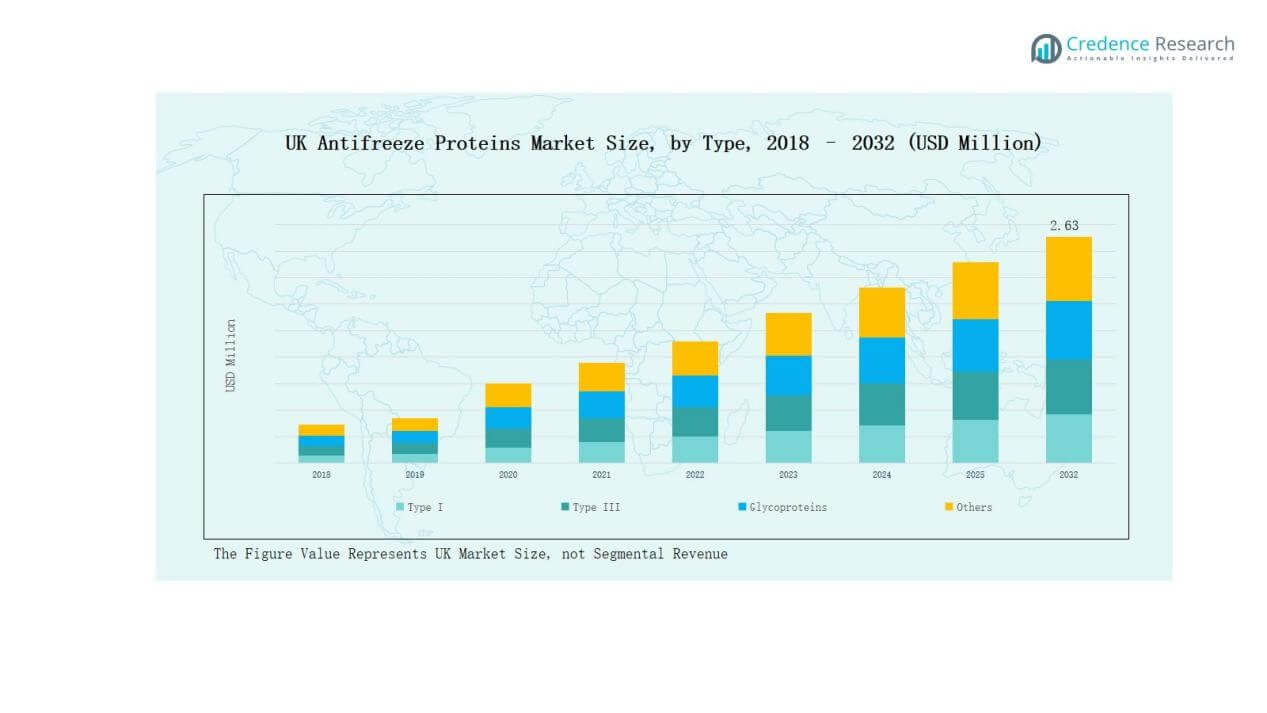

UK Antifreeze Proteins Market size was valued at USD 0.24 million in 2018, reached USD 0.53 million in 2024, and is anticipated to reach USD 2.63 million by 2032, at a CAGR of 20.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Antifreeze Proteins Market Size 2024 |

USD 0.53 Million |

| UK Antifreeze Proteins Market, CAGR |

20.75% |

| UK Antifreeze Proteins Market Size 2032 |

USD 2.63 Million |

The UK Antifreeze Proteins Market is shaped by leading players such as Unilever PLC UK, Biocatalysts Ltd UK, FrieslandCampina UK, Miltenyi Biotec UK, CellGenix UK, Novozymes UK, Arctic Bioscience UK, Pluriomics UK, Thermo Fisher Scientific UK, and Henkel UK. These companies drive growth through advanced biotechnology research, product innovation, and strategic partnerships across medical, cosmetic, and food applications. The competitive landscape reflects a balance between global leaders leveraging strong R&D pipelines and regional firms focusing on niche expertise. Among regions, Northern UK commanded the largest share at 39% in 2024, supported by advanced biotechnology clusters, healthcare infrastructure, and a robust seafood processing industry that boosts adoption of antifreeze proteins.

Market Insights

Market Insights

- The UK Antifreeze Proteins Market grew from USD 0.24 million in 2018 to USD 0.53 million in 2024 and is projected to reach USD 2.63 million by 2032, at a CAGR of 20.75%.

- Type I proteins dominated with 41% share in 2024, driven by applications in medical cryopreservation and frozen food processing, while Type III proteins expanded in cosmetics and advanced therapies.

- Solid form led with 59% share in 2024 due to longer shelf life and compatibility with pharmaceuticals and cosmetics, while liquid form held 41% with rising demand in laboratories.

- Medical end-user segment accounted for 46% share in 2024, followed by cosmetics at 27% and food at 21%, reflecting diverse adoption across healthcare, beauty, and frozen food preservation.

- Northern UK commanded 39% share in 2024, supported by strong biotechnology clusters, healthcare research centers, and seafood processing industries, securing its position as the leading regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The UK Antifreeze Proteins Market by type is dominated by Type I proteins, holding around 41% share in 2024. Their leadership stems from extensive use in medical cryopreservation and frozen food processing, supported by strong biotechnology research across the UK. Type III proteins follow with growing adoption in advanced therapies and cosmetics, while glycoproteins and other types remain niche but show potential in food innovation and skincare applications.

For instance, Unilever’s R&D center in Bedford has explored antifreeze protein use in ice cream production to reduce ice crystal growth, improving texture and shelf life.

By Form

In terms of form, the solid segment accounted for nearly 59% share in 2024, making it the leading format in the UK Antifreeze Proteins Market. Solid forms are preferred for longer shelf life, easy transport, and compatibility with pharmaceutical and cosmetic formulations. The liquid segment, with a 41% share, is growing steadily due to rising demand for ready-to-use solutions in research and clinical laboratories.

For instance, Sirona Biochem advanced its solid glycoprotein-based antifreeze compounds into cosmetic product testing, enhancing formulation robustness.

By End-User

The medical segment leads the market with 46% share in 2024, driven by its critical role in cryosurgery, organ preservation, and regenerative medicine applications. Cosmetics follows with 27% share, supported by growing demand for antifreeze proteins in anti-aging and skin protection products. The food segment holds 21% share, benefiting from increased use in frozen seafood and dairy preservation, while others remain limited but present opportunities in niche R&D and biotechnology applications.

Key Growth Drivers

Rising Demand in Medical Applications

Medical usage represents the largest growth driver for the UK Antifreeze Proteins Market. Increasing demand for antifreeze proteins in cryopreservation, organ transplantation, and regenerative medicine is expanding their adoption. The proteins help maintain cell viability at low temperatures, enabling advanced healthcare solutions. With the UK’s strong biotechnology ecosystem and investments in life sciences research, healthcare institutions continue to integrate antifreeze proteins into clinical applications. This trend ensures steady demand, especially as the aging population boosts requirements for long-term preservation solutions.

For instance, Oxford University researchers have investigated antifreeze protein applications in preserving donor hearts prior to transplantation, improving viability during transport.

Expanding Role in Cosmetics Industry

Cosmetics are emerging as a fast-growing segment in the UK Antifreeze Proteins Market. The ability of antifreeze proteins to protect skin cells against environmental stress and cold damage positions them as valuable active ingredients in skincare formulations. British cosmetic manufacturers increasingly integrate these proteins into anti-aging, hydrating, and protective products. Rising consumer awareness of natural and biotechnology-driven solutions accelerates demand. Moreover, the UK’s strong presence of global beauty brands and innovation hubs supports further adoption, making cosmetics a critical growth driver in the forecast period.

For instance, Croda International has invested in protein-based cosmetic actives, introducing biotech-derived ingredients aimed at improving skin resilience and combating oxidative stress.

Adoption in Frozen Food Preservation

The food sector significantly drives growth in the UK Antifreeze Proteins Market. Antifreeze proteins improve the texture, freshness, and shelf life of frozen seafood, dairy, and processed foods. Growing consumer preference for high-quality frozen meals and seafood preservation in the UK enhances their use. Food manufacturers adopt these proteins to prevent ice crystal formation, ensuring better taste and nutritional value. With the UK’s thriving frozen food industry and exports, antifreeze proteins provide a competitive edge, strengthening their role as a key driver across the market landscape.

Key Trends & Opportunities

Key Trends & Opportunities

Biotechnology Innovation and R&D Expansion

Innovation in biotechnology and protein engineering is a notable trend in the UK Antifreeze Proteins Market. Research institutions and companies are exploring new variants of antifreeze proteins with enhanced stability and broader applicability. Advances in genetic engineering allow scalable production from plants and microbes, reducing reliance on costly natural sources. This R&D focus not only lowers production costs but also creates opportunities for tailored formulations across medical, food, and cosmetic industries. The UK’s robust research funding and university collaborations further strengthen this trend.

For instance, Unilever has explored the use of fish-derived antifreeze proteins in its ice cream formulations to improve shelf life and texture.

Growing Sustainability and Plant-Based Sources

Sustainability drives opportunities in the UK Antifreeze Proteins Market, with rising interest in plant-based sources. Companies are increasingly focusing on eco-friendly and ethical alternatives to fish-derived proteins. Plant and insect-based antifreeze proteins reduce biodiversity concerns and appeal to environmentally conscious consumers. This aligns with the UK’s strong sustainability regulations and consumer demand for green products. The shift toward plant-based solutions creates commercial opportunities in cosmetics, food, and pharmaceuticals, positioning antifreeze proteins as sustainable innovations in biotechnology-driven industries.

For instance, Kaneka Corporation launched a series of type I antifreeze proteins for food applications such as noodles and rice, expanding their footprint in plant-based solutions.

Key Challenges

High Production Costs

High production cost remains a major challenge for the UK Antifreeze Proteins Market. Extraction from natural sources such as fish is resource-intensive and requires advanced purification processes. Even synthetic and recombinant production methods demand costly biotechnology infrastructure. These expenses limit affordability, especially for large-scale food or cosmetic applications. Without significant breakthroughs in cost reduction, many small and mid-sized companies struggle to adopt antifreeze proteins commercially. This cost barrier restricts wider market penetration despite strong interest from various end-use industries.

Regulatory Complexity and Approval Barriers

Regulatory hurdles significantly challenge the UK Antifreeze Proteins Market. Products targeting medical, cosmetic, or food applications must comply with stringent safety and efficacy standards. Approval processes involve lengthy trials, documentation, and compliance with both national and EU-aligned regulations. These barriers often delay commercialization and increase operational costs. Smaller companies face additional difficulties navigating the regulatory landscape without sufficient resources. Complex regulations can slow innovation adoption, limiting the pace at which antifreeze proteins expand across key industries in the UK market.

Limited Awareness and Commercial Adoption

Limited awareness among end-users poses a challenge to the UK Antifreeze Proteins Market. Many food manufacturers, cosmetic companies, and medical institutions are still unfamiliar with the full potential of antifreeze proteins. This knowledge gap reduces willingness to invest in adoption or product reformulation. Additionally, consumer recognition of antifreeze proteins remains low compared to traditional biotechnology-based solutions. Without broader education and targeted marketing, the pace of commercial adoption may remain slow, restricting the market from reaching its full growth potential in the UK.

Regional Analysis

Northern UK

Northern UK leads the UK Antifreeze Proteins Market with a 39% share in 2024. The region benefits from advanced biotechnology clusters and well-established healthcare research centers that support adoption across medical applications. Strong seafood processing industries also drive demand for antifreeze proteins in frozen food preservation. Universities and research hubs in the region actively contribute to protein innovation, supporting commercial growth. The presence of global players and regional specialists further strengthens market penetration. It continues to serve as the innovation hub for antifreeze proteins, ensuring sustained leadership.

Southern UK

Southern UK holds a 27% share in 2024, supported by the strong presence of cosmetics and personal care industries. The demand for antifreeze proteins in skincare formulations, particularly anti-aging and protective products, is driving growth. The region benefits from proximity to large consumer markets and advanced retail distribution networks. Research institutions also collaborate with manufacturers to expand product testing and clinical validation. It remains a key area for cosmetic innovation and biotechnology adoption. The focus on high-value applications secures its importance within the national landscape.

Eastern UK

Eastern UK accounts for 19% share in 2024, supported by growth in agricultural biotechnology and plant-based protein research. The region is advancing production from alternative sources, aligning with sustainability goals. Food companies in Eastern UK increasingly use antifreeze proteins in frozen dairy and processed products to enhance quality. The area’s infrastructure for R&D and government-supported innovation hubs foster greater adoption. It plays a significant role in supporting sustainable solutions across the market. Rising demand from both food and research sectors underpins its steady expansion.

Western UK

Western UK represents 15% share in 2024, contributing steadily to the UK Antifreeze Proteins Market. The region focuses on niche applications in medical cryopreservation and smaller-scale food industries. Local biotech firms are gradually entering the space through collaborations with universities and healthcare institutions. Its market growth is slower compared to other regions due to limited industrial capacity. However, ongoing innovation projects and partnerships with national players create opportunities for expansion. It continues to provide support for specialized adoption, ensuring balanced participation in the overall market.

Market Segmentations:

Market Segmentations:

By Type

- Type I

- Type III

- Glycoproteins

- Others

By Form

By End-User

- Medical

- Cosmetics

- Food

- Others

By Sources

- Fish

- Plants

- Insects

- Others

By Region

- Northern UK

- Southern UK

- Eastern UK

- Western UK

Competitive Landscape

The UK Antifreeze Proteins Market is characterized by a mix of global leaders and regional specialists competing across medical, food, and cosmetic applications. Key players such as Unilever PLC, Biocatalysts Ltd, FrieslandCampina UK, Miltenyi Biotec, CellGenix, Novozymes, Arctic Bioscience, Pluriomics, Thermo Fisher Scientific, and Henkel UK dominate the landscape through biotechnology expertise and product diversification. The market is moderately concentrated, with leading companies focusing on research partnerships, product innovation, and expansion into plant-based and sustainable protein sources. Global players leverage strong R&D funding and international networks, while domestic firms emphasize niche expertise and tailored applications. Strategic alliances between biotech companies and academic institutions enhance innovation pipelines, creating competitive advantages. Rising demand in medical and cosmetic sectors drives firms to prioritize advanced formulations, while food preservation applications expand steadily. It remains a competitive market where innovation, regulatory compliance, and sustainable sourcing strategies define leadership and long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Unilever PLC UK

- Biocatalysts Ltd UK

- FrieslandCampina UK

- Miltenyi Biotec UK

- CellGenix UK

- Novozymes UK

- Arctic Bioscience UK

- Pluriomics UK

- Thermo Fisher Scientific UK

- Henkel UK

Recent Developments

- In March 2024, Kaneka Corporation launched an innovative production process for synthetic antifreeze proteins. This development aims to reduce manufacturing costs and increase production efficiency.

- In October 2024, FrieslandCampina secured EU approval for its Hyvital Whey HA 300 protein hydrolysate for infant formulas.

- In April 2024, Henkel completed the acquisition of Seal for Life Industries LLC, enhancing its protective coatings and sealing solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End User, Sources and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antifreeze proteins will expand in medical cryopreservation and organ transplantation.

- Cosmetic applications will grow with rising focus on anti-aging and protective skincare products.

- Food industry adoption will increase to improve quality and shelf life of frozen products.

- Plant-based and insect-based proteins will gain traction as sustainable alternatives to fish sources.

- Biotechnology innovation will drive scalable and cost-efficient production methods.

- Strategic partnerships between research institutions and biotech firms will accelerate product development.

- Regulatory clarity will support faster commercialization across pharmaceuticals and cosmetics.

- Regional players will strengthen their position through specialized applications and niche expertise.

- Consumer awareness of biotechnology-driven products will improve adoption in retail markets.

- Investment in sustainable R&D will position the UK as a leader in antifreeze protein innovation.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: