| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Digital Signature Market Size 2024 |

USD 381.46 million |

| UK Digital Signature Market CAGR |

32.7% |

| UK Digital Signature Market Size 2032 |

USD 3,667.89 million |

Market Overview:

The UK Digital Signature Market is projected to grow from USD 381.46 million in 2024 to an estimated USD 3,667.89 million by 2032, with a compound annual growth rate (CAGR) of 32.7% from 2024 to 2032.

The rising need for secure and efficient transactions in sectors such as finance, healthcare, real estate, and legal services is significantly driving the adoption of digital signatures in the UK. The widespread implementation of remote and hybrid work models has accelerated the shift to digital documentation and signing practices. In addition, the government’s initiatives around digital identity frameworks and compliance mandates further stimulate market expansion. Technological advancements like biometric authentication and blockchain integration are also enhancing trust and usability. The growing demand for environmentally sustainable practices is encouraging enterprises to reduce paper usage by adopting digital signatures. Increasing cyber threats have also prompted organizations to adopt advanced signature solutions with robust encryption. Furthermore, customer expectations for faster, mobile-enabled transactions are influencing widespread integration of digital signature tools into business platforms.

The UK remains a pivotal market in Europe due to its mature IT infrastructure, high regulatory compliance, and early adoption of digital services. The country’s legal environment, shaped by regulations like the Electronic Communications Act and alignment with the EU’s eIDAS framework, encourages secure and standardized use of digital signatures. Government investments in digital public services and cybersecurity bolster user confidence in these technologies. The presence of leading digital signature vendors and cloud service providers further supports domestic adoption. Moreover, increasing digitalization in public sector workflows enhances regional growth prospects. The financial services hub in London acts as a strong demand center for compliant and secure signing solutions. Additionally, nationwide initiatives to digitize SMEs are expanding adoption beyond large enterprises into small and medium-sized business segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Digital Signature Market is forecast to grow from USD 381.46 million in 2024 to USD 3,667.89 million by 2032, driven by a high CAGR of 32.7%.

- Secure transaction needs in finance, healthcare, real estate, and legal sectors are propelling widespread adoption of digital signature solutions.

- Remote and hybrid work models are accelerating the demand for efficient digital documentation and signing platforms.

- Technological advancements, including biometric authentication and blockchain integration, are enhancing both trust and functionality.

- Legal backing through frameworks like the Electronic Communications Act and eIDAS alignment provides a strong compliance foundation.

- Challenges persist due to cyber threats, lack of standardization, and limited digital literacy in traditional sectors.

- London leads regional demand, with strong adoption in financial services, while nationwide SME digitization is expanding broader market penetration.

Report Scope

This report segments UK Digital Signature Market as follow

Market Drivers:

Regulatory Backing and Legal Recognition

The UK digital signature market benefits significantly from a strong regulatory framework that ensures the legal enforceability and compliance of electronic signatures. Key regulations such as the Electronic Communications Act 2000 and the UK’s retained version of the EU’s eIDAS Regulation have established a clear legal foundation for digital signature adoption. These frameworks provide trust, standardization, and legal certainty for electronic transactions, encouraging businesses and public sector entities to transition from traditional methods to secure, legally compliant digital alternatives. For example, platforms like SigniFlow enable businesses across the UK to meet and exceed the requirements of UK-eIDAS using advanced electronic signatures, providing a seamless and secure solution for document signing processes. This legal clarity has enabled rapid integration of digital signature solutions into core operations across industries such as legal services, financial institutions, and healthcare.

Accelerated Digital Transformation Across Sectors

The digitalization of operational workflows across various sectors is a major driver of market growth. Industries including banking, insurance, real estate, and pharmaceuticals are increasingly adopting digital signatures to streamline document approvals, reduce processing times, and eliminate manual handling. The shift to digital-first models has been further reinforced by remote and hybrid work environments, where seamless, secure document execution has become essential. Digital signature platforms are now integral to ensuring business continuity, supporting remote collaboration, and reducing dependency on physical paperwork. For instance, HR Dept, the UK’s largest network of HR professionals, adopted SigniFlow to transform paper-based processes into a fully digital, end-to-end eSign and approval workflow, ensuring compliance and efficiency across its franchises. As organizations aim to increase productivity and reduce turnaround times, digital signatures are becoming a standard feature in enterprise digital ecosystems Continuous innovation in digital signature technologies has contributed to broader adoption across the UK market. The integration of biometric authentication, blockchain verification, and AI-powered identity checks has enhanced the security and reliability of digital signature solutions. These advancements not only safeguard sensitive data but also offer enhanced user experiences through automation and personalization. Additionally, the integration of digital signatures into widely used enterprise software platforms, such as document management systems and customer relationship management tools, has made deployment easier and more scalable. The emergence of cloud-based and mobile-first digital signature applications is also meeting growing demand for flexible, user-centric solutions that operate securely across devices.

Environmental and Operational Efficiency Goals

Sustainability and cost-efficiency are increasingly influencing digital signature adoption in the UK. Organizations are actively seeking paperless solutions to align with their environmental, social, and governance (ESG) objectives, and digital signatures offer a viable alternative that reduces paper consumption and lowers carbon footprints. In parallel, companies benefit from cost savings through reduced printing, mailing, and storage expenses. The operational efficiency achieved through faster transaction cycles and fewer administrative errors also strengthens the business case for adopting digital signature solutions. As environmental awareness and digital maturity continue to grow, these factors will remain strong incentives for market expansion.

Market Trends:

Rising Adoption in Government and Public Services

One of the most notable trends in the UK digital signature market is the growing implementation of electronic signature technologies across government and public sector operations. Agencies are digitizing administrative workflows to improve citizen services, ensure regulatory compliance, and reduce bureaucracy. The UK Government Digital Service (GDS) has been actively promoting the use of verified digital identification and authentication tools, which has indirectly increased the demand for secure digital signature solutions. For example, eSign is one of the electronic signature provider trusted on the UK Government’s Public Service Network (PSN), a high-security network that enables public sector organisations to work together and share resources securely. From licensing and permitting to e-voting and document authentication, public-facing services are increasingly transitioning to paperless platforms, creating long-term growth momentum for the market.

Integration with Identity Verification Platforms

Another significant trend is the integration of digital signatures with advanced identity verification systems. The synergy between electronic signature tools and eID solutions, including biometric ID, facial recognition, and digital wallets, is enhancing transaction security and user trust. For instance, nearly two-thirds (63%) of UK consumers use biometric technology, like fingerprint scans or FaceID, to access online services. This is particularly relevant in high-stakes industries such as real estate and legal services, where accurate identity authentication is critical. Companies are adopting multi-factor authentication and identity-linked signatures to align with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These integrations not only meet evolving compliance standards but also streamline onboarding and verification processes for end users.

Expansion of API-Driven Ecosystems

The UK digital signature landscape is witnessing an expansion in API-based deployment models, enabling seamless integration with existing digital ecosystems. Enterprises are increasingly leveraging open APIs to embed signature functionality directly into their proprietary applications, CRM platforms, and workflow automation tools. This trend is particularly prominent among fintech startups and digital-first enterprises that prioritize efficiency, scalability, and end-user experience. API-based digital signature models offer greater customization and flexibility, allowing organizations to maintain control over branding, user interface, and process logic while ensuring data security and regulatory compliance.

Increased Demand for Industry-Specific Solutions

Market demand is shifting toward digital signature solutions tailored to the unique needs of specific industries. In the legal sector, for instance, features like audit trails, advanced document validation, and long-term digital archiving are becoming essential. Meanwhile, in healthcare, there is rising interest in signatures that comply with data privacy laws such as the UK GDPR and NHS Digital standards. Vendors are responding by developing sector-specific platforms that address industry workflows and compliance requirements. This trend is driving specialization within the market, with solution providers customizing their offerings to meet the nuanced demands of professionals across different domains.

Market Challenges Analysis:

Data Security Concerns and Risk of Cyber Threats

Despite the growing adoption of digital signature solutions, data security remains a critical concern for organizations in the UK. The risk of cyberattacks, identity theft, and digital document tampering continues to challenge user confidence in electronic signatures, particularly for high-value or sensitive transactions. Although many digital signature platforms employ advanced encryption and authentication protocols, not all solutions offer uniform levels of security. Small and medium-sized enterprises (SMEs), in particular, may lack the resources to implement robust cybersecurity measures, making them more vulnerable to breaches. These concerns can slow adoption rates and create hesitancy among security-conscious industries.

Lack of Uniform Standards and Interoperability Issues

Despite alignment with eIDAS, the UK digital signature market faces ongoing challenges related to standardization and interoperability. Discrepancies in how providers interpret compliance measures result in inconsistent implementation across platforms and sectors, complicating cross-border transactions. For instance, a digital signature compliant in one territory may be invalid in another if the certificate authority is not recognized or if security standards differ. The lack of universally accepted digital ID systems further complicates verification processes, adding administrative burden and reducing efficiency. The UK government is working to address these issues through the development of the digital identity and attributes trust framework, which aims to set rules and standards on privacy, data protection, and cyber security, but full harmonization remains a work in progress

User Adoption Barriers and Resistance to Change

Resistance to technological change remains a persistent restraint, especially in traditional industries such as legal services and public administration. Concerns about the legality, usability, and reliability of digital signatures can hinder broader adoption. Additionally, users unfamiliar with digital technologies may struggle with onboarding and training, leading to inefficient usage or system rejection. Bridging the digital literacy gap and building awareness around the legal validity and operational benefits of digital signatures are essential to overcoming this challenge and expanding market penetration.

Market Opportunities:

The UK digital signature market presents strong growth potential as organizations across sectors accelerate their digital transformation initiatives. With increasing emphasis on remote operations, paperless workflows, and enhanced regulatory compliance, demand for secure and legally binding digital signature solutions is rising. This trend is especially pronounced among small and medium-sized enterprises (SMEs), which are beginning to embrace digital tools to streamline business operations and remain competitive. As digital literacy improves and cloud-based platforms become more affordable and accessible, vendors have a significant opportunity to expand their market reach by offering scalable and user-friendly solutions tailored to the needs of diverse business sizes.

In addition, the evolving regulatory landscape and public sector modernization efforts offer untapped potential for digital signature adoption. Government-led initiatives aimed at improving e-governance, identity verification, and digital service delivery create fertile ground for integration of digital signature technologies into public administration. Moreover, industry-specific compliance requirements in sectors such as finance, healthcare, and legal services are driving demand for customized and audit-ready digital signature solutions. Vendors that can offer sector-specialized features, seamless API integration, and robust identity verification mechanisms will be well-positioned to capitalize on these opportunities. As trust in digital processes grows and interoperability improves, the UK market is poised to witness sustained demand and long-term adoption of digital signatures across both public and private sectors.

Market Segmentation Analysis:

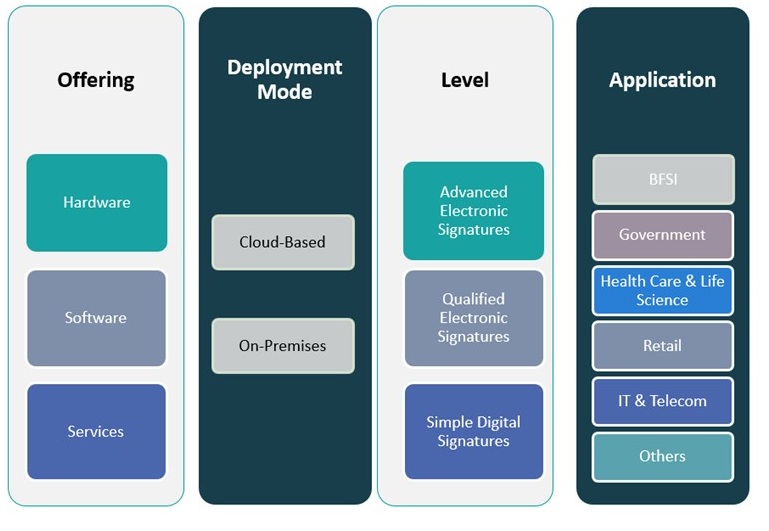

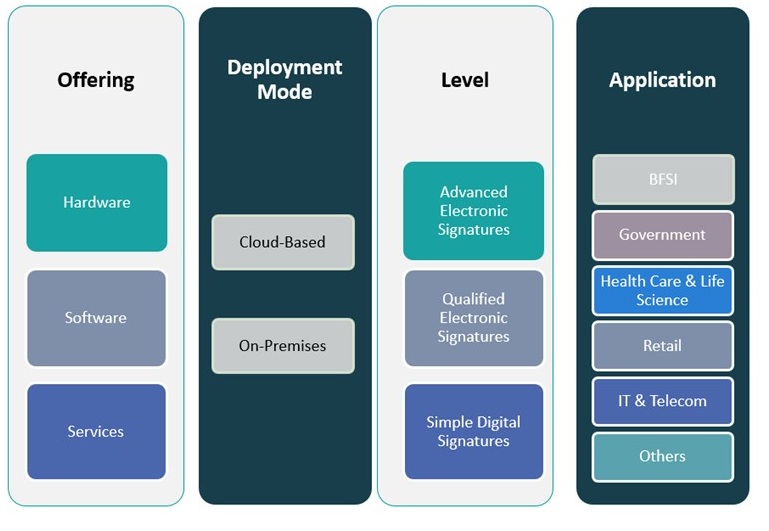

The UK digital signature market is segmented by offering, deployment mode, level, and application, each playing a vital role in shaping the market landscape.

By offering, the software segment holds a dominant share due to rising demand for flexible, scalable solutions that can be easily integrated into existing enterprise systems. Services, including consulting, integration, and support, are also witnessing increased demand as organizations seek expert guidance to ensure regulatory compliance and operational efficiency. The hardware segment remains niche, primarily supporting use cases involving secure signature creation devices.

By deployment mode, cloud-based solutions are gaining rapid traction due to their scalability, cost-effectiveness, and suitability for remote and hybrid work environments. On-premises deployment continues to serve organizations with strict data control requirements, particularly in the public sector and finance industries.

By signature level. Advanced electronic signatures are widely adopted due to their balance of security and usability, while qualified electronic signatures are gaining relevance in legal and highly regulated sectors due to their strong evidentiary value. Simple digital signatures, though limited in security, are still used in low-risk transactions for internal approvals and informal agreements.

By application, the BFSI sector leads adoption, driven by high regulatory requirements and transaction volumes. Government and healthcare organizations are increasingly adopting digital signatures to enhance service delivery and safeguard sensitive data. The IT & telecom sector, along with retail, is also embracing these solutions for improved document workflow and customer engagement. Other sectors, including education and logistics, are gradually recognizing the value of secure digital authentication.

Segmentation:

By Offering Segment:

- Hardware

- Software

- Services

By Deployment Mode Segment:

By Level Segment:

- Advanced Electronic Signatures

- Qualified Electronic Signatures

- Simple Digital Signatures

By Application Segment:

- BFSI (Banking, Financial Services, and Insurance)

- Government

- Healthcare & Life Sciences

- Retail

- IT & Telecom

- Others

Regional Analysis:

Within the UK, the digital signature market is witnessing substantial growth across all regions, with notable adoption in urban centers such as London, Manchester, Birmingham, and Edinburgh. These cities, known for their concentration of financial institutions, legal firms, and technology companies, are leading the way in implementing digital signature solutions to streamline operations and enhance security.

In London, the financial services sector is a significant driver of digital signature adoption, as firms seek to expedite transaction processes while ensuring compliance with stringent regulatory requirements. Similarly, legal firms in the city are leveraging digital signatures to facilitate remote client interactions and accelerate contract execution.

Manchester and Birmingham are also emerging as key markets, with businesses across various industries adopting digital signature technologies to improve operational efficiency and reduce reliance on paper-based processes. The presence of numerous SMEs in these cities presents a substantial opportunity for digital signature providers to offer scalable and cost-effective solutions tailored to the needs of smaller enterprises.

In Scotland, Edinburgh’s thriving financial and legal sectors are contributing to the growing demand for digital signature solutions. Organizations in the city are increasingly recognizing the benefits of digital signatures in enhancing document security and facilitating seamless remote transactions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Legalesign

- VirtualSignature-ID

- SigningHub

- Nitro

- Signable

Competitive Analysis:

The UK digital signature market is moderately consolidated, with a mix of global technology leaders and specialized local providers competing for market share. Key players such as DocuSign Inc., Adobe Inc., Thales Group, and OneSpan Inc. dominate the landscape by offering robust, scalable, and compliant signature solutions. These companies leverage cloud-based platforms, advanced encryption technologies, and seamless integrations with enterprise software to maintain their competitive edge. Meanwhile, UK-based and European providers like Signable and Universign are gaining traction by catering to regional compliance needs and offering cost-effective solutions for SMEs. The market is characterized by ongoing innovation, including integration with identity verification tools and sector-specific customization. Strategic partnerships, mergers, and acquisitions are also common as vendors seek to enhance capabilities and expand their customer base. With digital transformation accelerating across industries, competitive intensity is expected to rise, compelling companies to differentiate through enhanced security, user experience, and regulatory alignment.

Recent Developments:

- In March 2025, VirtualSignature-ID (now rebranded as VSID RegTech Group) launched a new brand identity and website to better reflect its comprehensive suite of advanced onboarding and digital identity solutions. The rebrand underscores its position as a government-accredited Identity Service Provider (IDSP) and highlights its unique offering of combining eSignatures with ID verification, AML, and KYC checks in a single platform

- In February 2023, GMO GlobalSign also launched the Qualified Signing Service (QSS), a cloud-based solution designed to generate qualified electronic signatures and seals compliant with the EU’s eIDAS regulation. This service supports industries such as fintech, legal, government, education, insurance, healthcare, and auditing, providing advanced, compliant signing capabilities for a global customer base, including the UK.

Market Concentration & Characteristics:

The UK digital signature market exhibits moderate to high market concentration, with a few dominant global players holding a significant share alongside a growing base of regional providers. The market is defined by its compliance-driven nature, shaped by stringent legal standards such as the Electronic Communications Act and the UK’s adoption of eIDAS regulations. Digital signature solutions are increasingly seen as essential components of secure digital transformation strategies, particularly in highly regulated sectors like finance, legal, and healthcare. The market is characterized by high entry barriers due to the need for strong cryptographic capabilities, regulatory certifications, and interoperability standards. Demand is skewed toward cloud-based and API-integrated solutions that enable scalability and ease of deployment. Customer preferences are rapidly evolving toward mobile accessibility, biometric authentication, and sector-specific features, making innovation and customization key competitive differentiators. As digital maturity grows, the market is expected to evolve toward greater specialization and increased demand for qualified electronic signatures.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Deployment Mode, Level and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of digital signatures is expected across SMEs, driven by affordable, cloud-based solutions.

- Demand for qualified electronic signatures will grow in sectors requiring higher legal validity and compliance.

- Integration with digital identity verification systems will become a standard feature across most platforms.

- Public sector modernization initiatives will accelerate implementation in government workflows and citizen services.

- Cross-platform interoperability and standardized protocols will become critical for broader enterprise adoption.

- Mobile-first solutions and biometric-enabled signing tools will gain traction among tech-savvy users.

- Vendors will focus on developing sector-specific solutions, particularly for legal, healthcare, and finance industries.

- Growth in remote and hybrid work environments will continue to fuel demand for secure digital transactions.

- Increasing regulatory scrutiny and data privacy concerns will drive innovation in encryption and authentication.

- Strategic partnerships and acquisitions will reshape the competitive landscape, fostering technological consolidation.