Market Overviews

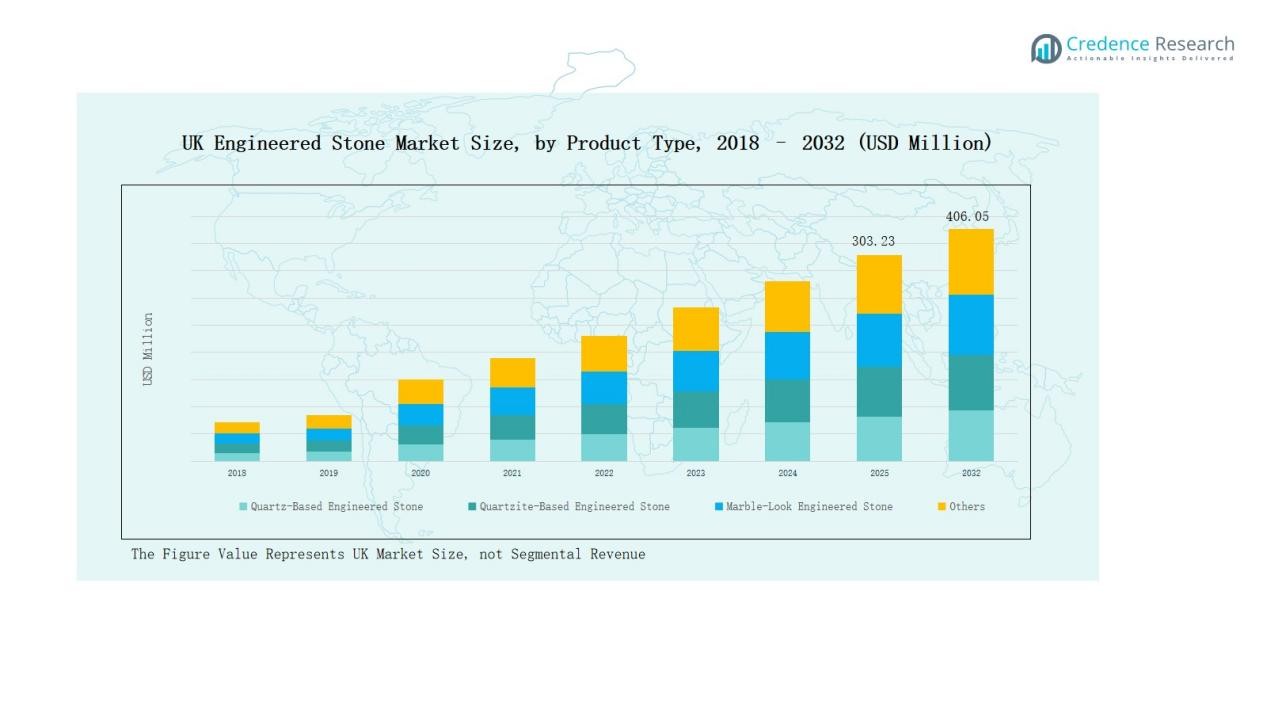

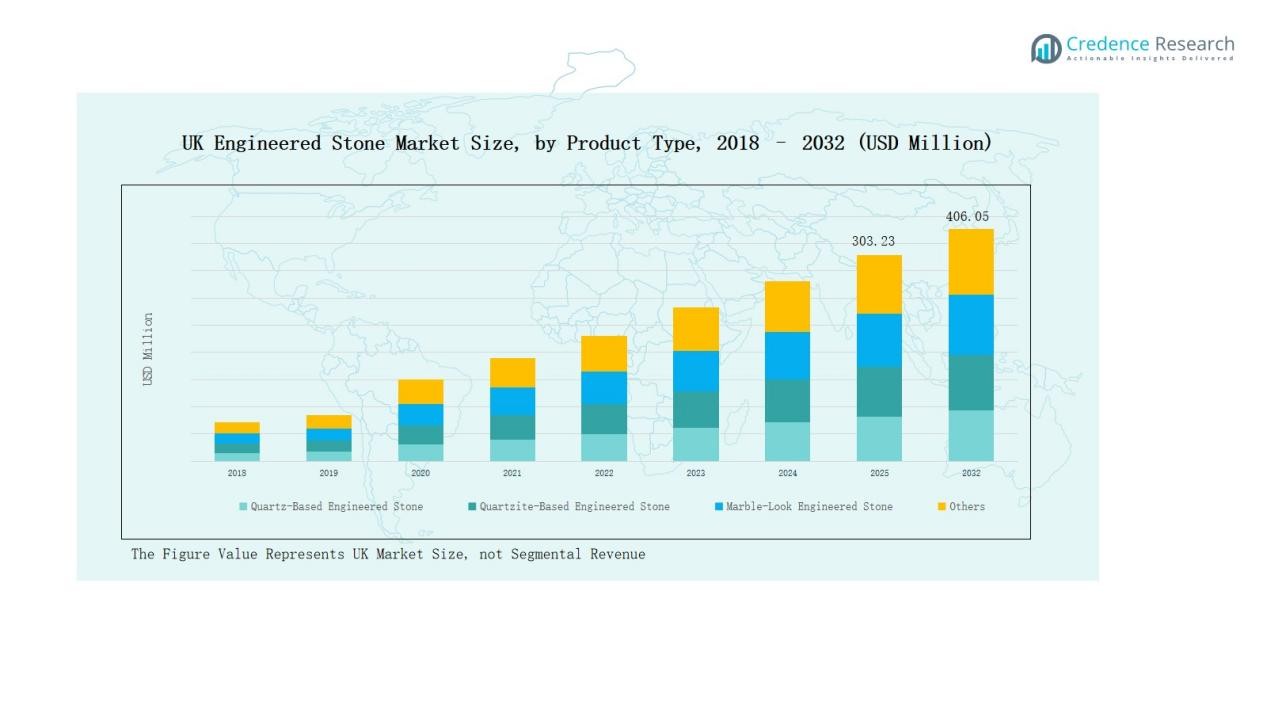

UK Engineered Stone Market size was valued at USD 214.57 million in 2018, reached USD 283.86 million in 2024, and is anticipated to reach USD 406.05 million by 2032, growing at a CAGR of 4.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Engineered Stone Market Size 2024 |

USD 283.86 Million |

| UK Engineered Stone Market, CAGR |

4.26% |

| UK Engineered Stone Market Size 2032 |

USD 406.05 Million |

The UK Engineered Stone Market is highly competitive, with key players including Caesarstone, Silestone UK (Cosentino), Lapitec UK, Compac UK, Stone Italiana UK, Unistone, Dekton UK, Technistone UK, Cimstone UK, and Florim UK. These companies compete by offering durable quartz-based and marble-look surfaces, expanding sustainable product portfolios, and strengthening partnerships with contractors, architects, and distributors. England emerged as the leading region, accounting for 52% market share in 2024, supported by robust residential renovations, luxury housing projects, and extensive commercial developments concentrated in London and surrounding metropolitan areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Engineered Stone Market grew from USD 214.57 million in 2018 to USD 283.86 million in 2024 and is projected to reach USD 406.05 million by 2032, at a CAGR of 4.26%.

- Quartz-based engineered stone led with 61% share in 2024, driven by its durability, cost-effectiveness, and design flexibility, while marble-look products gained traction in premium interior projects.

- The residential sector dominated applications with 64% share in 2024, supported by rising kitchen and bathroom renovations, modern housing upgrades, and consumer preference for stylish, low-maintenance interiors.

- Construction and infrastructure accounted for 58% share in 2024, fueled by large-scale residential and commercial projects, while interior design and decoration expanded in luxury and boutique segments.

- England emerged as the leading region with 52% share in 2024, supported by London’s housing renovations, luxury offices, and hospitality developments, followed by Scotland at 18%, Wales at 15%, and Northern Ireland at 15%

Market Segment Insights

By Product Type

Quartz-based engineered stone dominated the UK market in 2024, holding nearly 61% share. Its popularity stems from superior durability, design variety, and cost-effectiveness compared to natural stone. Strong demand in kitchen countertops and bathroom surfaces has reinforced its lead, supported by growing preference for low-maintenance materials in modern homes. Meanwhile, marble-look engineered stone is gaining traction in premium interior projects, appealing to luxury aesthetics, while quartzite-based and other materials remain niche, catering to specialized or regional requirements.

- For instance, Caesarstone introduced new mineral surfaces within its Metropolitan Collection in the UK market, which replicate authentic concrete and stone looks while offering enhanced durability for high-use kitchens.

By Application

The residential sector led the market with 64% share in 2024, driven by rising demand for stylish, durable, and low-maintenance surfaces in kitchens, bathrooms, and flooring. Growth in renovation projects, particularly in urban areas such as London, has accelerated adoption. Rising disposable incomes and preference for contemporary interior design also supported residential dominance. The commercial segment, although smaller, is expanding steadily as offices, retail outlets, and hospitality projects integrate engineered stone for its aesthetics, hygiene benefits, and cost-efficiency.

- For instance, Caesarstone introduced its Porcelain Collection featuring new finishes specifically designed for high-use residential kitchens, expanding consumer choices for modern interiors.

By End-Use Industry

Construction and infrastructure accounted for 58% of the UK market in 2024, supported by large-scale residential projects, commercial buildings, and public sector infrastructure upgrades. Engineered stone is increasingly favored for its strength, durability, and ability to replicate natural stone at lower costs. Interior design and decoration followed, capturing strong adoption in luxury housing and boutique commercial spaces, where aesthetics drive demand. Other industries, including furniture manufacturing and retail fixtures, contribute modestly but represent emerging avenues for future market growth.

Key Growth Drivers

Rising Demand for Durable and Aesthetic Surfaces

The UK market benefits from increasing demand for durable, stylish, and low-maintenance surfaces in homes and offices. Quartz-based engineered stone leads this growth due to its strength, stain resistance, and wide design options. Consumers prioritize surfaces that combine practicality with modern aesthetics, particularly in kitchens and bathrooms. Ongoing urbanization, rising disposable incomes, and lifestyle upgrades further reinforce adoption, making engineered stone a preferred choice over natural alternatives in both new construction and renovation projects across the country.

- For instance, Cambria launched its Inverness collection with intricate veining patterns, tailored to meet growing UK demand for high-end, contemporary interior design solutions.

Growth in Residential Renovation and Remodeling

Renovation activity remains a significant growth driver for the UK engineered stone market. Homeowners are investing in upgrading interiors, driven by evolving design preferences and the need for durable, value-adding materials. Kitchen and bathroom remodeling projects dominate demand, with quartz surfaces favored for functionality and visual appeal. Government support for sustainable housing and growing interest in energy-efficient homes also play a role. Renovation-focused retailers and contractors continue to expand product portfolios, boosting sales across urban and semi-urban regions.

- For instance, Cosentino Group launched Silestone HybriQ+ technology, enhancing engineered stone’s strength and sustainability, attracting UK home renovation projects focused on durable, eco-friendly kitchen surfaces.

Expanding Commercial and Infrastructure Projects

The expansion of commercial spaces, offices, retail outlets, and hospitality projects is creating strong demand for engineered stone in the UK. The material’s durability, hygiene benefits, and design flexibility make it ideal for high-traffic areas such as lobbies, countertops, and flooring. Public infrastructure developments, including airports, educational institutions, and healthcare facilities, further contribute to adoption. Developers increasingly prefer engineered stone for its cost efficiency and compliance with sustainability standards, reinforcing its role as a staple material in long-term infrastructure investments.

Key Trends & Opportunities

Rising Preference for Marble-Look and Luxury Finishes

A key trend in the UK engineered stone market is the growing demand for marble-look finishes. These products combine the luxury aesthetic of natural marble with the durability and affordability of engineered stone. Premium consumers and designers prefer such options for high-end kitchens, hotels, and retail spaces. The segment offers manufacturers an opportunity to expand portfolios with innovative, design-forward products that appeal to upscale projects. This trend also aligns with the rising preference for customized, visually distinctive interiors.

- For instance, Dekton by Cosentino also launched updated ultra-compact stone surfaces with marble-style veining, catering to high-end commercial spaces where both durability and refined aesthetics are critical.

Increasing Focus on Sustainable and Recycled Surfaces

Sustainability has become a central opportunity in the UK market, with manufacturers introducing recycled and silica-free quartz surfaces. Rising environmental awareness and stricter regulations are encouraging architects and contractors to choose eco-friendly materials. Surfaces made with recycled glass or reduced silica content align with green building certifications, enhancing their appeal in both residential and commercial projects. This shift not only strengthens compliance but also provides a competitive edge for brands positioning themselves as leaders in sustainable design solutions.

- For instance, Cosentino launched its Silestone HybriQ+ range in the UK, which uses 99% reused water, 100% renewable electricity, and a hybrid blend of minerals and recycled materials with significantly reduced crystalline silica content.

Key Challenges

Rising Raw Material and Manufacturing Costs

Escalating costs of raw materials, including quartz, resins, and pigments, present a major challenge for UK manufacturers. Energy-intensive production processes further increase expenses, straining margins for suppliers and distributors. Price sensitivity among residential consumers amplifies the issue, making it difficult to pass on cost increases fully. This challenge forces companies to focus on operational efficiency, supply chain optimization, and value-added innovations to remain competitive while balancing affordability with profitability in a highly competitive market landscape.

Intense Competition from Alternative Materials

Engineered stone faces rising competition from substitutes such as natural granite, ceramics, laminates, and even newer materials like sintered stone. These alternatives offer varied pricing, durability, and design advantages, making them attractive in both residential and commercial projects. Consumer preferences, particularly in the luxury segment, can shift toward natural stone due to its authenticity and prestige. This competitive environment pressures engineered stone manufacturers to differentiate through innovation, branding, and partnerships with architects and designers to retain market share.

Regulatory and Environmental Compliance Pressures

The UK market faces increasing scrutiny over environmental and health regulations tied to engineered stone production. Rising concerns around crystalline silica exposure and sustainability standards create compliance challenges for manufacturers. Stricter building codes and worker safety measures require investment in safer production technologies and sustainable materials. Non-compliance risks damaging reputations and limiting market access. Companies must proactively address these pressures by adopting advanced, eco-friendly production processes and ensuring alignment with evolving national and international regulatory frameworks.

Regional Analysis

England

England held the largest share of the UK Engineered Stone Market in 2024, accounting for 52% of total revenue. Strong demand from London and surrounding metropolitan areas supports growth, driven by residential remodeling and commercial projects. Luxury housing developments and high-end office spaces rely on quartz-based engineered stone for durability and aesthetics. Rising investments in hospitality and retail construction also stimulate adoption. The presence of leading distributors and contractors enhances product availability across regions. England remains the most competitive and innovation-focused market for engineered stone adoption.

Scotland

Scotland captured 18% of the UK Engineered Stone Market in 2024, supported by expanding residential and public sector construction. Cities such as Edinburgh and Glasgow are central hubs for housing upgrades and infrastructure projects. Engineered stone is gaining traction in kitchen and bathroom renovations due to its performance and cost efficiency. Government-backed initiatives promoting sustainable construction strengthen its presence in both residential and commercial projects. Strong focus on environmentally friendly materials increases demand for recycled and silica-free surfaces. Scotland offers steady opportunities for suppliers targeting mid to premium housing markets.

Wales

Wales accounted for 15% of the UK Engineered Stone Market in 2024, driven by regional housing developments and interior design adoption. Demand from residential projects dominates, supported by modern housing upgrades in Cardiff and Swansea. The commercial segment is gradually expanding, with retail outlets and small office projects using engineered stone for functional and aesthetic purposes. Contractors favor quartz-based products for their durability and low maintenance requirements. Distribution networks are improving, helping increase accessibility across urban and semi-urban areas. Wales remains a growth-oriented region supported by construction-led demand.

Northern Ireland

Northern Ireland represented 15% of the UK Engineered Stone Market in 2024, supported by a mix of residential and infrastructure projects. Belfast is the primary growth hub, where demand for durable surfaces in housing and offices is steadily rising. Government programs promoting construction activity create opportunities for engineered stone adoption in both private and public projects. Interior designers and contractors are increasingly choosing marble-look engineered stone for premium housing developments. The region’s smaller but expanding market supports steady growth for distributors and suppliers. Northern Ireland remains important for niche but high-quality demand.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Region

Competitive Landscape

The UK Engineered Stone Market is characterized by strong competition among international leaders and regional suppliers, each focusing on product innovation, sustainability, and distribution expansion. Key players such as Caesarstone, Silestone UK (Cosentino), Lapitec UK, Compac UK, and Stone Italiana UK maintain their dominance by offering durable quartz-based and marble-look surfaces with wide design variety. Domestic distributors, including Unistone, Dekton UK, Technistone UK, Cimstone UK, and Florim UK, enhance market reach through localized partnerships with contractors, architects, and retailers. Companies increasingly prioritize eco-friendly solutions, including recycled and silica-free engineered stone, aligning with regulatory requirements and consumer demand for sustainable interiors. Competitive strategies also include branding investments, showroom expansions, and close collaborations with kitchen studios and interior designers. Intense rivalry encourages continuous portfolio diversification, while emphasis on premium finishes ensures strong positioning in luxury residential and commercial projects. This competitive environment reinforces innovation, value-added services, and customer-centric approaches.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone

- Stone Italiana UK

- Silestone UK (Cosentino)

- Lapitec UK

- Compac UK

- Unistone

- Dekton UK (Cosentino)

- Technistone UK

- Cimstone UK

- Florim UK

Recent Developments

- In April 2024, Caesarstone UK launched its Mineral Surfaces collection, offering a low-silica alternative to quartz.

- In 2025, Vadara Quartz Surfaces entered the UK market through a distribution partnership with The Thomas Group.

- In January 2024, Smartstone Company launched its Sintered Collection made from all-natural materials, emphasizing high performance, aesthetic versatility, sustainability, and compliance with new federal regulations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz-based engineered stone will remain strong due to durability and versatility.

- Marble-look surfaces will see rising adoption in luxury residential and commercial projects.

- Residential renovations will continue to drive a majority of market demand across urban areas.

- Commercial adoption will expand with growth in hospitality, office, and retail developments.

- Sustainable and recycled engineered stone will gain traction under stricter environmental standards.

- Designers and architects will increasingly influence product choice through customized solutions.

- Expanding distribution networks will improve accessibility across semi-urban and regional markets.

- Partnerships between suppliers and contractors will strengthen competitive positioning in key regions.

- Rising awareness of silica-related health concerns will accelerate demand for safer alternatives.

- Premium finishes and innovation in surface design will shape the market’s long-term growth path.