Market Overview:

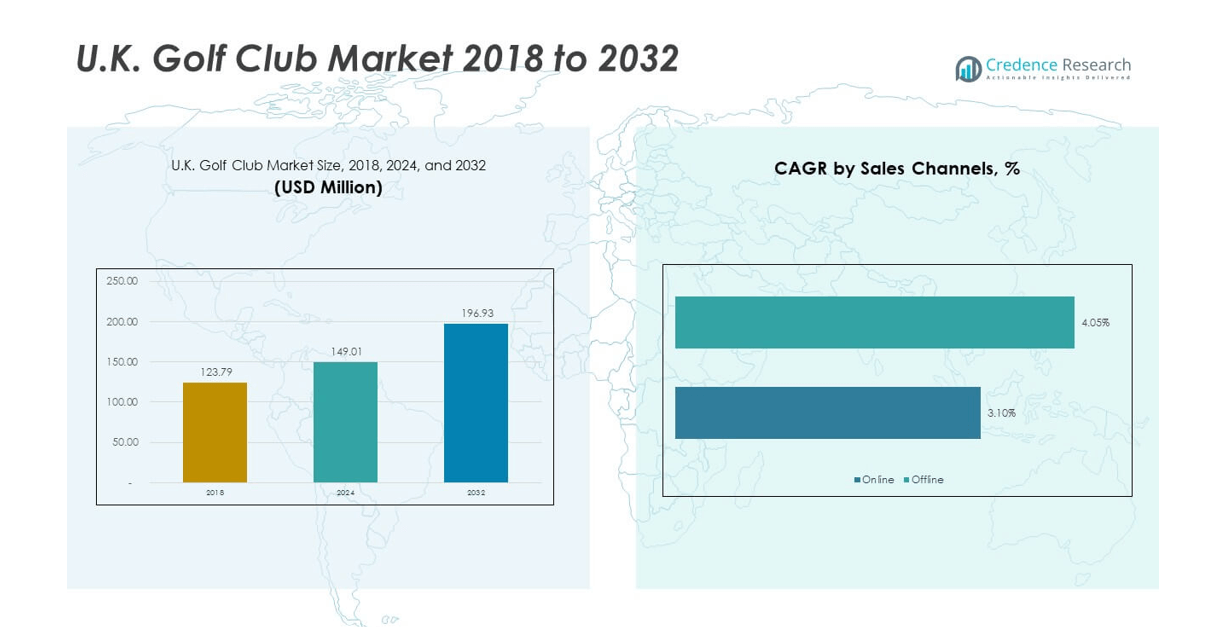

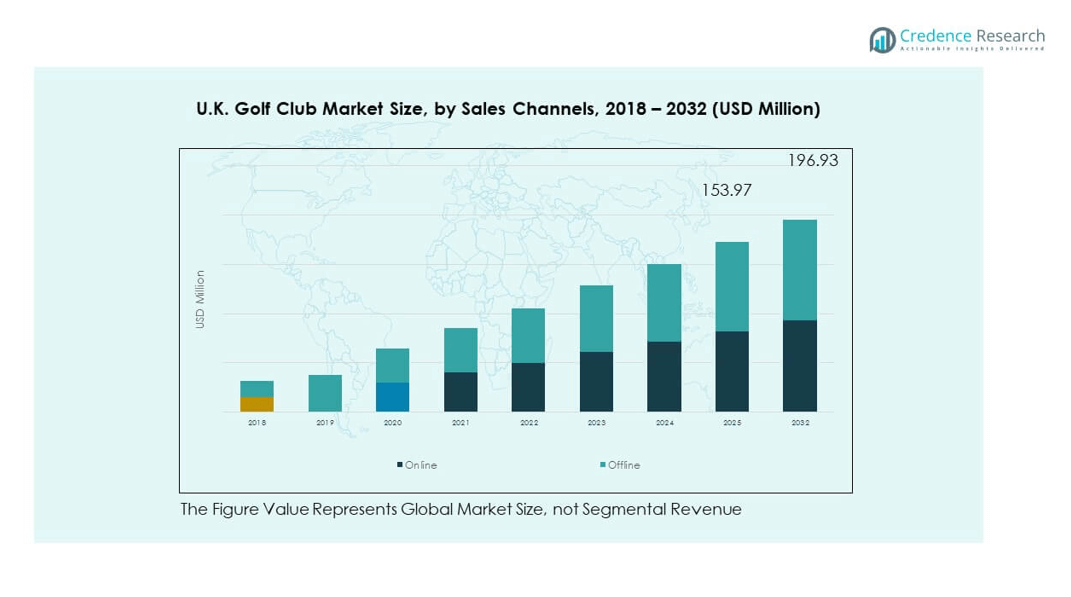

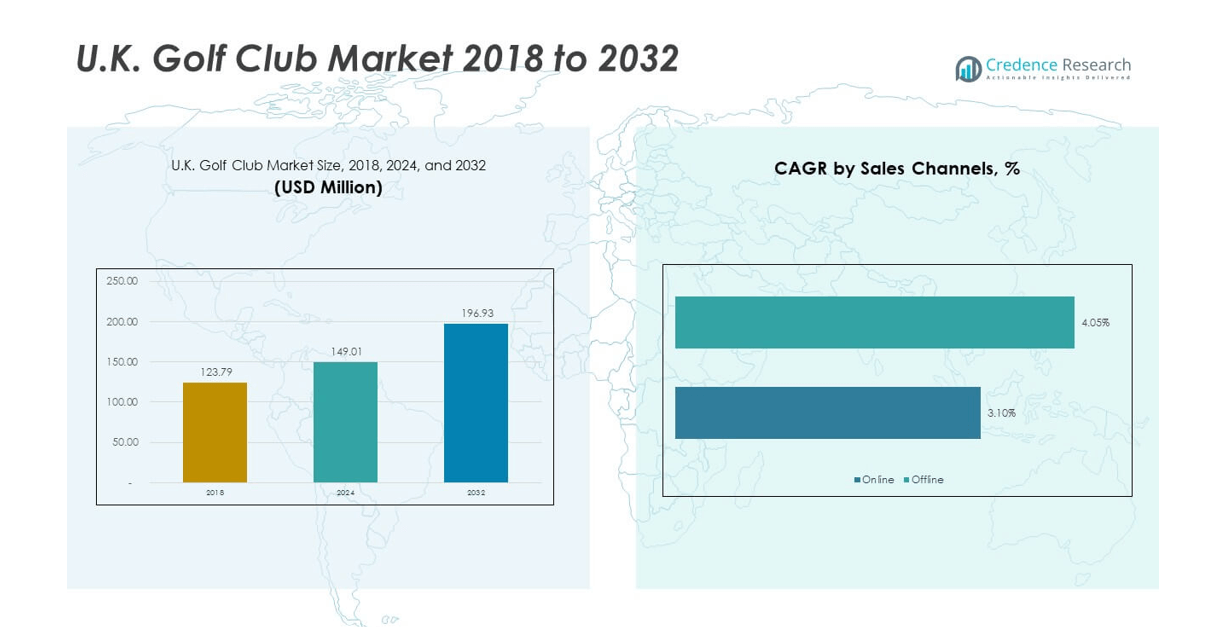

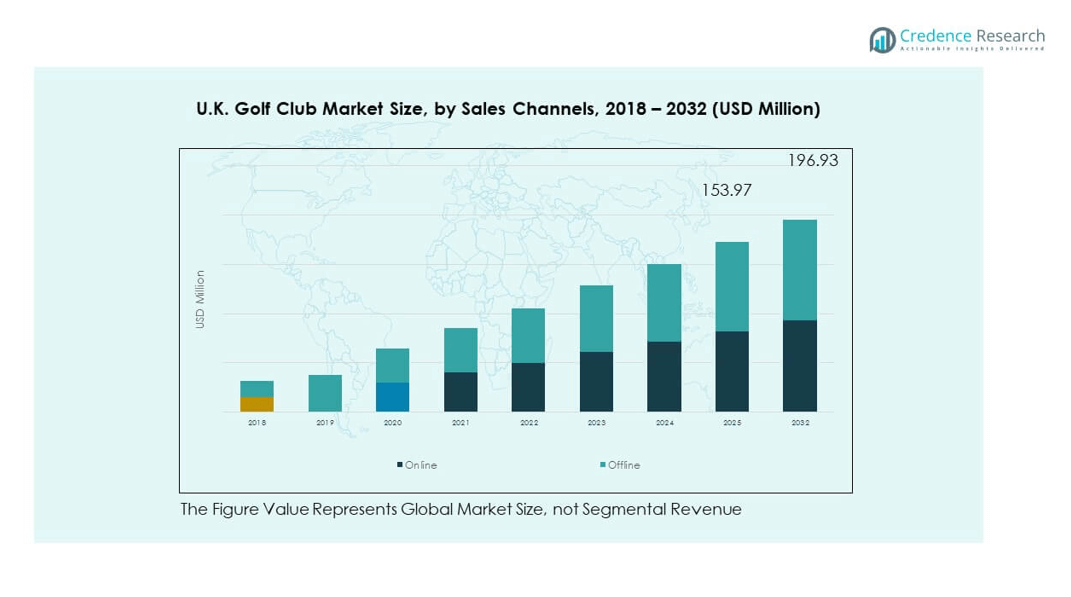

The U.K. Golf Club Market size was valued at USD 123.79 million in 2018 to USD 149.01 million in 2024 and is anticipated to reach USD 196.93 million by 2032, at a CAGR of 3.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Golf Club Market Size 2024 |

USD 149.01 million |

| U.K. Golf Club Market, CAGR |

3.55% |

| U.K. Golf Club Market Size 2032 |

USD 196.93 million |

The market is witnessing steady growth, driven by rising participation in golf as both a recreational activity and a professional sport. Increased awareness of golf as a social and networking activity, combined with initiatives by golf associations to attract younger demographics, is fueling demand. Technological advancements in club design, focusing on improved swing dynamics and customization, are enhancing player experience. Additionally, the growing trend of golf tourism and high-profile tournaments is encouraging consumers to invest in high-quality equipment, supporting market expansion.

Geographically, the market is dominated by regions with a strong golfing culture, including Scotland and England, which are home to prestigious courses and global tournaments. Emerging growth is observed in areas with increasing golf tourism and new course developments, particularly in coastal and countryside regions. Accessibility improvements, combined with the expansion of golf academies and training facilities, are driving interest among beginners. The integration of indoor golf simulators in urban areas is further widening the sport’s reach beyond traditional golf hubs.

Market Insights:

- The U.K. Golf Club Market was valued at USD 123.79 million in 2018, reached USD 149.01 million in 2024, and is projected to hit USD 196.93 million by 2032, growing at a CAGR of 3.55% during the forecast period.

- The Global Golf Club Market size was valued at USD 3,154.4 million in 2018 to USD 3,736.7 million in 2024 and is anticipated to reach USD 4,835.6 million by 2032, at a CAGR of 3.31% during the forecast period.

- Demand is supported by rising participation across age groups, from youth players engaged through school programs to seniors seeking low-impact sports.

- Advancements in club design, including lightweight materials, adjustable heads, and precision-engineered shafts, are improving performance and fueling premium product adoption.

- High equipment costs remain a restraint, limiting adoption among price-sensitive beginners and slowing penetration in lower-income segments.

- Seasonal factors and competition from alternative leisure activities such as faster-paced sports and digital entertainment are impacting consistent participation.

- Scotland and England lead the market due to their rich golfing heritage, iconic courses, and global tournament hosting, driving both domestic and tourism-driven sales.

- Growth opportunities exist in emerging golf tourism destinations within the U.K., as well as in expanding youth development programs to build long-term demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Golf Among Diverse Age Groups:

The U.K. Golf Club Market benefits from an expanding player base that spans multiple age segments. Youth participation has increased due to school programs and beginner-friendly golf events. Senior players remain a key demographic, with golf’s low-impact nature appealing to older age groups. Professional tournaments attract both domestic and international audiences, reinforcing brand recognition for golf clubs. Social media exposure of golf influencers and celebrities is stimulating interest among younger consumers. It has encouraged more recreational players to upgrade their equipment. Investment in grassroots initiatives is broadening access to golf facilities. This combination strengthens long-term demand.

- For instance, England’s junior membership network now includes about 45,000 young golfers—roughly 7% of all England Golf members—supported by programs active in 7,500 schools, while more than 17,000 juniors in England currently hold an official handicap index through the World Handicap System.

Technological Advancements in Club Design and Manufacturing:

Manufacturers are prioritizing innovations in materials and aerodynamics to enhance performance. The U.K. Golf Club Market benefits from precision-engineered shafts, adjustable heads, and lighter yet stronger club bodies. New technologies offer improved swing control, increased distance, and higher accuracy for both amateur and professional players. Custom fitting services are gaining traction as players seek tailored specifications. It is driving premium product adoption, supporting higher margins for manufacturers. Partnerships between technology firms and equipment brands have accelerated development cycles. Greater consumer awareness of performance benefits has created a competitive advantage for brands offering advanced products. This continuous innovation keeps the market dynamic.

- For instance, Arccos, a connected sensor brand, has logged over 1billion golf shots and reports members improving their scores by five shots on average within their first year of use, quantifying real-world outcomes of data-driven training.

Increased Focus on Golf Tourism and Destination Courses:

Golf tourism has emerged as a major driver for equipment demand, with the U.K. home to renowned courses that attract global players. Prestigious destinations in Scotland and England encourage visiting golfers to invest in high-quality clubs during or before their trips. The U.K. Golf Club Market benefits from repeat purchases by frequent travellers. Golf resorts often partner with manufacturers to promote branded merchandise. International events generate a surge in club sales among spectators who take up the sport after attending. It reinforces the market’s premium positioning. Seasonal packages and tours keep tourist demand consistent. These factors collectively boost equipment turnover.

Growth of Retail and E-commerce Channels for Golf Equipment:

Retailers are improving product accessibility through expanded physical outlets and digital storefronts. The U.K. Golf Club Market is seeing significant growth in online sales, driven by detailed product descriptions, virtual fitting tools, and flexible return policies. Specialist golf retailers provide expert advice that builds trust and loyalty. It has enabled consumers to make informed decisions without visiting multiple stores. Seasonal promotions and exclusive launches encourage timely purchases. E-commerce platforms have widened market reach beyond traditional golf hubs. Enhanced delivery networks ensure timely product availability. This omni-channel expansion supports sustained growth in sales volume.

Market Trends:

Sustainability and Eco-Friendly Manufacturing Practices:

Sustainability is becoming a priority for manufacturers and consumers alike. The U.K. Golf Club Market is witnessing greater adoption of recyclable materials and low-impact production techniques. Brands are focusing on reducing carbon footprints while maintaining product quality. Eco-friendly packaging and ethically sourced materials appeal to environmentally conscious buyers. It is influencing purchasing preferences, especially among younger demographics. Courses promoting sustainable practices are collaborating with brands to align values. Public awareness campaigns about environmental responsibility are reinforcing this shift. The sustainability trend is shaping both brand image and consumer loyalty.

- For instance, Galvin Green is ranked as the top golf apparel brand for both sustainability and innovation by UK golfers, with its eco-friendly product range utilizing Bluesign® or Oeko-Tex® Standard 100-approved fabrics and recycled plastic-derived fibers—its DWIGHT half-zip sweater won the ‘Sustainability in Sport’ award at the 2021 Sports Technology Awards.

Integration of Smart and Connected Golf Equipment:

Digital integration is transforming the golfing experience through connected devices. The U.K. Golf Club Market is introducing smart clubs with embedded sensors to track swing speed, ball trajectory, and impact points. Data-driven insights help players improve performance without constant coaching. It is enhancing the training process for both beginners and professionals. Integration with mobile apps allows real-time feedback during play. Tech-savvy golfers view these features as essential rather than optional. Brands offering seamless digital connectivity are gaining a competitive edge. The demand for precision analytics will likely intensify.

- For instance, Arccos Smart Sensors automatically track 98% of all tee shots and pair with mobile apps to deliver real-time, AI-powered analytics—facilitating performance improvement and data-driven club recommendations. Their system has proven impact, with average members lowering their handicap by five shots in the first year, and with over 1billion shots already tracked globally.

Expansion of Women’s Golf Participation and Equipment Lines:

Women’s participation in golf is expanding rapidly, prompting brands to diversify product lines. The U.K. Golf Club Market is responding with clubs designed for women’s swing dynamics, grip sizes, and aesthetic preferences. Golf associations are organizing more women-focused tournaments and training programs. It is creating an inclusive environment that fosters long-term engagement. Female ambassadors and influencers are driving visibility for golf among younger women. Retailers are allocating more space to women-specific equipment. This inclusivity strengthens market penetration across new segments. The growing female customer base is reshaping marketing strategies.

Rise of Indoor Golf and Simulation-Based Practice:

Indoor golf facilities and simulators are attracting urban consumers who lack access to traditional courses. The U.K. Golf Club Market benefits from sales to indoor players seeking performance-oriented clubs. Advanced simulators replicate real-course conditions with high accuracy. It allows players to practice year-round regardless of weather. Urban centers are witnessing a rise in golf-themed entertainment venues. Equipment sales are supported by partnerships with indoor facility operators. The trend aligns with busy lifestyles and the need for convenient practice options. It is creating new revenue streams for manufacturers.

Market Challenges Analysis:

High Equipment Costs Limiting Broader Consumer Adoption:

Premium pricing for golf clubs continues to deter potential entrants into the sport. The U.K. Golf Club Market faces difficulty in reaching price-sensitive segments, particularly beginners hesitant to commit to expensive equipment. It limits conversion rates from casual interest to active participation. Even with financing options, the high cost of advanced clubs restricts adoption in lower-income groups. Manufacturers balancing innovation with affordability encounter margin pressures. Currency fluctuations impact imported component prices, creating further cost instability. Market growth depends on effectively addressing this pricing barrier. The challenge is especially pronounced in regions with slower economic growth.

Competition from Alternative Leisure Activities and Sports:

Golf competes with a wide range of recreational activities for consumer time and spending. The U.K. Golf Club Market is affected by changing lifestyle preferences, with many consumers opting for faster-paced sports or fitness activities. It reduces the rate of new player acquisition. Urban living patterns often limit access to golf courses, further diverting interest. Streaming entertainment, esports, and low-cost fitness subscriptions present strong competition for leisure budgets. Seasonal constraints also impact consistent participation rates. Clubs and retailers must actively market the sport to maintain relevance. Overcoming these competitive pressures remains a persistent challenge.

Market Opportunities:

Emerging Demand from Youth-Focused Golf Development Programs:

Youth-focused initiatives are creating a foundation for future market growth. The U.K. Golf Club Market can leverage school partnerships and junior league programs to nurture interest early. It enables the cultivation of brand loyalty from the start of a player’s journey. Affordable entry-level sets and custom training packages can drive conversion from learning to active play. High-profile role models help inspire youth engagement. Golf’s inclusion in multi-sport academies expands exposure beyond traditional channels. Manufacturers offering tailored solutions for youth will capture an emerging segment.

Potential Growth Through International Tourism and Event Hosting:

International tourism remains a strong opportunity for expansion. The U.K. Golf Club Market benefits from hosting global tournaments and attracting traveling golfers to iconic courses. It boosts both short-term sales and long-term brand recognition. Partnerships with travel operators and resort chains can amplify reach. Branded merchandise tied to events generates incremental revenue. Growth in this segment depends on coordinated marketing between tourism boards and equipment brands. Expanding into destination-specific product lines could enhance appeal among visiting golfers.

Market Segmentation Analysis:

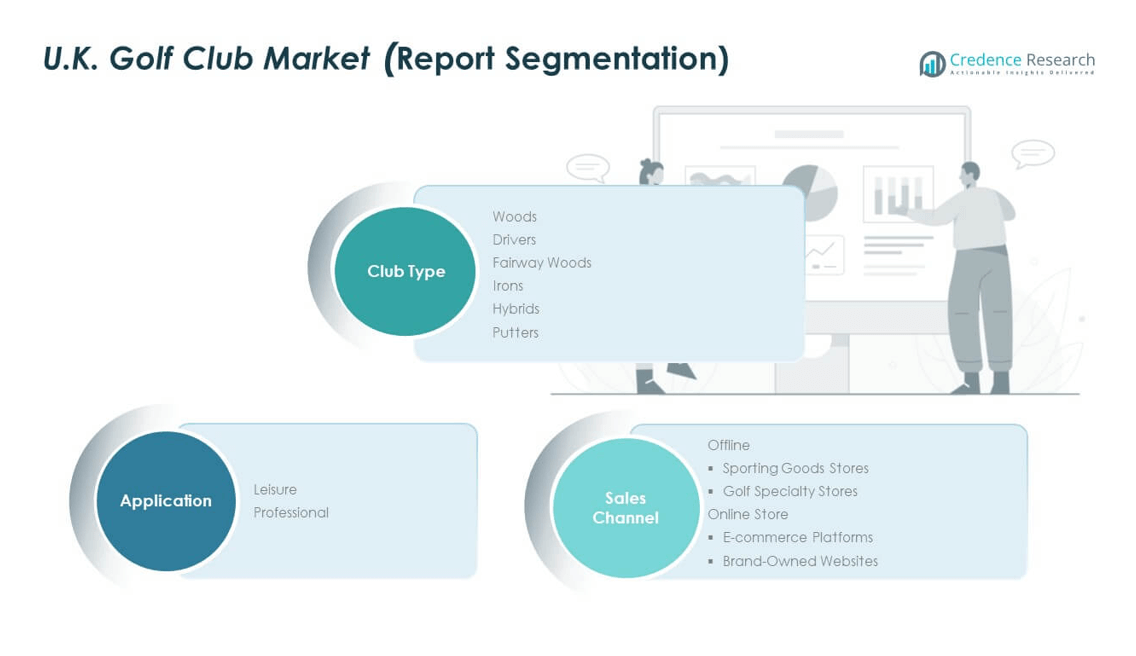

By Club Type

The U.K. Golf Club Market demonstrates a balanced demand across varied club types, reflecting diverse player preferences and performance requirements. Woods and drivers maintain strong sales among professionals and experienced amateurs seeking greater distance and precision off the tee. Fairway woods hold steady demand for versatility in mid-range play, while irons remain a core segment due to their use across skill levels. Hybrids are gaining popularity for their ease of control and forgiveness, appealing to both beginners and seasoned golfers. Putters continue to see consistent demand, driven by their critical role in short-game performance.

By Application

The market is split between leisure and professional use, with leisure golfers representing a larger share due to the growing number of casual players and club memberships. Professional demand remains significant, driven by tournament participation and the constant pursuit of performance enhancements. It benefits from a steady replacement cycle, as competitive players frequently upgrade equipment to align with the latest technology.

- For instance, the UK golf club market continues to see a majority share from leisure users, supported by club memberships and mass participation programs, yet professional demand remains evident from regular equipment upgrades driven by technological advancements and mandatory replacement cycles tied to competition preparation.

By Sales Channel

Sales channels show offline retail as a leading contributor, with sporting goods stores catering to a broad customer base and golf specialty stores offering expert fitting and premium selections. The online store segment is expanding, supported by e-commerce platforms delivering convenience and competitive pricing, while brand-owned websites strengthen direct-to-consumer engagement. Others, including event-based and pro-shop sales, provide targeted access to niche buyer groups. The diversification of distribution channels ensures market reach across both urban and regional golfing communities.

Segmentation:

By Club Type

- Woods

- Drivers

- Fairway Woods

- Irons

- Hybrids

- Putters

By Application

By Sales Channel

- Offline

- Sporting Goods Stores

- Golf Specialty Stores

- Online Store

- E-commerce Platforms

- Brand-Owned Websites

- Others

Regional Analysis:

Scotland

Scotland holds the largest share of the U.K. Golf Club Market, accounting for approximately 38% of total sales. Its dominance is rooted in its global reputation as the “Home of Golf,” with iconic courses such as St Andrews attracting both domestic and international players. Tourism-driven purchases are significant, as visiting golfers often invest in high-quality clubs before or during their trip. Local manufacturing expertise supports the availability of premium products tailored to serious players. It benefits from a high concentration of professional tournaments, which boost awareness and adoption of advanced club technologies. Seasonal demand peaks during major events, driving both retail and pro-shop sales.

England

England contributes around 35% of market share, supported by a dense network of golf courses and training academies across both rural and urban regions. The presence of well-developed distribution channels, including specialty golf retailers and large sporting goods stores, strengthens accessibility. England also benefits from a growing base of leisure golfers, particularly in suburban areas where course memberships are more affordable. It has a strong professional golf scene, with several PGA events stimulating demand for performance-focused clubs. Indoor golf simulators in metropolitan areas are expanding access to the sport, creating opportunities for equipment upgrades. The combination of accessibility, infrastructure, and competitive events sustains steady growth.

Wales and Northern Ireland

Wales and Northern Ireland together account for approximately 27% of the market, driven by niche tourism appeal and community-based golf participation. Wales leverages scenic coastal and countryside courses to attract both domestic and visiting players. Northern Ireland benefits from global recognition through championship courses such as Royal Portrush, enhancing its golf tourism profile. It experiences demand spikes during regional tournaments and seasonal travel periods. Smaller but dedicated golfing communities ensure a steady base of leisure equipment purchases. These regions present opportunities for targeted marketing strategies, particularly in promoting beginner-friendly clubs and tailored tourism packages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Orka Golf Limited

- Stewart Golf

- TaylorMade Golf Company

- The Masters Golf Company Ltd

- Cleveland Golf

- Acushnet Company

- Forgan

- Takomo Golf Company

- Golfsmith International Holdings, Inc.

- Wilson Sporting Goods Co.

- Other Key Players

Competitive Analysis:

The U.K. Golf Club Market is characterized by a mix of global brands and domestic manufacturers competing on innovation, quality, and brand reputation. Leading players focus on advanced materials, precision engineering, and performance-enhancing features to maintain market share. It sees strong competition in both premium and mid-range segments, with companies targeting specific customer groups such as professionals, leisure golfers, and beginners. Brand loyalty is reinforced through sponsorships, endorsements, and product customization. Distribution strategies combine specialty golf stores, sporting goods retailers, and e-commerce platforms to maximize reach. Price competitiveness is critical, especially in the entry-level market, while premium brands emphasize technological leadership and exclusivity to justify higher margins.

Recent Developments:

- In August 2025, TaylorMade officially expanded into forged wedges with the unveiling of its MG5 Forged Wedges in the U.K. retail market. The MG5 features machine-milled grooves, milled grind soles, and strategic mass placement for improved control, spin, and consistency—catering specifically to the needs of skilled and advanced golfers seeking elevated short-game performance.

- In May 2025, Takomo Golf Company finalized a major investment partnership with Mandatum Asset Management Growth Equity II fund. This EUR20 million funding round is set to support Takomo’s aggressive international expansion, including increased marketing and logistics capabilities in the U.K. and broader European market. The company’s direct-to-consumer business model and rapid turnover growth—rising nearly tenfold from 2022 to 2024—have made Takomo an emerging disruptor in the British golf equipment scene.

- In January 2025, Cleveland Golf debuted its RTZ Wedge line, featuring the revolutionary Z-Alloy steel, which offers a 10% softer feel compared to previous models. The wedges launch with four precision-milled grind options, exclusive finish choices, and enhanced grooves for optimal spin—each customized for diverse playing styles. Availability in the U.K. began in January, reflecting Cleveland’s enduring commitment to innovative wedge technology for British golfers.

Market Concentration & Characteristics:

The U.K. Golf Club Market exhibits moderate concentration, with a few dominant international brands holding significant share alongside specialized domestic manufacturers. It is driven by product innovation, brand heritage, and the ability to serve diverse customer needs across professional and leisure segments. High-end brands maintain strong visibility through endorsements and tournament sponsorships, while value-oriented players compete through competitive pricing and broad retail distribution. Seasonal demand fluctuations influence sales patterns, with peak activity during golfing season and major tournament periods. The market’s structure supports both premium and entry-level competition, fostering continuous product differentiation.

Report Coverage:

The research report offers an in-depth analysis based on club type, application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of advanced materials and manufacturing techniques will continue to improve club performance and durability.

- Expansion of golf tourism will drive higher demand for premium clubs among international and domestic travelers.

- Growth in women’s participation will encourage manufacturers to broaden product designs and specifications.

- Increasing use of smart technology and connected devices in clubs will enhance player performance analytics.

- Younger demographics will be targeted through beginner-friendly products and junior training initiatives.

- E-commerce platforms will strengthen their market presence through virtual fitting tools and direct-to-consumer models.

- Indoor golf facilities will boost year-round equipment sales, particularly in urban centers.

- Brand collaborations with golf academies and resorts will create exclusive product lines and service offerings.

- Customization services will gain traction as players seek equipment tailored to personal swing dynamics.

- Sustainability in manufacturing and packaging will influence consumer preferences and brand loyalty.