Market Overview:

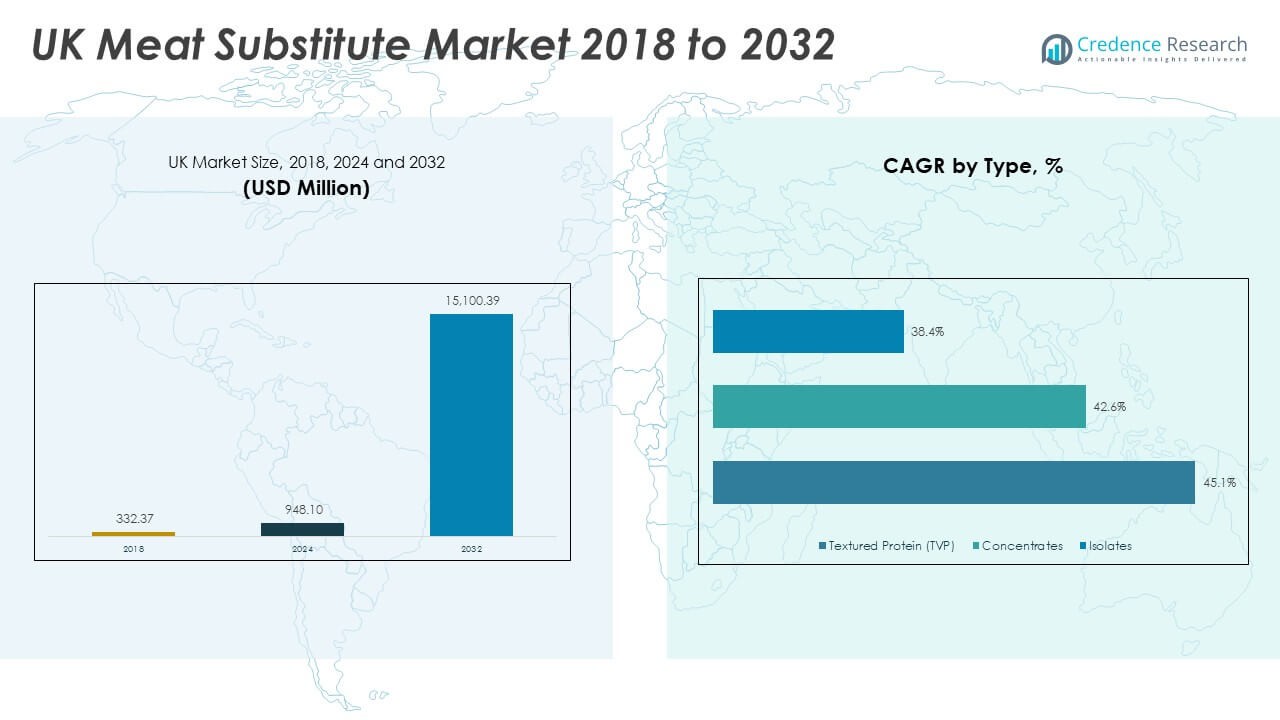

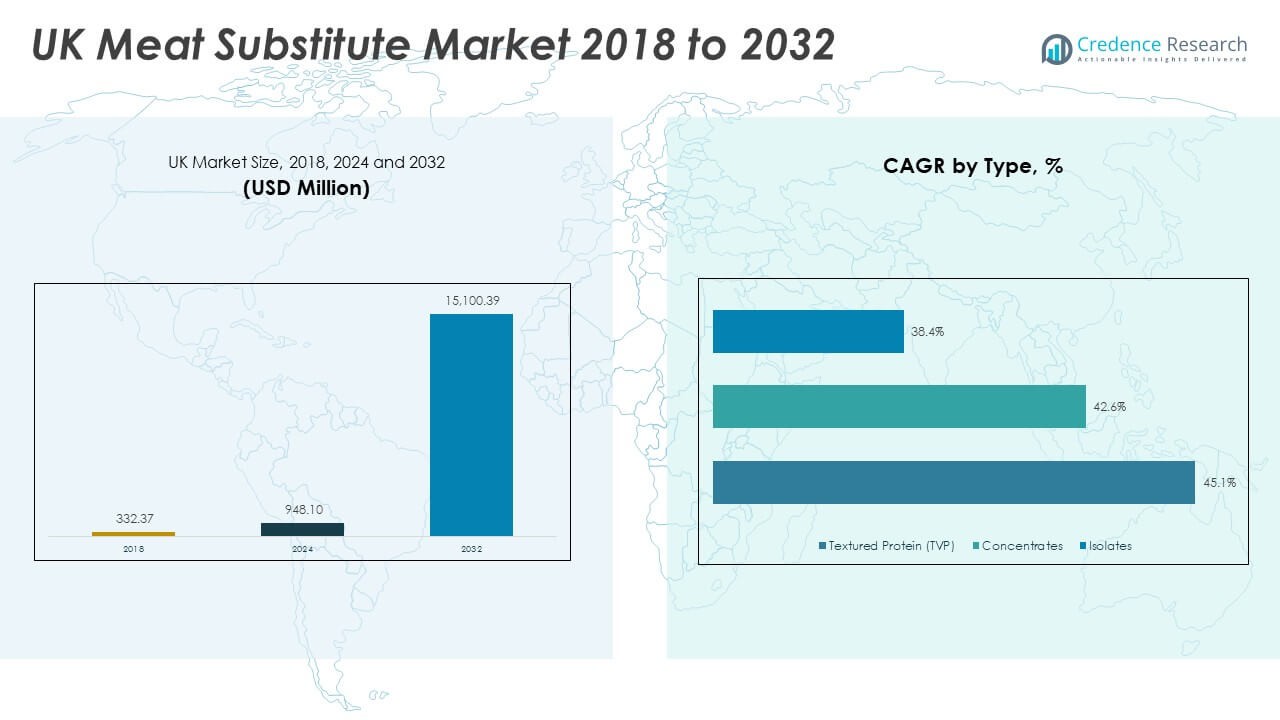

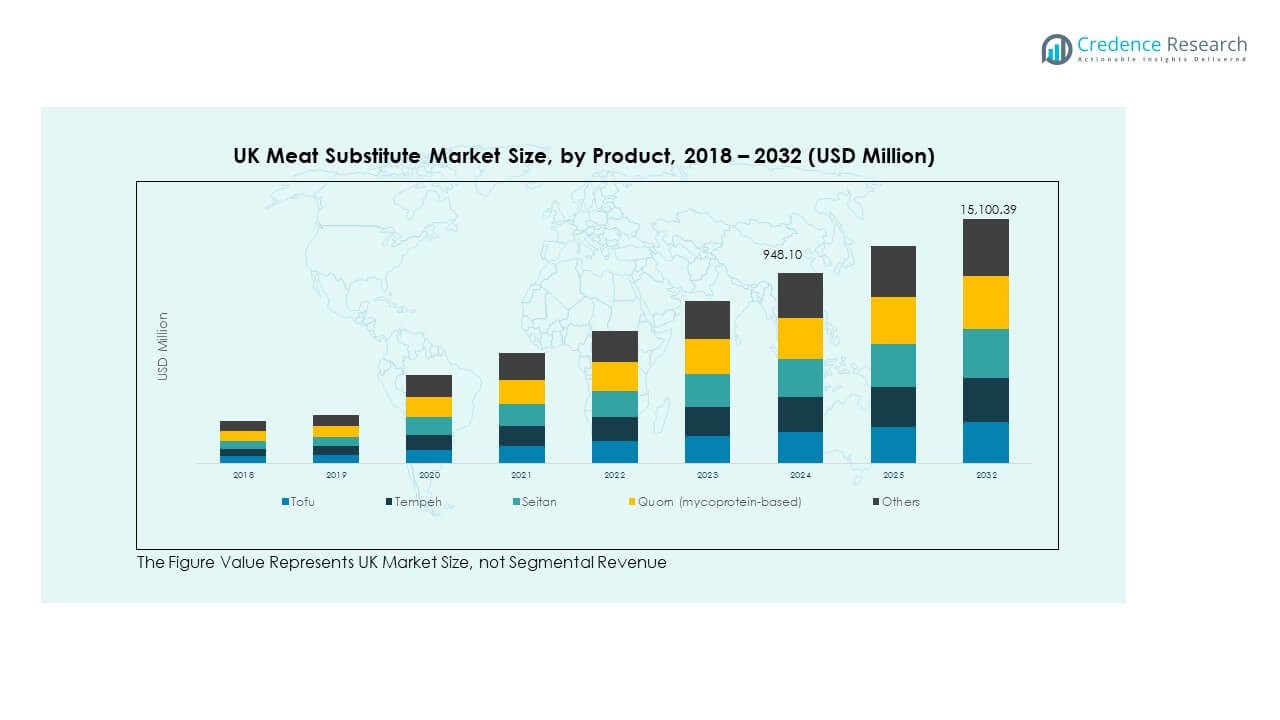

The UK Meat Substitute Market size was valued at USD 332.37 million in 2018 to USD 948.10 million in 2024 and is anticipated to reach USD 15,100.39 million by 2032, at a CAGR of 41.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Meat Substitute Market Size 2024 |

USD 948.10 Million |

| UK Meat Substitute Market, CAGR |

41.34% |

| UK Meat Substitute Market Size 2032 |

USD 15,100.39 Million |

The market is driven by rising health awareness, ethical concerns, and the environmental impact of animal farming. Consumers are increasingly adopting plant-based diets for lifestyle, wellness, and sustainability reasons. Flexitarian diets have gained traction, pushing manufacturers to expand product portfolios with meat-like textures and flavors. Growth is also supported by strong retail availability, rising product visibility in supermarkets, and aggressive marketing campaigns by brands. Government support for sustainable food practices further reinforces consumer adoption.

Geographically, the UK market shows strong performance in England due to higher awareness, developed retail infrastructure, and consumer preference for sustainable diets. Scotland and Wales are emerging as important growth regions, supported by rising vegetarian and vegan populations. Urban centers are leading adoption because of broader exposure to plant-based innovations and availability of diverse product ranges. Rural areas are catching up gradually, supported by e-commerce channels. Regional diversity is shaping market penetration, with both established and new players targeting localized consumer needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Meat Substitute Market size was USD 332.37 million in 2018, reached USD 948.10 million in 2024, and is projected to hit USD 15,100.39 million by 2032, growing at a CAGR of 41.34%.

- England commanded the largest share at 58%, driven by advanced retail infrastructure, strong urban consumer demand, and the presence of leading brands.

- Scotland accounted for 22% of the market, supported by a strong vegan community and expanding foodservice adoption, positioning it as the second-largest region.

- Wales and Northern Ireland held 20% combined, emerging steadily with growth fueled by rising e-commerce penetration and increasing health-conscious consumer segments.

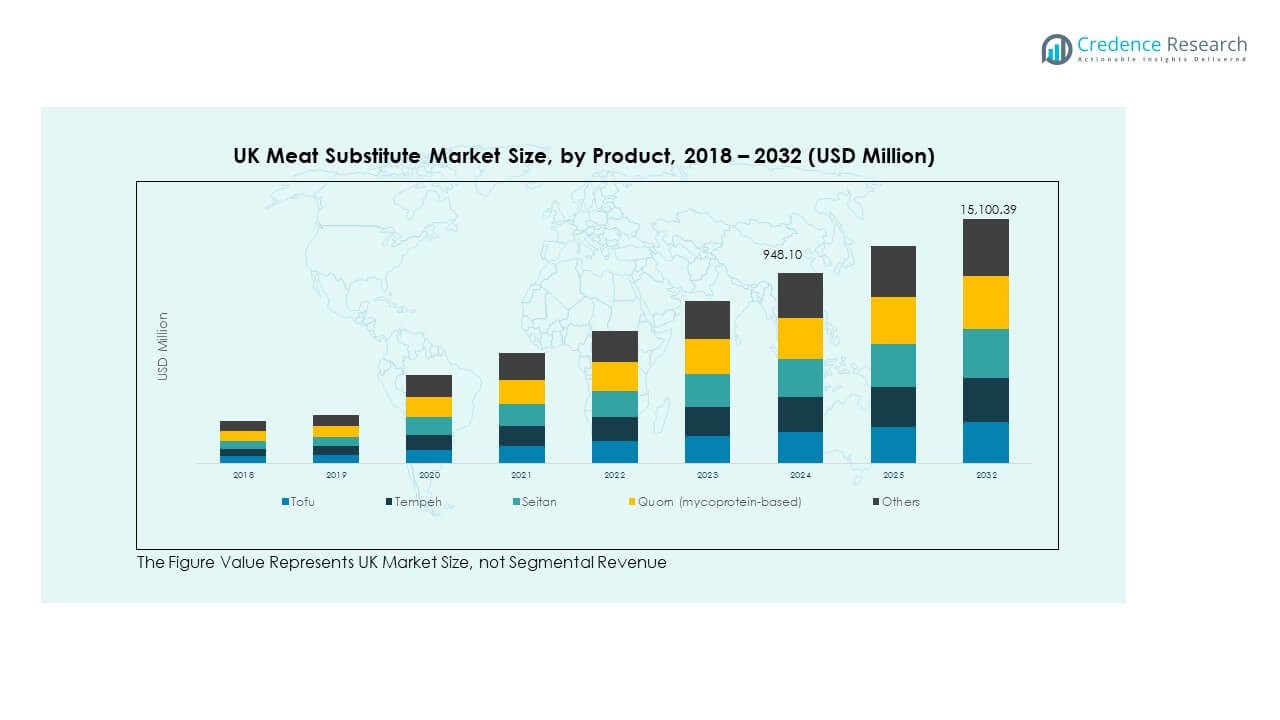

- By product, Quorn (mycoprotein-based) led with the highest share, while tofu maintained steady growth; together these categories accounted for over 45% of the UK Meat Substitute Market in 2024.

Market Drivers:

Rising Health Awareness and Dietary Shifts

The UK Meat Substitute Market is gaining traction from rising health awareness across the population. Consumers are shifting diets to reduce cholesterol, fat, and calorie intake for long-term wellness. Growing cases of obesity and cardiovascular issues are pushing demand for healthier food alternatives. Plant-based substitutes are perceived as nutritious and safe, aligning with preventive healthcare practices. Younger demographics, in particular, are adopting meat-free diets to maintain active lifestyles. Increased education about balanced diets is encouraging trials of substitutes in households. It is further supported by campaigns promoting healthy eating habits nationwide.

- For instance, the US-based Mushroom Meat Company launched a shredded beef alternative made with functional mushrooms and whole plants in May 2024 for the food service industry. It was tested at a steakhouse chain in California around that time.

Ethical Concerns and Animal Welfare Advocacy

Ethical concerns around industrial farming are playing a pivotal role in consumer choices. Public awareness of animal cruelty in conventional farming systems has grown significantly. Advocacy groups and NGOs have promoted vegetarianism and veganism through campaigns and outreach. Media coverage of livestock practices is shaping consumer perception, creating demand for alternatives. The UK Meat Substitute Market benefits from these shifts, with brands highlighting cruelty-free production. Transparency in sourcing and ethical positioning are now major purchase influencers. It is encouraging companies to expand sustainable and animal-free production methods.

- For instance, UK’s Quorn Foods reported that 70% of its product lines are now produced using fermentation technology that reduces carbon emissions by up to 50%, reinforcing its cruelty-free positioning in 2025.

Government Support and Sustainable Food Policies

Policy support is reinforcing growth of the UK Meat Substitute Market. Government initiatives encouraging carbon reduction and sustainable diets are shaping consumption. Subsidies and incentives for plant-based food innovation are gaining traction. Regulators are introducing frameworks to reduce dependence on livestock farming. Educational campaigns emphasize sustainable diets and their environmental benefits. Retailers are aligning with these policies, expanding plant-based product shelves. It is also supported by collaborations between policymakers, retailers, and food manufacturers to promote adoption.

Retail Expansion and Product Availability

Expansion of retail networks is directly boosting adoption of meat substitutes. Supermarkets and specialty stores are providing wider visibility for these products. Dedicated plant-based sections are normalizing alternatives in mainstream shopping. E-commerce platforms are ensuring access in both urban and rural regions. Strong marketing campaigns are creating familiarity with plant-based offerings. The UK Meat Substitute Market is supported by collaborations between food service chains and producers. It is ensuring consumers find substitutes not just at stores but in everyday dining.

Market Trends:

Advancements in Product Innovation and Taste Profiles

The UK Meat Substitute Market is experiencing growth from significant product innovation. Manufacturers are investing heavily in replicating authentic meat textures and flavors. Consumers are demanding substitutes that resemble traditional meat in every aspect. Food technology, including fermentation and protein blending, is enhancing authenticity. Partnerships with food scientists and chefs are creating restaurant-grade experiences at home. Companies are also diversifying into ready-to-cook and frozen meal categories. It is positioning the industry as a serious alternative rather than a niche segment.

- For instance, Beyond Meat relaunched an enhanced, unbreaded “Beyond Chicken® Pieces” product in the U.S. in May 2025, made with heart-healthy avocado oil to provide 21 grams of protein per serving and a tender texture. In contrast, Beyond Meat launched its Beyond Steak product into UK retail stores in May 2025.

Rising Popularity of Flexitarian Diets

Flexitarianism is becoming a mainstream dietary trend in the UK. Consumers are not fully eliminating meat but reducing consumption gradually. Substitutes are being integrated into weekly meals rather than occasional choices. The UK Meat Substitute Market benefits from this balanced approach to consumption. Flexitarians are driving steady and sustainable demand across both retail and foodservice. Campaigns highlighting moderation resonate with health-conscious but non-vegan consumers. It is shaping an inclusive market environment where substitutes appeal beyond strict vegans.

- For instance, a 2025 AHDB report, “Balancing health and sustainability,” advocates for including moderate amounts of lean red meat as part of a balanced, plant-rich diet, and considers the context of wider food systems. AHDB research also indicates a rise in people choosing to eat meat less often, or exploring vegan and plant-based alternatives. The report and wider AHDB findings reflect a general shift towards balanced diets that integrate plant-based options, rather than total elimination of animal proteins.

Collaboration with Foodservice and Restaurant Chains

Partnerships with restaurants and QSR chains are accelerating adoption rates. Popular chains are offering plant-based options alongside conventional menus. This integration normalizes substitutes in mainstream dining experiences. The UK Meat Substitute Market is supported by brand collaborations for menu innovation. Consumers are more likely to try substitutes when offered at trusted restaurants. This trend also builds credibility for products among hesitant buyers. It is ensuring substitutes become a regular part of dining culture nationwide.

Growing Focus on Sustainability and Carbon Reduction

Sustainability is a leading trend shaping consumer and business strategies. Buyers are evaluating food choices based on carbon footprints and ecological impact. Meat substitutes are marketed as climate-friendly options with reduced emissions. The UK Meat Substitute Market is aligning with global sustainability commitments. Brands are emphasizing recyclable packaging and eco-conscious sourcing. Consumers are responding positively to clear sustainability labeling and certifications. It is reinforcing the role of substitutes in broader climate-friendly lifestyle choices.

Market Challenges Analysis:

High Prices and Limited Affordability for Mass Consumers

Pricing remains a critical challenge in the UK Meat Substitute Market. Products are often priced higher than conventional meat, restricting adoption among cost-sensitive groups. The perception of substitutes as premium products limits mass-market penetration. Rising inflation and household budget constraints intensify affordability concerns. Consumers in lower-income groups hesitate to switch despite awareness. The industry faces difficulty balancing innovation costs with affordable pricing strategies. It is pressuring companies to optimize production processes for competitive price points.

Taste Acceptance and Consumer Perception Barriers

Consumer acceptance of substitutes remains uneven despite innovation efforts. Some buyers still believe products lack authentic taste and texture. Skepticism about nutritional value creates hesitation among traditional meat-eaters. Misconceptions around processed ingredients also impact trust levels. The UK Meat Substitute Market faces resistance from consumers preferring natural whole foods. Restaurants and retailers also need assurance about consistent quality and supply. It is challenging brands to overcome perceptions while improving sensory and nutritional profiles.

Market Opportunities:

Rising Demand for Plant-Based Protein Innovations

The UK Meat Substitute Market holds strong opportunities in plant-based protein innovations. Consumers are eager for advanced formulations that mimic meat closely. Producers can explore pea, soy, lentil, and mushroom-based blends for diversity. Growth of protein-focused diets provides further scope for fortified options. Expansion into protein-rich snacks and convenience foods can attract busy professionals. It is creating room for companies to differentiate with high-protein, clean-label offerings.

Expansion Across Foodservice and Export Markets

Opportunities lie in partnerships with global foodservice and hospitality players. Export potential is rising as international markets demand high-quality substitutes. The UK Meat Substitute Market can position itself as an innovation hub. Aligning with global sustainability agendas strengthens export competitiveness. Foodservice collaborations will build brand loyalty and expand regular use cases. It is also helping domestic players scale operations for international visibility.

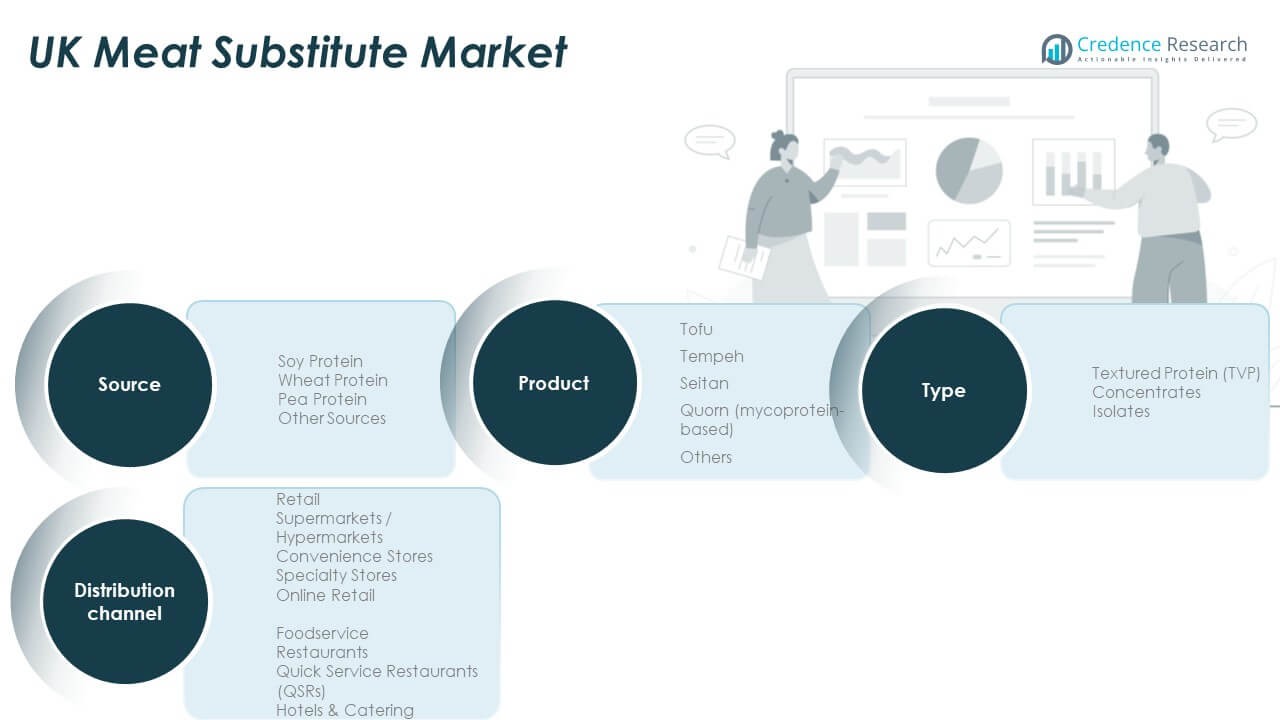

Market Segmentation Analysis:

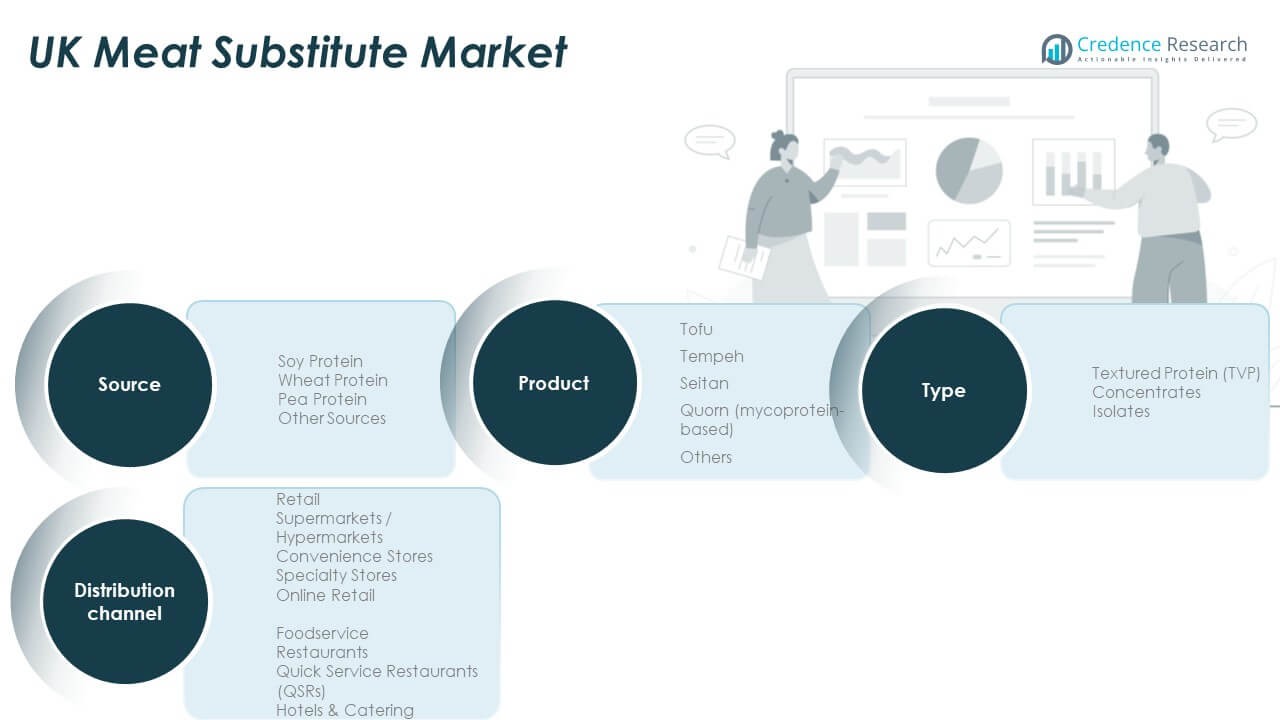

By Type

The UK Meat Substitute Market is segmented into textured protein (TVP), concentrates, and isolates. TVP leads due to its affordability and versatility in processed foods. Concentrates are gaining acceptance for balanced nutrition and functional applications. Isolates, with their higher purity, cater to consumers demanding premium protein products. It is evident that each type meets distinct consumer groups, driving market diversity.

- For instance, Quorn products are made from mycoprotein (a fermented fungus), not textured vegetable protein (TVP), which is typically soy-based. In 2024, Quorn held a 27.2% share of the UK’s grocery retail meat-alternative market, and the brand operates within a competitive landscape.

By Source

Key sources include soy protein, wheat protein, pea protein, and others. Soy protein dominates owing to its wide availability and proven functionality. Wheat protein is growing steadily, supported by its application in baked and plant-based meat alternatives. Pea protein is emerging as a clean-label, allergen-free option, attracting health-conscious consumers. Other niche sources are adding innovation and variety to the market.

- For instance, according to USDA data cited in 2024, soy protein isolate contains 81 grams of protein per 100 grams and remains the most utilized source for plant-based meat products in the UK, while pea protein companies like Heura raised $22.2 million to scale up production focused on allergen-free meat alternatives as of May 2025.

By Product

Product segmentation includes tofu, tempeh, seitan, Quorn (mycoprotein-based), and others. Quorn holds a leading position, driven by brand recognition and strong consumer loyalty. Tofu and tempeh continue to serve traditional and health-focused segments. Seitan offers high protein content and is favored by consumers seeking meat-like textures. It is clear that product variety allows wider adoption across demographics.

By Distribution Channel

The market is divided between retail and foodservice. Retail comprises supermarkets, convenience stores, specialty stores, and online retail, with supermarkets and online channels showing strong traction. Foodservice, including restaurants, QSRs, and hotels, is expanding offerings to meet mainstream demand. It is ensuring greater accessibility and visibility for meat substitute products across the country.

Segmentation:

- By Type

- Textured Protein (TVP)

- Concentrates

- Isolates

- By Source

- Soy Protein

- Wheat Protein

- Pea Protein

- Other Sources

- By Product

- Tofu

- Tempeh

- Seitan

- Quorn (Mycoprotein-Based)

- Others

- By Distribution Channel

- Retail

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice

- Restaurants

- Quick Service Restaurants (QSRs)

- Hotels & Catering

Regional Analysis:

England – Dominant Market Hub

England holds the largest share of the UK Meat Substitute Market at nearly 58%. Strong consumer awareness, higher disposable incomes, and established retail infrastructure contribute to its dominance. Supermarkets and specialty stores in metropolitan areas such as London, Manchester, and Birmingham lead product visibility. Demand is reinforced by health-conscious urban populations and rising adoption of flexitarian diets. England also serves as the primary launchpad for new product innovations, supported by active marketing campaigns. It remains the most competitive region, with both domestic and international brands strengthening presence.

Scotland – Rising Growth Landscape

Scotland accounts for around 22% of the UK Meat Substitute Market, with steady growth driven by a strong vegan and vegetarian community. The cultural openness to sustainable diets has positioned Scotland as a promising region. Foodservice operators, including restaurants and QSR chains, are rapidly expanding plant-based menus. Supermarkets in urban centers such as Edinburgh and Glasgow are increasing shelf space for substitutes. Government-backed sustainability programs further encourage local adoption of meat alternatives. It is creating a supportive ecosystem for both emerging brands and established players.

Wales and Northern Ireland – Emerging Opportunities

Wales and Northern Ireland collectively represent about 20% of the UK Meat Substitute Market. Growth is gradual but consistent, supported by increasing product availability through e-commerce and regional retail chains. Consumers in these areas are showing greater openness to substitutes, particularly among younger demographics. Local foodservice outlets are beginning to include plant-based options, broadening visibility. Rising awareness of health and environmental benefits is expected to fuel higher consumption levels. It is positioning these regions as emerging growth frontiers with untapped potential for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Meat Substitute Market is highly competitive with a strong mix of domestic and global players. Leading companies such as Quorn Foods, The Tofoo Co., VBites Foods Ltd., and Linda McCartney Foods focus on expanding product portfolios and building brand loyalty. Strategic emphasis is on replicating authentic meat texture and flavor while ensuring clean-label and sustainable credentials. New entrants are driving innovation by targeting niche segments like pea protein-based products and allergen-free substitutes. Distribution partnerships with supermarkets, QSRs, and online platforms are central to expansion. Companies also invest heavily in marketing campaigns to normalize substitutes among traditional meat consumers. It is fostering an environment where differentiation through innovation, sustainability, and affordability shapes long-term competitiveness.

Recent Developments:

- In September 2025, Quorn Foods launched a new foodservice range called Kitchen Kings, which features plant-based and gluten-free products aimed at simplifying menu planning for commercial kitchens. This range includes savory bites and vegan pieces targeted at foodservice operators.

- In April 2025, The Tofoo Co introduced two new meat alternative products: a Thai Burger and Southern Fried Pieces. These new offerings were designed as options for summer barbecues and were launched in major UK retailers Tesco and Waitrose. The Tofoo Co also relaunched its tempeh product with a new UK-made recipe in May 2025, boasting just four ingredients and a nutty taste profile.

- In September 2025, The Tofoo Co returned to the frozen category with a new pre-prepared frozen tofu range designed for busy shoppers, further expanding their product portfolio. The company was acquired by private equity firm Comitis Capital in August 2024, which enabled strategic expansion and new product development.

Report Coverage:

The research report offers an in-depth analysis based on type, source, product, and distribution channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of flexitarian diets will drive sustained growth.

- Product innovation will enhance meat-like taste and texture.

- Expansion of online retail will boost accessibility across regions.

- Partnerships with QSRs will normalize substitutes in daily dining.

- Clean-label and allergen-free options will gain consumer trust.

- Sustainability claims will strengthen brand positioning and loyalty.

- Younger demographics will remain primary adopters of plant-based diets.

- Competitive pricing strategies will expand penetration beyond premium markets.

- Export potential will increase as demand grows in international markets.

- Continuous R&D investment will accelerate category diversification.