Market Overview:

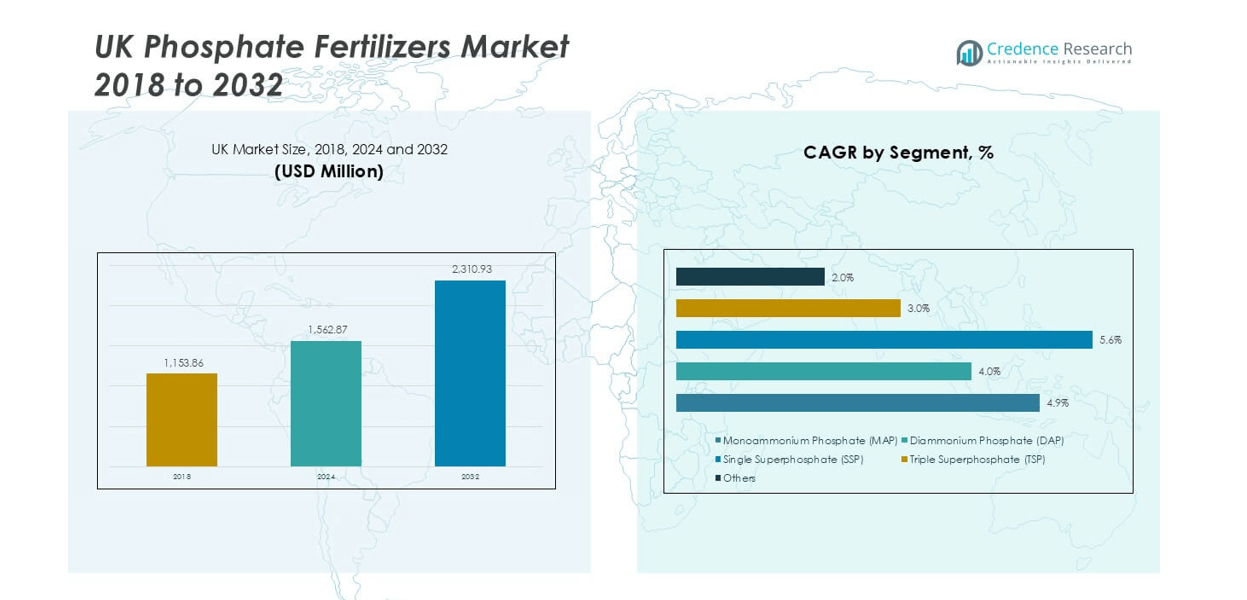

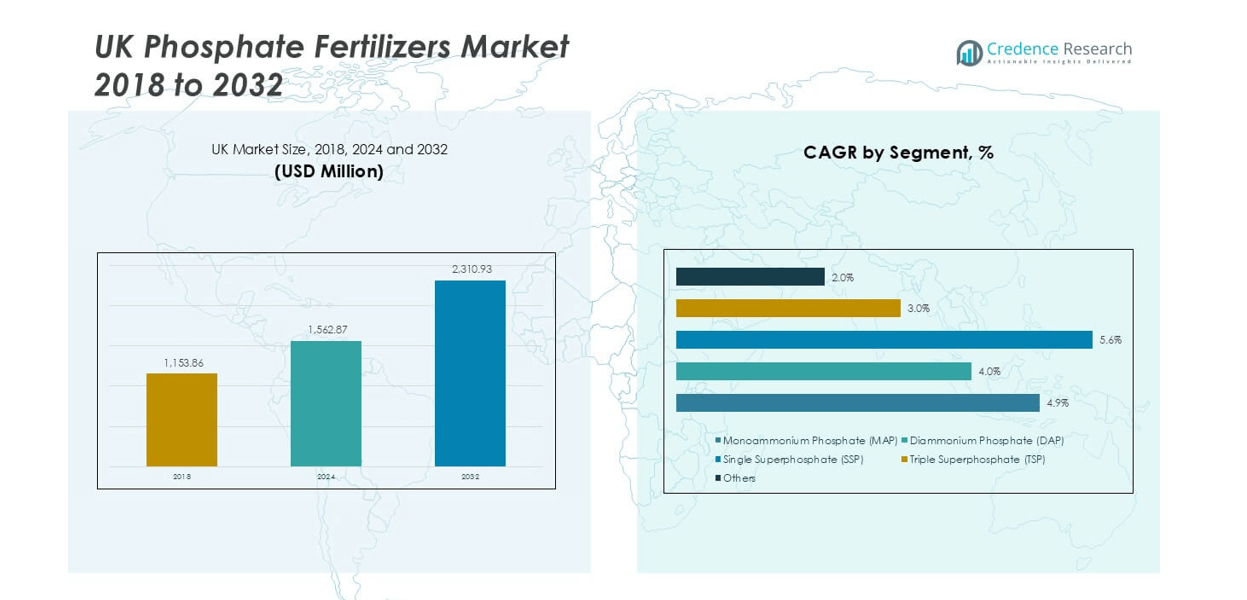

UK Phosphate Fertilizers market size was valued at USD 1,153.86 million in 2018, increased to USD 1,562.87 million in 2024, and is anticipated to reach USD 2,310.93 million by 2032, at a CAGR of 4.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Phosphate Fertilizers Market Size 2024 |

USD 1,562.87 million |

| UK Phosphate Fertilizers Market, CAGR |

4.91% |

| UK Phosphate Fertilizers Market Size 2032 |

USD 2,310.93 million |

The UK phosphate fertilizers market is led by major players such as Yara International, EuroChem Group, ICL Group Ltd, BASF SE, Nutrien Ltd., CF Industries Holdings, K+S AG, Helm AG, and COMPO Expert GmbH. These companies focus on supplying high-quality MAP, DAP, and specialty phosphate fertilizers, supporting precision farming and sustainable practices. England dominates with nearly 65% market share, driven by extensive cereal and grain cultivation, while Scotland, Wales, and Northern Ireland collectively account for the remaining 35%. Strategic expansions, product innovation, and strong distribution networks enable these players to maintain leadership and meet growing demand.

Market Insights

- The UK phosphate fertilizers market was valued at USD 1,562.87 million in 2024 and is projected to reach USD 2,310.93 million by 2032, growing at a CAGR of 4.91% during the forecast period.

- Rising demand for high-yield cereal and grain production is driving phosphate fertilizer adoption, with MAP holding the largest product share due to its balanced nutrient profile and high solubility.

- Key trends include the shift toward eco-friendly, enhanced-efficiency fertilizers and the adoption of precision farming techniques to improve nutrient use efficiency and reduce runoff.

- The market is moderately consolidated with major players like Yara International, EuroChem, and Nutrien focusing on R&D, distribution partnerships, and sustainability initiatives to strengthen competitiveness.

- England leads with nearly 65% of the market share, followed by Scotland at 15%, Wales at 12%, and Northern Ireland at 8%, reflecting strong demand in cereal-growing regions and pasture-based farming areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Monoammonium Phosphate (MAP) dominates the UK phosphate fertilizers market, holding the largest share due to its high nutrient concentration and excellent water solubility. MAP is preferred for its balanced nitrogen and phosphorus content, supporting strong root development and early plant growth. Diammonium Phosphate (DAP) follows, widely used for crops requiring higher phosphorus levels. Single Superphosphate (SSP) and Triple Superphosphate (TSP) serve niche applications in soils with sulfur deficiencies. The demand for MAP is driven by precision farming practices and the growing need for efficient, cost-effective nutrient solutions to boost agricultural productivity.

- For instance, UK arable farms applied on average 29 kg P₂O₅ per hectare in phosphate fertilizers in 2018-19.

By Application

Cereals & Grains represent the leading application segment, accounting for the highest market share in the UK. This dominance stems from the extensive cultivation of wheat, barley, and oats, which require significant phosphorus input for higher yields. Phosphate fertilizers enhance root growth and improve grain quality, making them crucial for this segment. Oilseeds and fruits & vegetables show steady growth, supported by rising demand for nutrient-dense crops. Government incentives for sustainable farming and improved fertilizer application techniques further drive phosphate fertilizer adoption across multiple crop categories.

- For instance, in agricultural practice, cereal farms with higher crop economic output generally apply more phosphorus fertilizer (P₂O₅) per hectare than lower-output farms. This reflects the common farming practice of investing more in inputs, like fertilizer, to achieve higher yields and returns, though specific application rates vary widely based on location, soil, and crop type.

Market Overview

Rising Demand for High-Yield Crops

Growing population and rising food security concerns are increasing the need for high-yield crops in the UK. Farmers are adopting phosphate fertilizers to boost soil fertility and crop productivity. Phosphorus supports root development, early plant growth, and nutrient absorption, resulting in better yields. The shift toward efficient and balanced nutrient application further accelerates phosphate fertilizer demand. Government focus on sustainable agriculture and precision farming practices encourages optimized fertilizer use, reinforcing long-term growth in the market.

- For instance, in 2023, the average phosphate application rate on tillage crops in Great Britain was 17 kg/ha, while the overall average rate for all crops and grass was 10 kg/ha.

Expansion of Precision Farming Techniques

The adoption of precision agriculture is boosting the use of targeted phosphate fertilizers across UK farmlands. Farmers are leveraging soil testing, GPS-guided equipment, and variable-rate technology to apply the right quantity of fertilizer, minimizing wastage. This approach improves nutrient efficiency, reduces costs, and enhances overall crop performance. With digital farming gaining traction, phosphate fertilizers with better solubility and compatibility with modern application systems are increasingly preferred, driving market penetration and supporting sustainable agricultural productivity.

- For instance, Cereal farms with crop output of £2,000-3,000/ha applied 47 kg/ha of phosphate in 2022/23, compared to 22 kg/ha on farms in the £1,000-2,000/ha output band.

Government Support and Subsidies

Government initiatives promoting balanced fertilization and improved soil health are supporting phosphate fertilizer usage. Subsidies and programs encouraging nutrient management planning are helping farmers adopt efficient products like MAP and DAP. Regulatory bodies emphasize reducing soil degradation, which drives adoption of scientifically recommended phosphorus application. Awareness campaigns about soil fertility management further strengthen demand. These initiatives align with the UK’s goals to ensure food security and promote environmentally sustainable farming practices, resulting in higher consumption of phosphate fertilizers across key agricultural regions.

Key Trends & Opportunities

Shift Toward Eco-Friendly Fertilizers

There is a growing trend toward adopting eco-friendly and low-impact phosphate fertilizers in the UK market. Farmers and producers are seeking products that minimize phosphorus runoff and protect water quality. The development of slow-release and enhanced-efficiency fertilizers presents significant opportunities for manufacturers. This trend is supported by stricter environmental regulations and increasing awareness of sustainable farming. Companies investing in research to create advanced formulations that improve nutrient uptake are likely to benefit from this shift toward environmentally responsible agriculture.

- For instance, in the most recent British Survey of Fertiliser Practice, overall phosphate application on all crops and grass was 26 kg/ha in 2024.

Rising Demand for Specialty Crops

The growing consumption of high-value crops such as fruits, vegetables, and oilseeds is creating opportunities for phosphate fertilizer suppliers. These crops require precise nutrient management for optimum quality and yield. Fertilizer companies are developing tailored formulations to meet specific crop needs, boosting adoption. With consumer preference shifting toward healthier and nutrient-rich foods, farmers are increasing investments in phosphate-based solutions. This demand trend opens room for customized products that support both yield and quality improvement in the specialty crop segment.

- For instance, Yara, a leading fertilizer company, supplies a range of specialized products for UK horticulture, including the nitrogen-calcium product YaraLiva Tropicote and the growing media mix Yara PG MIX.

Key Challenges

Environmental Concerns and Regulations

Stringent regulations aimed at reducing phosphorus runoff into water bodies pose a challenge for the market. Excessive use of phosphate fertilizers can lead to eutrophication, harming aquatic ecosystems. Compliance with nutrient management rules increases costs for farmers and suppliers. Fertilizer manufacturers must invest in innovation to create more efficient products that meet regulatory standards. Balancing productivity with environmental sustainability remains a critical issue that could limit growth if not addressed effectively.

Volatility in Raw Material Prices

The phosphate fertilizer market faces price fluctuations due to volatility in raw material supply and global trade dynamics. Changes in the cost of phosphate rock, energy, and logistics directly impact production expenses. These price swings create uncertainty for farmers, leading to cautious purchasing decisions. Import dependency on phosphate raw materials further exposes the UK market to international price shocks. Stabilizing supply chains and developing local processing capabilities are essential to mitigate this challenge.

Regional Analysis

England

England accounts for nearly 65% of the UK phosphate fertilizers market, making it the largest contributor. The dominance is driven by extensive arable farming, particularly in East Anglia and the Midlands, where cereals and grains require high phosphorus inputs. Farmers adopt advanced application methods, including precision farming, to optimize fertilizer use. Government-backed soil nutrient management programs also support demand growth. The focus on sustainable practices and yield enhancement for wheat and barley continues to propel phosphate fertilizer consumption, ensuring England remains the key market hub for manufacturers and distributors.

Scotland

Scotland holds about 15% market share in the UK phosphate fertilizers market, supported by strong cereal and oilseed cultivation across Aberdeenshire and the eastern lowlands. Phosphate fertilizers are crucial for improving root development and enhancing crop resilience in Scotland’s cooler climate. The region emphasizes balanced nutrient application due to its focus on soil health and sustainable farming. Growing interest in high-quality barley production for the whisky industry further boosts demand for phosphorus-based products. Increased adoption of integrated nutrient management programs is helping Scottish farmers improve productivity while adhering to environmental compliance standards.

Wales

Wales represents nearly 12% of the UK phosphate fertilizers market, with demand concentrated in livestock and mixed farming areas. Phosphorus application supports pasture growth, improving fodder quality for cattle and sheep farming, which dominate Welsh agriculture. Farmers are increasingly adopting soil testing and precision spreading to maximize efficiency and reduce nutrient runoff. Government initiatives to protect water quality encourage responsible phosphorus use, creating opportunities for enhanced-efficiency fertilizers. The region shows steady growth as awareness of nutrient management rises, driving adoption of phosphate products to sustain grassland productivity and support the dairy and meat sectors.

Northern Ireland

Northern Ireland contributes around 8% of the UK market share, primarily driven by its strong dairy and beef farming sectors. Pasture-based systems depend on phosphate fertilizers to maintain soil fertility and high-quality grass yields. Farmers are aligning with nutrient action plans to comply with water framework regulations, which influences the type and timing of phosphate applications. Adoption of granular and water-soluble phosphate products is increasing to improve efficiency. The region’s focus on sustainable livestock production and maintaining competitive output levels continues to support consistent fertilizer demand despite regulatory pressures on nutrient management.

Market Segmentations:

By Product Type:

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application:

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

- Others

By Geography:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK phosphate fertilizers market features a moderately consolidated competitive landscape, with key players focusing on product innovation, distribution expansion, and sustainable solutions. Leading companies such as Yara International, EuroChem Group, ICL Group Ltd, BASF SE, and Nutrien Ltd. dominate the market through extensive product portfolios and established distribution networks. These companies invest in R&D to develop enhanced-efficiency phosphate fertilizers that reduce runoff and improve nutrient uptake. Strategic partnerships with local distributors strengthen market penetration across key agricultural regions, particularly in England and Scotland. Mergers, acquisitions, and capacity expansions are common strategies to maintain a competitive edge. Additionally, companies emphasize digital tools and advisory services to support precision farming practices, helping farmers optimize phosphorus usage. The growing focus on sustainability and regulatory compliance is pushing manufacturers to innovate, creating competition based on product performance, environmental impact, and cost-effectiveness. This dynamic foster continuous innovation and healthy market rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2023, Yara announced that it is acquiring the organic-based fertilizer business of Agribios, a company in Italy. The acquisition includes a production facility in Ronco all’Adige, focused on sustainable farming solutions through organic-based and organo-mineral fertilizers. This deal aligns with Yara’s strategy to expand its offerings in regenerative agriculture, complementing its current mineral fertilizer portfolio.

- In May 2022, Coromandel International, a fertilizer manufacturer, plans to buy a 45% stake in Baobab Mining and Chemicals Corporation (BMCC), a rock phosphate mining firm based in Senegal Africa, for $19.6 million (approximately $150 crore).

- In May 2022, Indian Potash Ltd signed a five-year agreement with Israel Chemical Ltd to import 0.6-0.65 million tonnes of potash muriate annually.

- In February 2022, EuroChem Group (hereafter referred to as “EuroChem” or “the Group”), a leading global producer of fertilizer, recently announced that it had completed the acquisition of the Serra do Salitre phosphate project in Brazil.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK phosphate fertilizers market will grow steadily with rising demand for high-yield crops.

- Precision farming adoption will drive demand for water-soluble and enhanced-efficiency phosphate fertilizers.

- Sustainable and eco-friendly formulations will gain popularity due to stricter environmental regulations.

- Technological advances in soil testing and nutrient mapping will improve targeted phosphorus application.

- MAP will continue to dominate as the preferred product for cereals and grain cultivation.

- Demand for specialty phosphate products will rise with expanding fruit and vegetable production.

- Companies will focus on partnerships with distributors to strengthen regional market reach.

- Digital advisory services will support farmers in optimizing nutrient usage and improving ROI.

- Regulatory compliance will shape product innovation and encourage low-runoff solutions.

- England will remain the key demand center, while Scotland and Wales will show steady growth.