Market Overview:

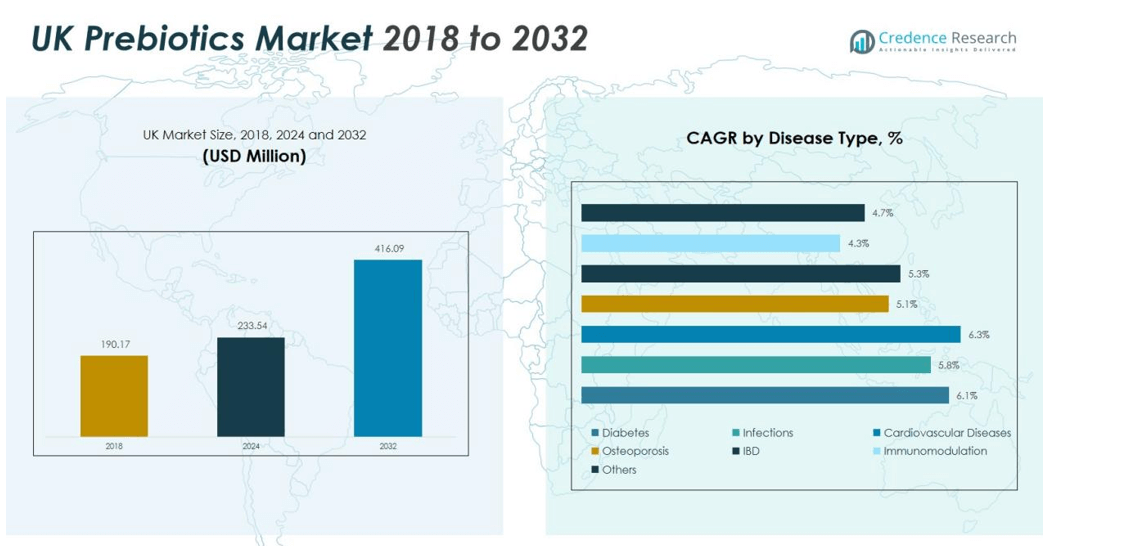

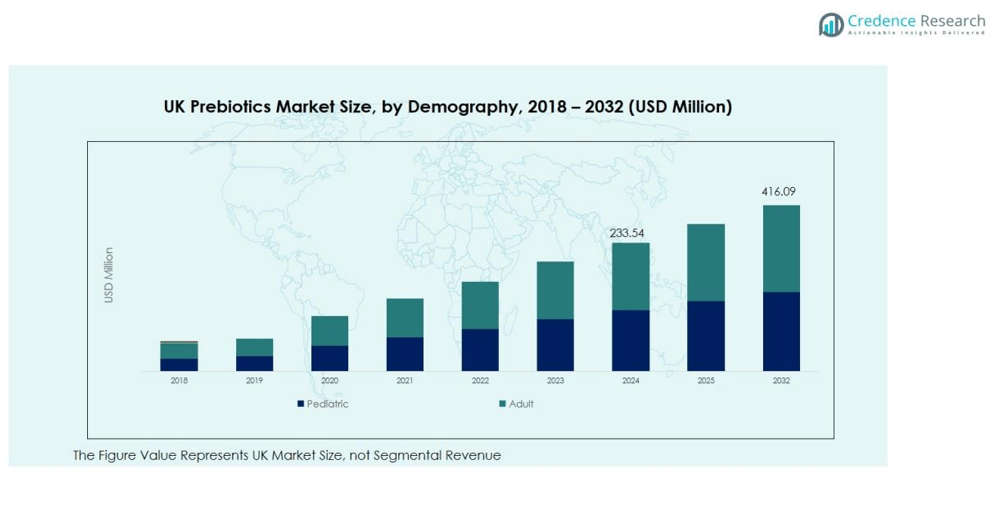

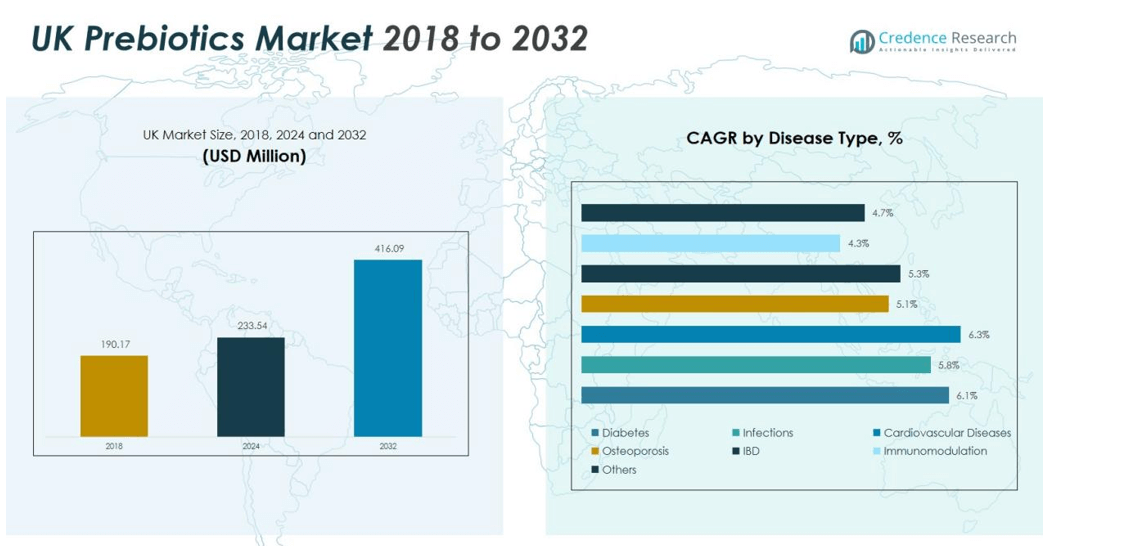

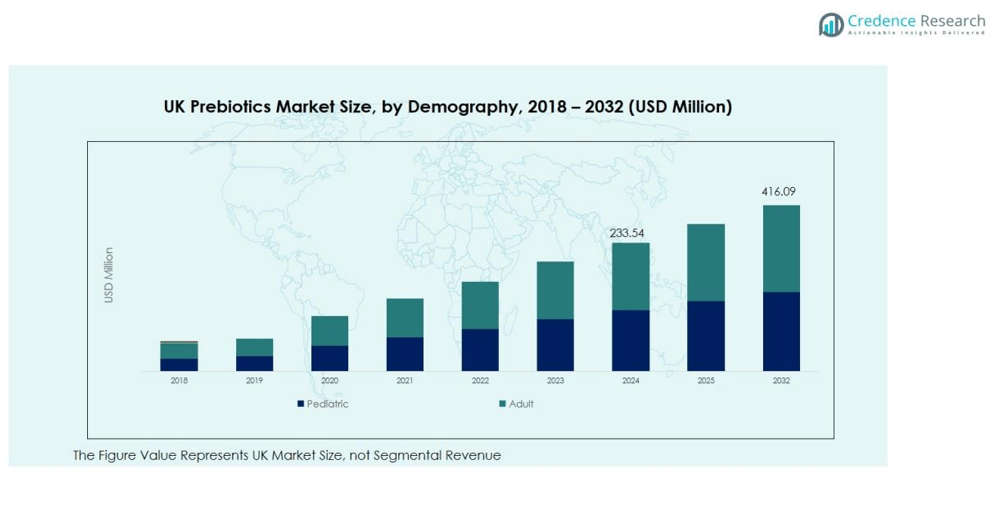

The UK Prebiotics Market size was valued at USD 190.17 million in 2018 to USD 233.54 million in 2024 and is anticipated to reach USD 416.09 million by 2032, at a CAGR of 7.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Prebiotics Market Size 2024 |

USD 233.54 million |

| UK Prebiotics Market, CAGR |

7.49% |

| UK Prebiotics Market Size 2032 |

USD 416.09 million |

Rising consumer awareness about gut microbiota balance and preventive healthcare drives product adoption. Food and beverage manufacturers are integrating inulin, fructo-oligosaccharides (FOS), and galacto-oligosaccharides (GOS) into clean-label and plant-based product lines. Continuous R&D investment and government support for functional food claims further encourage product development and differentiation among major brands.

Regionally, England dominates the UK Prebiotics Market, supported by a dense concentration of health-conscious consumers, advanced food processing facilities, and strong retail penetration. Scotland and Wales are emerging as growth regions driven by increasing demand for fortified dairy and bakery products, while Northern Ireland shows potential through expanding nutritional supplement sales. This regional diversification supports long-term stability and broader adoption across both urban and rural markets.

Market Insights:

- The UK Prebiotics Market was valued at USD 190.17 million in 2018, reached USD 233.54 million in 2024, and is projected to reach USD 416.09 million by 2032, registering a CAGR of 7.49% during the forecast period.

- England holds the largest regional share of 58%, supported by advanced food processing facilities, strong retail networks, and a large health-conscious population. Scotland follows with a 22% share, driven by functional food innovation, while Wales accounts for 14% due to growing consumer adoption of fortified dairy and bakery products.

- Northern Ireland represents the fastest-growing region with a 6% share, supported by expanding retail channels, cross-border trade, and investments in health-focused food processing industries.

- By product, inulin dominates the market with a 32% share, followed by fructo-oligosaccharides with 24%, both driven by their application in functional foods and beverages.

- By demography, adults account for 56% of market demand, followed by pediatrics at 28%, reflecting higher consumption of prebiotic-enriched foods for digestive wellness and immunity support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Digestive Health and Immune Support

Growing awareness of gut health and immunity drives the demand for functional ingredients. Consumers are increasingly choosing food and beverages enriched with prebiotics to maintain digestive balance. The UK Prebiotics Market benefits from the growing link between gut microbiota and overall wellness. It is supported by healthcare professionals recommending dietary fibers like inulin and fructo-oligosaccharides for long-term health benefits. This shift toward preventive nutrition continues to boost the market’s penetration across demographics.

- For Instance, In March 2020, BENEO announced a significant investment of more than €50 million to expand its chicory root fiber production facility in Pemuco, Chile, with an initial goal of increasing global inulin capacity by 20% by 2022″

Expansion of Functional and Clean-Label Food Categories

Food manufacturers are incorporating prebiotic fibers into dairy, bakery, and beverage products to meet clean-label demand. The market growth aligns with the rising preference for natural, plant-based formulations free from synthetic additives. It is also supported by product transparency and sustainability claims that attract health-conscious consumers. Major brands are reformulating traditional products to include prebiotic ingredients, creating competitive differentiation and market value.

- For Instance, Activia Proactive Mixed Berry Low Fat Yogurt contains 3 g of prebiotic chicory root fiber, 10 g of protein, and 0 g of added sugar per 5.3 oz (150 g) cup, providing live and active probiotics to support gut health.

Technological Advancements and Research Investment

Ongoing research in microbiome science enhances product innovation and application diversity. Companies are investing in process technologies that preserve the functional properties of prebiotic ingredients. It is helping manufacturers achieve improved texture, taste, and shelf stability in fortified products. Universities and food research institutions in the UK are also contributing to breakthroughs in gut health applications, strengthening industry-academia collaboration.

Growing Adoption Across Nutraceutical and Animal Nutrition Sectors

Prebiotics are gaining traction beyond food and beverages, expanding into nutraceuticals and animal feed. The rising demand for dietary supplements supports wider market use, especially among older populations. It is further driven by the push for antibiotic-free animal nutrition that promotes gut health in livestock. This cross-sector adoption highlights prebiotics’ versatility and long-term commercial potential in the UK market ecosystem.

Market Trends:

Integration of Prebiotics in Functional and Plant-Based Food Innovation

Food and beverage manufacturers are rapidly integrating prebiotic fibers into functional and plant-based products to meet consumer demand for health-oriented nutrition. The shift toward clean-label and vegan formulations supports sustained innovation in dairy alternatives, fortified snacks, and probiotic beverages. The UK Prebiotics Market benefits from this trend, supported by a growing preference for gut-friendly ingredients in everyday diets. It reflects a broader consumer movement toward foods that deliver both wellness and sustainability value. Major players are introducing new prebiotic blends that enhance taste and functionality while supporting digestive and immune health. Product launches featuring chicory root fiber and galacto-oligosaccharides are gaining strong traction in retail and online channels. The trend underscores how prebiotics are transitioning from niche ingredients to mainstream dietary components.

- For Instance, Müller expanded its UK health-focused dairy portfolio in April 2025 by acquiring Biotiful Gut Health, a move that enhances its kefir-based beverage range. While some sources reported the deal was worth over £100 million, the official financial terms were not publicly disclosed by the companies.

Rising Use of Prebiotics in Nutraceuticals and Personalized Nutrition

The growing focus on preventive healthcare and customized nutrition is reshaping prebiotic product development. Nutraceutical companies are formulating prebiotic supplements that target specific needs such as immunity, metabolism, and mental well-being. It aligns with the rise of microbiome-based diagnostics that enable tailored dietary solutions. The UK Prebiotics Market is expanding through partnerships between supplement brands, health-tech firms, and research institutions that explore microbiota diversity and personalized interventions. Consumer interest in gut-brain health and stress management is also fostering demand for prebiotic combinations with probiotics and botanical extracts. Product portfolios are evolving toward capsule, powder, and gummy formats for convenience and lifestyle compatibility. This trend signals a long-term shift toward evidence-based nutrition driven by science and personalization.

- For instance, in May 2025, SUANNUTRA partnered with Myota to launch precision prebiotic blends across the UK, Europe, and the US, featuring clinically supported ingredients with 22 human trials and 6 innovation awards, debuting at Vitafoods Europe 2025.

Market Challenges Analysis:

High Production Costs and Limited Ingredient Availability

Manufacturing prebiotic ingredients involves complex extraction and purification processes that increase overall production costs. The dependence on specific raw materials such as chicory root and plant-based fibers limits large-scale availability. The UK Prebiotics Market faces pressure from fluctuating agricultural yields and rising transportation expenses. It also encounters pricing challenges when competing with synthetic or lower-cost fiber alternatives. Small and medium manufacturers struggle to maintain profitability while ensuring consistent quality and compliance. This cost barrier restricts innovation and limits accessibility for new entrants in the market.

Regulatory Constraints and Low Consumer Awareness in Emerging Segments

Strict food labeling and health claim regulations slow product approvals and marketing activities. The limited number of authorized claims under EU and UK Food Standards restricts manufacturers from highlighting digestive or immune benefits directly. The UK Prebiotics Market faces slower consumer adoption in segments such as animal nutrition and fortified beverages due to knowledge gaps about prebiotic benefits. It requires continuous education and brand-driven awareness programs to build trust. The absence of standardized definitions for prebiotics also causes confusion among consumers and formulators. These regulatory and awareness challenges hinder faster category expansion despite strong scientific backing.

Market Opportunities:

Expansion into Functional Foods and Personalized Nutrition Solutions

The growing consumer shift toward preventive health creates strong opportunities for new prebiotic applications. Food manufacturers can develop fortified products targeting specific health outcomes such as immunity, digestion, and metabolism. The UK Prebiotics Market benefits from advancements in ingredient technology that improve solubility and sensory appeal. It allows producers to expand product lines across cereals, dairy alternatives, and beverages without compromising taste or texture. Personalized nutrition platforms integrating microbiome data also open avenues for tailored prebiotic formulations. This approach aligns with the country’s rising demand for evidence-based and lifestyle-specific nutrition solutions.

Collaborations and Technological Advancements Supporting Innovation

Strategic partnerships among ingredient suppliers, food brands, and research institutions drive product innovation and category awareness. These collaborations enable clinical validation and faster regulatory compliance for new prebiotic blends. The UK Prebiotics Market can leverage such alliances to strengthen domestic manufacturing and reduce reliance on imports. It also stands to benefit from advances in extraction and fermentation technologies that lower production costs and enhance purity. Startups focusing on gut microbiome analytics and sustainable ingredient sourcing present new growth potential. This innovation ecosystem positions the market for scalable, high-value opportunities in health and wellness sectors.

Market Segmentation Analysis:

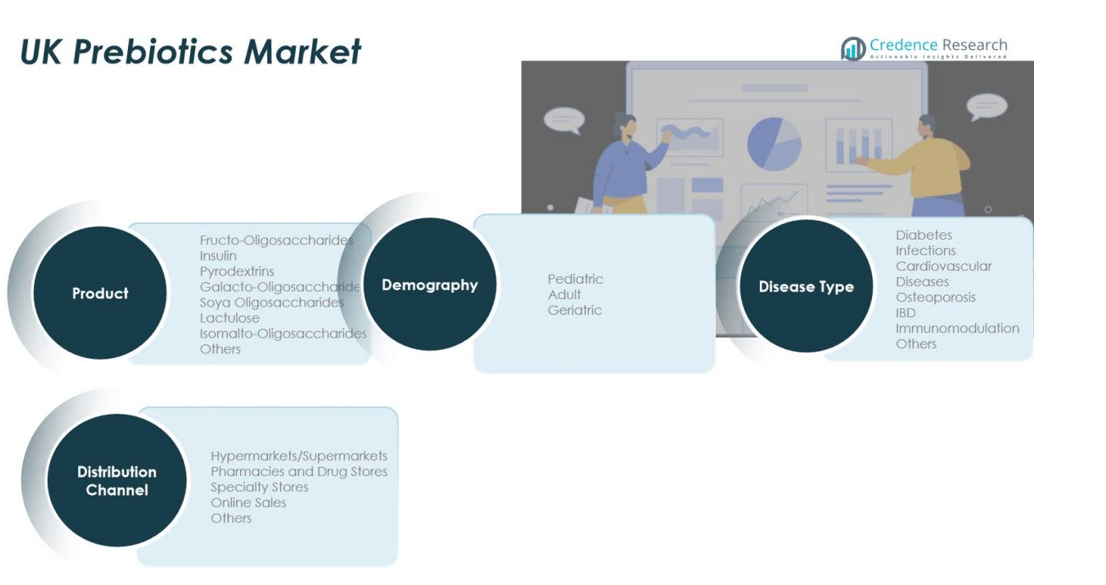

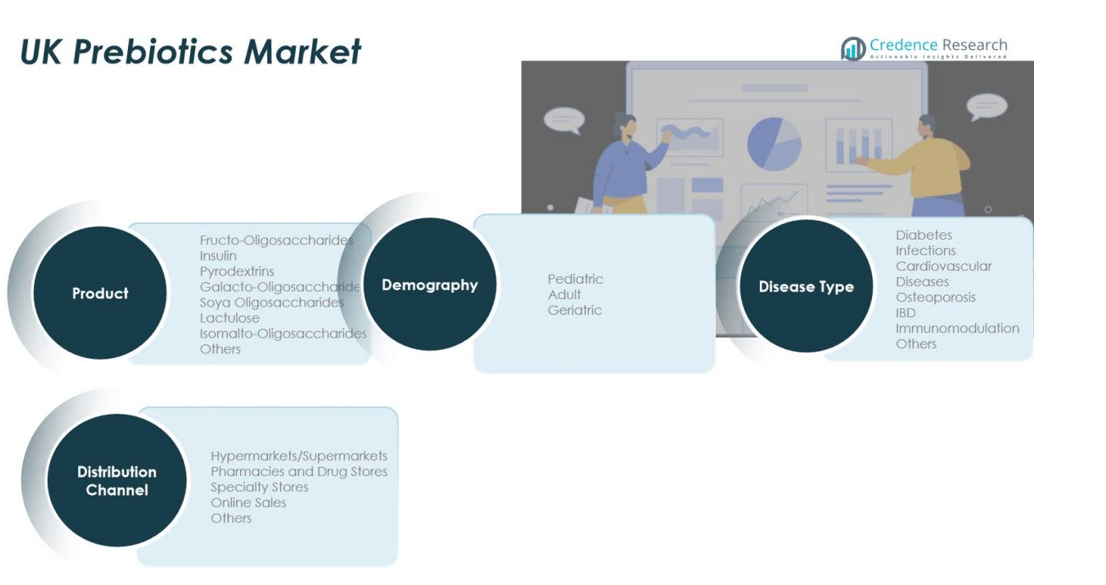

By Product

The UK Prebiotics Market is segmented by product into fructo-oligosaccharides, inulin, pyrodextrins, galacto-oligosaccharides, soya oligosaccharides, lactulose, isomalto-oligosaccharides, and others. Inulin holds the largest share due to its strong application in dairy, bakery, and beverage formulations. It offers excellent solubility and fiber content, supporting digestive health and weight management. Fructo-oligosaccharides and galacto-oligosaccharides show strong growth potential, driven by their use in infant nutrition and functional foods. The market continues to expand with new product launches and ingredient innovations aimed at improving taste, texture, and nutritional value.

- For instance, FrieslandCampina Ingredients launched Biotis® GOS-OP High Purity in 2024 with a 94% galacto-oligosaccharide concentration, allowing clinically effective dosages at just 2 g per serving.

By Disease

By disease, the market covers diabetes, infections, cardiovascular diseases, osteoporosis, inflammatory bowel disease (IBD), immunomodulation, and others. The diabetes segment leads due to rising awareness of dietary fiber’s role in blood sugar regulation. It benefits from increasing use of prebiotics in diabetic-friendly foods and supplements. The immunomodulation and IBD segments are growing quickly as consumers focus on gut health and immunity. Continuous research on microbiota-linked disorders strengthens demand across these therapeutic areas.

- For instance, in June 2025, Bactolife introduced a gut-health binding protein formulation in the U.S. proven effective at 100–200 milligrams per dose to enhance gut integrity and reduce microbial imbalance, while AB-BIOTICS launched Shape100™, clinically demonstrated to improve insulin sensitivity by 15% and modulate immune responses via microbiota mechanisms.

By Demography

By demography, the UK Prebiotics Market is divided into pediatric, adult, and geriatric segments. The adult category dominates due to the high prevalence of lifestyle-related digestive and metabolic issues. It sees consistent demand for functional food and nutraceutical products. The pediatric segment benefits from fortified infant formulas and child-friendly supplements. The geriatric population is emerging as a key consumer base seeking digestive wellness and immunity support through prebiotic intake.

Segmentations:

By Product:

- Fructo-Oligosaccharides

- Inulin

- Pyrodextrins

- Galacto-Oligosaccharides

- Soya Oligosaccharides

- Lactulose

- Isomalto-Oligosaccharides

- Others

By Disease Type:

- Diabetes

- Infections

- Cardiovascular Diseases

- Osteoporosis

- Inflammatory Bowel Disease (IBD)

- Immunomodulation

- Others

By Demography:

- Pediatric

- Adult

- Geriatric

By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Online Sales

- Others

Regional Analysis:

Dominance of England Driven by Strong Consumer Base and Food Industry Presence

England holds the largest share of the UK Prebiotics Market due to its strong consumer awareness and advanced food manufacturing ecosystem. The region benefits from established supply chains, robust retail penetration, and continuous product innovation from major brands. It is home to several health food manufacturers and research institutions promoting gut health solutions. The growing adoption of clean-label, high-fiber foods supports sustained demand across functional beverages, bakery, and dairy products. London, Birmingham, and Manchester are leading urban centers driving product sales through both offline and online distribution channels.

Emerging Growth Across Scotland and Wales Through Product Diversification

Scotland and Wales are witnessing steady expansion supported by increasing consumer focus on wellness and dietary improvement. The growing number of small and mid-sized producers investing in functional food innovation strengthens regional competitiveness. The UK Prebiotics Market benefits from these localized initiatives aimed at reducing dependence on imports and encouraging domestic ingredient sourcing. It is also driven by strong government support for health-focused food start-ups and nutrition research programs. Rising interest in prebiotic-enriched dairy, cereal, and beverage products reflects a shift toward balanced nutrition among regional consumers.

Expanding Opportunities in Northern Ireland Through Retail and Export Growth

Northern Ireland is emerging as a high-potential market with growing investments in health-oriented food processing. Retail chains and online platforms are expanding their product offerings to include prebiotic and probiotic-enriched categories. The UK Prebiotics Market finds new opportunities through increasing cross-border trade and partnerships with European distributors. It benefits from expanding awareness about gut health and the role of prebiotics in preventive healthcare. Rising disposable income and evolving dietary habits are expected to enhance demand across both urban and semi-urban markets in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Nestlé S.A.

- OptiBac Probiotics Ltd.

- Archer Daniels Midland Company

- BioGaia AB

- Lallemand Inc.

- Kerry Group plc

- Hansen Holding A/S

- DuPont Nutrition & Biosciences

- General Mills Inc.

- Arla Foods amba

- Biotiful Gut Health Ltd.

- Symprove Ltd.

- ProVen Probiotics

Competitive Analysis:

The UK Prebiotics Market is characterized by strong competition among global and domestic players focusing on innovation, quality, and product diversification. Key participants include Danone S.A., Yakult Honsha Co., Ltd., Nestlé S.A., OptiBac Probiotics Ltd., Archer Daniels Midland Company, BioGaia AB, and Lallemand Inc. Market leaders emphasize research-driven product development to enhance digestive health, immunity, and nutritional value. It is witnessing growing collaboration between ingredient suppliers and food manufacturers to create functional food and beverage solutions tailored to consumer needs. Companies invest in sustainable sourcing and advanced fermentation technologies to maintain regulatory compliance and competitive pricing. Increasing brand visibility through digital marketing and retail expansion further strengthens their market presence and customer engagement across the UK.

Recent Developments:

- In October 2025, Yakult Honsha completed a merger between Yakult Europe B.V. and Yakult Oesterreich GmbH, effective October 1, 2025, to enhance operational efficiency and strengthen sales activities across Austria.

- In August 2025, Nestlé entered a partnership with IBM Research to develop sustainable food packaging using generative AI, aiming to reduce plastic use through advanced, data‑driven material science.

Report Coverage:

The research report offers an in-depth analysis based on Product, Disease Type, Demography and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer awareness of gut health will continue to strengthen demand for prebiotic-enriched foods and supplements.

- The market will see growing adoption of plant-based and clean-label ingredients that support sustainable nutrition.

- Functional beverages and dairy alternatives fortified with inulin and oligosaccharides will gain wider retail presence.

- Technological innovation in extraction and fermentation will reduce production costs and enhance ingredient quality.

- Collaborations between food brands, research institutes, and startups will drive product development and regulatory alignment.

- E-commerce and digital health platforms will boost direct-to-consumer sales of prebiotic supplements and blends.

- The pediatric and geriatric nutrition segments will expand as preventive healthcare awareness grows.

- Personalized nutrition based on microbiome testing will create new opportunities for targeted prebiotic solutions.

- Domestic ingredient sourcing and government-backed food innovation programs will strengthen regional competitiveness.

- The UK Prebiotics Market will evolve toward science-backed, sustainable, and accessible products catering to modern health needs.