Market Overview

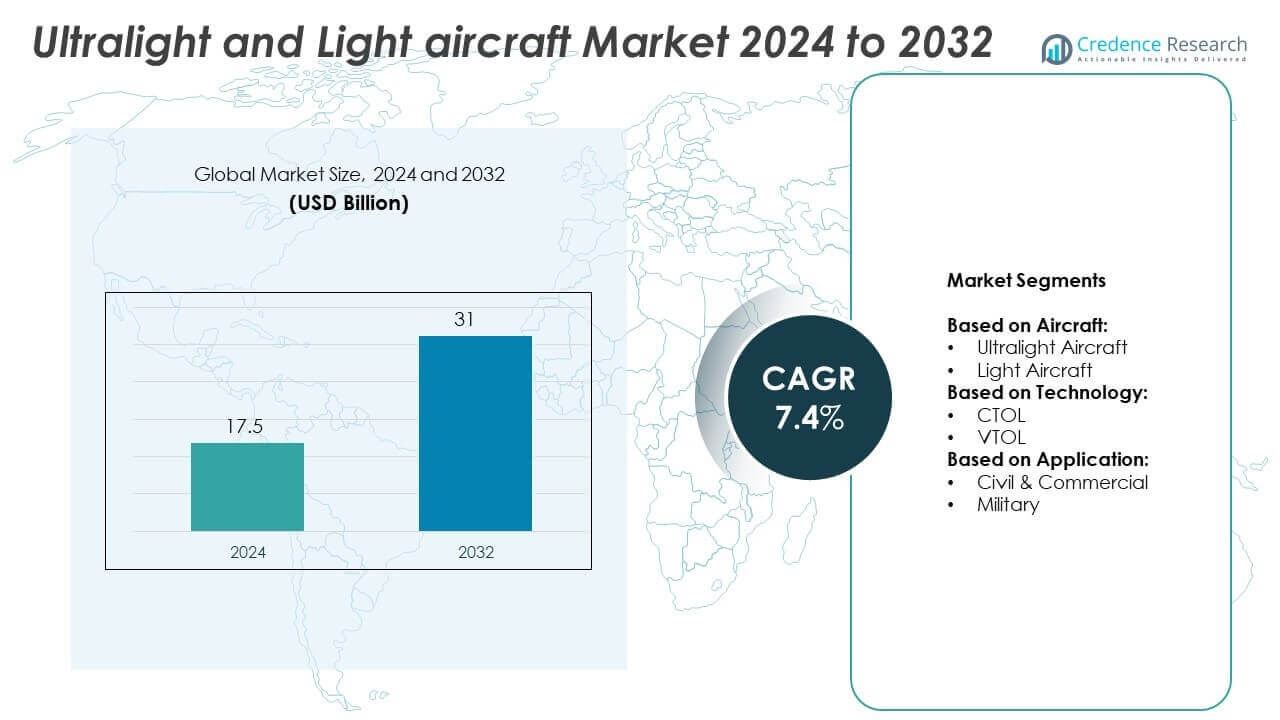

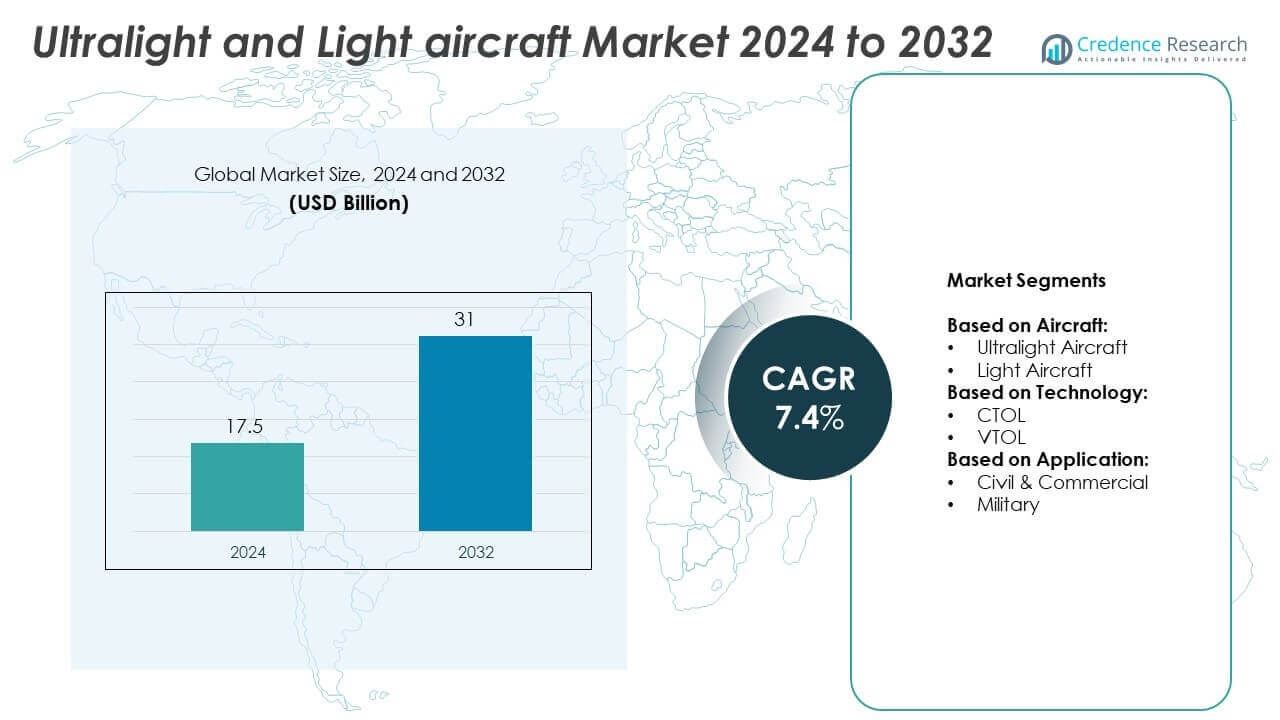

Ultralight and Light Aircraft Market size was valued at USD 17.5 billion in 2024 and is anticipated to reach USD 31 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultralight and Light Aircraft Market Size 2024 |

USD 17.5 Billion |

| Ultralight and Light Aircraft Market, CAGR |

7.4% |

| Ultralight and Light Aircraft Market Size 2032 |

USD 31 Billion |

The Ultralight and Light aircraft market grows with rising demand for recreational flying, pilot training, and regional connectivity. Advancements in lightweight materials, electric propulsion, and digital avionics enhance performance and efficiency. Government support for personal aviation, simplified licensing, and rural mobility boosts adoption. Trends include increased use in tourism, surveillance, and kit-built aircraft segments. Manufacturers focus on cost-effective designs, low emissions, and ease of operation. These drivers and trends collectively strengthen the market’s long-term growth outlook across regions.

North America leads the Ultralight and Light aircraft market due to strong aviation infrastructure and private flying culture. Europe follows with high demand from sport aviation and pilot training schools. Asia-Pacific shows rising interest in personal aviation and air mobility programs across China, India, and Australia. Latin America and the Middle East & Africa present growth potential in rural transport and public service applications. Key players operating in the market include Textron Aviation Inc., Pipistrel D.O.O, Cirrus Design Corporation, and Bombardier Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ultralight and Light aircraft market was valued at USD 17.5 billion in 2024 and is projected to reach USD 31 billion by 2032, growing at a CAGR of 7.4%.

- Rising interest in recreational aviation, flight training, and regional air connectivity drives overall market growth.

- Technological trends include adoption of electric propulsion, lightweight composite structures, and advanced digital avionics.

- Manufacturers focus on certified models, fuel-efficient engines, and cockpit automation to enhance safety and pilot experience.

- High maintenance costs, limited resale value, and regulatory complexities restrict wider adoption in price-sensitive regions.

- North America leads the market due to strong aviation ecosystems, followed by Europe and Asia-Pacific with expanding pilot training networks.

- Key players such as Pipistrel, Bombardier, Textron Aviation, and Cirrus Design compete on innovation, range, and operational versatility.

Market Drivers

Rising Interest in Personal Aviation and Recreational Flying Activities Among Hobbyists and Enthusiasts

The Ultralight and Light aircraft market benefits from growing demand for personal flying experiences. Aviation hobbyists and sports pilots increasingly choose affordable, low-maintenance aircraft. These aircraft offer flexible flying options with less regulatory pressure in several countries. Ultralight and Light aircraft support short-distance leisure flights, pilot training, and sport aviation. Enthusiasts favor them for weekend flying, airshows, and regional tourism. This demand is particularly strong in North America and Europe where flying clubs and recreational facilities are expanding. It drives volume sales and fuels innovation in design and safety.

- For instance, Flight Design General Aviation had delivered over 1,900 CT series aircraft worldwide since production began in 1997. In 2022, following the Russian invasion of Ukraine, Flight Design temporarily halted production at its Kherson, Ukraine, facility, which was responsible for producing the CT line.

Technological Advancements in Lightweight Materials and Fuel-Efficient Propulsion Systems

Continued advancements in composite materials, avionics, and engines support performance improvements. Aircraft now feature lightweight frames and aerodynamic designs that reduce drag and fuel usage. Engine technologies enhance power-to-weight ratios while lowering emissions and noise levels. These technical upgrades make aircraft more reliable, safer, and easier to operate. Innovation also extends to cockpit interfaces, digital navigation, and remote diagnostics. The Ultralight and Light aircraft market embraces such technologies to meet evolving user expectations. It enables manufacturers to attract new pilots and meet strict airworthiness regulations.

- For instance, Pipistrel introduced the Velis Electro, the world’s first type-certified electric light aircraft, which was certified by the European Union Aviation Safety Agency (EASA) in June 2020. Following its first delivery to a customer in Switzerland in July 2020, the Velis Electro has been adopted by pilot training programs in multiple European countries and worldwide. As of early 2024, Pipistrel has delivered more than 100 Velis Electro aircraft. The aircraft is designed primarily for local training flights with an endurance of approximately 50 minutes plus reserves.

Supportive Regulatory Frameworks and Pilot Licensing Reforms in Key Aviation Markets

Eased pilot license requirements and national sport pilot regulations support new entrants. Authorities in the U.S., Australia, and parts of Europe promote training for light-sport aviation. Regulatory frameworks reduce barriers to ownership by limiting complexity and cost. These reforms improve accessibility for younger pilots and retirees alike. The Ultralight and Light aircraft market sees steady interest from flight schools and first-time aviators. It benefits from policies that encourage fleet modernization and responsible flying. These changes also stimulate demand for certified aircraft and flight support services.

Growing Demand for Cost-Effective Aircraft in Rural, Remote, and Emerging Areas

Smaller, efficient aircraft suit applications in sparsely populated and infrastructure-limited regions. Ultralight and Light aircraft offer solutions for surveillance, agricultural spraying, medical support, and logistics. Operators value them for ease of deployment, low operational cost, and short takeoff capabilities. It helps communities with limited airport infrastructure and irregular transport access. The Ultralight and Light aircraft market grows with expanding service networks and use cases in Latin America, Africa, and Southeast Asia. Governments and private operators recognize their utility in emergency response and public service roles. These functional advantages continue to expand the buyer base.

Market Trends

Rising Popularity of Electric and Hybrid-Electric Propulsion for Sustainable and Quiet Operations

Electric and hybrid-electric aircraft are gaining traction among light aviation manufacturers. These systems reduce carbon emissions and noise pollution in sensitive or urban zones. Battery and motor efficiency improvements now allow for longer flight durations and lower maintenance costs. Developers focus on building certified electric aircraft for pilot training and short-range operations. Several companies test hybrid configurations to extend range while reducing fuel dependency. The Ultralight and Light aircraft market sees steady investment in clean propulsion solutions. It reflects a shift toward environmentally responsible aviation technologies.

- For instance, Bye Aerospace has received a significant number of orders for its all-electric eFlyer series. As of late 2022, the company’s backlog for the two-seat eFlyer 2 and four-seat eFlyer 4 was over 720 aircraft. By early 2024, the combined order book for the eFlyer 2 and eFlyer 4 had grown to 889 units. The two-seat eFlyer 2, which is designed for the flight training market, has a projected flight endurance of approximately 3.5 hours. The company is currently focused on the FAA certification process for the eFlyer 2, with the first production aircraft being built in September 2024.

Integration of Advanced Avionics and Flight Automation in Entry-Level Aircraft Platforms

Modern avionics are no longer limited to commercial or business jets. Touchscreen cockpits, autopilot systems, and GPS-based navigation now feature in many Light and Ultralight aircraft. These upgrades enhance safety, reduce pilot workload, and improve situational awareness. Many training aircraft adopt automation to support pilot learning and efficiency. Flight data recorders and cloud-based diagnostics help monitor performance and improve maintenance. The Ultralight and Light aircraft market embraces these features to appeal to new-age pilots. It promotes operational ease and regulatory compliance across segments.

- For instance, ICON Aircraft, manufacturer of the A5 Light Sport Aircraft, delivered its 100th A5 by July 2019 and reached its 200th delivery in September 2023. In December 2020, ICON introduced the Garmin G3X Touch glass cockpit and an optional 2-axis autopilot for the 2021 model year, replacing the standard Garmin aera 796 in limited editions

Increasing Demand for Kit-Built and Home-Assembled Aircraft Among Aviation Hobbyists

Do-it-yourself aircraft kits appeal to experienced aviation enthusiasts seeking customization. These kits offer cost savings, design flexibility, and builder satisfaction. Advances in prefabricated components and assembly instructions support safer builds. Home-built aircraft also qualify under specific aviation categories with fewer restrictions. Events like airshows and builder forums help expand awareness and community engagement. The Ultralight and Light aircraft market includes a vibrant kit segment that drives user-driven innovation. It fosters a loyal, growing base of private builders worldwide.

Growing Use of Ultralight and Light Aircraft in Specialized Commercial Applications

Operators adopt Light aircraft for niche commercial tasks where large aircraft are not viable. These include pipeline monitoring, aerial photography, tourism, and surveillance. Their short takeoff and landing capability supports remote-area access and low-infrastructure operations. Some regions use them for cargo drops, medical deliveries, and inspection services. Demand is rising in Asia-Pacific, Latin America, and parts of Africa. The Ultralight and Light aircraft market taps into these use cases to drive non-recreational adoption. It helps manufacturers diversify applications and product lines.

Market Challenges Analysis

High Operating Costs, Maintenance Requirements, and Limited Resale Value Restrain Wider Adoption

While Light and Ultralight aircraft offer affordable entry points, long-term ownership costs remain high. Insurance premiums, hangar fees, regular maintenance, and periodic inspections increase total cost of ownership. Many models require specialized mechanics, adding logistical burden for remote operators. Fuel efficiency varies by engine type, and older aircraft face poor mileage and emissions penalties. Resale markets for these aircraft remain limited, often reducing investment appeal for new buyers. The Ultralight and Light aircraft market contends with these concerns when targeting first-time owners. It must address lifecycle costs to unlock broader consumer adoption.

Regulatory Complexity, Airspace Restrictions, and Infrastructure Gaps Limit Operational Flexibility

Many regions lack clear or uniform rules for Ultralight and Light aircraft operations. Operators often face differing certification requirements, pilot licensing rules, and maintenance standards. Restricted airspace access near urban and defense zones further complicates planning. Infrastructure gaps, such as short runways or lack of refueling stations, pose operational hurdles. Weather dependency and payload limitations restrict year-round usability in certain climates. The Ultralight and Light aircraft market faces challenges in aligning product offerings with evolving aviation frameworks. It must work closely with regulators to streamline policies and improve deployment reach.

Market Opportunities

Expanding Use in Pilot Training, Tourism, and Rural Mobility Creates New Revenue Streams

Flight schools increasingly adopt Ultralight and Light aircraft for basic pilot training programs. These aircraft offer low acquisition cost, simplified controls, and safety features suitable for new learners. Tourism operators use them to offer scenic flights and aerial experiences in remote areas. In underserved regions, local governments explore Light aircraft to improve mobility and emergency services. Operators value their ability to operate from short airstrips with minimal infrastructure. The Ultralight and Light aircraft market gains visibility in these applications with strong public and private interest. It opens doors to long-term contracts and recurring demand.

Government Incentives and Public Safety Applications Support Market Expansion in Emerging Economies

Several governments now fund Light aircraft programs for surveillance, disaster relief, and border patrol. These aircraft provide cost-effective solutions for aerial coverage and rapid response needs. Defense agencies also evaluate their potential for non-combat missions in low-risk zones. Infrastructure and medical support agencies deploy them in hard-to-reach areas for outreach and supply drops. Policy incentives and subsidies help lower entry barriers for institutional buyers. The Ultralight and Light aircraft market aligns with these initiatives to enter new geographies. It benefits from rising government spending on aviation-linked public services.

Market Segmentation Analysis:

By Aircraft:

Ultralight aircraft hold a notable share due to their low cost, ease of operation, and minimal certification requirements in many regions. They appeal to hobbyists, flight schools, and sports pilots who prioritize affordability and simple maintenance. These aircraft suit short-distance flying and can operate from small airstrips or open areas. Light aircraft command steady demand across private aviation, pilot training, and short-haul commercial use. Their improved payload, range, and comfort features support diverse use cases. The Ultralight and Light aircraft market benefits from strong adoption across both categories. It attracts new and experienced aviators through differentiated options in performance and cost.

- For instance, CubCrafters is a prominent manufacturer of light sport and Part 23-certified aircraft, including its popular Carbon Cub series, which is widely adopted by private pilots and training operators in North America.

By Technology:

CTOL (Conventional Take-Off and Landing) dominates the technology segment, driven by mature infrastructure and established aircraft models. These aircraft require runways but offer higher reliability and broader model availability. Operators use them for training, transport, and utility missions across civilian and military segments. VTOL (Vertical Take-Off and Landing) aircraft represent an emerging area, with growing interest in air mobility and remote access. Electric VTOL platforms in development show promise for urban transport and rescue missions. The Ultralight and Light aircraft market watches this space for innovation that could reshape access and deployment strategies. It may see faster growth in VTOL once certification and cost barriers ease.

- For instance, By the end of 2021, Joby Aviation had already completed more than 1,000 test flights of its full-scale prototype aircraft. The aircraft is designed for a range of 240 kilometers (150 miles) and can carry a pilot and four passengers. In January 2022, Joby announced that its two pre-production prototypes had together completed more than 1,500 flights, covering a total distance of over 33,000 miles. A key milestone for the company was the flight of more than 150 miles on a single charge in July 2021.

By Application:

Civil and commercial applications lead the market, with demand coming from aviation schools, tourism operators, private owners, and charter services. These aircraft support low-volume transport, training, and aerial inspection tasks at relatively low operational cost. Businesses and individuals value their versatility and ease of operation in remote and regional areas. Military applications are smaller but remain important, especially for surveillance, logistics, and non-combat missions. Light aircraft offer cost-effective alternatives for border patrol, emergency supply delivery, and training exercises. The Ultralight and Light aircraft market addresses both segments with product lines tailored to mission needs. It continues to find new ground in both civilian and defense sectors.

Segments:

Based on Aircraft:

- Ultralight Aircraft

- Light Aircraft

Based on Technology:

Based on Application:

- Civil & Commercial

- Military

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the Ultralight and Light aircraft market, accounting for 38.5% in 2024. The region benefits from strong aviation infrastructure, favorable recreational flying regulations, and a large base of sport pilots. The U.S. alone supports thousands of general aviation airports, making it easier for users to operate and maintain aircraft. Flight training schools, aerial tourism services, and agricultural applications also contribute to demand. Manufacturers in the U.S. and Canada introduce new models regularly to meet safety, fuel efficiency, and automation needs. It maintains leadership in the global market due to high disposable income and a culture of private aviation.

Europe

Europe accounted for 26.1% of the global market share in 2024. Countries like Germany, France, and the UK show high interest in ultralight sports aviation and pilot training. Regulatory support from the European Union Aviation Safety Agency (EASA) simplifies licensing for Light Sport Aircraft (LSA), attracting new pilots. Demand grows from both private owners and small operators running regional services and flight schools. Recreational flying is popular in Central and Western Europe, supported by organized aviation clubs and events. The market also benefits from homebuilt aircraft communities and a rise in hybrid-electric model testing. It continues to gain traction through government-supported innovation and training programs.

Asia-Pacific

Asia-Pacific captured 18.4% of the global market in 2024. The region sees rising interest in personal aviation, training academies, and regional air services. Countries like China, Australia, India, and Japan invest in pilot development and regional connectivity projects. Australia maintains a strong sport aviation ecosystem, while India is expanding training centers and rural aviation services. China supports local production and is gradually opening low-altitude airspace for private and commercial use. The growing middle-class population, along with government-backed aviation initiatives, boosts long-term potential. The Ultralight and Light aircraft market in Asia-Pacific expands steadily with new investments and demand for affordable aircraft.

Latin America

Latin America held a market share of 10.2% in 2024. The region’s demand is driven by operational needs in rural and remote areas where infrastructure is limited. Countries like Brazil, Argentina, and Colombia use Light aircraft for surveillance, medical transport, agriculture, and local commuting. Private aviation is growing slowly due to cost constraints, but Light aircraft provide value in cost-sensitive markets. Manufacturers and local governments explore new training and tourism use cases to support growth. It presents opportunity through strategic partnerships with manufacturers and rural development programs.

Middle East & Africa

The Middle East & Africa region contributed 6.8% to the market share in 2024. Most demand comes from defense, medical evacuation, and surveillance operations. Some African nations use Light aircraft to provide healthcare access in isolated communities. Growth remains moderate due to infrastructure gaps and regulatory hurdles. However, training schools and emergency response agencies show increasing interest in cost-effective air mobility. The Ultralight and Light aircraft market in the region shows potential through focused investment and public-sector demand. It may gain further momentum through improved infrastructure and regional collaboration programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pipistrel D.O.O

- Flight Design General Aviation GmbH

- Bombardier Inc.

- Advanced Tactics Inc

- Vulcanair S.p.A.

- Evektor Aerotechnik

- Cirrus Design Corporation

- Aviation Partners, Inc.

- Textron Aviation Inc.

- Pilatus Aircraft Ltd

- Embraer Group

- Air Tractor Inc.

- Honda Aircraft Company, LLC

- Lancair Aerospace

- Piper Aircraft, Inc.

Competitive Analysis

The Ultralight and Light aircraft market features leading players such as Pipistrel D.O.O, Flight Design General Aviation GmbH, Bombardier Inc., Advanced Tactics Inc, Vulcanair S.p.A., Evektor Aerotechnik, Cirrus Design Corporation, Aviation Partners, Inc., Textron Aviation Inc., Pilatus Aircraft Ltd, Embraer Group, Air Tractor Inc., Honda Aircraft Company, LLC, Lancair Aerospace, and Piper Aircraft, Inc. These companies compete by focusing on innovation, safety, fuel efficiency, and lightweight design. Several firms offer electric and hybrid-electric models to meet growing demand for sustainable aviation. Product portfolios are diversified across civil, commercial, and training applications, with tailored aircraft for different mission profiles. Manufacturers invest in digital cockpit systems, composite materials, and automation to attract both new and experienced pilots. Many players actively engage in partnerships with training academies and air mobility programs. Some firms emphasize kit-based or homebuilt aircraft to tap into the aviation enthusiast segment. The market also sees increased focus on certification readiness and compliance with evolving safety standards. Competitive differentiation often depends on performance-to-cost ratio, service support, and customization options. Overall, strong R&D pipelines, regional expansion strategies, and rising demand for personal flying sustain long-term competition in the Ultralight and Light aircraft market.

Recent Developments

- In 2025, Textron Aviation Inc. announced the largest lineup of products at the 2025 EAA AirVenture, with a special 40th-anniversary Cessna Grand Caravan EX and celebration of the 70th anniversary of the Skyhawk.

- In 2025, Cirrus Aircraft announced the SR Series G7+ with Safe Return™ Emergency Autoland—the world’s first single-engine piston aircraft with FAA-approved autonomous emergency landing system.

- In 2024, Pilatus Aircraft Ltd delivered 153 aircraft in 2024, including 96 PC-12 NGXs and 51 PC-24s, prioritizing sustainability and supply chain integration, and expanding with facilities in Spain and the US.

Report Coverage

The research report offers an in-depth analysis based on Aircraft, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for personal and recreational flying.

- Electric and hybrid aircraft will gain traction due to lower emissions and maintenance costs.

- Asia-Pacific will emerge as a key growth region driven by pilot training and air mobility.

- Government programs will support Light aircraft for rural healthcare, surveillance, and transport.

- VTOL aircraft will open new opportunities for urban and remote area connectivity.

- Flight schools will continue to invest in Ultralight aircraft for affordable pilot training.

- Manufacturers will focus on composite materials and lightweight engines to improve efficiency.

- Civil and commercial applications will remain the dominant use segment across global markets.

- Kit-built and home-assembled aircraft will attract hobbyists and boost aftermarket demand.

- Regulatory reforms and simplified licensing will support market entry for new aviators.