| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Cheese Market Size 2024 |

USD 28,438.75 Million |

| U.S. Cheese Market, CAGR |

5.30% |

| U.S. Cheese Market Size 2032 |

USD 42,989.05 Million |

Market Overview

U.S. Cheese Market size was valued at USD 28,438.75 million in 2024 and is anticipated to reach USD 42,989.05 million by 2032, at a CAGR of 5.30% during the forecast period (2024-2032).

The U.S. cheese market is experiencing steady growth driven by rising consumer demand for high-protein and natural food products, particularly among health-conscious individuals seeking nutritious alternatives. The increasing popularity of convenience foods and ready-to-eat meals has further boosted the consumption of processed and shredded cheese in both retail and foodservice sectors. Additionally, the growing influence of global cuisines, especially Italian and Mexican dishes, has significantly contributed to the increased usage of cheese as a key ingredient. Market players are actively innovating with new flavors, organic and plant-based alternatives, and sustainable packaging to meet evolving consumer preferences. Premium and artisanal cheese varieties are gaining traction among urban consumers, reflecting a trend toward gourmet food experiences. Moreover, the rising adoption of cheese in snacking formats and quick meals continues to fuel market expansion. These trends collectively highlight a dynamic and evolving landscape, positioning cheese as a versatile and essential component of the American diet.

The U.S. cheese market exhibits strong geographical diversity, with key production and consumption hubs spread across the Midwest, West, South, and Northeast regions. The Midwest, particularly states like Wisconsin and Minnesota, serves as the heart of cheese production due to its robust dairy infrastructure and historical association with the industry. The West is known for innovation in organic, artisanal, and plant-based cheese, while the South and Northeast contribute significantly through rising urban demand and premium cheese preferences, respectively. Prominent players driving the market include Arla Foods, Saputo Inc., Sargento Foods Inc., Dairy Farmers of America, Tillamook Creamery, Schreiber Foods, Organic Valley, Leprino Foods, Bel Brands USA, and Borden Dairy. These companies play a vital role in shaping market dynamics through product innovation, regional expansion, and strategic partnerships. Their focus on quality, sustainability, and evolving consumer tastes continues to influence the competitive landscape of the U.S. cheese industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. cheese market was valued at USD 28,438.75 million in 2024 and is projected to reach USD 42,989.05 million by 2032, growing at a CAGR of 5.30% during the forecast period.

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Rising consumer preference for protein-rich and ready-to-eat foods continues to drive cheese consumption across all age groups.

- Specialty and artisanal cheese varieties are gaining popularity, driven by increasing interest in gourmet and global cuisines.

- Key players like Arla Foods, Saputo Inc., and Sargento Foods Inc. focus on innovation and sustainability to maintain a competitive edge.

- Market growth faces challenges such as rising raw material costs, supply chain disruptions, and growing health concerns regarding saturated fat intake.

- The Midwest remains the dominant cheese-producing region, while the West is emerging as a hub for plant-based and premium cheese varieties.

- Strategic collaborations and investments in plant-based cheese alternatives are shaping future market expansion opportunities.

Report Scope

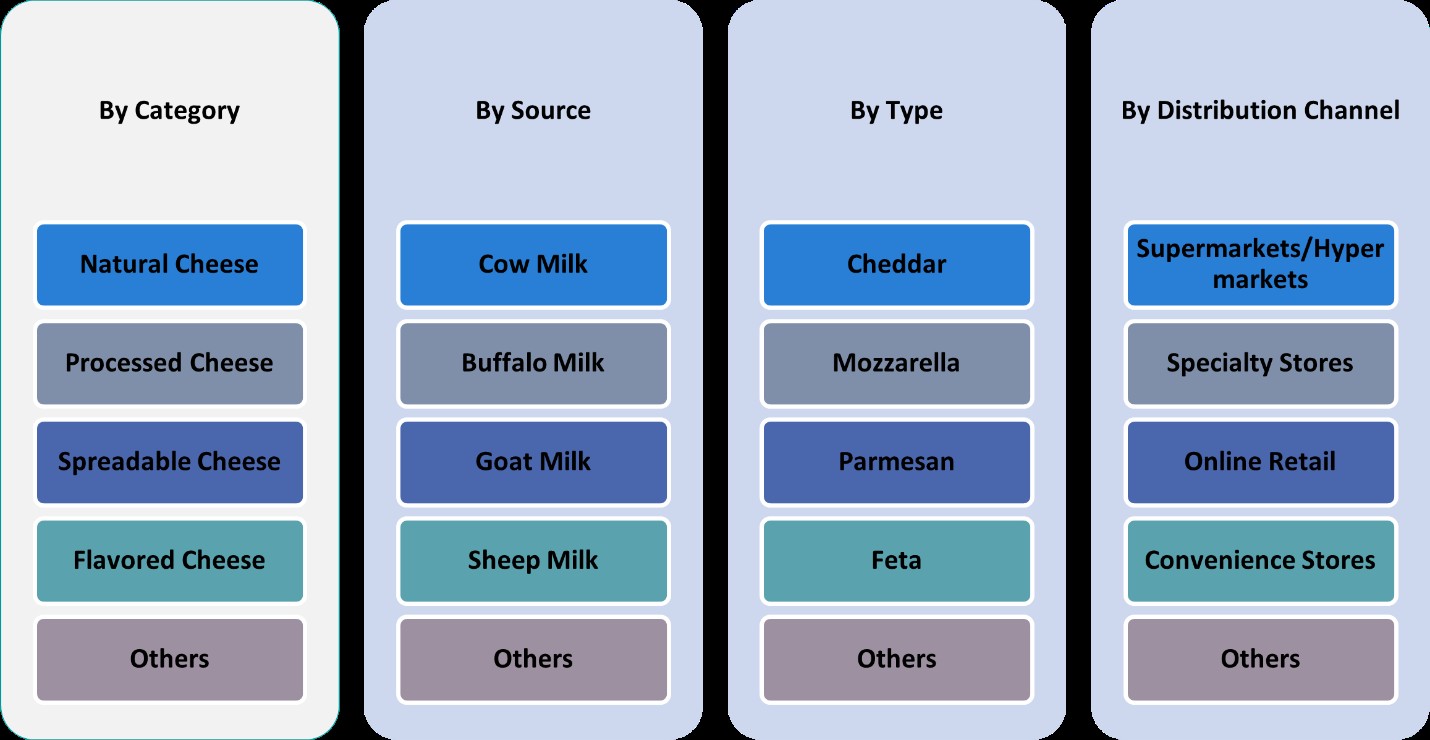

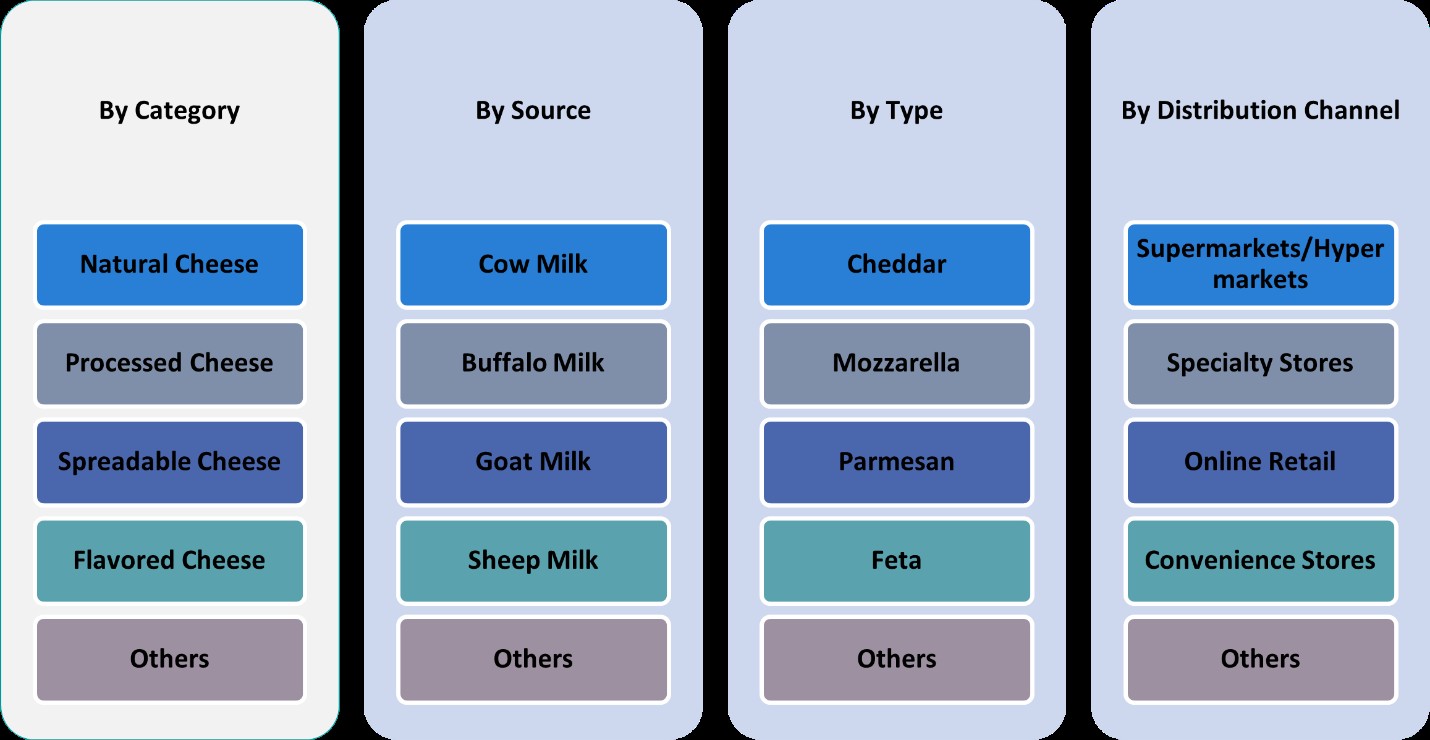

This report segments the U.S. Cheese Market as follows:

Market Drivers

Rising Demand for Protein-Rich and Nutrient-Dense Foods

The growing awareness among U.S. consumers regarding the importance of protein in daily diets is significantly driving the demand for cheese. For instance, the U.S. Department of Agriculture highlights cheese as an excellent source of protein, calcium, and vitamin B12, which support muscle health and bone strength. With increased focus on health and wellness, consumers are actively seeking out food options that support muscle health, bone strength, and overall nutrition. Cheese, particularly natural and low-fat varieties, has emerged as a favorable choice among health-conscious individuals. Furthermore, dietary trends like the ketogenic and low-carb diets have further reinforced cheese consumption, as it fits well within their nutritional frameworks. This shift in eating habits has opened up opportunities for manufacturers to promote cheese as both a healthy snack and a versatile cooking ingredient.

Expansion of Foodservice Industry and Quick-Service Restaurants

The growth of the foodservice industry, particularly fast food and quick-service restaurants (QSRs), has significantly contributed to the rising consumption of cheese in the U.S. Cheese remains a key ingredient in numerous popular menu items such as pizzas, burgers, sandwiches, pasta, and salads. As consumer lifestyles become increasingly fast-paced, there is a growing preference for convenient and flavorful meals, leading to higher demand for cheese-laden offerings. The aggressive expansion of international and domestic QSR chains across the country, coupled with the increasing availability of online food delivery services, has further fueled cheese usage in the commercial segment. This trend not only benefits traditional dairy-based cheeses but also supports innovation in processed and plant-based cheese formats suited for foodservice applications.

Innovation in Product Varieties and Flavors

Manufacturers in the U.S. cheese market are actively focusing on product innovation to meet the evolving preferences of diverse consumer groups. The introduction of new cheese types, including organic, lactose-free, plant-based, and exotic flavored varieties, has broadened the product landscape. Consumers are increasingly drawn to artisanal and gourmet cheese options, which offer unique taste experiences and cater to premium demand segments. In response, producers are developing cheeses with international profiles, such as feta, gouda, brie, and halloumi, to cater to adventurous palates. Additionally, innovations in packaging—such as resealable bags, single-serve portions, and eco-friendly materials—have enhanced product convenience and shelf appeal. These developments are instrumental in attracting new customers while retaining brand loyalty among existing buyers.

Growing Popularity of At-Home Cooking and Snacking

The rise in at-home cooking trends, especially following the COVID-19 pandemic, has played a pivotal role in boosting retail cheese consumption. Consumers are increasingly experimenting with cooking at home and incorporating cheese into various meals, including breakfast, lunch, dinner, and snacks. Cheese’s versatility and ability to enhance the flavor profile of dishes have made it a staple in many American households. Additionally, the demand for cheese-based snacks, such as cheese sticks, cubes, and spreads, has seen remarkable growth due to their convenience and nutritional value. This trend aligns with the broader consumer inclination toward functional snacking, where food choices deliver both taste and health benefits. As these preferences continue to evolve, the demand for cheese in home kitchens is expected to remain robust, further strengthening market growth.

Market Trends

Rising Popularity of Artisanal and Specialty Cheeses

The U.S. cheese market is witnessing a strong shift toward artisanal and specialty cheese varieties, driven by consumers seeking premium, high-quality, and unique flavor experiences. For instance, the American Cheese Society highlights the growing demand for handcrafted cheeses like brie, gouda, and blue cheese, which appeal to consumers valuing craftsmanship and authenticity. The increasing interest in gourmet cooking and pairing cheese with wine and charcuterie has further elevated the demand for specialty cheeses. Retailers and supermarkets are expanding their premium cheese selections, offering curated experiences that cater to evolving consumer palates and lifestyle preferences.

Surge in Demand for Plant-Based and Lactose-Free Alternatives

A notable trend shaping the U.S. cheese market is the rising demand for plant-based and lactose-free cheese options. For instance, the Plant-Based Foods Association reports increased consumer interest in non-dairy cheeses made from nuts, soy, and oats, driven by vegan and flexitarian diets. While traditionally considered niche, plant-based cheese is rapidly gaining mainstream acceptance as its taste and texture continue to improve. Innovations in fermentation techniques and ingredient sourcing are helping bridge the gap between dairy and non-dairy cheese, making them more appealing to health-conscious and environmentally aware consumers. Major dairy brands are also entering the plant-based segment to capitalize on this expanding trend.

Growth of Convenient and Ready-to-Use Cheese Formats

Convenience remains a key driver of cheese consumption in the U.S., fueling demand for pre-packaged, ready-to-use cheese products. Shredded, sliced, cubed, and snack-sized cheese options are increasingly popular among busy households, working professionals, and on-the-go consumers. These formats not only simplify meal preparation but also support portion control and dietary management. Furthermore, individually wrapped cheese snacks and string cheese are gaining traction in school lunches and health-conscious snacking routines. The trend toward convenience has prompted manufacturers to focus on packaging innovations that enhance shelf life, portability, and ease of use, making cheese more accessible and appealing across diverse consumer segments.

Integration of Technology in Production and Distribution

Technological advancements are playing a significant role in reshaping the U.S. cheese industry. Automation in cheese manufacturing, including advanced processing and quality control systems, is enhancing efficiency and consistency. Meanwhile, digital platforms and data analytics are streamlining distribution, inventory management, and consumer engagement strategies. E-commerce and direct-to-consumer models are gaining traction, especially for niche and specialty cheese brands that wish to reach targeted audiences. Additionally, blockchain and traceability technologies are being implemented to ensure transparency, safety, and sustainability throughout the supply chain. These tech-driven initiatives are helping manufacturers respond more swiftly to market demands while maintaining product integrity.

Market Challenges Analysis

Health Concerns and Dietary Restrictions Impacting Consumption

One of the primary challenges facing the U.S. cheese market is the growing awareness of health issues associated with high saturated fat and sodium content in certain cheese varieties. While cheese is a rich source of protein and calcium, excessive consumption has been linked to cardiovascular concerns and weight management issues. As a result, a segment of health-conscious consumers is reducing their intake or switching to low-fat or alternative products. Additionally, the rising prevalence of lactose intolerance and dairy-related allergies has limited cheese consumption among specific consumer groups. Although lactose-free and plant-based cheese alternatives are emerging to address this issue, they still face challenges related to taste, texture, and nutritional equivalency when compared to traditional dairy cheese. These health-related concerns pose a significant restraint on the market’s growth potential, particularly in regions with high awareness of nutritional labeling and dietary regulation.

Price Volatility and Supply Chain Disruptions

The U.S. cheese market also contends with price fluctuations driven by raw material costs, particularly milk, which constitutes a significant portion of production expenses. For instance, the U.S. Department of Agriculture has reported that variations in feed prices and environmental conditions significantly impact milk production, leading to inconsistent supply and pricing. Moreover, labor shortages and transportation inefficiencies across the supply chain have further strained the market, leading to delayed deliveries and increased operational costs. In addition, the regulatory landscape—encompassing food safety standards, labeling requirements, and import/export policies—adds another layer of complexity for manufacturers, especially smaller players with limited resources. Global trade uncertainties and tariffs on dairy products have also impacted the competitiveness of U.S. cheese in international markets. These economic and logistical challenges create obstacles for manufacturers trying to maintain consistent pricing, quality, and supply, ultimately impacting profitability and long-term growth prospects.

Market Opportunities

The U.S. cheese market presents significant opportunities fueled by evolving consumer preferences, dietary diversification, and the increasing appeal of global flavors. As more consumers explore international cuisines at home and in restaurants, demand for specialty and ethnic cheese varieties such as feta, paneer, queso fresco, and halloumi continues to grow. This trend offers manufacturers and retailers the chance to expand their product portfolios and introduce new, culturally inspired offerings. Additionally, the growing interest in gourmet and artisanal food experiences creates a favorable environment for premium cheese products that emphasize origin, aging process, and flavor complexity. By leveraging storytelling, sustainability, and product differentiation, brands can cater to discerning consumers willing to pay a premium for authenticity and quality.

Furthermore, the rising adoption of plant-based diets and lactose-free lifestyles opens up a growing segment for alternative cheese products. As consumer interest in vegan and allergen-free options increases, innovative non-dairy cheese formulations—particularly those replicating the taste and meltability of traditional dairy cheese—are gaining popularity. This shift offers a unique opportunity for both emerging startups and established dairy companies to invest in research and development for plant-based alternatives that address health, ethical, and environmental concerns. Additionally, expanding retail channels, including e-commerce and subscription-based direct-to-consumer models, provide cheese brands with new avenues to reach customers beyond conventional grocery shelves. Enhanced digital presence and tailored marketing strategies can help brands capture niche markets, build loyalty, and adapt to changing buying behaviors. With the convergence of these consumer and technological trends, the U.S. cheese market remains ripe for innovation and expansion.

Market Segmentation Analysis:

By Category:

The U.S. cheese market is segmented by category into cheddar, processed cheese, spreadable cheese, flavored cheese, and others. Among these, cheddar cheese holds a dominant market share due to its widespread use in households, restaurants, and food processing applications. Its versatility, long shelf life, and rich flavor profile make it a preferred choice for a variety of dishes including burgers, sandwiches, and casseroles. Processed cheese is also gaining strong traction, particularly in the convenience food sector, driven by its meltability, uniform texture, and longer storage capabilities. Spreadable cheese, favored for its ease of use and appeal as a snack or breakfast item, continues to attract health-conscious and busy consumers. Flavored cheese, infused with ingredients like herbs, spices, and smoked essences, is increasingly popular among gourmet enthusiasts and consumers seeking unique taste experiences. The “others” segment, which includes specialty and ethnic cheeses, is steadily growing due to rising multicultural influences and the consumer shift toward premium and niche dairy products.

By Source:

Based on source, the U.S. cheese market is segmented into cow milk, buffalo milk, goat milk, sheep milk, and others. Cow milk dominates the segment owing to its widespread availability, lower production costs, and established processing infrastructure. It serves as the primary source for producing mainstream cheese types such as cheddar, mozzarella, and American cheese. However, goat milk cheese is gaining recognition for its distinctive taste and health benefits, including easier digestibility and lower lactose content. Similarly, sheep milk cheese, known for its rich flavor and high fat content, appeals to consumers interested in artisanal and Mediterranean-style cheeses. Buffalo milk cheese, while less common in the U.S., is gradually entering niche markets, especially through imports and specialty stores offering mozzarella di bufala. The “others” category, including mixed-milk and plant-based sources, is also witnessing growth as manufacturers explore sustainable and allergen-free alternatives. This segmentation highlights the increasing diversification of cheese sources to meet varied nutritional needs and consumer preferences.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Midwestern United States

The Midwestern United States holds the largest share of the U.S. cheese market, accounting for approximately 39% of the total revenue in 2024. This dominance can be attributed to the region’s well-established dairy farming infrastructure, favorable climate, and strong presence of leading cheese manufacturers. States such as Wisconsin, known as “America’s Dairyland,” and Minnesota play a pivotal role in cheese production, particularly in cheddar, mozzarella, and specialty varieties. The region benefits from a robust supply chain and proximity to major agricultural resources, ensuring steady access to high-quality milk. Additionally, the cultural inclination toward traditional cheese consumption in the Midwest continues to drive demand across both retail and foodservice sectors. With supportive policies for dairy farmers and investment in processing technology, the Midwest is expected to maintain its leadership position throughout the forecast period.

Western United States

The Western United States captures around 26% of the U.S. cheese market, driven by increasing demand for specialty and artisanal cheeses in states like California, Oregon, and Washington. California, in particular, is a major player in dairy production and houses some of the nation’s most innovative cheese producers. The region has witnessed significant growth in organic and plant-based cheese products, reflecting the health-conscious and sustainability-driven preferences of its consumers. Additionally, the rise of multicultural influences and international cuisines has spurred demand for ethnic cheeses, including queso fresco and cotija. The West also benefits from a strong export infrastructure, with access to international markets across the Pacific. With continued investment in sustainable dairy practices and innovation in cheese formats, this region is poised for steady expansion in both domestic and export markets.

Southern United States

The Southern United States accounts for approximately 20% of the national cheese market share. Rising urbanization, population growth, and a thriving foodservice industry contribute to the region’s increasing cheese consumption. Major metropolitan areas such as Houston, Atlanta, and Miami are seeing heightened demand for processed and ready-to-use cheese products, driven by busy lifestyles and the popularity of quick-service restaurants. Additionally, southern cuisine’s rich use of cheese in dishes like mac and cheese, quesadillas, and casseroles supports strong retail demand. Although the region has fewer large-scale dairy farms compared to the Midwest, improved logistics and distribution networks are helping to meet growing consumption needs. Manufacturers are also capitalizing on regional flavor preferences by introducing spicy and flavored cheese variants that appeal to local tastes.

Northeastern United States

The Northeastern United States holds a market share of around 15%, and while it represents the smallest share among the regions, it shows strong potential for premium and gourmet cheese growth. States like New York and Vermont are known for their artisanal cheese offerings, often produced in small batches and marketed through specialty retailers. Consumers in the Northeast tend to prioritize quality, origin, and sustainability, making this region a lucrative market for organic and specialty cheese producers. The region’s dense population and high purchasing power support robust retail sales, particularly in urban centers such as Boston, Philadelphia, and New York City. Additionally, the region’s thriving hospitality and fine dining industries create demand for a wide range of cheese types used in gourmet preparations. Although smaller in scale, the Northeast’s focus on quality and innovation continues to add significant value to the overall market.

Key Player Analysis

- Arla Foods

- Saputo Inc.

- Sargento Foods Inc.

- Dairy Farmers of America

- Tillamook Creamery

- Schreiber Foods

- Organic Valley

- Leprino Foods

- Bel Brands USA

- Borden Dairy

Competitive Analysis

The U.S. cheese market features a competitive landscape shaped by both legacy brands and emerging players focusing on innovation, quality, and consumer-centric offerings. Leading companies such as Arla Foods, Saputo Inc., Sargento Foods Inc., Dairy Farmers of America, Tillamook Creamery, Schreiber Foods, Organic Valley, Leprino Foods, Bel Brands USA, and Borden Dairy play a pivotal role in driving market dynamics. These firms leverage strong distribution networks, diversified product portfolios, and established brand loyalty to maintain their positions. Their strategies focus on launching new cheese variants, expanding into plant-based and organic segments, and meeting changing dietary preferences. Many are investing in sustainable practices and advanced packaging to appeal to eco-conscious consumers. Additionally, technological advancements in processing and supply chain optimization enable efficient production and timely market delivery. As competition intensifies, these companies are increasingly engaging in mergers, acquisitions, and regional expansions to strengthen their market footprint, enhance production capacity, and respond to evolving consumer demands.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The U.S. cheese market demonstrates a moderately concentrated structure, with a mix of well-established national players and a growing number of regional and artisanal producers. While leading companies hold a significant share through extensive product portfolios and nationwide distribution, the market also allows room for innovation and niche differentiation, especially within specialty and organic cheese segments. Consumer demand for variety, convenience, and authenticity has encouraged the proliferation of small and mid-sized producers, contributing to a dynamic competitive environment. The market is characterized by continuous product innovation, including plant-based alternatives, flavored and spreadable cheeses, and sustainable packaging solutions. Additionally, brand loyalty, strong retail partnerships, and marketing capabilities play crucial roles in maintaining competitive advantage. The presence of private-label offerings in major supermarkets further intensifies competition. Overall, the U.S. cheese market balances dominance by key players with opportunities for smaller brands to capture consumer interest through innovation, quality, and regional appeal.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. cheese market is expected to experience steady growth driven by rising demand for protein-rich diets.

- Innovation in plant-based and lactose-free cheese options will gain momentum among health-conscious consumers.

- Premium and artisanal cheese varieties will continue to attract niche consumer segments.

- E-commerce and direct-to-consumer sales channels will expand cheese accessibility and convenience.

- Sustainability initiatives in packaging and production will become key competitive differentiators.

- Manufacturers will invest in advanced processing technologies to enhance product shelf life and quality.

- Regional cheese producers will find growth opportunities by offering locally sourced and specialty products.

- Demand for organic and clean-label cheese will rise with increasing focus on ingredient transparency.

- Strategic collaborations and acquisitions will shape market consolidation and expansion.

- Export potential for U.S. cheese will increase as global interest in American dairy products grows.