| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Loitering Munition Market Size 2023 |

USD 573.79 Million |

| U.S. Loitering Munition Market, CAGR |

10.9% |

| U.S. Loitering Munition Market Size 2032 |

USD 1,456.65 Million |

Market Overview:

U.S. Loitering Munition Market size was valued at USD 573.79 million in 2023 and is anticipated to reach USD 1,456.65 million by 2032, at a CAGR of 10.9% during the forecast period (2023-2032).

Several key factors are propelling the expansion of the U.S. loitering munition market. Foremost is the rising demand for precision strike capabilities that minimize collateral damage, a critical requirement in contemporary combat scenarios. Advancements in autonomous technologies, particularly the integration of artificial intelligence (AI) and sophisticated sensors, have enhanced the operational effectiveness of loitering munitions, enabling real-time decision-making and target engagement. Additionally, the need for cost-effective alternatives to traditional guided missiles has made loitering munitions an attractive option for military forces seeking flexible and efficient solutions. The U.S. military’s emphasis on modernizing its arsenal to address asymmetric threats and the increasing focus on unmanned systems further contribute to market growth

North America, and specifically the United States, dominates the loitering munition market, accounting for the largest share due to substantial defense budgets and a strong focus on technological innovation. The U.S. Department of Defense’s investments in research and development have led to the deployment of advanced loitering munitions like AeroVironment’s Switchblade series, which are integral to modern military operations. Furthermore, initiatives such as the Pentagon’s Replicator program aim to rapidly field autonomous systems, including loitering munitions, to enhance combat readiness and deterrence capabilities. These efforts underscore the strategic importance of loitering munitions in the U.S. defense landscape and are indicative of the region’s continued leadership in this market segment

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. loitering munition market was valued at USD 573.79 million in 2023 and is projected to reach USD 1,456.65 million by 2032, registering a CAGR of 10.9% during the forecast period.

- The global loitering munition market is valued at USD 1,967.89 million in 2023 and is expected to grow significantly, reaching USD 4,952.89 million at a CAGR of 10.8% by 2032, driven by increasing demand for precision strike systems.

- Rising demand for precision strike capabilities is a primary growth driver, as military operations increasingly focus on minimizing collateral damage in urban combat zones.

- Integration of AI, machine learning, and advanced sensors is enhancing target identification and real-time engagement capabilities, improving mission effectiveness.

- The U.S. military’s shift toward modernization and multi-domain operations is accelerating the adoption of unmanned, flexible weapon systems like loitering munitions.

- These systems offer a cost-effective alternative to traditional missiles, combining affordability with strategic versatility across various platforms and mission types.

- Regional growth is led by the South (38%), followed by the West (26%), Midwest (20%), and Northeast (16%), each contributing based on strategic and industrial strengths.

- Regulatory challenges, integration complexities, and high development costs remain key restraints despite the market’s strong technological momentum.

Market Drivers:

Increasing Demand for Precision Strike Capabilities

The growing emphasis on precision warfare is a primary driver of the U.S. loitering munition market. As modern conflicts increasingly occur in urban and complex terrains, the need to minimize collateral damage while neutralizing high-value targets has intensified. For instance, Loitering munitions, such as AeroVironment’s Switchblade, combine reconnaissance, surveillance, and strike capabilities in a single platform, allowing for real-time target identification and engagement with high precision. Loitering munitions offer the ability to identify, track, and engage targets with high accuracy, reducing unintended casualties and infrastructure destruction. Their dual role as surveillance tools and strike weapons allows forces to operate with greater flexibility and real-time responsiveness. These advantages have positioned loitering munitions as essential assets in achieving tactical superiority without resorting to large-scale kinetic force.

Technological Advancements in Autonomous Systems

Rapid advancements in autonomous technologies, including artificial intelligence (AI), machine learning, and real-time data processing, are significantly enhancing the capabilities of loitering munitions. For instance, XTEND, a leader in AI-powered tactical drone solutions, secured an $8.8 million contract from the U.S. Department of Defense’s Irregular Warfare Technical Support Directorate (IWTSD) to deliver Precision Strike Indoor & Outdoor (PSIO) small Unmanned Aerial Systems (sUAS). Modern systems are now capable of autonomously identifying and prioritizing targets, adapting to dynamic battlefield conditions, and executing complex mission profiles with minimal human intervention. These technologies not only improve the efficacy of loitering munitions but also expand their applicability across multiple mission types, including suppression of enemy air defenses (SEAD), counter-insurgency, and strategic target elimination. The U.S. Department of Defense’s increasing investment in AI-driven warfare systems reflects a strong commitment to leveraging these capabilities to maintain technological dominance.

Shifting Defense Strategies and Military Modernization

The transformation of U.S. military strategy to counter emerging threats—particularly from peer adversaries—has resulted in a renewed focus on unmanned and remotely operated systems. Loitering munitions fit this paradigm well, offering rapid deployment, operational flexibility, and cost efficiency. Unlike traditional missile systems that are launched and forgotten, loitering munitions can hover over areas of interest for extended periods, allowing military units to respond to evolving battlefield situations with greater control. As part of broader modernization initiatives, the integration of loitering munitions into U.S. military operations supports objectives such as multi-domain operations (MDO) and distributed lethality, ensuring force survivability and effectiveness in contested environments.

Cost Efficiency and Strategic Versatility

Cost-effectiveness is a critical factor driving the adoption of loitering munitions within U.S. defense programs. These systems are often less expensive than conventional guided missiles or manned aerial platforms, yet they provide comparable levels of operational effectiveness. Their disposable nature and ease of deployment allow for widespread use in diverse combat scenarios, from counter-terrorism missions to full-scale conflict engagements. Additionally, their ability to be launched from ground vehicles, air platforms, and even naval systems enhances their strategic versatility. The combination of affordability, adaptability, and combat readiness makes loitering munitions a practical solution for modern warfare requirements and a key investment focus in the evolving U.S. defense landscape.

Market Trends:

Integration of Artificial Intelligence and Autonomous Technologies

The U.S. loitering munition market is experiencing a significant transformation through the integration of artificial intelligence (AI) and autonomous technologies. For example, at AUSA 2024, UVision USA unveiled its Autonomous Multi-Launch Loitering Munition System, which can deploy and manage up to 21 HERO 120 munitions simultaneously from a single container, with capacity for an additional 10–12 munitions. Modern loitering munitions are now equipped with AI-driven systems that enable autonomous target identification, tracking, and engagement, reducing the need for constant human oversight.This advancement enhances operational efficiency and precision, allowing for rapid decision-making in dynamic combat environments.For instance, UVision’s Autonomous Multi-Launch Loitering Munition System, introduced in October 2024, can deploy multiple HERO 120 munitions simultaneously, utilizing AI for real-time target recognition and mission planning.Such innovations underscore the shift towards smarter, more responsive weapon systems in modern warfare.

Emphasis on Cost-Effective and Scalable Solutions

The demand for cost-effective and scalable loitering munitions is driving market growth in the United States. Anduril Industries, for instance, has developed the Bolt-M, a man-packable vertical takeoff and landing (VTOL) loitering munition equipped with advanced onboard AI/machine learning software for autonomous flight behaviors, target tracking, and engagement. Traditional guided missile systems often entail high costs and logistical complexities. In contrast, loitering munitions offer a more affordable alternative without compromising on effectiveness. Companies like Anduril Industries have responded to this demand by developing small, affordable drones capable of performing intelligence gathering and targeted strikes. Their VTOL Autonomous Air Vehicles (AAVs), for example, provide flexible capabilities with over 40 minutes of flight time and a range of up to 20 km, all at a cost significantly lower than that of conventional fighter jets.

Advancements in Launch Platforms and Deployment Flexibility

Recent developments have expanded the versatility of loitering munitions through advancements in launch platforms.The U.S. military is exploring various deployment methods to enhance tactical flexibility.For instance, the Pentagon’s Replicator initiative aims to rapidly field thousands of inexpensive, smart drones by August 2025, including loitering munitions like AeroVironment’s Switchblade 600.This initiative focuses on integrating drones across different platforms, such as ground vehicles and aircraft, to ensure rapid deployment and adaptability in various combat scenarios.

Strategic Focus on Countering Peer Adversaries

The strategic landscape is shifting towards preparing for potential conflicts with peer adversaries, prompting the U.S. to invest heavily in loitering munitions. The Pentagon’s “hellscape” strategy involves deploying a massive number of drones, including loitering munitions, to create a formidable defense in regions like the Taiwan Strait. This approach aims to disrupt and delay any offensive actions by adversaries, leveraging the capabilities of autonomous drone swarms for reconnaissance, missile guidance, and direct attacks. Such strategies highlight the critical role of loitering munitions in modern defense planning.

Market Challenges Analysis:

Regulatory and Ethical Concerns

One of the significant restraints in the U.S. loitering munition market is the growing scrutiny surrounding the use of autonomous weapons, particularly regarding ethical and legal implications. The deployment of loitering munitions capable of autonomous decision-making raises concerns over compliance with international humanitarian law and rules of engagement. Human rights organizations and regulatory bodies are increasingly calling for stringent oversight, transparency, and accountability in the deployment of such systems. For example, the International Traffic in Arms Regulations (ITAR) in the U.S. impose significant restrictions on the transfer of sensitive loitering munition technologies, reflecting a regulatory environment that demands adherence to international laws and emphasizes the need for clear human control over the use of force. These ethical dilemmas may delay procurement processes, hinder technological integration, and create barriers to broader adoption, especially in joint military operations or coalition warfare settings.

Technological Limitations and Vulnerabilities

Despite advancements, loitering munitions remain vulnerable to certain operational challenges, including electronic warfare (EW) tactics, cyber interference, and environmental disruptions. Adversaries with robust EW capabilities can jam or spoof communication links, compromising mission execution and rendering systems inoperative. Additionally, while AI integration enhances autonomy, it also introduces the risk of system errors, misidentification of targets, or unintended escalation. These technological vulnerabilities necessitate continuous upgrades and robust counter-countermeasure strategies, increasing the overall cost and complexity of system development and maintenance.

Budgetary Constraints and Procurement Delays

Although the U.S. defense budget remains substantial, fluctuating funding allocations and the prioritization of other defense programs can limit the consistent procurement of loitering munitions. Congressional approvals, bureaucratic procurement cycles, and changing defense strategies often delay program rollouts and long-term contracts. Furthermore, defense contractors face the challenge of scaling up production and ensuring timely delivery while meeting evolving operational requirements. These fiscal and administrative hurdles may impede market momentum and affect the timely deployment of advanced loitering systems, particularly in rapidly evolving conflict zones.

Market Opportunities:

The U.S. loitering munition market presents substantial growth opportunities driven by the increasing focus on next-generation warfare technologies. As the U.S. military continues to modernize its arsenal, loitering munitions are emerging as critical tools for achieving precision strike capabilities and operational agility. Their ability to provide real-time intelligence and conduct targeted attacks makes them indispensable in asymmetric warfare scenarios and urban combat zones. Furthermore, the U.S. Department of Defense’s emphasis on integrating unmanned systems across all branches of the armed forces opens new pathways for loitering munitions to be deployed in joint operations, enhancing their tactical relevance.

In addition, evolving global security dynamics and the potential for high-intensity conflicts with peer adversaries are accelerating demand for scalable and cost-effective strike solutions. Loitering munitions offer a compelling value proposition with their relatively low cost, rapid deployment potential, and multi-platform compatibility. This creates an opportunity for U.S. defense contractors to innovate in modular system design, AI-driven targeting, and swarm technologies. The expanding scope for homeland defense, counter-terrorism, and border security applications further strengthens market potential. As the Pentagon advances initiatives like the Replicator program and invests in drone-centric warfare strategies, the U.S. loitering munition market is well-positioned to attract robust investments and strategic collaborations, driving sustained long-term growth.

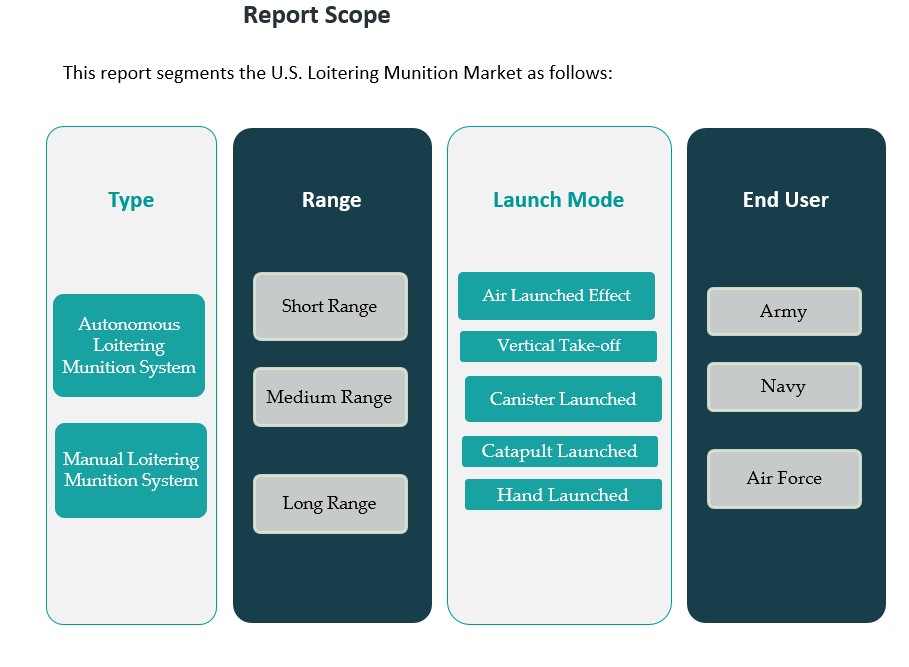

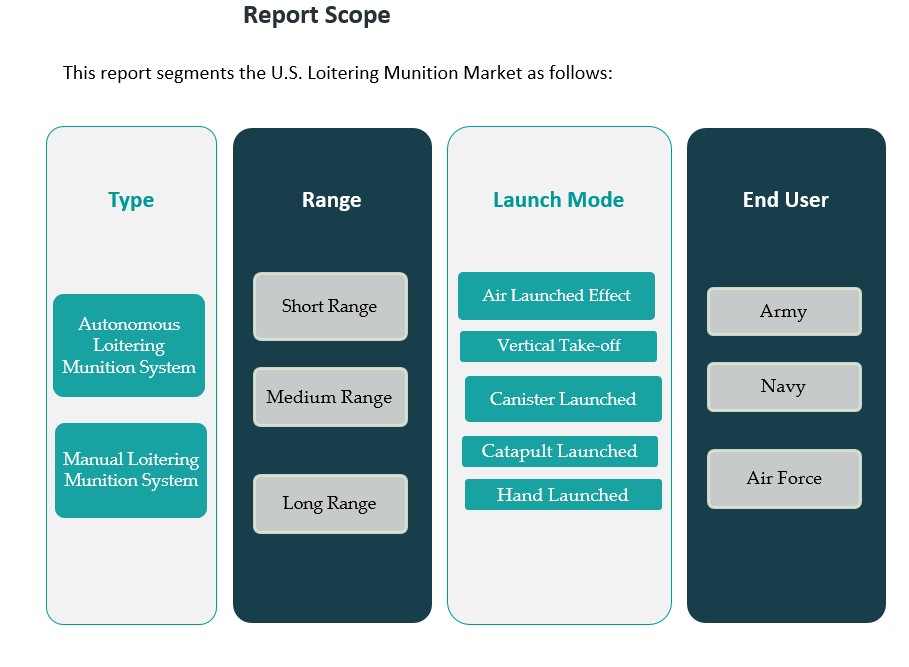

Market Segmentation Analysis:

The U.S. loitering munition market is segmented by type, range, launch mode, and end user, reflecting a diverse application landscape shaped by evolving defense strategies and operational requirements.

By type, the market is divided into autonomous and manual loitering munition systems. Autonomous systems are witnessing significant growth, driven by advancements in artificial intelligence and the increasing demand for real-time, decision-making capabilities with minimal human intervention. Manual systems continue to play a crucial role in operations where human control is preferred for strategic oversight and precision.

By range, the market is segmented into short, medium, and long-range munitions. Short-range systems are favored in urban and tactical environments due to their mobility and ease of deployment, while medium and long-range variants are increasingly utilized for extended surveillance and strategic strikes beyond the immediate battlefield, offering flexibility in varied terrain and conflict scenarios.

By launch mode segment includes air launched effect, vertical take-off, canister launched, catapult launched, and hand launched systems. Among these, canister and catapult launched systems are popular for their adaptability and rapid deployment capability in field operations. Vertical take-off and hand-launched systems are gaining traction for use in difficult terrains and stealth operations.

By end user, the market is categorized into land, air, and navy segments. The land segment dominates due to widespread deployment in ground operations, while the air and naval segments are expanding, supported by integration with aerial platforms and shipborne systems to enhance multi-domain combat effectiveness.

Segmentation:

By Type:

- Autonomous Loitering Munition System

- Manual Loitering Munition System

By Range:

- Short Range

- Medium Range

- Long Range

By Launch Mode:

- Air Launched Effect

- Vertical Take-off

- Canister Launched

- Catapult Launched

- Hand Launched

By End User:

Regional Analysis:

The U.S. loitering munition market demonstrates regional diversity shaped by varying defense priorities, technological infrastructure, and military strategies. The market is segmented into four major regions: Northeast, Midwest, South, and West. Each region contributes uniquely to the growth and deployment of loitering munitions based on its defense contractors, military installations, and research hubs.

South Region – Dominant Market Share (38%)

The South region holds the largest market share at 38%, driven by the presence of significant military bases and strong government defense contracts. States like Texas, Florida, and Virginia serve as key hubs for advanced military testing and deployment. Texas, in particular, benefits from numerous military installations and a robust defense manufacturing ecosystem. Additionally, partnerships between private defense companies and regional U.S. Army facilities in this region are accelerating the adoption of loitering munitions.

West Region – Technological Innovation Hub (26%)

The West region accounts for 26% of the market share and stands out due to its emphasis on technological innovation and aerospace development. California leads this region, housing several major defense contractors and tech startups focused on AI-integrated weapons systems. Research and development activities in Silicon Valley contribute to advancements in loitering munition autonomy and targeting accuracy. The close proximity of private innovation clusters and military test ranges supports rapid prototyping and field testing.

Midwest Region – Manufacturing and Supply Chain Base (20%)

The Midwest region represents 20% of the market, largely fueled by its manufacturing capabilities and supply chain contributions to the defense sector. States such as Ohio and Michigan support key components production, including propulsion systems and sensors for loitering munitions. The region also benefits from strong university-defense partnerships that promote innovation in materials science and electronic warfare technologies.

Northeast Region – Defense Policy and Command (16%)

The Northeast holds 16% of the market share, with a focus on strategic command centers and defense policy institutions. Washington, D.C., and surrounding areas serve as critical hubs for defense procurement decisions and military strategy development. While the region is less involved in direct manufacturing, it plays a vital role in shaping national security agendas and allocating budgets for loitering munition programs.

Key Player Analysis:

- AeroVironment, Inc.

- UVision Air Ltd.

- Paramount Group

- Elbit Systems Ltd

- Rheinmetall AG

- Thales

- Uvision

- KNDS

- Paramount Group

- RTX

- AEVEX Aerospace

- Elbit Systems

- Teledyne FLIR Defense

- Rheinmetall

- Northrop Grumman

- Others

Competitive Analysis:

The U.S. loitering munition market is characterized by intense competition among leading defense contractors and specialized technology firms. Key players such as AeroVironment Inc., Raytheon Technologies Corporation, Northrop Grumman Corporation, and Lockheed Martin Corporation dominate the landscape through continuous innovation, government contracts, and strategic partnerships. These companies are investing heavily in artificial intelligence, autonomous guidance systems, and precision strike capabilities to enhance product performance and reliability. Emerging firms are also entering the market, leveraging advanced sensor technologies and lightweight materials to offer cost-effective and agile solutions. The competitive environment is further intensified by the Department of Defense’s push for rapid prototyping and deployment under various modernization initiatives. Collaborative ventures between private enterprises and military research institutions are fostering faster innovation cycles, positioning the U.S. as a global leader in loitering munitions. Overall, the market reflects a balance of legacy defense giants and agile disruptors driving technological advancement.

Recent Developments:

- In October 2024, AeroVironment (AV), a leading U.S. defense technology company, secured a significant new contract with the U.S. Army for its Switchblade loitering munition systems. The award included a $54.9 million delivery order and raised the total contract ceiling to $743 million. This contract, which also supports allied partners such as Lithuania, Romania, and Sweden, ensures continued production and delivery of AV’s battle-proven Switchblade systems.

- In Oct 2024, UVision, another key player in the U.S. loitering munition market, announced at the Association of the United States Army (AUSA) conference that its autonomous multi-launch loitering munition system is in the final testing phase and is expected to be ready for deployment in fiscal year 2025. The new system, designed for the Hero 120 loitering munition, features a 21-canister portable array and aims to deliver enhanced operational flexibility for larger conventional forces like the U.S. Army. UVision is actively seeking new markets and customers for this advanced system as it prepares for its official launch.

Market Concentration & Characteristics:

The U.S. loitering munition market exhibits a high degree of concentration, dominated by a few established defense contractors with longstanding government affiliations. Companies such as AeroVironment, Raytheon, and Lockheed Martin command significant market share due to their technological capabilities, integrated supply chains, and consistent engagement in Department of Defense programs. These firms benefit from classified R&D budgets, proprietary technologies, and strong procurement pipelines. The market is characterized by high entry barriers, including strict regulatory compliance, extensive testing requirements, and substantial capital investment. It is technology-intensive, with a focus on autonomous flight control, AI-based targeting, and compact warhead delivery. Demand is primarily driven by evolving military doctrines that emphasize precision engagement, low-collateral damage, and tactical versatility. The market also favors modular and scalable systems, allowing adaptability across different combat scenarios. Despite its concentrated nature, the market is open to innovation through defense innovation units and rapid acquisition frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type. Range, Launch Mode and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of AI and machine learning will enhance the autonomy and decision-making capabilities of loitering munitions.

- Expansion of tactical use cases across all branches of the U.S. military will drive diversified demand.

- Government investments in defense modernization will sustain procurement of advanced loitering munition systems.

- Integration with unmanned aerial systems (UAS) will expand operational flexibility in both surveillance and strike missions.

- Rising geopolitical tensions and asymmetric warfare strategies will reinforce the need for precision loitering solutions.

- Continued collaboration between defense contractors and military R&D centers will accelerate system innovation.

- Miniaturization of components will support the development of lightweight and portable loitering munitions.

- Increased focus on interoperability will facilitate deployment across joint and coalition forces.

- Streamlined acquisition frameworks will shorten development cycles and enhance market responsiveness.

- Emphasis on cost-effective solutions will open opportunities for emerging players with modular technologies.