| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Brush Cutters Market Size 2024 |

USD 1,411.98 Million |

| U.S. Brush Cutters Market, CAGR |

4.51% |

| U.S. Brush Cutters Market Size 2032 |

USD 2,009.56 Million |

Market Overview:

The U.S. Brush Cutters Market is projected to grow from USD 1,411.98 million in 2024 to an estimated USD 2,009.56 million by 2032, with a compound annual growth rate (CAGR) of 4.51% from 2024 to 2032.

Several factors are propelling the growth of the U.S. brush cutters market. The rising demand for land clearing in agriculture, forestry, and real estate development is a significant driver. Urban expansion and infrastructural projects necessitate efficient vegetation management solutions, boosting the adoption of brush cutters. Technological advancements, such as the integration of GPS and automation systems, are enhancing operational efficiency and reducing labor costs. Additionally, the market is witnessing a shift towards eco-friendly equipment, with manufacturers introducing electric-powered and hybrid models to meet environmental regulations and consumer preferences. The growing emphasis on user-friendly designs and ergonomic features is also improving operator comfort and broadening the market appeal. Increasing safety standards across industries are encouraging the use of mechanized brush cutting over manual clearing methods. Furthermore, the rising popularity of multifunctional outdoor equipment among professionals and homeowners is accelerating product demand.

Within North America, the United States represents the largest market for brush cutters, driven by its expansive agricultural sector, large-scale real estate development, and robust landscaping industry. The demand is particularly strong in regions experiencing rapid urbanization and infrastructural growth. Moreover, government incentives promoting sustainable agriculture and land management are likely to support the adoption of advanced brush cutting solutions, especially those offering eco-friendly features. Southern and Midwestern states, in particular, show higher equipment usage due to extensive farmland and vegetation density. The Western region, facing increased wildfire risks, is also investing heavily in land clearing tools to support preventive vegetation management. Regional equipment rental services are further enabling access to advanced brush cutters, especially for seasonal or large-scale projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. brush cutters market is projected to grow from USD 1,411.98 million in 2024 to USD 2,009.56 million by 2032, registering a CAGR of 4.51% during the forecast period, driven by rising demand for land clearing in agriculture, forestry, landscaping, and infrastructure development.

- The Global Brush Cutters market is projected to grow from USD 4,376.82 million in 2024 to USD 6,180.02 million by 2032, registering a CAGR of 4.41%, driven by rising demand for efficient vegetation tools.

- Urban expansion and commercial real estate development are significantly increasing the need for efficient vegetation management solutions, making brush cutters essential equipment across residential, municipal, and industrial settings.

- The growing popularity of battery-powered and hybrid brush cutters is reshaping the product landscape, as users shift toward low-emission, noise-reducing equipment to meet environmental standards and urban usage requirements.

- Infrastructure modernization projects and utility maintenance programs are creating a consistent demand for brush cutters in transportation and energy sectors, where maintaining vegetation around highways and power lines is critical.

- Despite rising adoption, the market faces constraints from the high initial costs of advanced models and ongoing maintenance requirements, which can be a barrier for smaller businesses and individual users.

- Performance limitations in extremely rugged or uneven terrains, along with varied environmental compliance standards across U.S. states, present operational and regulatory challenges to manufacturers and end users.

- Regionally, the Southern U.S. holds the largest market share due to its expansive farmland and landscaping needs, followed by the Midwest, West, and Northeast, with each region exhibiting distinct demand drivers such as wildfire mitigation, agricultural use, and seasonal vegetation control.

Market Drivers:

Expansion of Landscaping and Commercial Grounds Maintenance

The growing focus on aesthetic landscaping and grounds maintenance in residential, commercial, and public spaces is a major factor driving demand for brush cutters in the United States. For instance, Husqvarna, a leading manufacturer, reports that its commercial brush cutters are widely adopted by both small and large landscaping businesses, with features such as anti-vibration systems and low-weight designs specifically developed in collaboration with professional end-users. As urbanization accelerates, municipalities, real estate developers, and property management firms increasingly prioritize well-maintained landscapes for functional and visual appeal. This trend fuels the need for efficient vegetation control equipment capable of trimming heavy undergrowth and managing irregular terrains. Brush cutters provide a versatile solution for maintaining parks, roadsides, recreational spaces, and large commercial properties, contributing to sustained market growth.

Increased Agricultural and Forestry Applications

Brush cutters are essential tools in modern agricultural and forestry operations across the U.S., where clearing overgrown vegetation is critical for land preparation, crop management, and fire prevention. Farmers and forestry workers utilize these tools to manage brush, weeds, and dense grass in hard-to-reach or uneven areas. For instance, manufacturers such as Schiller Grounds Care, Inc. supply high-durability brush cutters specifically designed for rugged agricultural use, enabling farmers to efficiently clear overgrown vegetation and prepare land for planting. With rising demand for efficient and sustainable farming practices, the need for equipment that offers durability and versatility has increased. Moreover, regulatory bodies are emphasizing land clearing and vegetation control as part of wildfire mitigation strategies, particularly in states prone to dry conditions, such as California and Arizona, further amplifying brush cutter adoption.

Technological Advancements and Eco-Friendly Innovations

Manufacturers are continually introducing technologically advanced brush cutters that improve operational efficiency and environmental sustainability. Battery-powered and hybrid brush cutters are gaining traction due to their lower emissions, quieter operation, and compliance with environmental regulations. Additionally, innovations such as anti-vibration systems, lightweight materials, and ergonomic handles are enhancing user comfort and safety, thereby expanding the product’s appeal across both professional and DIY user segments. These advancements not only contribute to product differentiation but also support long-term market growth by addressing customer preferences and regulatory standards.

Growth in Infrastructure and Utility Maintenance

The expansion of infrastructure development and the need for vegetation control around highways, railways, and utility lines are further driving brush cutter demand in the U.S. With increased federal and state-level investments in infrastructure modernization, maintaining right-of-way areas is becoming increasingly critical. Brush cutters enable precise and efficient clearing of encroaching vegetation, which is vital for operational safety and regulatory compliance in sectors such as transportation and energy. As public and private entities invest in long-term maintenance of physical infrastructure, the demand for reliable and high-performance brush cutting equipment is expected to remain strong.

Market Trends:

Adoption of Battery-Powered Equipment

One of the most notable trends in the U.S. brush cutters market is the increasing shift toward battery-powered models. As end users seek alternatives to conventional gas-powered equipment, the adoption of lithium-ion battery brush cutters is gaining traction. These models offer advantages such as low noise levels, reduced emissions, and improved ease of use, aligning with growing environmental consciousness. For instance, GreenWorks Tools and STIHL have introduced battery-powered brush cutters that are gaining significant traction due to their quiet operation, low emissions, and ease of maintenance. These models are particularly appealing to urban users and municipalities for their low noise levels and environmental benefits. Manufacturers are investing in research and development to extend battery life, enhance cutting power, and reduce charging times, enabling users to perform longer and more efficient operations. This trend is particularly evident in residential landscaping and municipal park maintenance, where sustainability and noise control are becoming key purchasing factors.

Growth of the Rental Equipment Segment

The expansion of the equipment rental industry is influencing buying behavior within the U.S. brush cutters market. Many landscaping companies, construction firms, and agricultural operations are opting to rent high-powered brush cutting tools instead of making large capital investments. This shift is driven by the need for cost optimization, especially among small to mid-sized businesses and seasonal contractors. Rental providers are offering flexible packages, maintenance support, and access to the latest models, allowing users to remain technologically competitive without ownership risks. For example, Cat brushcutter rentals like the BR378 feature high-strength blades, a fully balanced blade carrier for navigating rocks and stumps, and a motor protection guard for enhanced durability. As a result, rental brush cutters are becoming increasingly available across national and regional rental chains, contributing to broader market accessibility and usage.

Integration of Smart Features and Telematics

The U.S. brush cutters market is also witnessing the gradual incorporation of smart features and telematics into commercial-grade models. Equipment manufacturers are integrating GPS tracking, engine performance monitoring, and remote diagnostics to enhance fleet management and operator oversight. These digital capabilities are particularly beneficial for large-scale landscape service providers and municipalities that manage multiple units across various sites. In addition to improving operational efficiency, these features also aid in predictive maintenance, reducing downtime and repair costs. The growing trend toward digitalized equipment is expected to transform traditional vegetation management practices into more data-driven and responsive systems.

Rise in DIY Landscaping and Consumer Market Expansion

The increasing popularity of do-it-yourself (DIY) landscaping projects is expanding the consumer base for brush cutters in the United States. Homeowners are taking a more hands-on approach to property maintenance, leading to a rise in retail sales of lightweight, user-friendly brush cutter models. Retailers are responding by stocking more compact and electric variants suitable for domestic use, which has significantly increased product visibility in home improvement outlets and e-commerce platforms. Additionally, online tutorials and influencer-driven content have made it easier for consumers to understand and operate these machines, further contributing to the segment’s growth. This trend reflects a shift in the market from being purely professional-focused to catering to individual consumers seeking long-term value and autonomy in outdoor maintenance.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary restraints limiting the growth of the U.S. brush cutters market is the high upfront cost associated with advanced and commercial-grade equipment. While battery-powered and hybrid models offer numerous operational advantages, they often come at a premium price. Small businesses, independent landscapers, and homeowners may find the initial investment financially burdensome, particularly when budget constraints are tight. In addition to purchase costs, brush cutters require regular maintenance, including blade sharpening, motor servicing, and battery replacements, all of which contribute to the total cost of ownership and may deter cost-sensitive buyers.

Regulatory and Environmental Compliance Challenges

Although the market is moving toward eco-friendly alternatives, compliance with environmental regulations can still pose a challenge for manufacturers and users alike. Gas-powered brush cutters are subject to emission control standards that vary across states, adding complexity to manufacturing and distribution. For instance, the U.S. Environmental Protection Agency (EPA) has re-proposed emission reduction standards for small handheld engines, including brush cutters, requiring manufacturers to reduce hydrocarbons and nitrogen oxides by an additional 78% beyond previous standard. Companies must invest in modifying engine designs and integrating clean technology to meet these evolving standards, which can raise production costs and impact pricing strategies. Moreover, operators in highly regulated regions may face restrictions on using certain types of equipment, limiting operational flexibility and influencing procurement decisions.

Operational Limitations in Harsh or Uneven Terrain

Despite technological improvements, brush cutters often face performance limitations in extremely rugged or densely vegetated environments. In such conditions, even high-powered models may experience reduced efficiency, overheating, or mechanical strain. Operators must exercise caution to avoid injury or equipment damage, especially in areas with hidden obstacles or steep slopes. These operational challenges may necessitate the use of additional equipment or manual labor, thereby increasing project complexity and cost. As a result, end users may hesitate to adopt brush cutters for intensive or large-scale vegetation management without supplementary tools or support.

Market Opportunities:

The U.S. brush cutters market presents significant growth opportunities driven by expanding demand across both commercial and residential sectors. With increasing urban sprawl, infrastructure development, and environmental conservation initiatives, there is a growing need for efficient vegetation control in public spaces, transportation corridors, and utility rights-of-way. This scenario offers manufacturers the chance to diversify their product portfolios by introducing specialized brush cutters tailored to distinct applications such as municipal landscaping, highway maintenance, and forest management. Additionally, the shift toward electrification and sustainability opens avenues for the development of battery-powered models that cater to both regulatory compliance and eco-conscious consumers.

Another compelling opportunity lies in the rise of precision landscaping and smart equipment integration. As digital tools gain traction in agriculture and grounds maintenance, brush cutter manufacturers can capitalize by embedding features such as GPS-guided operation, telematics, and IoT-based diagnostics into their offerings. These innovations not only enhance operational efficiency but also appeal to large-scale operators seeking data-driven solutions for fleet and resource management. Furthermore, the increasing popularity of home improvement activities and DIY landscaping is expanding the consumer market segment, especially for lightweight, user-friendly models available through retail and e-commerce channels. By addressing both high-performance industrial needs and convenience-focused residential demands, companies can tap into a broad and evolving customer base, positioning themselves for long-term growth in the U.S. brush cutters market.

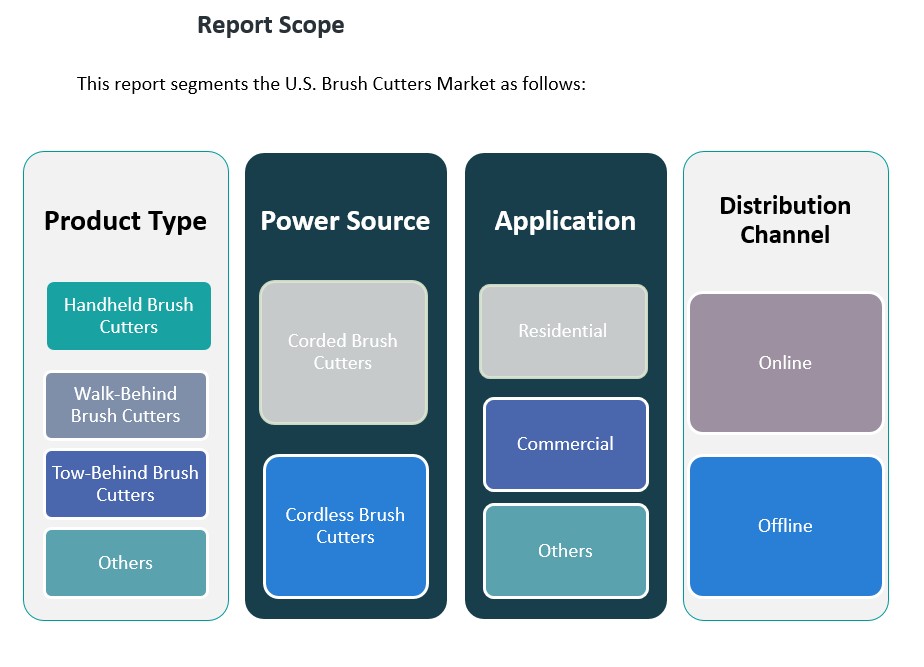

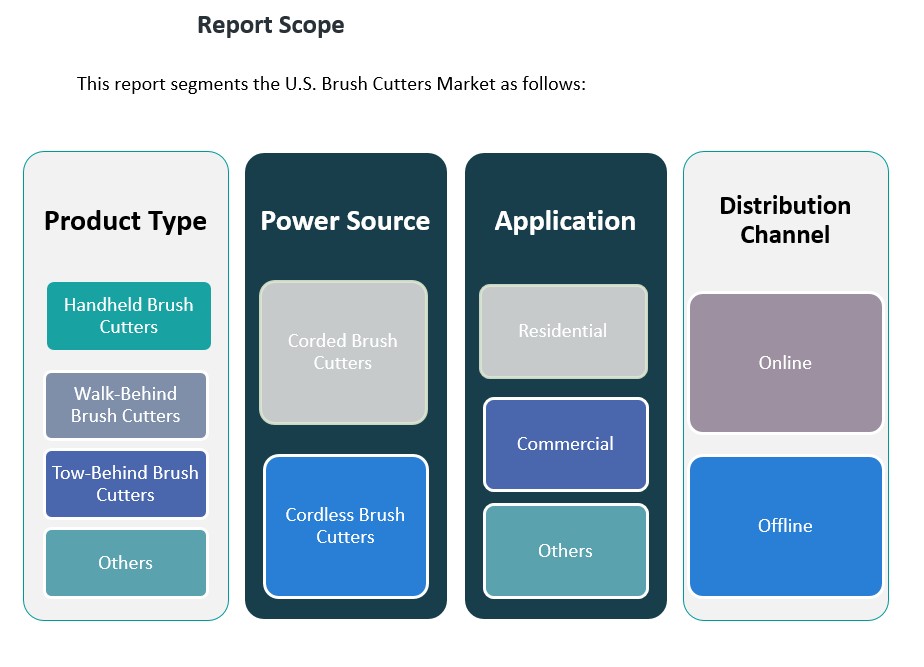

Market Segmentation Analysis:

The U.S. brush cutters market is segmented based on product type, power source, application, and distribution channel.

By product types, handheld brush cutters dominate due to their versatility, portability, and ease of use for both residential and light commercial applications. Walk-behind brush cutters are increasingly used in commercial landscaping and public space maintenance, offering higher cutting power for dense vegetation. Tow-behind variants, designed for large-scale land clearing and agricultural use, hold a steady share within the market. The “others” category includes specialty and multi-function units that cater to niche applications and professional users seeking precision.

By power source, the market is bifurcated into corded and cordless brush cutters. Cordless models, particularly those powered by lithium-ion batteries, are gaining traction due to their convenience, mobility, and reduced environmental impact. Corded models still maintain relevance in cost-sensitive and continuous-use scenarios where access to power outlets is readily available.

By application, the commercial segment leads market share, driven by widespread use in landscaping services, municipal maintenance, and infrastructure upkeep. However, the residential segment is expanding rapidly as more homeowners invest in property maintenance equipment for DIY landscaping.

By distribution channel segment, offline sales remain dominant due to customer preference for hands-on equipment evaluation and after-sales support through specialized dealers and hardware retailers. Nonetheless, online platforms are growing at a faster rate, fueled by convenience, competitive pricing, and increasing consumer trust in e-commerce. This dual-channel strategy is allowing manufacturers and retailers to broaden their market reach across diverse customer bases.

Segmentation:

By Product Type

- Handheld Brush Cutters

- Walk-Behind Brush Cutters

- Tow-Behind Brush Cutters

- Others

By Power Source

- Corded Brush Cutters

- Cordless Brush Cutters

By Application

- Residential

- Commercial

- Others

By Distribution Channel

Regional Analysis:

The U.S. brush cutters market demonstrates varied regional dynamics driven by differences in land use patterns, vegetation density, urban development, and agricultural activities. The market is broadly segmented into four key regions: the South, Midwest, West, and Northeast. Each region contributes uniquely to overall market growth, with specific demand patterns shaped by both environmental and economic factors.

The Southern region holds the largest share of the U.S. brush cutters market, accounting for approximately 36% of total revenue. This dominance is attributed to the region’s extensive agricultural base, abundant vegetation, and year-round landscaping requirements. States such as Texas, Florida, and Georgia have high brush cutter usage across residential, commercial, and government sectors. The warm climate and frequent storms in this region necessitate continuous vegetation management, driving sustained demand for both handheld and walk-behind brush cutter models.

The Midwest region follows, contributing around 28% of the market share. Known for its vast farmlands and forestry operations, this region heavily relies on brush cutters for land clearing, field maintenance, and agricultural applications. Tow-behind and heavy-duty walk-behind brush cutters are particularly favored in rural areas for their efficiency in managing overgrowth across large plots. Additionally, government-supported agricultural modernization and conservation programs further support equipment adoption.

The Western region represents nearly 22% of the market, with demand largely driven by wildfire prevention efforts and the need for right-of-way vegetation management around critical infrastructure. States like California, Arizona, and Oregon are investing in advanced land-clearing equipment to mitigate fire risks, especially in mountainous and forested zones. As environmental regulations tighten, the use of electric and hybrid brush cutters is growing in popularity across public and private sectors in this region.

The Northeast region accounts for the remaining 14% of the market. While smaller in share, this region shows consistent demand from residential users and municipal services focused on park maintenance and roadside vegetation control. Urban areas such as New York, Massachusetts, and Pennsylvania have increasing requirements for compact, low-emission brush cutters suitable for noise-sensitive environments. Seasonal demand peaks in spring and summer, driven by climate-related growth cycles and local landscaping trends.

Key Player Analysis:

- MTD Holdings Inc.

- Homelite Corporation

- The Grasshopper Company

- Oregon Tool, Inc.

- Stihl Inc.

Competitive Analysis:

The U.S. brush cutters market is moderately fragmented, with both global and regional players competing on product innovation, distribution reach, and pricing strategies. Key companies such as Husqvarna Group, STIHL Inc., Honda Power Equipment, and Echo Incorporated hold strong market positions through diversified product portfolios and robust dealer networks. These players continuously invest in R&D to introduce advanced features, including battery-powered systems, ergonomic designs, and smart functionalities, to cater to evolving customer preferences. Emerging companies and private-label brands are gaining traction by offering cost-effective models through online and retail channels. Competitive differentiation is increasingly driven by sustainability initiatives and after-sales service support. Additionally, collaborations with equipment rental companies and landscaping service providers are enabling leading manufacturers to expand their customer base. As market demand intensifies, the competitive landscape is expected to witness further innovation and strategic alliances aimed at capturing both commercial and residential segments.

Recent Developments:

- In early 2025, STIHL rolled out a comprehensive lineup of new battery-powered outdoor tools, focusing on innovations in trimmers, blowers, mowers, and heavy-duty equipment. The 2025 catalog highlights models such as the HSA 140 T/R hedge trimmers, the KGA 770 battery-powered sweeper, and the TSA 300 battery-powered concrete saw, emphasizing improved performance and environmental friendliness. STIHL’s strategy this year is clearly geared toward expanding its battery-powered offerings, with more than 50 new products introduced to the market.

- In March 2025, DeWALT, a brand under Stanley Black & Decker, expanded its outdoor power equipment lineup by launching new gas and battery-powered products. Notable releases include the 60V MAX* Brushless Cordless Backpack Blower, new walk-behind mowers, and a range of handheld tools such as pole saws, chainsaws, and hedge trimmers. These products are designed to enhance productivity and cater to both residential and professional landscaping needs.

Market Concentration & Characteristics:

The U.S. brush cutters market exhibits a moderately concentrated structure, with a mix of established global brands and regional players competing across various segments. Leading companies such as Husqvarna, STIHL, Honda Power Equipment, and Echo Incorporated maintain strong market positions through extensive product portfolios and well-established distribution networks. These firms focus on continuous innovation, introducing features like battery-powered systems, ergonomic designs, and smart functionalities to meet evolving consumer preferences. The market is characterized by a diverse product range, including handheld, walk-behind, and tow-behind brush cutters, catering to both residential and commercial applications. Technological advancements, particularly in battery technology and automation, are driving the adoption of eco-friendly and efficient brush cutters. Additionally, the rise of e-commerce platforms has facilitated greater market penetration, allowing smaller players to reach a broader customer base. Overall, the U.S. brush cutters market is dynamic, with innovation and strategic distribution playing pivotal roles in shaping its competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Power Source, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. brush cutters market is expected to witness steady growth driven by increasing demand for vegetation management in both urban and rural areas.

- Advancements in battery technology will continue to accelerate the adoption of cordless and eco-friendly brush cutter models.

- Integration of smart features like GPS, telematics, and remote diagnostics will enhance operational efficiency across commercial applications.

- Expansion of infrastructure and utility maintenance projects will generate consistent equipment demand.

- The residential segment will grow as DIY landscaping becomes more popular among homeowners.

- Rental service providers will play a greater role in market access, especially for seasonal or cost-conscious users.

- Manufacturers will prioritize ergonomic and lightweight designs to improve user safety and comfort.

- Regulatory pressures on emissions will encourage a shift away from gas-powered equipment.

- E-commerce channels will expand market reach for both established and emerging players.

- Strategic partnerships and product diversification will shape competitive dynamics and sustain long-term market growth.