| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Caffeinated Beverage Market Size 2024 |

USD 73,618.11 million |

| U.S. Caffeinated Beverage Market CAGR |

4.98% |

| U.S. Caffeinated Beverage Market Size 2032 |

USD 1,08,633.82 million |

Market Overview

U.S. Caffeinated Beverage market size was valued at USD 73,618.11 million in 2024 and is anticipated to reach USD 1,08,633.82 million by 2032, at a CAGR of 4.98% during the forecast period (2024-2032).

The U.S. caffeinated beverage market is primarily driven by growing consumer preference for energy-boosting and functional drinks, especially among millennials and working professionals seeking mental alertness and physical stamina. Increasing health consciousness has also encouraged the consumption of low-calorie and natural caffeine sources, prompting manufacturers to innovate with plant-based and organic formulations. The rise of on-the-go lifestyles and a surge in fitness culture have further accelerated demand for ready-to-drink caffeinated options such as energy drinks, cold brew coffee, and fortified teas. Market players are capitalizing on these trends by introducing new flavors, sustainable packaging, and targeted marketing strategies through digital platforms. Additionally, the expansion of e-commerce and convenience stores has enhanced product accessibility, contributing to steady market growth. The influence of social media and endorsements by celebrities and fitness influencers continues to shape consumer perceptions and preferences, reinforcing the market’s upward trajectory and encouraging continued innovation across product categories.

The U.S. caffeinated beverage market exhibits diverse consumer preferences across various regions, influenced by cultural and lifestyle factors. Key players such as Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and 5-hour ENERGY dominate the market, each offering a wide range of products tailored to regional demands. The Western U.S. leads in health-conscious and functional beverages, while the Southern U.S. has a strong demand for energy drinks. The Northeastern region shows a preference for premium and artisanal coffee products, while the Midwest focuses on convenience and affordability. These companies leverage their extensive distribution networks and marketing strategies to meet regional preferences, ensuring accessibility and brand loyalty. Their focus on innovation, product diversification, and sustainability aligns with the changing consumer trends, making them key players in shaping the market’s growth across the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. caffeinated beverage market was valued at USD 73,618.11 million in 2024 and is expected to reach USD 1,08,633.82 million by 2032, growing at a CAGR of 4.98% from 2024 to 2032.

- The global caffeinated beverage market was valued at USD 252,050.67 million in 2024 and is expected to reach USD 369,284.04 million by 2032, growing at a CAGR of 4.89%.

- Increasing health consciousness among consumers is driving the demand for natural, low-sugar, and functional caffeinated drinks.

- There is a rising trend toward premiumization, with consumers opting for specialty drinks like organic coffee and energy beverages with added health benefits.

- Intense competition, including established brands like Nestlé, Red Bull, and PepsiCo, challenges smaller players to innovate and differentiate through product features.

- Health concerns related to excessive caffeine and sugar intake are limiting market growth, especially among younger consumers.

- The Western U.S. leads in the demand for health-oriented and functional beverages, while the Southern U.S. sees high demand for energy drinks.

- Regional preferences and local competition significantly influence the growth trajectory of leading brands across the U.S. market.

Report Scope

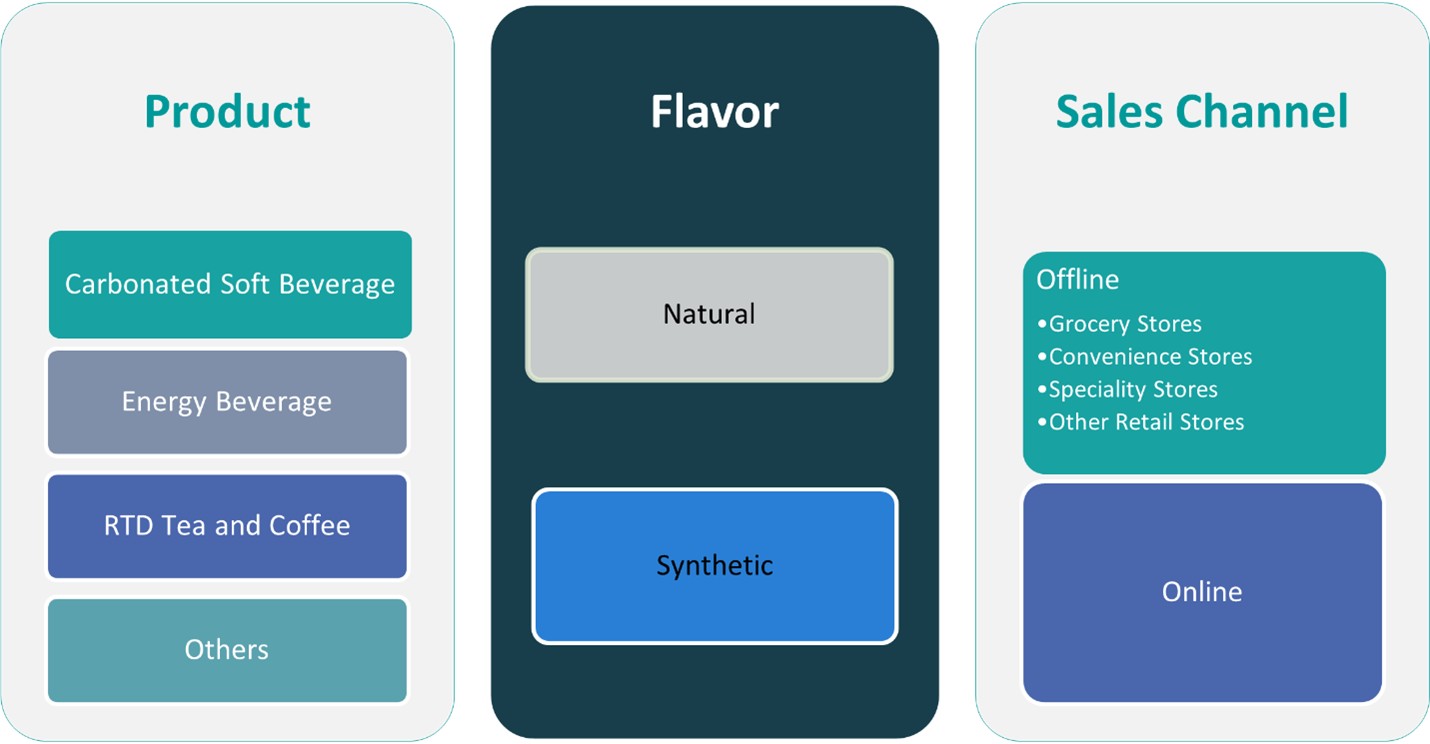

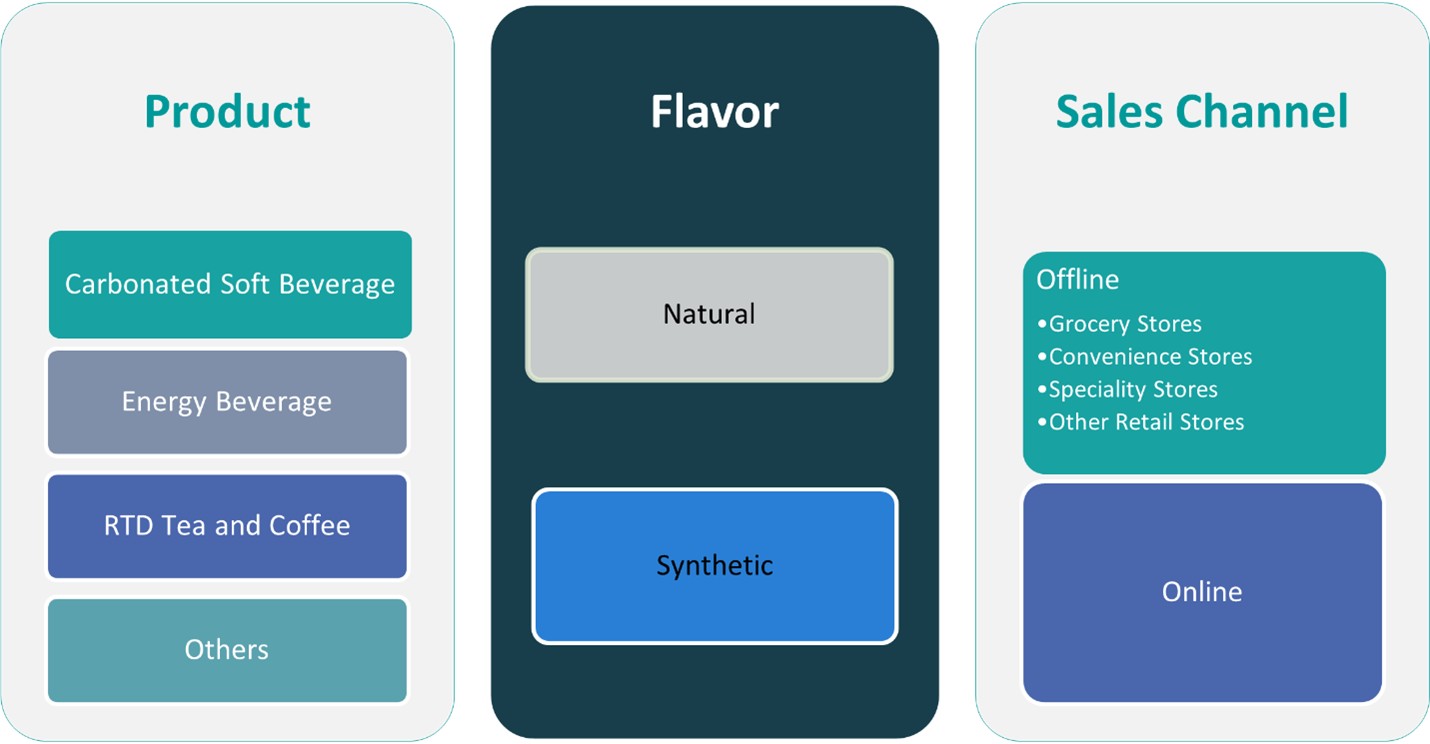

This report segments the U.S. Caffeinated Beverage Market as follows:

Market Drivers

Rising Demand for Energy and Mental Alertness

One of the primary drivers of the U.S. caffeinated beverage market is the increasing demand for products that enhance energy and mental performance. With fast-paced lifestyles, long working hours, and the rise of remote and hybrid work cultures, a growing number of consumers rely on caffeinated drinks to improve alertness and maintain productivity throughout the day. For instance, the expansion of the market for caffeinated beverages can be attributed to increasing energy drink consumption coupled with busy lifestyles adopted by most consumers. Caffeine’s well-established role in stimulating the central nervous system has made it a staple in the daily routines of students, professionals, and shift workers. As awareness grows about the benefits of moderate caffeine consumption—such as improved concentration and reduced fatigue—the market continues to witness rising interest in beverages that offer a quick and effective energy boost without the use of synthetic stimulants.

Health-Conscious Consumer Preferences

Changing consumer attitudes toward health and wellness have also significantly influenced the caffeinated beverage market in the U.S. There is a strong shift toward clean-label, low-sugar, and organic beverage options that contain natural sources of caffeine, such as green tea extract, yerba mate, and guarana. This trend is especially prevalent among millennials and Gen Z consumers who are more inclined to read product labels and avoid artificial additives. In response, manufacturers are reformulating their product offerings to include healthier variants, such as cold brew coffee with no added sugar, herbal energy drinks, and plant-based caffeine shots. The increasing availability of these health-oriented products has not only broadened the consumer base but also helped brands tap into new market segments that prioritize nutritional transparency and sustainability.

Omnichannel Expansion and Strategic Marketing

The rise of e-commerce and digital marketing has further contributed to the expansion of the caffeinated beverage market in the U.S. Brands are leveraging online platforms, mobile apps, and subscription models to improve product accessibility and build direct relationships with consumers. For instance, social media and the growing influence of online marketing have been beneficial for brands to connect with their target audience and create product awareness and loyalty among consumers. At the same time, increased placement in supermarkets, convenience stores, gyms, and vending machines is boosting offline visibility. Strategic marketing initiatives, including influencer partnerships, social media campaigns, and experiential events, are helping brands effectively target niche demographics and communicate product benefits. As consumers become more digitally connected, these omnichannel strategies are enabling manufacturers to broaden their reach and drive sustained market growth by delivering personalized and convenient purchasing experiences.

Innovation in Product Formats and Flavors

Product innovation is playing a crucial role in propelling market growth, with brands introducing novel formats and flavors to meet evolving consumer preferences. The U.S. market has seen a surge in the popularity of ready-to-drink (RTD) beverages, including canned cold brews, nitro coffee, sparkling caffeinated waters, and hybrid drinks that combine caffeine with vitamins, adaptogens, or probiotics. These innovative formats cater to convenience-driven consumers looking for quick and easy beverage options without compromising on taste or health benefits. Moreover, manufacturers are experimenting with bold and unique flavors—ranging from exotic fruits to dessert-inspired profiles—to enhance consumer engagement and differentiate their products in a highly competitive space. This ongoing diversification is fostering brand loyalty while driving repeat purchases across various retail channels.

Market Trends

Shift Toward Functional and Clean-Label Ingredients

A prominent trend in the U.S. caffeinated beverage market is the increasing consumer preference for functional beverages made with clean-label, natural ingredients. Shoppers are actively seeking products that offer not just energy but also additional health benefits, such as immune support, mental clarity, and digestive health. For instance, approximately 35% of consumers now prefer energy drinks that feature natural sources of caffeine, such as green tea or guarana, as opposed to synthetic caffeine. As a result, manufacturers are incorporating ingredients like adaptogens, nootropics, antioxidants, and electrolytes into their caffeinated beverages. This trend reflects a broader movement toward wellness-focused consumption, with many consumers turning away from traditional sugary energy drinks in favor of clean-energy alternatives that support a balanced and health-conscious lifestyle. Brands that transparently communicate ingredient sourcing, caffeine content, and health benefits are gaining a competitive edge in this evolving market.

Premiumization and Artisanal Offerings

Consumers’ growing willingness to pay for premium quality is encouraging the rise of artisanal and specialty caffeinated beverages. This includes craft coffee blends, nitro cold brews, organic matcha drinks, and small-batch energy beverages, often positioned as lifestyle products. Premiumization is particularly evident in the RTD (ready-to-drink) segment, where flavor innovation, specialty roasting, sustainable packaging, and ethical sourcing are used as key differentiators. As consumers become more discerning, they are increasingly associating premium caffeinated drinks with superior taste, craftsmanship, and transparency. This trend is also creating space for niche brands and local producers to thrive by emphasizing authenticity and uniqueness in their offerings.

Sustainability and Eco-Conscious Packaging

Sustainability is becoming a central focus across the U.S. beverage industry, and the caffeinated beverage segment is no exception. Eco-conscious consumers are now favoring brands that demonstrate strong environmental responsibility through recyclable, compostable, or reusable packaging. Companies are also investing in sustainable sourcing practices for ingredients like coffee beans and tea leaves, often highlighting certifications such as Fair Trade or Rainforest Alliance. For instance, Coca-Cola introduced label-free bottles in Japan, South Korea, and China to improve recyclability and minimize carbon emissions. As environmental awareness continues to influence purchase decisions, brands that prioritize green practices and reduce their carbon footprint are gaining stronger customer loyalty. The integration of sustainability into product and brand messaging is no longer optional but a critical part of long-term market relevance.

Digital-First Marketing and Direct-to-Consumer (DTC) Growth

Digital marketing and DTC channels are rapidly transforming the way caffeinated beverages are sold and promoted in the U.S. Startups and established brands alike are leveraging social media, influencer partnerships, and content-driven campaigns to target health-conscious and younger consumers. Subscription-based services and personalized product bundles are also gaining popularity, offering convenience and a curated experience. This digital-first approach not only enhances customer engagement but also provides valuable consumer insights for ongoing product development. As online shopping becomes more ingrained in consumer behavior, brands investing in robust e-commerce strategies and data-driven marketing are positioned to gain significant traction in the competitive caffeinated beverage landscape.

Market Challenges Analysis

Health Concerns and Regulatory Scrutiny

One of the primary challenges facing the U.S. caffeinated beverage market is the growing concern over the health implications of excessive caffeine and sugar consumption. Consumers are becoming increasingly aware of the potential side effects associated with high caffeine intake, including insomnia, anxiety, and cardiovascular issues. For instance, the U.S. Food and Drug Administration (FDA) has stated that 400 milligrams per day is generally considered safe for healthy adults, but many Americans underestimate the safe limit. This awareness is leading to more cautious consumption, especially among vulnerable groups such as adolescents and individuals with pre-existing health conditions. Moreover, regulatory agencies and health organizations are placing caffeinated beverages particularly energy drinks under greater scrutiny due to their marketing tactics and stimulant content. Stricter labeling requirements, potential restrictions on caffeine levels, and growing advocacy for transparency in product claims may pose hurdles for manufacturers. These regulatory pressures could impact product formulations and marketing strategies, especially for companies heavily reliant on high-caffeine products.

Market Saturation and Intense Competition

The U.S. caffeinated beverage market is characterized by intense competition and increasing saturation, which creates significant barriers to entry for new players and challenges existing brands to maintain market share. The presence of numerous established companies, private labels, and emerging startups has led to a crowded landscape with limited shelf space and price-based competition. As a result, brands are under constant pressure to innovate and differentiate through product features, branding, and customer engagement. However, continuous innovation demands high investment in R&D, marketing, and distribution—an approach that may not be sustainable for smaller players. Additionally, the rapid pace of changing consumer preferences means that even successful products can quickly lose relevance if they fail to align with evolving trends. Navigating this competitive intensity while sustaining profitability and brand loyalty remains a persistent challenge for market participants.

Market Opportunities

The U.S. caffeinated beverage market presents substantial growth opportunities driven by evolving consumer preferences and lifestyle changes. As demand for functional and health-oriented beverages rises, brands have the chance to expand their portfolios with innovative products that cater to wellness-conscious consumers. This includes beverages infused with natural caffeine sources, adaptogens, nootropics, and other ingredients that support energy, focus, and overall well-being. Plant-based formulations, sugar-free options, and beverages with added health benefits such as immunity support or hydration are increasingly appealing to younger demographics and fitness enthusiasts. Additionally, the growing interest in sustainable and ethically sourced products allows companies to differentiate themselves by emphasizing eco-friendly packaging, transparent labeling, and fair-trade sourcing. These attributes not only enhance brand reputation but also foster deeper consumer loyalty in a market that values authenticity and purpose-driven practices.

Furthermore, the rapid expansion of e-commerce and direct-to-consumer (DTC) channels offers new avenues for market penetration and customer engagement. Digital platforms enable brands to reach broader audiences, personalize marketing efforts, and gather valuable consumer insights for continuous innovation. Subscription models and customized beverage offerings can strengthen long-term relationships with customers while providing steady revenue streams. There is also untapped potential in targeting niche markets such as cognitive health, gaming, and plant-based nutrition with tailored caffeinated beverage solutions. Regional expansion within the U.S., particularly in underserved or health-focused communities, presents additional room for growth. As consumer behavior continues to shift toward convenience and customization, brands that effectively combine innovation, health benefits, and digital engagement are well-positioned to capture emerging opportunities and reinforce their competitive edge in the dynamic U.S. caffeinated beverage landscape.

Market Segmentation Analysis:

By Product:

The U.S. caffeinated beverage market is segmented by product into carbonated soft beverages, energy beverages, RTD tea and coffee, and others, with each category catering to distinct consumer needs. Energy beverages represent a rapidly expanding segment, driven by the increasing demand for quick energy boosts among young adults, athletes, and working professionals. Brands are continuously innovating with natural caffeine sources, lower sugar content, and added functional benefits to attract health-conscious consumers. RTD tea and coffee are also gaining significant traction as convenient, healthier alternatives to traditional carbonated drinks. This segment is particularly popular among urban consumers who seek on-the-go options with minimal preparation. Carbonated soft beverages, although facing health-related scrutiny, still retain a substantial consumer base due to brand loyalty and widespread availability. Meanwhile, niche categories under “others,” including caffeinated waters and herbal energy shots, are slowly gaining market share as brands explore new formulations to meet demand for unique, functional, and plant-based alternatives. Together, these product segments reflect the market’s dynamic and evolving nature.

By Flavor:

Based on flavor, the U.S. caffeinated beverage market is divided into natural and synthetic categories. The natural flavor segment is witnessing significant growth as consumers increasingly prefer beverages made with organic ingredients and clean-label formulations. Rising awareness about the adverse effects of artificial additives and synthetic sweeteners has prompted manufacturers to shift toward naturally flavored products using ingredients like fruit extracts, herbs, and botanical infusions. This trend is further supported by the wellness movement, where transparency and authenticity in ingredient sourcing influence purchasing decisions. On the other hand, synthetic flavors continue to hold a portion of the market, especially in traditional carbonated drinks and mass-market energy beverages where bold, long-lasting flavor profiles are prioritized. However, their market share is gradually declining due to shifting consumer expectations around health and sustainability. Moving forward, brands that invest in developing appealing, naturally flavored caffeinated beverages are likely to gain a competitive edge, especially among younger, label-conscious consumers seeking both taste and wellness benefits.

Segments:

Based on Product:

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

Based on Flavor:

Based on Sales Channel:

- Offline

- Grocery Stores

- Convenience Stores

- Speciality Stores

- Other Retail Stores

- Online

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States holds the largest share of the U.S. caffeinated beverage market, accounting for approximately 33% of the total market in 2024. This region, particularly states like California, Oregon, and Washington, has been a leader in health-conscious and sustainable consumption trends. The demand for organic, plant-based, and functional beverages is strong, especially among younger demographics and urban professionals. High levels of innovation, widespread availability of premium and artisanal brands, and a well-established café culture have all contributed to the region’s dominance. Additionally, the West Coast is home to several key beverage manufacturers and startup incubators, further fostering product development and consumer engagement. The presence of eco-conscious consumers has also propelled the growth of natural and clean-label caffeinated drinks, making this region a prime market for emerging trends in wellness and sustainability.

Midwestern United States

The Midwestern United States contributes around 23% to the national caffeinated beverage market. While slightly more conservative in consumer behavior compared to coastal regions, the Midwest is showing a steady rise in demand for convenient and functional beverage options. Ready-to-drink (RTD) coffee and energy drinks are popular choices among working professionals and college students in urban hubs like Chicago, Minneapolis, and Detroit. The region’s strong distribution networks and retail presence enable wide accessibility of both mainstream and niche beverage brands. While traditional carbonated soft drinks continue to maintain a loyal consumer base, increasing health awareness is slowly shifting preferences toward better-for-you alternatives. Manufacturers are capitalizing on this shift by introducing low-sugar, naturally flavored caffeinated beverages tailored to Midwestern tastes and budgets.

Southern United States

The Southern United States holds approximately 25% of the U.S. caffeinated beverage market, fueled by a blend of traditional beverage consumption and rising interest in energy drinks. States like Texas, Florida, and Georgia have large populations and diverse consumer bases, which support strong demand across all product categories. Energy beverages, in particular, are highly popular among younger consumers and blue-collar workers seeking quick and affordable energy sources. While the region still favors sweet, synthetic flavors in many beverages, there is a growing openness to natural and functional drinks. Regional events, sports culture, and rising urbanization contribute to an environment that supports fast-paced beverage consumption habits, making the South a crucial market for expansion and innovation.

Northeastern United States

The Northeastern United States represents about 19% of the total U.S. caffeinated beverage market, with a strong inclination toward premium and RTD coffee products. Urban centers like New York City and Boston are hotspots for cold brews, nitro coffees, and specialty energy beverages that blend functionality with flavor. The Northeast also has a highly educated and health-conscious consumer base that favors beverages with natural ingredients and transparent labeling. This region is seeing robust growth in subscription-based coffee services and DTC energy drinks, reflecting the digital-savvy lifestyle of its population. Though smaller in market share, the region’s consumers tend to have higher spending power, making it an attractive target for premium and niche caffeinated beverage brands aiming to build brand equity and customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Red Bull

- PepsiCo

- The Coca-Cola Company

- 5-hour ENERGY

Competitive Analysis

The U.S. caffeinated beverage market is highly competitive, with major players like Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and 5-hour ENERGY leading the charge. These companies dominate with their extensive product portfolios and strong brand recognition, each capitalizing on consumer demand for convenience, flavor, and functional benefits. Innovation plays a crucial role in maintaining market share, with many brands introducing low-sugar, organic, and plant-based options to cater to the growing demand for healthier alternatives. Additionally, marketing strategies, including sponsorships, celebrity endorsements, and targeted campaigns, are central to attracting a diverse consumer base. Companies are also leveraging their extensive distribution networks to ensure widespread availability of their products across retail and online platforms. Furthermore, consumer preference for premium, artisanal, and specialty beverages is prompting brands to enhance their offerings with unique flavors and functional ingredients. To stay competitive, brands are increasingly focusing on sustainability practices, such as using eco-friendly packaging and promoting transparency in sourcing. As the market continues to evolve, the ability to quickly adapt to shifting trends and consumer preferences is essential for maintaining a strong competitive position.

Recent Developments

- In March 2025, PepsiCo expanded its Pepsi MAX Caffeine Free line with a new 500ml bottle in the UK, responding to rising demand for caffeine-free and sugar-free colas among younger consumers.

- In February 2025, Coca-Cola introduced Simply Pop, a prebiotic, fruit juice-enriched soda targeting the “better-for-you” market segment, competing with brands like Poppi and Olipop.

- In January 2025, Nestlé implemented a new global organizational structure for its Waters & Premium Beverages division, operating as a standalone business.

- In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

- In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD’ Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Market Concentration & Characteristics

The U.S. caffeinated beverage market exhibits moderate to high concentration, with a few dominant players holding a significant share of the market. These companies leverage their established brand recognition, extensive distribution networks, and marketing capabilities to maintain their competitive position. Despite the dominance of these large players, the market also features a growing number of smaller brands that cater to niche consumer segments, such as health-conscious and environmentally aware individuals. This dynamic has led to increased product diversification, with many brands focusing on organic, low-sugar, and functional beverages to meet changing consumer preferences. Additionally, innovation plays a key role in maintaining market relevance, as companies introduce new flavors, ingredients, and packaging to differentiate themselves. The rise of direct-to-consumer channels and e-commerce platforms further contributes to the market’s fragmentation, allowing smaller brands to gain traction. Overall, the U.S. caffeinated beverage market remains competitive, driven by both large corporations and emerging players.

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. caffeinated beverage market is projected to continue its growth trajectory, driven by evolving consumer preferences and lifestyle changes.

- Health-conscious consumers are increasingly seeking beverages that offer functional benefits, such as enhanced focus, improved metabolism, and stress reduction.

- There is a growing demand for natural and organic ingredients, with consumers favoring beverages that are free from artificial additives and preservatives.

- Personalized beverage options are gaining popularity, allowing consumers to tailor their drinks to individual taste preferences and dietary needs.

- The rise of ready-to-drink (RTD) coffee and cold brew options reflects consumer desire for convenience without compromising on quality.

- Sustainability is becoming a key consideration, with brands focusing on eco-friendly packaging and responsible sourcing of ingredients.

- Technological advancements are enabling brands to innovate in product development, enhancing flavor profiles and incorporating functional ingredients.

- The influence of social media and digital platforms is shaping consumer trends, with influencers and online communities driving interest in new beverage offerings.

- Emerging markets present new opportunities for growth, as rising disposable incomes and urbanization increase demand for caffeinated beverages.

- Brands that prioritize transparency, quality, and consumer engagement are well-positioned to succeed in the competitive landscape of the U.S. caffeinated beverage market.