| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Clinical Trial Management System (CTMS) Market Size 2024 |

USD 94.93 Million |

| U.S. Clinical Trial Management System (CTMS) Market, CAGR |

11.31% |

| U.S. Clinical Trial Management System (CTMS) Market Size 2032 |

USD 940.47 Million |

Market Overview

The U.S. Clinical Trial Management System (CTMS) Market is projected to grow from USD 358.64 million in 2024 to an estimated USD 940.47 million by 2032, with a compound annual growth rate (CAGR) of 11.31% from 2025 to 2032. This growth is driven by the increasing complexity of clinical trials, the need for efficient data management, and the rising adoption of digital solutions in healthcare.

Key drivers of this market include the increasing number of clinical trials, advancements in CTMS technologies, and the growing demand for decentralized trials. These factors are complemented by supportive government initiatives and a shift towards patient-centric approaches in clinical research. The integration of artificial intelligence and machine learning into CTMS platforms further enhances data analytics capabilities, improving decision-making and trial outcomes.

Geographically, North America leads the CTMS market, with the U.S. accounting for a significant share due to its robust healthcare infrastructure and high volume of clinical research activities. Key players in the U.S. market include Oracle Corporation, Medidata Solutions, Parexel International, Bio-Optronics, and IBM, among others. These companies are at the forefront of developing innovative CTMS solutions, contributing to the market’s growth and evolution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. CTMS market is projected to grow from USD 358.64 million in 2024 to USD 940.47 million by 2032, with a CAGR of 11.31% from 2025 to 2032. The market’s expansion reflects the increasing complexity of clinical trials and a rising demand for digital solutions.

- The global CTMS market is projected to grow from USD 1,230.00 million in 2024 to USD 3,197.78 million by 2032, with a CAGR of 11.20%. The demand for efficient and streamlined management of clinical trials drives this growth.

- Key drivers include the growing number of clinical trials, the integration of advanced technologies like AI and machine learning, and the shift towards decentralized clinical trials (DCTs), which enhance efficiency and patient participation.

- Advancements in CTMS technologies, such as cloud-based solutions and real-time data monitoring, contribute significantly to the market’s growth by improving trial management and reducing operational costs.

- The primary challenges include data integration and interoperability issues among various trial management platforms, which hinder seamless operations and data flow between stakeholders.

- Stricter regulatory requirements and the need for robust data security and privacy protocols present a challenge for CTMS providers in ensuring full compliance with industry standards such as HIPAA and FDA regulations.

- The Northeast region leads the market with its strong concentration of pharmaceutical companies, research institutions, and CROs, contributing to the highest adoption rates of CTMS platforms in clinical trials.

- The West and Midwest regions also show significant growth potential, driven by biotechnology hubs, major academic institutions, and ongoing investments in clinical trial infrastructure, which further accelerate CTMS adoption.

Market Drivers

Increasing Complexity and Volume of Clinical Trials

The U.S. clinical trial landscape has evolved significantly in recent years, with a substantial rise in the complexity and number of clinical trials being conducted. This surge is primarily driven by the rapid advancements in medical research, the increasing number of drug candidates entering clinical trials, and the growing number of regulatory requirements. For instance, 85% of clinical trials in the U.S. now involve multiple sites, reflecting the increasing complexity of trial designs. As clinical trials become more complex, managing them manually or using traditional methods is no longer feasible. Clinical Trial Management Systems (CTMS) help streamline trial management by automating various tasks such as data collection, participant management, and document tracking. These systems ensure greater efficiency, accuracy, and compliance in managing large-scale trials. With clinical trials becoming more intricate, CTMS platforms are increasingly crucial to managing multiple phases, a larger volume of data, and the growing demand for transparency and real-time access to information across all trial stakeholders.

Growing Adoption of Digital Solutions in Healthcare

The healthcare industry in the U.S. has witnessed a major digital transformation in recent years, driven by the need for improved operational efficiency, patient care, and compliance with healthcare regulations. This shift towards digital technologies has permeated clinical trial processes as well, where traditional, paper-based systems are being replaced with electronic solutions like CTMS. For instance, Pfizer utilized digital CTMS platforms during its COVID-19 vaccine trials to manage over 150 clinical trials simultaneously, ensuring efficient data management and compliance. The adoption of digital solutions is gaining momentum as they offer enhanced functionality, including real-time monitoring, data analytics, and seamless integration with other healthcare systems. By leveraging digital tools, clinical trial teams can better manage operational complexities, streamline workflows, reduce human error, and make data-driven decisions. Furthermore, digital CTMS solutions facilitate the remote monitoring of trials, which has become increasingly important with the rise of decentralized clinical trials (DCTs). This growing trend towards digitization in clinical trials is a key factor driving the demand for CTMS platforms in the U.S.

Rising Demand for Decentralized Clinical Trials (DCTs)

The rise of decentralized clinical trials (DCTs) is another significant driver of the U.S. CTMS market. DCTs are gaining popularity as they allow for greater flexibility, patient convenience, and faster recruitment. Traditional clinical trials often require participants to travel to specific locations for visits, tests, and monitoring, which can be burdensome, particularly for patients located in remote areas. DCTs, on the other hand, allow participants to take part in trials from the comfort of their homes through remote monitoring and telemedicine tools. With the increasing demand for DCTs, CTMS platforms have adapted to support these innovative trial designs by offering functionalities such as remote patient monitoring, eConsent, virtual visits, and electronic data capture. CTMS systems are critical for the smooth management of decentralized trials, ensuring data accuracy, compliance, and timely reporting while minimizing the need for physical infrastructure. This evolution of clinical trials towards more patient-centric models has contributed to the growing adoption of CTMS solutions in the U.S. market.

Regulatory Compliance and Data Security Requirements

As clinical trials are subject to stringent regulations imposed by organizations like the U.S. Food and Drug Administration (FDA) and the International Conference on Harmonisation (ICH), ensuring compliance is a major driver of the CTMS market. With the increasing complexity of regulatory requirements, managing compliance manually or with outdated systems can lead to errors, delays, and costly penalties. CTMS solutions are designed to help organizations stay compliant with regulations by automating the process of documenting and tracking compliance-related activities. These systems provide secure, auditable records of trial data, ensuring that trials meet the regulatory standards set by governing bodies. Additionally, CTMS platforms offer robust data security features to protect sensitive patient information, which is crucial for complying with laws such as the Health Insurance Portability and Accountability Act (HIPAA). The need for regulatory compliance and robust data security solutions is accelerating the adoption of CTMS in the U.S., making it an essential tool for clinical trial sponsors, contract research organizations (CROs), and research institutions.

Market Trends

Shift Toward Cloud-Based CTMS Solutions

The U.S. clinical trial industry is increasingly adopting cloud-based Clinical Trial Management Systems (CTMS), reflecting the broader shift towards cloud technology across the healthcare sector. For instance, Parexel International Corporation has conducted over 250 fully virtual or hybrid decentralized clinical trials (DCTs), leveraging cloud-based CTMS platforms to facilitate seamless data sharing and collaboration among stakeholders, including pharmaceutical companies, CROs, and clinical trial sites. These platforms provide robust backup and disaster recovery options, ensuring data security and compliance with stringent regulations. Additionally, cloud-based systems enhance accessibility, enabling teams to monitor trial progress and make real-time decisions from any location, which is particularly beneficial for managing multi-site trials globally.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into CTMS platforms is reshaping the U.S. clinical trial landscape. For instance, AI-powered predictive analytics tools are being used to analyze historical clinical trial data, identify potential issues, and optimize patient recruitment rates, significantly improving trial enrollment timelines. Machine learning models are employed to monitor trial data in real-time, enabling early identification of risk factors such as patient dropout rates or adverse events. These technologies also automate routine administrative tasks, reducing human error and operational costs. Studies have shown that AI-driven solutions can improve trial efficiency by up to 30%, streamlining operations and accelerating the development of new therapies while maintaining compliance and minimizing risks.

Decentralized and Remote Trials

Decentralized clinical trials (DCTs) are gaining significant traction in the U.S. market as they provide greater flexibility and convenience for participants, particularly in the wake of the COVID-19 pandemic. DCTs leverage technologies such as telemedicine, wearable devices, and remote monitoring tools, which allow for patient participation without the need to visit clinical sites. This shift is particularly beneficial for patients in rural or underserved areas who might otherwise struggle to access trial sites. CTMS platforms are evolving to support these decentralized models by enabling remote patient monitoring, virtual visits, electronic informed consent (eConsent), and real-time data capture. As DCTs become a mainstream option, the demand for CTMS platforms that can seamlessly integrate with telemedicine and remote monitoring systems is rapidly increasing. This trend is not only improving patient recruitment and retention but also driving the need for more flexible, innovative CTMS solutions.

Increased Focus on Data Security and Compliance

As clinical trials generate vast amounts of sensitive data, maintaining data security and regulatory compliance is more critical than ever. With stricter regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the 21st Century Cures Act, clinical trial sponsors and contract research organizations (CROs) are under increasing pressure to safeguard patient information and ensure compliance with data privacy laws. CTMS platforms are enhancing their security features by offering robust encryption, secure data storage, and audit trails to meet these evolving requirements. Additionally, as clinical trials become more global, ensuring compliance with various regional and international regulatory standards adds another layer of complexity. As a result, CTMS solutions are being designed to provide multi-layered security measures, automated compliance tracking, and real-time reporting capabilities, which are essential for maintaining trial integrity, safeguarding patient data, and minimizing the risk of costly regulatory violations.

Market Challenges

Data Integration and Interoperability Issues

The U.S. Clinical Trial Management System (CTMS) market faces notable challenges in achieving seamless data integration and interoperability across various systems used during clinical trials. For instance, clinical trials involve multiple stakeholders, such as sponsors, contract research organizations (CROs), research institutions, and regulatory bodies, each utilizing different technologies and platforms. This diversity often results in inefficiencies, data silos, and increased operational costs. CTMS platforms must integrate effectively with tools like Electronic Data Capture (EDC) systems, laboratory management systems, and other healthcare technologies to ensure smooth data flow. However, differences in formats, protocols, and standards create barriers to full interoperability. For instance, manual data entry is often required to bridge gaps between systems, leading to increased risk of errors, delays in data processing, and challenges in maintaining data accuracy. To address these issues, CTMS vendors are focusing on developing robust integration capabilities and aligning with industry standards. For instance, some companies are adopting middleware solutions to facilitate data exchange between disparate systems, while others are leveraging advanced APIs to enhance compatibility. These efforts aim to streamline clinical trial management, reduce operational inefficiencies, and support the broader adoption of CTMS platforms in the market.

Regulatory Compliance and Changing Standards

Another major challenge faced by the U.S. CTMS market is the constantly evolving regulatory landscape and the need for systems to stay compliant with the latest industry standards. Clinical trials are subject to strict regulations set by the U.S. Food and Drug Administration (FDA), the International Council for Harmonisation (ICH), and other regulatory authorities. These regulations are continually updated to address new healthcare technologies, patient privacy concerns, and evolving clinical trial practices. Keeping up with these changes requires frequent updates and modifications to CTMS platforms. Failure to meet the latest compliance standards can lead to legal repercussions, data breaches, and trial delays. Additionally, the complexity of complying with regulations like HIPAA for data privacy and security, along with global regulations for international trials, adds an extra layer of challenge. Clinical trial management systems must be adaptable and capable of aligning with a wide range of regulatory requirements across multiple regions. As a result, CTMS vendors need to invest in continuous compliance monitoring and system updates to stay ahead of regulatory changes and ensure that clinical trials are conducted in full accordance with legal and ethical guidelines.

Market Opportunities

Expansion of Decentralized Clinical Trials (DCTs)

The increasing adoption of decentralized clinical trials (DCTs) presents a significant opportunity for growth in the U.S. CTMS market. As clinical research shifts towards more patient-centric models, DCTs are gaining popularity due to their ability to offer greater convenience and flexibility for participants. The COVID-19 pandemic accelerated the adoption of remote monitoring, virtual consultations, and digital data collection methods. These innovations have reshaped the clinical trial landscape, enabling broader patient participation and reducing operational costs. CTMS platforms that support decentralized trials, with features like real-time patient monitoring, eConsent, and remote data capture, are becoming essential tools for managing these trials effectively. This trend opens up new avenues for CTMS providers to develop and offer solutions that cater specifically to the needs of DCTs, thereby creating substantial market growth opportunities.

Integration with Artificial Intelligence (AI) and Machine Learning (ML)

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into CTMS platforms offers another significant market opportunity. AI and ML can be leveraged to optimize clinical trial processes, improve patient recruitment, predict trial outcomes, and enhance data analysis. As pharmaceutical companies and research institutions increasingly seek ways to reduce the time and cost associated with clinical trials, the demand for intelligent, data-driven CTMS solutions is expected to rise. By incorporating advanced analytics and predictive modeling, AI and ML can help clinical trial teams make faster, more accurate decisions, ultimately improving trial success rates. As these technologies become more sophisticated and accessible, CTMS platforms that incorporate AI and ML will be in high demand, presenting a valuable growth opportunity for vendors in the U.S. market.

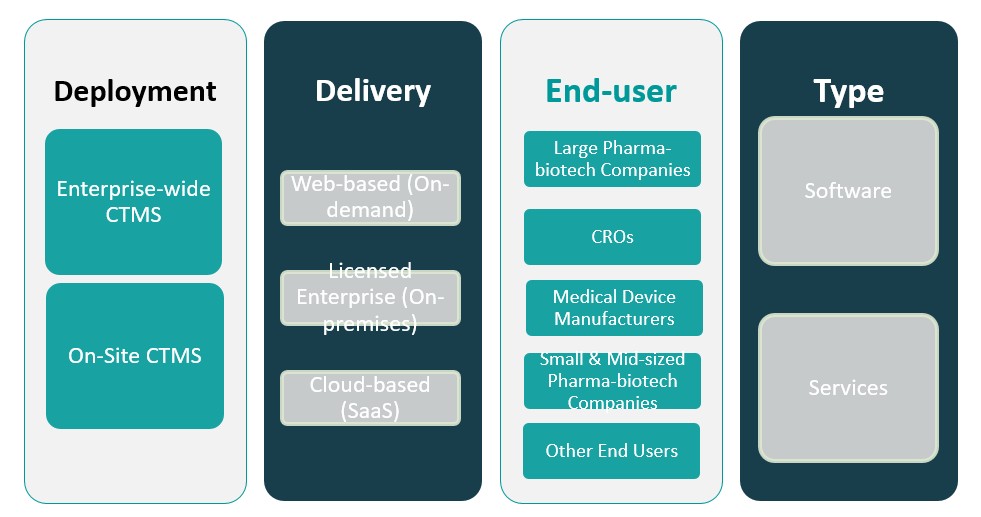

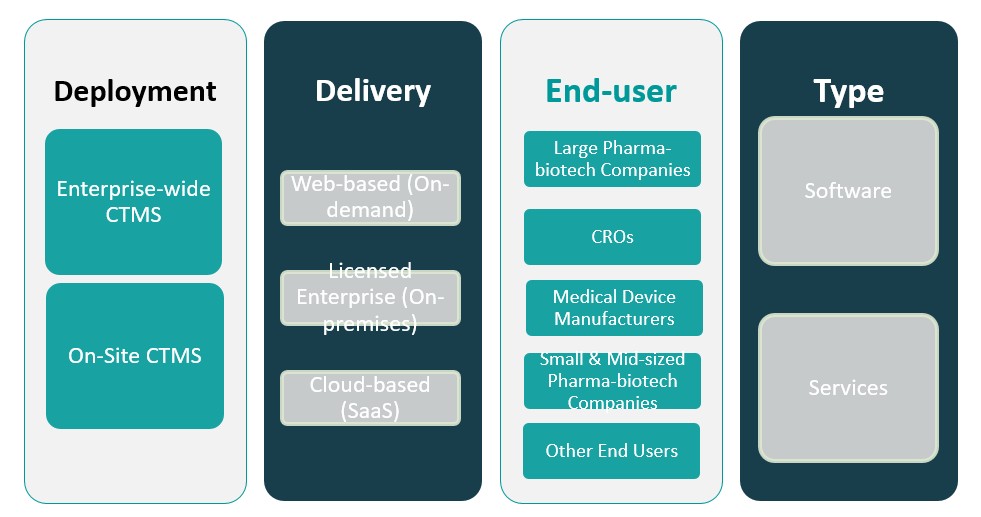

Market Segmentation Analysis

By deployment

The market includes enterprise-wide CTMS and on-site CTMS. Enterprise-wide CTMS dominates the segment, offering centralized oversight and streamlined coordination across multiple clinical trial sites. These solutions are particularly favored by large organizations managing complex, multi-phase trials. On-site CTMS, while less dominant, remains relevant for smaller organizations or research centers that operate within a localized environment and require tailored functionality with in-house control.

By delivery mode

The market is segmented into web-based (on-demand), licensed enterprise (on-premises), and cloud-based (Software-as-a-Service or SaaS) CTMS. Web-based CTMS leads the segment due to its flexibility, real-time access, and ease of deployment without significant infrastructure investments. Cloud-based CTMS is gaining rapid traction, driven by the growing need for remote trial management, scalability, and cost efficiency. Licensed enterprise solutions, while still in use, are experiencing slower growth due to higher upfront costs and maintenance demands.

Segments

Based on Deployment

- Enterprise-wide CTMS

- On-Site CTMS

Based on Delivery

- Web-based (On-demand)

- Licensed Enterprise (On-premises)

- Cloud-based (SaaS)

Based on End User

- Large Pharma-biotech Companies

- CROs

- Medical Device Manufacturers

- Small & Mid-sized Pharma-biotech Companies

- Other End Users

Based on Type

Based on Region

- Northeast Region

- West Region

- Midwest Region

- South Region

- Southeast Region

Regional Analysis

Northeast Region (30%)

The Northeast holds the largest share of the U.S. CTMS market, primarily due to the presence of major pharmaceutical companies, biotech firms, and renowned medical research institutions. States such as Massachusetts, New York, and Pennsylvania are hubs for clinical trials, benefiting from a high volume of research activities. The strong ecosystem of academic institutions, healthcare providers, and government funding fosters the widespread use of CTMS platforms in this region. Furthermore, the demand for advanced digital solutions to streamline clinical trial management, combined with strong regulatory standards, accelerates the adoption of CTMS technologies.

West Region (25%)

The West region, including states like California, Washington, and Oregon, is another key player in the U.S. CTMS market. Known for its strong biotechnology sector, the West is home to numerous startups, research institutions, and established pharmaceutical companies. The growing number of clinical trials, especially in cities like San Francisco and San Diego, drives demand for CTMS platforms. Moreover, the increasing preference for cloud-based and decentralized clinical trial models, which are prominent in this region, is expected to further boost the market. California, in particular, leads in technology adoption, which makes it an ideal environment for cloud-based CTMS solutions.

Key players

- Forte Research Systems

- ICON plc

- Merge Healthcare Incorporated

- Bio-Optronics

- DSG INC

- ArisGlobal

- ERT Clinical Bioclinica

- Oracle Corporation

- Medidata Solutions

- DATATRAK International, Inc

Competitive Analysis

The U.S. Clinical Trial Management System (CTMS) market is highly competitive, with several prominent players providing innovative solutions. Forte Research Systems is a leading provider, known for its user-friendly and highly specialized CTMS offerings tailored to academic research organizations. ICON plc stands out with its comprehensive services and global presence, facilitating a wide array of clinical trials across diverse sectors. Medidata Solutions, a subsidiary of Dassault Systèmes, is a major competitor with its robust, cloud-based CTMS platform that integrates artificial intelligence to enhance trial efficiencies. Bio-Optronics excels in providing customizable CTMS solutions for small to mid-sized organizations, ensuring a high degree of flexibility. On the other hand, Oracle Corporation and Merge Healthcare Incorporated provide powerful, enterprise-wide CTMS platforms, driven by their extensive experience in the healthcare IT space. The market is increasingly shifting towards AI-powered, cloud-based solutions to optimize data management, trial monitoring, and patient recruitment, pushing these players to innovate continuously.

Recent Developments

- In May 2024, ICON released its ICON Cares 2023 Report, highlighting initiatives to increase patient access to clinical trials and drive innovation through technology and partnerships.

- In July 2024, Merative released new versions of Merge Imaging Suite components, enhancing usability, deployment, and maintenance.

- In February 2025, Oracle was recognized as a ‘Leader’ in the Everest Group Life Sciences CTMS Products PEAK Matrix Assessment 2024.

- In February 2025, Medidata secured the SCOPE Best of Show Award for Clinical Data Studio.

- In 2024, ArisGlobal reported significant customer growth, including 11 new top-tier pharma LifeSphere customers and a 40% year-over-year increase in new customers in the Asia Pacific region.

Market Concentration and Characteristics

The U.S. Clinical Trial Management System (CTMS) market exhibits moderate concentration, with a few large players dominating the landscape, such as Oracle Corporation, Medidata Solutions, and ICON plc, alongside several smaller but specialized firms like Forte Research Systems and Bio-Optronics. These companies offer a wide range of solutions, from cloud-based platforms to AI-integrated tools, catering to various end-users, including large pharmaceutical companies, contract research organizations (CROs), and medical device manufacturers. The market is characterized by rapid technological advancements, with a strong emphasis on digital transformation, such as the rise of decentralized clinical trials (DCTs), artificial intelligence, and machine learning integrations. Competition is driven by the need for scalable, user-friendly, and compliance-driven platforms that streamline trial management, improve operational efficiency, and reduce costs. Despite the presence of dominant players, the market also sees innovation from niche players offering customized solutions, creating a dynamic competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment, Delivery, End User, Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The shift towards cloud-based CTMS solutions will continue to grow, driven by their scalability, flexibility, and cost-effectiveness. Cloud platforms will enable seamless collaboration among stakeholders, improving operational efficiency.

- AI and ML technologies will increasingly be integrated into CTMS platforms, enabling better data analysis, predictive insights, and optimized decision-making. These technologies will drive more efficient trial management and improve patient recruitment.

- The demand for decentralized trials will rise, fueled by patient-centric models and technological advancements. CTMS platforms will evolve to support remote patient monitoring, eConsent, and virtual visits, streamlining the trial process.

- With the growing complexity of clinical trials, CTMS platforms will continue to prioritize compliance with evolving regulatory standards like HIPAA and the FDA. Enhanced data security will be a key focus, ensuring protection of sensitive patient data.

- Mobile applications integrated with CTMS platforms will become increasingly common, providing real-time access to trial data and facilitating remote monitoring of clinical trial progress, improving efficiency and data accuracy.

- Improved patient recruitment capabilities will be a priority for CTMS providers. Advanced tools for patient matching and engagement, leveraging data analytics, will accelerate participant enrollment and improve retention rates.

- CTMS platforms will continue to focus on reducing operational costs through automation and improved data management. By streamlining administrative tasks, these platforms will help organizations lower trial expenses and enhance ROI.

- CTMS platforms will become more integrated with other healthcare IT systems, such as Electronic Health Records (EHR) and Electronic Data Capture (EDC) systems. This will ensure seamless data flow and improve overall trial coordination.

- Smaller pharmaceutical and biotech companies will increasingly adopt CTMS platforms tailored to their specific needs. The rise of flexible, scalable solutions will allow these organizations to manage trials efficiently, even with limited resources.

- As the U.S. market matures, CTMS providers will look to expand internationally. With the rise of global clinical trials, the demand for scalable, adaptable CTMS solutions will increase, opening new opportunities for market growth.