Market Overview:

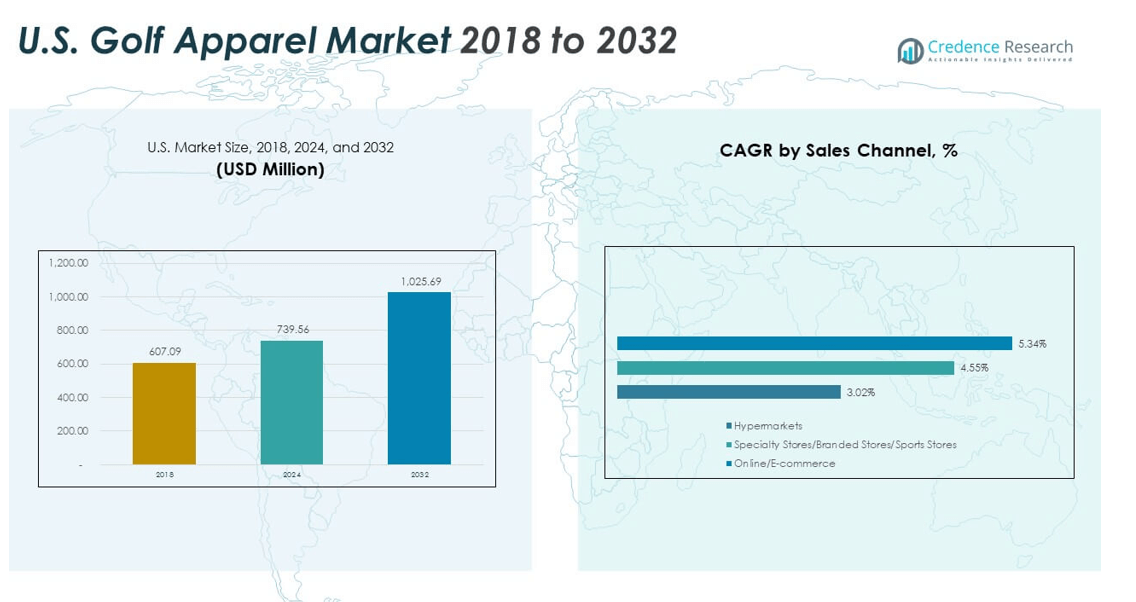

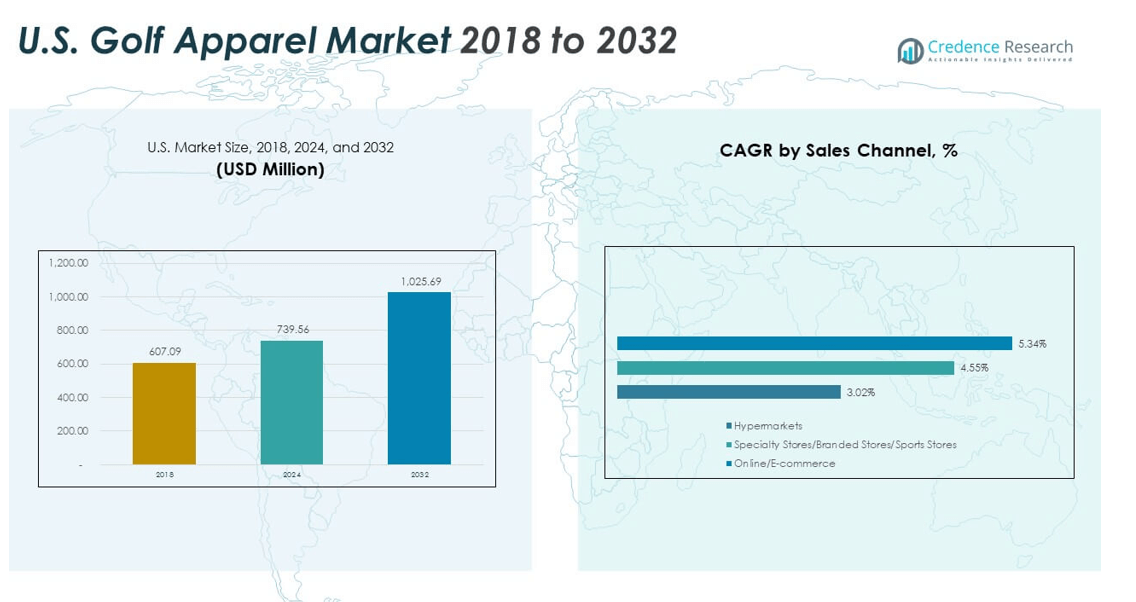

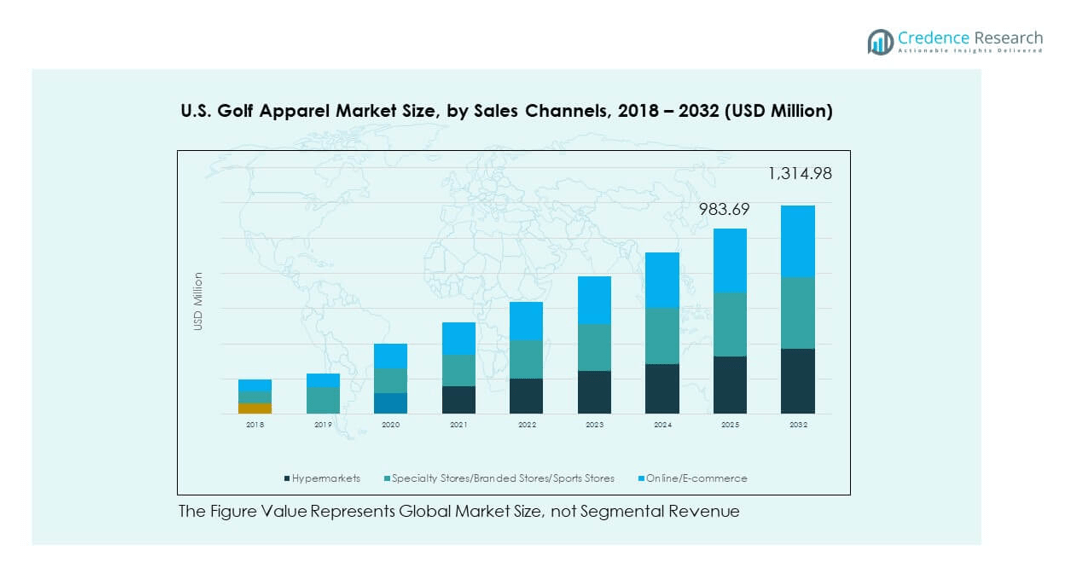

The U.S. Golf Apparel Market size was valued at USD 607.09 million in 2018 to USD 739.56 million in 2024 and is anticipated to reach USD 1,025.69 million by 2032, at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Golf Apparel Market Size 2024 |

USD 739.56 million |

| U.S. Golf Apparel Market, CAGR |

4.61% |

| U.S. Golf Apparel Market Size 2032 |

USD 1,025.69 million |

The market is driven by a growing interest in golf as both a recreational activity and a professional sport, supported by rising participation rates across various age groups. Advancements in fabric technology, such as moisture-wicking and UV-protective materials, are enhancing product appeal. Fashion trends are increasingly influencing golf apparel designs, attracting a younger demographic and encouraging brand collaborations. The expansion of e-commerce platforms is also improving product accessibility and driving consumer engagement.

Regionally, the South leads the U.S. Golf Apparel Market, supported by a favorable climate, extensive golf course networks, and strong tourism-driven demand. The West follows, driven by luxury golf resorts, high-profile tournaments, and a style-conscious consumer base. The Midwest maintains steady growth through a large golfing community and seasonal championship events, while the Northeast benefits from high spending on premium brands despite a shorter playing season. Each region demonstrates distinct consumer preferences shaped by climate, culture, and retail access, creating diverse opportunities for apparel brands across the country

Market Insights:

- The U.S. Golf Apparel Market was valued at USD 739.56 million in 2024 and is projected to reach USD 1,025.69 million by 2032, growing at a CAGR of 4.16%.

- The Golf Apparel Market size was valued at USD 3,367.9 million in 2018 to USD 4,189.0 million in 2024 and is anticipated to reach USD 5,977.2 million by 2032, at a CAGR of 4.61% during the forecast period.

- Rising golf participation among diverse age groups and the influence of professional tournaments are driving consistent demand.

- Advancements in fabric technology, including moisture-wicking and UV protection, enhance performance and boost product appeal.

- High competition and market saturation among established brands create pricing pressures and reduce differentiation.

- Seasonal demand fluctuations and economic downturns impact sales cycles and inventory management.

- The South holds the largest share at 38%, followed by the West at 26%, with the Midwest and Northeast accounting for 19% and 17% respectively.

- Regional consumer preferences vary, with warmer states favoring breathable fabrics and colder regions prioritizing insulated apparel.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Golf Participation and Expanding Consumer Base

The U.S. Golf Apparel Market benefits from a steady rise in golf participation across diverse demographics. Younger players are entering the sport, encouraged by inclusive initiatives and social engagement opportunities. It gains further momentum from the growing interest among women golfers, supported by targeted marketing campaigns and apparel designs. Golf’s popularity as a leisure activity and networking platform attracts corporate professionals, expanding the apparel customer base. National tournaments and televised events amplify the sport’s visibility, increasing demand for performance-driven clothing. Seasonal and year-round golfing in various states provides continuous sales opportunities. Apparel brands focus on catering to amateur and professional players alike. This diversified audience fuels consistent revenue growth.

Advancements in Fabric Technology and Performance Features

Technological innovations in textile manufacturing significantly enhance the U.S. Golf Apparel Market. Brands integrate moisture-wicking, UV-protection, and stretchable fabrics to improve player comfort and mobility. Performance-driven materials help regulate temperature, ensuring consistent comfort in varying weather. Consumers value these enhancements, leading to repeat purchases and higher brand loyalty. Collaborations with textile innovators enable apparel producers to stay ahead in quality and functionality. Sustainability-focused materials appeal to environmentally conscious buyers without compromising performance. Lightweight construction and ergonomic tailoring elevate the athletic appeal of the garments. It positions golf apparel as both a sports necessity and a lifestyle product.

- For example, Nike introduced Dri-FIT technology in 1991 as part of its FIT performance line, designed to wick sweat away from the skin to the fabric’s surface for faster evaporation and dryness. Many current Nike golf shirts, such as the Dri-FIT Victory Polo, are made from 100% recycled polyester and feature this moisture-management technology for comfort during play.

Influence of Fashion and Lifestyle Integration

Golf apparel increasingly reflects broader fashion trends, appealing to style-conscious players. The U.S. Golf Apparel Market sees brands merging athletic utility with contemporary design. Fashion-forward patterns, color palettes, and versatile cuts attract younger audiences seeking apparel suitable for both the course and casual settings. Cross-over styles encourage purchases beyond sports usage, widening revenue streams. Social media influencers and celebrity golfers play a strong role in promoting apparel collections. Luxury collaborations introduce premium golf clothing lines to high-spending segments. Retailers focus on seasonal collections to match lifestyle trends. This fusion of style and function broadens market penetration.

- For instance, Adidas has elevated its golf line by merging performance-driven fabrics with fashion-forward silhouettes via collaborations, such as the 2025 partnership with JAY3LLE, which introduced bold designs like pleated skorts and bomber jackets for women.

E-commerce Expansion and Retail Accessibility

The rapid growth of e-commerce significantly influences the U.S. Golf Apparel Market. Online retail platforms offer wide product variety, competitive pricing, and convenient delivery, enhancing customer reach. Direct-to-consumer sales models allow brands to build stronger relationships and gather purchase data for targeted marketing. Integration of virtual fitting tools and AI-based recommendations improves the shopping experience. Multi-channel retail strategies ensure brand presence across online, specialty golf stores, and sports outlets. Exclusive online product launches create urgency and boost sales. Improved logistics and return policies enhance consumer trust. It strengthens the market’s overall accessibility and revenue potential.

Market Trends

Sustainable and Eco-Friendly Apparel Development

A growing shift toward sustainability is reshaping the U.S. Golf Apparel Market. Brands are adopting organic cotton, recycled polyester, and water-efficient production techniques to reduce environmental impact. Eco-friendly packaging complements this commitment, appealing to green-conscious consumers. Certifications and transparency in sourcing enhance trust among buyers. Sustainability messaging becomes a core part of branding strategies, influencing purchase decisions. Partnerships with environmental organizations strengthen brand image and outreach. Innovation in biodegradable fabrics introduces new competitive advantages. The trend creates a balance between performance, style, and environmental responsibility.

Integration of Smart and Wearable Technology

Technological integration is emerging as a defining trend in the U.S. Golf Apparel Market. Wearable sensors embedded in clothing track player performance metrics such as swing speed and posture. Smart fabrics adapt to body temperature and weather conditions, enhancing comfort. Bluetooth-enabled accessories connect apparel to mobile devices for data analysis. Golfers seeking performance improvement are early adopters of such innovations. Collaborations between apparel brands and tech companies accelerate product development. The combination of athletic wear and data-driven insights provides a distinctive value proposition. This fusion enhances both competitive play and recreational enjoyment.

Personalization and Customization Demand

Consumer preference for personalization is growing rapidly in the U.S. Golf Apparel Market. Brands offer customized fits, embroidery, and color selections to meet individual tastes. Golf clubs and corporate groups order bespoke apparel for branding and events. Customization enhances consumer loyalty by creating unique ownership experiences. Digital tools allow customers to visualize designs before purchase, improving satisfaction rates. Limited-edition collections with personalization options generate exclusivity appeal. Professional players endorsing personalized gear inspire adoption across amateur circles. This trend deepens brand-consumer engagement and drives premium pricing.

- For example, Under Armour provides corporate customization services for polos and other apparel, offering sizes from XS to 4XL with options for embroidered or printed branding. Through authorized retailers and online design platforms, customers can upload logos, select products, and create personalized designs for individuals, teams, and corporate groups.

Athleisure Influence on Golf Apparel Designs

The rise of athleisure is impacting the U.S. Golf Apparel Market’s design direction. Golf clothing is now designed for multifunctional use, blending sports performance with everyday wearability. Stretch fabrics, relaxed fits, and modern styling make apparel suitable beyond the course. This versatility attracts non-golfing consumers interested in sports-inspired fashion. Retailers showcase golf apparel alongside lifestyle collections to tap into wider audiences. The athleisure trend reduces the gap between sportswear and casual wear. It creates opportunities for brands to expand into lifestyle apparel markets while maintaining golf-specific performance attributes.

- For example, Adidas’s Ultimate365 Golf line features stretch fabrics and relaxed-fit designs that combine moisture-wicking technologies and water-resistant finishes for seamless performance both on and off the course. Their Primeknit polos elevate comfort and breathability, while the brand’s spikeless golf shoes offer traction and style suited for versatile wear.

Market Challenges Analysis

High Competition and Market Saturation

The U.S. Golf Apparel Market faces intense competition from established brands and emerging labels. Premium and mid-tier players compete for similar consumer segments, creating pricing pressure. High product similarity reduces differentiation, making brand loyalty harder to sustain. Frequent discounting strategies by large retailers erode profit margins. Market saturation in mature segments limits rapid expansion opportunities. The challenge intensifies with international brands entering the U.S. market through e-commerce platforms. Consumer demand for innovation forces continuous investment in R&D. It raises operational costs and compresses profitability for smaller players.

Seasonality and Economic Sensitivity

The U.S. Golf Apparel Market is affected by seasonal demand patterns tied to weather conditions. Harsh winters or prolonged rains in key golfing regions can reduce apparel sales. Economic downturns impact discretionary spending, leading to reduced purchases of non-essential sportswear. Luxury and premium apparel categories are especially vulnerable to consumer spending cuts. Inventory management becomes challenging during fluctuating demand cycles. Seasonal product lines risk overstock or understock issues. Brands dependent on in-person sales face additional hurdles during travel or event restrictions. It emphasizes the importance of diversified retail channels to mitigate these risks.

Market Opportunities

Growth in Emerging Golfer Demographics

An expanding demographic of younger and more diverse golfers presents new opportunities for the U.S. Golf Apparel Market. Outreach programs, school golf initiatives, and urban golfing facilities are encouraging participation. Apparel brands can design collections targeting these new players with modern styles and accessible price points. Collaborations with influencers and digital platforms extend market visibility. Women’s golf continues to grow, creating scope for gender-specific designs. The opportunity lies in building brand loyalty early through targeted campaigns. It allows brands to shape long-term purchasing habits.

Expansion in International Tourism and Golf Resorts

Golf tourism offers a promising growth avenue for the U.S. Golf Apparel Market. Destination resorts and luxury golfing experiences create demand for premium apparel lines. International visitors seek high-quality branded clothing as part of their travel experience. Exclusive collections tied to resort branding can generate significant sales. Events hosted at tourist destinations drive merchandising opportunities. Brands that partner with resorts gain exposure to affluent and global audiences. It strengthens brand positioning while opening new revenue channels.

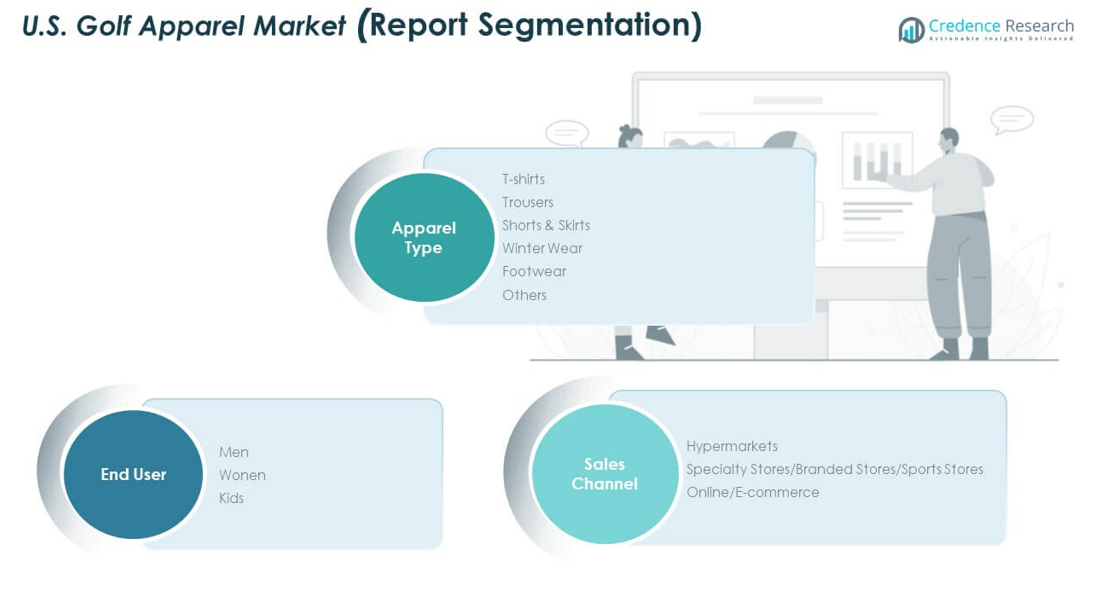

Market Segmentation Analysis:

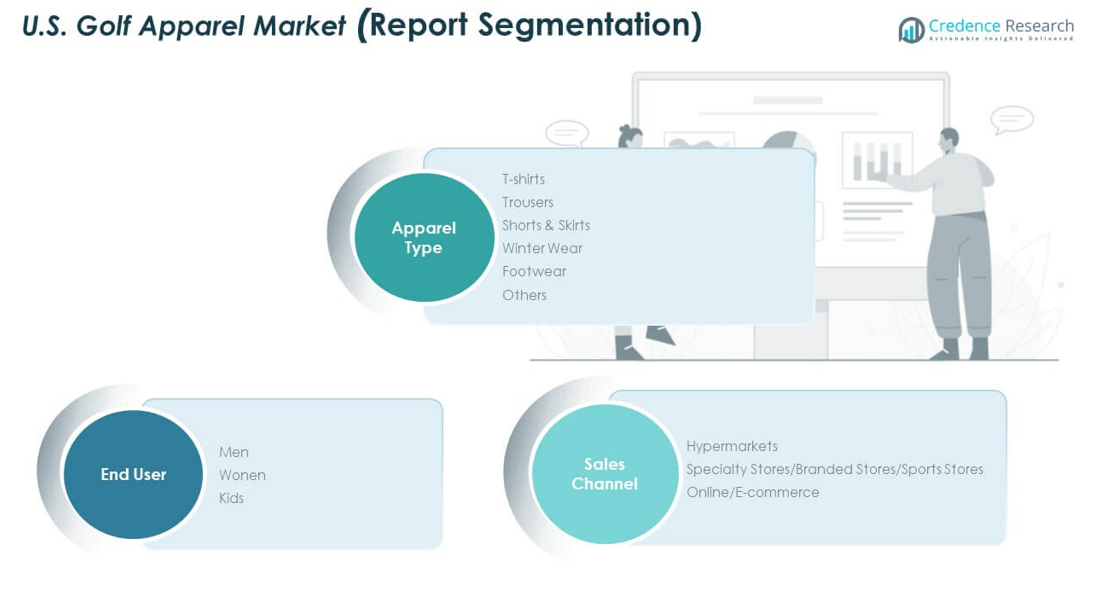

By apparel type, the U.S. Golf Apparel Market features diverse product categories catering to performance, comfort, and style. T-shirts hold a strong share due to their versatility, breathability, and use in both casual and professional golfing. Trousers remain essential for formal golfing attire, while shorts and skirts appeal to warmer weather and modern style preferences. Winter wear supports year-round participation in colder regions, incorporating thermal and weather-resistant materials. Footwear serves a critical role in enhancing grip, comfort, and stability, while the ‘others’ category includes accessories that complement overall apparel sales.

- For instance, Galvin Green’s INTERFACE-1 outerwear range is designed as a hybrid solution for golfers, offering windproof and water-repellent polyester with breathable, stretchy construction. Pieces like the Leonard jacket incorporate Thermore® padding for added warmth while maintaining flexibility and comfort in cold, blustery conditions.

By end user, men account for the largest share, supported by their long-standing dominance in golf participation and spending patterns. Women represent a growing segment, driven by increased engagement in the sport and expanding product lines tailored to female golfers. Kids form a niche but steadily expanding category, fueled by youth golf programs, school-level tournaments, and parental investment in early skill development.

- For example, Garb Inc., founded in 1996 as the original junior golf apparel brand, is a leading supplier of children’s golf clothing. The company has been the primary kids’ apparel provider for major events such as the U.S. Open, PGA Championship, and Ryder Cup since 2001, reinforcing its strong presence in youth golf.

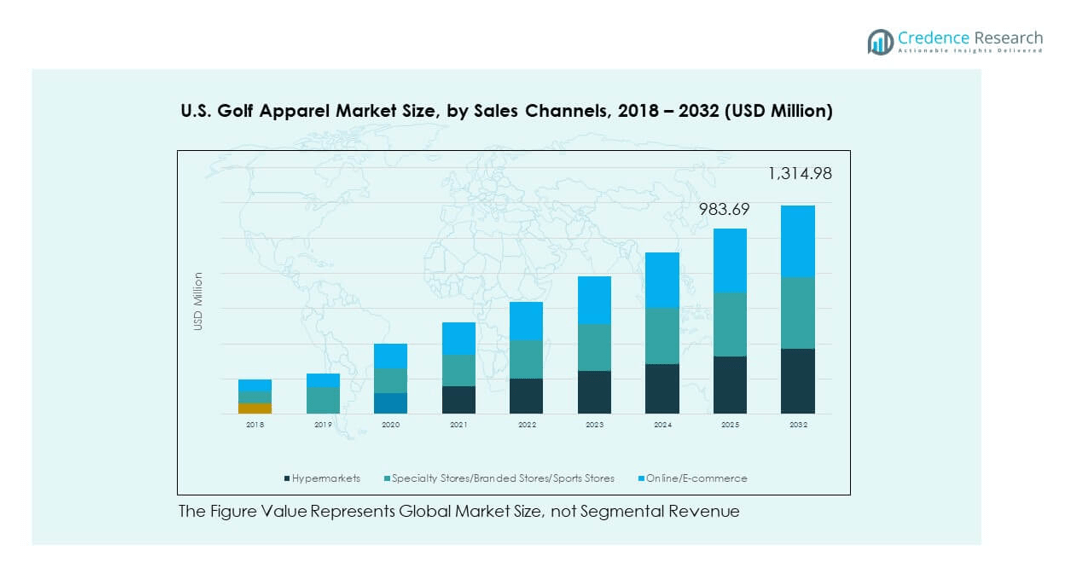

By sales channel, specialty stores, branded outlets, and sports stores lead in value share due to their ability to offer personalized service, premium collections, and exclusive product lines. Hypermarkets maintain steady demand by providing convenience and competitive pricing. Online channels are experiencing rapid growth, driven by ease of access, expanded product variety, and digital marketing campaigns targeting younger and tech-savvy consumers. This diversified distribution structure ensures strong market accessibility across urban, suburban, and regional golfing communities.

Segmentation:

By Apparel Type

- T-shirts

- Trousers

- Shorts & Skirts

- Winter Wear

- Footwear

- Others

By End User

By Sales Channel

- Hypermarkets

- Specialty Stores/Branded Stores/Sports Stores

- Online/E-commerce

Regional Analysis:

The South region commands the largest share of the U.S. Golf Apparel Market at nearly 38%, driven by its year-round golf-friendly climate and a dense network of courses in states such as Florida, Texas, and Georgia. This region benefits from a high concentration of golf resorts, professional tournaments, and affluent retirement communities that actively participate in the sport. Consumer spending on premium golf apparel is strong, supported by tourism and a steady influx of visiting golfers. Retailers in the South leverage both specialty stores and resort-based outlets to capture demand. Seasonal product variation is minimal, enabling consistent sales throughout the year. It remains the core hub for both domestic and visiting golfers seeking high-quality apparel.

The West accounts for approximately 26% of the market share, supported by diverse golfing landscapes in states like California, Arizona, and Nevada. The region’s blend of luxury golf resorts, celebrity-driven events, and high-profile tournaments boosts apparel sales. Warm climates encourage demand for breathable, moisture-wicking fabrics, while cooler highland areas sustain sales of lightweight winter gear. The West attracts a mix of professional players, tourists, and recreational golfers, creating varied product demand. Retail presence is strong in urban centers and resort destinations, with online sales growing rapidly. It benefits from an image-driven consumer base that values both performance and style.

The Midwest and Northeast collectively hold 36% of the market share, with the Midwest contributing 19% and the Northeast 17%. The Midwest’s large golfing community and hosting of championship events maintain strong seasonal demand for both summer and transitional weather apparel. The Northeast’s market is shaped by a shorter golfing season but higher spending on premium brands, driven by affluent urban consumers in states like New York, Massachusetts, and Pennsylvania. Both regions experience significant seasonal spikes, requiring retailers to manage inventory cycles strategically. Specialty stores and golf clubs serve as primary sales channels, supplemented by e-commerce during off-season months. It relies on aligning product availability with the peak playing season to sustain revenue.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amer Sports

- Roger Cleveland Golf Company Inc

- Golfsmith International Holdings Inc

- Dixon Golf Inc.

- Perry Ellis

- Fila

- Ralph Lauren

- Oxford Golf

- Sunice

- EP NY

- Other Key Players

Competitive Analysis:

The U.S. Golf Apparel Market features a competitive landscape dominated by established global brands and specialized golf apparel companies. Key players such as Amer Sports, Ralph Lauren, Perry Ellis, and Fila leverage strong brand recognition, diverse product portfolios, and strategic endorsements to maintain market leadership. Competition centers on innovation in fabric technology, style integration, and sustainable production. Mid-tier and emerging brands compete by offering cost-effective yet performance-oriented products, targeting niche segments. E-commerce platforms intensify competition by enabling smaller brands to access broader audiences. Retail partnerships, athlete sponsorships, and product customization strengthen brand positioning. It remains a dynamic market where differentiation through quality, design, and marketing drives competitive advantage.

Recent Developments:

- In July 2025, Flag & Anthem, a premium U.S. apparel brand known for its versatile golf collections, entered a strategic partnership with RepSpark. This collaboration aims to streamline wholesale ordering for golf shops, boutiques, resorts, and specialty retailers, enhancing the brand’s presence in the golf sector.

- In July 2025, Nike Golf launched a special trio of golf sneakers the Victory Tour 4, Air Zoom Infinity Tour 2, and Air Max 90 Golf in celebration of The Open Championship. The limited-edition footwear features a distinctive white and metallic gold design, honoring the legacy of the championship.

- In May 2025, Amer Sports reached an agreement to acquire the land, building, and machinery of its trusted manufacturing partner Savrom, marking a significant strategic step by bringing Alpine binding production back in-house through the acquisition of a new Romanian facility.

Market Concentration & Characteristics:

The U.S. Golf Apparel Market exhibits moderate to high concentration, with a few leading players capturing significant revenue share. It is characterized by brand-driven competition, seasonal product cycles, and strong influence from professional golf events. Innovation, style diversity, and sustainability commitments are critical to retaining consumer loyalty. The market blends premium, mid-tier, and value segments, supported by both offline specialty retail and rapidly expanding e-commerce channels. Consumer preferences are shaped by performance features, brand endorsements, and fashion alignment with broader lifestyle trends. Strategic marketing tied to tournaments and celebrity golfers enhances brand visibility. It continues to evolve as brands balance functional performance with aesthetic appeal to address a diverse golfing population.

Report Coverage:

The research report offers an in-depth analysis based on Apparel Type, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of eco-friendly and recycled material usage will strengthen brand positioning among environmentally conscious consumers.

- Growth in youth and women’s golf participation will broaden the target audience for apparel collections.

- Technological integration in fabrics, such as temperature regulation and enhanced stretch, will improve performance appeal.

- Increased personalization and made-to-order apparel options will drive customer loyalty and premium sales.

- Strategic collaborations with luxury fashion brands will elevate style influence within the sport.

- Rising popularity of golf tourism and resort-based experiences will create opportunities for exclusive apparel lines.

- Enhanced online retail capabilities and virtual try-on tools will improve purchase confidence and reach.

- Seasonal product innovation tailored to regional climates will optimize inventory turnover and sales cycles.

- Greater emphasis on inclusive sizing and adaptive designs will cater to a more diverse golfing population.

- Sponsorship of professional tournaments and player endorsements will continue to boost market visibility and consumer engagement.