Market Overview:

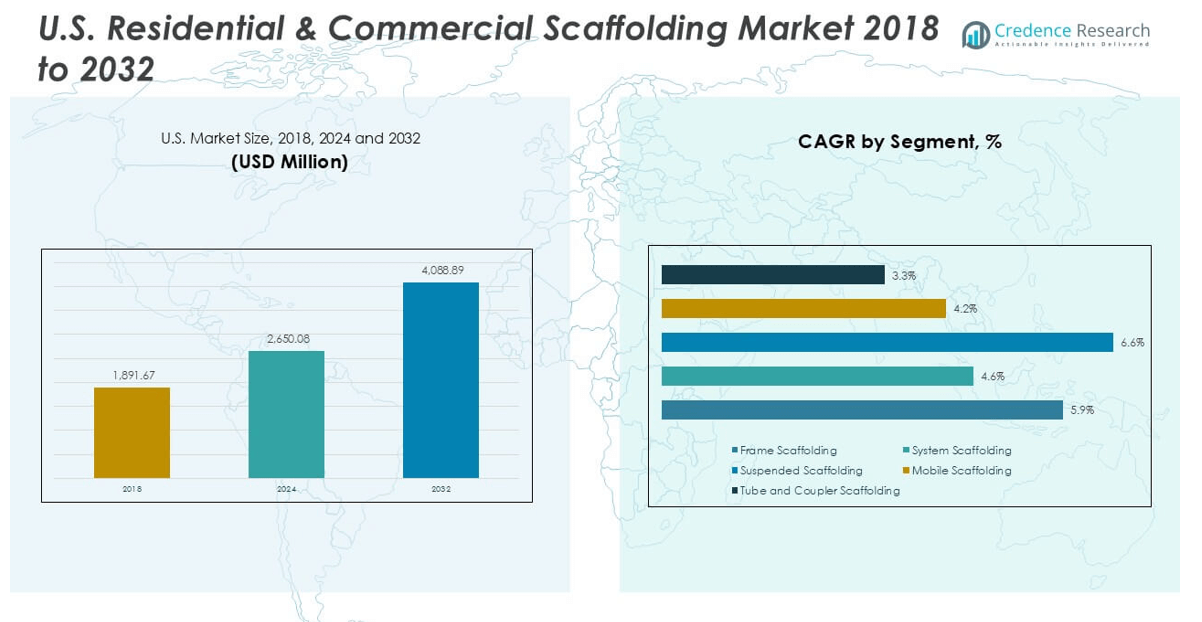

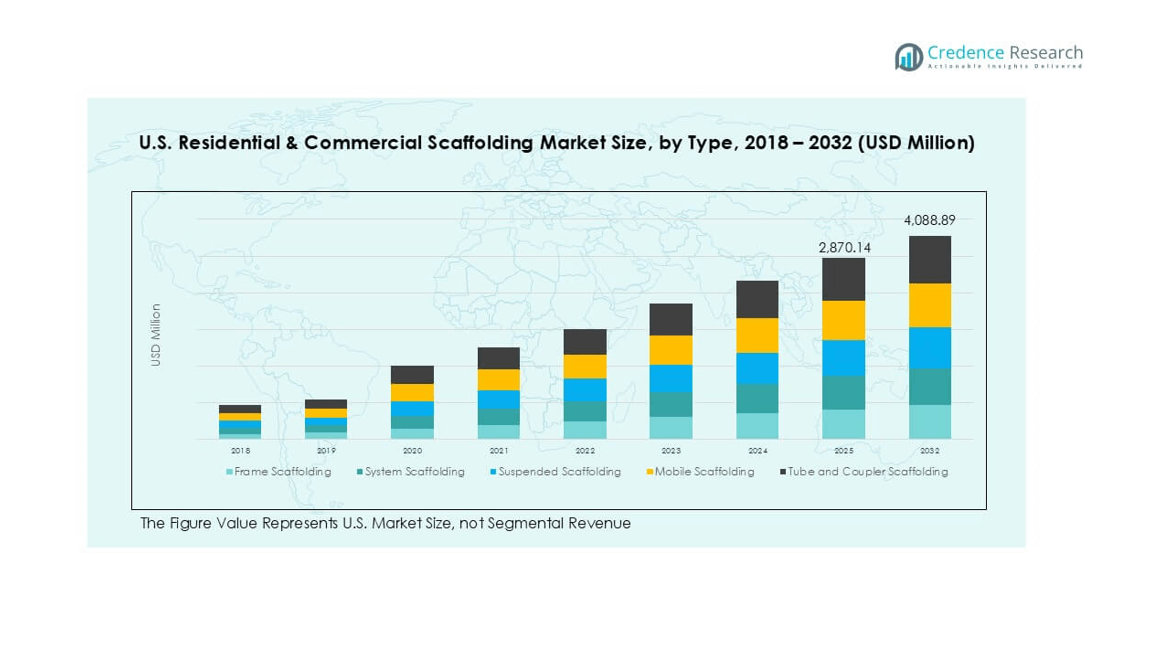

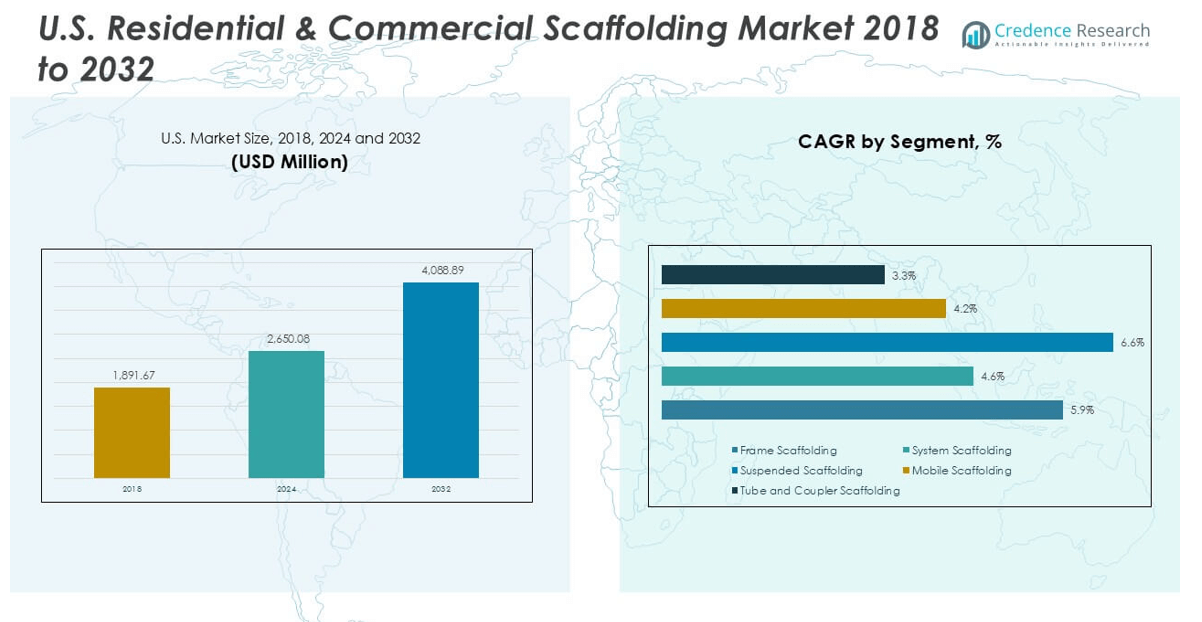

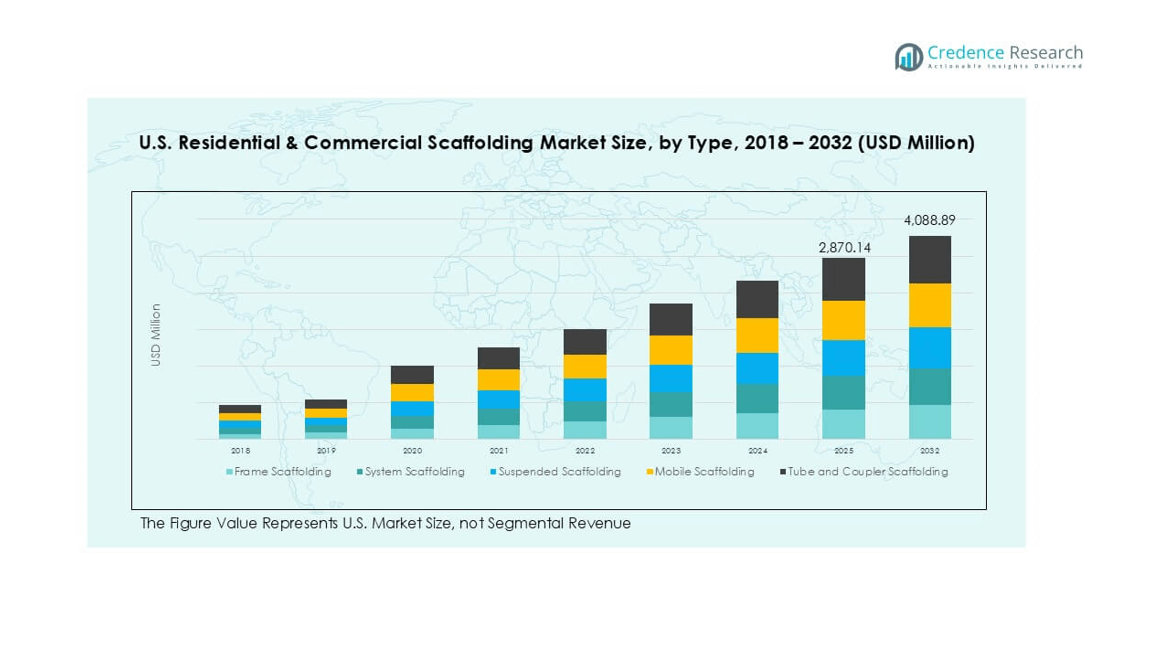

The U.S. Residential & Commercial Scaffolding market was valued at USD 1891.67 million in 2018 and reached USD 2650.08 million in 2024. It is projected to attain a value of USD 4088.89 million by 2032, expanding at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Residential & Commercial Scaffolding Market Size 2024 |

USD 2650.08 million |

| U.S. Residential & Commercial Scaffolding Market, CAGR |

6.6% |

| U.S. Residential & Commercial Scaffolding Market Size 2032 |

USD 4088.89 million |

The U.S. Residential & Commercial Scaffolding market is led by key players such as Penn Tool Co., Safway Group, Spider Staging, Lynn Ladder & Scaffolding Co., Inc., and Ver Sales, Inc., all of which maintain strong market positions through broad product offerings, rental services, and a focus on safety and regulatory compliance. These companies actively invest in modular scaffolding systems, lightweight materials, and geographic expansion to stay competitive. Regionally, the South holds the largest market share at 33%, driven by rapid residential construction and commercial development in states like Texas and Florida. The Midwest follows with 24%, supported by industrial and infrastructure activity. The West and Northeast regions account for 22% and 21% respectively, driven by urban high-rise projects and renovation needs.

Market Insights

- The U.S. Residential & Commercial Scaffolding market was valued at USD 1891.67 million in 2018 and reached USD 2650.08 million in 2024. It is projected to attain a value of USD 4088.89 million by 2032, expanding at a CAGR of 6.6% during the forecast period.

- Market growth is driven by increased construction activities in residential and commercial sectors, along with rising demand for safe and efficient scaffolding systems in both new construction and renovation projects.

- Trends such as the adoption of modular and mobile scaffolding, lightweight aluminum structures, and technology integration like BIM are shaping the market landscape.

- The market is moderately fragmented with key players including Safway Group, Spider Staging, Penn Tool Co., and Lynn Ladder & Scaffolding Co., Inc., focusing on rental services, innovation, and geographic expansion.

- Regionally, the South holds the largest market share at 33%, followed by the Midwest (24%), West (22%), and Northeast (21%). Frame scaffolding dominates the type segment due to its ease of use and widespread application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the U.S. Residential & Commercial Scaffolding market, frame scaffolding dominates the type segment, accounting for the largest market share due to its ease of assembly, cost-effectiveness, and widespread use in both low- and mid-rise construction. It remains the preferred choice for residential projects and small commercial buildings. Meanwhile, system scaffolding is gaining traction for its flexibility and time-saving modular design, especially in complex commercial structures. Suspended and mobile scaffolding are primarily used for maintenance and façade work, while tube and coupler scaffolding retains relevance in customized or irregular architectural applications.

- For instance, Layher’s Allround® System Scaffolding has been adopted in over 80 countries and allows over 8,000 possible assembly combinations, enabling highly customized modular structures even in complex layouts.

By Material

Steel scaffolding leads the material segment, holding the majority share due to its high durability, strength, and capacity to support heavy loads—making it suitable for large-scale and high-rise commercial projects. Steel’s reusability and resistance to harsh weather conditions further drive its dominance. Aluminum scaffolding, though lighter and easier to transport, holds a smaller but growing share, particularly in residential and indoor applications where mobility and quick assembly are prioritized. Bamboo and wood scaffolding, though limited in usage due to safety and regulation concerns, remains minimally used in specialized, short-term residential work or restoration projects.

- For instance, Bil-Jax’s aluminum scaffold towers weigh 35% less than their steel counterparts while maintaining a load capacity of up to 750 pounds per platform.

By Application

The new construction sub-segment holds the dominant share in the application segment, driven by increasing residential developments and commercial infrastructure projects across urban and suburban areas. This growth is supported by federal investments in housing and infrastructure upgrades. Renovation and maintenance follow closely, propelled by aging infrastructure and the need for structural refurbishments, especially in older city zones. The “others” category, including temporary installations and event structures, contributes marginally but steadily, supported by short-duration demand from non-core sectors such as film, events, and seasonal architectural projects.

Market Overview

Surge in Urban Infrastructure and Residential Projects

The rapid expansion of urban centers across the U.S. has driven significant investments in new residential and commercial infrastructure. Government-backed housing initiatives, coupled with rising urban population density, are accelerating construction activity, thereby fueling demand for scaffolding systems. Developers increasingly rely on safe and scalable scaffolding solutions for high-rise buildings, apartment complexes, and office structures. This ongoing construction boom across urban and suburban areas continues to be a major growth catalyst for the scaffolding market.

- For instance, Safway Group provided over 200,000 square feet of scaffolding systems for the Hudson Yards project in New York, enabling multi-level façade and structural work simultaneously.

Rise in Renovation and Retrofit Activities

Aging residential and commercial buildings across the U.S. are undergoing renovation and energy efficiency upgrades, creating a steady demand for scaffolding services. From structural repairs to façade restoration and window replacement, scaffold access is essential in many retrofit projects. As sustainability initiatives and green building certifications gain traction, property owners are investing more in renovations, which in turn stimulates demand for both temporary and long-term scaffolding systems tailored for maintenance operations.

- For instance, BrandSafway deployed over 100,000 linear feet of scaffolding during the energy retrofit of Willis Tower, supporting simultaneous HVAC, glazing, and structural enhancements.

Focus on Worker Safety and Regulatory Compliance

Stringent occupational safety regulations by OSHA and other state agencies have increased the demand for standardized, high-quality scaffolding equipment. Construction companies are prioritizing advanced scaffolding systems that comply with safety norms, minimize workplace accidents, and reduce liability. The shift toward structured safety protocols is compelling end users to invest in system scaffolding and modular platforms that offer better load-bearing capacity and stability. This regulatory environment is acting as a significant driver for market expansion.

Key Trends & Opportunities

Adoption of Lightweight and Mobile Scaffolding Solutions

Contractors are increasingly favoring aluminum and mobile scaffolding systems due to their ease of transport, quick assembly, and adaptability in confined spaces. This trend is especially notable in residential and small-scale commercial projects where time efficiency and labor costs are crucial. Manufacturers are innovating lightweight designs without compromising structural integrity, opening opportunities to serve a broader range of users including general contractors, facility managers, and DIY renovation firms.

- For instance, Safway Group launched its QuikDeck Suspended Access System, reducing installation time by over 30% compared to traditional systems, and its lightweight aluminum modules enable easier assembly for crews of fewer than five workers.

Technological Advancements in Scaffolding Design

The market is witnessing a steady rise in demand for modular, pre-engineered, and smart scaffolding systems that improve operational efficiency and safety. Integration of RFID tags, sensors, and real-time tracking software in scaffolding components enables better inventory management and worker accountability. Additionally, 3D modeling and Building Information Modeling (BIM) are being used to plan complex scaffolding layouts, especially for large commercial projects. These advancements are positioning scaffolding not just as equipment but as a value-added service.

- For instance, PERI USA implemented its PERI UP Flex Modular Scaffolding System on the LaGuardia Terminal B project, using BIM to model over 2,400 components digitally before installation, which cut setup time by more than 40% and ensured structural compatibility across varying floor heights.

Key Challenges

Fluctuating Raw Material Prices

The scaffolding industry remains vulnerable to volatility in steel and aluminum prices, which directly impacts manufacturing and rental costs. Tariffs, supply chain disruptions, and global trade dynamics often lead to unpredictable price swings, challenging manufacturers and service providers to maintain competitive pricing. This cost instability not only compresses profit margins but also deters smaller contractors from upgrading to safer or more advanced scaffolding systems.

Labor Shortages in the Construction Industry

The ongoing shortage of skilled construction labor in the U.S. is impacting the scaffolding sector’s operational capacity. Assembling and dismantling scaffolding requires trained professionals to ensure safety and efficiency. However, the industry faces a growing gap in experienced labor due to an aging workforce and declining interest among younger workers. This shortage slows project timelines and may lead to increased safety risks due to inadequate or improper scaffolding use.

Intense Market Competition and Price Pressure

The U.S. scaffolding market is highly fragmented, with numerous regional players competing alongside large rental and equipment firms. This saturation results in aggressive pricing strategies that pressure margins and hinder investments in innovation or quality upgrades. Customers often choose suppliers based solely on cost, rather than safety or durability, forcing companies to continually balance pricing competitiveness with service and product quality.

Regional Analysis

Northeast Region

The Northeast region accounted for approximately 21% of the U.S. residential and commercial scaffolding market in 2024, driven by dense urban construction and ongoing high-rise developments in cities like New York, Boston, and Philadelphia. The region experiences consistent demand for scaffolding in both new construction and renovation projects, particularly in commercial real estate and infrastructure modernization. Historic building restorations and strict safety regulations also contribute to the steady use of scaffolding systems. The market is dominated by frame and suspended scaffolding solutions, especially for façade maintenance and urban projects requiring vertical access in space-constrained environments.

Midwest Region

The Midwest held a 24% market share in 2024, supported by strong activity in industrial construction, warehousing, and infrastructure upgrades across states like Illinois, Ohio, and Michigan. The region’s expanding logistics and manufacturing hubs drive continuous demand for scaffolding in both commercial and residential applications. Renovation of older housing stock and urban redevelopment in cities like Chicago contribute to growth. Steel scaffolding is most widely used here, favored for its durability and cost-efficiency in large-scale projects. The region’s relatively lower construction costs and centralized location support the presence of several regional scaffolding service providers.

South Region

With the largest market share of around 33% in 2024, the South leads the U.S. scaffolding market due to rapid urban expansion, population growth, and high levels of residential construction in states such as Texas, Florida, and Georgia. The warm climate facilitates year-round construction, boosting consistent scaffolding demand for both new builds and renovations. Commercial projects such as office parks, retail centers, and mixed-use developments contribute significantly. Mobile and system scaffolding types are widely used in the region for their adaptability and ease of deployment across sprawling construction sites. Government investments in infrastructure also support long-term market expansion.

West Region

The West region captured about 22% of the market share in 2024, led by active construction in California, Washington, and Arizona. Major metropolitan areas like Los Angeles and San Francisco drive scaffolding demand in high-rise residential, commercial, and seismic retrofitting projects. Environmental regulations and a strong emphasis on green building codes promote safe and compliant scaffolding practices. The region also sees high demand for aluminum scaffolding, favored for its lightweight and corrosion-resistant properties. Technological integration, including digital planning tools, is more prevalent in the West, aligning with the region’s innovation-driven construction landscape.

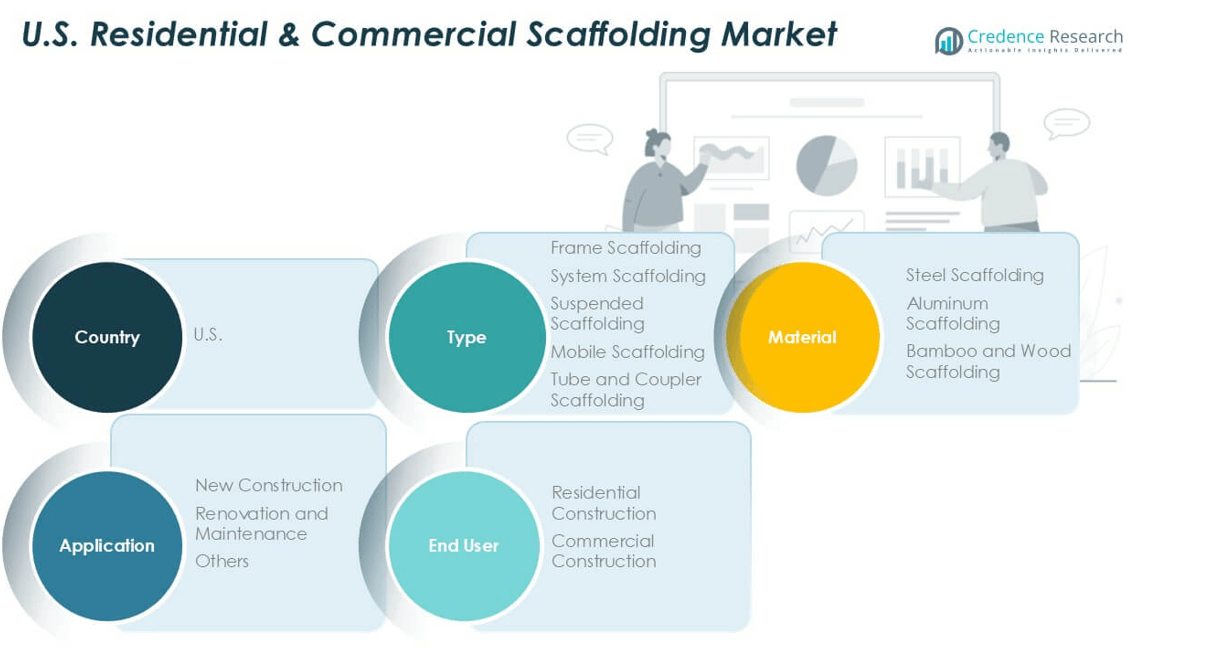

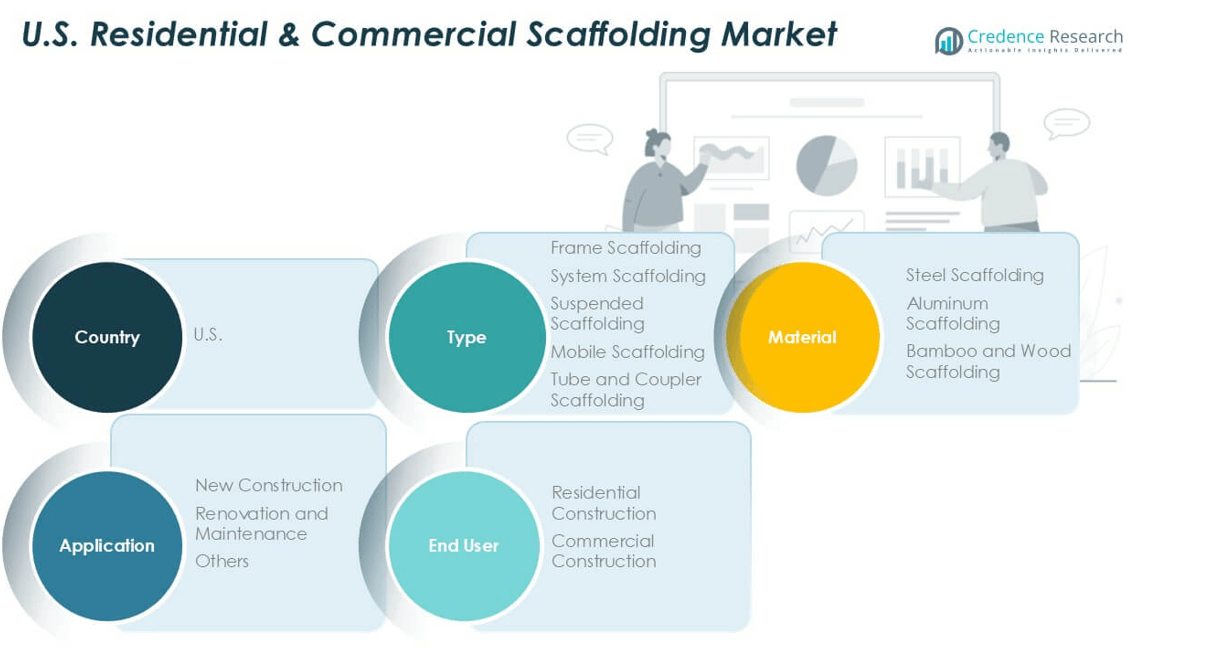

Market Segmentations:

By Type

- Frame Scaffolding

- System Scaffolding

- Suspended Scaffolding

- Mobile Scaffolding

- Tube and Coupler Scaffolding

By Material

- Steel Scaffolding

- Aluminum Scaffolding

- Bamboo and Wood Scaffolding

By Application

- New Construction

- Renovation and Maintenance

- Others

By End User

- Residential Construction

- Commercial Construction

By Geography

- Northeast Region

- Midwest Region

- South Region

- West Region

Competitive Landscape

The U.S. residential and commercial scaffolding market is moderately fragmented, with a mix of regional players and nationally recognized firms competing across segments. Key companies such as Penn Tool Co., Safway Group, Spider Staging, and Lynn Ladder & Scaffolding Co., Inc. maintain strong market positions through diversified product portfolios, rental services, and strategic partnerships. These players focus on enhancing safety standards, product innovation, and quick delivery capabilities to meet project-specific demands. Smaller firms such as American Scaffolding, Inc. and BETCO Scaffolds cater to localized markets with personalized services and competitive pricing. Market competition is intensifying due to the rising demand for modular and mobile scaffolding systems, prompting companies to invest in advanced technologies and sustainable materials. Mergers, acquisitions, and geographic expansion remain key strategies for larger players aiming to consolidate their presence. Overall, companies that prioritize regulatory compliance, on-time service, and cost-effective solutions are well-positioned to gain a competitive edge in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Penn Tool Co.

- Ver Sales, Inc.

- Associated Scaffolding Co., Inc.

- QuickAlly Access Solutions

- Lynn Ladder & Scaffolding Co., Inc.

- Spider Staging

- Safway Group

- American Scaffolding, Inc.

- BETCO Scaffolds

- Seaway Scaffold & Equipment Co.

Recent Developments

- In July 2025, ULMA Construction highlighted their “Smart Construction Technology” for ambitious residential projects, specifically mentioning the Symphony Village project in Rome. This technology likely involves innovative formwork systems and other solutions to enhance efficiency and quality in large-scale residential developments. The Symphony Village project, located near Rome, is a large-scale residential complex comprising 470 living units across multiple buildings.

- In June 2025, Altrad completed a €1.25 billion bond issue to support growth and optimize capital structure, signifying robust financial health and the ability to invest in industrial and construction scaffolding services.

- In March 2025, Mohed Altrad detailed strategic expansions in energy services, adding to the Group’s already diverse scaffolding portfolio. This includes continued acquisitions and a decentralized structure to encourage subsidiary autonomy and operational innovation.

- In January 2024, Renta Group acquired Scaffolding Group, a Polish scaffolding company catering to industrial customers in Southern Poland. The acquisition allows the company to enter the Polish industrial scaffolding market and continue to scale the operations geographically and further expand the customer base of the company.

Market Concentration & Characteristics

The U.S. Residential & Commercial Scaffolding Market displays a moderately concentrated structure, with a mix of national and regional players competing for market share. Large companies such as Safway Group, Spider Staging, and Penn Tool Co. hold significant positions due to their established distribution networks, broad product portfolios, and ability to serve large-scale commercial projects. Regional firms, including Lynn Ladder & Scaffolding Co., Inc. and American Scaffolding, Inc., contribute to strong localized competition by offering cost-effective and tailored solutions. It shows clear segmentation by product type, with frame scaffolding accounting for a dominant share due to its ease of assembly and suitability for a wide range of applications. Steel remains the preferred material for large-scale commercial use, while aluminum gains traction in residential and small-scale projects. Demand patterns vary by region, with the South leading in overall share due to rapid construction activity. Buyers focus on safety compliance, product reliability, and cost-effectiveness when selecting suppliers.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady demand due to continued urban development and infrastructure upgrades across major U.S. cities.

- Residential construction growth, especially in multi-family housing projects, will drive scaffold rentals and sales.

- Commercial sector projects, including retail centers, hospitals, and office buildings, will contribute significantly to scaffolding usage.

- Adoption of modular and mobile scaffolding systems is likely to increase, improving efficiency and safety on job sites.

- Integration of digital inspection and monitoring technologies will support safer and more compliant scaffolding operations.

- Contractors will continue to prefer rental scaffolding over purchase to reduce upfront costs and streamline operations.

- Labor shortages in the construction sector may increase demand for easy-to-install scaffolding solutions.

- Regulatory pressures will push firms to invest in OSHA-compliant and safer scaffolding platforms.

- Southern and Western regions will continue to dominate the market due to higher construction activity and favorable climate.

- Mergers and partnerships among scaffold manufacturers and rental companies may reshape the competitive landscape.