Market Overview:

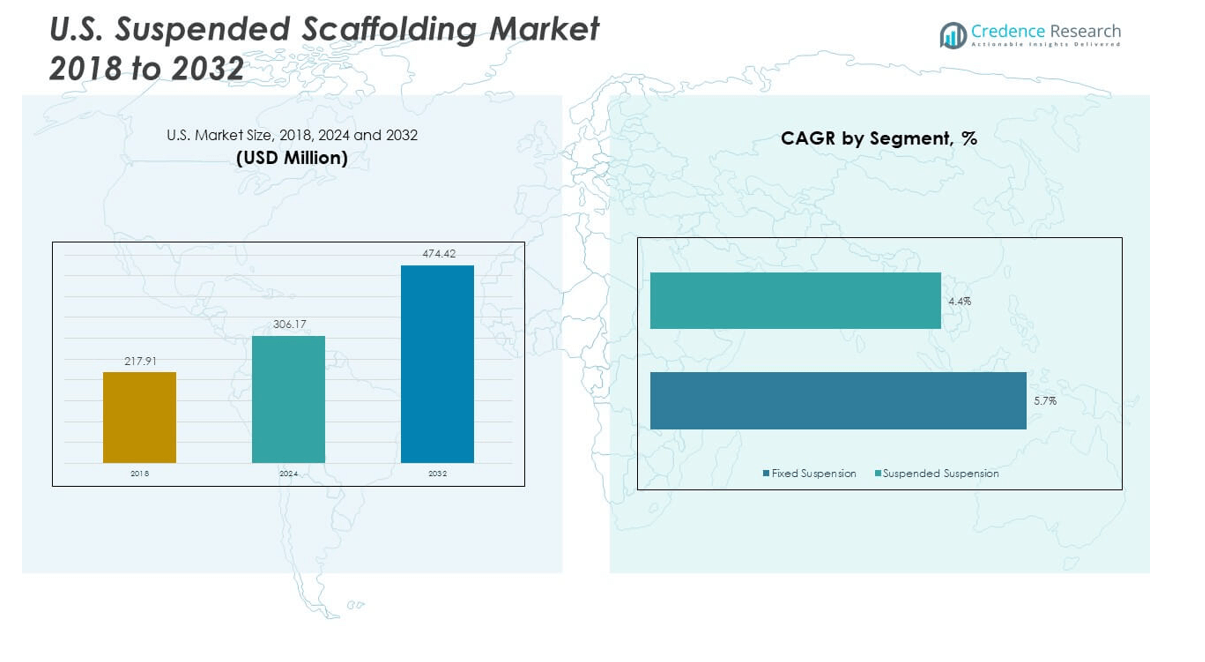

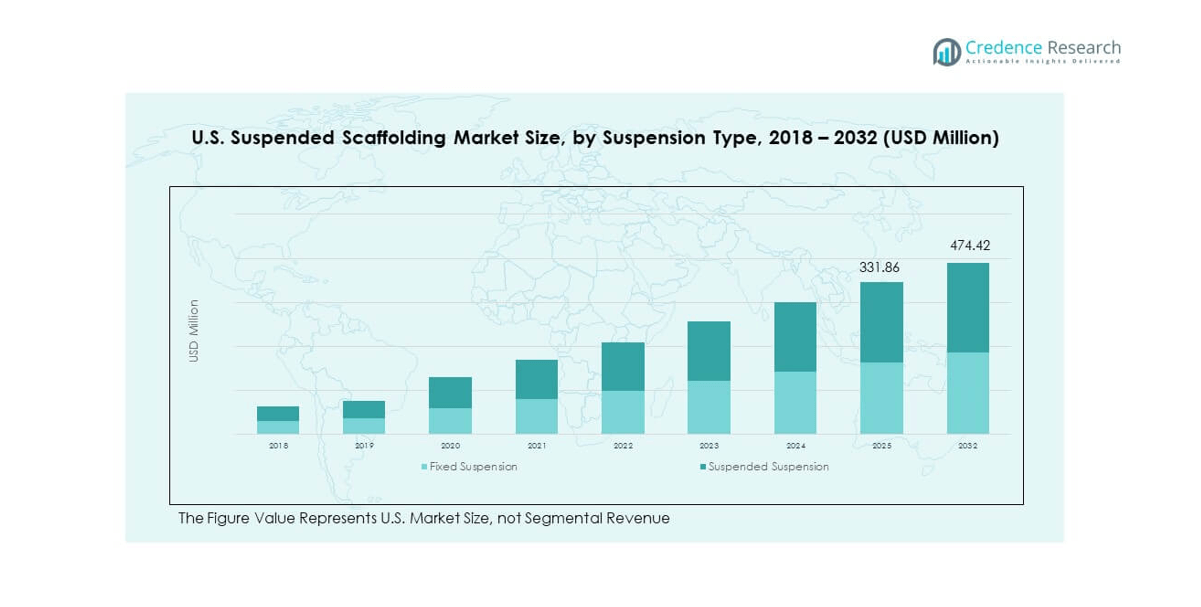

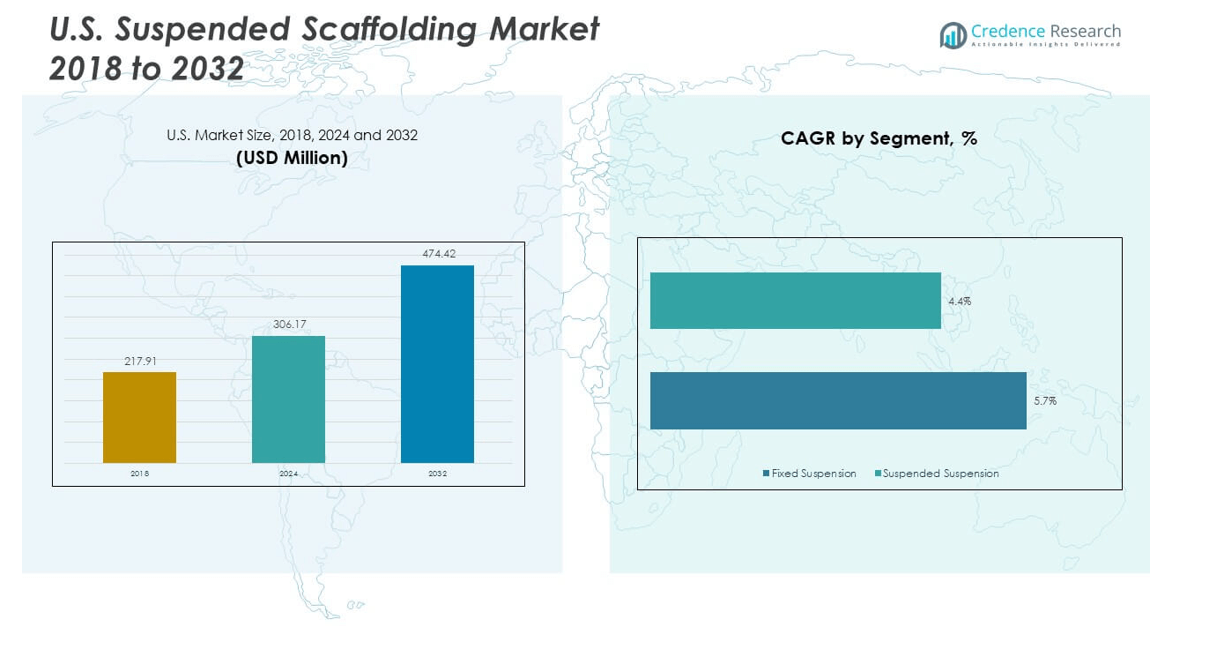

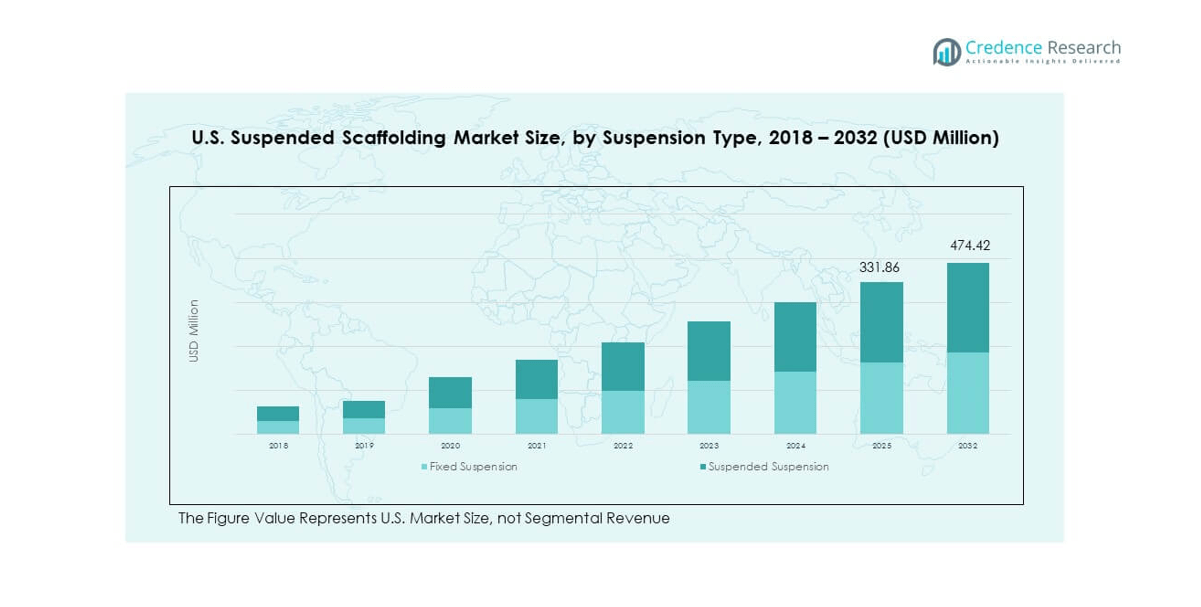

The U.S. Suspended Scaffolding Market size was valued at USD 217.91 million in 2018 to USD 306.17 million in 2024 and is anticipated to reach USD 474.42 million by 2032, at a CAGR of 5.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Suspended Scaffolding Market Size 2024 |

USD 306.17 million |

| U.S. Suspended Scaffolding Market, CAGR |

5.72% |

| U.S. Suspended Scaffolding Market Size 2032 |

USD 474.42 million |

The U.S. Suspended Scaffolding Market is witnessing robust growth due to increased demand across high-rise building projects, maintenance operations, and infrastructure refurbishment. The growing emphasis on worker safety, combined with the need for efficient vertical access solutions, is propelling the adoption of suspended scaffolding systems. Technological advancements, including motorized platforms and modular configurations, have further enhanced operational efficiency and ease of installation. Additionally, strict safety regulations by U.S. occupational health agencies are encouraging construction firms to opt for certified, reliable scaffolding systems, boosting market demand from both commercial and residential sectors.

Geographically, the U.S. market is led by states with high construction activity such as California, Texas, and New York, where urban expansion and commercial infrastructure development drive suspended scaffolding usage. Coastal regions with older buildings require frequent maintenance, further increasing demand for vertical access systems. Meanwhile, emerging markets in the Midwest and Southeast are gaining traction due to growing industrial projects and infrastructure upgrades. The adoption of modern construction technologies and increased funding in public infrastructure in these regions contribute to the expansion of the suspended scaffolding market across the U.S.

Market Insights:

- The U.S. Suspended Scaffolding Market was valued at USD 306.17 million in 2024 and is projected to reach USD 474.42 million by 2032, growing at a CAGR of 5.72%.

- The Global Suspended Scaffolding Market size was valued at USD 882.70 million in 2018 to USD 1,240.25 million in 2024 and is anticipated to reach USD 1,921.79 million by 2032, at a CAGR of 5.24% during the forecast period.

- Rising demand for vertical access solutions in high-rise construction continues to boost market adoption across urban development projects.

- Maintenance and retrofitting of aging infrastructure, especially in older metropolitan areas, significantly drive recurring demand.

- Regulatory compliance with OSHA and ANSI safety standards promotes the use of certified, technologically advanced scaffolding systems.

- High equipment ownership costs and the shortage of skilled labor for setup and operation act as key market restraints.

- The Northeast region leads the U.S. Suspended Scaffolding Market with a 31.5% share, supported by dense construction activity and aging buildings.

- The Southern and Western regions follow in market share, driven by industrial expansion, commercial development, and favorable construction climates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Growth in High-Rise Construction Driving Demand for Suspended Access Systems

The increasing number of high-rise residential and commercial projects across urban areas is a major growth driver for the U.S. Suspended Scaffolding Market. Vertical construction demands efficient and safe access systems, positioning suspended scaffolding as a critical solution. Developers and contractors prefer suspended platforms for exterior work due to their adaptability and minimal ground space usage. Cities such as New York, Chicago, and Miami are seeing a surge in skyscraper developments, which drives the market. The focus on space optimization in dense urban environments reinforces this demand. The flexibility of suspended scaffolding to work around unique facades and structural elements increases its utility. The U.S. Suspended Scaffolding Market benefits from the structural shift toward upward construction in land-constrained zones.

Strict Regulatory Compliance and Focus on Worker Safety Standards

Compliance with OSHA and ANSI safety regulations is reinforcing the use of certified and engineered suspended scaffolding systems. Contractors are prioritizing safer construction environments, leading to higher investments in compliant scaffolding equipment. The U.S. Suspended Scaffolding Market benefits from these regulatory pushes, as non-compliant structures face operational halts and penalties. Equipment with fall protection, overload sensors, and stability enhancements are gaining preference. Increased awareness around worker safety in hazardous construction environments strengthens this demand. Firms seek risk mitigation and insurance compliance, both of which are addressed by adopting standardized scaffolding systems. The push for zero-incident work zones continues to shape procurement behavior within the industry.

- For instance, BrandSafway’s QuikDeck® Suspended Access Platform was engineered as a first-of-its-kind dual-tier motorized suspended platform for the Second Narrows Water Supply Tunnel project in Vancouver, recognized as Suspended Access Project of the Year by the Scaffold & Access Industry Association (SAIA) in 2024. This innovation doubled the available work area and allowed teams to access both tunnel tiers safely and efficiently, eliminating the need for crane-assisted platform relocation and exemplifying next-level compliance with international safety benchmarks

Maintenance and Retrofit Demand from Aging Infrastructure and Buildings

Aging infrastructure and older building stock across major U.S. cities generate significant demand for repair and maintenance work. Suspended scaffolding offers an efficient and low-disruption method to access building exteriors, especially in dense city areas. It enables maintenance tasks such as facade cleaning, waterproofing, and window replacements with minimal ground interference. The U.S. Suspended Scaffolding Market benefits from increased government investment in infrastructure rehabilitation programs. Cities with historic architecture or aging public buildings rely on suspended access for periodic upgrades. Construction firms recognize the cost-effectiveness of deploying suspended systems over fixed scaffolding in renovation projects. The market responds strongly to the lifecycle needs of urban infrastructure.

Technological Integration Improving Operational Efficiency and User Safety

The integration of electric hoists, motorized platforms, and digital monitoring into scaffolding systems has boosted market confidence. These innovations reduce setup time and labor costs while improving load handling and worker safety. Contractors prefer automated height adjustments and overload detection features, which improve site efficiency. The U.S. Suspended Scaffolding Market responds positively to these innovations by adopting advanced platforms across both commercial and industrial projects. Real-time diagnostics and remote-control features enhance usability. These systems also enable faster completion of projects, appealing to firms working on strict timelines. Technology is transforming scaffolding from a labor-intensive component to a smart, performance-enhancing tool.

- For example, Tractel’s Power Climber PC3 Electric Series Traction Hoist features a load-dependent traction system that greatly reduces the likelihood of wire rope jams, and it includes a built-in pendant port for remote control Its robust electrical design supports fast maintenance users can replace the entire motherboard in under five minutes to resolve power issues.

Market Trends:

Increased Adoption of Modular and Lightweight Suspended Scaffolding Systems

Contractors are showing growing preference for modular scaffolding systems that can be quickly assembled, customized, and dismantled. These systems improve site productivity and reduce labor hours, aligning with evolving cost and time efficiency goals. Aluminum and composite materials are replacing heavy steel units to ease transportation and improve structural load distribution. The U.S. Suspended Scaffolding Market reflects this trend through rising demand for lightweight, portable units that meet performance and safety benchmarks. Contractors working across multiple locations prefer scalable systems that adapt to varying project needs. This shift also supports sustainability goals due to material recyclability. The push toward flexible engineering solutions strengthens this trend’s hold in the sector.

- For instance, Layher Holding GmbH & Co. KG, a global leader in modular scaffolding, has successfully implemented their Allround Scaffolding system in major infrastructure projects worldwide.

Growth of Rental Services Supporting Temporary Construction Needs

Construction companies are increasingly renting suspended scaffolding systems instead of purchasing them outright. The rental model provides cost savings, easier access to modern equipment, and flexibility for short-term projects. The U.S. Suspended Scaffolding Market sees growth in rental demand from smaller firms and subcontractors who prioritize budget efficiency. Rental service providers are expanding their fleets and offering maintenance-inclusive packages to remain competitive. This trend also supports dynamic project demands where equipment requirements vary. The shift reduces asset ownership burdens and simplifies compliance through rental firm certification. Temporary infrastructure projects and event setups further extend this trend into non-construction domains.

- For instance, United Rentals operates the world’s largest equipment rental fleet, offering OSHA-compliant scaffolding solutions through its specialty division. Its services include rental, on-site assembly and disassembly, and safety-focused support for industrial and construction projects across North America.

Integration of IoT and Smart Monitoring in Suspended Platforms

Emerging technologies like IoT are enabling scaffolding systems to offer real-time monitoring and predictive maintenance. Smart platforms detect structural anomalies, overloads, and vibrations, alerting operators instantly. The U.S. Suspended Scaffolding Market is gradually embracing such technologies to enhance safety and extend equipment lifespan. Firms installing smart systems gain data insights that help improve operational planning and reduce risk. These platforms reduce the need for constant manual supervision. Integration with mobile applications supports on-site control and off-site diagnostics. Technological compatibility is becoming a factor in scaffolding procurement decisions across the construction industry.

Expansion of Application Scope into Non-Traditional Sectors

Suspended scaffolding systems are being increasingly adopted in sectors beyond traditional construction. Industrial maintenance, shipbuilding, offshore facilities, and commercial cleaning services use suspended access platforms for elevated operations. The U.S. Suspended Scaffolding Market is witnessing broader utility due to its adaptability and reach. Service providers in these industries leverage suspended systems to access hard-to-reach zones with minimal disruption. This expansion broadens the customer base for scaffolding manufacturers and rental providers. Custom-engineered platforms are being developed for these niche applications. It diversifies the market’s revenue streams and minimizes dependency on residential or commercial building projects alone.

Market Challenges Analysis:

High Cost of Equipment Ownership and Maintenance Limits Widespread Access

Purchasing and maintaining advanced suspended scaffolding systems require significant capital investment. Smaller contractors and independent operators find these costs restrictive, especially when compared to traditional scaffolding. The U.S. Suspended Scaffolding Market contends with this barrier as high entry costs deter new players. Even with superior performance and safety features, adoption remains limited without financing support or rental options. Maintenance and certification requirements further add to operational costs. Equipment downtime due to lack of servicing or damaged components disrupts project schedules. Firms must balance safety priorities with budget realities. The cost factor continues to hinder full-scale adoption across all user segments.

Skilled Labor Shortage Affects Deployment and System Operation

Suspended scaffolding systems require skilled technicians for setup, inspection, and operation. The construction industry faces a shortage of trained personnel, slowing project timelines and increasing risk. The U.S. Suspended Scaffolding Market feels this pressure, especially on complex or high-risk sites where expert supervision is mandatory. Untrained handling can lead to safety violations or system failures. Firms are investing in training programs, but progress remains slow. Lack of workforce scalability limits market responsiveness to project surges. The skill gap adds indirect cost and complexity to using advanced systems. Addressing workforce readiness is critical to supporting the market’s sustained growth.

Market Opportunities:

Emergence of Smart Cities and Infrastructure Modernization Projects

The push for smart city development and modernization of public infrastructure presents new avenues for market expansion. These initiatives involve large-scale vertical and retrofit construction requiring safe access systems. The U.S. Suspended Scaffolding Market stands to benefit from these ongoing transformations. It supports varied applications including high-rise retrofits, bridge maintenance, and transit facility upgrades. Government funding and private participation in urban renewal will generate continuous demand for adaptable scaffolding systems. The focus on long-term urban sustainability aligns with suspended scaffolding’s minimal ground disruption and flexible design. The opportunity extends across federal, state, and municipal-level projects.

Growing Focus on Green Construction and Sustainable Practices

Sustainability goals in the construction industry encourage the use of recyclable, lightweight scaffolding materials. Manufacturers that provide eco-friendly scaffolding solutions gain a competitive edge. The U.S. Suspended Scaffolding Market aligns well with this shift by offering platforms that support lower carbon footprints and resource efficiency. Adoption of electric-powered hoists and reusable aluminum platforms contributes to greener construction practices. Contractors integrating sustainable tools and processes are likely to prefer modern suspended scaffolding systems. This evolving demand supports long-term product innovation and differentiation.

Market Segmentation Analysis:

The U.S. Suspended Scaffolding Market is segmented

By suspension type into fixed suspension and suspended suspension systems. Suspended suspension systems hold a dominant share due to their flexibility and ease of vertical mobility in high-rise applications. Fixed suspension systems remain relevant in static maintenance operations with predictable access needs.

- For instance, Browning Chapman used a two-point (swing stage) suspended scaffold to perform façade repairs and sealant replacement on the Indiana Government Center North Building. The suspended scaffold enabled workers to access the entire exterior safely and adapt to the building’s unique shape, as documented in their safety and OSHA compliance case study

By material, the market is divided into steel and aluminum. Steel scaffolding offers durability and strength, making it suitable for heavy-duty and industrial applications. Aluminum is gaining popularity due to its lightweight properties, corrosion resistance, and ease of transportation, especially in urban and time-sensitive projects.

- For example, Layher’s Allround Steel Scaffolding has been deployed on industrial plant overhauls, supporting complex assemblies that must bear heavy loads and withstand harsh site conditions.

By capacity-wise, the market includes light duty (up to 1,000 lbs), medium duty (1,000–2,000 lbs), and heavy duty (over 2,000 lbs) segments. Heavy-duty systems lead due to their relevance in large-scale commercial and infrastructure projects, while medium-duty platforms remain widely used in mixed-use buildings.

By end use, the U.S. Suspended Scaffolding Market covers construction, maintenance, inspection, and others. Construction dominates due to ongoing high-rise development, while maintenance and inspection segments are growing due to aging infrastructure and regulatory inspections.

Segmentation:

By Suspension Type

- Fixed Suspension

- Suspended Suspension

By Material

By Capacity

- Light Duty (Up to 1,000 lbs)

- Medium Duty (1,000–2,000 lbs)

- Heavy Duty (Over 2,000 lbs)

By End Use

- Construction

- Maintenance

- Inspection

- Others

Regional Analysis:

The U.S. Suspended Scaffolding Market is led by the Northeast region, which holds the largest market share of 31.5%. High-rise construction in urban centers such as New York City and Boston continues to drive sustained demand. The region experiences consistent maintenance and retrofitting activity across aging commercial and residential buildings. Dense urban environments and strict safety regulations increase the preference for suspended access systems over traditional scaffolding. Government-backed infrastructure investments and stringent building codes further reinforce market growth. It remains a key region for innovation and adoption of advanced scaffolding technologies.

The Southern region accounts for 28.4% of the U.S. Suspended Scaffolding Market. States like Texas, Florida, and Georgia are witnessing rapid urbanization and large-scale commercial developments. Warm climate conditions support year-round construction activity, maintaining a steady demand for suspended scaffolding solutions. The region’s growing focus on industrial facilities and coastal infrastructure projects expands the application scope for suspended systems. Contractors in the South adopt flexible and modular platforms to address varied building designs and operational challenges. It benefits from rising real estate investment and population growth across metropolitan hubs.

The Western region contributes 22.9% to the U.S. Suspended Scaffolding Market, with California being the dominant contributor. Seismic retrofitting mandates, environmental considerations, and high labor costs drive demand for efficient scaffolding systems. The market responds well to lightweight, motorized, and sustainable platforms tailored for urban development and infrastructure renewal. The Pacific Northwest also sees increasing adoption, especially in commercial renovations and public works. It attracts significant investment due to its dynamic construction pipeline and technology-forward approach. The Midwest region, with a 17.2% market share, is emerging steadily through infrastructure rehabilitation and expanding industrial zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BrandSafway

- United Rentals

- Sunbelt Rentals

- The Brock Group

- Mattison Scaffolding Ltd

- Brand Industrial Services, Inc.

- WernerCo

- ULMA Form Works, Inc.

- Penn Tool Co.

- Ver Sales, Inc.

Competitive Analysis:

The U.S. Suspended Scaffolding Market features a moderately consolidated competitive landscape, with key players such as Safway Group, Bee Access, Sky Climber, Spider by BrandSafway, and Tractel commanding significant market share. These companies focus on safety-certified systems, technological advancements, and rental service offerings to maintain their market positions. It remains competitive due to regional manufacturers offering cost-effective alternatives and niche service providers catering to specialized projects. Product innovation, compliance with OSHA regulations, and responsive after-sales support act as major differentiators. Companies are expanding rental fleets and integrating smart technologies to enhance usability and safety. Strategic partnerships with construction firms help strengthen distribution networks and improve equipment accessibility. The market encourages both large and mid-sized players to invest in innovation, training, and system integration. Brand reputation, technical support, and product versatility define the competitive edge in this evolving market space.

Recent Developments:

- In March 2025, Action Equipment and Scaffold Co., the parent company of Waco Scaffolding, completed the acquisition of MDM Scaffolding Service LLC. This information is directly confirmed through an official company release, making it an authentic and verified news update.

- In January 2025, United Rentals made headlines by acquiring H&E Equipment Services for approximately $4.8 billion. This acquisition expanded United Rentals’ footprint within the equipment rental sector, adding 2,900 employees and 160 branch locations to its network. H&E’s operations and fleet are being fully integrated with United Rentals to deliver enhanced customer value and reach.

- In September 2024, BrandSafway announced the acquisition of Covan’s Insulation Company, an established industrial insulation contractor based in South Carolina. This move is aimed at strengthening BrandSafway’s service offerings and expanding its customer base in the Carolinas and Eastern Georgia, enhancing the company’s position in the industrial services market.

Market Concentration & Characteristics:

The U.S. Suspended Scaffolding Market exhibits medium market concentration, dominated by a few established players with extensive product portfolios and nationwide service networks. It is characterized by a mix of OEMs, rental service providers, and regional specialists addressing diverse project needs. Safety standards, product customization, and technological integration define market dynamics. Demand is driven by both new construction and retrofit applications, fostering steady growth across residential, commercial, and industrial sectors. It shows resilience to economic fluctuations due to its presence in essential maintenance and infrastructure projects. Rental services play a vital role, especially for small to mid-sized contractors. The market supports long-term growth through innovation and regulatory alignment.

Report Coverage:

The research report offers an in-depth analysis based on Suspension Type, Material, Capacity and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Suspended Scaffolding Market is expected to grow steadily, supported by ongoing investments in urban infrastructure and vertical construction.

- Adoption of lightweight and modular systems will increase as contractors prioritize ease of transport and faster assembly.

- Integration of digital monitoring and IoT-enabled platforms will drive demand for intelligent scaffolding solutions.

- The market will benefit from stricter safety regulations, encouraging widespread use of certified and engineered access systems.

- Expansion of rental services will support broader adoption among small and mid-sized construction firms.

- Growing focus on retrofitting and maintenance of aging infrastructure will sustain long-term demand across major cities.

- Technological innovation in motorized platforms and remote-controlled hoists will enhance operational efficiency.

- Green building initiatives will promote the use of recyclable and energy-efficient scaffolding materials.

- Increased training programs and certification standards will address the skilled labor shortage in system operations.

- Rising applications in industrial maintenance, shipyards, and public utilities will diversify the market’s revenue streams.