Market Overview

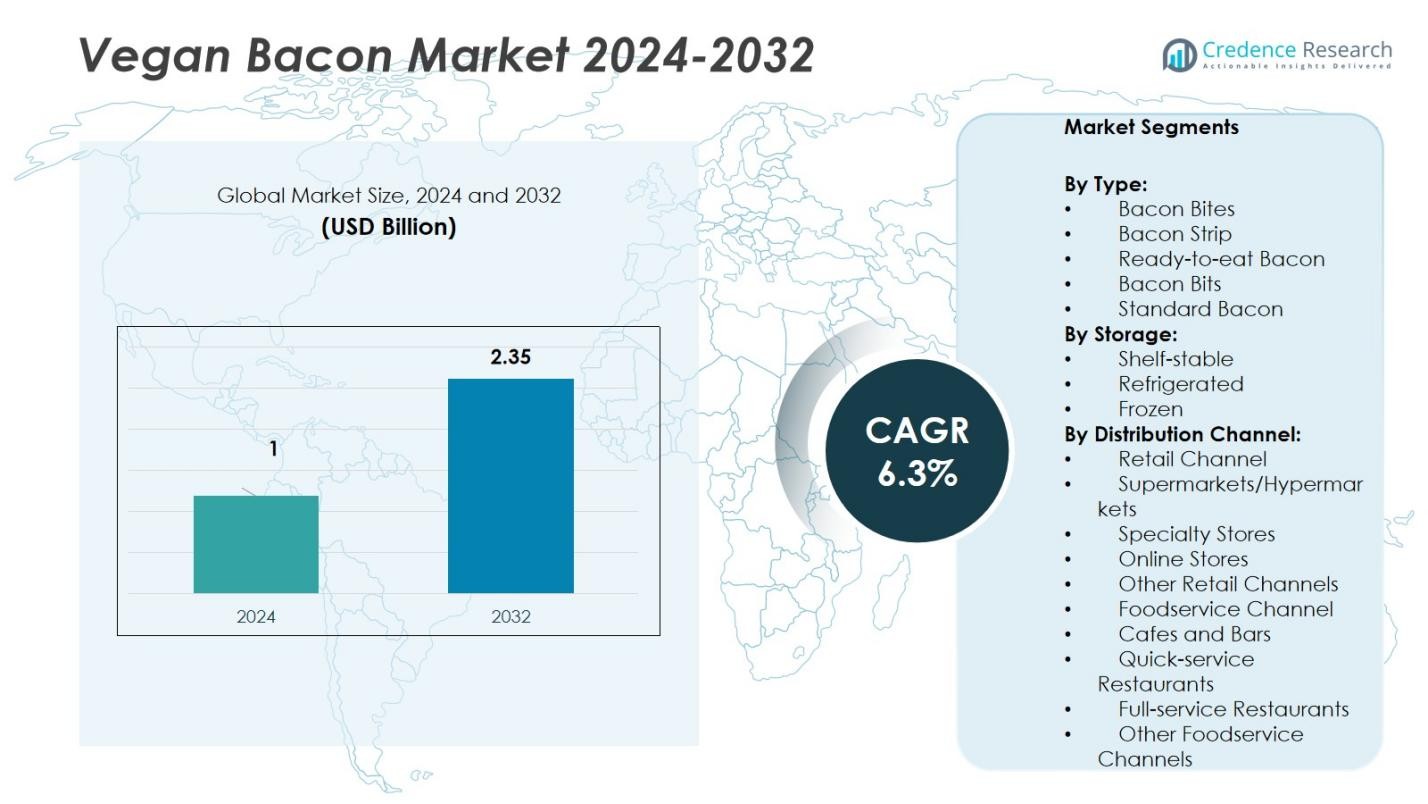

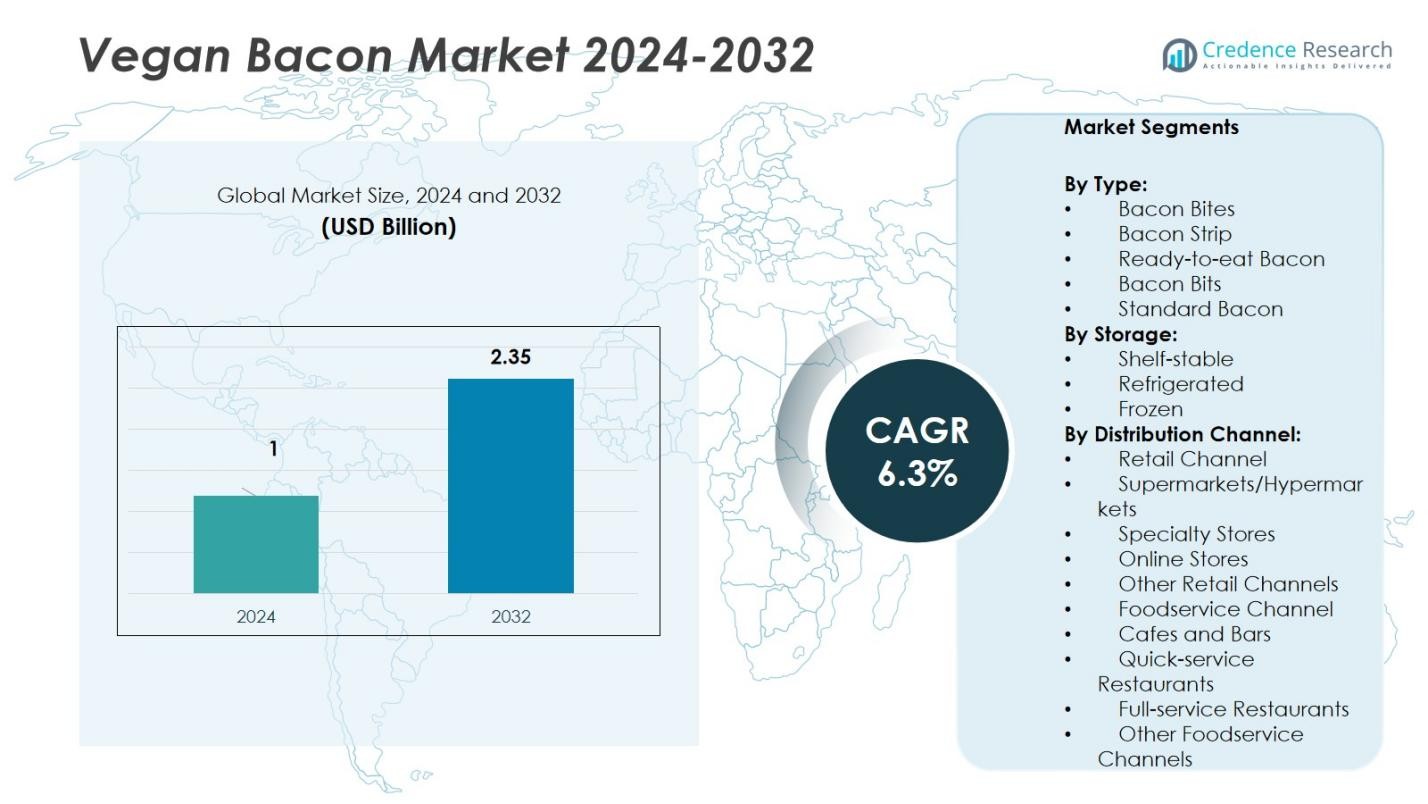

Vegan Bacon Market size was valued USD 1 Billion in 2024 and is anticipated to reach USD 2.35 Billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Bacon Market Size 2024 |

USD 1 Billion |

| Vegan Bacon Market, CAGR |

6.3% |

| Vegan Bacon Market Size 2032 |

USD 2.35 Billion |

The competitive landscape of the Vegan Bacon Market is led by major players such as Beyond Meat, Cool Foods Inc., Hooray Foods, Kellogg NA Co., Omni Foods, Tofurky, LikeMeat GmbH, Upton’s Naturals, Whole Perfect Food and Sweet Earth Foods. These companies leverage robust research and development, strategic alliances, product diversification and strong distribution networks to strengthen their market presence. They emphasise clean‑label credentials, innovative textures and flavours that mirror traditional bacon experiences, appealing to both retail and foodservice channels. North America remains the leading region with an exact market share of 40.1%, reflecting deep consumer adoption of plant‑based meat alternatives and extensive organised retail channels.

Market Insights

Market Insights

- The Vegan Bacon Market size was valued at USD 1 Billion in 2024 and is projected to reach USD 2.35 Billion by 2032, growing at a CAGR of 6.3%.

- Rising adoption of plant-based diets and growing consumer preference for healthier meat alternatives drive market growth globally.

- Increasing integration into cafes, restaurants, and quick-service outlets, along with product innovations in flavor and texture, supports market expansion.

- The market is competitive with key players including Beyond Meat, Cool Foods Inc, Tofurky, Hooray Foods, Kellogg NA Co., Omni Foods, LikeMeat GmbH, Upton’s Naturals, Whole Perfect Food, and Sweet Earth Foods leading product innovation and distribution strategies.

- North America leads with 40.1% market share, followed by Asia-Pacific at 28%, Europe at 22.5%, and Latin America, Middle East & Africa at 9.4%. The Bacon Strip segment dominates with 38% share, while refrigerated storage holds 45%, and supermarkets/hypermarkets capture 40% distribution share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Vegan Bacon Market is led by the Bacon Strip segment, holding 38% share. Its popularity arises from consumer preference for versatile, familiar bacon alternatives that can be cooked or added to dishes easily. Bacon Strip demand is driven by growing plant-based breakfast trends and rising awareness of health-conscious meat substitutes. Ready-to-eat Bacon and Bacon Bites follow, with 22% and 18% share, respectively, catering to convenience-focused consumers. Standard Bacon and Bacon Bits maintain niche demand, mainly in recipe applications. The market benefits from product innovation, flavor variety, and enhanced texture that replicate traditional bacon experience.

- For instance, MyForest Foods experienced a 300% year-on-year sales growth, or a fourfold increase in retail footprint, for its mycelium-based MyBacon in 2024, driven by its unique mushroom-derived texture grown with proprietary AirMycelium technology.

By Storage

Refrigerated products dominate the Vegan Bacon Market with 45% share, owing to their freshness and longer shelf life compared to frozen alternatives. Consumers prefer refrigerated bacon for superior taste, texture, and easy cooking, making it ideal for both retail and foodservice channels. Frozen storage holds 30% share, appealing to bulk buyers and QSRs requiring long-term preservation. Shelf-stable products account for 25% share, often used in packaged meal kits or snack formats. Growing cold-chain infrastructure and expanded retail refrigeration support refrigerated segment growth across North America and Europe.

- For instance, Major retail expansions, such as the initial success of brands like Hooray Foods in securing national distribution in grocery stores, highlighted a growing demand for refrigerated vegan bacon supported by expanding cold-chain infrastructure.

By Distribution Channel

Supermarkets and hypermarkets lead distribution with 40% share, driven by high consumer footfall and organized retail penetration. These channels provide wide product variety, competitive pricing, and promotional activities that enhance market visibility. Online stores follow with 20% share, growing due to e-commerce adoption and home delivery convenience. Specialty stores capture 15% share, serving health-conscious and niche buyers. Foodservice channels collectively hold 25% share, with quick-service restaurants and cafes driving adoption of plant-based bacon in menu offerings. Strategic partnerships and product launches further stimulate market penetration across these channels.

Key Growth Drivers

Rising Adoption of Plant-Based Diets

Consumer preference for plant-based and flexitarian diets drives the Vegan Bacon Market. Health-conscious buyers increasingly choose meat alternatives to reduce cholesterol, saturated fat, and overall calorie intake. Environmental awareness and sustainability concerns further encourage adoption, positioning vegan bacon as a favorable protein source. Expansion in product variety, taste, and texture enhances appeal among both traditional and modern consumers. This shift boosts demand across retail and foodservice channels globally, supporting consistent market growth and prompting manufacturers to innovate in flavors, packaging, and cooking convenience.

- For instance, UK brand Squeaky Bean launched ready-to-eat crispy vegan bacon strips in 2024, offering a sweet and salty taste with the same characteristic streaks and crispy texture as real bacon, making it a convenient option for consumers.

Expansion of Foodservice Channels

The Vegan Bacon Market benefits from increasing integration into restaurants, cafes, and quick-service outlets. Rising menu diversification and consumer demand for plant-based options encourage foodservice providers to adopt vegan bacon. Full-service restaurants and QSRs promote it in sandwiches, wraps, and breakfast items, expanding market visibility. Partnerships with major chains and menu innovations stimulate trial and repeat purchases. Growing foodservice distribution complements retail growth, providing multiple touchpoints for consumers. This broad channel expansion strengthens market penetration, brand recognition, and revenue generation across regions.

- For instance, UK-based THIS™ announced collaboration with the popular café chain Caffè Nero, introducing vegan bacon as a key ingredient in their breakfast rolls, which led to an expanded plant-based menu and a reported 23% increase in vegan food sales for the chain.

Technological Advancements and Product Innovation

Advances in plant-based protein processing and flavoring technologies enhance the market’s growth prospects. Manufacturers replicate bacon taste, texture, and cooking characteristics using soy, pea, or wheat proteins. Innovations in ready-to-eat, shelf-stable, and refrigerated formats cater to convenience-seeking consumers. Functional and clean-label product offerings meet regulatory and consumer expectations for healthier alternatives. Continuous R&D supports differentiation in premium and mainstream segments, driving market expansion. Investment in scalable production and quality control ensures consistent supply, fostering trust and long-term adoption in both retail and foodservice channels.

Key Trends & Opportunities

Integration with Online Retail and E-Commerce

The growing popularity of e-commerce provides opportunities for vegan bacon manufacturers to reach wider audiences. Consumers increasingly purchase plant-based foods online for convenience, subscription services, and home delivery. Digital marketing and direct-to-consumer models enable product awareness, trial, and brand loyalty. Online platforms also facilitate international expansion, connecting regional producers with global markets. Enhanced packaging, promotions, and subscription options encourage repeat purchases. This trend aligns with urban lifestyle changes and supports premium product launches, expanding overall market size while strengthening visibility in emerging consumer segments.

- For instance, Geo D Foods, an online retailer, offers shelf-stable, pre-cooked vegan bacon that caters to diverse dietary preferences, including vegan, halal, and kosher consumers, enhancing convenience and broad market reach.

Expansion into Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth potential. Rising health awareness, urbanization, and disposable income fuel plant-based product adoption. Localized flavor innovation and retail partnerships increase accessibility. Government initiatives promoting sustainable food production and plant-based diets further support market entry. Manufacturers targeting these regions can leverage e-commerce and organized retail to reach diverse consumer groups. Expansion in these markets provides revenue diversification, reduces dependency on mature regions, and accelerates long-term market growth, establishing new consumer bases for vegan bacon globally.

- For instance, in Latin America, Brazilian startup Fazenda Futuro expanded its plant-based meat alternatives, including burgers and sausages, across multiple countries such as Chile and Mexico, strengthening its regional footprint.

Key Challenges

High Production Costs

Premium ingredients, advanced processing techniques, and stringent quality standards contribute to elevated production costs in vegan bacon manufacturing. These costs limit price competitiveness against conventional bacon, affecting affordability and consumer adoption in cost-sensitive regions. Supply chain complexities for plant-based proteins and specialty flavoring add operational challenges. Price fluctuations in raw materials, packaging, and cold-chain logistics further impact margins. Manufacturers must balance quality and cost efficiency while maintaining taste and texture standards. High production expenses may slow expansion in emerging markets, posing a challenge for scaling operations globally.

Regulatory Compliance and Labeling Constraints

The Vegan Bacon Market faces regulatory hurdles regarding labeling, health claims, and food safety standards. Varying regulations across regions require strict adherence to ingredient disclosure, allergen labeling, and certification. Mislabeling or non-compliance risks recalls, fines, and reputational damage. Meeting diverse regional standards increases operational complexity and cost. Companies must ensure transparency and traceability throughout production and distribution. Compliance challenges may slow product launches, limit marketing claims, and affect global expansion strategies, requiring robust legal, regulatory, and quality assurance frameworks to sustain market growth.

Regional Analysis

North America

The North America region holds a 40.1% share of the global vegan bacon market in 2025. This dominance stems from strong consumer demand for plant‑based diets, widespread retail channels, and high engagement in foodservice innovations. Manufacturers and brands invest heavily in both product development and marketing, pushing vegan bacon into mainstream breakfast items and restaurant menus. The well‑established cold‑chain infrastructure supports refrigerated and frozen formats, while e‑commerce growth broadens access. North America represents both a mature base and a testbed for premium launches and branding strategies.

Europe

Europe accounts for 22.5% of the global vegan bacon market. The region benefits from high vegan and flexitarian consumer prevalence, strong sustainability policy frameworks, and a robust retail presence of plant‑based alternatives. Supermarkets and specialty stores actively broaden shelf‑space, and foodservice outlets integrate vegan bacon into breakfast and snack menus. Growth in Western Europe is complemented by emerging opportunities in Eastern Europe, though overall infrastructure and consumer awareness vary by country.

Asia‑Pacific

The Asia‑Pacific region holds a 28% share of the vegan bacon market. Rising urbanisation, increasing disposable incomes, and growing health and environmental awareness fuel demand for vegan bacon in markets such as China, India, and Southeast Asia. Local manufacturers are emerging, and e‑commerce platforms enable reach into underserved areas. Challenges remain in limited cold‑chain logistics and price sensitivity, but the region presents high growth potential for both global and local brands.

Latin America, Middle East & Africa (LAMEA)

The combined Latin America, Middle East, and Africa region holds 9.4% share of the global vegan bacon market. Market growth in these regions is supported by increasing vegetarian and flexitarian populations, rising awareness of plant‑based options, and expanding organised retail and online channels. However, distribution infrastructure, consumer taste preferences, and cost constraints present hurdles. For businesses, LAMEA offers strategic opportunities for first‑mover advantage and localisation of flavour profiles to drive adoption.

Market Segmentations:

By Type:

- Bacon Bites

- Bacon Strip

- Ready-to-eat Bacon

- Bacon Bits

- Standard Bacon

By Storage:

- Shelf-stable

- Refrigerated

- Frozen

By Distribution Channel:

- Retail Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

- Other Retail Channels

- Foodservice Channel

- Cafes and Bars

- Quick-service Restaurants

- Full-service Restaurants

- Other Foodservice Channels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Vegan Bacon Market is dominated by key players including Beyond Meat, Cool Foods Inc, Tofurky, Hooray Foods, Kellogg NA Co., Omni Foods, LikeMeat GmbH, Upton’s Naturals, Whole Perfect Food, and Sweet Earth Foods. These companies leverage strong R&D capabilities, innovative product portfolios, and strategic partnerships to maintain market leadership. They focus on enhancing flavor, texture, and convenience of plant-based bacon, catering to both retail and foodservice segments. Supermarkets, specialty stores, and e-commerce platforms serve as critical distribution channels for market expansion. Competitive strategies also include sustainability initiatives, premium and ready-to-eat product launches, and aggressive marketing campaigns to increase brand recognition. Smaller regional players increasingly adopt localized flavors and affordable pricing to capture niche markets. The overall market remains dynamic, with continuous innovation and partnerships driving growth, while companies strive to differentiate products amid rising consumer demand for plant-based alternatives.

Key Player Analysis

- Sweet Earth Foods

- Hooray Foods

- Omni Foods

- Cool Foods Inc

- LikeMeat GmbH

- Beyond Meat

- Tofurky

- Whole Perfect Food

- Upton’s Naturals

- Kellogg NA Co.

Recent Developments

- In October 2024, Sweet Earth Foods launched a new line of vegan bacon slabs featuring patented marbling technology to enhance texture and appeal.

- In June 2025, Plukon Food Group B.V. acquired Vega Insiders (a company that produces vegan bacon strips among other products) to strengthen its alternative‑protein portfolio.

- In October 2025, Impossible Foods introduced a ready‑to‑cook vegan bacon product with clean‑label ingredients and improved texture, aimed at sandwiches, breakfast items, and snack formats.

- In November 2025, Beyond Meat launched a new smoky vegan bacon strip for retail and foodservice channels, delivering enhanced flavor and crispiness to attract health‑conscious and flexitarian consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Storage, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with increasing adoption of plant-based diets globally.

- Expansion in retail and e-commerce channels will drive wider product availability.

- Foodservice integration in cafes, restaurants, and QSRs will boost demand.

- Product innovation in flavor, texture, and convenience will strengthen market appeal.

- Sustainable and clean-label formulations will attract environmentally conscious consumers.

- Growth in emerging markets will create new revenue opportunities.

- Strategic partnerships and collaborations will enhance brand presence and distribution.

- Ready-to-eat and frozen formats will gain popularity among convenience-seeking consumers.

- Marketing campaigns and consumer awareness programs will support trial and adoption.

- Technological advancements in processing and preservation will improve product quality and shelf-life.

Market Insights

Market Insights