Market Overview:

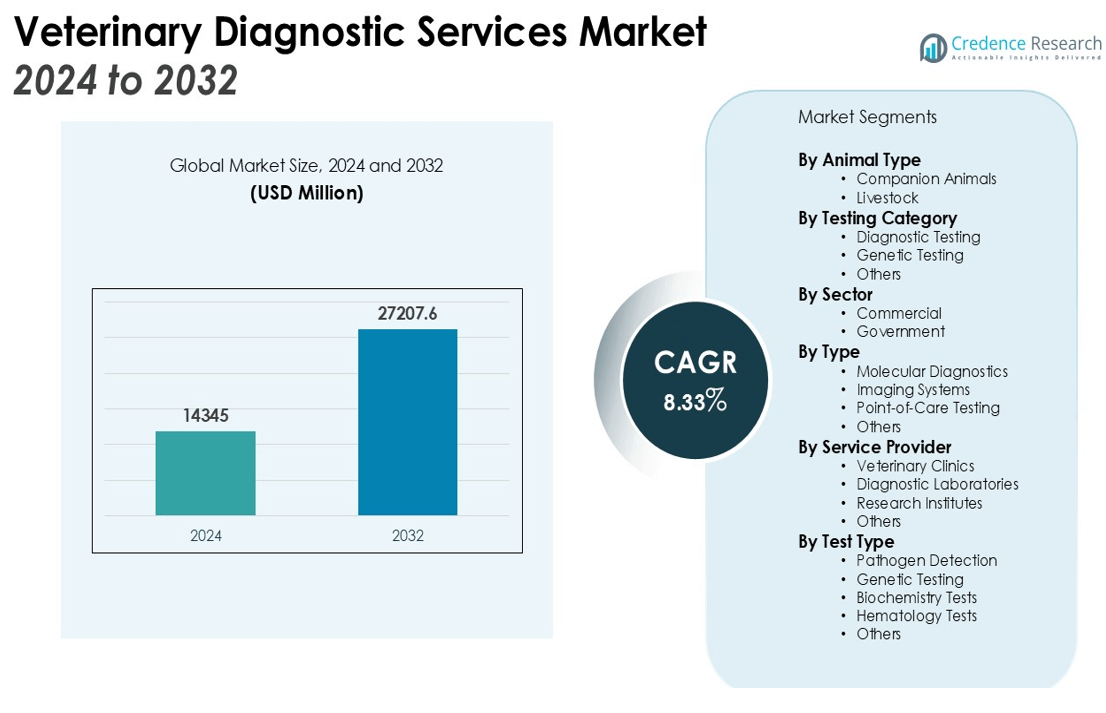

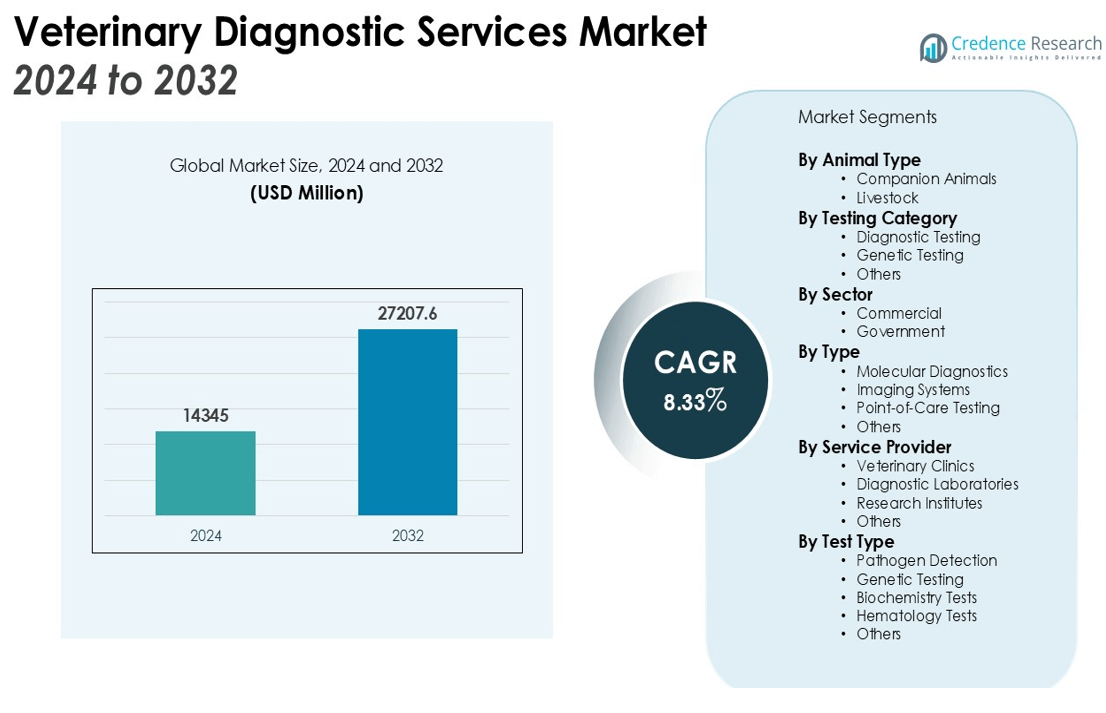

The Veterinary Diagnostic Services Market size was valued at USD 14345 million in 2024 and is anticipated to reach USD 27207.6 million by 2032, at a CAGR of 8.33% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Veterinary Diagnostic Services Market Size 2024 |

USD 14345 million |

| Veterinary Diagnostic Services Market, CAGR |

8.33% |

| Veterinary Diagnostic Services Market Size 2032 |

USD 27207.6 million |

Key drivers of the market include advancements in diagnostic technology, including molecular diagnostics, imaging systems, and point-of-care testing devices. Additionally, the increasing focus on preventive healthcare and the rising awareness among pet owners about animal health contribute to the market’s growth. Furthermore, the expanding veterinary healthcare infrastructure and government support for animal health are expected to drive demand for diagnostic services. The growing prevalence of zoonotic diseases also adds pressure on the veterinary healthcare system, further boosting the demand for diagnostic services.

Geographically, North America dominates the veterinary diagnostic services market, owing to the high adoption of pet care services and advanced healthcare infrastructure in the region. Europe holds the second-largest share, driven by increasing pet ownership and a rising number of veterinary clinics. The Asia Pacific region is expected to witness the fastest growth during the forecast period, fueled by increasing awareness of animal health, improving veterinary care facilities, and rising disposable incomes in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Veterinary Diagnostic Services Market was valued at USD 14345 million in 2024 and is expected to reach USD 27207.6 million by 2032, growing at a CAGR of 8.33% during the forecast period.

- Key drivers of market growth include advancements in diagnostic technologies such as molecular diagnostics, imaging systems, and point-of-care testing devices, all of which enable faster and more accurate disease detection.

- The increasing awareness of preventive healthcare among pet owners has significantly boosted the demand for veterinary diagnostic services, with more pet owners seeking early disease detection to prevent long-term health issues.

- Government support for animal health and ongoing regulatory advancements contribute to market growth, encouraging the use of more sophisticated diagnostic tools and infrastructure improvements.

- North America held 40% of the global market share in 2024, driven by high adoption rates of pet care services, advanced healthcare infrastructure, and widespread use of diagnostic technologies.

- Europe accounted for 30% of the market share in 2024, with growing pet ownership and the adoption of advanced diagnostic technologies driving steady growth in veterinary diagnostic services.

- The Asia-Pacific region, holding 15% of the market share in 2024, is expected to witness the fastest growth due to rising pet ownership, increasing awareness of animal health, and expanding veterinary care infrastructure.

Market Drivers:

Advancements in Diagnostic Technology

The growth of the Veterinary Diagnostic Services Market is largely driven by significant advancements in diagnostic technology. Innovations in molecular diagnostics, imaging systems, and point-of-care testing devices have revolutionized the way veterinary diseases are diagnosed. These technologies enable faster, more accurate detection, improving the overall efficiency of veterinary healthcare. As a result, veterinary clinics and diagnostic labs are adopting these cutting-edge technologies to enhance diagnostic accuracy and treatment outcomes, thereby driving the market’s expansion.

- For instance, veterinary diagnostic laboratories like NC State University’s Vector Borne Disease Diagnostic Laboratory utilize PCR testing with a turnaround time of about 10 business days from when the sample is received.

Increasing Awareness of Preventive Healthcare for Animals

There is a growing emphasis on preventive healthcare in the veterinary industry, which plays a crucial role in expanding the Veterinary Diagnostic Services Market. Pet owners are becoming more aware of the importance of regular health check-ups and early disease detection for their animals. This shift in attitude has led to an increase in the demand for diagnostic services, as pet owners seek to prevent potential health issues before they escalate into more serious conditions. Veterinary diagnostic services are becoming an integral part of routine animal healthcare.

Government Support and Regulatory Advancements

Government initiatives aimed at improving animal healthcare systems contribute to the growth of the Veterinary Diagnostic Services Market. Many governments across the globe are increasing their investments in animal health to combat zoonotic diseases and improve overall veterinary care. These investments support the development and implementation of advanced diagnostic technologies, which enhance the capacity of veterinary diagnostic services. Regulatory advancements also encourage the use of more sophisticated and efficient diagnostic tools in veterinary practices.

- For instance, Zoetis’s VETSCAN HM5, a veterinary hematology analyzer, enhances in-clinic diagnostics by providing a full, 5-part CBC differential in less than 4 minutes.

Rising Pet Ownership and Veterinary Care Infrastructure

The rise in global pet ownership has led to an increased need for veterinary diagnostic services. As more people adopt pets, the demand for specialized veterinary care grows. The expanding veterinary healthcare infrastructure, particularly in emerging economies, is another key driver of the market. Veterinary clinics and diagnostic centers are being established at an increasing rate, especially in regions with rising disposable incomes, further boosting demand for high-quality diagnostic services.

Market Trends:

Growing Adoption of Point-of-Care Diagnostic Devices

A key trend in the Veterinary Diagnostic Services Market is the increasing adoption of point-of-care (POC) diagnostic devices. These devices enable veterinary professionals to conduct real-time tests and obtain immediate results, improving the efficiency of diagnostics and treatment decisions. POC technologies, including portable ultrasound devices, rapid diagnostic tests, and handheld imaging systems, are becoming widely integrated into veterinary practices. This trend is driven by the growing demand for faster and more convenient diagnostic solutions. It reduces the need for extensive laboratory testing and enhances overall clinical workflows, especially in emergency or rural settings where access to centralized labs is limited. The shift towards these solutions is expected to continue as technology advances, making them more affordable and accessible.

- For instance, IDEXX Laboratories offers the IDEXX inVue Dx Cellular Analyzer, which provides automated blood morphology and ear cytology results with reference laboratory-level accuracy within 10 minutes.

Expansion of Molecular Diagnostics and Advanced Imaging Solutions

Another notable trend shaping the Veterinary Diagnostic Services Market is the expansion of molecular diagnostics and advanced imaging solutions. Molecular diagnostics, such as PCR testing, allow for highly accurate and detailed disease detection at the genetic level. These methods are increasingly being used to diagnose infectious diseases, genetic disorders, and cancers in animals. Advanced imaging solutions, including MRI and CT scans, are also gaining traction for their ability to provide detailed internal images that assist in diagnosing complex conditions. The use of these sophisticated technologies is transforming veterinary care, enabling earlier detection of diseases and more precise treatments. This trend highlights the growing need for specialized, high-tech diagnostic services within the veterinary healthcare industry.

- For instance, Thermo Fisher Scientific offers the VetMAX-Gold BVDV PI Detection Kit, a USDA-licensed real-time PCR test for bovine viral diarrhea virus (BVDV) that delivers results in approximately 1.5 hours.

Market Challenges Analysis:

High Cost of Advanced Diagnostic Technologies

One of the significant challenges facing the Veterinary Diagnostic Services Market is the high cost of advanced diagnostic technologies. While innovations such as molecular diagnostics and advanced imaging solutions have revolutionized animal healthcare, their adoption is often limited by the high initial investment required for equipment. Many veterinary practices, especially in developing regions, may struggle to afford these sophisticated tools, leading to unequal access to cutting-edge diagnostic services. The high costs also extend to maintenance, training, and the need for specialized personnel, which can further strain financial resources in smaller clinics and rural areas. This financial barrier slows the widespread adoption of these technologies, limiting the growth potential of the market.

Lack of Skilled Workforce and Training Programs

Another challenge impacting the Veterinary Diagnostic Services Market is the shortage of skilled professionals and the lack of comprehensive training programs. The effective use of advanced diagnostic tools requires specialized knowledge and expertise, which is often in short supply. Veterinary technicians and diagnostic professionals need proper training to operate complex devices such as molecular diagnostic equipment and imaging systems. However, the availability of quality education and certification programs for these advanced technologies is limited, especially in emerging markets. This shortage of trained professionals can hinder the delivery of high-quality diagnostic services, creating a gap in the market’s ability to meet growing demand.

Market Opportunities:

High Cost of Advanced Diagnostic Technologies

One of the significant challenges facing the Veterinary Diagnostic Services Market is the high cost of advanced diagnostic technologies. While innovations such as molecular diagnostics and advanced imaging solutions have revolutionized animal healthcare, their adoption is often limited by the high initial investment required for equipment. Many veterinary practices, especially in developing regions, may struggle to afford these sophisticated tools, leading to unequal access to cutting-edge diagnostic services. The high costs also extend to maintenance, training, and the need for specialized personnel, which can further strain financial resources in smaller clinics and rural areas. This financial barrier slows the widespread adoption of these technologies, limiting the growth potential of the market.

Lack of Skilled Workforce and Training Programs

Another challenge impacting the Veterinary Diagnostic Services Market is the shortage of skilled professionals and the lack of comprehensive training programs. The effective use of advanced diagnostic tools requires specialized knowledge and expertise, which is often in short supply. Veterinary technicians and diagnostic professionals need proper training to operate complex devices such as molecular diagnostic equipment and imaging systems. However, the availability of quality education and certification programs for these advanced technologies is limited, especially in emerging markets. This shortage of trained professionals can hinder the delivery of high-quality diagnostic services, creating a gap in the market’s ability to meet growing demand.

Market Segmentation Analysis:

By Animal Type

The Veterinary Diagnostic Services Market is divided into companion animals and livestock. Companion animals, including dogs, cats, and horses, hold the largest share due to the rising pet ownership and increased focus on pet healthcare. This segment is driven by pet owners’ growing awareness of preventive care and the demand for specialized veterinary services. Livestock diagnostics, particularly in agriculture-driven economies, also play a critical role in ensuring the health of animals for food production, disease control, and overall farm management.

- For instance, Zoetis’s Vetscan Imagyst® is the first of its kind, offering 7 applications on a single AI-powered diagnostic platform.

By Testing Category

The market is further segmented into diagnostic testing, genetic testing, and other testing categories. Diagnostic testing, which includes molecular diagnostics, imaging, and point-of-care testing, leads the market, driven by its efficiency and accuracy in diagnosing common and complex animal diseases. Genetic testing is witnessing growth due to its ability to identify genetic predispositions and improve breeding programs for companion animals and livestock. Other testing, such as pathogen detection and environmental monitoring, also plays a key role in disease prevention and ensuring animal health.

- For instance, IDEXX Laboratories has expanded its Catalyst® platform with 10 new menu additions since 2012, enhancing its diagnostic testing capabilities.

By Sector

The Veterinary Diagnostic Services Market is segmented into commercial and government sectors. The commercial sector, which includes veterinary clinics, diagnostic labs, and pet care services, holds the largest market share. The rise in the number of veterinary clinics and diagnostic centers worldwide is a primary driver of this sector’s growth. The government sector focuses mainly on livestock health management, disease surveillance, and ensuring food safety, which is critical for rural and agricultural regions.

Segmentations:

By Animal Type:

- Companion Animals

- Livestock

By Testing Category:

- Diagnostic Testing

- Genetic Testing

- Others

By Sector:

By Type:

- Molecular Diagnostics

- Imaging Systems

- Point-of-Care Testing

- Others

By Service Provider:

- Veterinary Clinics

- Diagnostic Laboratories

- Research Institutes

- Others

By Test Type:

- Pathogen Detection

- Genetic Testing

- Biochemistry Tests

- Hematology Tests

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading Market in Veterinary Diagnostic Services

North America accounted for 40% of the Veterinary Diagnostic Services Market in 2024, driven by its advanced healthcare infrastructure and high pet ownership rates. The widespread adoption of diagnostic technologies, such as molecular diagnostics and imaging systems, has been a key factor in the market’s growth. In this region, both public and private sectors support the integration of innovative diagnostic tools into everyday veterinary practices. North America’s well-established regulatory frameworks and focus on preventive healthcare further fuel market expansion, solidifying its dominant position in the global market.

Europe: Steady Growth and Technological Integration

Europe captured 30% of the Veterinary Diagnostic Services Market in 2024, supported by a strong veterinary care network and a growing pet population. Countries such as Germany, the UK, and France are leading the adoption of advanced diagnostic technologies, including PCR testing and digital imaging. Increased awareness of animal health and an emphasis on preventive diagnostics contribute to the region’s steady growth. The European market is further bolstered by government initiatives that promote animal welfare and encourage the adoption of cutting-edge diagnostic technologies, strengthening its position within the global market.

Asia-Pacific: Rapid Growth and Expanding Opportunities

The Asia-Pacific region held 15% of the Veterinary Diagnostic Services Market in 2024 but is expected to witness the fastest growth during the forecast period. Rising disposable incomes, urbanization, and an increasing awareness of animal health are key factors driving demand for veterinary services. Countries like China, India, and Japan are experiencing a surge in pet ownership, fueling the need for veterinary care and diagnostic services. As infrastructure improves and adoption of diagnostic technologies increases, the region presents significant growth opportunities for market players, positioning it as an emerging hub in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IDEXX

- Neogen Corporation

- Zoetis Services LLC

- Antech Diagnostics, Inc. (Mars, Inc.)

- NationWide Laboratories

- Agrolabo S.p.A.

- Esaote SPA

- Ellie Diagnostics

- FUJIFILM Corporation

- Thermo Fisher Scientific, Inc.

Competitive Analysis:

The Veterinary Diagnostic Services Market is highly competitive, with key players such as IDEXX Laboratories, Zoetis, and Roche Diagnostics leading the way by offering advanced diagnostic solutions, including molecular diagnostics, imaging systems, and point-of-care devices. These companies prioritize research and development to enhance diagnostic accuracy and expand service offerings. Smaller players also carve out their niches by focusing on specialized diagnostic tools or regional services. Strategic partnerships between veterinary clinics, diagnostic labs, and research institutions further drive innovation. The growing demand for preventive healthcare and early disease detection increases competition as companies strive to provide cost-effective solutions. Regional expansion into emerging markets offers significant growth opportunities, allowing players to tap into previously underserved customer bases.

Recent Developments:

- In August 2025, Zoetis announced its second-quarter 2025 financial results, which included revenue of $2.5 billion, and raised its full-year guidance.

- In April 2023, Mars, Incorporated announced a definitive agreement to acquire Heska Corporation, a global provider of advanced veterinary diagnostics, which will join the Science & Diagnostics division of Mars Petcare alongside Antech.

- In January 2025, IDEXX Laboratories announced the launch of IDEXX Cancer Dx™, a diagnostic panel designed for the early detection of canine lymphoma, which became available in the U.S. and Canada in late March 2025.

Market Concentration & Characteristics:

The Veterinary Diagnostic Services Market is moderately concentrated, with a few large players dominating the space, including IDEXX Laboratories, Zoetis, and Roche Diagnostics. These companies leverage their advanced technological capabilities, extensive product portfolios, and strong market presence to maintain leadership. Smaller, regional players also contribute to the market by offering specialized services or focusing on local customer needs. The market is characterized by high competition in diagnostic technology, with a focus on improving accuracy, speed, and cost-effectiveness. Companies invest heavily in research and development to innovate and maintain their competitive edge. The increasing demand for preventive healthcare and early diagnosis continues to drive the market, prompting both established and new entrants to adapt quickly to changing customer preferences and technological advancements.

Report Coverage:

The research report offers an in-depth analysis based on Animal Type, Testing Category, Sector, Type, Service Provider, Test Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for advanced diagnostic technologies, such as molecular diagnostics and imaging systems, will continue to grow, enhancing diagnostic accuracy and treatment outcomes.

- Increasing pet ownership and the rising awareness of preventive healthcare will drive consistent growth in the companion animal diagnostic services market.

- Livestock health management will become more critical, especially in emerging economies, leading to a rise in demand for veterinary diagnostic services in agriculture.

- Technological advancements in point-of-care testing and portable diagnostic devices will improve accessibility to veterinary services, particularly in rural and underserved areas.

- Government initiatives focused on animal health, particularly in emerging markets, will create opportunities for veterinary diagnostic service providers to expand their reach.

- The growing prevalence of zoonotic diseases will further accelerate the need for effective animal disease detection and surveillance systems.

- Expansion of veterinary healthcare infrastructure in developing regions will increase access to high-quality diagnostic services for both pets and livestock.

- The rise of telemedicine and remote diagnostics will offer new ways for veterinary care, reducing the need for in-person visits and expanding diagnostic capabilities.

- Partnerships between diagnostic service providers, veterinary clinics, and research institutions will foster innovation and improve service delivery.

- Increased investment in training and development of skilled veterinary professionals will support the growth of the market and ensure the effective use of advanced diagnostic technologies.