Market Overview

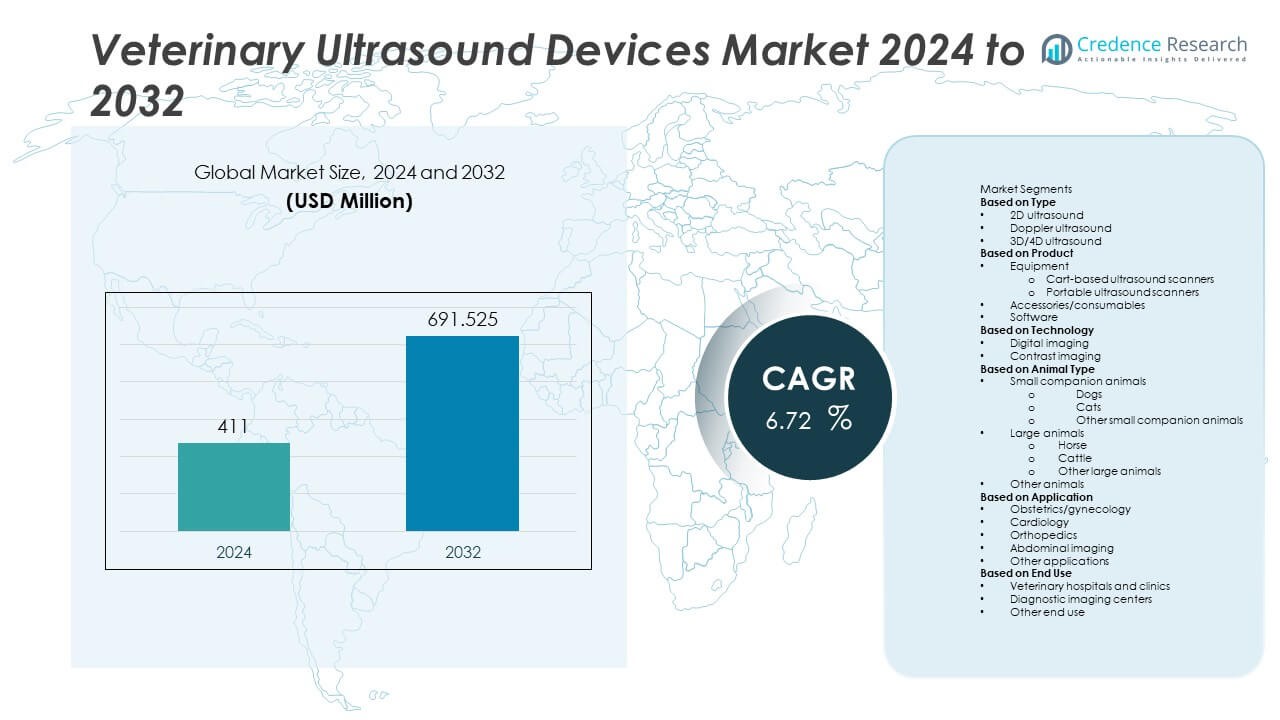

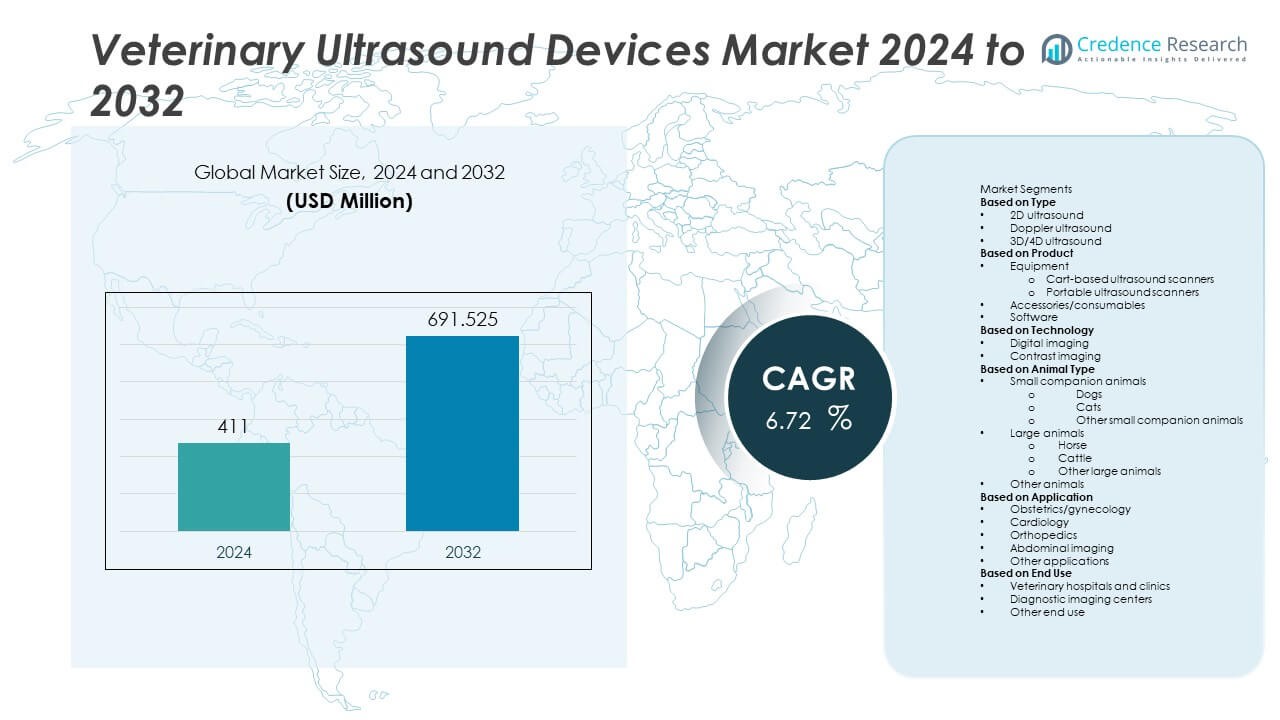

The Veterinary Ultrasound Devices Market was valued at USD 411 million in 2024 and is projected to reach USD 691.525 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 6.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veterinary Ultrasound Devices Market Size 2024 |

USD 411 Million |

| Veterinary Ultrasound Devices Market, CAGR |

6.72% |

| Veterinary Ultrasound Devices Market Size 2032 |

USD 691.525 Million |

The Veterinary Ultrasound Devices Market is driven by rising pet ownership, increasing demand for non-invasive diagnostics, and growing awareness of animal health. Advancements in portable and AI-enabled ultrasound systems support broader adoption across both urban clinics and rural practices.

The Veterinary Ultrasound Devices Market demonstrates strong regional presence in North America, Europe, and Asia Pacific, driven by advanced veterinary infrastructure, rising pet ownership, and increasing livestock management needs. North America leads in technology adoption and clinical integration, while Europe shows steady demand supported by stringent animal health regulations. Asia Pacific is witnessing rapid growth due to expanding veterinary services in both urban and rural areas, particularly in countries like China and India. Latin America and the Middle East & Africa are emerging regions, showing growing interest in portable and cost-effective ultrasound solutions. Key players shaping the market include GE Healthcare, known for its robust imaging portfolio, Esaote, which offers specialized veterinary ultrasound systems, and Shenzhen Mindray Animal Medical Technology, recognized for its advanced yet affordable solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Veterinary Ultrasound Devices Market was valued at USD 411 million in 2024 and is expected to reach USD 691.5 million by 2032, growing at a CAGR of 6.72% during the forecast period.

- The market is driven by rising pet ownership, increased livestock monitoring needs, and the growing demand for early and accurate diagnostic tools in veterinary care.

- There is a strong shift toward portable and handheld ultrasound devices, as veterinarians prefer compact systems with wireless capabilities for greater flexibility in field operations.

- Companies are investing in AI-based imaging enhancements and real-time cloud connectivity, improving diagnosis speed and accuracy in both large and small animal practices.

- High initial costs of advanced ultrasound equipment and a lack of skilled operators in rural areas limit adoption, especially in developing countries.

- North America leads the market due to well-established veterinary infrastructure, followed by Europe, while Asia Pacific is witnessing rapid growth due to rising pet adoption and expanding veterinary services in China and India.

- Leading players such as GE Healthcare, IMV Technologies, Mindray Medical, Esaote, and Fujifilm Sonosite dominate the competitive landscape by expanding their product portfolios, launching AI-integrated devices, and strengthening distribution networks globally.

Market Drivers

Rising Pet Ownership and Growing Awareness of Animal Health Fuel Market Expansion

The Veterinary Ultrasound Devices Market benefits significantly from the increasing number of companion animals and heightened awareness about animal healthcare. Pet owners are becoming more attentive to preventive diagnostics and regular health checkups, which boosts the demand for advanced diagnostic tools. Veterinary clinics and hospitals are investing in ultrasound devices to improve diagnostic capabilities. It supports early disease detection, leading to faster and more accurate treatment. This trend is especially strong in developed countries, where pet humanization drives higher healthcare spending. The market is responding to this shift with improved product accessibility and tailored features for small animals.

- For instance, GE launched a portable veterinary ultrasound system with AI-assisted diagnostics and achieved over 6,000 unit sales globally within the first nine months of 2024.

Increased Demand for Efficient and Non-Invasive Diagnostic Tools Supports Adoption

Veterinary professionals prefer ultrasound devices for their non-invasive nature and real-time imaging benefits. It allows for detailed internal examinations without the need for surgical procedures, making it a preferred diagnostic method. The Veterinary Ultrasound Devices Market continues to gain traction in both companion and livestock segments due to its safety and accuracy. Farmers and livestock owners also seek these tools to monitor reproductive health and improve breeding efficiency. Real-time data collection supports timely intervention in animal health management. This functional advantage increases device adoption across rural and urban settings.

- For instance, IMV Imaging introduced the Easi-Scan:Go Curve wireless bovine ultrasound scanner, which weighs 1.1 kg and connects via a 5 GHz Wi-Fi link to smart devices, enabling real-time reproductive imaging for livestock veterinarians directly in-field, significantly reducing diagnostic time and increasing breeding success rates.

Technological Advancements and Portability Drive Clinical Integration

Ongoing innovation in ultrasound technology contributes to stronger clinical integration across veterinary facilities. It includes the development of portable, wireless, and battery-operated ultrasound machines that enhance mobility and usability. The Veterinary Ultrasound Devices Market benefits from these innovations, making devices more accessible in field conditions and remote locations. Improved software with image enhancement and cloud-based storage strengthens diagnostic precision. Manufacturers are focusing on compact and user-friendly designs to cater to veterinarians with diverse practice needs. These advancements make ultrasound a standard tool in modern veterinary care.

Expanding Livestock Sector and Preventive Veterinary Care Boost Demand

The global livestock industry plays a crucial role in strengthening demand for veterinary diagnostics. It relies on ultrasound devices to ensure herd health, reproductive success, and disease control. The Veterinary Ultrasound Devices Market supports preventive veterinary care practices that minimize productivity losses. Government programs promoting animal health and food safety further encourage diagnostic infrastructure in rural areas. It helps maintain livestock health standards, particularly in economies dependent on animal-based agriculture. The market responds to these needs with scalable and rugged solutions fit for field applications.

Market Trends

Increased Adoption of Handheld and Portable Devices Across Clinical Settings

Veterinary clinics and mobile practitioners are shifting toward handheld and portable ultrasound systems for convenience and flexibility. These compact devices allow real-time diagnosis in the field, reducing the need for animal transport. The Veterinary Ultrasound Devices Market reflects this trend through rising demand for wireless and battery-powered units. It supports more efficient care, especially for large animals in rural and agricultural areas. Portability also enables faster diagnostic turnaround, which enhances treatment outcomes. Manufacturers are focusing on integrating lightweight designs without compromising image quality.

- For instance, Clarius Mobile Health offers a wireless handheld veterinary ultrasound scanner weighing only 270 grams, with a battery life of up to 60 minutes and cloud connectivity for immediate image sharing.

Integration of Artificial Intelligence and Advanced Imaging Software

Artificial intelligence is becoming a central feature in veterinary diagnostics, improving speed and accuracy of image interpretation. AI-powered ultrasound platforms can now identify abnormalities and suggest probable diagnoses, reducing operator dependency. The Veterinary Ultrasound Devices Market benefits from this shift toward automation and smarter imaging tools. It enhances diagnostic consistency across different user skill levels. AI algorithms also assist in training new veterinarians, providing interactive feedback during procedures. These advancements support better clinical decision-making across companion and livestock segments.

- For instance, Butterfly Network’s iQ+ Vet ultrasound device integrates AI that automates bladder volume calculation and gestational age assessment, processing over 20,000 frames per exam to guide interpretation.

Rising Demand from Equine and Livestock Segments for Reproductive Monitoring

The need for accurate reproductive tracking in livestock and equine care continues to grow. Ultrasound devices help veterinarians assess fertility cycles, detect pregnancies, and manage breeding programs. The Veterinary Ultrasound Devices Market sees strong traction in these sectors due to the economic importance of animal reproduction. It plays a crucial role in improving herd productivity and livestock management efficiency. Timely detection of reproductive disorders reduces financial losses for farm operators. Equipment tailored for large animals is gaining market share within this growing application area.

Expansion of Telemedicine and Remote Veterinary Services

Telemedicine is reshaping veterinary diagnostics by enabling remote consultations and expert guidance. Veterinary ultrasound images can now be transmitted digitally for off-site review, enhancing diagnostic reach. The Veterinary Ultrasound Devices Market is aligning with this trend by developing devices compatible with cloud storage and remote access. It allows specialists to support field veterinarians with real-time interpretations. This model proves valuable in underserved areas with limited veterinary expertise. The integration of digital workflows is strengthening collaborative care across regions.

Market Challenges Analysis

High Cost of Equipment and Limited Accessibility in Rural Areas

The high initial cost of veterinary ultrasound systems presents a barrier for small clinics and rural veterinary practices. Advanced imaging features and portability increase the price point, making devices less accessible for budget-constrained users. The Veterinary Ultrasound Devices Market faces adoption challenges in developing regions where veterinary infrastructure remains limited. It impacts the ability of veterinarians in remote areas to perform timely diagnostics. Lack of government subsidies or financing options further slows market penetration. Cost-sensitive buyers often rely on outdated methods, reducing overall demand for modern ultrasound solutions.

Shortage of Skilled Professionals and Inconsistent Training Standards

Operating veterinary ultrasound devices requires specific technical skills that many general practitioners may lack. Limited availability of structured training programs creates inconsistencies in diagnostic accuracy. The Veterinary Ultrasound Devices Market encounters hurdles when users are unable to interpret imaging results effectively. It restricts the potential benefits of advanced features like Doppler imaging or AI-based diagnostics. Variability in skill levels also affects equipment utilization rates in multi-practice facilities. Without standardized training and certification, the full value of ultrasound technology remains underutilized across various care settings.

Market Opportunities

Growing Demand for Preventive Care and Early Diagnosis in Companion Animals

The increasing focus on preventive care creates a strong opportunity for diagnostic solutions in veterinary medicine. Pet owners are seeking routine checkups and early disease detection to improve animal health and longevity. The Veterinary Ultrasound Devices Market stands to benefit from this trend by offering non-invasive tools that support early-stage diagnosis. It enables veterinarians to detect conditions such as tumors, cardiac issues, and organ abnormalities with greater precision. Rising disposable income and pet insurance coverage further encourage investment in advanced diagnostic technologies. This shift in consumer behavior is expanding the role of ultrasound in everyday veterinary practice.

Expansion into Emerging Markets and Telemedicine Integration

Emerging economies present untapped potential due to rising livestock populations and increasing investment in veterinary infrastructure. Governments and private sectors are improving access to veterinary services, creating demand for affordable and portable ultrasound systems. The Veterinary Ultrasound Devices Market can expand its footprint in these regions by offering cost-effective models suited for field conditions. It also has an opportunity to integrate with telemedicine platforms, enabling remote diagnostics and real-time expert consultation. Digital connectivity supports faster diagnosis in remote areas where veterinary specialists are limited. These trends position ultrasound devices as essential tools for scalable and efficient animal healthcare delivery.

Market Segmentation Analysis:

By Type

The Veterinary Ultrasound Devices Market includes two main types: portable and cart-based systems. Portable ultrasound devices are gaining popularity due to their ease of use, compact design, and suitability for field applications. They support veterinarians in remote or rural areas where mobility is critical. Cart-based systems remain relevant in large veterinary hospitals and academic institutions where advanced features and higher image resolution are required. It offers more comprehensive imaging capabilities and integrates easily with other diagnostic tools. The market is witnessing a shift toward portable solutions, driven by demand for flexibility and on-site diagnostics.

- For instance, E.I. Medical Imaging’s Ibex EVO II weighs just 2.72 kg and delivers 128-channel imaging for field-ready applications, while still supporting linear, convex, and micro-convex probes for large and small animals alike. Meanwhile, Mindray introduced its TE7 Vet cart-based system, integrating a 15.6-inch high-resolution touchscreen, offering over 20 preset veterinary-specific imaging applications, ideal for clinical settings.

By Product

The product segment consists of 2D ultrasound, 3D/4D ultrasound, and Doppler ultrasound systems. 2D ultrasound dominates the market due to its affordability and broad application across species. It supports basic diagnostic functions and is widely used in both small and large animal practices. 3D/4D ultrasound is gradually expanding, offering detailed visualization that aids in complex assessments, particularly in reproductive and organ-specific imaging. Doppler ultrasound plays a crucial role in vascular and cardiac diagnostics, enabling real-time monitoring of blood flow and heart conditions. The Veterinary Ultrasound Devices Market benefits from growing interest in advanced products that deliver precision and speed in clinical evaluations.

- For instance, SonoScape’s S9 Pro Vet supports 2D, 3D, and Color Doppler imaging and features a 15-inch LED monitor and 320 GB storage, allowing enhanced reproductive imaging in bovine and equine practices. Additionally, Esaote’s MyLab™ DeltaVET system offers 4D real-time imaging capabilities and up to five transducer ports, facilitating rapid transitions between different scanning modes without system reboots.

By Technology

Based on technology, the market includes digital and analog ultrasound systems. Digital ultrasound holds the majority share due to its superior image quality, faster processing, and integration with digital storage systems. It aligns with the industry’s movement toward paperless records and telemedicine compatibility. Analog systems are still present in budget-sensitive regions but are gradually being phased out due to limited features and lower diagnostic accuracy. The Veterinary Ultrasound Devices Market continues to evolve with a strong preference for digital platforms that enhance workflow efficiency and support data sharing. It positions digital technology as the core enabler of modern veterinary diagnostics.

Segments:

Based on Type

- 2D ultrasound

- Doppler ultrasound

- 3D/4D ultrasound

Based on Product

- Equipment

- Cart-based ultrasound scanners

- Portable ultrasound scanners

- Accessories/consumables

- Software

Based on Technology

- Digital imaging

- Contrast imaging

Based on Animal Type

- Small companion animals

- Dogs

- Cats

- Other small companion animals

- Large animals

- Horse

- Cattle

- Other large animals

- Other animals

Based on Application

- Obstetrics/gynecology

- Cardiology

- Orthopedics

- Abdominal imaging

- Other applications

Based on End Use

- Veterinary hospitals and clinics

- Diagnostic imaging centers

- Other end use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Veterinary Ultrasound Devices Market with a commanding 38.5% market share in 2024, driven by advanced veterinary healthcare infrastructure and high pet ownership rates. The United States contributes the largest portion, supported by widespread adoption of companion animals and increasing demand for non-invasive diagnostic tools. It benefits from strong investments in veterinary R&D, continuous technological innovation, and the presence of key market players offering a wide range of ultrasound systems. Veterinary clinics and hospitals across the region are rapidly adopting portable and AI-integrated ultrasound devices to improve diagnostic accuracy and clinical efficiency. Furthermore, robust reimbursement structures and growing availability of pet insurance encourage veterinarians and pet owners to opt for high-end diagnostic services. The market in Canada also shows consistent growth, supported by expanding livestock monitoring programs and increasing attention to rural veterinary accessibility.

Europe

Europe holds the second-largest position with a 28.3% market share in the Veterinary Ultrasound Devices Market, supported by stringent animal welfare regulations and a strong focus on veterinary care standards. Countries such as Germany, France, and the United Kingdom represent significant revenue contributors due to their advanced veterinary service ecosystems. It benefits from well-established animal health monitoring systems and rising awareness of preventive care. The European market shows a growing preference for portable ultrasound devices, especially among equine and livestock practitioners who require mobility and real-time diagnostics. Governments and veterinary associations are promoting regular checkups and early detection programs, which further fuel device adoption. Emerging Eastern European countries are also witnessing increased demand, driven by expanding agricultural activities and veterinary infrastructure development.

Asia Pacific

Asia Pacific accounts for 20.7% of the market share, with substantial growth potential due to rising livestock populations, increasing demand for veterinary services, and ongoing modernization of animal healthcare systems. China and India lead the regional market, supported by large agricultural economies and a growing focus on food safety and animal productivity. It experiences accelerated adoption of veterinary ultrasound equipment in livestock diagnostics, particularly in reproductive health monitoring. Urbanization and rising disposable incomes are also increasing pet ownership in key cities, driving demand for companion animal diagnostics. Japan and South Korea show notable advancements in veterinary imaging, backed by technology-oriented healthcare providers and research institutions. The market continues to grow as portable and cost-effective ultrasound solutions become more accessible across rural and semi-urban areas.

Latin America

Latin America represents a 7.6% share of the global Veterinary Ultrasound Devices Market, with growth supported by improving veterinary care standards and expanding cattle farming industries. Brazil and Mexico serve as the primary markets, driven by large livestock populations and increasing awareness of disease prevention. It shows growing interest in reproductive monitoring and general diagnostics for both livestock and companion animals. However, limited access to advanced technology and training remains a challenge in several parts of the region. Initiatives from both private and public sectors to enhance veterinary capabilities are helping bridge the gap. The market shows gradual growth as portable ultrasound systems gain traction among rural veterinarians.

Middle East & Africa

The Middle East & Africa region contributes 4.9% to the global market, characterized by emerging adoption trends and growing demand for veterinary services, especially in the livestock sector. It remains in the early stages of technological integration, with limited penetration of high-end ultrasound equipment. Countries such as South Africa, Saudi Arabia, and the UAE are investing in modernizing veterinary infrastructure and training. The market benefits from government-led animal health programs and rising interest in animal welfare standards. Portable and rugged devices designed for field conditions are particularly well-suited for the region’s geographic and logistical challenges. While the market remains small in share, its upward trajectory indicates strong future potential with targeted investments and strategic partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heska Corporation

- GE Healthcare

- Shenzhen Mindray Animal Medical Technology

- Lepu Medical Technology

- Esaote

- BMV Medtech Group

- IMV Imaging

- Avante Animal Health

- Samsung Healthcare

- Clarius

- EDAN Instruments

- Fujifilm Sonosite

Competitive Analysis

The Veterinary Ultrasound Devices Market is competitive, with key players including GE Healthcare, Esaote, Fujifilm Sonosite, Shenzhen Mindray Animal Medical Technology, Heska Corporation, IMV Imaging, and Samsung Healthcare. These companies compete based on innovation, product performance, portability, and regional presence. GE Healthcare and Fujifilm Sonosite lead in technological integration, offering advanced imaging platforms with high-resolution and real-time diagnostics. Esaote maintains a strong position with its specialized veterinary-focused systems tailored for both small and large animals. Mindray leverages its cost-effective yet technologically advanced devices, targeting both emerging and developed markets. Heska focuses on enhancing point-of-care capabilities and workflow efficiency through compact ultrasound solutions. IMV Imaging excels in livestock diagnostics and provides durable, portable devices optimized for field conditions. Samsung Healthcare contributes with its imaging excellence and integration of smart technologies into veterinary systems. The market reflects a shift toward AI integration, handheld devices, and digital connectivity, encouraging players to innovate and differentiate their offerings to capture a diverse customer base across global veterinary sectors.

Recent Developments

- In January 2025, Mindray Animal introduced the high-end Vetus series, specifically targeting veterinary needs with advanced imaging capabilities and portability. The series included the Vetus 80, Vetus 9 (featuring ZONE Sonograph™ Technology), Vetus 50, and the Vetus E7, which is a laptop-based system powered by ZST+.

- In October 2024, GE Healthcare launched updates for the Logiq e R9 portable veterinary ultrasound system, enhancing its capabilities with a new probe technology (L4-20t-RS XDclear transducer), remote operation, and advanced imaging functions. These improvements aim to boost diagnostic confidence for veterinarians.

- In January 2023, GE HealthCare partnered with Sound Technologies to distribute the Vscan Air™ wireless, pocket-sized ultrasound device to veterinary practices in the USA. This device provides whole-patient scanning capabilities, dual-probe technology, and supports both iOS and Android devices for point-of-care diagnostics in animals.

Market Concentration & Characteristics

The Veterinary Ultrasound Devices Market shows a moderately concentrated structure, with a few global players holding significant influence across regions. It features a mix of established medical imaging companies and specialized veterinary device manufacturers competing on innovation, pricing, and product versatility. The market is characterized by increasing demand for portable, user-friendly, and AI-supported systems tailored for both companion and large animal diagnostics. Product differentiation largely depends on imaging quality, mobility, and integration with digital platforms. Companies invest in expanding their geographic footprint, especially in high-growth regions like Asia Pacific and Latin America, to capture emerging demand. It maintains a strong focus on non-invasive, real-time diagnostics that support preventive care, field-based monitoring, and reproductive health assessments. The market favors compact and durable devices that meet the needs of veterinary professionals operating in diverse clinical and environmental settings. Strategic partnerships, R&D investment, and product customization remain central to gaining competitive advantage in this evolving landscape

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Technology, Animal Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for portable and handheld ultrasound devices across veterinary clinics and field settings.

- Technological advancements will drive the integration of AI and machine learning for faster and more accurate diagnostics.

- Digital connectivity will enhance remote consultations and telemedicine capabilities in veterinary care.

- Companion animal diagnostics will continue to expand due to increasing pet ownership and preventive healthcare practices.

- Livestock monitoring will remain a key growth area, particularly for reproductive health and disease management.

- Manufacturers will focus on developing cost-effective solutions for emerging markets to boost adoption.

- Veterinary professionals will require more training and support tools to fully utilize advanced ultrasound systems.

- Regulatory support and veterinary healthcare infrastructure improvements will support market growth in developing regions.

- Demand for integrated imaging systems with cloud storage and mobile compatibility will increase.

- Market competition will intensify, encouraging continuous innovation and product differentiation among leading players.