Market Overview

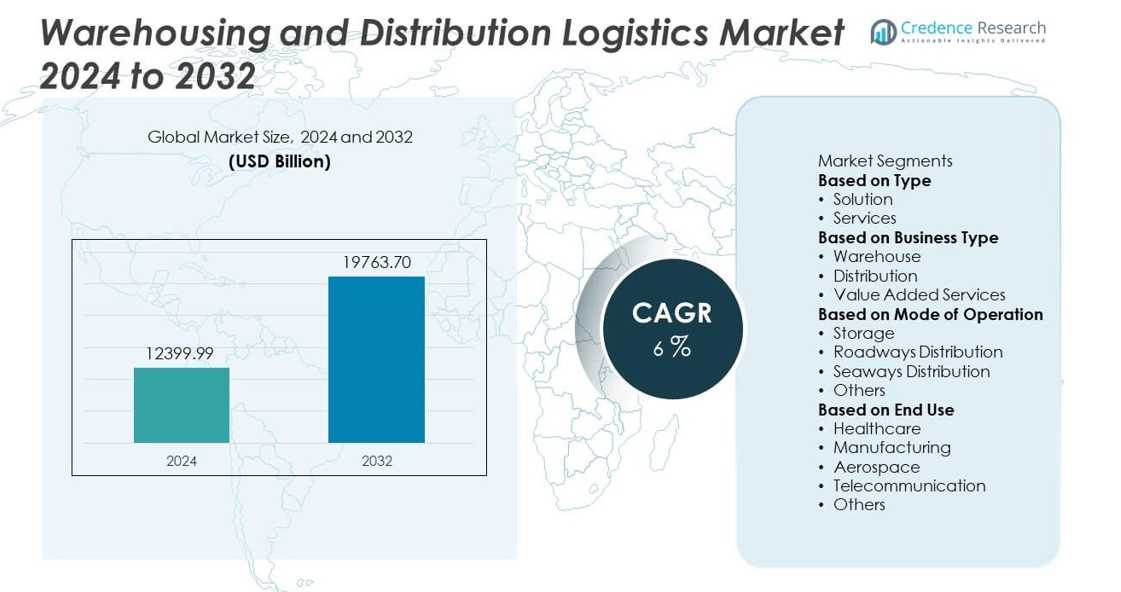

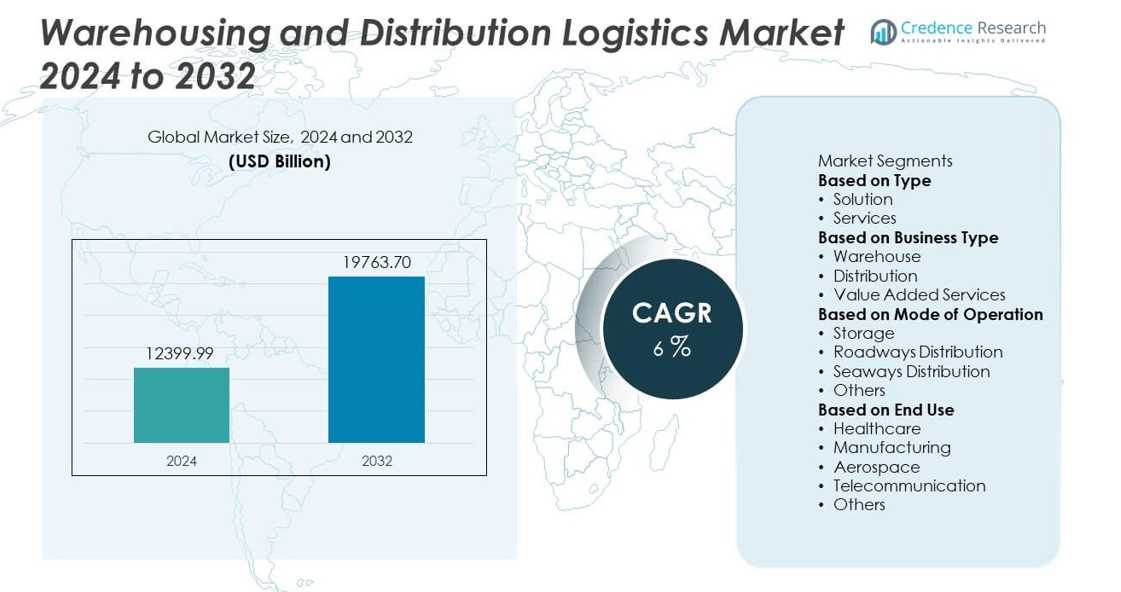

The Warehousing and Distribution Logistics Market was valued at USD 12,399.99 billion in 2024 and is anticipated to reach USD 19,763.70 billion by 2032, expanding at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Warehousing and Distribution Logistics Market Size 2024 |

USD 12,399.99 billion |

| Warehousing and Distribution Logistics Market, CAGR |

6.% |

| Warehousing and Distribution Logistics Market Size 2032 |

USD 19,763.70 billion |

The Warehousing and Distribution Logistics Market grows with rising e-commerce demand, global trade expansion, and increasing need for efficient last-mile delivery. Companies invest in advanced storage, automation, and transportation networks to improve speed and accuracy.

The Warehousing and Distribution Logistics Market demonstrates strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region shaped by distinct drivers. North America leads with advanced automation, smart warehouses, and strong demand from e-commerce and retail sectors. Europe emphasizes sustainability and green logistics practices, with countries like Germany, the UK, and the Netherlands focusing on energy-efficient facilities and cross-border integration. Asia Pacific emerges as the fastest-growing region, supported by rapid industrialization, urbanization, and large-scale investments in infrastructure in China, India, and Southeast Asia. Latin America and the Middle East & Africa gradually expand logistics networks through infrastructure upgrades and government-backed projects. Key players shaping the market include DHL Supply Chain, CEVA Logistics, Kerry Logistics, and Agility, each leveraging global networks, digital platforms, and strategic partnerships to strengthen efficiency, expand service coverage, and meet the growing demands of global trade.

Market Insights

- The Warehousing and Distribution Logistics Market was valued at USD 12,399.99 billion in 2024 and is projected to reach USD 19,763.70 billion by 2032, expanding at a CAGR of 6% during the forecast period.

- Rising e-commerce activity, global trade growth, and demand for efficient last-mile delivery drive the adoption of advanced warehousing and distribution solutions.

- Key trends include integration of automation, robotics, IoT-based monitoring, and sustainable practices such as energy-efficient warehouses and electric transport systems.

- Competitive dynamics remain strong, with players like DHL Supply Chain, CEVA Logistics, Kerry Logistics, and Agility focusing on expanding networks, adopting smart technologies, and enhancing service offerings.

- High operational costs, labor shortages, and infrastructure constraints act as restraints, particularly in emerging economies with limited access to modern logistics facilities.

- North America and Europe lead with advanced logistics infrastructure, strict regulations, and sustainability goals, while Asia Pacific records the fastest growth driven by urbanization, industrial expansion, and e-commerce penetration.

- Latin America and the Middle East & Africa provide emerging opportunities as governments invest in logistics infrastructure, trade corridors, and smart city projects to strengthen supply chain resilience and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and E-commerce Expansion

The Warehousing and Distribution Logistics Market grows with the expansion of global trade and e-commerce platforms. Online retailing creates massive demand for efficient storage and quick distribution systems. It requires companies to build advanced facilities capable of handling large product volumes with accuracy. Cross-border transactions push logistics providers to enhance customs clearance and international shipping solutions. Businesses expand warehouse networks closer to urban centers to reduce delivery times. Growing consumer expectations for faster services further strengthen demand for reliable warehousing and distribution solutions.

- For instance, DHL eCommerce, opened a new 25,000 m² e-commerce hub near Coventry Airport, creating up to 600 local jobs. The state-of-the-art facility features a high-speed sorting system that can process over 1 million parcels per day and is highly sustainable with solar panels and EV charging points. This investment supports the growth of both domestic and international e-commerce for UK businesses.

Adoption of Automation and Smart Technologies

The Warehousing and Distribution Logistics Market benefits from increasing adoption of automation, robotics, and IoT-driven systems. Automated storage and retrieval systems improve accuracy and reduce operational costs. It enables faster order processing and better inventory management. Smart sensors and tracking platforms give companies real-time visibility across supply chains. Robotics and AI-based solutions help manage labor shortages while boosting efficiency. This technological shift drives stronger investment in modern warehouse infrastructure worldwide.

- For instance, CEVA Logistics has deployed two autonomous STRADOT robots at its Nanteuil-le-Haudouin site in France. Starting in September 2025, the robots will automate the movement of vehicles across 2,000 dedicated parking slots. This system is expected to improve efficiency and space usage by handling thousands of vehicle movements monthly.

Growing Demand for Cold Chain and Specialized Storage

The Warehousing and Distribution Logistics Market expands with rising demand for cold chain and specialized storage. Food, pharmaceuticals, and chemicals require temperature-controlled environments to ensure product quality and safety. It encourages companies to invest in cold storage facilities with advanced monitoring systems. Rising global vaccine distribution also accelerates adoption of cold chain logistics. Demand for specialty storage of hazardous materials and high-value products strengthens further. This driver ensures continuous development of tailored warehousing solutions for critical industries.

Focus on Cost Optimization and Sustainable Practices

The Warehousing and Distribution Logistics Market gains momentum from the focus on cost reduction and sustainability. Companies seek energy-efficient warehouses that lower operational expenses. It drives adoption of green buildings, renewable energy integration, and waste reduction practices. Optimized distribution models reduce transportation costs and carbon emissions. Advanced analytics help businesses improve space utilization and labor efficiency. Growing corporate responsibility toward sustainability aligns warehousing practices with environmental regulations and customer expectations.

Market Trends

Integration of Advanced Automation and Robotics

The Warehousing and Distribution Logistics Market shows strong movement toward automation and robotics. Companies deploy automated guided vehicles, robotic picking systems, and conveyor technologies to improve efficiency. It reduces reliance on manual labor and ensures faster, error-free operations. AI-powered solutions support predictive inventory management and enhance warehouse planning. Robotics also helps companies manage rising labor costs and workforce shortages. This trend strengthens adoption of technology-driven facilities across both developed and emerging regions.

- For instance, DHL Supply Chain introduced Boston Dynamics’ Stretch robots across its U.S. facilities, each capable of unloading 700 cases per hour and operating for 16 hours on a single charge, significantly cutting unloading time and labor needs.

Growth of Omnichannel Fulfillment Models

The Warehousing and Distribution Logistics Market benefits from the expansion of omnichannel retail strategies. Retailers integrate physical and digital supply chains to offer seamless customer experiences. It requires flexible warehouses capable of handling bulk distribution and last-mile delivery. Businesses redesign networks to support same-day or next-day delivery services. Micro-fulfillment centers near urban hubs gain popularity for faster order processing. This trend reshapes warehousing strategies to align with evolving consumer expectations.

- For instance, CEVA Logistics is currently constructing a 143,000 m² multi-customer warehouse in Singapore’s Jurong Industrial Estate, set to open in 2027. The facility is designed for omnichannel distribution, will be equipped with smart automation, and will complement existing automated facilities on its campus.

Rising Demand for Green and Sustainable Logistics

The Warehousing and Distribution Logistics Market reflects increasing focus on sustainability. Companies adopt energy-efficient building designs, solar-powered facilities, and electric material-handling equipment. It aligns operations with global carbon reduction goals and regulatory standards. Green certifications for warehouses gain importance as businesses highlight eco-friendly practices. Logistics providers also invest in alternative fuels and route optimization to cut emissions. This trend reinforces the industry’s transition toward environmentally responsible operations.

Expansion of Cold Chain and Temperature-Controlled Logistics

The Warehousing and Distribution Logistics Market records strong growth in cold chain solutions. Rising demand for fresh food, biopharmaceuticals, and chemicals drives investment in temperature-controlled facilities. It ensures product safety, compliance, and extended shelf life. Advanced monitoring systems track temperature and humidity levels in real time. Vaccine distribution and global food trade continue to push cold chain adoption. This trend emphasizes the critical role of specialized warehousing in supporting sensitive product categories.

Market Challenges Analysis

High Operational Costs and Infrastructure Limitations

The Warehousing and Distribution Logistics Market faces challenges from rising operational costs and infrastructure constraints. Land scarcity in urban centers increases expenses for building and maintaining modern facilities. It creates barriers for companies seeking large-scale distribution hubs near key consumption areas. Energy use, labor costs, and advanced technology investments further raise financial pressure. Smaller businesses struggle to compete with global players that can absorb higher costs. Infrastructure limitations in developing regions also slow the growth of efficient warehousing networks. These challenges make cost optimization a constant concern for industry stakeholders.

Complexity in Supply Chain Management and Compliance

The Warehousing and Distribution Logistics Market also encounters difficulties related to supply chain complexity and regulatory requirements. Global supply chains face frequent disruptions from geopolitical tensions, natural disasters, and transportation delays. It forces companies to maintain contingency plans, increasing inventory and operational inefficiencies. Compliance with varying international trade regulations and safety standards adds another layer of difficulty. Managing cross-border logistics often requires specialized expertise and robust digital systems. Shortages of skilled labor for advanced warehouse operations further complicate efficiency. These issues highlight the ongoing struggle to balance flexibility, compliance, and cost-effectiveness in a dynamic global environment.

Market Opportunities

Expansion of E-commerce and Last-Mile Delivery Services

The Warehousing and Distribution Logistics Market presents strong opportunities through the rapid expansion of e-commerce and last-mile delivery services. Growing online sales drive demand for advanced storage solutions and distribution hubs near urban centers. It encourages companies to invest in micro-fulfillment centers and regional warehouses that support faster deliveries. The rise of subscription-based services and direct-to-consumer models further boosts the need for efficient order management systems. Retailers and logistics providers continue to explore innovative ways to meet consumer expectations for speed and accuracy. These trends create lasting opportunities for modern warehousing solutions globally.

Adoption of Digital Platforms and Global Trade Growth

The Warehousing and Distribution Logistics Market benefits from opportunities tied to digital transformation and expanding global trade. Cloud-based platforms and blockchain systems enhance transparency, security, and efficiency in warehouse operations. It enables real-time tracking, automated inventory control, and data-driven decision-making. Cross-border trade expansion creates demand for logistics networks capable of managing complex regulatory and customs requirements. Growth in emerging markets offers potential for infrastructure investments that support long-term supply chain resilience. Companies that integrate advanced technologies with global distribution capabilities can secure competitive advantages and expand their market presence.

Market Segmentation Analysis:

By Type

The Warehousing and Distribution Logistics Market is segmented into storage, transportation, and value-added services. Storage solutions dominate due to rising demand from e-commerce, retail, and manufacturing industries that require efficient inventory management. It ensures safe handling of products, including perishable goods and high-value items. Transportation services continue to grow with the rise in global trade and last-mile delivery. Companies also invest in value-added services such as packaging, labeling, and reverse logistics to enhance customer satisfaction. This segment reflects the growing need for integrated solutions that combine storage and distribution for maximum efficiency.

By Business Type

The Warehousing and Distribution Logistics Market divides into organized and unorganized providers. Organized players dominate with advanced facilities, global networks, and technology-driven operations. It supports large-scale businesses seeking consistent service quality and compliance with international standards. Unorganized providers remain important in developing regions, offering low-cost solutions with limited infrastructure. Their role is significant in meeting local and regional distribution needs where affordability is critical. The shift toward organized logistics strengthens with growing emphasis on automation, sustainability, and reliability, driving more investment in structured networks.

- For instance, CEVA Logistics broke ground in May 2025 on a 143,000 m² warehouse in Singapore, which will be integrated with existing automated sites and is expected to be operational by 2027. The new facility will bolster the efficiency and scale of CEVA’s operations compared to smaller competitors. This investment reflects CEVA’s focus on automation and sustainability to enhance logistics capabilities.

By Mode of Operation

The Warehousing and Distribution Logistics Market includes manual, semi-automated, and fully automated operations. Manual systems remain common in smaller facilities or cost-sensitive regions, relying heavily on labor for daily tasks. It offers flexibility but often lacks efficiency compared to modern methods. Semi-automated systems integrate equipment such as conveyor belts and forklifts to balance cost and productivity. Fully automated warehouses lead adoption in developed regions, supported by robotics, IoT, and AI technologies. These facilities enable faster processing, higher accuracy, and lower operational costs over time. The shift toward automation accelerates as companies aim to improve competitiveness and meet rising customer expectations.

- For instance, DHL eCommerce launched an automated 25,000 m² hub in Coventry with over 120 EV charging stations. The high-speed sorting system enables a throughput of over 1 million parcels daily, aiming for improved accuracy through advanced automation.

Segments:

Based on Type

Based on Business Type

- Warehouse

- Distribution

- Value Added Services

Based on Mode of Operation

- Storage

- Roadways Distribution

- Seaways Distribution

- Others

Based on End Use

- Healthcare

- Manufacturing

- Aerospace

- Telecommunication

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 32% share of the Warehousing and Distribution Logistics Market, reflecting its strong infrastructure, advanced technology adoption, and well-developed e-commerce ecosystem. The United States dominates regional demand, supported by large-scale retailers, third-party logistics providers, and advanced last-mile delivery networks. It benefits from significant investments in automation, robotics, and smart warehouses that improve efficiency and accuracy. Canada contributes with growing adoption of sustainable logistics practices and investment in cold storage facilities for food and pharmaceuticals. Mexico expands its role as a manufacturing and distribution hub due to proximity to the U.S. and favorable trade agreements. North America continues to lead with highly integrated logistics networks and strong focus on speed, reliability, and customer satisfaction.

Europe

Europe accounts for nearly 27% share of the Warehousing and Distribution Logistics Market, driven by its focus on sustainability and innovation in supply chains. Countries such as Germany, the UK, France, and the Netherlands lead adoption due to their central role in global trade and advanced infrastructure. It emphasizes green warehousing practices, with facilities adopting renewable energy, eco-friendly materials, and energy-efficient equipment. Strong regulations from the European Union support the development of standardized logistics practices across member states. Cold chain logistics for food, pharmaceuticals, and chemicals remain a priority across the region. Europe’s strategic location between Asia and North America further strengthens its position in global distribution networks.

Asia Pacific

Asia Pacific captures about 29% share of the Warehousing and Distribution Logistics Market and represents the fastest-growing region. Rapid urbanization, industrialization, and expansion of e-commerce platforms in China, India, and Southeast Asia drive high demand. It records significant growth in last-mile delivery and micro-fulfillment centers to meet consumer expectations for quick deliveries. China dominates with large investments in smart warehouses and advanced automation technologies. India benefits from government-led infrastructure programs and expanding online retail. Japan and South Korea continue to adopt robotics and AI solutions to improve efficiency in their logistics networks. Asia Pacific’s rapid growth highlights its role as a key hub for global supply chain expansion.

Latin America

Latin America holds around 7% share of the Warehousing and Distribution Logistics Market, with Brazil and Mexico leading adoption. The region benefits from expanding retail networks, rising e-commerce penetration, and growing investment in infrastructure. It faces challenges from uneven development across countries and limited automation in many facilities. However, demand for modern warehouses near urban centers continues to grow. Cold chain logistics expands rapidly, supported by food exports and pharmaceutical requirements. International players increasingly invest in partnerships to improve efficiency and expand service coverage across the region. Latin America offers long-term growth potential as logistics networks modernize and trade activities expand.

Middle East and Africa

The Middle East and Africa together account for about 5% share of the Warehousing and Distribution Logistics Market. The United Arab Emirates and Saudi Arabia dominate regional adoption, supported by investments in smart cities, free trade zones, and logistics hubs. It benefits from strong government support for diversification away from oil-based economies. Africa shows steady progress, with South Africa and Nigeria leading adoption, though infrastructure limitations remain a challenge. Demand for cold chain solutions rises with growing food imports and pharmaceutical distribution needs. Regional development projects, including port expansions and industrial corridors, create opportunities for modern warehousing and logistics solutions. Long-term growth is expected as both regions focus on infrastructure development and integration into global trade routes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Warehousing and Distribution Logistics Market features leading players such as DHL Supply Chain, CEVA Logistics, Kerry Logistics, Agility, WHA Corp, Keppel Logistics, CJ Century Logistics, CWT Ltd, Tiong Nam Logistics, and YCH Group. These companies compete by offering comprehensive logistics solutions that include warehousing, transportation, supply chain management, and value-added services tailored to diverse industries such as retail, e-commerce, automotive, and healthcare. They invest heavily in automation, robotics, and IoT-enabled systems to enhance efficiency, accuracy, and visibility across operations. Strategic expansions through acquisitions, partnerships, and regional hubs allow them to strengthen global reach while addressing growing demand for faster delivery and seamless supply chain integration. Sustainability initiatives, including energy-efficient warehouses and the use of green transport fleets, further differentiate their offerings. With rising customer expectations and rapid growth in e-commerce, competition continues to intensify, driving players to innovate and maintain operational excellence across global markets.

Recent Developments

- In July 2025, CEVA Logistics Opened a 4,300 m² international road transport (TIR) hub in Alashankou, China, with an additional 1,000 m² area dedicated to handling dangerous goods.

- In June 2025, CEVA Logistics Expanded its Central Africa presence by launching a new logistics platform in Kribi, Cameroon. The center will include 25,000 m² of container storage for 2,200 TEUs and 5,000 m² of warehouse space.

- In May 2025, CEVA Logistics Broke ground on a new multi-customer warehouse in western Singapore’s Jurong Industrial Estate, adding around 143,000 m² to its footprint. The facility is designed to be sustainability-certified and fully operational by 2027, boosting CEVA’s total warehouse capacity in Singapore to 370,000 m².

- In May 2025, DHL Supply Chain Acquired IDS Fulfillment, adding over 1.3 million square feet of e-commerce-focused warehouse and distribution space across multiple U.S. locations.

- In April 2025, CEVA Logistics Started construction on a new pharmaceutical logistics warehouse near Strasbourg Airport, covering 17,000 m² and scheduled for early 2026 opening

Report Coverage

The research report offers an in-depth analysis based on Type, Business Type, Mode of Operation, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation adoption will rise as companies deploy robotics and AI-driven systems to boost speed and accuracy.

- Demand for cooler and specialized storage will expand with growing emphasis on pharmaceuticals, perishables, and temperature-sensitive goods.

- Omnichannel fulfillment will reshape warehouse design to support both bulk distribution and last-mile delivery simultaneously.

- Green warehouses with energy-efficient operations and renewable energy installations will become standard to meet sustainability goals.

- Micro-fulfillment centers will grow near urban centers to support consumer expectations for fast delivery.

- Digital platforms, including IoT and cloud-based systems, will drive data-driven decision-making and real-time visibility across supply chains.

- Emerging markets will see growth in modern logistics infrastructure as investments support trade corridors and smart city development.

- Partnerships between logistics providers and e-commerce firms will deepen to manage seasonal surges and fulfillment complexity.

- Demand for flexible, modular warehouses will grow to adapt rapidly to shifting inventory and market demands.

- Workforce upskilling in technology operation and automation will become vital for maintaining efficient warehouse operations in the future.