| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste Oil Market Size 2024 |

USD 50.03 Million |

| Waste Oil Market, CAGR |

4.51% |

| Waste Oil Market Size 2032 |

USD 73.01 Million |

Market Overview:

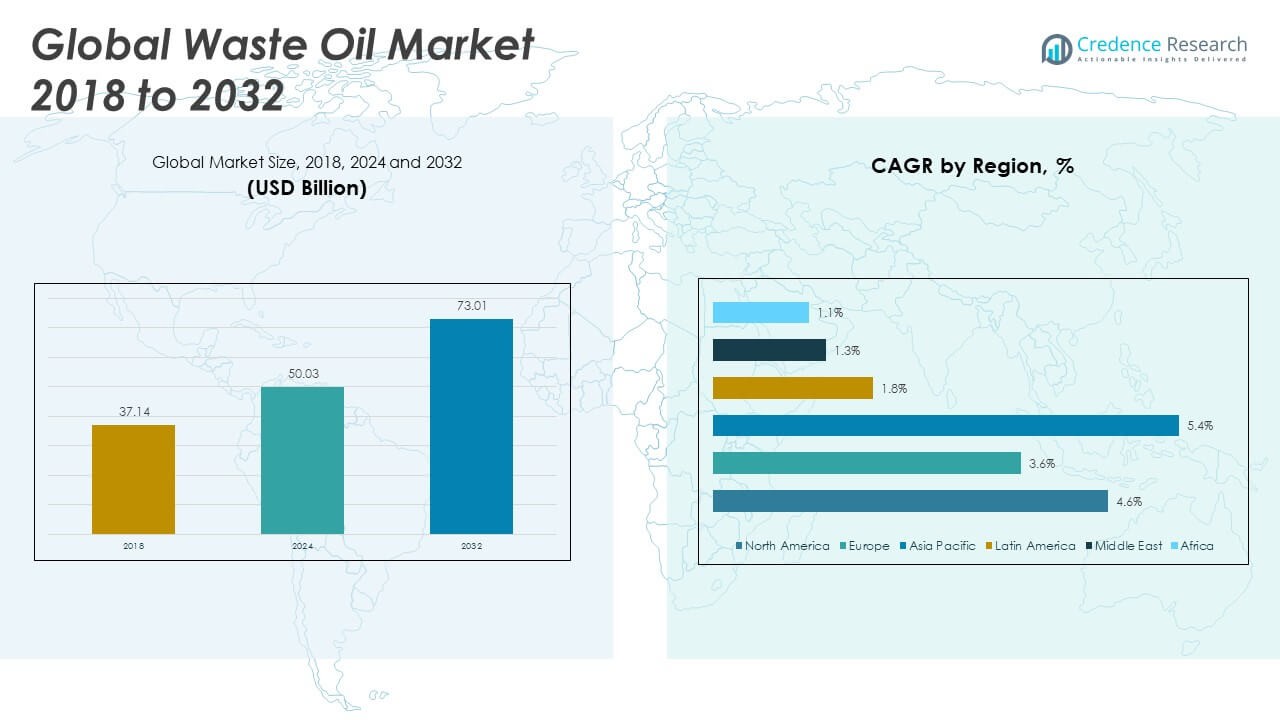

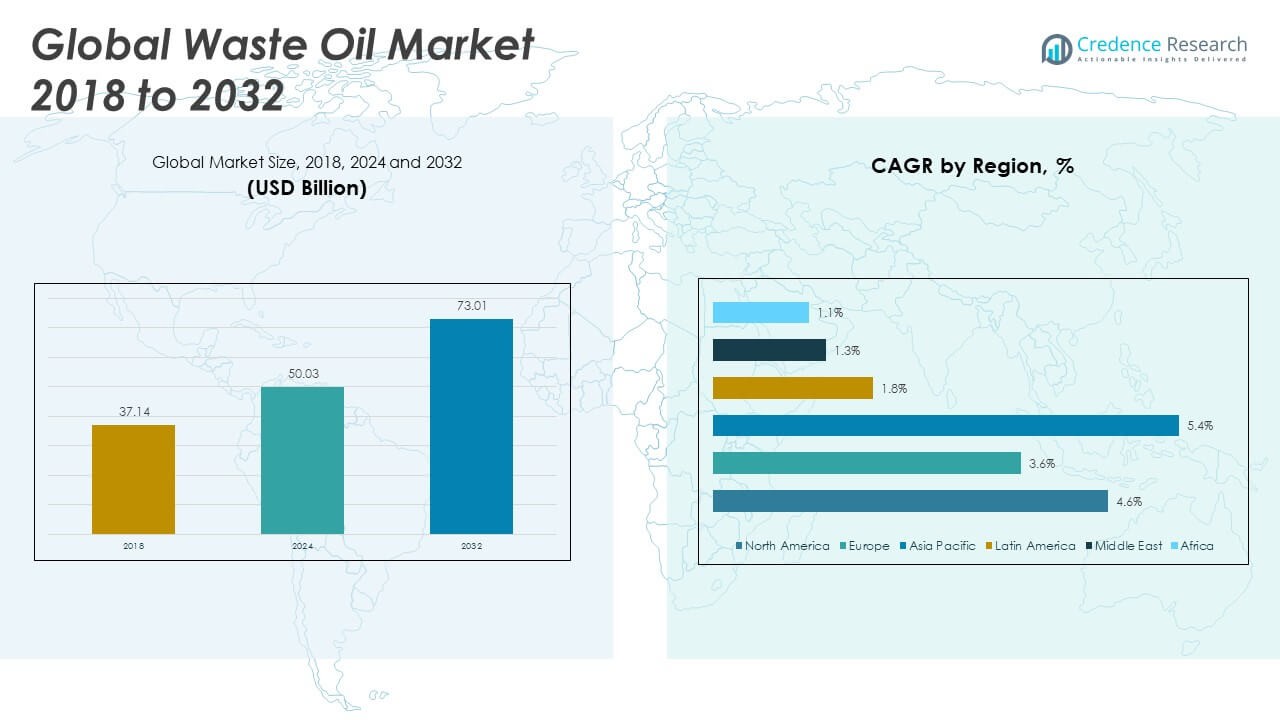

The Global Waste Oil Market size was valued at USD 37.14 billion in 2018 to USD 50.03 billion in 2024 and is anticipated to reach USD 73.01 billion by 2032, at a CAGR of 4.51%% during the forecast period.

The global waste oil market growth is propelled by several key factors. Rapid industrialization and urbanization increase the consumption of lubricants and oils, resulting in higher volumes of waste oil generation. The expanding automotive sector contributes significantly to used engine oil production, creating a steady supply for recycling and re-refining processes. Additionally, governments worldwide enforce stringent environmental regulations that encourage waste oil recycling to reduce pollution and conserve natural resources. These policies compel industries to adopt sustainable waste management practices. Technological advancements in recycling and re-refining methods improve efficiency and cost-effectiveness, making waste oil recovery increasingly attractive to businesses. These innovations enable the production of high-quality base oils and reduce dependency on virgin crude oil, further strengthening market demand.

Regionally, North America dominates the waste oil market due to its strict environmental regulations and well-established infrastructure supporting oil collection, recycling, and re-refining. The presence of advanced technologies and strong regulatory frameworks fosters market stability and growth. Europe follows closely, driven by its commitment to sustainability and circular economy principles, which promotes extensive recycling activities and resource recovery. The Asia-Pacific region experiences rapid industrialization and urban growth, leading to increased waste oil generation. Countries such as China and India are actively improving their waste oil collection systems and recycling capabilities to manage this growth. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual market expansion, as emerging economies recognize the environmental and economic benefits of waste oil recycling and invest in necessary infrastructure and regulatory measures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Waste Oil Market is expected to grow from USD 50.03 billion in 2024 to USD 73.01 billion by 2032, registering a CAGR of 4.51%%.

- Rapid industrial growth and infrastructure expansion significantly increase waste oil generation from sectors like manufacturing and construction.

- The automotive industry remains a primary contributor to used oil volumes, boosting demand for recycling and re-refining services globally.

- Strict environmental regulations worldwide compel industries to adopt formal waste oil management practices to avoid pollution and penalties.

- Technological innovations in re-refining processes improve efficiency, reduce energy costs, and enhance the quality of recycled base oils.

- North America leads the market with strong regulatory frameworks and advanced infrastructure, followed by Europe and Asia Pacific.

- Inconsistent feedstock quality, fragmented collection systems, and high setup costs pose ongoing challenges to recycling efficiency and market expansion.

Market Drivers:

Rapid Industrial Expansion and Growing Demand for Lubricants Fuel Waste Oil Generation

The rapid growth of industries worldwide drives a substantial increase in the consumption of lubricants and oils, generating significant volumes of waste oil. Manufacturing, construction, and transportation sectors consume vast amounts of lubricants to maintain machinery and equipment efficiency. This consumption creates a continuous supply of used oils that require proper handling and recycling. It boosts the demand for waste oil collection and re-refining services, supporting market expansion. Industrial activities in emerging economies contribute heavily to waste oil volumes due to accelerated infrastructure development. The need to manage waste oil responsibly also grows in parallel with industrial output, reinforcing the market’s relevance and scope.

For instance, Shell reported that its global lubricant sales reached approximately 4,100 kilotonnes in 2023, with a significant portion entering industrial and transport applications, ultimately contributing to waste oil streams.

Expansion of the Automotive Industry Increases Waste Oil Collection and Recycling Opportunities

The automotive sector remains one of the largest contributors to waste oil production, primarily through used engine oils. Growing vehicle ownership and maintenance activities worldwide raise the quantity of waste oil requiring treatment. It encourages investments in efficient collection systems and advanced recycling technologies. Automotive manufacturers and service providers focus on sustainable practices, encouraging the reuse and re-refining of waste oil. This trend supports environmental goals while reducing dependence on virgin oil resources. The global waste oil market benefits from the automotive industry’s commitment to extending lubricant life cycles and reducing waste disposal impacts.

For example, Valvoline reported that in 2023, its quick-lube service centers collected and recycled over 40 million gallons of used oil from vehicles in North America alone.

Stringent Environmental Regulations Compel Adoption of Sustainable Waste Oil Management Practices

Governments across the globe impose strict regulations aimed at minimizing environmental pollution caused by improper disposal of waste oil. These regulations mandate the collection, treatment, and recycling of waste oil to prevent soil and water contamination. Regulatory frameworks provide clear guidelines for industries and waste management firms to ensure compliance and promote circular economy principles. It drives the establishment of formal waste oil recycling infrastructure and enhances market transparency. Regulatory enforcement also encourages innovation in re-refining technologies, increasing the quality and quantity of recycled base oils. The growing legal emphasis on sustainable waste handling positions the market for continued growth and technological advancement.

Technological Innovations Enhance Efficiency and Economic Viability of Waste Oil Recycling Processes

Technological advancements in waste oil recycling improve the efficiency and cost-effectiveness of recovery and re-refining operations. New methods enable the production of high-quality base oils that meet industry standards and customer expectations. It reduces processing time and energy consumption, making recycling more competitive against virgin oil production. Improved technologies also enable the handling of a broader range of waste oil types, including contaminated and mixed oils. The integration of automation and monitoring systems further optimizes operational performance and reduces human error. Such innovations strengthen market confidence, encourage wider adoption, and expand the potential applications of recycled oils in various industries.

Market Trends:

Rising Preference for Re-Refined Base Oils Among Industrial and Automotive End-Users

End-users across industrial and automotive sectors increasingly favor re-refined base oils due to cost benefits and sustainability. Re-refined oils now match the performance standards of virgin oils, making them a viable alternative in demanding applications. The Global Waste Oil Market sees a steady shift in consumption patterns as industries adopt cleaner and more economical solutions. It supports carbon footprint reduction and resource conservation objectives. Demand for Group II and Group III base oils from re-refining processes continues to grow across Europe, North America, and Asia. Regulatory support and growing end-user confidence further promote this transition toward re-refined products.

For example, Neste reported that its proprietary re-refining technology enabled the production of Group II and Group III base oils from waste oil, achieving yields of up to 85% in 2023.

Integration of Circular Economy Principles into Waste Oil Management Strategies

Many countries adopt circular economy frameworks that prioritize resource reuse and waste minimization, driving changes in waste oil handling. Governments and organizations encourage closed-loop systems where used oil is collected, treated, and converted into valuable outputs. It enables industries to recover value while aligning with sustainability targets. Companies in the Global Waste Oil Market implement integrated waste management programs that ensure compliance and operational efficiency. Investment in such systems enhances brand reputation and reduces environmental liabilities. This trend positions waste oil as a resource rather than a liability across multiple regions.

Advancements in Re-Refining Technologies Support Market Scalability and Product Innovation

Technology continues to transform the economics and scalability of waste oil recycling. Advanced vacuum distillation and hydrotreating methods produce cleaner base oils with fewer impurities. It allows refiners to meet higher performance and emission standards demanded by modern engines and machinery. The Global Waste Oil Market benefits from increased investment in modular and mobile recycling units that serve remote or underdeveloped areas. These innovations reduce transportation needs and operational costs. Continuous R&D in catalyst design and process optimization also opens new avenues for efficiency and throughput.

For instance, PURAGLOBE announced that its new patented UOP HyLube™ process at its German facility enabled the production of Group III+ base oils with up to 98% removal of contaminants, meeting the latest OEM specifications for high-performance automotive lubricants.

Digitalization and Automation Improve Operational Efficiency Across Waste Oil Value Chains

The adoption of digital tools and automation technologies optimizes collection, monitoring, and processing of waste oil. Smart sensors and IoT platforms help track oil quality, volume, and logistics in real time. It enhances traceability and ensures regulatory compliance, especially in markets with strict environmental oversight. The Global Waste Oil Market leverages data-driven platforms to streamline inventory management and reduce operational risks. AI-enabled systems improve decision-making in processing plants by predicting maintenance needs and process failures. These capabilities support scalable, data-informed operations that increase profitability and reduce environmental impact.

Market Challenges Analysis:

Fluctuating Feedstock Quality and Complex Collection Systems Undermine Recycling Efficiency

The waste oil industry faces a persistent challenge in maintaining consistent feedstock quality due to contamination and improper segregation. Used oils often contain water, heavy metals, and other impurities that complicate re-refining processes and increase treatment costs. It creates variability in output quality, which limits the applicability of recycled oils in high-performance environments. The Global Waste Oil Market depends on robust and reliable collection systems to secure clean input materials. However, fragmented waste streams and lack of standardization across regions make it difficult to enforce quality control. Informal collection networks in developing economies further disrupt supply chains and reduce recycling yields.

For instance, Lube-Tech, a U.S.-based industrial oil recycler, highlights that industrial oils often arrive contaminated with water and metals, requiring a multi-step process-oil removal, metals removal, oil recovery, and water discharge-to ensure compliance and efficiency.

Regulatory Inconsistencies and High Initial Capital Requirements Restrict Market Growth

Waste oil recycling facilities require significant upfront investments in infrastructure, technology, and compliance systems. The cost of setting up and maintaining advanced re-refining units deters small and medium-sized operators from entering the market. It affects capacity expansion in regions with limited government support or regulatory clarity. The Global Waste Oil Market also encounters inconsistent policy enforcement across countries, leading to loopholes and unregulated disposal practices. It weakens environmental protection efforts and hinders the adoption of formal recycling methods. The absence of harmonized global standards limits cross-border collaboration and slows progress in achieving circular economy goals.

Market Opportunities:

Industries worldwide prioritize sustainability and resource efficiency, creating strong demand for re-refined oils and eco-friendly waste management. The Global Waste Oil Market can capitalize on this shift by offering reliable recycling solutions that reduce reliance on virgin oil. Governments and corporations invest in green technologies and promote cleaner production methods. It creates opportunities for service providers to expand their operations and cater to diverse industrial needs. Growth in sectors like power generation, manufacturing, and transportation supports long-term demand for reprocessed oils. Companies that align with environmental goals can secure competitive advantages and new client bases.

Developing regions in Asia, Africa, and Latin America present significant growth opportunities due to rising lubricant consumption and underdeveloped waste oil recovery systems. The Global Waste Oil Market can benefit by entering these regions with scalable, low-cost collection and recycling models. It supports waste minimization goals while creating employment and infrastructure. Governments increasingly recognize the environmental risks of improper disposal and introduce policies to formalize recycling practices. Early investments in these markets can yield long-term returns through regulatory support and industrial partnerships. The shift toward sustainable waste management opens new avenues for global market penetration.

Market Segmentation Analysis:

The Global Waste Oil Market comprises diverse waste oil types that support several industrial applications. Transmission oils, transformer oils, and hydraulic oils represent major sources of waste oil due to their widespread use in automotive, energy, and manufacturing sectors. Lubricating oils hold a dominant share owing to high consumption across engines and machinery. Fuel oils and metalworking fluid oils also contribute significantly to the waste stream, while refrigerant oils and others maintain niche applications in HVAC and specialty systems.

By technology, vacuum distillation leads the market due to its high efficiency in separating contaminants and producing reusable base oil. Hydrogen treatment follows, favored for its ability to enhance the quality and stability of refined outputs. Thin film evaporation offers compact, high-throughput processing, especially in modular units. Other emerging technologies support localized waste oil recycling in smaller industrial setups.

By end use, re-refiners form the largest segment, driven by increasing demand for reprocessed base oils. Boilers and asphalt plants use waste oil as a cost-effective fuel alternative. The market also sees growing use in biodiesel production, road oil applications, and space heating, particularly in regions with high energy costs. Steel mills and others contribute to steady, industrial-scale demand. The Global Waste Oil Market benefits from its broad applicability across these end-use segments.

Segmentation:

By Type Segment

- Transmission Oils

- Transformer Oils

- Hydraulic Oils

- Fuel Oils

- Lubricating Oils

- Metalworking Fluid Oils

- Refrigerant Oils

- Others

By Technology Segment

- Vacuum Distillation

- Hydrogen Treatment

- Thin Film Evaporation

- Others

By End Use Segment

- Boiler

- Road Oil

- Biodiesel

- Space Heater

- Asphalt Plant

- Re-Refiners

- Steel Mills

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America Waste Oil Market size was valued at USD 11.63 billion in 2018 and is projected to reach USD 15.44 billion in 2024. It is anticipated to grow further to USD 22.62 billion by 2032, registering a CAGR of 4.60% during the forecast period. The North American segment holds a significant share in the Global Waste Oil Market due to stringent regulations on waste oil management and recycling. Growing industrial activities and automotive sectors drive the demand for efficient waste oil treatment solutions. Investments in advanced technologies for oil recovery and recycling support market growth. The region focuses on environmental sustainability and compliance with government policies, which stimulates market expansion. Waste oil recycling initiatives among industries further bolster the market. North America’s mature infrastructure and technological advancements sustain steady growth in this market.

Europe Waste Oil Market size was valued at USD 8.81 billion in 2018 and is expected to increase to USD 11.35 billion in 2024. The market is forecasted to reach USD 15.40 billion by 2032, with a CAGR of 3.60%. Europe holds a substantial portion of the Global Waste Oil Market, driven by robust environmental regulations and stringent waste disposal laws. The region emphasizes sustainable waste management practices, encouraging recycling and reuse of waste oil. Industrial sectors such as manufacturing and automotive contribute significantly to waste oil generation. Europe invests in advanced recycling facilities to improve oil recovery rates. Growing awareness about environmental protection and circular economy principles promotes market growth. The region continues to adopt innovative technologies to enhance waste oil processing efficiency.

Asia Pacific Waste Oil Market size was valued at USD 14.32 billion in 2018 and is expected to grow to USD 20.10 billion by 2024. It is projected to reach USD 31.36 billion by 2032, exhibiting the highest CAGR of 5.40% in the forecast period. The Asia Pacific region dominates the Global Waste Oil Market due to rapid industrialization and expanding automotive and manufacturing sectors. Increasing demand for waste oil recycling and treatment arises from growing environmental concerns and regulations. Emerging economies such as China and India invest heavily in waste management infrastructure. Technological advancements and government incentives encourage the adoption of sustainable waste oil practices. The rising awareness of environmental hazards caused by improper oil disposal drives market growth. Asia Pacific’s expanding industrial base continues to fuel demand for efficient waste oil management.

Latin America Waste Oil Market size was valued at USD 1.10 billion in 2018 and is anticipated to grow to USD 1.46 billion by 2024. The market is expected to reach USD 1.73 billion by 2032, with a CAGR of 1.80%. Latin America contributes modestly to the Global Waste Oil Market, with growth supported by increasing industrialization and automotive activities. The region faces challenges in waste oil collection and recycling infrastructure, which restrain market expansion. Governments focus on improving regulatory frameworks to encourage sustainable waste oil handling. Increasing environmental awareness among industries promotes recycling initiatives. However, slower adoption of advanced technologies limits market growth. Efforts to modernize waste management systems continue to create opportunities in the region.

Middle East Waste Oil Market size was valued at USD 0.77 billion in 2018 and is projected to reach USD 0.92 billion by 2024. It is expected to grow to USD 1.05 billion by 2032, registering a CAGR of 1.30%. The Middle East holds a smaller share of the Global Waste Oil Market, constrained by limited waste oil recycling infrastructure. The region’s economy depends heavily on oil and gas industries, generating significant waste oil. Efforts to improve environmental policies and waste management practices are underway. Industrial growth and urbanization increase waste oil generation, driving the need for better treatment solutions. Investment in waste oil recovery technologies is gradually increasing. The Middle East is focusing on adopting sustainable waste oil management to comply with international environmental standards.

Africa Waste Oil Market size was valued at USD 0.50 billion in 2018 and is expected to grow to USD 0.76 billion by 2024. The market is anticipated to reach USD 0.85 billion by 2032, with a CAGR of 1.10%. Africa accounts for the smallest share in the Global Waste Oil Market due to limited infrastructure and regulatory enforcement. The region faces challenges in waste oil collection and proper disposal methods. Industrialization and automotive sectors are growing but at a slower pace compared to other regions. Increasing environmental concerns promote the gradual adoption of waste oil recycling practices. International support and investments aim to enhance waste management systems. Despite constraints, Africa shows potential for growth in the waste oil market with improved policies and technology adoption.

Key Player Analysis:

- Enfields Chemicals CC

- Solway Recycling Ltd

- Business Waste

- Oil Salvage Ltd

- Slicker Recycling

- Safetykleen

- MIB Waste Services

- Falzon Group

- Gecco Fuels

- Valgrove

- EWOR and Omnia Group

Competitive Analysis:

The Global Waste Oil Market features a moderately competitive landscape with a mix of global and regional players focusing on collection, recycling, and re-refining operations. Leading companies such as Safetykleen, Slicker Recycling, Enfields Chemicals CC, and Solway Recycling Ltd invest in advanced technologies and environmental compliance to strengthen their market position. It emphasizes integrated service models that cover waste oil collection, transportation, processing, and distribution of re-refined products. Market participants compete based on operational scale, service efficiency, regulatory adherence, and customer relationships. Regional players maintain competitiveness through flexible pricing and localized logistics, particularly in emerging economies. Strategic partnerships, mergers, and facility expansions remain common strategies to enhance capacity and market access. The market continues to evolve as demand for sustainable and circular waste management solutions grows across industrial sectors. Companies that prioritize innovation, regulatory alignment, and end-to-end service delivery are best positioned for long-term growth.

Recent Developments:

- In 2024, the Slicker Recycling company formalized a partnership with Safetykleen Europe to double the amount of used oil collected and re-refined in the UK. This collaboration, building on a decade-long relationship, is expected to significantly increase the circularity of waste oil management

- In June 2022, Shell, a UK-based oil company, introduced a used oil management service initiative in India. This service was designed to organize India’s waste oil disposal system and increase the rate of re-refining, contributing to Shell’s broader circular economy goals. The initiative seeks to create a formal ecosystem for waste oil management, addressing the challenge of spent oil disposal, which is a significant barrier to industrial circularity in India

Market Concentration & Characteristics:

The Global Waste Oil Market exhibits moderate market concentration, with a mix of established multinational firms and regional players operating across collection, treatment, and re-refining stages. It is characterized by regulated operations, high compliance requirements, and the need for specialized infrastructure. Large players dominate developed markets through integrated service models and advanced processing technologies, while smaller firms compete on flexibility and localized service delivery. The market depends heavily on consistent waste oil supply, strict environmental standards, and growing demand for re-refined products. It remains sensitive to feedstock quality and regional policy shifts, which influence entry barriers and operational efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology and End Use. t details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for re-refined base oils will increase due to rising emphasis on sustainability and circular economy practices.

- Technological advancements will improve recycling efficiency and expand the economic viability of waste oil treatment.

- Regulatory support will strengthen across developed and emerging markets, encouraging formal collection and reprocessing.

- Investment in mobile and modular refining units will grow to address infrastructure gaps in remote and developing regions.

- Strategic partnerships between waste management firms and industrial users will enhance supply chain stability.

- Asia Pacific will remain the fastest-growing region, driven by industrial expansion and improving waste oil recovery systems.

- Companies will adopt digital monitoring tools to enhance traceability and operational transparency.

- Market players will focus on securing long-term contracts with municipal and commercial waste generators.

- Re-refined oil applications will diversify, expanding into new industrial and energy segments.

- Competitive pressure will drive consolidation and innovation among regional service providers.