Market Overview

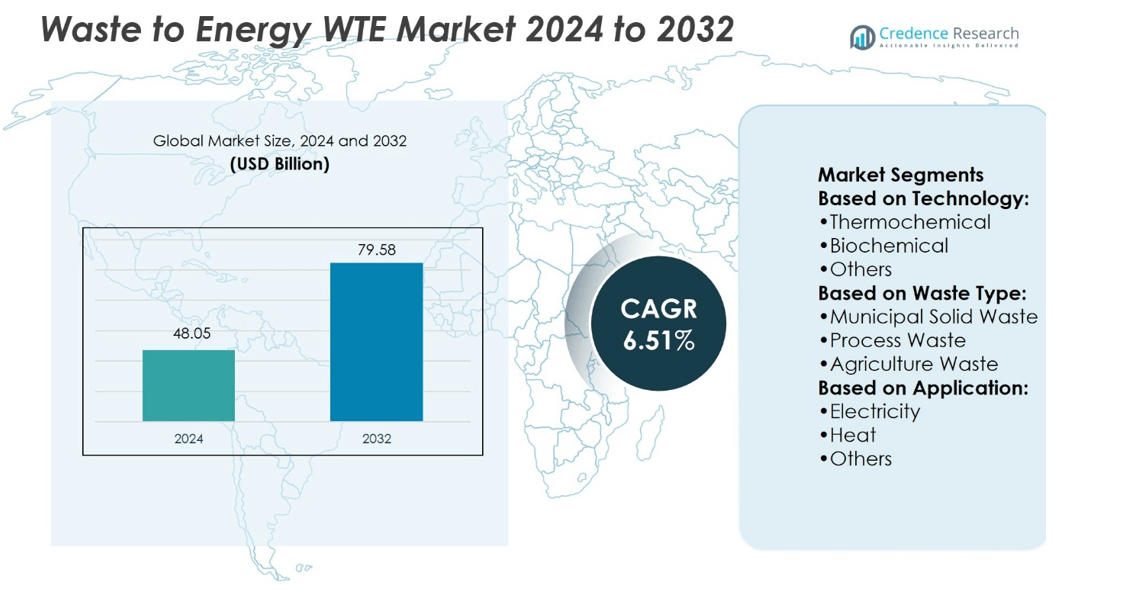

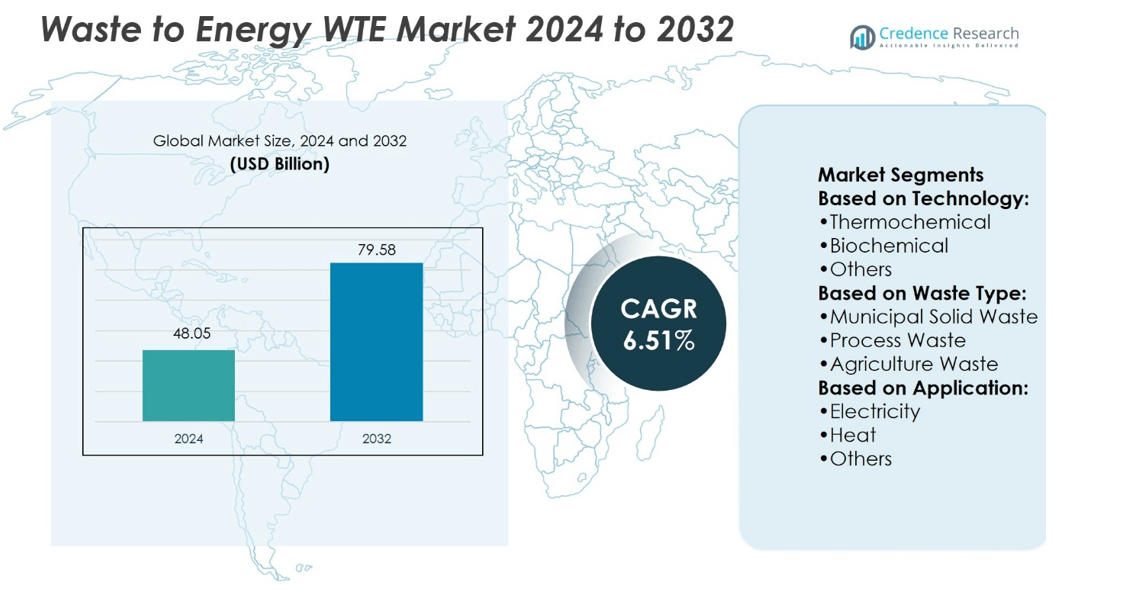

Waste to Energy WTE Market size was valued at USD 48.05 billion in 2024 and is anticipated to reach USD 79.58 billion by 2032, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste to Energy (WTE) Market Size 2024 |

USD 48.05 billion |

| Waste to Energy (WTE) Market, CAGR |

6.51% |

| Waste to Energy (WTE) Market Size 2032 |

USD 79.58 billion |

The Waste to Energy WTE Market advances through strong drivers and evolving trends shaping global adoption. Governments enforce strict landfill diversion policies and renewable energy mandates, creating steady demand for new projects. Rising urban waste volumes push municipalities to adopt thermal and biochemical conversion methods that ensure reliable disposal and energy recovery. Technology providers integrate advanced flue gas cleaning, digital monitoring, and modular plant designs to improve efficiency and reduce emissions. Investors view the sector as a stable renewable source with long-term growth potential. The market strengthens its role within circular economy strategies and sustainable urban infrastructure planning.

Europe holds the largest share of the Waste to Energy WTE Market, supported by strict landfill restrictions and advanced district heating networks. Asia-Pacific follows with rapid expansion in China, India, and Japan due to urbanization and rising energy demand. North America maintains steady growth through plant upgrades and municipal contracts, while Latin America and the Middle East & Africa emerge as developing regions. Key players shaping the market include Hitachi Zosen, SUEZ, JFE Engineering, Mitsubishi Heavy Industries, and Everbright Environment.

Market Insights

- Waste to Energy WTE Market size was valued at USD 48.05 billion in 2024 and is projected to reach USD 79.58 billion by 2032, at a CAGR of 6.51%.

- Strong government regulations on landfill diversion and renewable energy mandates fuel consistent project demand.

- Technology trends include gasification, pyrolysis, digital monitoring, and advanced flue gas cleaning for higher efficiency.

- Competition remains strong with global firms expanding portfolios across thermal and biochemical processes.

- High capital investment and strict emission compliance act as restraints on rapid new deployments.

- Europe leads the market with 38% share, Asia-Pacific holds 45–47%, North America maintains 12%, while Latin America and Middle East & Africa contribute 5%.

- The sector gains importance in circular economy strategies, linking waste reduction with renewable power and material recovery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Emphasis on Sustainable Waste Management Practices

The Waste to Energy WTE Market benefits from rising focus on sustainable waste solutions. Governments prioritize diversion of municipal solid waste away from landfills toward energy recovery. It enables cities to address growing waste volumes while producing reliable electricity. Policies encourage incineration, gasification, and pyrolysis facilities to reduce environmental impact. Municipal authorities sign long-term contracts to ensure consistent waste supply to operators. Strong emphasis on circular economy goals drives investment into advanced facilities.

- For instance, Mitsubishi Heavy Industries developed and operates the TuasOne WTE plant in Singapore. The plant processes 3,600 tonnes of waste every day and generates 120 MW of electricity. This power is sufficient to supply and the plant showcases the integration of waste processing and energy generation.

Rising Demand for Renewable and Alternative Energy Sources

Global energy demand pressures utilities to diversify sources beyond fossil fuels. The Waste to Energy WTE Market supports this goal by providing baseload renewable electricity. It generates power from non-recyclable waste, reducing dependency on coal and natural gas. Utilities adopt WTE facilities to meet renewable portfolio standards and emission targets. It also provides district heating in urban regions, improving overall energy efficiency. Investors view WTE as a stable long-term solution within energy transition strategies.

- For instance, Hitachi Zosen Inova and partners are building a new WTE plant in Abu Dhabi. It will treat 900,000 tonnes of municipal solid waste per year—about 2,700 tonnes per day—and generate 80 MW of electricity.

Advancements in Conversion and Emission Control Technologies

Technological progress strengthens adoption of modern WTE facilities worldwide. The Waste to Energy WTE Market integrates advanced flue gas cleaning, ensuring compliance with strict emission norms. It includes continuous monitoring systems that control nitrogen oxides, dioxins, and particulates. Gasification and pyrolysis systems improve thermal efficiency and maximize recovery of metals and ash. Operators deploy high-pressure boilers and turbines to boost electricity output per ton of waste. It builds confidence among regulators, investors, and local communities.

Strong Government Support and Public Funding Mechanisms

Policy frameworks remain central in shaping market development globally. The Waste to Energy WTE Market gains momentum through subsidies, tax credits, and green bonds. National governments allocate funds to expand capacity in both developed and emerging economies. It aligns with climate action commitments and sustainable development targets. Multilateral agencies also provide loans to large-scale projects in Asia, Europe, and Latin America. Consistent government support lowers investment risk and strengthens private sector participation.

Market Trends

Increasing Role of Advanced Thermal and Biological Processes

The Waste to Energy WTE Market evolves with adoption of advanced thermal and biological processes. Gasification and pyrolysis deliver higher efficiency compared to traditional incineration. It supports recovery of valuable by-products, including metals and synthetic fuels. Anaerobic digestion expands in regions prioritizing organic waste management. Technology providers emphasize modular and scalable designs for flexible deployment. This trend drives innovation pipelines and competitive differentiation.

- For instance, in France, SUEZ manages 31 energy recovery units (ERUs) treating 3.5 million tonnes of waste annually, thanks to advanced industrial and digital tech like computer vision for process optimization.

Growing Integration with Smart Grids and District Heating Networks

Utilities connect WTE facilities with smart grid infrastructure to maximize output and efficiency. The Waste to Energy WTE Market aligns with grid modernization strategies across developed economies. It ensures stable baseload supply while supporting variable renewable integration. District heating projects integrate with WTE plants to provide combined heat and power. Operators highlight efficiency gains when electricity and thermal energy are delivered simultaneously. This integration strengthens the role of WTE in sustainable urban development.

- For instance, JFE deployed advanced DEM‑CFD multiphase simulation for a 100 t/day furnace, optimizing waste feed behavior. That led to a 30 percent faster development cycle and a 20 percent reduction in NOₓ emissions, while boosting electricity output thanks to a new counterflow combustion design informed by Ansys simulations.

Expansion of Public-Private Partnerships in Infrastructure Projects

Public-private partnerships accelerate project execution and financing across multiple geographies. The Waste to Energy WTE Market benefits from shared investment risk and access to technical expertise. Municipalities contract private firms to design, build, and operate facilities under long-term agreements. It creates stable revenue models while ensuring compliance with waste management policies. Private equity and infrastructure funds enter the sector due to predictable cash flows. The trend enhances project bankability and global investment appeal.

Rising Focus on Circular Economy and Material Recovery

Circular economy objectives reshape priorities within waste management systems worldwide. The Waste to Energy WTE Market adapts by integrating metal recovery and ash utilization. Operators deploy advanced sorting to recover recyclable materials before combustion. It improves resource efficiency and reduces landfill dependency. Facilities also investigate secondary uses for bottom ash in construction materials. This trend aligns WTE projects with sustainability goals and industrial decarbonization agendas.

Market Challenges Analysis

High Capital Investment and Complex Regulatory Compliance

The Waste to Energy WTE Market faces challenges from high upfront investment requirements. Construction of large-scale plants demands advanced technology, land, and infrastructure, raising financial barriers. It relies on long-term contracts and supportive policies to ensure economic viability. Regulatory frameworks often impose strict emission standards, which require costly control systems. Operators must install continuous monitoring and flue gas treatment, increasing operational expenses. These factors slow down new project approvals, especially in emerging economies.

Public Opposition and Concerns Over Environmental Impact

Public resistance remains a key challenge for many proposed WTE projects. The Waste to Energy WTE Market must address fears of air pollution and health risks. Communities express concern over dioxins, particulates, and potential odor issues near plants. It pushes operators to invest in transparent monitoring and advanced emission control. Opposition often leads to delays in permitting, litigation, and higher development costs. Overcoming these perceptions is critical for long-term acceptance and expansion.

Market Opportunities

Expansion Potential in Emerging Economies and Rapidly Urbanizing Regions

The Waste to Energy WTE Market holds strong growth opportunities in emerging economies with rising waste volumes. Rapid urbanization creates pressure on landfills, prompting governments to explore sustainable alternatives. It allows cities to convert municipal waste into energy while reducing environmental strain. International investors view these markets as attractive due to rising energy demand. Local authorities seek partnerships to bring in advanced technology and financing support. Expansion in Asia, Latin America, and Africa offers untapped potential for project developers.

Rising Role of Innovation in Energy and Material Recovery

Technological innovation opens new opportunities for efficiency and resource recovery. The Waste to Energy WTE Market increasingly integrates systems that extract metals, plastics, and reusable ash. It creates additional revenue streams beyond electricity and heat generation. Advanced conversion methods also enable production of synthetic fuels and hydrogen. Operators leverage digital tools for predictive maintenance and improved performance. These innovations strengthen the long-term role of WTE within the circular economy.

Market Segmentation Analysis:

By Technology

The Waste to Energy WTE Market divides into thermochemical and biochemical processes. Thermochemical methods, including incineration, gasification, and pyrolysis, dominate large-scale operations due to high efficiency in reducing waste volume and generating electricity. It allows consistent baseload power, making it suitable for urban centers with high waste generation. Biochemical methods, primarily anaerobic digestion, focus on processing organic fractions of waste. This segment appeals to municipalities targeting organic diversion and production of biogas for power and heat. Growing adoption of modular designs strengthens flexibility in both approaches.

- For instance, the Kelvin WTE facility under construction in West Bromwich, U.K., will divert of non-recyclable waste per year, generating 44 MW of gross baseload electricity, enough to power over 95,000 homes.

By Waste Type

The Waste to Energy WTE Market processes diverse waste streams, with municipal solid waste holding a central role. Municipal contracts ensure consistent feedstock, securing steady output for energy plants. It drives deployment in densely populated regions facing landfill shortages. Process waste from industrial facilities also gains importance, particularly where regulations demand sustainable disposal. Agriculture waste, including crop residues and animal by-products, supports rural energy projects and bio-digestion facilities. The “others” category includes hazardous and commercial waste, serving specialized conversion applications.

- For instance, Enerkem’s demonstration facility in Edmonton, Alberta, which was retired in January 2024, was designed to process up to 350 metric tonnes of MSW per day and had a nameplate capacity of approximately 38 million liters of biofuels annually. Over its operational lifespan, the plant produced a total of 5 million liters of biofuels (methanol and ethanol combined).

By Application

Application segments in the Waste to Energy WTE Market emphasize electricity and heat generation. Electricity remains the dominant output, supplied directly into national grids through long-term power purchase agreements. It provides utilities with reliable renewable energy that complements variable sources like solar and wind. Heat applications expand where district heating infrastructure is developed, particularly in European cities. Operators highlight efficiency improvements when plants deliver combined heat and power, raising overall output from the same tonnage of waste. Industrial sites also explore localized heat supply to reduce fossil fuel use.

Segments:

Based on Technology:

- Thermochemical

- Biochemical

- Others

Based on Waste Type:

- Municipal Solid Waste

- Process Waste

- Agriculture Waste

Based on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America contributes close to 12% share of the Waste to Energy WTE Market. The United States leads with established plants, mostly in the Northeast and Florida. Policies encourage landfill diversion and promote renewable sources. Canada supports smaller projects in provinces with strong green targets. Existing plants undergo retrofits to meet modern efficiency and emission standards. Public opposition slows down new approvals in some states. The region focuses on gradual upgrades rather than rapid new construction.

Europe

Europe holds about 38% share of the Waste to Energy WTE Market. Strong laws against landfills and strict environmental standards drive the demand. Countries like Germany, Sweden, and Denmark lead with advanced plants and district heating networks. Governments support projects through subsidies and public funding. Technology innovation, including cleaner flue gas systems, keeps adoption high. Europe also invests in both thermal and biological solutions to meet climate targets. The region continues to expand capacity as cities face space limits for waste.

Asia-Pacific

Asia-Pacific accounts for nearly 45–47% share of the global market, the largest share worldwide. China operates hundreds of incineration plants that supply renewable power to the grid. India expands anaerobic digestion projects to process municipal waste. Japan and South Korea integrate WTE plants with strict emission controls. Rapid urbanization increases waste levels, pushing cities to adopt energy recovery systems. Governments set ambitious renewable targets that include WTE capacity. Investors find the region attractive for large-scale projects with steady feedstock.

North America

North America contributes close to 12% share of the Waste to Energy WTE Market. The United States leads with established plants, mostly in the Northeast and Florida. Policies encourage landfill diversion and promote renewable sources. Canada supports smaller projects in provinces with strong green targets. Existing plants undergo retrofits to meet modern efficiency and emission standards. Public opposition slows down new approvals in some states. The region focuses on gradual upgrades rather than rapid new construction.

Latin America

Latin America holds about 3% share of the global market. Brazil, Mexico, and Chile show interest in WTE to reduce landfill use. Governments test pilot projects in capital cities where waste volumes are high. Financing challenges slow down large-scale adoption. Partnerships with private firms and international banks support progress. The region looks at both thermal and biological solutions. Growth is expected as urban populations rise.

Middle East & Africa

The Middle East & Africa together account for around 2% share. The UAE and Saudi Arabia invest in large-scale incineration plants as part of renewable programs. Ethiopia’s Reppie plant is a key project in Africa. Other countries, including Kenya and South Africa, explore WTE potential. Limited funding and technical barriers remain challenges. International partnerships and aid play a major role in project development. Governments see WTE as a way to reduce landfills and create energy security.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Waste to Energy WTE Market players including Stellar3, Hitachi Zosen, SUEZ, JFE Engineering, Reworld, Marubeni, Babcock & Wilcox, Enerkem, Everbright Environment, and Mitsubishi Heavy Industries. The Waste to Energy WTE Market remains highly competitive, shaped by technology innovation, project financing, and regional expansion strategies. Companies invest heavily in advanced incineration, gasification, and pyrolysis systems to improve efficiency and comply with tightening emission standards. Competition intensifies in Asia-Pacific, where rapid urbanization and government mandates generate large-scale opportunities. Europe continues to be a hub for integrated waste management solutions, supported by strong policy frameworks and circular economy goals. In North America, operators focus on upgrading existing facilities and forming long-term contracts with municipalities to secure steady feedstock. Emerging markets in Latin America and the Middle East & Africa attract global attention due to growing waste volumes and limited landfill capacity. Competitive advantage is built through proven track records, access to project financing, and the ability to deliver turnkey solutions. Strategic alliances, public-private partnerships, and cross-border investments further reinforce market positions. Continuous development of biochemical pathways, such as biofuel and biogas production, expands the competitive landscape beyond thermal technologies. With governments enforcing stricter environmental policies and communities demanding sustainable waste solutions, the market rewards firms that combine technical expertise with reliable project delivery. The competitive environment is expected to remain strong, with innovation and regional diversification driving leadership.

Recent Developments

- In May 2025, Veolia North America partnered with Ingenium to launch a high-temperature treatment site in Gum Springs, Arkansas, integrating waste-heat recovery and on-site solar generation to boost energy efficiency.

- In October 2024, SUEZ and CMA CGM Group signed a memorandum of understanding to collaborate on biomethane production in Europe. This partnership aims to support the low-carbon conversion of maritime transport, aligning with sustainability goals.

- In July 2024, Babcock & Wilcox Renewable Service A/S was acquired by Hitachi Zosen Inova AG from Babcock & Wilcox Enterprise, enhancing its capabilities in renewable energy solutions. This strategic acquisition expands service offerings in the biomass and waste-to-energy sectors, strengthening Hitachi Zosen Inova’s position in the global renewable energy market.

- In October 2023, Mitsubishi Heavy Industries secured a contract to rebuild the Abukuma Clean Center in Fukushima, Japan, including two 60-tpd stoker incinerators with next-generation flue-gas conditioning.

Report Coverage

The research report offers an in-depth analysis based on Technology, Waste Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger government policies on landfill reduction.

- Urbanization will increase municipal waste volumes and drive new WTE projects.

- Advanced gasification and pyrolysis will gain wider adoption for efficiency gains.

- Biochemical processes will support growth in organic waste conversion to energy.

- Public-private partnerships will remain central to large project financing.

- Integration with smart grids will improve power stability from WTE facilities.

- District heating networks will expand in regions adopting combined heat and power.

- Technology upgrades will reduce emissions and strengthen public acceptance of projects.

- Circular economy goals will increase focus on material recovery with energy production.

- Emerging economies will present strong opportunities for new WTE infrastructure development.