Market Overview

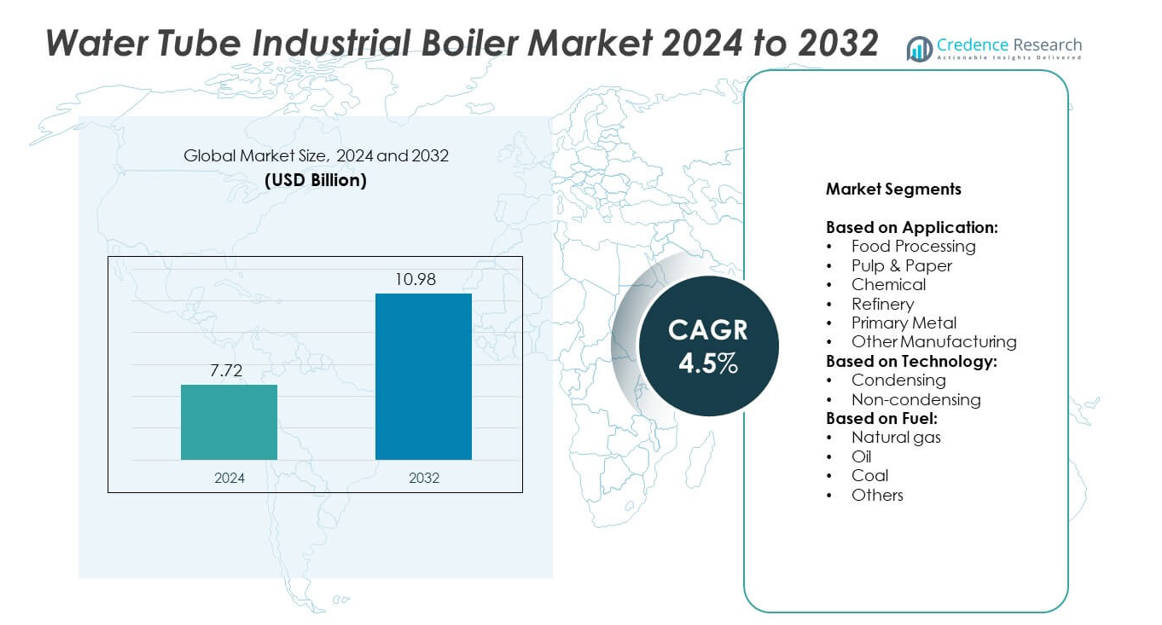

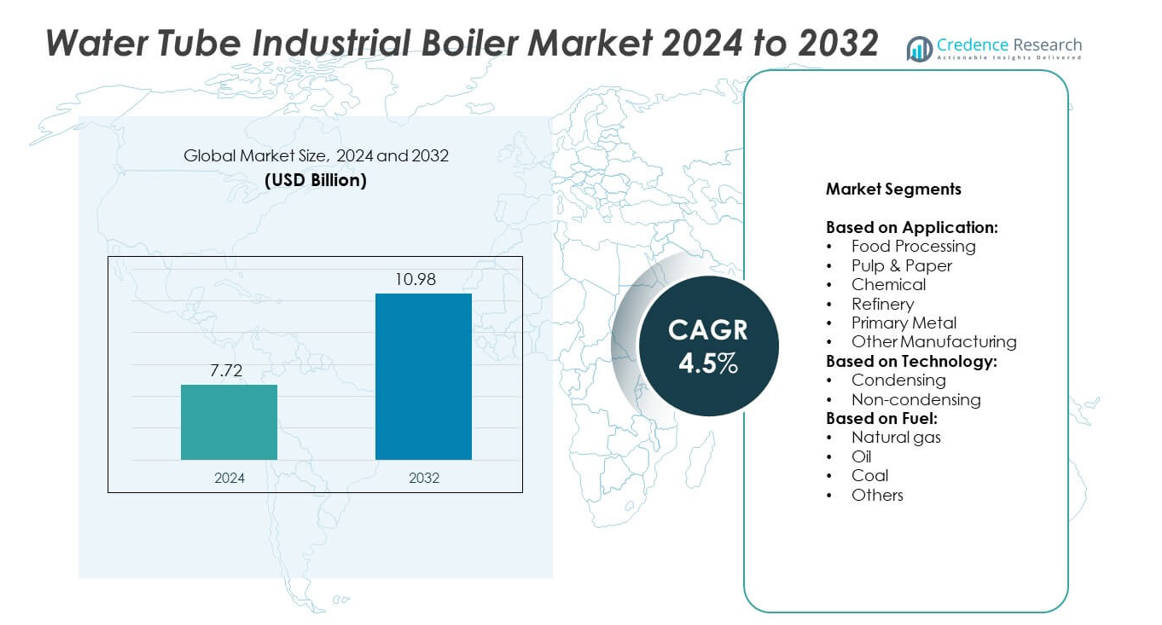

Water Tube Industrial Boiler Market size was valued at USD 7.72 billion in 2024 and is anticipated to reach USD 10.98 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Tube Industrial Boiler Market Size 2024 |

USD 7.72 billion |

| Water Tube Industrial Boiler Market, CAGR |

4.5% |

| Water Tube Industrial Boiler Market Size 2032 |

USD 10.98 billion |

The Water Tube Industrial Boiler market grows due to rising industrialization, expanding power generation, and increasing demand for high-pressure steam. It supports applications in chemical, food processing, and metal industries, improving operational efficiency. Adoption of energy-efficient and low-emission boilers drives regulatory compliance. Technological advancements, including digital monitoring and automation, enhance reliability and reduce maintenance. Growing investments in renewable and hybrid fuel-compatible systems strengthen sustainability initiatives. Rising infrastructure development in emerging economies further propels market growth and long-term opportunities.

The Water Tube Industrial Boiler market shows strong growth across North America, Europe, and Asia-Pacific, driven by industrial expansion and power generation needs. Asia-Pacific leads in adoption due to rapid industrialization and infrastructure development. North America and Europe focus on energy-efficient and low-emission systems to meet regulatory standards. Key players such as Harbin Boiler, Bharat Heavy Electricals, Babcock Wilcox Enterprises, and Doosan Heavy Industries drive market innovation, offering high-capacity, technologically advanced, and fuel-flexible solutions to support diverse industrial applications globally.

Market Insights

- Water Tube Industrial Boiler market was valued at USD 7.72 billion in 2024 and is projected to reach USD 10.98 billion by 2032, growing at a CAGR of 4.5%.

- Rising industrialization and expansion of power generation plants drive market demand globally.

- Adoption of energy-efficient, low-emission, and hybrid fuel-compatible boilers supports sustainability initiatives.

- Leading players such as Harbin Boiler, Bharat Heavy Electricals, Babcock Wilcox Enterprises, and Doosan Heavy Industries focus on high-capacity and technologically advanced solutions.

- High capital costs, stringent regulations, and operational complexities restrain market growth in certain regions.

- North America, Europe, and Asia-Pacific witness strong adoption due to industrial expansion and regulatory compliance requirements.

- Asia-Pacific leads market growth through rapid industrialization, infrastructure development, and rising demand in chemical, metal, and power sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Industrialization Driving Demand for High-Efficiency Boilers

The Water Tube Industrial Boiler market benefits from rapid industrialization across emerging economies. Industries such as chemicals, power generation, and oil & gas require high-capacity steam and heat solutions. It delivers superior thermal efficiency, enabling factories to maintain consistent operations while reducing energy losses. Rising energy demand and expansion of manufacturing units further stimulate adoption. Companies increasingly prioritize reliable and robust boiler systems to support production targets. It remains a preferred choice for sectors needing continuous and high-pressure steam supply. Investment in modernization of industrial infrastructure continues to boost market growth.

- For instance, Bharat Heavy Electricals Limited (BHEL) has supplied numerous 500 MW thermal power units to facilities across India.

Stringent Environmental Regulations Encouraging Advanced Boiler Solutions

Environmental norms compel industries to adopt cleaner and safer boiler technologies. Water tube boilers offer better emissions control and lower fuel consumption compared to conventional fire-tube systems. It enables compliance with carbon and particulate matter regulations, reducing penalties and operational risks. Companies focus on integrating automation and monitoring systems to optimize performance and minimize wastage. Governments provide incentives for installing energy-efficient systems, accelerating adoption rates. Industrial operators prefer technologies that enhance environmental sustainability without compromising productivity. It strengthens the market presence of water tube boilers across regulated regions.

- For instance, MHI was awarded the installation of FGD systems for the 2x600MW Mouda-II coal-fired power plant belonging to NTPC in India.

Expansion of Power Generation Infrastructure Supporting Market Growth

Increasing global demand for electricity drives investments in thermal power plants. Water tube boilers support high-capacity and high-pressure steam generation, making them essential in power infrastructure projects. It enables plants to maintain operational efficiency and stability under varying load conditions. Rising adoption in co-generation facilities ensures simultaneous electricity and heat production, improving overall efficiency. Technological upgrades enhance reliability and reduce maintenance requirements, appealing to plant operators. Power generation companies actively replace older systems with water tube boilers to meet performance targets. It remains critical for meeting the energy needs of growing urban and industrial populations.

Technological Advancements Enhancing Boiler Efficiency and Reliability

Innovation in design and materials strengthens the Water Tube Industrial Boiler market. Advanced automation, digital monitoring, and corrosion-resistant materials improve lifespan and operational safety. It provides precise control over pressure and temperature, optimizing energy use and reducing downtime. Companies invest in R&D to develop compact and modular systems suitable for diverse industrial applications. Enhanced performance and lower maintenance costs make water tube boilers attractive for both new installations and retrofits. It drives competitive differentiation for manufacturers offering technologically superior solutions. Continuous innovation ensures long-term market growth and adoption.

Market Trends

Shift Toward Energy-Efficient and Low-Emission Boiler Systems

The Water Tube Industrial Boiler market is witnessing a strong shift toward energy-efficient solutions. Industries prioritize systems that reduce fuel consumption and lower greenhouse gas emissions. It supports compliance with stringent environmental regulations while minimizing operational costs. Manufacturers develop advanced designs with enhanced heat transfer efficiency to meet these demands. Companies adopt automated controls to optimize performance and reduce energy wastage. Rising awareness of sustainability drives adoption across chemical, power, and manufacturing sectors. It positions water tube boilers as a preferred choice for environmentally conscious industrial operations.

- For instance, HBC successfully developed and deployed a 660 MW ultra-supercritical CFB boiler in the Binchang Project, a large-scale project developed under China’s 13th Five-Year Plan.

Integration of Digital Technologies and Smart Monitoring Systems

Digital transformation influences trends in the Water Tube Industrial Boiler market. Companies implement sensors, IoT-enabled monitoring, and predictive analytics to improve operational efficiency. It allows real-time performance tracking, fault detection, and preventive maintenance. Remote monitoring reduces downtime and extends equipment lifespan, improving cost-effectiveness. Manufacturers focus on delivering intelligent solutions that integrate with broader industrial automation systems. It supports industries in achieving operational reliability and energy optimization. Adoption of smart technologies strengthens competitiveness for both suppliers and end-users.

- For instance, Foster Wheeler (now part of Wood Group) has implemented low-NOx burner systems for refineries and industrial applications globally, including in the UAE. The company’s technologies have demonstrated significant emissions reduction capabilities; for example, its Vortex Series burners were engineered to achieve NOx reductions of up to 72% under optimal conditions.

Growing Adoption of Modular and Compact Boiler Designs

Industries prefer modular and compact water tube boilers due to space and scalability advantages. The Water Tube Industrial Boiler market responds with customizable systems suitable for small, medium, and large plants. It enables faster installation, easier maintenance, and flexible capacity expansion. Companies invest in lightweight and corrosion-resistant materials to enhance durability and transportability. Compact designs reduce operational footprint while maintaining high-pressure steam output. Rising urbanization and limited industrial space further fuel demand. It drives innovation toward smaller, yet high-capacity boiler solutions.

Focus on Renewable and Hybrid Fuel Capabilities

The market trend includes adoption of hybrid and renewable fuel-compatible boilers. Water tube boilers are being modified to use biomass, biofuel, and low-emission natural gas. It supports industries in diversifying energy sources and reducing reliance on conventional fossil fuels. Companies explore dual-fuel systems to balance cost and sustainability goals. Integration of renewable fuels ensures continuity of operations during energy transitions. It aligns with global initiatives for carbon reduction and sustainable industrial practices. Market players leverage this trend to differentiate through eco-friendly and versatile offerings.

Market Challenges Analysis

High Initial Investment and Installation Costs Limiting Market Penetration

The Water Tube Industrial Boiler market faces challenges from high upfront costs. Advanced designs, high-quality materials, and automation systems increase capital expenditure. It may discourage small and medium-sized enterprises from adopting these systems despite long-term efficiency benefits. Installation requires skilled labor and careful planning, adding to operational complexity. Companies must allocate significant resources for foundation, piping, and auxiliary equipment. Financing options and government incentives partially mitigate these barriers. It continues to impact market growth in regions with limited industrial budgets.

Complex Maintenance Requirements and Operational Expertise Constraints

Maintenance and operational expertise pose significant challenges in the Water Tube Industrial Boiler market. High-pressure systems require regular inspections, monitoring, and timely replacement of critical components. It demands trained personnel to ensure safety and prevent downtime. Failure to maintain proper operating conditions can lead to equipment degradation or accidents. Companies face additional costs for spare parts, monitoring tools, and specialized training. Limited availability of skilled technicians in certain regions slows adoption. It creates a barrier for industries seeking reliable yet manageable boiler solutions.

Market Opportunities

Expansion of Industrial and Power Generation Infrastructure Driving Growth Opportunities

The Water Tube Industrial Boiler market presents opportunities through global industrial expansion. Increasing investments in power plants, chemical facilities, and manufacturing units create demand for high-capacity boilers. It delivers reliable high-pressure steam, supporting continuous operations and productivity. Emerging economies focus on modernizing energy infrastructure, favoring advanced water tube systems. Companies can leverage turnkey solutions and modular designs to capture new installations. Rising urbanization and industrialization further strengthen market prospects. It offers potential for long-term partnerships with energy and industrial sectors seeking efficient steam generation.

Adoption of Renewable Energy and Hybrid Fuel Technologies Creating Market Prospects

Opportunities in the Water Tube Industrial Boiler market grow with the shift toward renewable and hybrid fuel usage. Companies explore biomass, biofuel, and low-emission natural gas to reduce carbon footprints. It enables industries to meet sustainability goals while maintaining operational efficiency. Manufacturers can develop flexible systems compatible with multiple fuel types to attract eco-conscious clients. Technological innovations in digital monitoring and automation enhance performance and reliability. Growing corporate focus on environmental compliance supports adoption of advanced water tube boilers. It opens avenues for manufacturers to differentiate through sustainable and versatile offerings.

Market Segmentation Analysis:

By Application:

The Water Tube Industrial Boiler market serves diverse industrial applications. In the food processing sector, it provides consistent steam for cooking, sterilization, and drying processes, enhancing operational efficiency. Chemical industries adopt it for high-pressure steam needed in reactions, distillation, and evaporation. Refineries rely on water tube boilers to generate heat and power for crude oil processing and petrochemical production. The pulp & paper segment benefits from continuous steam supply for pulping, bleaching, and drying operations. Primary metal industries utilize it to support smelting, forging, and metal finishing processes. Other manufacturing sectors, including textiles and pharmaceuticals, adopt it for process heating and energy requirements, strengthening overall market demand.

- For instance, Thermax Ltd. has installed boilers for various dairy plants. For instance, Thermax successfully commissioned a CPFD (multifuel) boiler for Govind dairy in Phaltan, India. It also supplied a 20-ton-per-hour (TPH) hybrid reciprocating grate boiler to a large dairy company in southern India in October 2021.

By Technology:

Technological segmentation divides the market into condensing and non-condensing water tube boilers. Condensing boilers enhance energy efficiency by recovering latent heat from flue gases. It enables industries to reduce fuel consumption while maintaining high steam output. Non-condensing boilers offer robust performance for high-pressure applications and large-scale operations. It remains preferred in sectors requiring rapid steam generation and consistent operational reliability. Companies focus on providing both technologies to meet diverse industrial needs and efficiency targets.

- For instance, B&W provides industrial boilers with steam capacities ranging up to 200,000 kg/hr (or 200 tons/hr) and has historically offered boilers with maximum working pressures exceeding 140 bar, illustrating their capability for high-pressure steam supply

By Fuel:

Fuel-based segmentation includes natural gas, oil, coal, and other fuels. Natural gas-fired water tube boilers gain preference for cleaner emissions and operational flexibility. It supports industries aiming for sustainability and compliance with environmental regulations. Oil-fired boilers remain widely used in regions with limited natural gas infrastructure, offering reliable performance under varying loads. Coal-fired boilers continue to serve heavy industries where cost-effective fuel availability is critical. Other fuels, including biomass and hybrid options, provide opportunities for industries pursuing renewable energy adoption. It enables manufacturers to cater to evolving energy requirements and sustainability goals.

Segments:

Based on Application:

- Food Processing

- Pulp & Paper

- Chemical

- Refinery

- Primary Metal

- Other Manufacturing

Based on Technology:

- Condensing

- Non-condensing

Based on Fuel:

- Natural gas

- Oil

- Coal

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 28% share of the Water Tube Industrial Boiler market, driven by strong industrial infrastructure and stringent energy efficiency regulations. Industries in the region invest heavily in high-capacity, high-pressure boilers to meet growing energy demands. It supports applications in chemical manufacturing, power generation, and food processing with reliable steam output. Technological adoption, including condensing and non-condensing systems, improves operational efficiency. Companies focus on natural gas-fired boilers to comply with environmental norms and reduce emissions. Expansion of renewable energy and hybrid fuel adoption further strengthens market opportunities. It remains a critical region for manufacturers introducing advanced, automation-ready solutions.

Europe

Europe accounts for a 25% share of the Water Tube Industrial Boiler market, backed by regulatory emphasis on emissions reduction and energy efficiency. Industries prioritize eco-friendly boiler systems that reduce carbon footprint. It is widely adopted in chemical, pulp & paper, and refinery applications requiring continuous high-pressure steam. Government incentives encourage retrofitting older boilers with condensing technologies. Companies invest in natural gas and biomass-compatible systems to meet sustainability targets. Industrial modernization projects and replacement of outdated infrastructure support steady market growth. It positions Europe as a strategic region for high-performance and technologically advanced boilers.

Asia-Pacific

Asia-Pacific holds a dominant 30% share of the Water Tube Industrial Boiler market, fueled by rapid industrialization and expansion of power generation infrastructure. The region witnesses high adoption in primary metal, chemical, and manufacturing sectors. It benefits from rising investments in new plants and capacity expansion projects. Coal-fired and oil-fired boilers remain widely used due to fuel availability, while natural gas systems gain traction in urban industrial hubs. Technological advancements, modular designs, and automation attract large-scale industrial users. It remains a key growth engine for global manufacturers targeting emerging markets. Rising energy demand and infrastructure investments strengthen adoption across countries like China, India, and Japan.

Latin America

Latin America contributes a 10% share of the Water Tube Industrial Boiler market, supported by growing industrial activities and modernization of power plants. Industries adopt water tube boilers to enhance energy efficiency and meet increasing steam demands. It supports applications in chemical processing, food manufacturing, and metal industries. Expansion projects and replacement of older fire-tube systems drive market opportunities. Companies focus on oil and natural gas-fired boilers due to fuel availability. Rising industrialization and infrastructure development in countries such as Brazil and Mexico further encourage market growth. It remains a region with significant potential for new installations and upgrades.

Middle East & Africa

The Middle East & Africa holds a 7% share of the Water Tube Industrial Boiler market, driven by investments in energy-intensive industries such as oil refining, petrochemicals, and power generation. It enables high-pressure steam generation for continuous industrial operations in challenging environments. Companies adopt both non-condensing and condensing technologies to optimize fuel efficiency and reduce operational costs. Natural gas remains the dominant fuel, while hybrid and renewable options are gradually emerging. Regional governments support industrial growth through energy efficiency initiatives and modernization projects. It continues to offer niche opportunities for manufacturers focusing on durable and technologically advanced boiler solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dongfang Boiler Group

- Thermax

- Babcock Wilcox Enterprises

- Doosan Heavy Industries

- Mitsubishi Heavy Industries

- Hyundai Heavy Industries

- Foster Wheeler

- Bharat Heavy Electricals

- Siemens

- Harbin Boiler

- Toyo Engineering

- Acurex

- Alstom

- Clyde Bergemann

- CMI Group

Competitive Analysis

Key players in the Water Tube Industrial Boiler market include Harbin Boiler, Bharat Heavy Electricals, Babcock Wilcox Enterprises, Toyo Engineering, Clyde Bergemann, CMI Group, Doosan Heavy Industries, Dongfang Boiler Group, Foster Wheeler, Thermax, Acurex, Alstom, Mitsubishi Heavy Industries, Hyundai Heavy Industries, and Siemens. These companies lead through technological innovation, high-capacity boiler solutions, and global operational reach. They focus on energy-efficient and low-emission systems to meet industrial and regulatory demands. Companies invest in digital monitoring, automation, and predictive maintenance to enhance performance and reliability. They offer modular and customizable solutions catering to food processing, chemical, refinery, and power generation sectors. Strategic collaborations, joint ventures, and long-term supply agreements help expand market penetration. Regional production hubs and service networks strengthen after-sales support and maintenance capabilities. Investment in research and development enables them to introduce hybrid and renewable fuel-compatible boilers. Competitive pricing strategies and flexible financing options attract a diverse industrial client base. These players leverage their brand reputation, technological expertise, and global experience to maintain leadership and address evolving market requirements. The focus on sustainability, operational efficiency, and innovation positions them strongly against emerging competitors in the water tube boiler segment.

Recent Developments

- In 2025, Babcock & Wilcox (B&W) indeed has been involved in delivering advanced boiler systems, including a significant retrofit contract in Southeast Asia to upgrade a coal power plant and a contract for industrial boilers

- In 2024, Doosan signed a memorandum of understanding with the Jeju Special Self-Governing Province to cooperate on clean energy projects, including wind and hydrogen power.

- In 2024 (January), Thermon Group Holdings Inc. acquired Vapor Power International, LLC, expanding its electric resistance and low-emission technology offerings aligned with decarbonization trends

Report Coverage

The research report offers an in-depth analysis based on Application, Technology, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity and high-pressure boilers will continue to rise across industries.

- Adoption of energy-efficient and low-emission systems will expand globally.

- Integration of digital monitoring and automation will enhance operational efficiency.

- Modular and compact boiler designs will gain preference in space-constrained facilities.

- Renewable and hybrid fuel-compatible boilers will attract environmentally conscious industries.

- Replacement of outdated fire-tube boilers will drive market growth in developed regions.

- Emerging economies will invest in new industrial and power generation infrastructure.

- Technological advancements will reduce maintenance requirements and improve lifespan.

- Manufacturers will focus on customizing solutions for specific industrial applications.

- Strong regulatory frameworks will encourage adoption of sustainable and efficient boiler systems.