Market Overview:

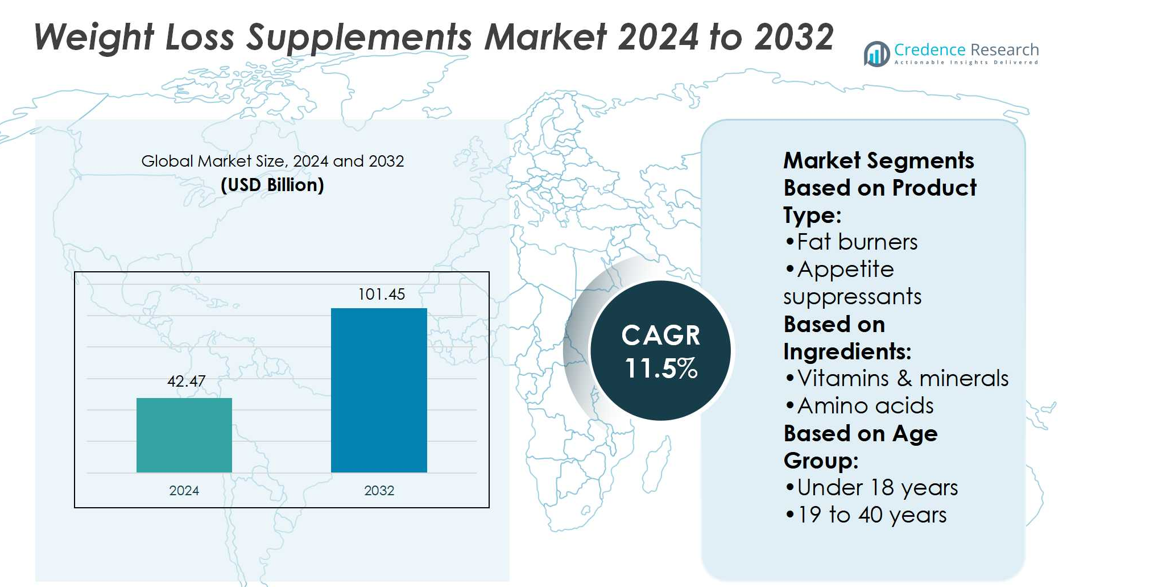

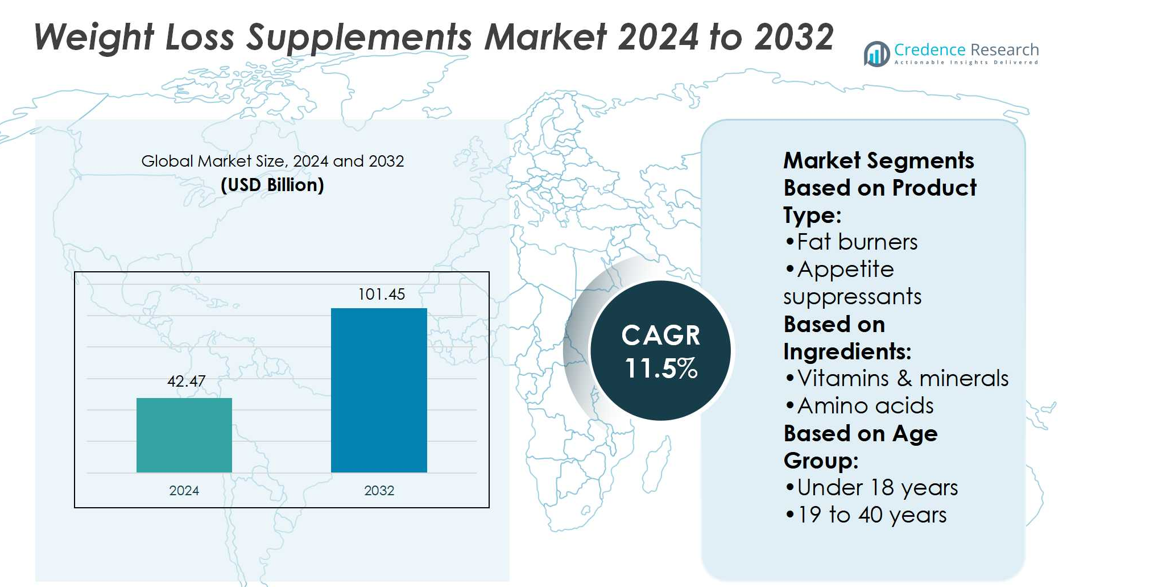

Weight Loss Supplements Market size was valued USD 42.47 billion in 2024 and is anticipated to reach USD 101.45 billion by 2032, at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Weight Loss Supplements Market Size 2024 |

USD 42.47 billion |

| Weight Loss Supplements Market, CAGR |

11.5% |

| Weight Loss Supplements Market Size 2032 |

USD 101.45 billion |

The Weight Loss Supplements Market features strong competition from leading players such as Herbalife Nutrition Ltd., AdvoCare International, L.P., Beachbody, LLC, LifeVantage Corporation, Arbonne International, LLC, GNC Holdings, Inc., Isagenix International LLC, Atkins Nutritionals, Inc., Forever Living Products International, LLC, and Amway Corporation. These companies focus on diverse strategies including product innovation, clean-label formulations, and multi-channel distribution to strengthen market presence. North America leads the global market with a 38% share, supported by high obesity prevalence, advanced retail infrastructure, and strong consumer demand for quick and reliable weight management solutions.

Market Insights

- The Weight Loss Supplements Market size was USD 42.47 billion in 2024 and will reach USD 101.45 billion by 2032, growing at a CAGR of 11.5%.

- Rising obesity prevalence, sedentary lifestyles, and increasing fitness awareness drive strong demand for fat burners, appetite suppressants, and natural supplements, with fat burners holding the largest segment share at 38%.

- The market is witnessing trends toward clean-label and botanical-based products, supported by innovation in plant-derived formulations and growing consumer preference for natural solutions.

- Leading players such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, and others focus on product innovation, digital marketing, and multi-channel distribution, intensifying competition across global markets.

- North America leads with a 38% share due to advanced infrastructure and high supplement adoption, followed by Europe at 28% and Asia Pacific at 22%, while Latin America and the Middle East & Africa show emerging opportunities driven by rising health awareness and expanding retail access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the Weight Loss Supplements Market, fat burners hold the dominant share at 38%. This leadership stems from their strong consumer preference for quick calorie burning and metabolism-boosting benefits. Appetite suppressants and carbohydrate blockers follow, driven by demand from calorie-conscious users and those managing sugar intake. Weight loss support products and specialty supplements maintain niche demand. Rising sedentary lifestyles and the popularity of fitness-focused diets strengthen fat burner adoption, while innovations such as thermogenic blends and caffeine-based formulations enhance their market edge.

- For instance, Beachbody Shakeology Chocolate-Vegan shake, one serving (40 g) delivers a review of the Shakeology nutritional information confirms that a 40 g (one scoop) serving size provides the stated amounts of protein and fiber.The Chocolate-Vegan formula contains 16 g of protein per serving from a plant-based blend that includes pea, flax, rice, and quinoa.

By Ingredients

Natural extracts and botanicals dominate this segment with a 41% share, supported by growing demand for plant-based and clean-label products. Consumers prefer green tea extracts, Garcinia cambogia, and herbal blends due to perceived safety and effectiveness. Vitamins and minerals rank second, appealing to those seeking balanced nutrient intake alongside weight management. Amino acids hold relevance for muscle preservation during weight loss. Rising awareness of herbal wellness, coupled with regulatory support for natural formulations, drives the strong growth of this sub-segment in global and regional markets.

- For instance, The Atkins Strong Chocolate Chip Cookie Dough 20g Protein Bar contains 20 g protein, 8 g prebiotic fiber, 3 g net carbs, and 1 g sugar per 60 g serving.

By Age Group

The 19 to 40 years age group leads with 46% share, fueled by a younger demographic’s high fitness awareness and social influence. This segment actively purchases fat burners, appetite suppressants, and botanical-based supplements to meet lifestyle and appearance goals. The 41 to 50 years group represents the second-largest share, largely driven by preventive health concerns and metabolic slowdown. Demand among those above 51 years is growing steadily, encouraged by products addressing weight management alongside wellness needs. Marketing campaigns targeting millennials and urban professionals amplify dominance of the 19 to 40 years bracket.

Market Overview

Rising Obesity and Lifestyle Disorders

The increasing prevalence of obesity and lifestyle-related disorders serves as a major driver for the Weight Loss Supplements Market. Consumers facing health risks such as diabetes, cardiovascular issues, and high cholesterol actively seek weight management solutions. Supplements offer an accessible and affordable approach compared to medical treatments, attracting broad consumer adoption. Urbanization, sedentary jobs, and poor dietary habits continue to intensify demand. This rising need for effective, convenient, and safe solutions ensures consistent market expansion across both developed and emerging regions.

- For instance, Glanbia Nutritionals developed OptiSol® 1007, a heat-stable whey protein concentrate that solves thermal instability. This product was among over 120 entries shortlisted at the Food Formulation Innovation show, and it enables neutral-pH protein beverages without cloudiness or sedimentation.

Expanding Fitness and Wellness Culture

The surge in fitness awareness and wellness-focused lifestyles strongly supports market growth. Younger demographics, particularly millennials and Gen Z, prioritize physical fitness and body image, boosting supplement demand. Fitness influencers, social media campaigns, and wellness programs further fuel adoption. Consumers increasingly incorporate fat burners, appetite suppressants, and natural supplements into their routines alongside exercise. This cultural shift toward proactive health management, supported by gyms and sports nutrition outlets, highlights supplements as essential tools in achieving weight loss and performance goals.

- For instance, NutriSport Pharmacal has delivered contract manufacturing services since 1997 in the US, with its facility being FDA-inspected and cGMP / Part 111 compliant, verified by third-party audits (e.g. NSF, Natural Product Association).

Innovation in Natural and Clean-Label Formulations

Innovation in natural and plant-based supplements significantly boosts market growth. Consumers increasingly prefer clean-label formulations containing green tea, Garcinia cambogia, and herbal extracts due to perceived safety and efficacy. Manufacturers are investing in research to improve bioavailability and create blends with fewer side effects. Regulatory encouragement for botanical products enhances consumer trust and accelerates adoption. This trend caters to rising demand for transparency, sustainability, and wellness-driven consumption, positioning natural extracts as central to product development and competitive advantage.

Key Trends & Opportunities

Personalized and Digitalized Supplement Solutions

Personalized weight loss supplements integrated with digital platforms present strong opportunities. Companies are offering app-based guidance, tailored dosage plans, and AI-driven recommendations aligned with consumer goals. Wearable devices that track metabolism and calorie burn support supplement personalization, improving results and engagement. This integration of digital health tools with supplements enhances credibility, appeals to tech-savvy consumers, and strengthens brand loyalty.

- For instance, Ajinomoto published the ANPS-Meal system,The study evaluated 1,816 meals to test and validate the new model.The ANPS-Meal system scores are based on four key components: protein and vegetables (for encouraged intake) and saturated fatty acids and sodium (for limited intake).

Expansion into Emerging Economies

Emerging economies represent significant growth opportunities due to rising disposable incomes and urbanization. Countries in Asia Pacific, Latin America, and the Middle East are witnessing a cultural shift toward fitness and wellness. Increased retail penetration and online platforms enhance accessibility to weight loss supplements. Growing awareness campaigns about obesity and preventive health encourage adoption, creating untapped revenue potential for global and regional manufacturers.

- For instance, Abbott’s Medical Devices segment generated approximately US 19 billion in sales, representing around 45% of Abbott’s total revenue. The company reported that the Medical Devices segment has had a strong run of organic sales growth.

Key Challenges

Regulatory Compliance and Product Safety

Strict regulatory frameworks present a significant challenge in the Weight Loss Supplements Market. Many regions impose stringent guidelines on ingredient approval, labeling, and claims verification. Non-compliance can lead to product recalls, reputational damage, or market withdrawal. Rising consumer concern about adulterated or unsafe products further pressures manufacturers to maintain transparency and invest in quality assurance. Balancing innovation with regulatory demands remains a key barrier to seamless market growth.

High Competition and Price Sensitivity

The market faces intense competition from established brands, local players, and alternative weight management solutions. Price-sensitive consumers often compare supplements with lifestyle modifications, diet plans, or cheaper substitutes. This competition drives pricing pressure and limits profitability for premium products. New entrants further crowd the space with aggressive marketing, making differentiation challenging. Building trust through brand value, scientific validation, and innovative formulations is critical to overcoming this highly competitive environment.

Regional Analysis

North America

North America holds the largest share of 38% in the Weight Loss Supplements Market, driven by high obesity rates and widespread adoption of dietary supplements. The United States dominates the region, supported by advanced retail infrastructure, strong e-commerce penetration, and active fitness culture. Consumers seek quick, convenient, and science-backed solutions, boosting sales of fat burners and appetite suppressants. Strict regulatory frameworks ensure product quality, increasing trust among buyers. The presence of established players and constant innovation in natural and clean-label formulations further strengthen North America’s leadership in the global market.

Europe

Europe accounts for 28% of the Weight Loss Supplements Market, with rising obesity awareness and emphasis on preventive healthcare fueling demand. The United Kingdom, Germany, and France lead adoption due to growing fitness culture and supportive government campaigns against obesity. Consumers in Europe favor natural and botanical supplements, aligning with the region’s preference for clean-label and sustainable products. Regulatory guidelines from the European Food Safety Authority ensure quality standards, enhancing consumer confidence. Increasing online retail adoption and promotional campaigns by leading brands continue to expand the market across Western and Eastern Europe.

Asia Pacific

Asia Pacific captures 22% market share in the Weight Loss Supplements Market and is the fastest-growing region. Rising disposable incomes, urbanization, and growing health consciousness in countries like China, India, and Japan drive strong adoption. Younger demographics actively pursue supplements for fitness, appearance, and lifestyle goals, boosting demand for fat burners and natural extracts. Expanding e-commerce platforms and the influence of social media fitness trends strengthen product visibility and availability. Local manufacturers and international brands are increasing investments in the region, positioning Asia Pacific as a major growth hub in the coming years.

Latin America

Latin America holds 7% of the Weight Loss Supplements Market, supported by growing obesity prevalence and an expanding middle-class population. Brazil and Mexico are the primary contributors, driven by increasing awareness of health risks and rising demand for affordable supplements. Herbal and plant-based formulations are gaining popularity as consumers seek safe and natural solutions. Distribution through pharmacies, supermarkets, and online channels has widened product access. However, economic instability and lower purchasing power in certain countries limit growth. Despite these challenges, targeted marketing and localized product development support steady market expansion in the region.

Middle East & Africa

The Middle East & Africa account for 5% of the Weight Loss Supplements Market, with gradual adoption influenced by urbanization and rising obesity rates. Gulf countries such as Saudi Arabia and the UAE drive regional demand, supported by higher disposable incomes and growing interest in fitness. Herbal supplements are particularly favored due to cultural preferences for natural remedies. Limited awareness and regulatory hurdles slow adoption in parts of Africa. However, the expansion of international brands, coupled with government health campaigns, creates opportunities for growth, positioning the region as an emerging but underpenetrated market.

Market Segmentations:

By Product Type:

- Fat burners

- Appetite suppressants

By Ingredients:

- Vitamins & minerals

- Amino acids

By Age Group:

- Under 18 years

- 19 to 40 years

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Weight Loss Supplements Market players such as Herbalife Nutrition Ltd., AdvoCare International, L.P., Beachbody, LLC, LifeVantage Corporation, Arbonne International, LLC, GNC Holdings, Inc., Isagenix International LLC, Atkins Nutritionals, Inc., Forever Living Products International, LLC, and Amway Corporation. The competitive landscape of the Weight Loss Supplements Market is defined by high rivalry, product innovation, and diverse distribution strategies. Companies differentiate themselves through specialized formulations such as fat burners, appetite suppressants, and natural botanical blends. The shift toward clean-label and plant-based products has intensified competition, as firms invest in research to meet consumer demand for safe and transparent solutions. E-commerce platforms, fitness influencers, and personalized marketing campaigns further strengthen brand visibility. Strong focus on regulatory compliance, quality assurance, and clinical validation remains central to building consumer trust. Intense competition continues to drive innovation and strategic expansion globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Novo Nordisk disclosed that the U.S. FDA granted further approval for Wegovy. This approval extends its indication to include the reduction of major cardiovascular events, such as heart attack, or stroke, in adults diagnosed with known heart disease who are either obese or overweight.

- In February 2024, Herbalife unveiled its latest innovation, the Herbalife GLP-1 Nutrition Companion, introducing a new series of food and supplement product combinations. These offerings, available in both Classic and Vegan options, are now accessible in the U.S. and Puerto Rico, offering consumers a diverse array of flavors to choose from.

- In January 2024, Abbott, a U.S. introduced its latest offering, the PROTALITY brand. This new line features a high-protein nutrition shake, designed to cater to the increasing demographic of adults seeking to manage weight loss while preserving muscle mass and ensuring optimal nutrition.

- In January 2024, GNC, a U.S. based company, unveiled its latest product, GNC Total Lean GlucaTrim, a multi-action weight loss supplement. Engineered with an innovative formula, it aids in weight and inch reduction while preserving lean muscle mass and promoting healthy blood sugar and insulin levels

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ingredients, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness stronger demand for clean-label and botanical-based supplements.

- Digital platforms will play a bigger role in personalized supplement plans.

- Rising obesity rates will continue to fuel steady product adoption worldwide.

- E-commerce will emerge as the leading distribution channel for weight loss products.

- Fitness culture among millennials and Gen Z will accelerate supplement consumption.

- Regulatory scrutiny will intensify, pushing companies to enhance product safety and transparency.

- Innovation in formulation technologies will improve supplement bioavailability and effectiveness.

- Emerging economies will offer significant growth opportunities due to rising health awareness.

- Partnerships with gyms, wellness centers, and digital health apps will expand market reach.

- Competitive intensity will rise, encouraging brand differentiation and targeted marketing strategies.