Market Overview

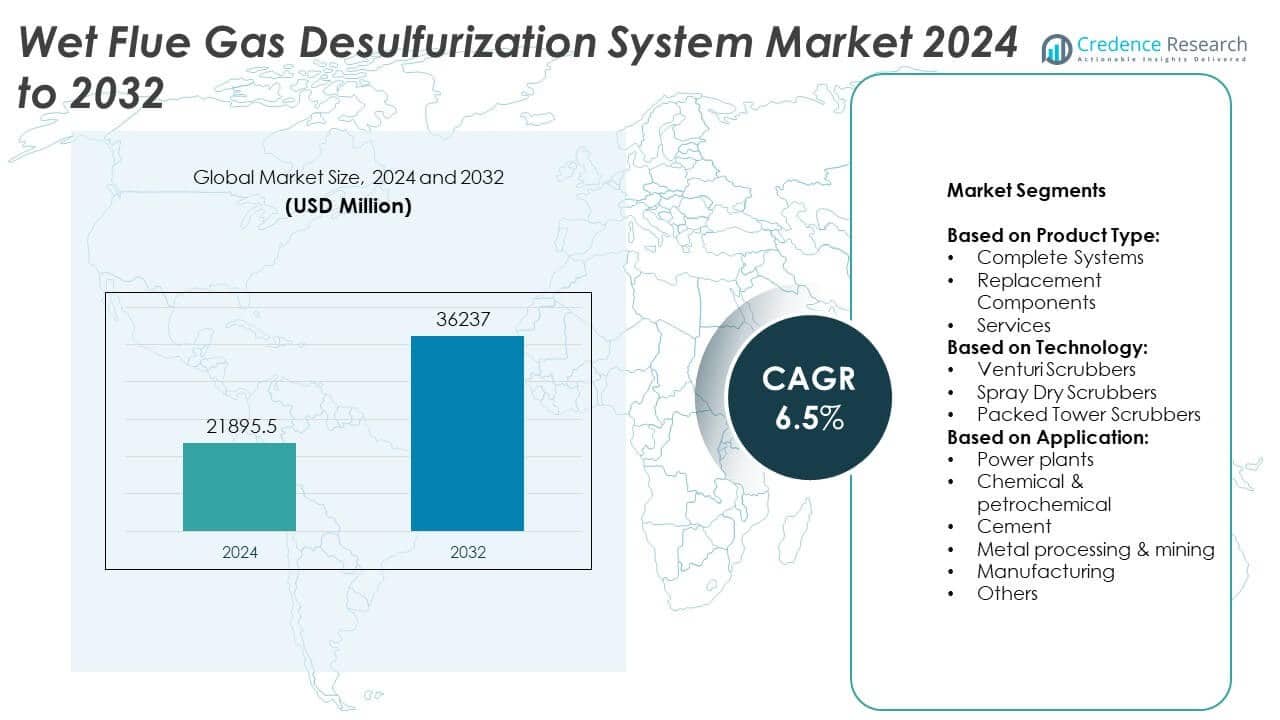

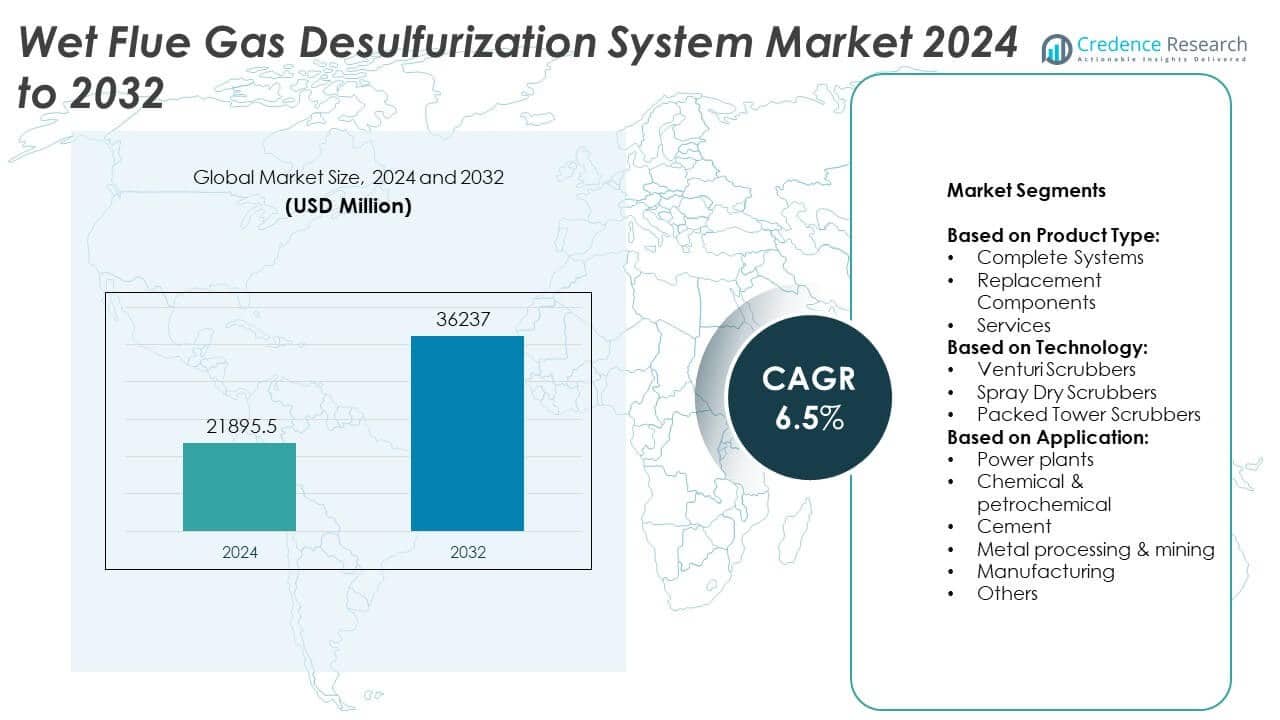

Wet Flue Gas Desulfurization System market size was valued at USD 21,895.5 million in 2024 and is anticipated to reach USD 36,237 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wet Flue Gas Desulfurization System market Size 2024 |

USD 21,895.5 Million |

| Wet Flue Gas Desulfurization System market, CAGR |

6.5% |

| Wet Flue Gas Desulfurization System market Size 2032 |

USD 36,237 Million |

The Wet Flue Gas Desulfurization System market advances on the back of stringent emission regulations, aging thermal power infrastructure, and rising environmental awareness across industrial sectors. Regulatory frameworks in Asia, North America, and Europe drive investments in high-efficiency desulfurization technologies for coal-fired power plants and heavy industries. Market trends highlight a shift toward energy-efficient designs, digital system integration, and expanded adoption in waste-to-energy and biomass plants. Industrial diversification, combined with increasing demand for retrofits and water-saving technologies, shapes future deployments. Vendors respond with compact, modular systems and predictive maintenance features that support compliance, cost reduction, and long-term operational reliability.

Asia Pacific leads the Wet Flue Gas Desulfurization System market due to large-scale coal-based power generation and strict pollution control mandates in China, India, and Southeast Asia. Europe follows with strong regulatory enforcement across industrial sectors, while North America sees steady demand driven by power plant retrofits and environmental upgrades. Latin America and the Middle East show emerging opportunities tied to industrial expansion and clean energy goals. Key players such as Babcock & Wilcox Enterprises, Mitsubishi Heavy Industries Ltd., General Electric, and Valmet maintain competitive positions through advanced technologies, global project execution, and robust service portfolios across major end-use industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wet Flue Gas Desulfurization System market was valued at USD 21,895.5 million in 2024 and is projected to reach USD 36,237 million by 2032, growing at a CAGR of 6.5%.

- Stringent air pollution regulations across Asia, Europe, and North America drive the adoption of high-efficiency wet scrubber systems in power generation and heavy industries.

- The market shows a rising trend toward water- and energy-optimized system designs, integration of smart monitoring technologies, and diversification into waste-to-energy and biomass applications.

- Leading companies including Babcock & Wilcox, Mitsubishi Heavy Industries, and GE Power dominate through technological innovation, large-scale project delivery, and strong service networks.

- High capital costs, operational expenses, and complexities in wastewater and sludge management remain key restraints, particularly in price-sensitive or infrastructure-limited regions.

- Asia Pacific leads the market due to coal-based power dependence and policy-driven clean air initiatives, while Europe and North America show stable retrofit-driven demand.

- Emerging markets in Latin America and the Middle East offer long-term potential through industrial growth, refinery expansion, and international environmental compliance initiatives.

Market Drivers

Stringent Emission Regulations and Compliance Mandates Strengthen Market Adoption

Governments across major industrial economies implement strict environmental policies to reduce sulfur dioxide emissions from coal-fired power plants and industrial boilers. Regulatory frameworks such as the U.S. Clean Air Act and the EU Industrial Emissions Directive compel operators to adopt advanced emission control systems. The Wet Flue Gas Desulfurization System market benefits from mandatory compliance requirements that favor wet scrubber installations due to their higher SO₂ removal efficiency. Countries in Asia Pacific, including China and India, enforce tighter air quality norms, accelerating demand for desulfurization retrofits. Environmental penalties and operating license renewals often hinge on adopting compliant pollution control infrastructure. This regulatory pressure ensures consistent growth momentum in the market.

- For instance, Valmet supplied its flue gas desulfurization system to a biomass power plant in Japan with an SO₂ removal efficiency exceeding 98%, ensuring full compliance with Japan’s stringent environmental emission limits. This regulatory pressure ensures consistent growth momentum in the market.

Coal-Dependent Power Generation Drives Installation of Wet Scrubbers

The continued reliance on coal-fired power plants in emerging economies sustains long-term demand for desulfurization technologies. Despite global shifts toward renewables, countries such as China, Indonesia, and South Africa maintain substantial coal-based energy portfolios. These regions invest in emission control upgrades to meet global climate goals without disrupting energy security. The Wet Flue Gas Desulfurization System market benefits from large-scale capacity additions and modernization projects within thermal power infrastructure. It remains a preferred solution due to its proven performance in high-sulfur fuel applications. Utilities prioritize wet scrubbers for their ability to meet stringent local and international emission standards.

- For instance, Mitsubishi Heavy Industries deployed a FGD system for the 1,320 MW Cirebon power plant in Indonesia, capable of removing 51,000 tons of SO₂ annually through its advanced limestone-gypsum process.

Industrial Expansion in Cement, Metal, and Chemical Sectors Stimulates Demand

Growth in industrial output across heavy-emitting sectors fuels investment in desulfurization systems. Cement manufacturing, iron and steel processing, and chemical production release significant volumes of SO₂ during combustion and calcination processes. Regulatory bodies mandate installation of flue gas treatment technologies to reduce environmental impacts. The Wet Flue Gas Desulfurization System market sees steady uptake from non-utility sectors where high operational throughput requires reliable emission controls. Industrial operators value the system’s compatibility with varying flue gas compositions and large flow rates. Adoption is further supported by sustainability goals integrated into corporate environmental strategies.

Technological Advancements and Efficiency Improvements Encourage Replacement and Retrofit

Ongoing innovations in desulfurization technology improve operational efficiency, energy consumption, and water usage. System manufacturers introduce advanced absorbents, spray nozzles, and limestone handling systems to optimize performance. It encourages utility operators and industrial users to replace aging or inefficient systems with upgraded wet scrubber solutions. The Wet Flue Gas Desulfurization System market benefits from this replacement cycle, particularly in developed regions with legacy infrastructure. Integration of automation and remote monitoring capabilities further enhances system reliability. These advancements contribute to lower lifecycle costs and stronger return on investment for plant operators.

Market Trends

Rising Preference for Limestone-Gypsum Process in Utility-Scale Installations

Utilities increasingly adopt the limestone-gypsum wet scrubber process due to its high sulfur removal efficiency and reliable byproduct management. This trend aligns with the need to meet stricter SO₂ emission standards while ensuring operational stability in high-capacity plants. The Wet Flue Gas Desulfurization System market reflects growing investment in this process across coal-fired power stations, particularly in Asia Pacific and North America. Operators favor the gypsum byproduct’s commercial use in the construction sector, which reduces waste disposal costs. The mature technology and broad supplier ecosystem also support widespread adoption. It delivers consistent performance across variable fuel qualities and fluctuating load conditions.

- For instance, Ducon Infratechnologies Ltd. implemented a wet FGD solution for a major steel plant in India with an operational capacity to treat 2.5 million Nm³/hr of flue gas, meeting CPCB emission norms.

Integration of Digital Monitoring and Automation Enhances System Performance

Plant operators integrate digital sensors, real-time analytics, and control automation into desulfurization systems to improve reliability and reduce downtime. These technologies enable continuous monitoring of pH levels, reagent usage, and flue gas composition. The Wet Flue Gas Desulfurization System market sees rising demand for smart systems that support predictive maintenance and process optimization. Automation reduces manual intervention, increases safety, and ensures compliance with emission thresholds. Vendors offer integrated platforms that combine system diagnostics with remote access capabilities. It enhances operator decision-making and improves operational transparency across complex industrial setups.

- For instance, Babcock & Wilcox deployed its SPIG FGD system for the 1350 MW Conesville power station retrofit project in the US integrating real time digital monitoring with a sulfur dioxide removal rate of 99.2% and reducing operational downtime by over 480 hours annually

Growing Deployment in Waste-to-Energy and Biomass Plants Expands Market Scope

The shift toward sustainable energy drives adoption of wet scrubbers in biomass-fired and waste-to-energy plants. These facilities generate acidic gases during combustion of organic and waste-derived fuels, necessitating efficient flue gas cleaning. The Wet Flue Gas Desulfurization System market broadens beyond traditional coal applications into diversified energy portfolios. Governments support renewable energy projects with emission mandates, encouraging inclusion of flue gas treatment technologies. System scalability and adaptability make wet scrubbers suitable for varying plant sizes and configurations. It ensures compliance with evolving emission targets in non-conventional power generation.

Focus on Water and Energy Optimization Shapes Future System Designs

Manufacturers emphasize water conservation and energy efficiency in next-generation wet scrubber systems. Design improvements reduce water consumption through closed-loop operation and enhanced droplet separation. The Wet Flue Gas Desulfurization System market incorporates variable-speed drives, low-energy pumps, and high-efficiency fans to lower auxiliary power demand. Environmental concerns and tightening resource regulations drive this trend in both developed and developing regions. Operators seek systems with lower lifecycle costs and minimized environmental footprints. It aligns with broader goals of sustainability and responsible industrial practices.

Market Challenges Analysis

High Capital and Operational Costs Restrict Adoption in Cost-Sensitive Markets

The initial capital investment and recurring operational expenses associated with wet flue gas desulfurization systems present a significant barrier in developing economies. Installation of absorber towers, slurry preparation units, and wastewater treatment components involves high infrastructure spending. Operation requires continuous supply of limestone, water, and power, leading to increased lifecycle costs. The Wet Flue Gas Desulfurization System market faces resistance from small and medium industrial units that operate on tight margins. These facilities often opt for less efficient but lower-cost alternatives or delay compliance upgrades. It limits penetration in regions where financial incentives or regulatory enforcement remain weak.

Wastewater Management and Sludge Disposal Pose Environmental and Technical Risks

Wet scrubber systems generate large volumes of contaminated water and solid gypsum byproducts that require effective handling and disposal. Meeting stringent wastewater discharge norms demands installation of advanced treatment systems, increasing operational complexity. Sludge handling introduces additional environmental and logistical challenges, particularly in space-constrained sites. The Wet Flue Gas Desulfurization System market contends with tightening environmental standards that impact system design and cost structure. Plant operators must invest in robust effluent management protocols to avoid non-compliance penalties. It complicates system deployment in regions lacking adequate infrastructure or disposal mechanisms.

Market Opportunities

Retrofitting Aging Thermal Power Plants in Asia and Eastern Europe Opens New Revenue Streams

Aging coal-fired plants across Asia and Eastern Europe present a strong opportunity for retrofit-based flue gas treatment solutions. Many of these facilities lack modern emission controls, making them prime candidates for wet desulfurization upgrades. Government-backed clean energy transitions and funding programs support modernization efforts without decommissioning existing infrastructure. The Wet Flue Gas Desulfurization System market benefits from this shift as utilities seek proven, high-efficiency technologies. It meets regulatory thresholds while extending plant life and maintaining grid stability. Vendors offering modular and compact retrofit solutions gain competitive advantage in these transitional markets.

Commercial Utilization of Gypsum Byproduct Creates Economic Incentives for Investment

The gypsum produced from wet desulfurization systems finds growing demand in cement, drywall, and agricultural industries. This commercial reuse reduces waste management burdens and improves overall project economics for plant operators. The Wet Flue Gas Desulfurization System market gains momentum where regulatory frameworks encourage circular economy practices. It enables operators to offset part of their capital and operational costs through byproduct sales. Countries with large construction pipelines and fertilizer demand create favorable conditions for gypsum valorization. This trend supports sustainable deployment of flue gas desulfurization systems in both utility and industrial settings.

Market Segmentation Analysis:

By Product Type:

Complete systems, replacement components, and services. Complete systems hold a dominant share due to large-scale installations in power and industrial facilities. Demand for replacement components remains consistent, driven by routine maintenance and system upgrades. Service offerings gain traction as plant operators seek expert support for system optimization, monitoring, and regulatory compliance. The aftermarket segment benefits from long-term service contracts and system lifecycle management requirements. It reinforces recurring revenue opportunities for technology providers.

- For instance, Thermax Limited successfully implemented a complete wet flue gas desulfurization (FGD) system for a 500 MW coal-fired power plant in India. The system is designed to handle a gas flow rate of 1.4 million Nm³/hr and includes design, commissioning, and 15 years of long-term maintenance support. This project highlights Thermax’s expertise in providing comprehensive environmental solutions for power plants.

By Technology:

The market includes venturi scrubbers, spray dry scrubbers, and packed tower scrubbers. Venturi scrubbers find use in high-dust load applications where particle removal and SO₂ control must operate concurrently. Spray dry scrubbers appeal to smaller facilities requiring compact design and simplified residue handling. Packed tower scrubbers dominate utility-scale installations due to their high removal efficiency and suitability for continuous operation. Each technology addresses different operational environments and emission targets, giving end users flexibility in system selection. The Wet Flue Gas Desulfurization System market integrates these technologies based on application complexity, fuel type, and regulatory constraints.

- For instance, Tri-Mer Corporation deployed a venturi scrubber system at a U.S. metal finishing facility with a processing capacity of 85,000 cfm and simultaneous control of SO₂ and particulate emissions below 5 mg/Nm³.

By Application:

Power plants represent the largest segment, driven by widespread deployment across coal-fired generation units. The chemical and petrochemical industries adopt desulfurization systems to meet process emission limits and ensure environmental safety. Cement and metal processing facilities rely on wet scrubbers for consistent SO₂ reduction during high-temperature operations. Manufacturing and mining sectors contribute to system demand through compliance-driven upgrades. Other applications, including waste-to-energy plants and biomass facilities, also adopt wet scrubbers to meet regional clean air standards. It reflects the expanding role of emission control systems across diverse industrial landscapes.

Segments:

Based on Product Type:

- Complete Systems

- Replacement Components

- Services

Based on Technology:

- Venturi Scrubbers

- Spray Dry Scrubbers

- Packed Tower Scrubbers

Based on Application:

- Power plants

- Chemical & petrochemical

- Cement

- Metal processing & mining

- Manufacturing

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 18.2% in the Wet Flue Gas Desulfurization System market. The region benefits from established regulatory frameworks such as the U.S. Environmental Protection Agency’s Clean Air Interstate Rule and Mercury and Air Toxics Standards. These policies mandate the reduction of sulfur dioxide and other hazardous pollutants, especially from coal-fired power plants and heavy industries. The United States drives the majority of regional demand, with investments in retrofitting older thermal power stations and deploying emission control technologies in cement and petrochemical plants. Canada contributes to market growth through environmental compliance in its mining and metal processing sectors. It also shows growing interest in energy-efficient and water-saving scrubber systems, reflecting environmental sustainability goals across industrial operators.

Europe

Europe accounts for 25.6% of the global Wet Flue Gas Desulfurization System market. The region remains highly regulated under the Industrial Emissions Directive, pushing power utilities and industrial sectors to adopt robust emission control solutions. Germany, Poland, and the United Kingdom lead market adoption, supported by modernization of coal-fired power plants and expansion of waste-to-energy infrastructure. The cement, chemical, and metal industries also contribute significantly to system installations. Vendors offer advanced scrubbing technologies tailored to comply with the EU Best Available Techniques Reference Document (BREF), further driving adoption. It reflects strong policy alignment, stringent enforcement, and investment in sustainable energy technologies across the continent.

Asia Pacific

Asia Pacific dominates the market with a share of 38.9%, making it the leading regional contributor to global revenues. Rapid industrialization, dependence on coal for electricity, and heightened pollution levels across China and India support high installation volumes. Government-led clean air initiatives, such as China’s Ultra-Low Emission (ULE) program and India’s National Clean Air Programme (NCAP), mandate deployment of wet flue gas desulfurization systems across thermal power stations. Japan, South Korea, and Southeast Asian countries also invest in industrial emission control, adding to regional demand. The scale of projects in Asia Pacific often involves complete systems with customized configurations for high-capacity, high-emission plants. It maintains a strong demand trajectory supported by economic growth and regulatory expansion.

Latin America

Latin America contributes 8.1% to the global Wet Flue Gas Desulfurization System market. Brazil, Mexico, and Argentina lead regional demand, particularly in power generation and refining sectors. Enforcement of environmental norms remains inconsistent, but growing public awareness and cross-border trade agreements encourage cleaner industrial practices. Refineries and cement plants are major application sectors, with upgrades aligned to international environmental standards. Market growth remains moderate but steady, with opportunities arising from foreign investments in green infrastructure and emission control partnerships.

Middle East & Africa

The Middle East & Africa region holds a market share of 9.2%. The market gains traction in oil-producing economies such as Saudi Arabia, the UAE, and South Africa. Industrial expansion and new refinery projects drive adoption of SO₂ control systems to meet domestic and export-oriented environmental requirements. Water conservation and operational efficiency are critical factors influencing system selection in this arid region. South Africa’s aging power infrastructure presents retrofit opportunities, while the Gulf region sees demand in petrochemical and energy-intensive industries. It reflects a growing but still emerging market with selective high-value opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GEA Group Aktiengesellschaft

- Valmet

- Hitachi Zosen Inova AG

- Thermax Limited

- Nederman Holding AB

- Verantis Environmental Solutions Group

- KC Cottrell India

- Marsulex Environmental Technologies

- A. HAMON

- KCH Services, Inc.

- Mitsubishi Heavy Industries Ltd.

- General Electric

- Ducon Infratechnologies Ltd.

- Tri-Mer Corporation

- Babcock & Wilcox Enterprises, Inc.

- CECO Environmental

Competitive Analysis

Key players in the Wet Flue Gas Desulfurization System market include Babcock & Wilcox Enterprises, Inc.; Mitsubishi Heavy Industries Ltd.; and General Electric (GE) Power. These companies maintain strong competitive positioning through distinct technological strengths and global project portfolios. Babcock & Wilcox offers high-efficiency tray-tower systems with availability above 99.5%, delivering cost-effective performance across utility and industrial installations. Mitsubishi Heavy Industries operates over 300 installations worldwide and specializes in wet limestone-gypsum and seawater FGD systems known for their high SO₂ removal and energy efficiency. GE Power secures its market presence through strategic turnkey projects such as the MB Power India contract, where its WFGD solution processes 7.4 million cubic meters of flue gas per hour. Each competitor emphasizes regulatory compliance, project scalability, and system integration to strengthen customer trust and extend their footprint. The market remains technology-driven, and leadership depends on the ability to meet complex environmental standards while offering reliable long-term operational support.

Recent Developments

- In 2025, Valmet will deliver the modernization of ŠKO-ENERGO’s Mladá Boleslav heating plant in the Czech Republic. The order comprises the conversion of the two original circulating fluidized bed (CFB) boilers from coal to biomass and the delivery of a new bubbling fluidized bed (BFB) boiler. The order also comprises a flue gas cleaning system for the new boiler and changes to the flue gas cleaning systems of the modernized boilers.

- In December 2024, Thermax Limited. stated that it is installing its FGD technology in 5,030 MW in India, by curbing more than 3.5 million tonnes of SO2 per year equivalent to 39 tones per hour. That will enable power plants to meet regulatory requirements in coming years.

- In January 2023, Babcock & Wilcox Enterprises, Inc. with a strong portfolio of cutting-edge air quality control system (AQCS) technologies and processes, covering Wet flue gas desulfurization (FGD) systems have strengthened by combining Hamon Research-Cottrell environmental technologies.

Market Concentration & Characteristics

The Wet Flue Gas Desulfurization System market exhibits a moderately concentrated structure, with a mix of global engineering firms and regional solution providers competing across utility and industrial sectors. Leading players maintain a competitive edge through proprietary technologies, large-scale project execution capabilities, and strong aftersales networks. The market favors established companies with proven system reliability, regulatory compliance expertise, and the ability to deliver turnkey solutions. It reflects characteristics of long-term infrastructure investment cycles, with high capital intensity and extended contract durations. Buyer decisions depend heavily on technology efficiency, operational costs, and regulatory alignment. Demand patterns remain closely tied to coal-fired power generation, cement production, and industrial emissions in high-pollution regions. The market also shows strong service orientation, with recurring revenue potential from component replacement, system upgrades, and maintenance contracts. It operates within a strict regulatory framework, which shapes product design, innovation, and deployment timelines.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow steadily due to stricter emission regulations across developing and developed economies.

- Retrofit opportunities in aging coal-fired plants will drive long-term system upgrades.

- Adoption in non-power sectors like cement, metal processing, and petrochemicals will continue to expand.

- Digital integration will improve operational monitoring, predictive maintenance, and system efficiency.

- Vendors will focus on reducing water usage and energy consumption in system designs.

- Government incentives for clean energy transitions will support new installations in emerging markets.

- Byproduct utilization, particularly gypsum, will create economic value and promote system adoption.

- Modular and compact systems will gain popularity among small-scale and decentralized facilities.

- Regional players will strengthen their presence through cost-effective and localized solutions.

- Strategic collaborations and turnkey project execution will shape competitive positioning globally.