| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

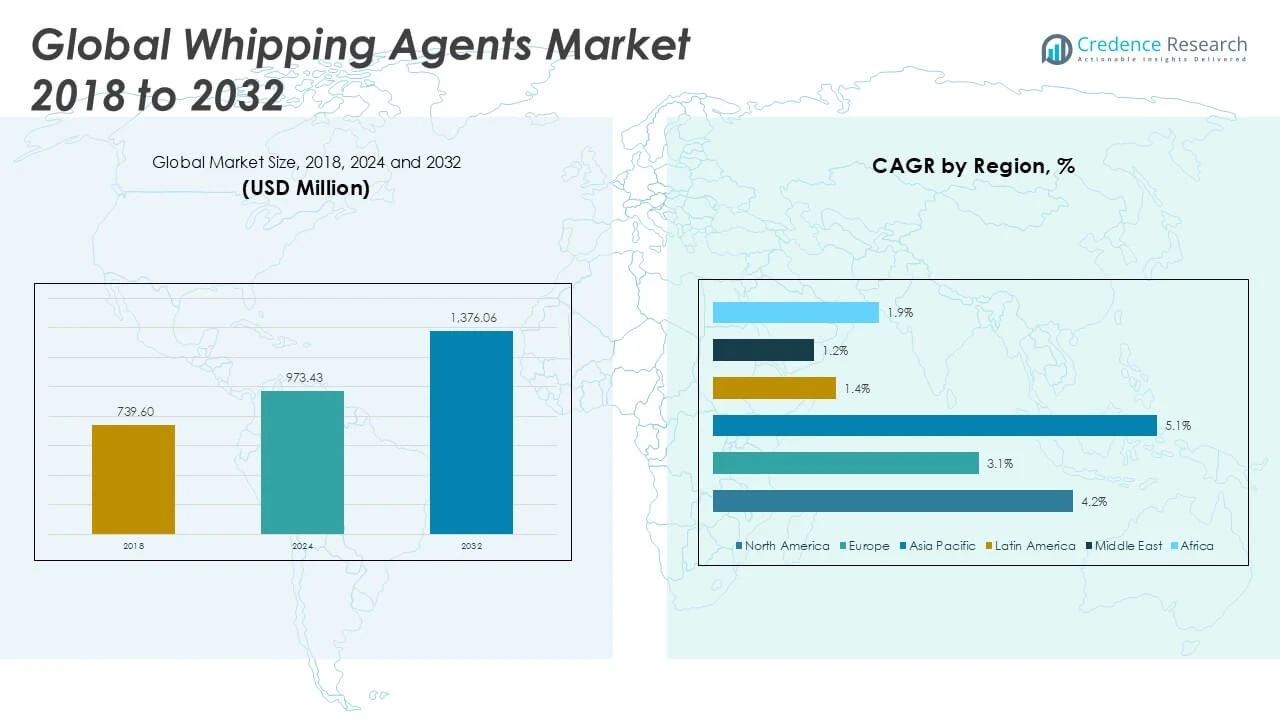

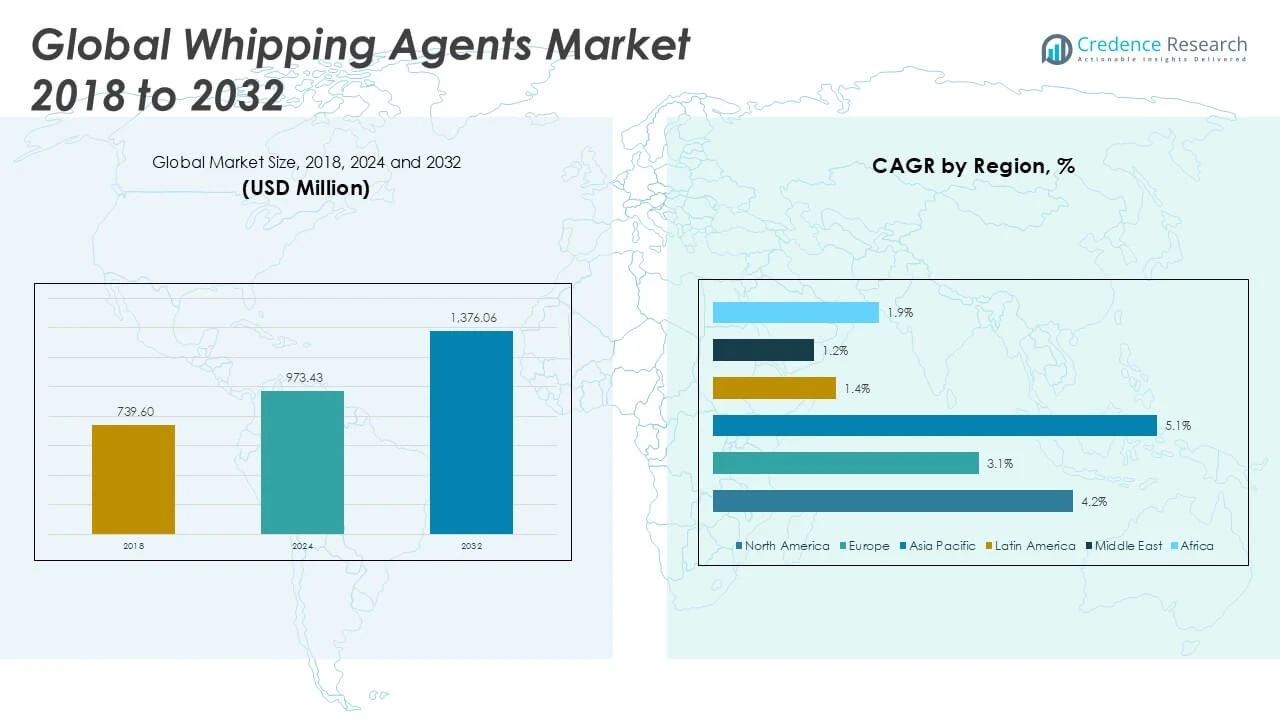

| Whipping Agents Market Size 2024 |

USD 973.43 Million |

| Whipping Agents Market, CAGR |

4.12% |

| Whipping Agents Market Size 2032 |

USD 1,376.06 Million |

Market Overview

The Global Whipping Agents Market is projected to grow from USD 973.43 million in 2024 to an estimated USD 1,376.06 million by 2032, with a compound annual growth rate (CAGR) of 4.12% from 2025 to 2032.

Key drivers of this market include the rising popularity of convenience foods, which require ingredients that enhance texture and stability, such as whipping agents. Additionally, the growing consumer inclination towards plant-based and clean-label products is influencing product formulations, leading to the development of innovative whipping agents derived from ingredients like soy and aquafaba. Technological advancements in food processing are also contributing to the market’s expansion by improving the efficiency and quality of whipping agents.

Geographically, North America holds a significant share of the global whipping agents market, benefiting from a robust food processing sector and high consumer demand for bakery and dairy products. Europe follows closely, with countries like Germany, France, and the UK leading in innovation and production. The Asia-Pacific region is emerging as a rapidly growing market, driven by increasing urbanization, rising disposable incomes, and a shift towards Western-style dietary habits. Key players in this market include Sensient Technologies, Archer Daniels Midland, Ingredion, Wacker Chemie, Kraton, Cargill, Evonik Industries, Kerry Group, and BASF, among others.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Whipping Agents Market is projected to grow from USD 973.43 million in 2024 to USD 1,376.06 million by 2032, with a CAGR of 4.12%. The market is driven by increasing demand across various food and beverage sectors.

- Rising demand for convenience foods, plant-based alternatives, and clean-label products fuels the growth of the whipping agents market. Advancements in food technology also contribute significantly to market expansion.

- Regulatory challenges and rising raw material costs can impede market growth. Limited awareness in some regions and dependency on key ingredients also pose challenges.

- North America holds a significant market share, driven by strong demand in the bakery and dairy industries. The U.S. is a key player, with a growing focus on product innovation and consumer demand for high-quality whipping agents.

- Europe follows closely with demand led by countries like Germany, France, and the UK. The region’s focus on innovation, clean-label products, and stringent regulations drives growth.

- The Asia-Pacific region is the fastest-growing market, with increasing urbanization and rising disposable incomes in countries such as China and India. A shift towards Western-style dietary habits contributes to market expansion.

- Leading players include Sensient Technologies, Archer Daniels Midland, Ingredion, Cargill, and Kerry Group, which dominate the market with strong R\&D and diverse product offerings. Strategic mergers and innovations are central to staying competitive.

Market Drivers

Rising Demand for Convenience and Ready-to-Eat Food Products Driving Market Expansion

The Global Whipping Agents Market benefits significantly from the increasing consumer preference for convenience and ready-to-eat food products. Busy lifestyles and urbanization have accelerated demand for products that require minimal preparation time while delivering superior texture and taste. It supports manufacturers in enhancing the sensory qualities of bakery, dairy, and dessert items. The versatility of whipping agents in providing stability and volume to food formulations strengthens their appeal across various food segments. Growing retail penetration of pre-packaged and frozen desserts also fuels market growth. Food manufacturers continuously seek ingredients like whipping agents to meet evolving consumer expectations for quality and convenience.

- For instance, busy individuals prefer ready-to-eat food products, pushing the use of whipping agents in cakes, pastries, and smoothies.

Innovation in Plant-Based and Clean Label Whipping Agents Boosts Market Growth

The shift towards plant-based diets and clean-label products drives innovation in the Global Whipping Agents Market. Consumers increasingly demand natural, non-GMO, and allergen-free ingredients, prompting suppliers to develop alternative whipping agents from sources such as soy, aquafaba, and other plant derivatives. It encourages research into formulations that maintain product performance while adhering to health and sustainability trends. Manufacturers prioritize transparency and simplicity in ingredient lists, which influences product development strategies. This trend supports wider adoption of whipping agents in vegan and health-conscious food applications, expanding the market reach.

- For instance, manufacturers are reformulating whipping agents to align with vegan and vegetarian dietary trends, expanding the market for plant-derived alternatives.

Technological Advancements in Food Processing Enhancing Product Efficiency

Technological progress in food processing techniques contributes to the market by improving the functional properties and stability of whipping agents. Innovations in emulsification, aeration, and formulation enable whipping agents to perform effectively under diverse conditions, including freezing and high-temperature baking. It facilitates consistent product quality and extended shelf life, critical factors for commercial food producers. Enhanced processing capabilities allow whipping agents to be tailored for specific applications, increasing their utility in the food industry. Investment in research and development strengthens competitive positioning and encourages adoption by manufacturers worldwide.

Growing Popularity of Bakery and Dairy Products Expanding Market Demand

The rising global consumption of bakery and dairy products plays a crucial role in driving demand within the Global Whipping Agents Market. Consumers show strong interest in premium desserts, pastries, and dairy-based beverages that rely on whipping agents for texture and volume. It supports growth in both mature and emerging markets where dietary habits increasingly incorporate these food categories. The expanding product portfolios of food and beverage companies, focusing on innovative and indulgent offerings, further stimulate demand. Market players leverage this trend by aligning whipping agent formulations to enhance product appeal and meet regulatory standards.

Market Trends

Increased Adoption of Natural and Plant-Based Whipping Agents Transforming Market Dynamics

The Global Whipping Agents Market is witnessing a marked shift toward natural and plant-based ingredients. Consumers demand products free from synthetic additives and allergens, prompting manufacturers to replace traditional whipping agents with alternatives derived from soy, aquafaba, and other botanical sources. It encourages transparency and cleaner labeling in food products, aligning with growing health and sustainability awareness. This transition expands application opportunities in vegan and vegetarian food segments. Suppliers invest in refining plant-based formulations to match or exceed the performance of conventional agents. The trend pushes innovation while meeting regulatory and consumer-driven requirements.

- For instance, soy-based whipping agents account for approximately 45 million units sold annually, reflecting the growing preference for dairy-free solutions.

Advancements in Formulation Technology Enabling Enhanced Product Performance

Technological progress within the Global Whipping Agents Market focuses on improving functional properties such as stability, texture, and shelf life. Enhanced emulsification and aeration techniques enable whipping agents to maintain consistent performance under various processing and storage conditions. It allows manufacturers to develop products tailored for specific applications, including frozen desserts and baked goods. Continuous research drives new product launches that meet both industrial efficiency and consumer preference standards. These advancements support expanded usage across food and beverage sectors and reinforce competitive advantage for producers.

- For instance, leading manufacturers have integrated real-time monitoring sensors into packaging, improving quality control and supply chain transparency.

Growing Demand for Clean-Label and Allergen-Free Solutions Influencing Market Offerings

The rise in consumer awareness about food ingredients has led to increased demand for clean-label and allergen-free whipping agents within the Global Whipping Agents Market. Consumers scrutinize ingredient lists and prefer products with recognizable and minimal components. It compels manufacturers to reformulate whipping agents using simpler, natural ingredients that exclude common allergens such as dairy, gluten, and soy where possible. This trend supports diversification of product portfolios and entry into new markets with stringent regulatory standards. Producers who align with these demands enhance brand loyalty and market penetration.

Expansion of Emerging Markets Driving Regional Growth Opportunities

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities for the Global Whipping Agents Market. Rising disposable incomes, urbanization, and Westernization of diets contribute to increased consumption of bakery, dairy, and confectionery products that use whipping agents. It encourages market players to establish regional production facilities and customize formulations to suit local preferences. Partnerships and collaborations within these regions facilitate quicker market access and innovation adoption. This expansion diversifies revenue streams and strengthens the global footprint of key industry participants.

Market Challenges

Stringent Regulatory Compliance and Quality Standards Restricting Market Expansion

The Global Whipping Agents Market faces challenges due to increasingly stringent regulatory frameworks governing food additives and ingredients. Compliance with diverse safety, labeling, and quality standards across different countries complicates product development and approval processes. It requires significant investment in testing, certification, and documentation to meet these requirements. Small and mid-sized manufacturers may struggle to allocate resources for compliance, limiting their market participation. Regulatory uncertainty in emerging markets further complicates strategic planning. These factors collectively slow down product launches and hinder rapid market expansion.

- For instance, the whipping agents market saw over 4.3 million metric tons of product demand in 2024, with projections indicating a steady increase in adoption across bakery, confectionery, and dairy applications.

Fluctuating Raw Material Prices and Supply Chain Disruptions Impacting Profitability

Volatility in the prices of raw materials used in whipping agents poses a notable challenge for the Global Whipping Agents Market. Dependence on agricultural commodities and plant-based inputs subjects manufacturers to price fluctuations caused by climatic conditions, geopolitical factors, and trade policies. It increases production costs and affects profit margins, particularly for suppliers focusing on natural and clean-label products. Supply chain disruptions further exacerbate the issue by causing delays and shortages. Managing consistent quality and availability while controlling costs remains a critical concern for market participants.

Market Opportunities

Expanding Applications in Plant-Based and Vegan Food Segments Creating Growth Potential

The Global Whipping Agents Market benefits from expanding opportunities in plant-based and vegan food applications. Rising consumer demand for sustainable and cruelty-free products drives manufacturers to develop whipping agents compatible with vegan formulations. It enables suppliers to capture emerging niche markets, including dairy alternatives, vegan desserts, and plant-based bakery products. Innovations targeting improved texture and stability in these segments increase product adoption. Collaboration with food manufacturers to customize solutions further enhances market penetration. This trend supports long-term growth and diversification of product portfolios.

Increasing Demand in Emerging Economies Offering New Market Prospects

Emerging economies in Asia-Pacific, Latin America, and the Middle East present substantial growth opportunities for the Global Whipping Agents Market. Urbanization, rising disposable incomes, and evolving dietary preferences drive demand for bakery, dairy, and confectionery products that use whipping agents. It motivates key players to invest in regional production facilities and local partnerships to tailor products to specific consumer tastes. Expanding retail channels and foodservice sectors in these regions enhance accessibility and consumption. Capitalizing on these markets allows companies to broaden their global reach and revenue streams.

Market Segmentation Analysis

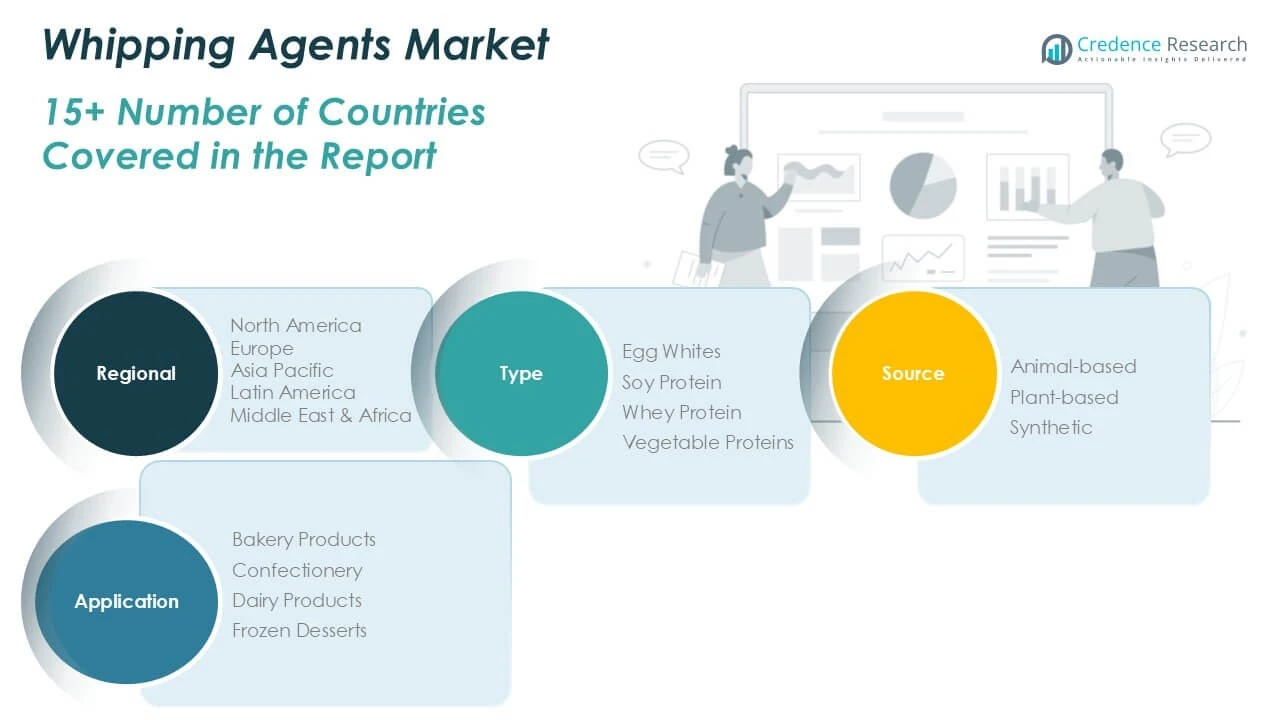

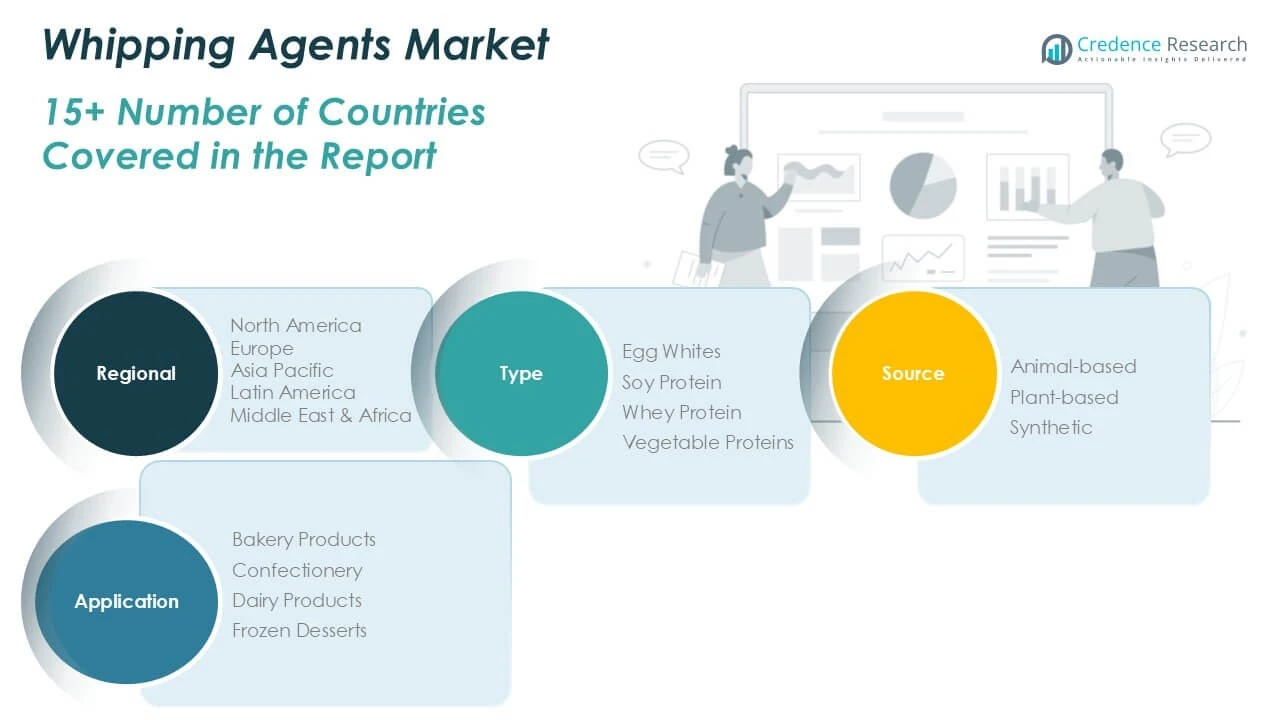

By Type

The Global Whipping Agents Market divides primarily into egg whites, soy protein, whey protein, and vegetable proteins. Egg whites dominate due to their superior whipping and foaming properties, widely used in bakery and confectionery products. It maintains strong demand owing to its natural origin and functional benefits. Soy protein and whey protein serve as popular alternatives, offering high nutritional value and stability. Vegetable proteins gain traction amid rising vegan and clean-label preferences. Each type supports specific applications, influencing formulation choices in diverse food products.

By Source

The market categorizes whipping agents into animal-based, plant-based, and synthetic sources. Animal-based whipping agents retain substantial market share given their performance in traditional food products. Plant-based whipping agents exhibit rapid growth driven by consumer preference for sustainable and allergen-free ingredients. It encourages innovation in plant-derived formulations that match the functional characteristics of animal-based agents. Synthetic whipping agents remain niche, used in specialized applications requiring tailored properties. This segmentation reflects evolving consumer demands and technological advancements.

By Application

Applications of whipping agents encompass bakery products, confectionery, dairy products, and frozen desserts. Bakery products lead demand due to the extensive use of whipping agents in pastries, cakes, and bread to enhance texture and volume. Confectionery and dairy products follow closely, relying on whipping agents for improved mouthfeel and stability. Frozen desserts show increasing consumption driven by product innovation and convenience trends. It enables food manufacturers to diversify offerings and meet varied consumer preferences globally.

Segments

Based on Type

- Egg Whites

- Soy Protein

- Whey Protein

- Vegetable Proteins

Based on Source Segment

- Animal-based

- Plant-based

- Synthetic

Based on Application

- Bakery Products

- Confectionery

- Dairy Products

- Frozen Desserts

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Whipping Agents Market

The North America Whipping Agents Market held a market value of USD 368.98 million in 2024 and is projected to reach USD 523.24 million by 2032, growing at a CAGR of 4.2%. It accounts for approximately 30.8% of the global market share in 2024, leading regional consumption. The region benefits from high consumer awareness of product quality and innovation in food ingredients. The United States and Canada drive demand through extensive bakery, dairy, and frozen dessert industries. Rising health consciousness encourages development of plant-based whipping agents. Investment in research and advanced manufacturing techniques supports sustained market growth.

Europe Whipping Agents Market

Europe’s whipping agents market valued USD 200.56 million in 2024 and is expected to reach USD 261.50 million by 2032, with a CAGR of 3.1%. It contributes around 16.7% to the global market share in 2024. Key countries such as Germany, France, and the UK lead due to established food processing sectors and stringent quality regulations. It faces challenges from regulatory complexity but maintains growth through innovation in clean-label and allergen-free whipping agents. Consumer demand for premium bakery and confectionery products also supports market expansion.

Asia Pacific Whipping Agents Market

The Asia Pacific region recorded a market value of USD 335.12 million in 2024, projected to grow to USD 511.77 million by 2032 at a CAGR of 5.1%. It represents approximately 28.0% of the global market share in 2024. Rapid urbanization, increasing disposable incomes, and westernized food habits drive demand for whipping agents in countries such as China, India, and Japan. The expanding bakery and dairy sectors, coupled with rising consumer preference for convenience foods, fuel market growth. Local manufacturers adopt innovations to cater to regional taste preferences.

Latin America Whipping Agents Market

Latin America’s whipping agents market stood at USD 27.86 million in 2024 and is forecasted to reach USD 32.00 million by 2032, registering a CAGR of 1.4%. It accounts for roughly 2.3% of the global market share in 2024. Brazil and Mexico dominate regional demand, supported by growing bakery and dairy industries. Market growth is limited by economic volatility and regulatory challenges. Nevertheless, increasing urbanization and gradual adoption of Western food trends provide opportunities for incremental growth.

Middle East Whipping Agents Market

The Middle East market value reached USD 19.19 million in 2024 and is anticipated to rise to USD 21.62 million by 2032, with a CAGR of 1.2%. It holds around 1.6% of the global market share in 2024. Growing foodservice and hospitality sectors in countries such as UAE and Saudi Arabia contribute to market expansion. Preference for imported bakery and dessert products encourages demand for high-quality whipping agents. Investment in cold chain infrastructure and retail development supports steady growth.

Africa Whipping Agents Market

Africa’s whipping agents market had a valuation of USD 21.72 million in 2024, expected to reach USD 25.92 million by 2032, growing at a CAGR of 1.9%. It represents about 1.8% of the global market share in 2024. South Africa leads regional consumption due to developed food processing industries. Limited infrastructure and economic challenges restrict faster growth. However, rising urban populations and increasing exposure to international food products gradually increase market potential.

Key players

- Kerry Group

- Tate and Lyle

- BASF

- Archer Daniels Midland

- Ingredion

- Wacker Chemie

- Kraton

- Cargill

- Evonik Industries

- Sensient Technologies

- Dupont

- MGP Ingredients

- Ashland

Competitive Analysis

The Global Whipping Agents Market features intense competition among well-established multinational corporations and regional players. Leading companies such as Kerry Group, Tate and Lyle, BASF, and Archer Daniels Midland leverage extensive product portfolios and robust R\&D capabilities to maintain market dominance. It fosters innovation focused on clean-label, plant-based, and allergen-free whipping agents to meet evolving consumer preferences. Strategic partnerships, acquisitions, and expansion of manufacturing facilities strengthen competitive positioning. Market players emphasize sustainability and regulatory compliance to differentiate their offerings. Regional players focus on localized formulations and cost-effective solutions to capture emerging market share. The dynamic competitive landscape requires continuous innovation and agility, ensuring companies remain responsive to market trends and customer demands.

Recent Developments

- in January 2025, Wacker Chemie AG reported sales for Q1 2025 on par with the prior-year level totaling €1.48 billion, with positive developments in the Silicones and biotechnology divisions.

- In December 2024, BASF signed a binding agreement to sell its Food and Health Performance Ingredients business to Louis Dreyfus Company, including the production site in Illertissen, Germany.

Market Concentration and Characteristics

The Global Whipping Agents Market is characterized by moderate to high concentration, with a few dominant players controlling a significant share. Leading companies like Kerry Group, BASF, and Cargill hold substantial market power due to their extensive product portfolios, strong R\&D capabilities, and established global distribution networks. It is marked by a mix of large multinational corporations and regional players, with competition focusing on product innovation, quality, and sustainability. The market’s growth is driven by evolving consumer preferences for clean-label and plant-based ingredients, encouraging companies to adapt quickly to trends. Despite the presence of key players, regional players contribute significantly by offering localized products at competitive prices. Competitive dynamics are influenced by regulatory compliance, technological advancements, and strategic partnerships, fostering continuous market evolution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As consumer interest in plant-based diets grows, the demand for plant-based whipping agents will rise. This shift will lead to innovations in formulations that maintain the functional properties of traditional ingredients.

- Advancements in food processing technologies will enhance the performance and cost-effectiveness of whipping agents. These innovations will cater to diverse food applications, ensuring consistency in texture and stability.

- Consumers’ preference for clean-label products will push manufacturers to offer more natural, allergen-free, and non-GMO whipping agents. This trend will influence product formulations and marketing strategies.

- With the rise in veganism and dairy-free diets, the whipping agents market will see an increase in demand for alternatives such as soy protein and aquafaba. This shift will open new market opportunities for suppliers.

- Manufacturers will focus on sustainable sourcing and eco-friendly packaging in response to growing environmental concerns. This commitment to sustainability will enhance their competitive edge.

- As urbanization and disposable incomes increase in regions like Asia-Pacific, Latin America, and Africa, the demand for processed and convenience foods will drive growth in the whipping agents market. This will offer significant expansion opportunities.

- Health-conscious consumers will drive the market for functional foods that offer additional nutritional benefits. Whipping agents will play a crucial role in the formulation of healthy and functional baked goods and dairy products.

- Regulatory frameworks around food safety and labeling will encourage manufacturers to innovate and improve formulations. These regulations will influence how companies approach production, ingredients, and market expansion.

- The growing consumer preference for frozen and ready-to-eat desserts will drive demand for whipping agents. These ingredients are critical for maintaining texture and stability in frozen food products.

- To capture new market opportunities, industry leaders will continue forming strategic alliances and partnerships. Mergers and acquisitions will help companies expand their product portfolios and geographic reach.