Market Overview

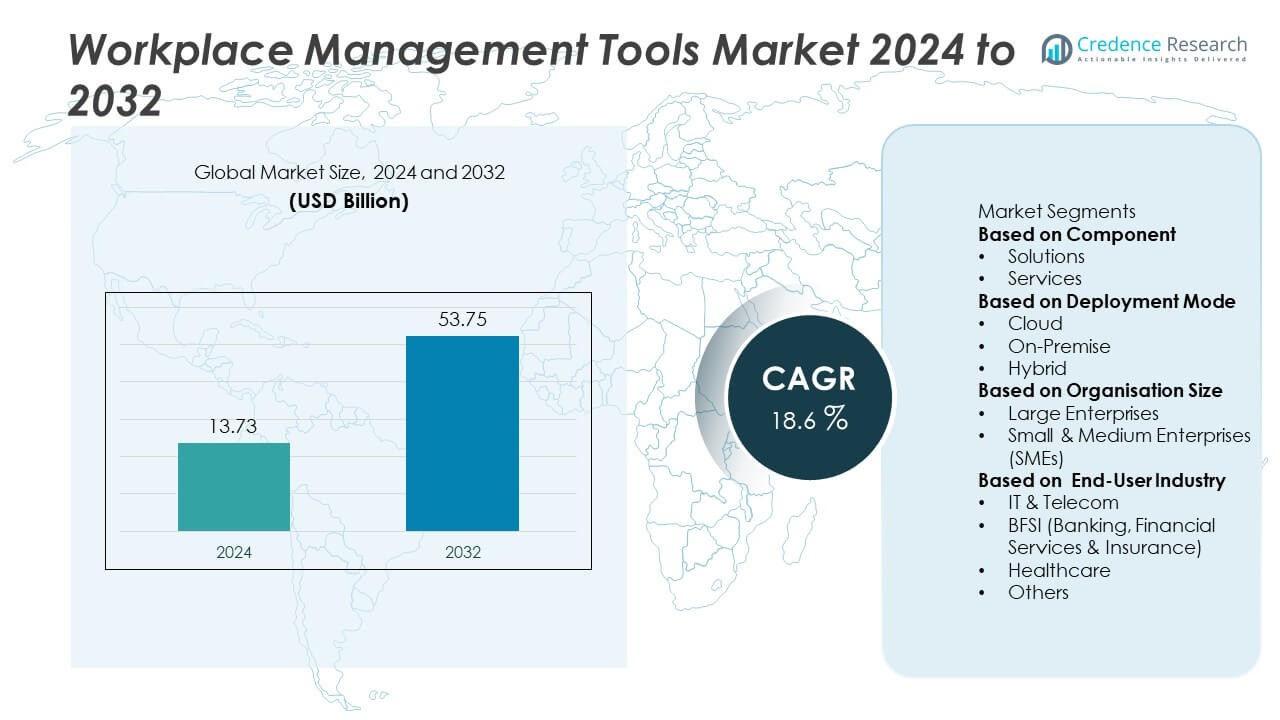

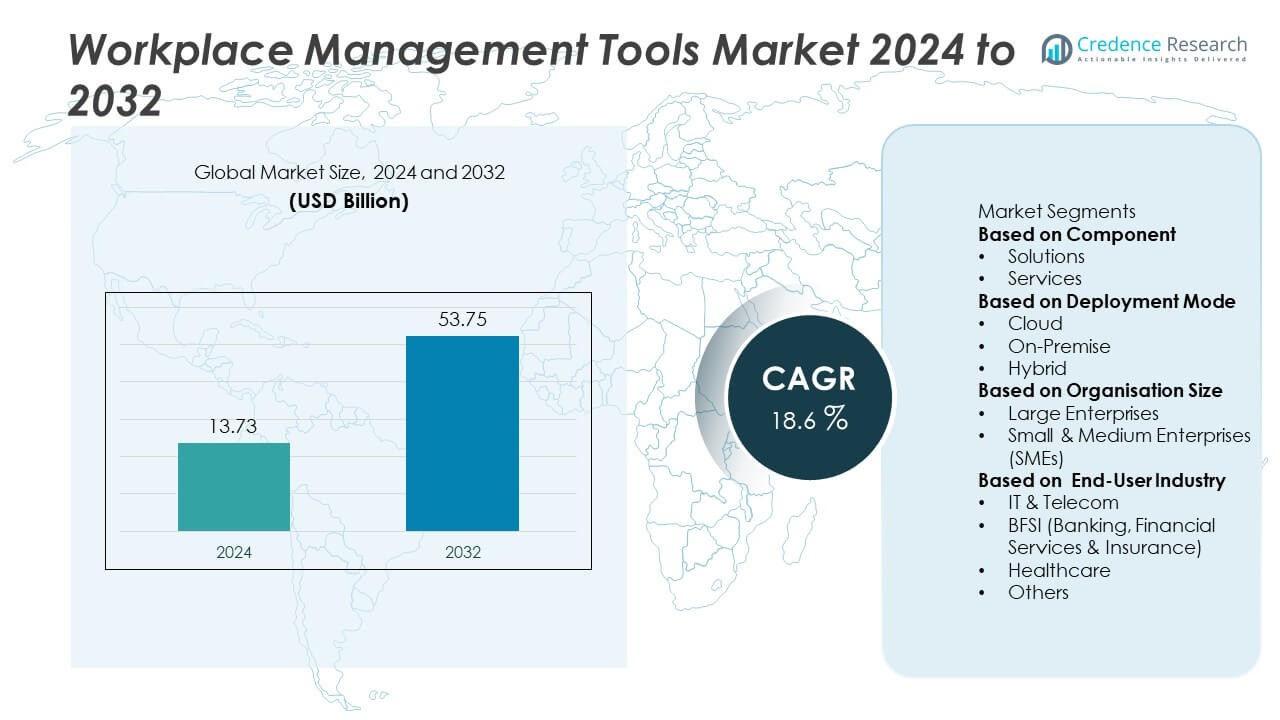

The global Workplace Management Tools market was valued at USD 13.73 billion in 2024 and is projected to reach USD 53.75 billion by 2032, growing at a compound annual growth rate (CAGR) of 18.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Workplace Management Tools Market Size 2024 |

USD 13.73 Billion |

| Workplace Management Tools Market, CAGR |

18.6% |

| Workplace Management Tools Market Size 2032 |

USD 53.75 Billion |

The Workplace Management Tools market is highly competitive, with key players such as Matrix42 AG, Citrix Systems Inc., RingCube Technologies Inc., Cisco Systems Inc., Ivanti Software Inc., Dell Inc., VMware Inc., Microsoft Corporation, Bitrix Inc., and Atlantis Computing Inc. These companies are distinguished by their investments in product innovation, acquisitions, and global expansion, enabling them to offer integrated solutions that combine workplace optimisation, IoT connectivity, and cloud services. North America leads the market with a 28.1% share, followed by Europe at 25.1%, and Asia-Pacific at 24%. The Middle East & Africa and Latin America together account for about 22% of the market. These regions are witnessing strong growth, driven by the increasing adoption of cloud-based solutions, smart office infrastructure, and workplace modernisation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Workplace Management Tools market stood at USD 13.73 billion in 2024 and is projected to reach USD 53.75 billion by 2032, expanding at a CAGR of 18.6%.

- Demand rises as organisations streamline workflows, monitor space utilisation, and improve employee experience in hybrid and remote settings.

- AI‑driven platforms with predictive analytics, modular subscription models, and cloud flexibility reshape the market, while the Solutions segment leads with a 62.5% share and On‑Premise deployment holds 57.2%.

- Challenges persist around data security, legacy systems integration, change management, and employee adoption, which slow or delay tool implementation.

- Regionally, North America holds 28.1% of the market, Europe 25.1%, Asia‑Pacific 24%, and the combined Latin America and Middle East & Africa share approximately 22%.

Market Segmentation Analysis:

By Component

In the Workplace Management Tools market, the Solutions sub‑segment leads with a share of 62.5%. This dominance is driven by the growing demand for integrated platforms that offer features like resource scheduling, space optimization, and employee experience management. Businesses increasingly seek solutions that streamline operations and enhance productivity, particularly in hybrid and remote work environments. Services, which focus on deployment and support, hold a smaller share but are growing as companies require tailored support for complex tool implementations.

- For instance, Citrix, a business unit of Cloud Software Group, launched new high-value offerings in March 2024 to empower enterprises in consolidating their application delivery infrastructure.

By Deployment Mode

The On‑Premise sub‑segment holds the largest share of 57.2% in the deployment mode segment. Organisations in regulated industries, such as finance and healthcare, prefer on‑premise solutions for their enhanced data security and control. This segment is driven by the need to comply with strict regulations and internal governance. While On‑Premise remains dominant, Cloud and Hybrid models are gaining traction due to their flexibility, scalability, and cost-effectiveness, reflecting a gradual shift toward more cloud-based deployments in the market.

- For instance, VMware Inc. introduced its hybrid cloud management tool, the former vRealize Suite (now known as VMware Aria Suite), which has been shown in a commissioned Forrester study to enable a composite organization to increase capacity utilization by over 15% and reduce deployment times from weeks to minutes, delivering significant efficiency gains for various clients.

By Organisation Size

Large Enterprises capture the dominant share of 65%+ in the organisation size segment. Their complex operational structures and larger budgets make them the primary adopters of comprehensive workplace management tools. These organisations require advanced solutions to optimise resources, manage large, dispersed workforces, and support data-driven decision-making. Meanwhile, Small and Medium Enterprises (SMEs) are experiencing rapid growth as cloud-based tools become more affordable, providing SMEs with scalable, cost-effective solutions to meet their operational needs.

Key Growth Drivers

Digital Workplace Efficiency & Resource Optimization

Organizations adopt workplace management tools to streamline workflows, monitor space utilisation and align assets with workforce needs. These platforms deliver real‑time dashboards, analytics and alerts that enable facility managers to optimise occupancy and trim operational costs. As companies focus on maximising return on real estate investments and improving employee experience, demand for such tools increases. In hybrid work environments, these solutions become essential for coordinating flexible spaces, enabling teams to work dynamically while maintaining productivity and control.

- For instance, Matrix42 AG’s integrated workspace management solutions aim to help organizations optimize costs and manage technology risks by providing comprehensive visibility and automation of IT and software assets, which demonstrates a clear value proposition for real estate and asset optimization.

Cloud & Remote‑Work Enablement

The surge in remote and hybrid work models drives adoption of cloud‑based workplace management platforms designed to support distributed teams and flexible environments. These tools empower organisations to manage bookings, resource allocation and employee presence across multiple sites and time zones. Cloud deployment enables fast roll‑out, reduced capital expenditure and seamless updates. Companies shift away from traditional on‑site systems because they require fewer hardware investments and support mobile access, helping IT departments respond rapidly to changing workplace demands and workforce mobility.

- For instance, Microsoft 365’s integration with cloud management tools allows organizations to significantly reduce the need for on-site infrastructure, potentially cutting down on hardware investments and related IT management costs.

Regulatory Compliance & Analytics‑Driven Decision‑Making

Workplace management tools increasingly integrate compliance modules and advanced analytics to support regulatory obligations, safety protocols and strategic resource planning. Organisations face stricter regulations on workplace safety, data protection and employee well‑being, so they turn to tools that provide audit logs, occupancy tracking and usage analytics. These systems offer insights into facility performance, employee behaviour and cost drivers, enabling evidence‑based decisions. Vendors embed predictive analytics and AI features to identify utilisation trends and support proactive planning, further accelerating market growth.

Key Trends & Opportunities

AI‑Powered Analytics & Predictive Workplace Management

Workplace management platforms now incorporate artificial intelligence and machine learning to offer predictive analytics, optimal space planning and workforce forecasting. These capabilities help firms anticipate occupancy peaks, adjust resource allocation and improve employee satisfaction by matching spaces to task type and demand. Vendors present modules that analyse usage patterns and recommend actions automatically. The growing acceptance of data‑driven decisions opens opportunities for new offerings in the market, as organisations invest in smart systems that reduce waste and unlock value from existing assets.

- For instance, a Gartner report noted that organizations using AI for automation can experience a significant increase in operational efficiency, while IBM has observed productivity gains of 30-40% in specific segments like code documentation and testing using generative AI to assist developers.

Growth of SMEs & Modular Subscription Models

While larger firms lead early adoption, small and medium enterprises now gain traction in the workplace management tools market as modular, subscription‑based offerings lower entry barriers. Cloud‑delivered models provide scalability and affordability without heavy infrastructure commitments. SMEs can adopt core functionalities such as desk booking and meeting‑room management and then expand as needed. This shift broadens the vendor addressable market and presents opportunities to tailor solutions for smaller organisations with simpler workflows, enabling wider market growth and diversification beyond enterprise use cases.

- For instance, Omnissa enables organizations to enhance their digital workplace strategy by leveraging its Workspace ONE unified endpoint management and Digital Employee Experience Management (DEEM) solutions.

Key Challenges

Data Security & Integration Complexity

Implementing workplace management tools involves integration with legacy systems, IoT sensors, HR databases and facility management platforms, which presents significant complexity. Organisations express concern about securing sensitive employee data, location tracking and usage analytics across hybrid environments. These security and integration challenges slow deployment and may push firms to delay adoption until robust governance frameworks and technical compatibility are in place.

Change Management & User Adoption Barriers

Introducing new workplace management systems requires changes in processes, roles and behaviours across the organisation. Resistance among employees, insufficient training and unclear value propositions hinder rollout and reduce return on investment. Without effective change management and stakeholder engagement, organisations struggle to drive user adoption, limiting the potential benefits of the tools and slowing market uptake.

Regional Analysis

North America

The North American region holds a market share of 28.1% in the Workplace Management Tools market. Strong demand arises from high adoption of cloud‑based platforms, smart building initiatives, and mature IT infrastructure across enterprises. The region benefits from early implementation in sectors like real estate, professional services, and IT, which fuels continued investment. Additionally, regulatory frameworks and data‑privacy requirements drive firms to deploy robust workplace management solutions. The presence of leading vendors in the U.S. further accelerates innovation and deployment, solidifying North America’s leading position in the global market.

Europe

Europe captures a market share of 25.1% in the Workplace Management Tools market. Adoption is driven by cost‑optimization mandates, regulatory requirements for workspace monitoring, and the shift to hybrid work models across major economies. Businesses in countries such as the UK and Germany prioritise solutions that integrate analytics with facility management, which supports uptake. The region’s focus on environmental sustainability and space utilisation further supports investment in workplace management tools. Vendor consolidation and enterprise digital transformation initiatives continue to enhance Europe’s growth trajectory in this market.

Asia-Pacific

Asia-Pacific holds a market share of 24% in the Workplace Management Tools market, with significant growth driven by urbanisation, rising infrastructure investment in smart offices, and the increasing adoption of remote and hybrid work models in countries like India, China, and Australia. The relatively lower penetration compared to North America and Europe presents significant growth potential for vendors targeting emerging markets. The demand for cost-effective, cloud-based solutions and the localisation of offerings are key drivers of expansion in the region, providing strong opportunities for growth across both developed and developing markets.

Middle East & Africa / Latin America

The Middle East & Africa (MEA) and Latin America regions together account for about 22% of the global Workplace Management Tools market share. MEA’s growth is driven by large infrastructure projects, digital transformations in the oil and gas sectors, and rapid urbanisation, particularly in the UAE and Saudi Arabia. In Latin America, growing interest in cloud-based workplace management solutions is evident, with multinational companies and local businesses increasingly adopting such tools to improve efficiency. While adoption is slower compared to developed regions, both regions present strong future opportunities as workplace modernisation continues.

Market Segmentations:

By Component

By Deployment Mode

By Organisation Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End‑User Industry

- IT & Telecom

- BFSI (Banking, Financial Services & Insurance)

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Workplace Management Tools market involves leading players such as Matrix42 AG, Citrix Systems Inc., RingCube Technologies Inc., Cisco Systems Inc., Ivanti Software Inc., Dell Inc., VMware Inc., Microsoft Corporation, Bitrix Inc., and Atlantis Computing Inc. These firms distinguish themselves through continuous investments in product innovation, strategic acquisitions, and expansion of global footprints. They reinforce market positioning by bundling workplace optimisation platforms with analytics, IoT connectivity and cloud services. Smaller entrants and niche vendors concentrate on specialised verticals, modular offerings or geographic markets to challenge broader incumbents. As competition heats up, pricing pressures emerge and service differentiation becomes key success factor in winning enterprise deals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Matrix42 AG

- Citrix Systems Inc.

- RingCube Technologies Inc.

- Cisco Systems Inc.

- Ivanti Software Inc.

- Dell Inc.

- VMware Inc.

- Microsoft Corporation

- Bitrix Inc.

- Atlantis Computing Inc.

Recent Developments

- In October 2025, Microsoft Corporation introduced new admin‑controls and detailed usage‑reporting features for Microsoft 365 Copilot, enabling IT teams to monitor prompt submissions and app interactions across Word, Excel, Teams and more.

- In October 2025, Microsoft also published an update for Microsoft Viva’s data‑ingestion framework (MODIS), enabling direct connectors to HR systems like Workday and SAP SuccessFactors and introducing a dedicated “Organizational Data Source Admin” role.

- In June 2023, Strata Decision Technology announced the launch of the Real-Time Workforce Management (RTWM) solution, specifically developed to meet nursing leaders’ financial and operational objectives. This new offering builds upon Strata’s extensive StrataJazz platform and aims to provide nursing leadership with precise and practical data to enhance communication between leaders and staff.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Organisation Size, End‑User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see a stronger push from AI‑enabled tools offering predictive space and workforce analytics.

- Hybrid and remote working models will force organisations to invest in tools that support bookings, presence tracking and multi‑location coordination.

- Modular subscription models will open the market to SMEs, enabling more flexible adoption of core functionality and gradual growth.

- Vendors will increasingly package solutions and services to address enterprise complexity and expand into new geographies.

- In regulated sectors, demand will grow for workplace management platforms that embed compliance, audit logs and usage tracking.

- Integration will deepen across IoT sensors, HR systems and facility management platforms enabling real‑time operational insights.

- On‑premise solutions will retain relevance in sensitive industries but cloud and hybrid deployments will gain share.

- Data security, privacy concerns and legacy integration issues will remain key risks and may slow some roll‑outs.

- Regions such as Asia‑Pacific and MEA will deliver above‑average growth as smart offices and infrastructure investments increase.

- Tool adoption will shift from solely large enterprises toward SMEs, driving diversification of vendor offerings and market expansion.