Market Overview

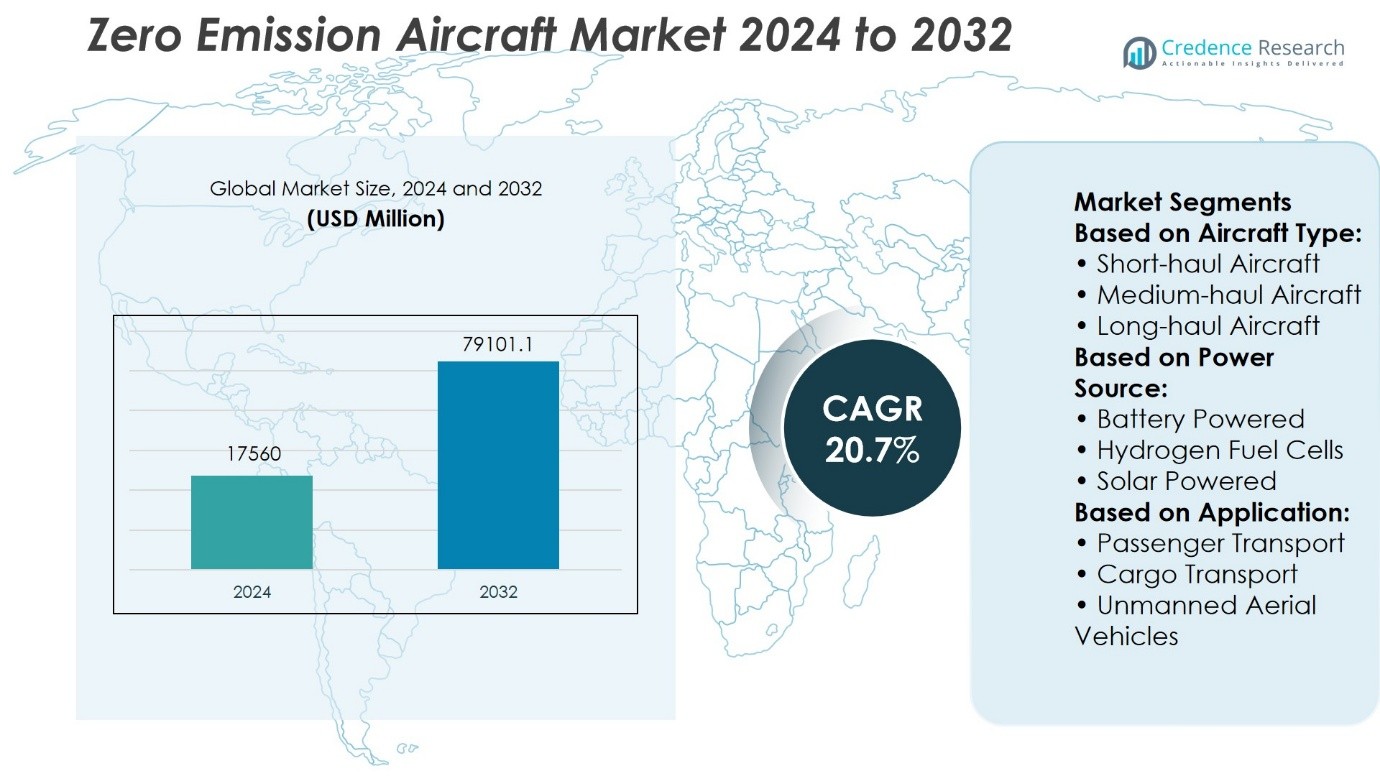

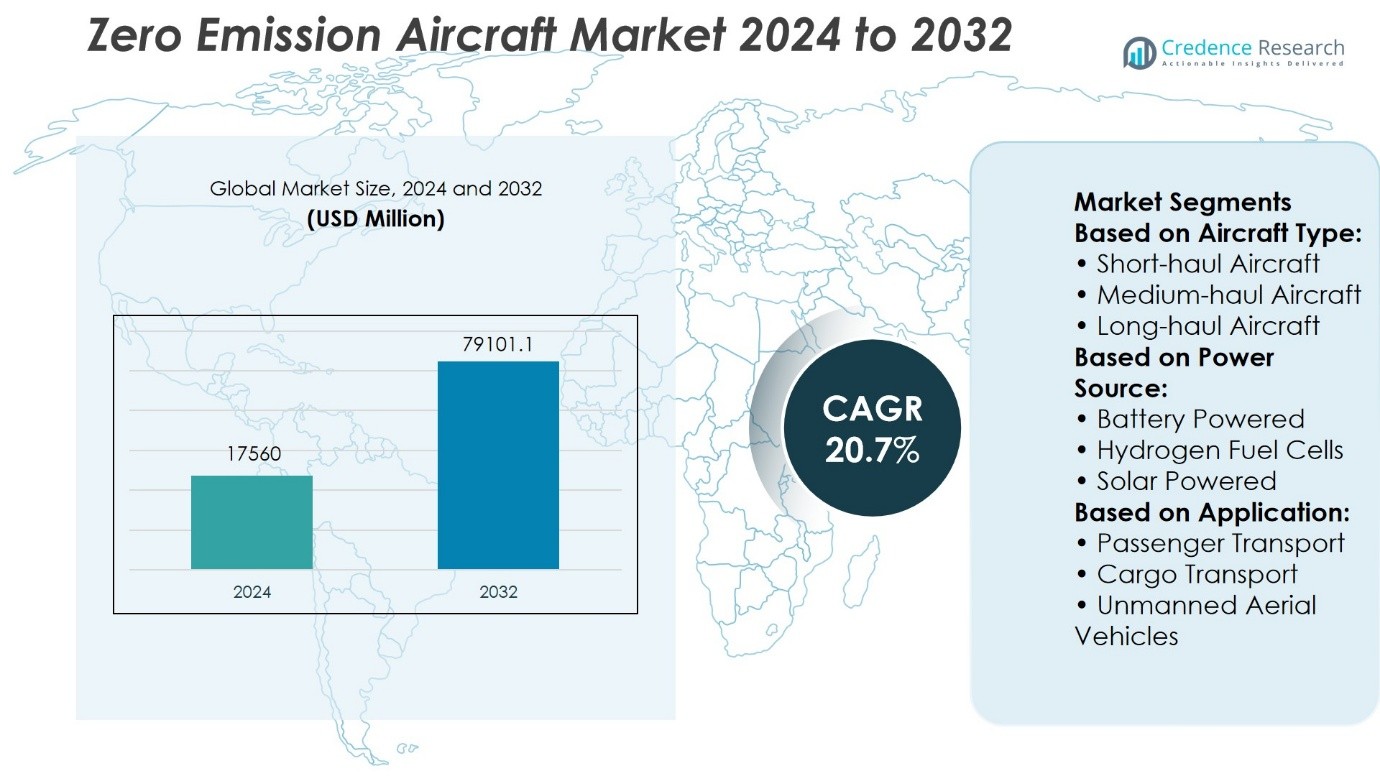

Zero Emission Aircraft Market size was valued at USD 17560 million in 2024 and is anticipated to reach USD 79101.1 million by 2032, at a CAGR of 20.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zero Emission Aircraft Market Size 2024 |

USD 17560 Million |

| Zero Emission Aircraft Market, CAGR |

20.7% |

| Zero Emission Aircraft Market Size 2032 |

USD 79101.1 Million |

The Zero Emission Aircraft Market advances through strong regulatory mandates, rising airline commitments, and increasing investment in sustainable propulsion technologies. Governments push decarbonization targets that drive research in hydrogen fuel cells, electric systems, and hybrid concepts. Airlines adopt zero-emission platforms to meet carbon-neutral pledges while enhancing operational efficiency on regional routes. It gains momentum from collaborations between aerospace firms, energy providers, and infrastructure developers that build the ecosystem for future deployment. The market also reflects trends in digitalization, predictive analytics, and material innovations that strengthen performance and accelerate the path toward commercial readiness.

The Zero Emission Aircraft Market shows strong presence across North America and Europe, where regulatory support, infrastructure development, and advanced aerospace ecosystems drive early adoption. Asia-Pacific follows with growing investments in hydrogen and electric aviation to meet regional mobility needs. Latin America and the Middle East & Africa display gradual progress through pilot programs and renewable energy integration. Key players shaping the market include Ampaire, Eviation, Heart Aerospace, Joby Aviation, Lilium, BETA Technologies, Bye Aerospace, and Aurora Flight Sciences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Zero Emission Aircraft Market size was valued at USD 17,560 million in 2024 and is expected to reach USD 79,101.1 million by 2032, growing at a CAGR of 20.7%.

- Regulatory mandates and government-backed decarbonization programs drive strong demand for hydrogen fuel cells, electric propulsion, and hybrid aircraft solutions.

- Airlines invest in zero-emission platforms to align with sustainability pledges and improve operational efficiency, particularly in regional and commuter routes.

- Market trends highlight the adoption of predictive analytics, digital platforms, and advanced materials to enhance performance and accelerate certification readiness.

- Competition intensifies as established aerospace firms and startups focus on scaling prototypes, forming energy partnerships, and moving toward commercialization.

- Restraints include high development costs, complex certification processes, and infrastructure gaps for hydrogen refueling and electric charging systems.

- North America and Europe dominate adoption, Asia-Pacific shows rising investments, while Latin America and Middle East & Africa progress gradually through pilot programs.

Market Drivers

Rising Regulatory Pressure to Reduce Aviation Emissions

Governments worldwide enforce stricter emission standards to address climate change, driving investments into alternative propulsion technologies. The Zero Emission Aircraft Market benefits from policy frameworks such as the European Green Deal and the U.S. Sustainable Aviation Fuel Grand Challenge. It gains traction as aviation authorities prioritize decarbonization through funding incentives and certification pathways. Regulations requiring airlines to meet carbon-neutral targets stimulate adoption of hydrogen and electric aircraft platforms. The market aligns with national and international commitments to net-zero emissions, which accelerates development timelines. It secures regulatory support that pushes manufacturers to deploy viable solutions at scale.

- For instance, Airbus advanced its ZEROe hydrogen program by testing a cryogenic hydrogen tank capable of storing 10 kilograms of liquid hydrogen at –253°C during 2024 trials, a milestone toward commercial hydrogen-powered aircraft deployment.

Growing Investments in Hydrogen and Electric Propulsion Technologies

A surge in research and development drives innovation in hydrogen fuel cells and electric propulsion systems. The Zero Emission Aircraft Market advances as companies invest in prototype testing and large-scale demonstration programs. It leverages breakthroughs in battery energy density and hydrogen storage to enhance aircraft performance. Collaborations between aerospace firms, energy companies, and research institutes speed up commercialization efforts. The industry secures capital inflows from both private investors and public agencies that support clean aviation initiatives. It creates momentum for next-generation propulsion systems that meet commercial aviation requirements.

- For instance, Rolls-Royce successfully tested a 1.5 MW hydrogen fuel cell system in 2024 at its Friedrichshafen facility in Germany, generating enough power to sustain a regional aircraft and marking one of the largest aviation-focused hydrogen fuel cell demonstrations worldwide.

Increasing Airline Commitments to Sustainable Operations

Airlines expand commitments to carbon neutrality, pushing demand for zero-emission aircraft in fleet renewal strategies. The Zero Emission Aircraft Market gains from early adoption programs led by regional and low-cost carriers. It supports airlines that announce firm orders and partnerships with aircraft developers to align with sustainability pledges. Corporate pressure from environmentally conscious travelers reinforces the urgency for green aviation solutions. Airlines view these aircraft as an opportunity to differentiate brand value while meeting emissions regulations. It strengthens the link between airline sustainability goals and aircraft innovation pipelines.

Advancements in Infrastructure for Hydrogen and Electric Aviation

Infrastructure development plays a pivotal role in enabling widespread adoption of zero-emission aircraft. The Zero Emission Aircraft Market benefits from airport projects that expand hydrogen refueling systems and electric charging facilities. It supports ecosystem growth where governments and private firms invest in airport-ready energy hubs. Demonstration corridors and green airport initiatives establish frameworks for commercial deployment. Logistics providers and ground service companies contribute to integrating renewable energy into aviation supply chains. It ensures that infrastructure aligns with aircraft readiness, creating an environment for reliable long-term operations.

Market Trends

Accelerating Development of Hydrogen-Powered Aircraft Programs

Hydrogen emerges as a leading pathway for sustainable aviation with strong momentum in prototype testing. The Zero Emission Aircraft Market gains attention as Airbus, ZeroAvia, and Universal Hydrogen push forward with large-scale demonstration projects. It highlights progress in liquid hydrogen storage, which improves safety and energy efficiency for commercial applications. Partnerships with energy firms ensure access to renewable hydrogen production capacity. Governments support these initiatives with grants that reduce development risks for aerospace companies. It positions hydrogen-powered aircraft as a viable long-term solution for regional and narrow-body operations.

- For instance, ZeroAvia completed the first flight of its Dornier 228 testbed in 2023 powered by a 600-kW hydrogen-electric engine, achieving a 10-minute flight at 3,500 feet, a significant milestone toward certifying hydrogen propulsion for 20-seat regional aircraft.

Expansion of Electric Aviation Across Regional and Short-Haul Segments

Electric propulsion gains traction in regional and commuter markets where short-haul routes align with battery capacity. The Zero Emission Aircraft Market benefits from testing programs led by startups and established players such as Eviation and Heart Aerospace. It accelerates the shift toward all-electric aircraft capable of carrying 9 to 19 passengers on distances under 500 kilometers. Battery advancements improve range and payload capability, strengthening the case for commercial viability. Airlines sign agreements to integrate electric fleets into regional routes, creating near-term adoption opportunities. It supports the expansion of cleaner aviation solutions in segments with high frequency and short distances.

- For instance, Etihad Airways secured a $1.2 billion sustainability-linked loan (SLL) tied to ESG targets, marking its third sustainable financing deal. This transaction is the largest of its kind, bringing the airline’s total funds raised through green instruments to over $1.9 billion since 2019. Etihad claims this is the first-ever SLL in the aviation sector tied to ESG targets.

Strategic Collaborations Between Aerospace and Energy Industries

Cross-industry partnerships accelerate the commercialization of zero-emission aircraft by aligning aerospace expertise with renewable energy capabilities. The Zero Emission Aircraft Market evolves through joint ventures that bring together aircraft manufacturers, hydrogen producers, and infrastructure developers. It fosters integrated supply chains that cover aircraft design, fuel distribution, and charging solutions. Energy companies invest in airport infrastructure to provide hydrogen and electricity at scale. Aerospace firms secure long-term energy commitments that support prototype testing and eventual deployment. It reflects a trend where multi-sector cooperation drives faster technology adoption.

Increasing Focus on Digitalization and Predictive Analytics in Zero-Emission Operations

Digital platforms gain importance in optimizing zero-emission flight operations and maintenance. The Zero Emission Aircraft Market integrates predictive analytics to manage energy consumption, charging schedules, and route efficiency. It relies on digital twins and advanced simulation to refine aircraft performance before certification. Airlines use cloud-based platforms to assess operational scenarios for electric and hydrogen fleets. Software solutions play a role in extending asset life cycles and reducing operational risks. It establishes digitalization as a core trend that supports sustainable aviation ecosystems.

Market Challenges Analysis

High Technical Barriers in Propulsion and Energy Storage

The development of zero-emission aircraft faces significant hurdles in propulsion efficiency and energy density. The Zero Emission Aircraft Market struggles with the limitations of current battery technology, where weight-to-power ratios restrict long-range operations. It confronts challenges in hydrogen storage, requiring cryogenic tanks and complex safety systems that add weight and cost. Aerospace firms must balance structural integrity with new fuel systems that differ from conventional jet engines. Certification processes for novel propulsion technologies extend development cycles and increase financial risk. It slows large-scale adoption, particularly in long-haul and high-capacity aircraft categories.

Infrastructure Gaps and High Capital Requirements for Deployment

Widespread adoption depends on the readiness of ground infrastructure that supports electric charging and hydrogen refueling. The Zero Emission Aircraft Market encounters delays due to the absence of standardized systems across airports. It demands large capital investments in renewable energy generation, distribution, and storage facilities at major hubs. Airlines face higher upfront costs for integrating these aircraft into fleets, which complicates financial planning. Governments and private players must coordinate to ensure consistent global infrastructure development. It creates uncertainty in adoption timelines and slows the pace of commercial deployment.

Market Opportunities

Rising Potential in Regional and Short-Haul Aviation Segments

Regional and commuter routes present immediate opportunities for deploying zero-emission aircraft. The Zero Emission Aircraft Market benefits from the suitability of electric and hydrogen propulsion for flights under 500 kilometers. It enables airlines to serve high-frequency routes with lower emissions and reduced fuel costs. Startups and established manufacturers position themselves to deliver small- to medium-capacity aircraft tailored for regional networks. Governments support this shift with funding aimed at connecting smaller cities through sustainable aviation programs. It creates a growth pathway where early adoption can demonstrate scalability and reliability.

Expanding Scope for Strategic Collaborations and Green Infrastructure Development

Cross-industry partnerships open opportunities to accelerate commercialization through shared expertise and resources. The Zero Emission Aircraft Market gains strength as aerospace firms, energy providers, and airport operators collaborate to build fueling and charging networks. It allows stakeholders to integrate renewable energy directly into aviation infrastructure. Airlines secure long-term supply agreements that lower operational risks and encourage fleet modernization. Technology firms provide digital solutions that optimize aircraft performance and support predictive maintenance. It creates an ecosystem where coordinated investment enhances adoption speed and operational feasibility.

Market Segmentation Analysis:

By Aircraft Type

Short-haul aircraft lead adoption due to their suitability for regional operations and limited energy demands. The Zero Emission Aircraft Market prioritizes this category as battery and hydrogen propulsion technologies can meet performance requirements for flights under 500 kilometers. It provides airlines with immediate opportunities to modernize fleets on commuter routes. Medium-haul aircraft gain attention through prototype programs that aim to extend ranges while balancing payload capacity. Long-haul aircraft face technical and infrastructure barriers, yet manufacturers explore hybrid hydrogen concepts to reduce emissions in larger models. It reflects a gradual expansion from short-haul readiness to long-haul innovation.

- For instance, Airbus’s ZEROe hydrogen program, initiated in 2020, shifted in 2025 to a fully electric propulsion system powered by hydrogen fuel cells; its Aerostack joint-venture fuel cell demonstrator successfully achieved 1.2 megawatts of output during its 2023 test campaign.

By Power Source

Battery-powered aircraft dominate early commercialization because of advances in energy density and falling storage costs. The Zero Emission Aircraft Market develops aircraft in the 9 to 19 passenger range where battery systems align with range expectations. It secures interest from regional operators that plan near-term deployment. Hydrogen fuel cells show strong momentum for both regional and medium-haul segments, with multiple aerospace firms testing fuel cell systems capable of powering aircraft beyond 1,000 kilometers. Solar-powered aircraft remain in experimental stages, primarily used for endurance and research applications rather than commercial passenger operations. It underlines the growing diversification of propulsion technologies.

- For instance, magniX was awarded US $74.3 million by NASA under its Electric Powertrain Flight Demonstration (EPFD) program to develop and demonstrate megawatt-class electric propulsion systems over a five-year span .

By Application

Passenger transport forms the largest application area, with airlines integrating zero-emission models into sustainability-driven fleet renewal plans. The Zero Emission Aircraft Market accelerates through commitments from carriers seeking to offer low-carbon services on regional routes. It drives demand for platforms that combine energy efficiency with operational reliability. Cargo transport shows promise, particularly for express and e-commerce logistics firms aiming to reduce emissions in last-mile and regional distribution. Unmanned aerial vehicles contribute to the ecosystem by advancing electric and hydrogen propulsion on a smaller scale, creating testbeds for scalable technologies. It highlights the broad application base where passenger, cargo, and UAV segments collectively shape adoption pathways.

Segments:

Based on Aircraft Type:

- Short-haul Aircraft

- Medium-haul Aircraft

- Long-haul Aircraft

Based on Power Source:

- Battery Powered

- Hydrogen Fuel Cells

- Solar Powered

Based on Application:

- Passenger Transport

- Cargo Transport

- Unmanned Aerial Vehicles

Based on the Geography:

- North America

- Europe

- Germany

- France

- UK.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- The Rest of the Middle East and Africa

Regional Analysis

North America

North America holds approximately 40% of the Zero Emission Aircraft Market, making it the largest regional contributor. The region benefits from its strong aerospace ecosystem, advanced research infrastructure, and significant government backing. The U.S. supports innovation through funding programs and regulatory incentives that encourage airlines and manufacturers to transition toward sustainable aviation. It develops extensive pilot projects for hydrogen refueling and electric charging systems across major airports. Airlines in the region explore fleet modernization with smaller electric aircraft, while military contracts accelerate adoption of experimental propulsion systems. It positions North America as the most mature market with the highest readiness for scaling zero-emission aviation technologies.

Europe

Europe accounts for nearly 35% of the Zero Emission Aircraft Market, driven by strict environmental regulations and ambitious net-zero targets. The European Union prioritizes hydrogen and electric aviation through the Clean Aviation program and national-level green energy schemes. It creates favorable conditions for aerospace companies to develop and commercialize fuel-cell and battery-powered aircraft. Airports in France, Germany, and the Netherlands install early-stage hydrogen hubs and electrified charging infrastructure. Regional airlines actively participate in demonstration flights to prove commercial feasibility. It establishes Europe as a critical innovation hub where strong regulatory frameworks and collaborative ecosystems push the adoption of sustainable aviation solutions.

Asia-Pacific

Asia-Pacific holds about 15% of the Zero Emission Aircraft Market, reflecting a growing emphasis on sustainable aviation within high-density travel corridors. Countries such as China, Japan, and South Korea allocate significant resources to prototype testing and eVTOL development. It aligns clean aviation initiatives with urban mobility solutions and regional air transport needs. Investments target both electric and hydrogen propulsion platforms suitable for short- and medium-haul flights. Partnerships between Asian manufacturers and international aerospace leaders strengthen regional capabilities. It demonstrates a rising commitment to balancing rapid aviation growth with environmental sustainability, particularly in markets where regional travel dominates passenger traffic.

Latin America

Latin America contributes nearly 6% to the Zero Emission Aircraft Market, with adoption driven by regional mobility requirements and sustainability goals. The region evaluates electric aircraft for short-haul passenger routes and cargo logistics serving remote communities. It leverages renewable energy resources to support electric charging and hydrogen production for future aviation projects. Governments explore partnerships with global technology firms to introduce demonstration programs across major airports. Local research initiatives examine cost-effective ways of integrating clean aviation into existing fleets. It signals early adoption potential despite challenges linked to funding and infrastructure gaps, particularly in less-developed aviation hubs.

Middle East & Africa

The Middle East & Africa account for roughly 4% of the Zero Emission Aircraft Market, reflecting gradual but important steps toward sustainable aviation. Gulf nations lead with investment programs that link zero-emission aviation to their long-term green energy strategies. It supports hydrogen and electric integration at major international airports, with plans for regional hubs dedicated to renewable aviation fuels. African nations explore battery-powered commuter aircraft to improve connectivity in underserved regions. Collaborative projects emerge between airlines, energy companies, and airport operators. It positions the region as an emerging participant where strategic investments and airport modernization plans create future opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heart Aerospace

- Evektor, spol. s r. o.

- Joby Aero, Inc.

- Ampaire Inc.

- Lilium GmbH

- BETA Technologies, Inc.

- Eviation

- Equator Aircraft AS

- Aurora Flight Sciences (The Boeing Company)

- Bye Aerospace

Competitive Analysis

The Zero Emission Aircraft Market features include Ampaire Inc., Aurora Flight Sciences (The Boeing Company), BETA Technologies, Inc., Bye Aerospace, Equator Aircraft AS, Evektor, spol. s r. o., Eviation, Heart Aerospace, Joby Aero, Inc., and Lilium GmbH. The Zero Emission Aircraft Market reflects a competitive landscape defined by rapid innovation, diverse propulsion strategies, and strong funding momentum. Companies pursue electric, hybrid-electric, and hydrogen-powered designs to address varying ranges and operational needs. It shows intense activity in regional aircraft, commuter planes, and eVTOL platforms, with several prototypes advancing into certification phases. Competitive advantage relies on technological breakthroughs in battery density, hydrogen storage, and lightweight materials, as well as partnerships with energy providers and airport operators. Strategic collaborations with airlines and regulators accelerate adoption by aligning product development with sustainability targets. The market competition focuses on proving commercial viability, scaling infrastructure readiness, and achieving early mover advantages in regional and short-haul aviation segments.

Recent Developments

- In August 2025, the zero-emission aircraft market valued at USD 7.86 billion in 2025. Regulatory mandates like carbon offset programs and emissions regulations in the European Union and worldwide are propelling development. Hydrogen fuel cell aircraft hold the largest market share, with ongoing innovations targeting medium-haul flights.

- In May 2025, multiple significant developments signalled the continued momentum in the zero-emission market. A leading electric vehicle manufacturer announced the launch of a next-gen solid-state battery EV, offering extended range and zero emissions, set to redefine urban mobility standards.

- In July 2024, Embraer unveiled updates to its Energia sustainable aircraft concepts at the Farnborough Airshow. The company expanded its research to include 50-seat aircraft, up from the previous focus on 30-seat models. Embraer also broadened its exploration to include hydrogen gas turbine/dual fuel (GT/DF) technologies, alongside its ongoing work on Hybrid Electric and Fuel Cell solutions.

- In July 2024, Airbus announced a partnership with aircraft lessor Avolon to explore the potential of hydrogen-powered aircraft. This collaboration, the first of its kind within the ZEROe project, will focus on financing, commercialization, and leasing models for future hydrogen aircraft.

Market Concentration & Characteristics

The Zero Emission Aircraft Market demonstrates a fragmented yet dynamic structure, shaped by the coexistence of established aerospace corporations and agile startups. It features concentrated innovation in electric, hybrid-electric, and hydrogen propulsion systems, with companies competing to move prototypes from testing toward certification. The market remains characterized by high research intensity, long development cycles, and reliance on regulatory approvals, which create barriers to entry but also ensure strong technological differentiation. It shows regional concentration in North America and Europe, where infrastructure readiness and policy incentives drive faster progress, while Asia-Pacific and emerging economies build capacity more gradually. Competition extends beyond aircraft design to include ecosystem development, where partnerships with airports, energy providers, and governments determine commercialization speed. It reflects a market defined by technological experimentation, strategic collaboration, and early adoption strategies that focus on regional and commuter aircraft segments before scaling to medium- and long-haul applications.

Report Coverage

The research report offers an in-depth analysis based on Aircraft Type, Power Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Zero-emission aircraft will expand adoption in regional and commuter routes supported by advancing propulsion systems.

- Hydrogen fuel cells will play a central role in scaling aircraft beyond short-haul operations.

- Electric propulsion will dominate near-term deployments in training, light aircraft, and eVTOL platforms.

- Infrastructure investment in hydrogen refueling and electric charging will determine the pace of commercialization.

- Airlines will increasingly commit to zero-emission fleets to align with corporate sustainability targets.

- Regulatory support and certification frameworks will accelerate market readiness across regions.

- Collaborations between aerospace manufacturers and energy providers will strengthen integrated supply chains.

- Advances in battery energy density and lightweight materials will improve performance and range.

- Digital platforms using predictive analytics will enhance efficiency in zero-emission flight operations.

- Emerging markets will gradually adopt clean aviation technologies as infrastructure and funding improve.