Market Overview

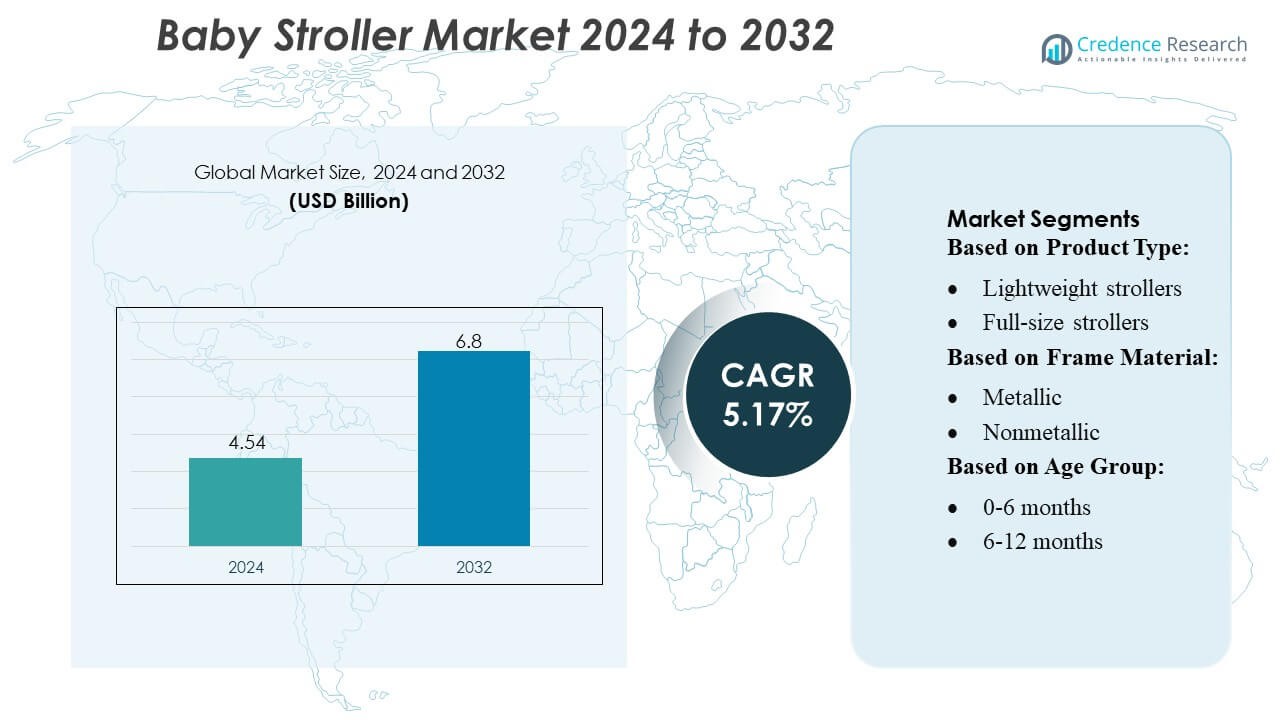

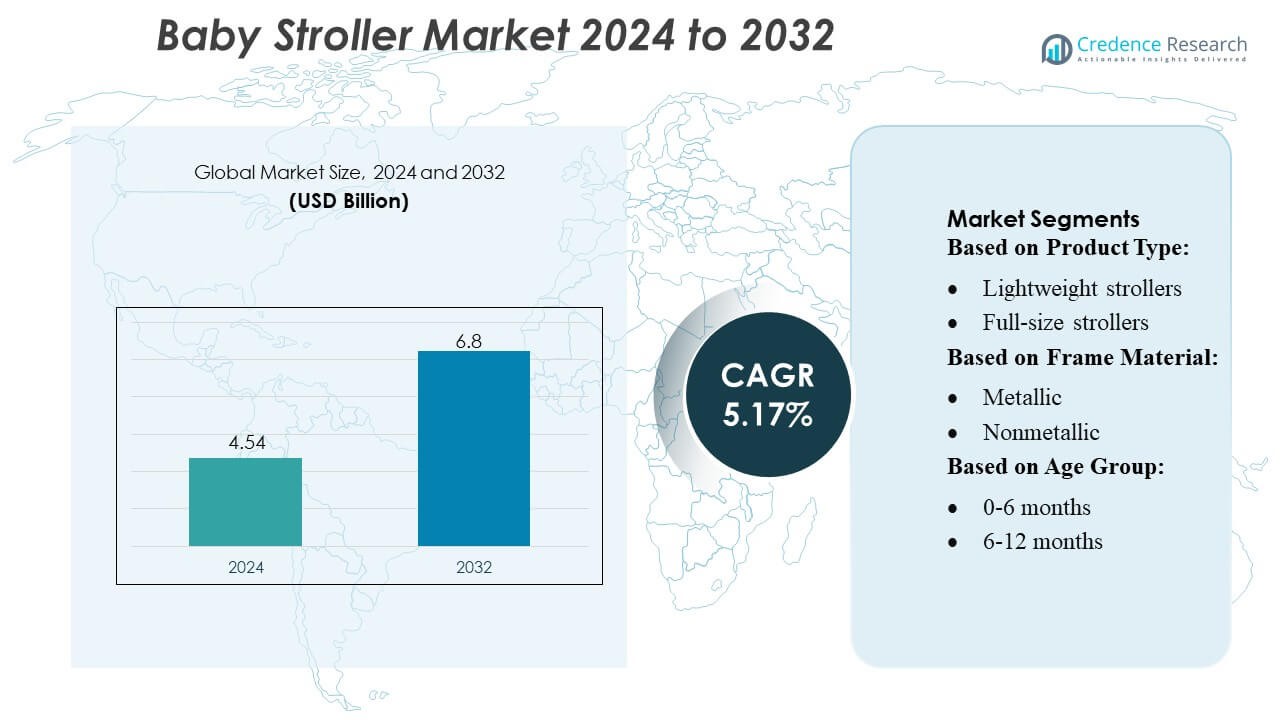

Baby Stroller Market size was valued USD 4.54 billion in 2024 and is anticipated to reach USD 6.8 billion by 2032, at a CAGR of 5.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Baby Stroller Market Size 2024 |

USD 4.54 Billion |

| Baby Stroller Market, CAGR |

5.17% |

| Baby Stroller Market Size 2032 |

USD 6.8 Billion |

The Baby Stroller Market includes several influential players such as Evenflo Company, Inc., Peg Perego, Combi USA, Inc., Baby Trend, Inc., Mothercare PLC, Dorel Industries Inc., Britax Child Safety, Inc., Baby Jogger, LLC, Artsana USA, Inc., and Mamas & Papas (Holdings) Ltd, each strengthening competitiveness through innovation in safety, comfort, and multifunctional design. These companies focus on lightweight frames, modular travel systems, and advanced safety certifications to meet evolving consumer expectations. Asia Pacific leads the global market with approximately 34–36% share, supported by rising birth rates, expanding middle-class income, and increasing adoption of modern mobility solutions across rapidly urbanizing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Baby Stroller Market reached USD 4.54 billion in 2024 and is projected to hit USD 6.8 billion by 2032 at a CAGR of 5.17%, driven by rising demand for safe, durable, and multifunctional mobility solutions for infants and toddlers.

- Growing urbanization and dual-income households fuel strong preference for lightweight, compact, and travel-friendly strollers, while the 12–36 months segment holds the largest share due to frequent outdoor mobility needs.

- Leading players enhance competitiveness through innovations in modular travel systems, ergonomic seating, advanced suspension, and safety certifications tailored to evolving consumer expectations.

- Market restraints include high price sensitivity in developing regions and the availability of low-cost alternatives, which challenge premium brands in defending value and differentiation.

- Asia Pacific leads with 34–36% share, followed by North America and Europe, supported by rising birth rates and expanding middle-class income; metallic-frame strollers dominate material preferences due to durability and stability.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Lightweight strollers dominate the Baby Stroller Market with an estimated 32–34% share, driven by rising preference for compact mobility solutions among urban households and frequent travelers. Their foldable design, low weight, and affordability strengthen adoption across middle-income consumer groups. Travel systems follow closely due to their integrated car-seat compatibility, appealing to parents seeking convenience and multi-functionality. Full-size strollers maintain steady demand in premium segments, while jogging and double strollers gain traction among fitness-oriented and multi-child families. The category continues shifting toward ergonomic, multifunctional, and easy-maneuver models.

- For instance, Goodbaby International Holdings Ltd. (which owns Evenflo), reports that its factories produced over 10,000 strollers per day across its portfolio a scale that underscores its capability to supply lightweight and compact models in volume.

By Frame Material

Metallic frame strollers lead the market with approximately 63–66% share, supported by high durability, superior load-bearing capacity, and enhanced safety—critical factors influencing parental purchase decisions. Aluminum alloys remain the preferred choice due to their strength-to-weight advantage, corrosion resistance, and extended product lifecycle. Nonmetallic frames, including advanced plastics and composite materials, grow gradually as brands introduce lightweight, shock-absorbing structures that improve handling. Demand for metallic frames remains dominant as manufacturers emphasize robust engineering and stability to meet stringent safety regulations in North America, Europe, and emerging urban markets.

- For instance, Peg Perego Vivace Stroller — a modern Peg Perego stroller — is specified to use a frame made of 80% aluminum, 15% plastic and 5% polyurethane.

By Age Group

The 12–36 months segment holds the largest share at roughly 40–42%, as toddlers in this age range require more frequent outdoor mobility, contributing to strong demand for versatile, mid-sized strollers with enhanced comfort and maneuverability. The 6–12 months category also performs well as parents shift from infant carriers to more stable stroller designs. Strollers for 0–6 months remain niche but essential due to compatibility with bassinets and travel systems. Above 36 months records moderate uptake, driven by premium lightweight models designed for extended use during travel, shopping, and recreational activities.

Key Growth Drivers

1. Rising Urbanization and Growing Dual-Income Households

Rapid urbanization and the expansion of dual-income families strengthen demand for baby strollers as parents prioritize convenient, time-efficient mobility solutions. Compact living spaces and increased travel frequency reinforce the need for lightweight, foldable, and easy-maneuver models. Working parents value strollers that support daily commuting, shopping, and daycare routines. This shift toward modern parenting lifestyles accelerates adoption in metropolitan regions across Asia Pacific, North America, and Europe, driving consistent growth across mid-range and premium stroller categories.

- For instance, Robert Bosch GmbH manufactures the TDL110 transport data logger, a device that uses Bluetooth Low Energy (BLE) connectivity for configuration and data retrieval.

2. Product Innovations in Safety, Comfort, and Multifunctionality

Continuous innovation in stroller safety systems, ergonomic seating, and multifunctional design drives market expansion. Manufacturers integrate advanced suspension, enhanced braking systems, UV-protective canopies, breathable fabrics, and modular attachments to improve user experience. Travel systems combining stroller frames with infant car seats gain strong traction among first-time parents seeking superior versatility. Smart strollers with tracking sensors, automatic braking, and mobile app connectivity emerge as premium offerings, reinforcing differentiation and boosting demand in technologically progressive markets.

- For instance, Lorex Technology Inc. offers the 2K Indoor Wi-Fi Security Camera (model W461ASC-E), which is suitable for baby monitoring. This camera delivers 2K (2560×1440) resolution video, has up to 32 feet (10m) of infrared night vision, and provides 2.4 GHz Wi-Fi connectivity.

3. Rising Birth Rates in Select Markets and Expanding E-Commerce Penetration

Although global birth rates vary, developing economies such as India, Indonesia, and parts of Africa experience steady growth in newborn populations, sustaining stroller demand. At the same time, e-commerce penetration accelerates market accessibility by offering wider product catalogs, promotional pricing, doorstep delivery, and peer reviews that influence purchasing decisions. Online platforms enable greater brand visibility and successful entry of international players into emerging markets. The combination of demographic momentum and digital retail expansion significantly strengthens long-term market growth.

Key Trends & Opportunities

1. Growing Preference for Lightweight and Travel-Friendly Strollers

Parents increasingly prefer lightweight, compact, and cabin-friendly stroller models due to frequent travel, urban lifestyles, and the need for portable solutions. Ultra-light aluminum frames, one-hand fold mechanisms, and compact travel systems create strong opportunities for brands targeting on-the-go consumers. The rise in airline travel with infants strengthens demand for strollers meeting cabin baggage standards. Manufacturers that offer durable yet portable designs capture a rapidly expanding segment, particularly in North America, Europe, and Asia’s urban centers.

- For instance, Angelcare Monitor Incorporation’s AC327 includes a wireless “SensAsure” movement sensor pad that is placed under the crib mattress and monitors movement without touching the baby. The transmission between the sensor pad, nursery unit, and parent unit uses a secure 2.4 GHz digital frequency.

2. Expanding Demand for Eco-Friendly and Sustainable Materials

Demand for eco-friendly baby strollers rises as parents prioritize sustainable, non-toxic, and ethically manufactured products. Manufacturers adopt recycled fabrics, BPA-free plastics, organic cotton padding, and renewable frame materials to meet green consumer expectations. Certifications related to safety and sustainability enhance brand credibility, creating opportunities for premium and mid-range product differentiation. Growing environmental awareness, especially among millennial parents, supports strong uptake of sustainable stroller collections across North America, Europe, and developed Asia Pacific markets.

- For instance, Maxi-Cosi Inc.’s See Pro 360° Baby Monitor employs AI Motion & Sound Detection powered by Zoundream’s CryAssist technology. The monitor offers 2K Ultra HD (2560×1440) HDR video with a 360° pan and 90° tilt field of view.

3. Premiumization and Smart Technology Integration

The premium stroller segment expands as parents invest in advanced features such as all-terrain wheels, height-adjustable handlebars, reversible seats, suspension systems, and AI-enabled safety support. Smart strollers with tracking modules, electronic braking, and automated push assistance gain early adoption in high-income markets. This premiumization trend enables manufacturers to command higher margins and build strong brand loyalty. Increasing disposable income and the influence of global lifestyle brands further accelerate demand for high-performance stroller models.

Key Challenges

1. High Price Sensitivity and Intense Market Competition

Price sensitivity among middle-income consumers limits adoption of premium stroller models, especially in emerging markets. A wide availability of low-cost, unbranded, and counterfeit products intensifies price competition and challenges branded players in defending market share. Frequent discounting on e-commerce platforms further compresses margins. Manufacturers must balance cost efficiency with feature enhancement to remain competitive. This environment pushes brands to differentiate through durability, safety certifications, and value-added functionalities.

2. Safety Concerns, Product Recalls, and Regulatory Compliance

Strict global safety regulations and increasing scrutiny over product quality pose major challenges for manufacturers. Stroller recalls due to faulty wheels, folding mechanisms, or choking hazards negatively affect brand trust and demand. Companies must meet evolving standards related to stability, material toxicity, braking efficiency, and child restraint systems across different regions. Ensuring compliance increases production complexity and cost, particularly for brands expanding into multiple geographic markets. Failure to comply risks legal penalties and reputational damage.

Regional Analysis

North America

North America holds approximately 28–30% of the Baby Stroller Market, supported by high purchasing power, strong preference for premium multifunctional strollers, and widespread adoption of travel systems. Parents increasingly favor advanced safety features, ergonomic designs, and lightweight aluminum frames, driving consistent upgrade cycles. The U.S. leads regional demand due to robust retail networks and well-established e-commerce channels offering diverse branded offerings. Growing emphasis on outdoor activities and urban mobility also strengthens demand for jogging and all-terrain strollers. Continuous product innovation and stringent safety certifications sustain the region’s strong market position.

Europe

Europe accounts for around 24–26% of the market, driven by high awareness of child safety standards and strong adoption of sustainable, eco-friendly stroller materials. Countries such as Germany, France, the U.K., and the Netherlands exhibit strong demand for compact, travel-friendly, and modular stroller designs suited to urban commuting. Rising dual-income households and premium lifestyle preferences fuel steady growth across mid-range and high-end categories. Europe’s strict product safety regulations encourage manufacturers to focus on durable construction and ergonomic enhancements, strengthening consumer trust. The region remains a significant hub for design-led and innovation-driven stroller brands.

Asia Pacific

Asia Pacific leads the Baby Stroller Market with nearly 34–36% share, supported by rising birth rates in India, Southeast Asia, and parts of China, along with growing urbanization and expanding middle-class incomes. Parents increasingly shift toward modern mobility solutions, boosting demand for lightweight, value-driven stroller models. China remains the largest contributor due to strong domestic manufacturing capabilities and high adoption of premium global brands. Rapid growth in e-commerce platforms across India and Indonesia improves product accessibility. Continuous product launches tailored to regional price sensitivity and portability preferences reinforce Asia Pacific’s dominant position.

Latin America

Latin America captures an estimated 7–8% share of the market, with Brazil, Mexico, and Argentina emerging as primary demand centers. Growing urban populations and increased awareness of infant mobility products support gradual adoption of strollers, especially affordable lightweight models. Economic fluctuations and price sensitivity influence consumer preference, encouraging manufacturers to balance affordability with essential safety features. Expansion of online retail channels improves access to international brands, while local distributors strengthen presence in mid-range categories. Increasing participation of women in the workforce contributes to rising demand for convenient and multifunctional stroller solutions.

Middle East & Africa

The Middle East & Africa region holds approximately 5–6% of the market, driven by rising disposable incomes in Gulf countries and growing adoption of premium baby products among urban families. The UAE and Saudi Arabia lead demand due to strong retail infrastructure, high import penetration, and preference for durable, luxury stroller brands. In Africa, expanding middle-class populations in South Africa, Kenya, and Nigeria contribute to gradual market growth, primarily for value-oriented models. Increasing awareness of child safety and expansion of organized retail support steady but moderate growth across the region.

Market Segmentations:

By Product Type:

- Lightweight strollers

- Full-size strollers

By Frame Material:

By Age Group:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Baby Stroller Market features a competitive landscape shaped by leading players such as Evenflo Company, Inc., Peg Perego, Combi USA, Inc., Baby Trend, Inc., Mothercare PLC, Dorel Industries Inc., Britax Child Safety, Inc., Baby Jogger, LLC, Artsana USA, Inc., and Mamas & Papas (Holdings) Ltd. the Baby Stroller Market is defined by continuous innovation, shifting consumer preferences, and strong emphasis on safety, durability, and multifunctional design. Manufacturers focus on introducing lightweight frames, compact folding mechanisms, reversible seats, and enhanced suspension systems to meet the mobility needs of modern parents. Premium brands differentiate through high-performance materials and advanced ergonomics, while mid-range players strengthen appeal with value-driven features and regulatory compliance. Expanding e-commerce platforms intensify competition by increasing price transparency and broadening access to global stroller models. Companies also invest in sustainability, smart connectivity, and design customization to capture diverse consumer segments and maintain competitive momentum.

Key Player Analysis

- Evenflo Company, Inc

- Peg Perego

- Combi USA, Inc

- Baby Trend, Inc.

- Mothercare PLC

- Dorel Industries Inc.

- Britax Child Safety, Inc.

- Baby Jogger, LLC

- Artsana USA, Inc.

- Mamas & Papas (Holdings) Ltd

Recent Developments

- In March 2025, Lamborghini partnered with Silver Cross to launch the limited-edition Reef AL Arancio luxury baby stroller. The stroller is designed with Lamborghini’s signature style and available in only 500 units worldwide, each featuring an Arancio orange accent on a sleek black frame, a leather handlebar, and a price. It includes premium features like all-terrain wheels, full suspension, and a brake pedal inspired by the car designs.

- In November 2024, Momcozy, a leading maternity brand, has unveiled two cutting-edge strollers. The newly introduced Momcozy ClickGo Lightweight Stroller and ChangeGo Baby Stroller prioritize advanced functionality, ensuring utmost comfort and convenience for users.

- In May 2024, Goodbaby International’s brand, Visitors will have the opportunity to preview two new limited editions of Evenflo’s Shyft™ DualRide™ Infant Car Seat and Stroller Combo. The brand launched two limited editions: the Shyft DualRide Infant Car Seat and Stroller Combo and the Revolve360 Extend series.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Frame Material, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance with increasing adoption of lightweight, compact, and travel-friendly stroller designs.

- Product innovation will accelerate as brands integrate enhanced safety systems and ergonomic features.

- Premium stroller categories will grow as parents prioritize durability, comfort, and multifunctionality.

- Smart mobility features such as tracking, app connectivity, and automatic braking will gain gradual traction.

- Sustainable materials and eco-friendly manufacturing practices will become stronger differentiators.

- E-commerce platforms will continue expanding market access and influencing purchasing decisions.

- Urbanization and dual-income households will support steady demand for convenient daily-use strollers.

- Customizable and modular stroller systems will attract consumers seeking long-term value and versatility.

- Emerging markets will contribute significantly to volume growth due to rising birth rates and improving incomes.

- Partnerships, product diversification, and regulatory compliance will remain crucial for competitive positioning.

Market Segmentation Analysis:

Market Segmentation Analysis: