Market Overview

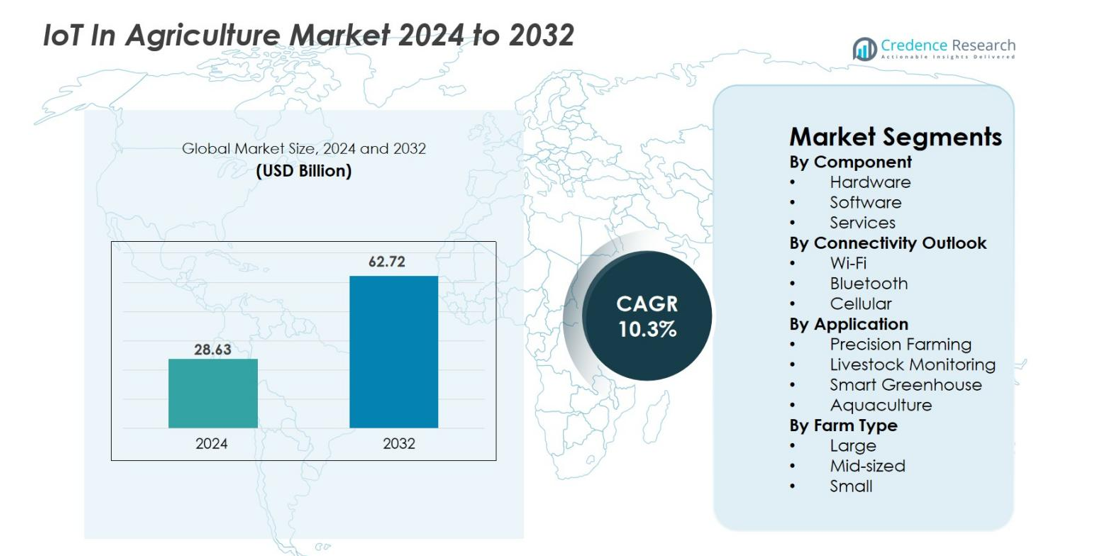

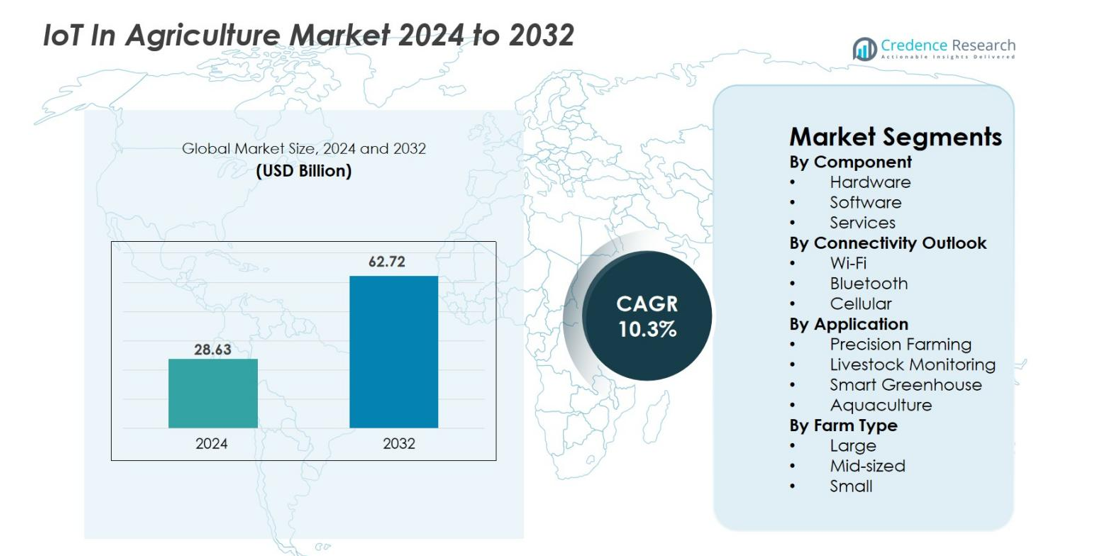

IoT in Agriculture Market size was valued at USD 28.63 Billion in 2024 and is anticipated to reach USD 62.72 Billion by 2032, at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IoT in Agriculture Market Size 2024 |

USD 28.63 Billion |

| IoT in Agriculture Market, CAGR |

10.3% |

| IoT in Agriculture Market Size 2032 |

USD 62.72 Billion |

IoT in Agriculture Market is shaped by strong participation from leading players such as Valmont Industries, Trimble Inc., Cropin, Blue River Technology, Agrostar, Deere & Company, FarmWise Labs, Topcon Positioning Systems, Raven Industries, and AGCO Corporation. These companies focus on advanced sensors, precision equipment, AI-enabled analytics, and automated irrigation systems to enhance farm productivity and resource efficiency. North America emerged as the leading region in 2024, capturing 38.6% of the global market due to early digital adoption, robust connectivity infrastructure, and widespread use of smart farming technologies across large commercial farms. Europe and Asia-Pacific follow with rising investment in sustainable and data-driven agriculture.

Market Insights

- The IoT in Agriculture Market was valued at USD 28.63 Billion in 2024 and is projected to reach USD 62.72 Billion by 2032, expanding at a CAGR of 10.3%.

- Rising demand for precision farming, automation, and real-time monitoring drives adoption of sensors, smart irrigation, and AI-enabled platforms across crop and livestock management.

- Key trends include rapid integration of drones, cloud analytics, and cellular IoT, with hardware holding a dominant 54.2% share and cellular connectivity leading with 47.6% in 2024.

- Leading players such as Trimble, Valmont Industries, Deere & Company, and AGCO Corporation strengthen market presence through product innovation, data-driven tools, and strategic collaborations.

- North America led the market with a 38.6% share in 2024, followed by Europe at 27.3% and Asia-Pacific at 22.8%, reflecting strong digital infrastructure and rising smart farming adoption across regional agricultural landscapes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The IoT in Agriculture market by component is primarily divided into Hardware, Software, and Services. Hardware dominates the segment, accounting for approximately 47.5% of the market in 2024, driven by widespread adoption of sensors, GPS devices, and drones that enable real-time data collection and farm automation. Software follows with 31.2% share, fueled by increasing demand for AI-driven analytics, farm management platforms, and predictive tools to optimize crop yields. Services, holding 21.3%, support installation, monitoring, and maintenance, further enhancing operational efficiency and maximizing ROI across agricultural enterprises globally.

- For instance, the machinery and equipment maker John Deere offers precision-agriculture solutions that integrate IoT sensors and GPS-enabled field equipment to let farmers monitor soil conditions and optimize planting/harvesting schedules across fields.

By Connectivity

In terms of connectivity, Wi-Fi leads the IoT in Agriculture market with a 39.6% share in 2024, supported by its high-speed, low-cost deployment in smart farms and greenhouses. Cellular connectivity accounts for 34.2%, driven by its wide coverage, especially in remote areas, facilitating data transfer from sensors, drones, and machinery. Bluetooth, representing 26.2%, is preferred for short-range communication between devices like livestock monitors and field sensors. The growth of connectivity infrastructure and demand for real-time monitoring continue to propel the adoption of these technologies in precision agriculture.

- For instance, John Deere’s Operations Center platform relies on Wi-Fi and cellular modules embedded in tractors and harvesters to transmit real-time agronomic data from the field.

By Application

Among applications, Precision Farming holds the largest share at 41.8% in 2024, owing to its role in optimizing crop production, resource utilization, and soil health using IoT-enabled devices and data analytics. Smart Greenhouses follow with 22.5%, driven by climate-controlled environments and automation systems for enhanced yield. Livestock Monitoring accounts for 20.3%, fueled by sensors and wearables that track animal health and behavior. Aquaculture, at 15.4%, is gaining traction through IoT-enabled water quality monitoring and automated feeding systems. Rising demand for efficiency, sustainability, and cost reduction drives growth across all applications.

Key Growth Drivers

Rising demand for precision agriculture and optimized resource management

The increasing global population and changing dietary patterns are intensifying the need for higher agricultural productivity while conserving resources. IoT in Agriculture enables precision farming through sensors, GPS devices, and drones that monitor soil conditions, crop health, and weather patterns in real time. Farmers leverage this data to optimize irrigation, reduce fertilizer and pesticide usage, and enhance crop yield efficiency. Adoption is particularly strong in regions facing water scarcity or environmental stress, as IoT solutions help balance productivity with sustainability. The capability to generate actionable insights for decision-making, coupled with improved farm management efficiency, is driving significant investment and accelerating market growth across both developed and emerging agricultural markets.

- For instance, Trimble’s Ag Software combines drone imagery and sensor inputs to deliver variable-rate fertilization maps, enabling farmers to reduce input costs and improve field-level crop uniformity.

Technological advancements in IoT hardware, connectivity, and analytics

Rapid innovation in sensor technology, IoT-enabled devices, cloud computing, and data analytics is fueling adoption across agriculture. Modern IoT hardware, including drones, automated tractors, and environmental sensors, offer higher reliability, better energy efficiency, and resilience under varying environmental conditions. Meanwhile, improved connectivity options such as 5G, LPWAN, and hybrid networks allow real-time monitoring even in remote farmlands. Cloud-based platforms combined with predictive analytics enable data-driven decision-making, remote operation, and proactive maintenance. These technological improvements reduce operational costs, improve yield predictability, and allow scalability for both large commercial farms and mid-sized operations. Consequently, enhanced automation, operational efficiency, and actionable insights are major growth drivers for the IoT in Agriculture market.

- For instance, DJI’s Agras T40 drone uses advanced spraying systems and is designed to integrate with multispectral imaging data (typically from a separate drone like the DJI Mavic 3 Multispectral or Phantom 4 Multispectral) to automate crop monitoring and input application, improving precision under diverse field conditions.

Government initiatives and sustainability regulations promoting smart farming

Increasing regulatory pressure and government support for sustainable agricultural practices are driving IoT adoption. Policies promoting efficient water use, reduced chemical inputs, and climate-smart farming encourage farmers to adopt smart agriculture solutions. Additionally, grants, subsidies, and research programs in countries across North America, Europe, and Asia support deployment of IoT-enabled farm technologies. These regulations, combined with growing awareness of climate change impacts and the need for resilient agricultural systems, push farmers and agribusinesses to integrate IoT platforms for monitoring, automation, and predictive management. The alignment of government initiatives with environmental sustainability objectives ensures steady growth and investment in IoT solutions across multiple applications, making regulatory and sustainability support a key market driver.

Key Trends & Opportunities

Integration of AI, machine learning, and predictive analytics in IoT platforms

A significant trend in the IoT in Agriculture market is the integration of artificial intelligence, machine learning, and predictive analytics into IoT platforms. By combining real-time sensor data with historical weather, crop, and soil information, AI-powered systems provide actionable insights for precision planting, irrigation scheduling, pest management, and yield optimization. Predictive analytics allow farmers to anticipate risks, reduce operational losses, and improve overall farm efficiency. This convergence of IoT and AI not only enhances decision-making but also creates opportunities for vendors to offer comprehensive, end-to-end farm management solutions. Adoption of these advanced platforms is expanding rapidly, particularly among large-scale commercial farms seeking to maximize output, minimize resource usage, and ensure sustainable agricultural practices.

- For instance, Microsoft’s AI Sowing App, developed with ICRISAT, analyzes historical climate data and real-time field conditions to advise farmers on optimal sowing dates, improving yield consistency.

Expansion into smallholder farms and emerging regions

IoT adoption, historically concentrated in large-scale commercial farms, is increasingly penetrating smallholder and mid-sized farms in developing countries. Cost reductions in sensors, connectivity, and modular IoT platforms make technology more accessible. Governments and NGOs are supporting digital agriculture initiatives, improving rural connectivity and training farmers to leverage smart farming tools. This democratization of IoT opens vast opportunities for market expansion, enabling precision agriculture and resource efficiency for smaller farms. Emerging regions in Asia, Africa, and Latin America present high growth potential, as IoT solutions help enhance productivity, reduce costs, and improve food security. Vendors can capitalize on this trend by providing scalable, affordable, and easy-to-use platforms tailored for diverse farm sizes and conditions.

- For instance, FAO’s Hand-in-Hand Initiative has deployed IoT-based soil and weather monitoring tools across small farms in Africa, helping growers improve irrigation efficiency and crop planning.

Key Challenges

High initial investment and cost barriers for small-scale farms

Despite falling technology costs, the upfront investment required for IoT implementation remains significant. Hardware acquisition, connectivity infrastructure, software licensing, installation, and training contribute to high total costs, which smallholder and resource-constrained farmers often cannot afford. Limited access to financing and uncertain short-term returns further constrain adoption. This challenge is particularly acute in developing regions, where capital availability and risk tolerance are low. Consequently, high initial costs continue to impede widespread deployment of IoT solutions in agriculture, restricting market growth to well-funded commercial farms unless cost-effective models, subsidies, or financing solutions are introduced.

Connectivity limitations, interoperability issues, and technical expertise gaps

Reliable connectivity, device interoperability, and technical expertise are critical for effective IoT deployment in agriculture. Rural areas often suffer from weak or unstable internet coverage, limiting real-time monitoring and data-driven decision-making. Interoperability challenges between different IoT devices or platforms create integration difficulties, reducing operational efficiency. Additionally, farmers may lack the technical skills to deploy, operate, and maintain these systems effectively. Training and technical support are often insufficient, particularly in emerging markets. Addressing these infrastructure and expertise gaps is essential for broader IoT adoption, but until resolved, these factors remain major challenges to scaling IoT in agriculture globally.

Regional Analysis

North America

North America held the largest share of the IoT in Agriculture market in 2024, accounting for 38.6% due to early technology adoption, strong digital infrastructure, and widespread use of precision farming tools across the U.S. and Canada. High deployment of GPS-enabled equipment, automated irrigation systems, and livestock monitoring platforms continues to accelerate growth. Government incentives supporting smart farming and sustainability initiatives further drive digital transformation across large commercial farms. Increasing integration of drones, AI-based analytics, and cloud platforms strengthens operational efficiency and crop management, reinforcing North America’s leadership in connected agriculture solutions.

Europe

Europe captured 27.3% of the IoT in Agriculture market in 2024, supported by stringent sustainability regulations, advanced farming practices, and significant adoption of automation in countries such as Germany, France, and the Netherlands. The region benefits from strong emphasis on climate-smart agriculture, resource efficiency, and traceability across the food supply chain. IoT-based soil monitoring, greenhouse automation, and livestock health management systems gain traction as farms shift toward data-driven decision-making. Government-backed digital farming programs and rapid expansion of high-speed connectivity in rural areas continue to enhance IoT penetration across European agricultural operations.

Asia-Pacific

Asia-Pacific accounted for 22.8% of the IoT in Agriculture market in 2024 and is the fastest-growing region, driven by rising food demand, expanding agricultural automation, and large-scale adoption of smart farming technologies in China, India, Japan, and Australia. Increasing smartphone penetration, low-cost sensors, and cloud-based farm management systems enable wider IoT adoption among small and mid-sized farmers. Governments actively support digital agriculture through subsidies, pilot projects, and rural connectivity programs. Growing adoption of drone-based crop monitoring, automated irrigation, and AI-driven yield prediction strengthens the region’s rapid market expansion.

Latin America

Latin America represented 6.9% of the IoT in Agriculture market in 2024, driven by growing use of connected farming solutions across large-scale plantations in Brazil, Argentina, and Chile. The region increasingly deploys IoT-enabled soil sensors, GPS machinery, and remote monitoring platforms to enhance productivity and reduce operational costs in sugarcane, soybean, and coffee cultivation. Expansion of agritech startups and partnerships with global technology companies further accelerate adoption. Despite infrastructural limitations in rural areas, rising digital transformation efforts and demand for yield optimization support consistent regional growth.

Middle East & Africa

The Middle East & Africa accounted for 4.4% of the IoT in Agriculture market in 2024, with adoption led by smart irrigation, climate monitoring, and greenhouse automation in the UAE, Israel, Saudi Arabia, and South Africa. Water scarcity challenges drive strong demand for IoT-based irrigation management and soil moisture monitoring solutions. Governments actively promote digital agriculture through innovation hubs, agritech investments, and food security initiatives. While adoption levels vary across regions, increasing focus on precision farming and controlled-environment agriculture supports steady market expansion.

Market Segmentations

By Component

- Hardware

- Software

- Services

By Connectivity Outlook

By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Aquaculture

By Farm Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The IoT in Agriculture market features a diverse and rapidly evolving competitive landscape, driven by strong innovation in connected farming technologies and increasing demand for data-driven agricultural solutions. Leading players such as Valmont Industries, Trimble Inc., Cropin, Blue River Technology, Agrostar, Deere & Company, FarmWise Labs, Topcon Positioning Systems, Raven Industries, and AGCO Corporation actively expand their portfolios through advanced sensors, autonomous machinery, precision farming software, and AI-powered analytics platforms. These companies focus on offering integrated IoT ecosystems that enhance crop monitoring, optimize irrigation, and improve livestock management. Strategic initiatives—including partnerships with agritech startups, investments in cloud-based farm management systems, and development of drone-enabled field imaging—are central to strengthening market presence. Increasing adoption of machine learning, predictive analytics, and remote diagnostics further drives differentiation. As farms scale digital transformation, competition intensifies around cost-efficient solutions, interoperability, and real-time data accuracy, fueling continuous technological advancement across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, CropX Technologies announced the acquisition of Acclym (formerly Agritask) on September 2, 2025, to integrate its enterprise-grade agricultural intelligence platform into the CropX agronomic farm management system and scale sustainable, data-driven IoT agriculture solutions for global food brands.

- In May 2025, a study proposed Farm-LightSeek an edge-centric, multimodal agricultural IoT data analytics framework combining IoT sensors + lightweight LLMs for real-time farmland monitoring and decision-making.

- In April 2024, AGCO and Trimble closed their joint venture on April 1, 2024, forming PTx Trimble to combine Trimble’s precision agriculture business with AGCO’s JCA Technologies and deliver mixed-fleet, connected smart-farming and guidance solutions worldwide.

Report Coverage

The research report offers an in-depth analysis based on Component, Connectivity Outlook, Application, Farm Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- IoT adoption in agriculture will accelerate as farms increasingly rely on connected devices for real-time decision-making.

- AI and machine learning will enhance predictive analytics, enabling greater accuracy in yield forecasting and crop health assessment.

- Expansion of 5G and LPWAN networks will improve connectivity in rural regions, boosting large-scale IoT deployment.

- Autonomous farming equipment and drones will become more prevalent, reducing labor dependency and improving operational efficiency.

- Smart irrigation and water optimization technologies will gain wider adoption amid rising climate variability.

- Livestock monitoring systems will evolve with advanced biometric sensors and automated health tracking solutions.

- Cloud-based farm management platforms will integrate multi-source data to streamline operational planning.

- Sustainability initiatives will drive higher adoption of IoT tools for resource conservation and carbon-efficient farming.

- Agritech startups and global tech companies will intensify innovation through collaborations and AI-led platforms.

- Governments will expand digital agriculture programs, accelerating modernization across small and large farms.