Market Overview:

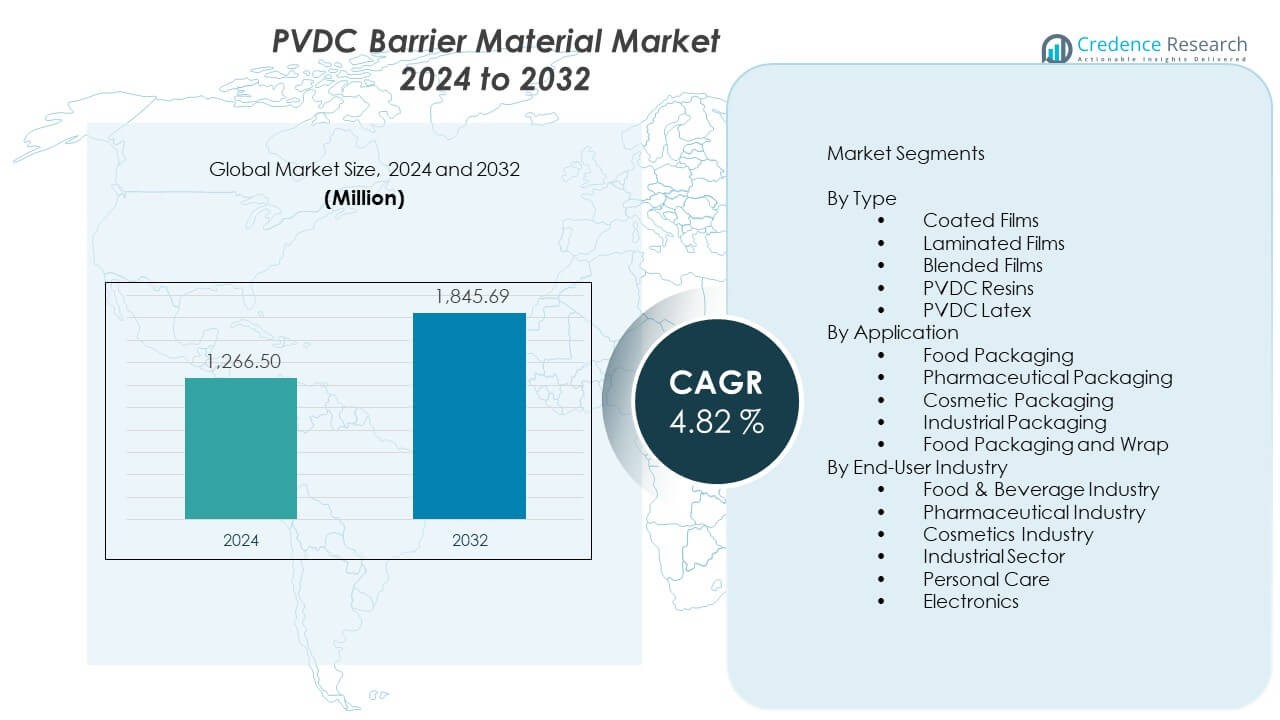

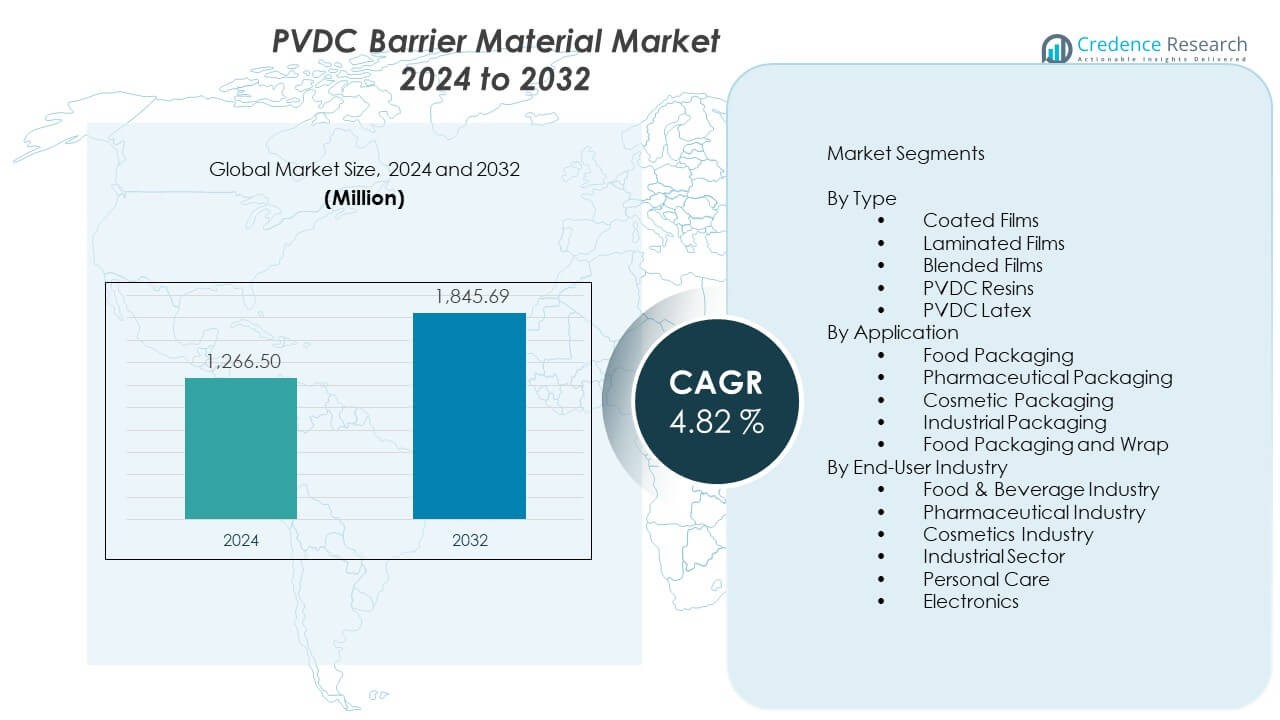

The PVDC Barrier Material Market is projected to grow from USD 1,266.5 million in 2024 to an estimated USD 1,845.69 million by 2032, with a compound annual growth rate (CAGR) of 4.82% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PVDC Barrier Material Market Size 2024 |

USD 1,266.5 Million |

| PVDC Barrier Material Market, CAGR |

4.82% |

| PVDC Barrier Material Market Size 2032 |

USD 1,845.69 Million |

Demand rises as food, pharmaceutical, and personal care brands shift toward high-barrier packaging that protects sensitive products from moisture, oxygen, and odor transfer. Manufacturers choose PVDC due to its strong sealing strength, extended shelf-life performance, and compatibility with multilayer films. Growing consumption of packaged foods encourages converters to upgrade to enhanced barrier laminates. Rising regulatory focus on product safety prompts more companies to adopt stable protective layers. The material supports consistent performance in harsh storage and transport conditions, which strengthens long-term adoption.

Asia Pacific leads due to strong packaging production, expanding FMCG output, and rapid growth in pharmaceutical manufacturing hubs. Europe remains a major user because of strict quality rules, mature packaging converters, and established film producers. North America also holds a sizable share driven by strong food processing and healthcare industries. Emerging markets in Latin America and the Middle East accelerate adoption as local packaging firms upgrade barrier structures. Growing investments in flexible packaging infrastructure help these regions expand capacity and diversify end-use applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The PVDC barrier material market is valued at USD 1,266.5 million in 2024, projected to reach USD 1,845.69 million by 2032, advancing at a CAGR of 4.82%.

- Asia Pacific holds about 40%, driven by strong packaging production; Europe holds around 25% due to strict quality standards; North America holds nearly 22%, supported by advanced food and pharma industries.

- Asia Pacific remains the fastest-growing region with a 40% share, supported by expanding FMCG demand, strong manufacturing networks, and rising pharmaceutical output.

- Food packaging accounts for about 45% of total application share, followed by pharmaceutical packaging at roughly 25%, driven by strict barrier requirements.

- The food and beverage industry holds nearly 50% of end-user demand, while the pharmaceutical industry contributes about 20%, supported by high-sensitivity product needs.

Market Drivers:

Rising Demand for High-Barrier Protection Across Food and Pharma Sectors

The PVDC barrier material market gains strong traction from brand demand for reliable product protection. Food producers require stable films that block moisture and oxygen in packed goods. Pharma companies depend on consistent barrier layers that secure sensitive formulations. It supports longer shelf life without complicated material redesigns. Converter lines value predictable sealing performance in large production runs. Regulatory checks encourage stronger adoption of safe and compliant structures. Packaging teams shift toward barrier upgrades that improve product confidence. The trend builds steady momentum across global production zones.

- For instance, Kureha Corporation offers its Krehalon Film designed for shelf-stable sausages and transport at room temperature under sterilisation conditions. Pharma companies depend on consistent barrier layers that secure sensitive formulations.

Growing Use of Multilayer Film Structures in Flexible Packaging Designs

The market benefits from increasing investment in advanced multilayer formats that raise barrier strength. Brands prefer structures that maintain performance during transport and varied storage conditions. PVDC enhances each layer without heavy material load. It keeps packaging stable in humidity-sensitive supply chains. Manufacturers upgrade coating lines to support rising output needs. Packagers use the material to handle fast-moving product categories. Supply chain pressures drive interest in dependable protective surfaces. The PVDC barrier material market secures wider acceptance across diverse product groups.

- For instance, Solvay’s Diofan® Ultra736 enables duplex barrier structures with thinner coatings yet high water-vapour resistance. PVDC enhances each layer without heavy material load. It keeps packaging stable in humidity-sensitive supply chains. Manufacturers upgrade coating lines to support rising output needs

Expanding Regulatory Emphasis on Product Safety and Material Integrity

Global safety rules encourage strong adoption of barrier layers that limit risk. Government agencies expect consistent material behavior under demanding conditions. PVDC supports compliance with strict food-contact and pharmaceutical-quality standards. It enables firms to avoid frequent requalification cycles. Producers adopt verified coatings that meet high threshold ranges. Buyers value materials that maintain clarity without losing protective strength. Standardization pushes companies to secure reliable film performance. The PVDC barrier material market benefits from clarity in requirement frameworks.

Higher Consumer Preference for Freshness, Shelf Stability, and Pack Durability

Consumers favor products that retain freshness and aroma throughout the storage cycle. PVDC offers dependable support for items sensitive to environmental exposure. It keeps active ingredients secure within controlled packaging environments. Brands depend on PVDC-based formats to reduce wastage in supply chains. E-commerce growth encourages protective structures that withstand long routes. Product managers emphasize materials that meet quality targets in harsh climates. Retailers expect packaging that handles repeated handling and display cycles. The PVDC barrier material market gains value from stronger end-user expectations.

Market Trends:

Shift Toward Sustainable Blends and Modified Barrier Structures

Manufacturers explore improved blends that lower environmental impact while maintaining performance. PVDC suppliers invest in cleaner production systems for stronger acceptance. It supports hybrid structures that balance barrier needs with recyclability initiatives. Research teams focus on thinner coatings that reduce overall material load. Brands request formats that meet updated sustainability targets without losing strength. Pilot programs test new chemistries with safer residue profiles. Packaging lines adopt low-emission variants for better regulatory alignment. The PVDC barrier material market observes rising interest in optimized eco-focused solutions.

- For instance, Solvay’s proof-of-concept recycling process for Ixan® PVDC films achieved compatibility with mechanical recycling of multilayer food packaging without degrading barrier performance.

Growth of High-Performance Packaging in Ready-to-Eat and Meal Solutions

Convenience foods require dependable barrier layers that hold flavor and texture. Ready meals depend on films that tolerate heating and cooling cycles. It enables reliable performance in controlled-atmosphere conditions. PVDC supports consistent protective properties in prepared meal formats. Producers choose strong materials to manage volatile aroma compounds. Retailers expand product ranges that need enhanced protection. Film converters scale production to meet rising demand. The PVDC barrier material market gains relevance in fast-moving prepared food segments.

- For instance, Kureha’s Krehalon Film demonstrates suitability under high temperature and pressure sterilisation conditions for meat casings. It enables reliable performance in controlled-atmosphere conditions.

Stronger Adoption of Precision Coating Technologies in Packaging Lines

Converters deploy advanced coating heads that ensure uniform PVDC application. The shift improves barrier accuracy across large industrial runs. It reduces defects that impact print quality and seal strength. Improved control enables consistent adhesion on diverse substrates. Production teams lower variability through real-time monitoring. New equipment allows higher throughput rates in compact facilities. Coating uniformity supports better product presentation. The PVDC barrier material market benefits from more efficient application systems.

Integration of Barrier Films in Smart and Trackable Packaging Formats

Smart packaging initiatives require compatible barrier layers that protect embedded indicators and sensors. PVDC maintains stable internal conditions that support freshness monitors. It helps brands introduce traceability elements without performance loss. Developers incorporate printed codes and security markers on PVDC-supported films. Packaging programs expand into digital tools that improve supply chain transparency. Brands leverage protective layers to maintain accurate readings across shipping routes. Technology teams prefer materials that prevent signal interference. The PVDC barrier material market gains traction within evolving smart-pack ecosystems.

Market Challenges Analysis:

Rising Concerns Over Environmental Impact and Waste Management Complexities

The PVDC barrier material market faces scrutiny from waste management policies that challenge chlorine-based materials. Recycling streams struggle to handle mixed structures containing PVDC. It creates pressure to redesign formats without lowering barrier strength. Disposal rules vary widely across regions, causing uncertainty for global suppliers. Brands assess alternative materials that claim lower environmental load. Producers invest in cleaner manufacturing methods to reduce criticism. Compliance teams struggle to balance performance with regulatory acceptance. These pressures create major constraints on long-term expansion.

Growing Competition from High-Barrier Alternatives with Improved Sustainability Claims

Packaging developers test EVOH, coated polyolefins, and new bio-based options that challenge PVDC. It faces stiff comparison against solutions that promise smoother recycling. Buyers evaluate alternatives with strong performance under extended storage periods. Suppliers work to differentiate PVDC through proven reliability in demanding applications. The shift encourages heavy investment in product refinements. Competing materials attract brand interest through integrated sustainability messaging. Conversion lines adapt to handle multiple barrier formats. These factors intensify pressure across major application categories.

Market Opportunities:

Expansion of High-Value Applications in Pharma, Personal Care, and Specialty Foods

The PVDC barrier material market gains opportunities from sectors that require precise protection. Pharma lines value coatings that secure moisture-sensitive drugs. Personal care companies demand barrier films that protect active formulas. It supports premium packaging that elevates product stability. Specialty food items need consistent oxygen control during distribution. Producers explore niche applications where reliability drives purchasing. Growth in regulated categories opens pathways for material innovation. These segments strengthen long-term development potential.

Adoption of Thin-Coat PVDC Technologies That Improve Efficiency and Performance

Manufacturers invest in thin-coat options that offer high barrier strength with lower material use. It helps converters reduce cost while maintaining durability. New coating systems allow faster runs with stable output. Brands prefer sustainable upgrades that keep protective performance intact. Equipment advances support wider adoption in emerging economies. Producers gain room to innovate with next-generation coatings. These improvements create competitive advantages across global supply networks. The opportunity widens scope for future production expansion.

Market Segmentation Analysis:

By Type

Coated films lead due to strong barrier strength and reliable sealing performance. Laminated films gain steady use in multilayer structures that support varied product conditions. Blended films attract interest from converters seeking balanced protection and flexibility. PVDC resins secure demand from producers that need high-purity inputs for advanced coating lines. PVDC latex supports water-based processing for converters pursuing cleaner operations. Each type meets different packaging specifications with consistent performance ranges. Buyers evaluate stability across long storage cycles. The PVDC barrier material market benefits from diverse material choices across production environments.

- For instance, Innovia’s PVDC-coated BOPP film shows water vapour transmission rates as low as 0.8 g/m²·24 h at 23 °C and 85% RH and about 30 cc/m²·24 h oxygen permeability at 23–25 °C, while Perlen Packaging’s PERLALUX® Ultra protect PVDC blister films are positioned with the highest water vapour and oxygen barrier properties, closely approaching cold-form laminates.

By Application

Food packaging dominates due to its need for strong protection against moisture and oxygen exposure. Pharmaceutical packaging depends on PVDC to safeguard active ingredients during transport. Cosmetic packaging adopts premium barrier formats to retain fragrance and texture. Industrial packaging secures value through dependable protective layers that prevent material degradation. Food packaging and wrap support widespread daily-use applications. It meets strict quality expectations across retail and institutional channels. Brands use PVDC-based structures for long shelf-life targets. Growth continues across regulated and high-sensitivity product categories.

- For instance, Kureha’s Krehalon Film for retort sausages can be sterilised at high temperatures and pressures yet allows room-temperature storage, while Perlen Packaging’s PERLALUX® Ultra protect PVDC blister films deliver ultra-high barrier for hygroscopic pharmaceuticals and Solvay’s Diofan® Ultra736 enables duplex blister structures that halve base-coat layers and cut the carbon footprint of finished films by up to 13%.

By End-User Industry

The food and beverage industry drives large-scale demand for high-barrier formats. Pharmaceutical companies need stable materials that maintain integrity under varied storage temperatures. The cosmetics industry values films that preserve volatile compounds. The industrial sector adopts protective layers that shield sensitive components from external stress. Personal care brands depend on consistent oxygen and moisture control. Electronics packaging requires dependable barriers to secure delicate assemblies. It responds to rising quality standards in multiple sectors. PVDC supports this broad ecosystem through proven reliability across critical environments.

Segmentation:

By Type

- Coated Films

- Laminated Films

- Blended Films

- PVDC Resins

- PVDC Latex

By Application

- Food Packaging

- Pharmaceutical Packaging

- Cosmetic Packaging

- Industrial Packaging

- Food Packaging and Wrap

By End-User Industry

- Food & Beverage Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Industrial Sector

- Personal Care

- Electronics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leadership and Strong Growth Momentum

The Asia Pacific region holds the largest share of the global PVDC barrier material market at roughly 40%. China drives high-volume production through strong packaging and pharmaceutical manufacturing clusters. India expands capacity through rising demand for flexible packaging in food and healthcare sectors. Japan maintains a steady position through advanced coating technologies and strict product-quality systems. The region benefits from strong conversion infrastructure and growing FMCG consumption. It supports continuous upgrades across laminated and coated film formats. The PVDC barrier material market gains long-term strength from these integrated supply networks.

Europe’s Established Packaging Base and Regulatory Alignment

Europe secures about 25% of the global share due to its advanced packaging ecosystem and strong regulatory frameworks. Germany and France lead adoption through consistent demand from food, pharma, and personal care industries. The region values materials that comply with strict safety and migration standards. It encourages the use of stable barrier structures that maintain performance in varied conditions. Packaging converters invest in precision coating lines to support export-focused industries. Demand holds steady through mature recycling programs that influence material selection. The PVDC barrier material market maintains a strong foothold through Europe’s disciplined quality environment.

North America’s Technical Advancement and High-End Application Demand

North America accounts for nearly 22% of the global share with strong uptake from food processing, healthcare, and personal care sectors. The United States leads through its large-scale production base and preference for premium protective films. Canada contributes steady demand through organized retail growth and rising packaged food consumption. The region adopts barrier formats that support extended shelf-life goals and stable pharmaceutical handling. Strong investment in coating technology improves supply reliability. It benefits from advanced material testing standards across major industries. The PVDC barrier material market sustains consistent growth through North America’s high-value application profile.

Key Player Analysis:

- Dow Chemical Company (including DowDuPont)

- Solvay S.A.

- Kureha Corporation

- Asahi Kasei Corporation

- Juhua

- Nantong SKT

- Keguan Polymer

- Kuraray Co., Ltd

- Jiangsu Golden Material Technology Co., Ltd.

- Innovia Films Ltd.

- Perlen Packaging AG

- Bilcare Limited

- Cosmo Films Ltd.

- Clondalkin Group Holdings B.V.

- Jindal Poly Films Ltd.

- Mitsubishi Chemical Holdings Corporation

- Polyplex Corporation Ltd.

- SKC Co., Ltd.

- Toray Industries, Inc.

- Treofan Group

Competitive Analysis:

The PVDC barrier material market features strong competition among global chemical producers and film converters that focus on high-barrier applications. Leading companies strengthen their portfolios through coating upgrades, resin innovations, and product-quality improvements. It gains support from players that expand regional capacity to meet food, pharma, and personal care demand. Large firms compete on purity, barrier strength, and process efficiency. Mid-size converters focus on specialty coatings that serve niche formats. Supply chains rely on long-term contracts with packaging manufacturers. The competitive environment remains stable, with steady investment in technology and performance consistency.

Recent Developments:

- In July 15, 2025, Kuraray Co., Ltd. announced sustainable packaging innovations including ISCC PLUS certified barrier materials and biocircular grades, supporting recyclable mono-material barrier formats.

- In June 17, 2024, Dow Chemical Company introduced two new grades of its RevoLoop recycled plastic resins, designed for non-food-contact packaging applications and supporting circular feedstocks in barrier film lines.

- In October 02, 2023, Solvay S.A. launched its Diofan® Ultra736 PVDC coating solution for pharmaceutical blister films offering ultra-high water vapor barrier and enabling halving of base-coat layers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type (Coated Films, Laminated Films, Blended Films, PVDC Resins, PVDC Latex) and By Application (Food Packaging, Pharmaceutical Packaging, Cosmetic Packaging, Industrial Packaging, Food Packaging and Wrap). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Strong demand for advanced barrier protection will support steady adoption across all major applications.

- Rising food packaging needs will push converters toward higher-performance coating technologies.

- Pharmaceutical expansion will strengthen long-term reliance on premium barrier formulations.

- New coating systems will improve process efficiency and lower operational burdens across production lines.

- Resin innovation will support thinner barrier structures without reducing strength.

- Regional manufacturing growth will widen supply networks in Asia Pacific and the Middle East.

- New compliance rules will shape product development across high-sensitivity sectors.

- Growing e-commerce penetration will raise demand for stable and transport-resistant packaging.

- Smart-pack integration will encourage barrier formats that support shelf-life monitoring tools.

- Sustainability programs will drive research toward cleaner PVDC blends and optimized structures.