Table of Content

CHAPTER NO. 1 : GENESIS OF THE MARKET

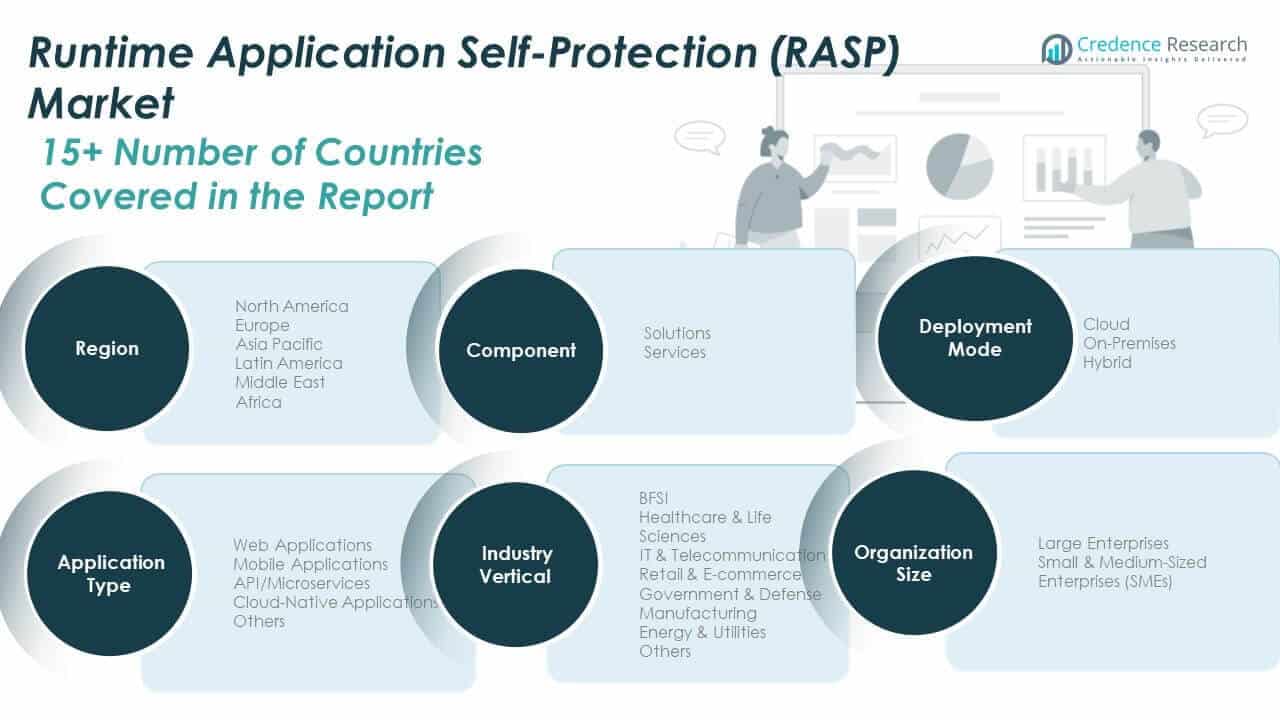

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

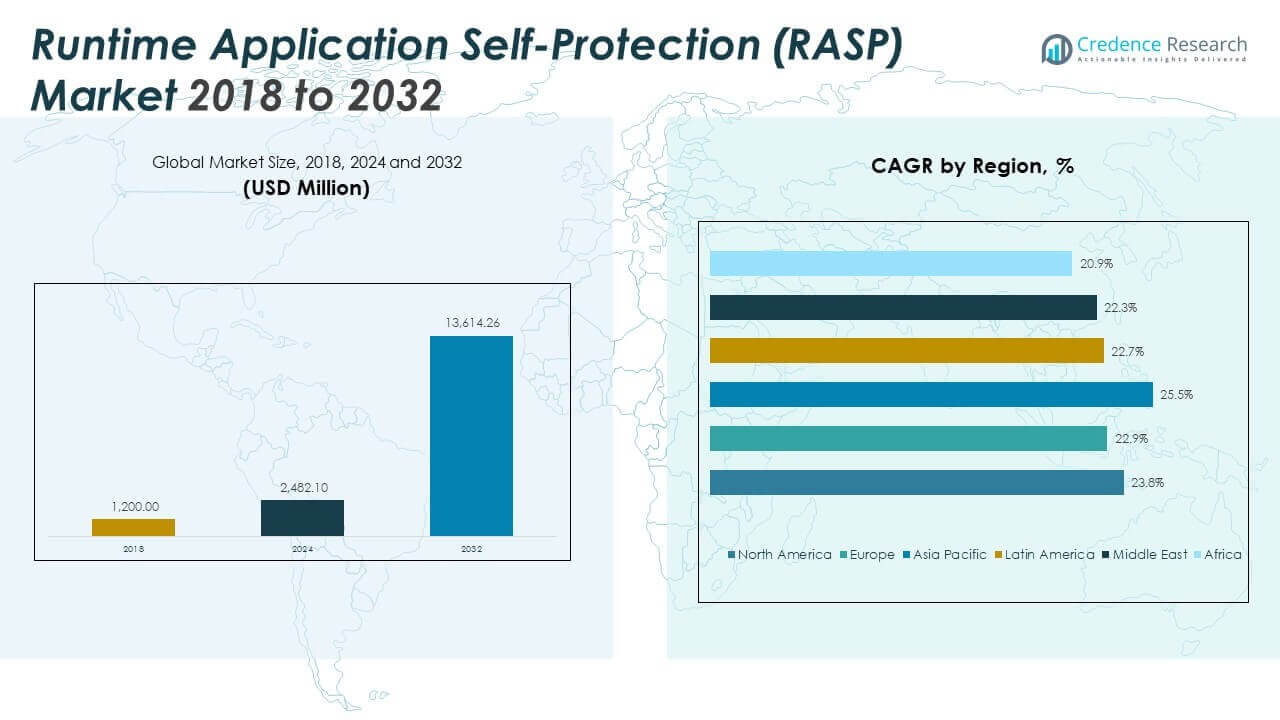

2.1 Pulse of the Industry – Market Snapshot

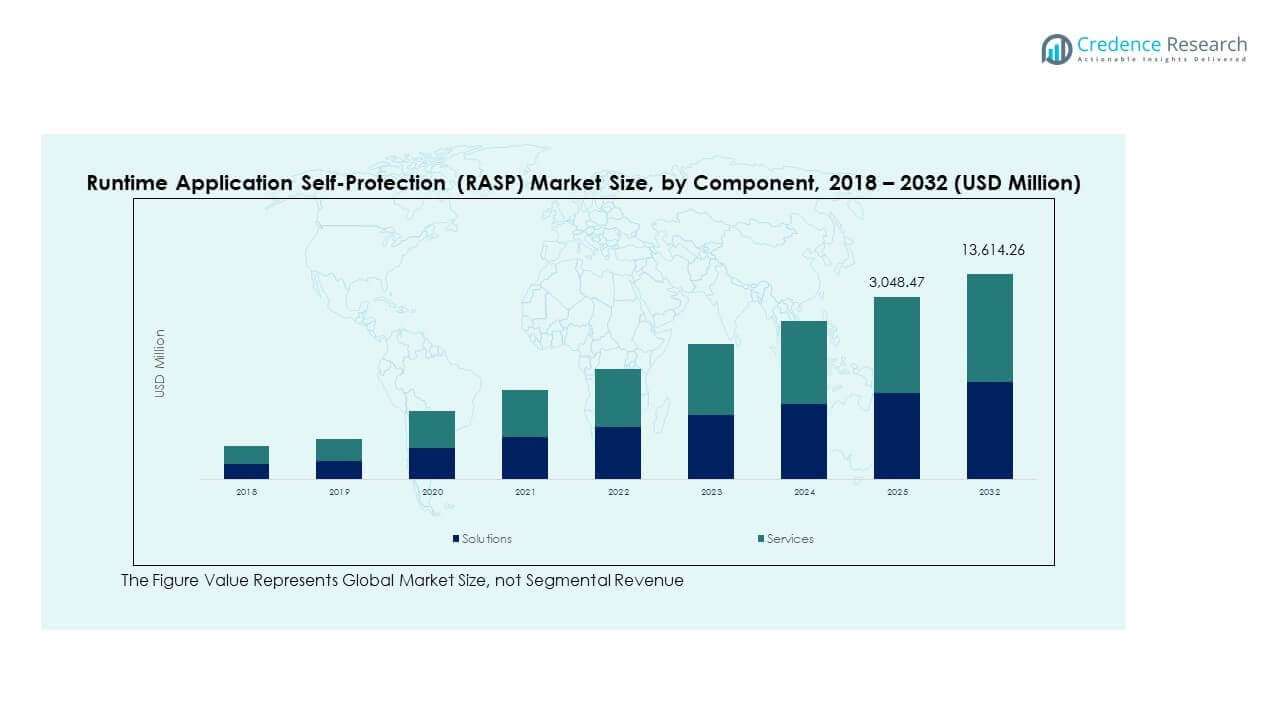

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

3.6 Price Trend Analysis

3.6.1 Regional Price Trend

3.6.2 Price Trend by product

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Product Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Component & Application Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis by Region

6.1.1. Global Runtime Application Self-Protection (RASP) Market Import Revenue By Region

6.2. Export Analysis by Region

6.2.1. Global Runtime Application Self-Protection (RASP) Market Export Revenue By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global Runtime Application Self-Protection (RASP) Market: Company Market Share

7.2. Global Runtime Application Self-Protection (RASP) Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

CHAPTER NO. 8 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – BY COMPONENT SEGMENT ANALYSIS

8.1. Runtime Application Self-Protection (RASP) Market Overview by Component Segment

8.1.1. Runtime Application Self-Protection (RASP) Market Revenue Share By Component

8.2. Solutions

8.3. Services

CHAPTER NO. 9 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – BY APPLICATION SEGMENT ANALYSIS

9.1. Runtime Application Self-Protection (RASP) Market Overview by Application Segment

9.1.1. Runtime Application Self-Protection (RASP) Market Revenue Share By Application

9.2. Web Applications

9.3. Mobile Applications

9.4. API/Microservices

9.5. Cloud-Native Applications

9.6. Others

CHAPTER NO. 10 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – BY DEPLOYMENT MODE SEGMENT ANALYSIS

10.1. Runtime Application Self-Protection (RASP) Market Overview by Deployment Mode Segment

10.1.1. Runtime Application Self-Protection (RASP) Market Revenue Share By Deployment Mode

10.2. Cloud

10.3. On-Premises

10.4. Hybrid

CHAPTER NO. 11 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – BY INDUSTRY VERTICAL SEGMENT ANALYSIS

11.1. Runtime Application Self-Protection (RASP) Market Overview by Industry Vertical Segment

11.1.1. Runtime Application Self-Protection (RASP) Market Revenue Share By Industry Vertical

11.2. BFSI

11.3. Healthcare & Life Sciences

11.4. IT & Telecommunications

11.5. Retail & E-commerce

11.6. Government & Defense

11.7 Manufacturing

11.8. Energy & Utilities

11.9. Others

CHAPTER NO. 12 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – BY SALES CHANNEL SEGMENT ANALYSIS

12.1. Runtime Application Self-Protection (RASP) Market Overview by Organization Size Segment

12.1.1. Runtime Application Self-Protection (RASP) Market Revenue Share By Organization Size

12.2. Large Enterprises

12.3. Small & Medium-Sized Enterprises (SMEs)

CHAPTER NO. 13 : RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – REGIONAL ANALYSIS

13.1. Runtime Application Self-Protection (RASP) Market Overview by Region Segment

13.1.1. Global Runtime Application Self-Protection (RASP) Market Revenue Share By Region

13.1.2. Regions

13.1.3. Global Runtime Application Self-Protection (RASP) Market Revenue By Region

13.1.4. Component

13.1.5. Global Runtime Application Self-Protection (RASP) Market Revenue By Component

13.1.6. Application

13.1.7. Global Runtime Application Self-Protection (RASP) Market Revenue By Application

13.1.8. Deployment Mode

13.1.9. Global Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

13.1.10. Industry Vertical

13.1.12. Global Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

13.1.13. Organization Size

13.1.14. Global Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

CHAPTER NO. 14 : NORTH AMERICA RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

14.1. North America Runtime Application Self-Protection (RASP) Market Overview by Country Segment

14.1.1. North America Runtime Application Self-Protection (RASP) Market Revenue Share By Region

14.2. North America

14.2.1. North America Runtime Application Self-Protection (RASP) Market Revenue By Country

14.2.2. Component

14.2.3. North America Runtime Application Self-Protection (RASP) Market Revenue By Component

14.2.4. Application

14.2.5. North America Runtime Application Self-Protection (RASP) Market Revenue By Application

14.2.6. Deployment Mode

14.2.7. North America Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

14.2.8. Industry Vertical

14.2.9. North America Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

14.2.10. Organization Size

14.2.11. North America Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

14.3. U.S.

14.4. Canada

14.5. Mexico

CHAPTER NO. 15 : EUROPE RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

15.1. Europe Runtime Application Self-Protection (RASP) Market Overview by Country Segment

15.1.1. Europe Runtime Application Self-Protection (RASP) Market Revenue Share By Region

15.2. Europe

15.2.1. Europe Runtime Application Self-Protection (RASP) Market Revenue By Country

15.2.2. Component

15.2.3. Europe Runtime Application Self-Protection (RASP) Market Revenue By Component

15.2.4. Application

15.2.5. Europe Runtime Application Self-Protection (RASP) Market Revenue By Application

15.2.6. Deployment Mode

15.2.7. Europe Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

15.2.8. Industry Vertical

15.2.9. Europe Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

15.2.10. Organization Size

15.2.11. Europe Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

15.3. UK

15.4. France

15.5. Germany

15.6. Italy

15.7. Spain

15.8. Russia

15.9. Rest of Europe

CHAPTER NO. 16 : ASIA PACIFIC RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

16.1. Asia Pacific Runtime Application Self-Protection (RASP) Market Overview by Country Segment

16.1.1. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue Share By Region

16.2. Asia Pacific

16.2.1. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Country

16.2.2. Component

16.2.3. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Component

16.2.4. Application

16.2.5. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Application

16.2.6. Deployment Mode

16.2.7. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

16.2.8. Industry Vertical

16.2.9. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

16.2.10. Organization Size

16.2.11. Asia Pacific Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

16.3. China

16.4. Japan

16.5. South Korea

16.6. India

16.7. Australia

16.8. Southeast Asia

16.9. Rest of Asia Pacific

CHAPTER NO. 17 : LATIN AMERICA RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

17.1. Latin America Runtime Application Self-Protection (RASP) Market Overview by Country Segment

17.1.1. Latin America Runtime Application Self-Protection (RASP) Market Revenue Share By Region

17.2. Latin America

17.2.1. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Country

17.2.2. Component

17.2.3. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Component

17.2.4. Application

17.2.5. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Application

17.2.6. Deployment Mode

17.2.7. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

17.2.8. Industry Vertical

17.2.9. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

17.2.10. Organization Size

17.2.11. Latin America Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

17.3. Brazil

17.4. Argentina

17.5. Rest of Latin America

CHAPTER NO. 18 : MIDDLE EAST RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

18.1. Middle East Runtime Application Self-Protection (RASP) Market Overview by Country Segment

18.1.1. Middle East Runtime Application Self-Protection (RASP) Market Revenue Share By Region

18.2. Middle East

18.2.1. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Country

18.2.2. Component

18.2.3. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Component

18.2.4. Application

18.2.5. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Application

18.2.6. Deployment Mode

18.2.7. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

18.2.8. Industry Vertical

18.2.9. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

18.2.10. Organization Size

18.2.11. Middle East Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

18.3. GCC Countries

18.4. Israel

18.5. Turkey

18.6. Rest of Middle East

CHAPTER NO. 19 : AFRICA RUNTIME APPLICATION SELF-PROTECTION (RASP) MARKET – COUNTRY ANALYSIS

19.1. Africa Runtime Application Self-Protection (RASP) Market Overview by Country Segment

19.1.1. Africa Runtime Application Self-Protection (RASP) Market Revenue Share By Region

19.2. Africa

19.2.1. Africa Runtime Application Self-Protection (RASP) Market Revenue By Country

19.2.2. Component

19.2.3. Africa Runtime Application Self-Protection (RASP) Market Revenue By Component

19.2.4. Application

19.2.5. Africa Runtime Application Self-Protection (RASP) Market Revenue By Application

19.2.6. Deployment Mode

19.2.7. Africa Runtime Application Self-Protection (RASP) Market Revenue By Deployment Mode

19.2.8. Industry Vertical

19.2.9. Africa Runtime Application Self-Protection (RASP) Market Revenue By Industry Vertical

19.2.10. Organization Size

19.2.11. Africa Runtime Application Self-Protection (RASP) Market Revenue By Organization Size

19.3. South Africa

19.4. Egypt

19.5. Rest of Africa

CHAPTER NO. 20 : COMPANY PROFILES

20.1. Contrast Security

20.1.1. Company Overview

20.1.2. Product Portfolio

20.1.3. Financial Overview

20.1.4. Recent Developments

20.1.5. Growth Strategy

20.1.6. SWOT Analysis

20.2. Imperva

20.3. Arxan Technologies / Digital.ai

20.4. Micro Focus (OpenText)

20.5. Guardsquare

20.6. Pradeo

20.7. Signal Sciences (Fastly)

20.8. Veracode

20.9. Waratek

20.10 Jscrambler

20.11. AppSealing

20.12. Check Point Software Technologies

20.13. Trend Micro

20.14. IBM Security