Market Overview

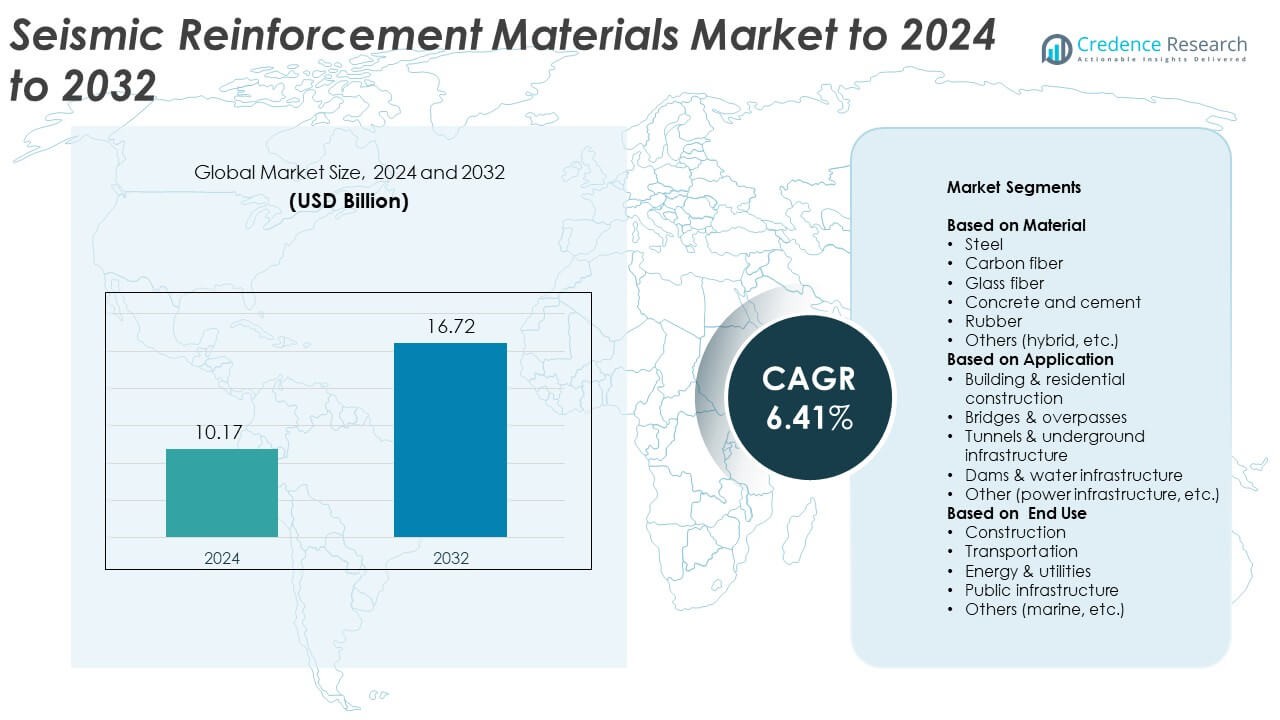

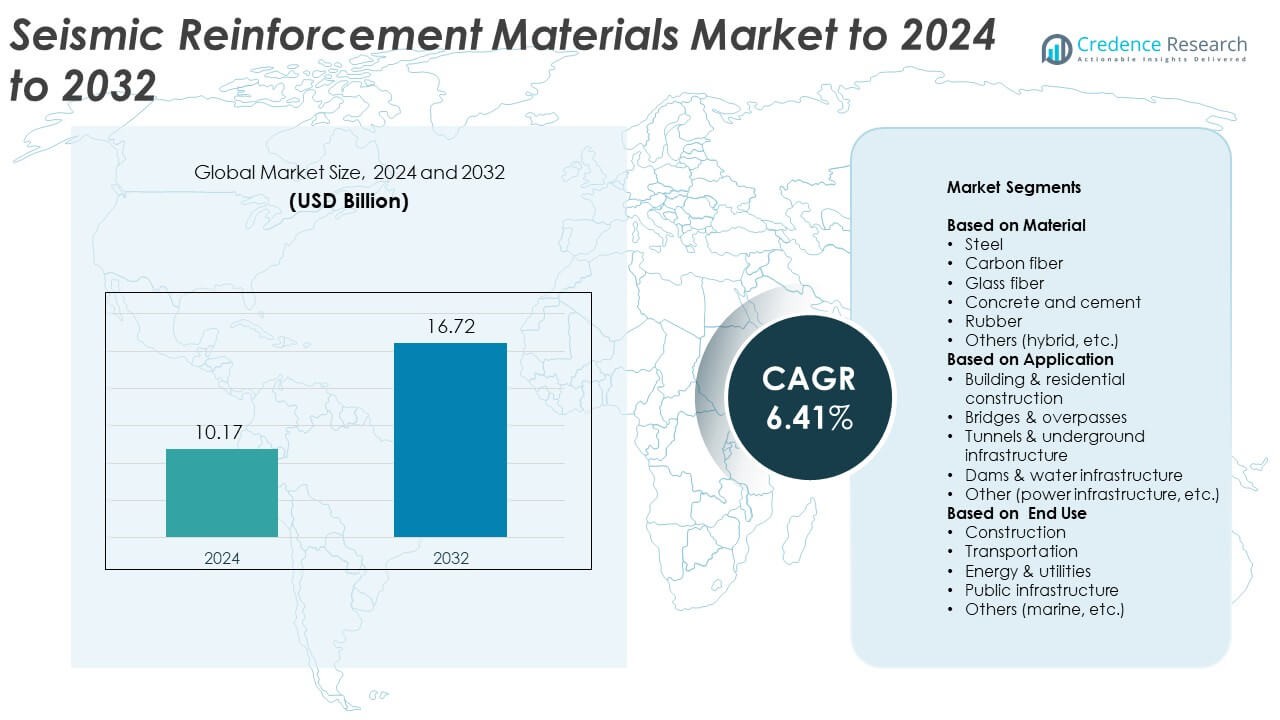

Seismic Reinforcement Materials Market size was valued USD 10.17 Billion in 2024 and is anticipated to reach USD 16.72 Billion by 2032, at a CAGR of 6.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Seismic Reinforcement Materials Market Size 2024 |

USD 10.17 Billion |

| Seismic Reinforcement Materials Market, CAGR |

6.41% |

| Seismic Reinforcement Materials Market Size 2032 |

USD 16.72 Billion |

The Seismic Reinforcement Materials Market features key players such as Arup Group, Sika AG, Hitech Materials Inc., Mammoet, BASF, Schneider Electric, Tata Steel, Hilti Group, Tensar International, Arcelor Mittal, 3M, Freyssinet, Lintec & Toray, U.S. Concrete, and Alemite. These companies strengthened their portfolios with advanced steel systems, high-performance fiber composites, and modern damping technologies used across retrofitting and new-build projects. North America led the market in 2024 with a 34% share due to strict seismic codes and large infrastructure upgrades, while Asia Pacific followed closely as rapid urban growth and high seismic exposure increased adoption of reinforced materials across major construction segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The seismic reinforcement materials market reached USD 10.17 Billion in 2024 and will reach USD 16.72 Billion by 2032 at a 6.41% CAGR based on rising global resilience needs.

- Growth is driven by stricter seismic codes, higher urban exposure, and strong demand for steel materials holding 42% share and building construction applications leading with 49% share.

- Carbon and glass fiber composites show strong adoption as lightweight retrofitting options, while base isolation and damping systems expand across high-rise, transport, and energy facilities.

- Competition intensifies as major companies upgrade composite technologies, develop hybrid reinforcement systems, and expand project partnerships to support construction, which led with 55% share in 2024.

- North America held 34% share, followed by Asia Pacific at 29% and Europe at 25%, while Latin America and the Middle East & Africa recorded smaller shares as retrofit programs gradually increased.

Market Segmentation Analysis:

By Material

Steel led the material segment in 2024 with about 42% share. Developers preferred steel because the material offers high ductility, strong load-bearing behavior, and proven performance in seismic retrofitting. Carbon fiber showed fast growth due to its light weight and high tensile strength, making the fiber ideal for column wrapping and joint strengthening. Glass fiber and rubber-based systems gained steady use in cost-sensitive projects. Concrete and cement composites supported base isolation and structural enhancement across large public sites. Demand rose as cities upgraded aging buildings and improved protection for high-risk zones.

- For instance, Nippon Steel & Sumitomo Metal Corporation developed BT-HT700 and BT-HT880 column steels with minimum yield strengths of 700 N/mm² and 880 N/mm², which were put into practical use in high-rise building columns to enhance seismic energy absorption and damage control performance.

By Application

Building and residential construction dominated the application segment in 2024 with nearly 49% share. This category led because urban regions focused on retrofitting old structures and improving resistance to frequent ground motion. Bridges and overpasses followed as governments reinforced transport corridors to avoid collapse during strong quakes. Tunnels and dams adopted advanced fiber-reinforced systems to improve crack control. Power infrastructure upgrades boosted spending on hybrid reinforcement solutions. Growth stayed strong as construction codes tightened and seismic mapping identified more vulnerable sites worldwide.

- For instance, Bridgestone Corporation reports that its high damping rubber bearings have been installed in over 700 buildings worldwide as of 2018.

By End Use

The construction segment held the largest share in 2024 with around 55% share. Contractors used steel plates, fiber wraps, and seismic dampers to meet stricter safety norms for new builds and retrofits. Transportation authorities reinforced bridges and metro systems using carbon and glass fiber materials to enhance durability and reduce maintenance downtime. Energy and utilities invested in vibration-control systems for substations and pipelines. Public infrastructure programs supported wider adoption of base isolation systems. Market expansion increased as governments funded resilience projects to reduce future disaster losses.

Key Growth Drivers

Rising Urban Seismic Risk

Growing urban density in high-risk seismic zones increased demand for advanced reinforcement solutions. Many older buildings in Asia, North America, and Europe require urgent retrofitting to meet updated safety norms. Builders adopted steel plates, fiber wraps, and damping systems to prevent collapse during strong ground motion. Government-funded resilience programs expanded as cities aimed to reduce economic losses and protect critical assets. The steady rise in multi-story structures further pushed the use of high-strength materials that support better energy absorption during earthquakes. These factors made rising seismic exposure a major growth driver.

- For instance, Miyamoto International has over 75 years of experience and has responded to more than 100 major earthquakes worldwide.

Stringent Building Safety Regulations

Countries strengthened seismic building codes to improve structural performance and reduce disaster-related fatalities. Regulators required contractors to use certified reinforcement systems in new buildings, bridges, and underground structures. This shift increased the use of steel reinforcement, carbon fiber composites, and base isolation technology. Infrastructure modernization projects adopted advanced materials to extend asset life and improve shock resistance. Compliance audits and inspection standards became stricter, pushing developers to upgrade reinforcement quality. As a result, stronger regulatory oversight emerged as a critical growth driver for the market.

- For instance, Taylor Devices reports that thousands of its fluid viscous dampers have been installed in over 750 bridges and other crucial structures worldwide, including high-rise buildings, to meet modern performance-based seismic design and safety requirements in regulated markets.

Infrastructure Modernization Investments

Governments increased capital spending on resilient transport networks, water systems, and energy facilities. Aging bridges, metro tunnels, and dams required reinforcement to handle stronger seismic loads. Developers selected carbon fiber and hybrid composites to reduce downtime and improve durability during retrofitting. National resilience programs in Japan, the United States, and China boosted long-term demand for high-performance materials. Public infrastructure upgrades also encouraged innovation in lightweight fiber systems and shock-absorbing solutions. Expanding redevelopment budgets made infrastructure renewal a major driver shaping future market expansion.

Key Trends & Opportunities

Growing Adoption of Fiber-Reinforced Composites

Carbon fiber and glass fiber gained momentum due to their high tensile strength, low weight, and easy installation at active sites. Engineers used composite wraps for rapid structural strengthening without major demolition. The trend expanded across residential retrofits, bridge columns, and utility structures. Manufacturers developed improved resin systems that enhanced bonding performance and moisture resistance. The rising preference for long-lasting composite solutions created opportunities for premium fiber products. This shift toward composite-based reinforcement became an important trend and opportunity in the market.

- For instance, the Sika StressHead (CarboStress) system, which uses external post-tensioned CFRP plates for strengthening, had approximately 100 projects worldwide as of older documentation (circa 2016-2018).

Expansion of Base Isolation and Energy-Dissipation Systems

Developers increased adoption of base isolators and damping systems to improve building flexibility during strong quakes. Advanced rubber bearings, lead-core isolators, and viscous dampers saw wider installation in hospitals, high-rise buildings, and data centers. These systems reduced structural stress and protected sensitive assets from vibration damage. Governments offered incentives for installing low-disruption seismic technologies, creating new commercial opportunities. The rise of smart, sensor-enabled damping devices further strengthened this emerging trend.

- For instance, Arup engineered the Başakşehir Pine and Sakura City Hospital in Istanbul as one of the world’s largest base-isolated healthcare projects, supported on about 2 068 seismic isolators to maintain continuous operation during strong earthquakes.

Key Challenges

High Cost of Advanced Reinforcement Materials

Carbon fiber composites, hybrid reinforcement systems, and modern base isolators remain costly compared with traditional steel solutions. Budget-constrained municipal projects often delay retrofits due to high installation and maintenance expenses. Many developing regions lack funding to upgrade aging public infrastructure, limiting large-scale adoption. Price volatility in raw materials also affects project planning. The financial burden associated with advanced seismic reinforcement remains a major challenge for widespread market penetration.

Limited Skilled Workforce and Technical Awareness

Seismic retrofitting and advanced material installation require trained engineers, certified inspectors, and specialized contractors. Many regions, especially emerging economies, lack adequate technical expertise to execute complex reinforcement projects. Awareness of composite behavior, bonding requirements, and installation best practices remains low among smaller construction firms. This skill gap leads to delays, misapplications, and quality issues in seismic upgrades. The shortage of trained professionals stands as a significant challenge affecting market efficiency and adoption rates.

Regional Analysis

North America

North America held the largest share of the seismic reinforcement materials market in 2024 with about 34%. Growth remained strong as the United States and Canada upgraded aging buildings, bridges, and water systems in high-risk seismic zones. Public funding supported retrofitting of schools, hospitals, and transportation corridors across western states. Developers adopted steel, carbon fiber, and damping systems to comply with stricter regional building codes. Large metro cities invested in resilience programs to reduce future economic losses. Rising construction of high-rise structures and ongoing modernization of critical infrastructure helped sustain regional demand.

Europe

Europe accounted for nearly 25% share in 2024, driven by major retrofitting initiatives across Italy, Greece, and Turkey where seismic exposure remains high. The region adopted advanced fiber composites and shock-absorbing bearings to upgrade cultural buildings and transport networks. Northern and Central European countries invested in structural reinforcement to meet updated safety requirements. Green renovation programs encouraged the use of lighter and more durable reinforcement materials. Infrastructure reinforcement gained priority after frequent seismic events affected southern areas. Strong regulatory standards and increasing awareness supported consistent market growth.

Asia Pacific

Asia Pacific captured around 29% share in 2024 and remained the fastest-growing region due to high seismic activity and rapid urban expansion. China, Japan, and India led investments in earthquake-resistant infrastructure and building retrofits. Japan continued large-scale deployment of base isolation systems in commercial and public facilities. China strengthened high-rise construction standards and expanded fiber-reinforced material adoption. India improved structural safety across bridges, metro systems, and industrial plants. Growing urban density and rising government spending on resilient infrastructure kept the region a major contributor to future market expansion.

Latin America

Latin America held nearly 7% share in 2024 with steady demand from countries facing frequent seismic events such as Chile, Mexico, and Peru. Governments improved building codes to reduce collapse risk, boosting the use of steel bracing, fiber wraps, and seismic dampers. Public infrastructure upgrades focused on bridges, water systems, and essential service buildings. Construction firms adopted cost-effective reinforcement solutions to support retrofitting across dense urban zones. Rising reconstruction activity after major earthquakes also contributed to market needs. Limited funding remained a constraint, but growing safety awareness supported moderate regional growth.

Middle East and Africa

The Middle East and Africa accounted for about 5% share in 2024, driven by selective seismic reinforcement projects in Turkey, Iran, and parts of East Africa. Countries focused on strengthening schools, hospitals, and transportation hubs exposed to tectonic activity. Developers used steel reinforcements and fiber composites to upgrade vulnerable structures. Ongoing urban development in Gulf nations supported limited adoption of damping and isolation systems in premium projects. Budget constraints and low awareness slowed wider uptake, but international partnerships and resilience programs helped improve long-term opportunities across key seismic zones in the region.

Market Segmentations:

By Material

- Steel

- Carbon fiber

- Glass fiber

- Concrete and cement

- Rubber

- Others (hybrid, etc.)

By Application

- Building & residential construction

- Bridges & overpasses

- Tunnels & underground infrastructure

- Dams & water infrastructure

- Other (power infrastructure, etc.)

By End Use

- Construction

- Transportation

- Energy & utilities

- Public infrastructure

- Others (marine, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes Arup Group, Sika AG, Hitech Materials Inc., Mammoet, BASF, Schneider Electric, Tata Steel, Hilti Group, Tensar International, Arcelor Mittal, 3M, Freyssinet, Lintec & Toray, U.S. Concrete, and Alemite. Companies focused on stronger seismic solutions that improved safety and reduced structural risk. Many firms expanded fiber composite lines that offered high strength and short installation time. Several players improved steel reinforcement quality to meet new global codes. Manufacturers also invested in advanced damping systems that lowered vibration during strong quakes. Research teams worked on hybrid materials that balanced cost and durability in busy sites. Firms grew their global supply chains to support large retrofitting programs. Many developers partnered with construction firms to deliver faster project execution. Digital tools supported inspection and testing across new and older structures. Sustainability goals pushed companies to design longer-lasting reinforcement products. The market showed steady competition as regions raised seismic safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arup Group

- Sika AG

- Hitech Materials Inc.

- Mammoet

- BASF

- Schneider Electric

- Tata Steel

- Hilti Group

- Tensar International

- Arcelor Mittal

- 3M

- Freyssinet

- Lintec & Toray

- U.S. Concrete

- Alemite

Recent Developments

- In 2024, Arup and the NHERI SimCenter released an open-source Seismic Downtime Model to help designers quantify and achieve higher resilience levels in their projects

- In 2024, Mammoet assembled and tested the SK6000, the world’s strongest land-based crane, at its Westdorpe facility in the Netherlands.

- In 2023, Tata Steel promoted Tiscon 550SD TMT rebars as earthquake-resistant reinforcement for Indian housing.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries increase investments in seismic-resilient infrastructure.

- Fiber-reinforced composites will gain wider adoption due to high strength and low weight.

- Base isolation and damping systems will expand across hospitals, high-rises, and data centers.

- Retrofitting of aging buildings will accelerate in high-risk seismic zones worldwide.

- Governments will strengthen building codes, pushing developers toward advanced materials.

- Smart sensors and monitoring systems will integrate with reinforcement solutions for real-time safety.

- Hybrid reinforcement materials will attract interest for faster installation and higher durability.

- Urban expansion in Asia Pacific will support strong long-term market growth.

- Public-private partnerships will increase funding for large-scale seismic upgrades.

- Manufacturers will innovate lighter, cost-efficient materials to meet rising project needs.