Market Overview

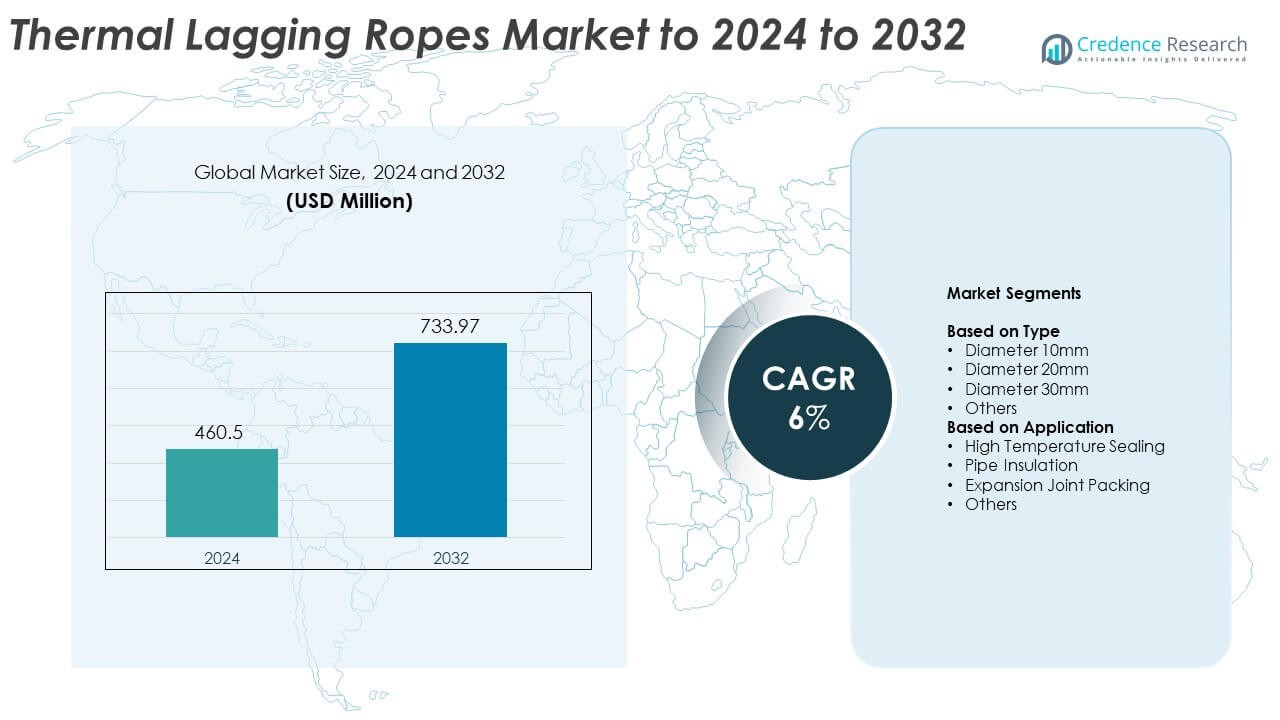

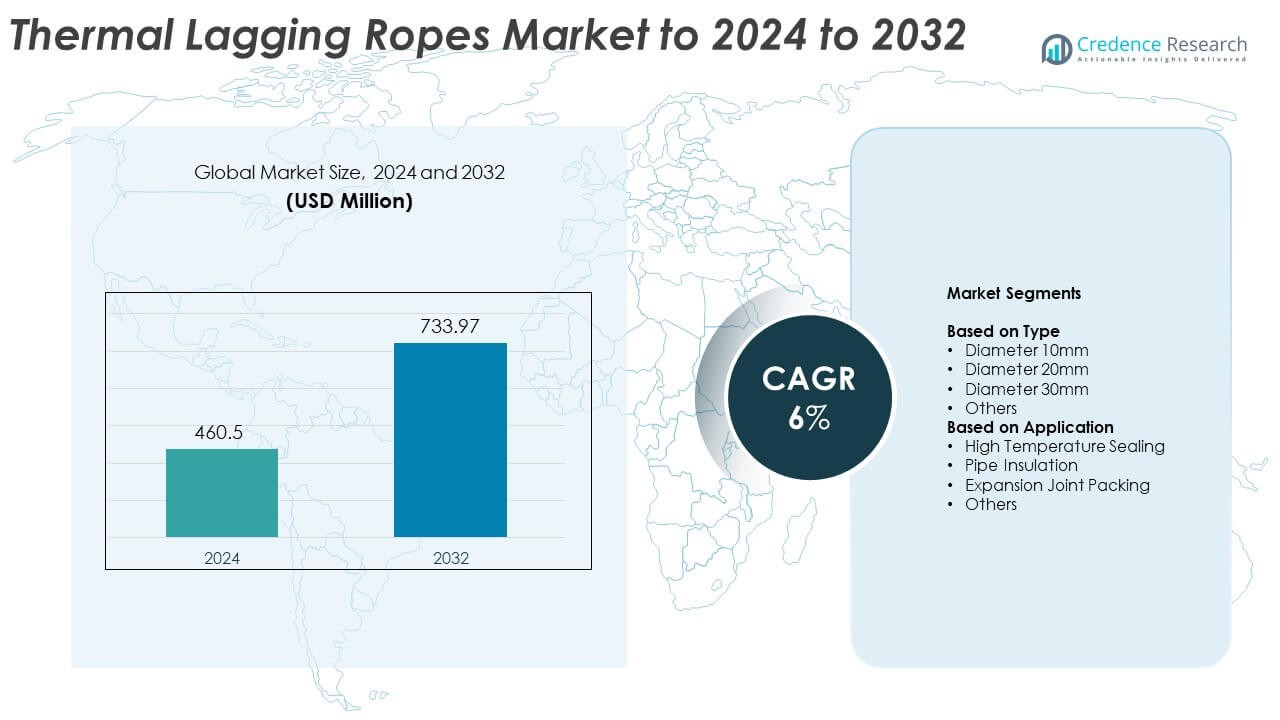

Thermal lagging ropes market size was valued at USD 460.5 million in 2024 and is anticipated to reach USD 733.97 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermal Lagging Ropes Market Size 2024 |

USD 460.5 Million |

| Thermal Lagging Ropes Market, CAGR |

6% |

| Thermal Lagging Ropes Market Size 2032 |

USD 733.97 Million |

Cheshire Ribbon, Morgan Advanced Materials, Vitcas, Sealing Devices Queensland, ALP Aeroflex, Kapaf, Hotspot, Associated Gaskets, Textile Technologies Europe, and Saint-Gobain remain the key players shaping the thermal lagging ropes market through advanced insulation materials and strong supply capabilities. These companies focus on high-temperature performance, long-life fiber construction, and compliance with industrial safety standards to meet growing demand across petrochemical, power, and metal-processing sectors. North America led the market in 2024 with about 38% share, supported by large refinery networks and strong maintenance activity, while Europe and Asia Pacific continued to expand due to modernization of industrial equipment and rising insulation requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Thermal lagging ropes market was valued at USD 460.5 million in 2024 and is projected to reach USD 733.97 million by 2032, growing at a CAGR of 6%.

- Strong industrial demand drove growth as refineries, power plants, and metal-processing units increased use of 20mm ropes, which held about 41% share due to reliable thermal resistance and wide equipment compatibility.

- Market trends showed rising adoption of eco-friendly insulation fibers and higher-grade heat-resistant materials as industries focused on safety, energy efficiency, and long service life.

- Competition intensified as manufacturers enhanced product durability, expanded distribution networks, and introduced improved rope designs, while lower-cost alternatives and material fluctuations created restraint.

- North America led the market with around 38% share, followed by Europe at 27% and Asia Pacific at 24%, supported by growing maintenance activity, industrial upgrades, and expansion of high-temperature sealing and insulation applications across major sectors.

Market Segmentation Analysis:

By Type

Diameter 20mm led the thermal lagging ropes market in 2024 with about 41% share. Industries preferred this size because it offers strong thermal resistance and fits most standard insulation channels in refineries and power plants. The 20mm category gained wider adoption as maintenance teams used this rope size for sealing hot surfaces and covering mid-sized pipelines with steady heat exposure. Diameter 10mm and 30mm ropes served niche uses in compact equipment and larger ducts, but the 20mm option stayed dominant due to its balance of durability, handling ease, and compatibility with routine industrial insulation tasks.

- For instance, Vitcas confirms its Ceramic Fibre Rope withstands continuous temperatures of 1,260°C, according to its published technical datasheet.

By Application

High temperature sealing dominated the application segment in 2024 with nearly 46% share. This segment grew as petrochemical plants, foundries, and boiler units needed reliable ropes to block heat leaks and maintain stable thermal performance during continuous operations. Demand increased because high temperature sealing improves energy efficiency and protects surrounding equipment from heat damage. Pipe insulation and expansion joint packing showed steady uptake in utility and metal-processing sites, but high temperature sealing remained ahead due to rising maintenance cycles and strict requirements for heat containment in heavy-duty systems.

- For instance, Textile Technologies Europe lists its E-glass fiberglass rope with a maximum operating (continuous service) temperature of 550°C and a peak (short-term exposure) temperature of 700°C for high-temperature sealing applications, as stated in its product specifications.

Key Growth Drivers

Rising Industrial Heat Management Needs

Demand increased as power plants, refineries, and metal-processing units focused on stronger heat control to protect machinery and improve system performance. Thermal lagging ropes supported these goals with reliable sealing and insulation across high-temperature zones. Industries adopted these ropes to reduce heat loss, improve equipment life, and meet strict operational safety norms. This factor remained a major growth driver due to expanding maintenance cycles and the need for stable thermal efficiency.

- For instance, Associated Gaskets documents its Ceramic Rope Lagging with continuous service capability up to 1,050°C, verified through its official product sheet.

Expansion of Petrochemical and Refining Operations

Growing petrochemical output led to higher rope consumption across furnaces, reactors, and high-heat pipelines. Operators required dependable thermal barriers that could tolerate long duty cycles and extreme temperatures. Thermal lagging ropes met these demands by offering stable insulation and mechanical strength in critical process units. This expansion acted as a key growth driver as global refining networks modernized plants and increased investment in thermal protection systems.

- For instance, Colan Australia reports that its silica fibre (silica-glass) heat-resistant ropes and fabrics have a continuous operating temperature of up to 1,000°C and a maximum or peak temperature of up to 1,050°C or 1,200°C for certain coated variants, as stated in its official product specifications.

Stricter Energy Efficiency and Safety Standards

Regulatory pressure pushed industries to adopt materials that limit heat loss, prevent leaks, and maintain safer work conditions. Thermal lagging ropes helped firms meet evolving standards linked to workplace safety and thermal containment. Rising audits and compliance checks encouraged companies to upgrade insulation systems. This dynamic acted as a key growth driver because organizations prioritized energy savings and safer high-temperature operations.

Key Trends and Opportunities

Shift Toward Eco-Friendly Insulation Materials

Manufacturers explored safer and low-emission fibers to replace traditional materials in high-temperature sealing products. This shift created opportunities for ropes made from recycled, bio-based, or low-toxicity fibers. Growing sustainability goals in construction, metal processing, and chemical sectors supported this trend. Companies leveraged this shift to attract buyers seeking cleaner insulation solutions that align with long-term environmental targets.

- For instance, biosoluble fibre ropes reinforced with high-temperature steel can withstand continuous operating temperatures up to 1,050°C and peak temperatures up to 1,150°C, offering a safer, low-toxicity alternative to traditional ceramic fibres, as stated in various manufacturer technical specifications

Automation in Industrial Maintenance

More industries introduced automated inspection tools and predictive maintenance systems that rely on stable insulation performance. This trend increased the need for durable lagging ropes that maintain integrity under continuous monitoring. The shift opened opportunities for advanced rope designs engineered for longer service cycles. Adoption rose as companies used data-driven maintenance to prevent failures and enhance thermal efficiency across facilities.

- For instance, silica fibre (silica-glass) heat-resistant ropes are generally capable of withstanding continuous operating temperatures of up to 1,000°C to 1,100°C.

Growth in High-Temperature Applications

Demand expanded in sectors using boilers, kilns, and thermal treatment systems due to higher output requirements. This trend created opportunities for ropes designed for extreme temperature resistance and mechanical stability. Industries upgraded insulation to handle intense thermal loads while reducing operational risks. The growth of heavy manufacturing supported this shift toward higher-grade lagging solutions.

Key Challenges

Fluctuating Raw Material Availability

The market faced challenges from unstable supplies of high-temperature fibers and specialty materials required for rope production. Supply disruptions increased lead times and pressured manufacturers to adjust sourcing strategies. Variability in fiber quality also raised production costs and affected product consistency. This factor posed a key challenge as companies worked to secure reliable and cost-stable inputs.

Competition from Alternative Insulation Technologies

Industries evaluated ceramic blankets, advanced coatings, and composite insulation as substitutes for thermal lagging ropes. These alternatives offered broader coverage and reduced installation frequency in some settings. The rising adoption of new insulation methods created competitive pressure for rope makers. This dynamic emerged as a key challenge as buyers compared long-term durability, cost efficiency, and ease of installation across insulation types.

Regional Analysis

North America

North America held around 38% share of the thermal lagging ropes market in 2024. Growth came from strong demand in oil and gas facilities, petrochemical plants, and power stations that rely on high-temperature sealing and insulation materials. The region saw steady maintenance spending as industries upgraded pipelines, boilers, and furnaces to improve energy efficiency. Adoption increased further as strict workplace safety norms encouraged companies to use durable ropes capable of handling continuous thermal stress. The presence of modern refining and manufacturing units kept North America in the leading position.

Europe

Europe accounted for nearly 27% share of the market in 2024. Demand rose as chemical plants, steel mills, and district heating networks expanded their use of lagging ropes for sealing and insulation. Regulations promoting energy savings and carbon reduction supported wider product adoption across European industrial clusters. Upgrades in older facilities also boosted consumption of heat-resistant rope materials. Rising investment in renewable energy infrastructure, especially biomass and waste-to-energy plants, contributed to stronger demand. Europe remained a key market due to its focus on efficiency and process safety.

Asia Pacific

Asia Pacific captured about 24% share in 2024, driven by rapid growth in refining, metals, and power generation sectors. Expanding industrial activity in China, India, Japan, and Southeast Asia increased the need for insulation solutions that manage high operational temperatures. Large-scale development of petrochemical complexes and manufacturing hubs strengthened demand for lagging ropes in sealing and pipeline protection. Companies in the region adopted these materials to reduce heat loss and improve equipment reliability. The rise in heavy industries kept Asia Pacific one of the fastest-growing markets.

Latin America

Latin America held close to 7% market share in 2024. Growth was supported by refinery upgrades, mining operations, and thermal power facilities that required durable insulation materials. Countries such as Brazil and Mexico invested in improving plant efficiency, which increased demand for heat-resistant ropes. Adoption also grew in cement and metals production where equipment operates under high temperatures. While overall industrial spending remained moderate, steady expansion in critical sectors maintained stable product demand. The region showed potential for long-term growth as modernization projects continued.

Middle East and Africa

Middle East and Africa accounted for roughly 4% share in 2024. The region’s oil and gas infrastructure relied on thermal lagging ropes for sealing and insulation across high-heat processing units. Petrochemical expansion in Gulf countries supported additional consumption as new plants required advanced thermal protection materials. Mining and power generation facilities in Africa also contributed to gradual demand. Despite lower diversification in some markets, ongoing industrial development and energy projects created steady growth opportunities. The region remained smaller but important due to its heavy reliance on high-temperature operations.

Market Segmentations:

By Type

- Diameter 10mm

- Diameter 20mm

- Diameter 30mm

- Others

By Application

- High Temperature Sealing

- Pipe Insulation

- Expansion Joint Packing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the thermal lagging ropes market includes Cheshire Ribbon, Morgan Advanced Materials, Vitcas, Sealing Devices Queensland, ALP Aeroflex, Kapaf, Hotspot, Associated Gaskets, Textile Technologies Europe, and Saint-Gobain. Manufacturers focused on improving high-temperature tolerance, mechanical strength, and insulation reliability to meet evolving needs in petrochemical, power generation, and metal-processing industries. Companies strengthened their positions by expanding distribution networks, enhancing production efficiency, and introducing upgraded rope designs suitable for continuous thermal exposure. Market competition intensified as producers emphasized compliance with safety and energy-efficiency standards, supporting stronger adoption across maintenance operations. Innovation in eco-friendly fibers, heat-stable constructions, and longer service-life materials further shaped the competitive dynamics in global industrial insulation applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cheshire Ribbon

- Morgan Advanced Materials

- Vitcas

- Sealing Devices Queensland

- ALP Aeroflex

- Kapaf

- Hotspot

- Associated Gaskets

- Textile Technologies Europe

- Saint-Gobain

Recent Developments

- In 2025, Morgan Advanced Materials, is expected to continue focusing on innovations in high-temperature insulation materials, including advancements in fiber compositions for better thermal performance, per market research trends.

- In 2023, ALP Aeroflex, launched “Aerocell Rail,” a high-end thermal insulation product for rail coaches.

- In 2023, Saint-Gobain, a major global insulation producer, contributed to the broader thermal insulation market through its product offerings, including glass wool and mineral wool used in various industrial insulation applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth as industries expand high-temperature operations.

- Demand will rise in refineries and petrochemical plants due to ongoing capacity upgrades.

- Manufacturers will develop stronger rope materials to support longer service life.

- Adoption will increase as companies focus on improving thermal efficiency in older plants.

- Eco-friendly and low-emission insulation materials will gain wider acceptance.

- Growth in metal processing and power generation will support higher consumption.

- Automated maintenance systems will push demand for ropes with enhanced durability.

- Expansion of heavy manufacturing in Asia Pacific will strengthen regional growth.

- Replacement demand will expand as industries follow strict safety and insulation standards.

- Innovation in high-temperature fiber technology will open new application opportunities.