Market Overview

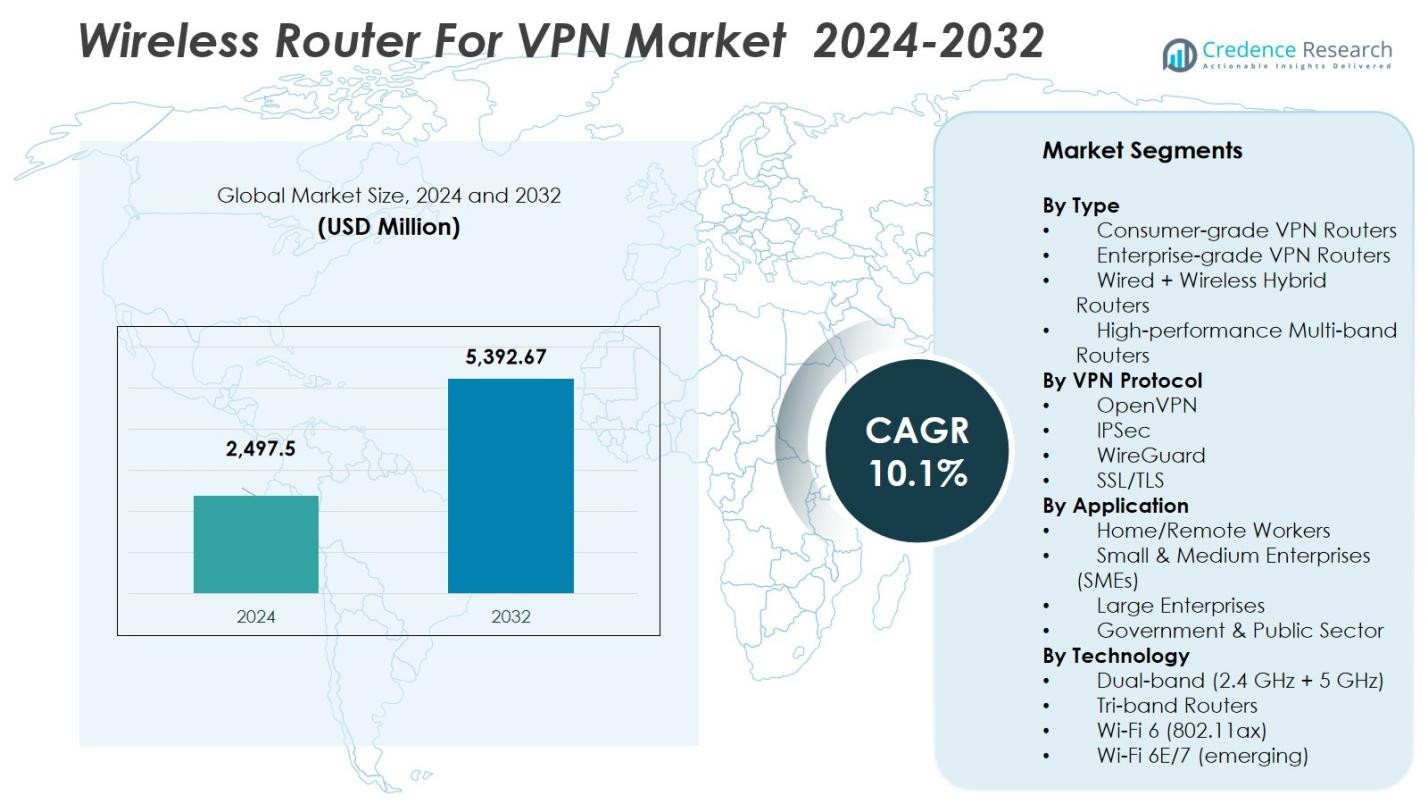

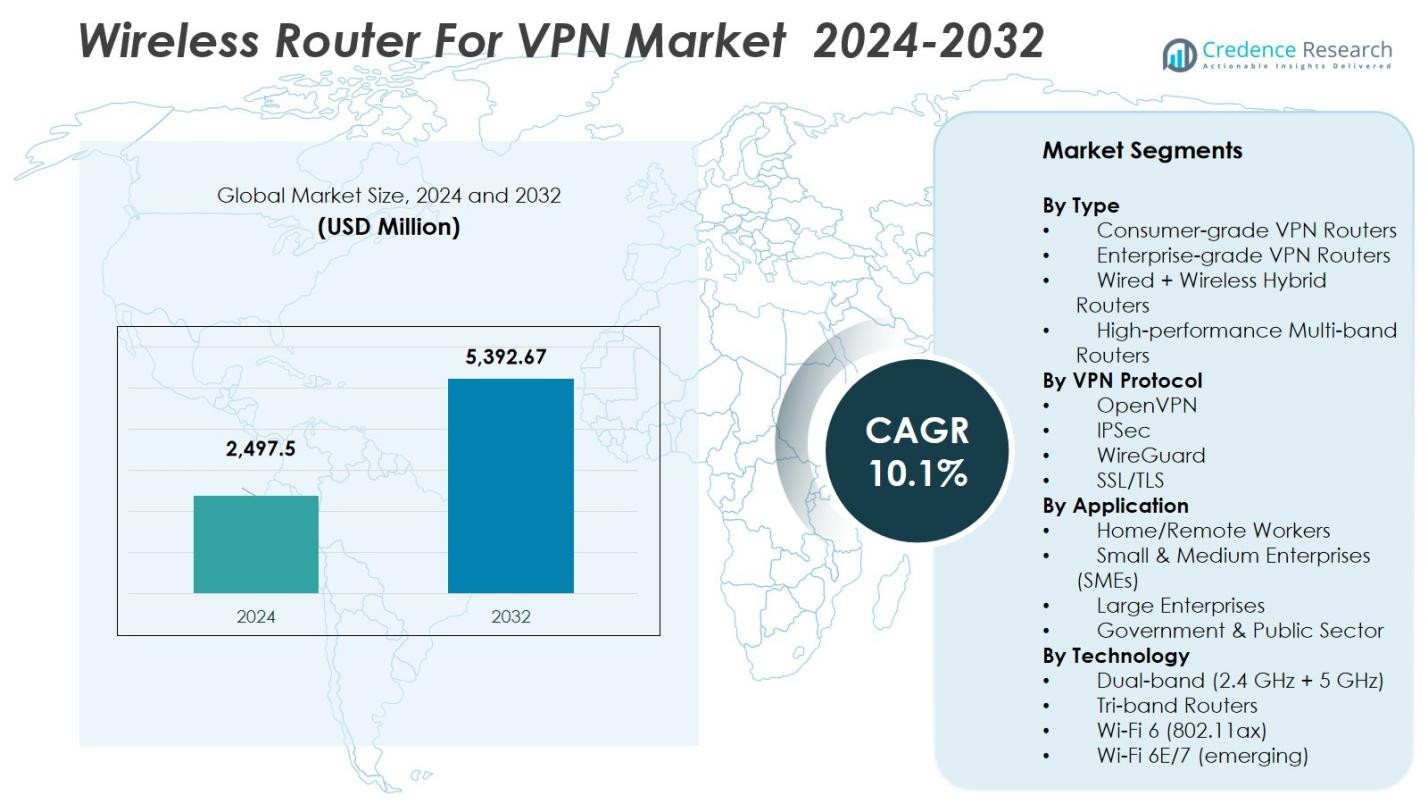

The Wireless Router For VPN Market size was valued at USD 2,497.5 million in 2024 and is anticipated to reach USD 5,392.67 million by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Router For VPN Market Size 2024 |

USD 2,497.5 Million |

| Wireless Router For VPN Market, CAGR |

10.1% |

| Wireless Router For VPN Market Size 2032 |

USD 5,392.67 Million |

The Wireless Router for VPN Market is driven by prominent players including Cisco Systems, Netgear, TP-Link, ASUS, Ubiquiti, Juniper Networks, Huawei, D-Link, Fortinet and MikroTik, all of which continue to enhance their product portfolios with stronger encryption, multi-band performance and next-generation Wi-Fi technologies. These companies focus on delivering secure, high-speed connectivity solutions to support growing demand from remote workers, SMEs and large enterprises. Innovations such as cloud-managed routing, AI-enhanced security and mesh-enabled VPN systems further strengthen their market positioning. North America leads the global market with a 38% share, supported by advanced digital infrastructure, heightened cybersecurity awareness and widespread adoption of secure remote-access solutions across corporate and residential environments.

Market Insights

- The Wireless Router for VPN Market was valued at USD 2,497.5 million in 2024 and is projected to reach USD 5,392.67 million by 2032, registering a CAGR of 10.1% during the forecast period.

- The market is expanding due to strong drivers such as rising remote work adoption, growing cybersecurity awareness and increased demand for secure, high-bandwidth connectivity across both residential and enterprise settings.

- Key trends include rapid adoption of Wi-Fi 6, Wi-Fi 6E and Wi-Fi 7 routers, along with growing interest in cloud-managed and mesh-enabled VPN solutions that enhance network control and coverage.

- Major players such as Cisco, Netgear, TP-Link, ASUS, Ubiquiti and Fortinet strengthen the landscape by introducing advanced encryption, multi-band capabilities and AI-driven security, while high costs and configuration complexity remain notable restraints.

- Regionally, North America leads with a 38% share, while consumer-grade VPN routers dominate the type segment with 45%, supported by widespread remote-work setups and strong cybersecurity adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the “By Type” segment of the wireless VPN-router market, the consumer-grade VPN routers currently dominate with an estimated market share of around 45%, driven by robust demand from remote workers and home offices. These devices are favoured for their ease of installation, lower cost and growing awareness of home-network security. Enterprise-grade VPN routers and hybrid wired + wireless variants follow, but the consumer segment leads thanks to the rapid proliferation of connected devices and increasing VPN adoption in residential settings.

- For instance, Linksys’s NordVPN-configured WRT3200ACM router, favored for its 1.8 GHz dual-core processor and multiple antennas optimized for multiple home devices.

By VPN Protocol

Within the “By VPN Protocol” segmentation, the IPSec protocol takes the lead with an approximate share of 38%, as businesses and advanced users prefer its mature architecture, strong encryption and wide compatibility with existing hardware. OpenVPN and SSL/TLS protocols hold smaller portions of the market, while WireGuard is gaining traction because of its performance and simplicity. The dominance of IPSec is underpinned by its broad ecosystem support and compatibility across router vendors.

- For instance, the TP-Link TL-R605 router supports and manages up to 20 LAN-to-LAN IPSec VPN connections, simplifying secure site-to-site communication.

By Application

Looking at the market by application, the SME (Small & Medium Enterprises) segment is currently the largest, holding 40% of the market. SMEs are investing in VPN-enabled wireless routers to secure distributed workforces, enable remote access and comply with regulatory standards without the heavy cost of full enterprise infrastructure. Home/remote workers and large enterprises follow close behind, but the SME space leads due to a balance of budget, security needs and scalability.

Key Growth Drivers

Key Growth Drivers

Rising Remote Work Adoption

The expansion of remote and hybrid work models continues to accelerate demand for wireless VPN routers, as households and businesses prioritize secure access to corporate networks. Organizations are deploying VPN-enabled routers to safeguard distributed teams and maintain data privacy across unsecured home networks. This shift has broadened the consumer and SME user base, increasing the need for reliable, encrypted connectivity. As cyber risks grow more sophisticated, businesses increasingly view secure wireless routing as a foundational digital-infrastructure investment, making remote-work adoption a long-term driver of market growth.

- For instance, LyconSys GmbH produces VPN routers used in critical infrastructures like railway and airport systems, providing secure remote network access essential for operational security.

Growing Cybersecurity Awareness

Heightened cybersecurity threats and a surge in data breaches have prompted users to adopt stronger network-level protection, driving wider acceptance of wireless VPN routers. These devices offer an additional security layer by encrypting traffic and limiting exposure to external attacks, making them essential for both personal and professional environments. Enterprises and SMEs are reinforcing their networks to comply with regulatory standards and internal security frameworks. This rising awareness, combined with stricter compliance requirements, is encouraging the upgrade to advanced VPN-enabled routers across sectors, boosting market expansion.

- For instance, GL.iNet’s Flint 2 and Flint 3 routers, popular among digital nomads and remote workers, support WireGuard VPN protocols and offer hardware-level encryption, enabling users to secure all connected devices with a single configuration and achieve speeds exceeding 500 Mbps.

Increasing Device Connectivity and Bandwidth Demands

The growing number of connected devices in homes and workplaces is pushing users toward high-performance VPN routers that can manage increased traffic loads without compromising security. As video conferencing, cloud computing and streaming become more bandwidth-intensive, users require routers capable of supporting simultaneous secure connections at high speeds. Multi-band and Wi-Fi 6/6E-enabled VPN routers address these requirements effectively. This surge in digital activity across consumer and enterprise environments is driving sustained demand for powerful, scalable and security-focused wireless routing solutions.

Key Trends & Opportunities

Adoption of Next-Generation Wi-Fi Technologies

A prominent trend in the market is the rapid adoption of Wi-Fi 6, Wi-Fi 6E and early Wi-Fi 7 technologies in VPN-enabled routers. These advancements present strong opportunities for manufacturers to offer devices with significantly improved throughput, reduced latency and enhanced support for encrypted traffic. Businesses and consumers increasingly prefer routers with next-generation capabilities to future-proof their networks. As data-heavy applications continue to expand, routers that combine advanced wireless performance with robust VPN functionalities are positioned for strong uptake across global markets.

- For instance, ASUS launched the RT-AXE7800 tri-band Wi-Fi 6E router delivering speeds up to 7.8 Gbps combined with comprehensive VPN features and enhanced network security, catering to high-demand users requiring both performance and privacy.

Growth of Cloud-Managed and Mesh-Enabled VPN Routers

Another emerging opportunity lies in cloud-managed and mesh-enabled VPN routers, which simplify network control and strengthen coverage. Cloud-based management allows IT teams to configure VPN access, monitor usage and apply security policies remotely, which appeals greatly to SMEs and multi-location businesses. Mesh systems also enhance performance for consumers by delivering seamless, secure coverage across larger spaces. As organizations seek scalable and easily deployable solutions, manufacturers that integrate VPN capabilities into cloud-first or mesh-network ecosystems stand to gain significant competitive advantage.

- For instance, Google Distributed Cloud offers cloud-managed VPN connections that integrate with Cloud Router, enabling IT teams to configure VPN access, manage routing dynamically, and monitor usage remotely, which is especially beneficial for organizations seeking scalable network solutions.

Key Challenges

High Implementation and Upgrade Costs

Despite growing demand, cost remains a significant barrier to adoption, especially for SMEs and budget-conscious consumers. High-performance VPN routers with advanced security features, multi-band support and enterprise-grade capabilities often come with premium price points. Additionally, ongoing expenses for firmware updates, security management and potential subscription-based VPN services add to the total cost of ownership. These financial constraints may slow adoption rates in emerging markets or smaller organizations, limiting broader penetration of advanced wireless VPN router solutions.

Complex Configuration and Compatibility Issues

Another challenge affecting market growth is the complexity associated with configuring VPN protocols and ensuring compatibility across various devices and network environments. Many users lack the technical expertise required to set up VPN routing securely, resulting in misconfigurations or incomplete protection. Enterprises also face integration challenges when aligning routers with legacy systems, authentication tools and multi-platform devices. As networks become more distributed, ensuring consistent performance and security across different hardware ecosystems becomes increasingly difficult, contributing to implementation barriers for both consumers and enterprises.

Regional Analysis

North America

North America holds the largest share of the wireless VPN router market, accounting for around 38% due to strong cybersecurity adoption, widespread remote-work infrastructure and early implementation of advanced Wi-Fi technologies. Enterprises across the United States and Canada invest heavily in secure networking solutions to support cloud applications, remote access and compliance requirements. The region’s mature digital ecosystem and high consumer awareness of cybersecurity further drive demand for VPN-enabled routers in both residential and commercial markets. Growing threats of cyberattacks continue to push organizations toward high-performance, multi-band and enterprise-grade VPN routers.

Europe

Europe represents around 28% of the wireless VPN router market, supported by stringent data protection regulations such as GDPR and increasing government initiatives promoting secure digital infrastructure. Businesses across Western and Northern Europe are adopting VPN-enabled routers to protect sensitive data and enable flexible work environments. The region shows strong demand from SMEs and public-sector organizations seeking reliable encrypted connectivity. Rising concerns over cyber espionage, combined with rapid digital transformation across industries, contribute to sustained market growth. Additionally, the expansion of smart homes and IoT ecosystems supports wider adoption of consumer-grade VPN routers.

Asia-Pacific

Asia-Pacific captures around 24% of the market and stands as the fastest-growing region due to rapid digitalization, increasing internet penetration and expanding SME sectors across China, India, Japan and Southeast Asia. The region benefits from rising investments in secure networking solutions to support cloud migration, remote operations and large-scale connected-device usage. Growing cybersecurity threats and government regulations on data protection are prompting organizations to deploy VPN-enabled routers. The surge in e-commerce, online education and remote work continues to accelerate demand for high-performance, cost-effective wireless VPN routers across emerging and developed markets in the region.

Latin America

Latin America holds around 6% of the wireless VPN router market, driven by growing digital adoption and increasing awareness of secure connectivity solutions among businesses and households. Countries such as Brazil, Mexico and Chile are experiencing rising demand for VPN-enabled routers as organizations modernize their IT infrastructure and address escalating cybersecurity challenges. Expansion of remote work, coupled with digital services growth, supports the need for encrypted wireless networks. Budget constraints and varied network infrastructure limit faster adoption, but ongoing government initiatives to enhance digital security frameworks continue to create opportunities for market penetration.

Middle East & Africa

The Middle East & Africa region accounts for around 4% of the market, supported by rising investments in secure communication networks across government, financial and enterprise sectors. GCC countries are driving adoption due to strong digital-transformation programs and heightened cybersecurity priorities. The region is experiencing increasing deployment of VPN-enabled routers to support remote operations, cloud services and secure data exchange. While adoption in Africa is still emerging due to infrastructure limitations, greater internet penetration and expanding SME activity are gradually boosting demand. Growing awareness of cyber threats is further encouraging uptake of secure wireless routing solutions.

Market Segmentations:

By Type

- Consumer-grade VPN Routers

- Enterprise-grade VPN Routers

- Wired + Wireless Hybrid Routers

- High-performance Multi-band Routers

By VPN Protocol

- OpenVPN

- IPSec

- WireGuard

- SSL/TLS

By Application

- Home/Remote Workers

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Government & Public Sector

By Technology

- Dual-band (2.4 GHz + 5 GHz)

- Tri-band Routers

- Wi-Fi 6 (802.11ax)

- Wi-Fi 6E/7 (emerging)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wireless VPN router market is defined by major players such as Cisco, Netgear, TP-Link, ASUS, Ubiquiti, Juniper Networks, Huawei, D-Link, Fortinet and MikroTik, each contributing to a dynamic and innovation-driven environment. The market remains highly competitive as companies emphasize product differentiation through advanced security features, multi-band performance, next-generation Wi-Fi capabilities and cloud-managed network solutions. Established vendors focus on strengthening enterprise-grade portfolios, while consumer-focused brands target affordability and ease of use. Strategic partnerships, continuous firmware enhancements and expansion into mesh and Wi-Fi 6/6E ecosystems are shaping competitive strategies. The rise in cyber threats and remote work is fueling demand for VPN-centric solutions, prompting companies to enhance encryption protocols and improve management tools. New entrants face barriers due to high technology requirements and strong brand loyalty in both consumer and enterprise segments. As security and performance expectations increase, competition will intensify around innovation, scalability and user-friendly network management.

Key Player Analysis

- Cisco Systems, Inc.

- Netgear, Inc.

- TP-Link Technologies Co., Ltd.

- ASUS Tek Computer Inc.

- Ubiquiti Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- D-Link Corporation

- Fortinet, Inc.

- MikroTik

Recent Developments

- In March 2024, ExpressVPN launched the portable VPN‑router “Aircove Go” — a palm‑sized WiFi 6 router with built‑in VPN protection for every device on the network.

- In August 2025, TP‑Link launched its “TL‑WR3602BE (BE3600)” WiFi‑7 travel router, which supports built‑in VPN client/server modes including OpenVPN & WireGuard.

- In September 2024, Netgear launched three new Wi‑Fi 7 routers (RS600, RS500, RS200) with enhanced security features for home networking.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, VPN Protocol, Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as remote and hybrid work models remain a long-term structural trend.

- Demand for next-generation Wi-Fi technologies will rise, driving adoption of Wi-Fi 6, Wi-Fi 6E and Wi-Fi 7 VPN routers.

- Enterprises will increasingly prioritize hardware-level encryption and advanced VPN protocols for secure distributed operations.

- Cloud-managed VPN routers will gain strong traction as organizations seek simplified remote network administration.

- Mesh-enabled VPN systems will become more mainstream as users demand seamless, secure whole-home coverage.

- SMEs will remain a major growth engine due to rising cybersecurity awareness and digital-transformation efforts.

- Integration of AI-driven security analytics will enhance router threat detection and automated network protection.

- Consumer demand will grow as households adopt more connected devices and require secure, high-performance networks.

- Manufacturers will expand investments in firmware upgrades and long-term device security support.

- Competition will intensify as vendors focus on innovation, scalability and user-friendly VPN management tools.

Key Growth Drivers

Key Growth Drivers