Market Overview

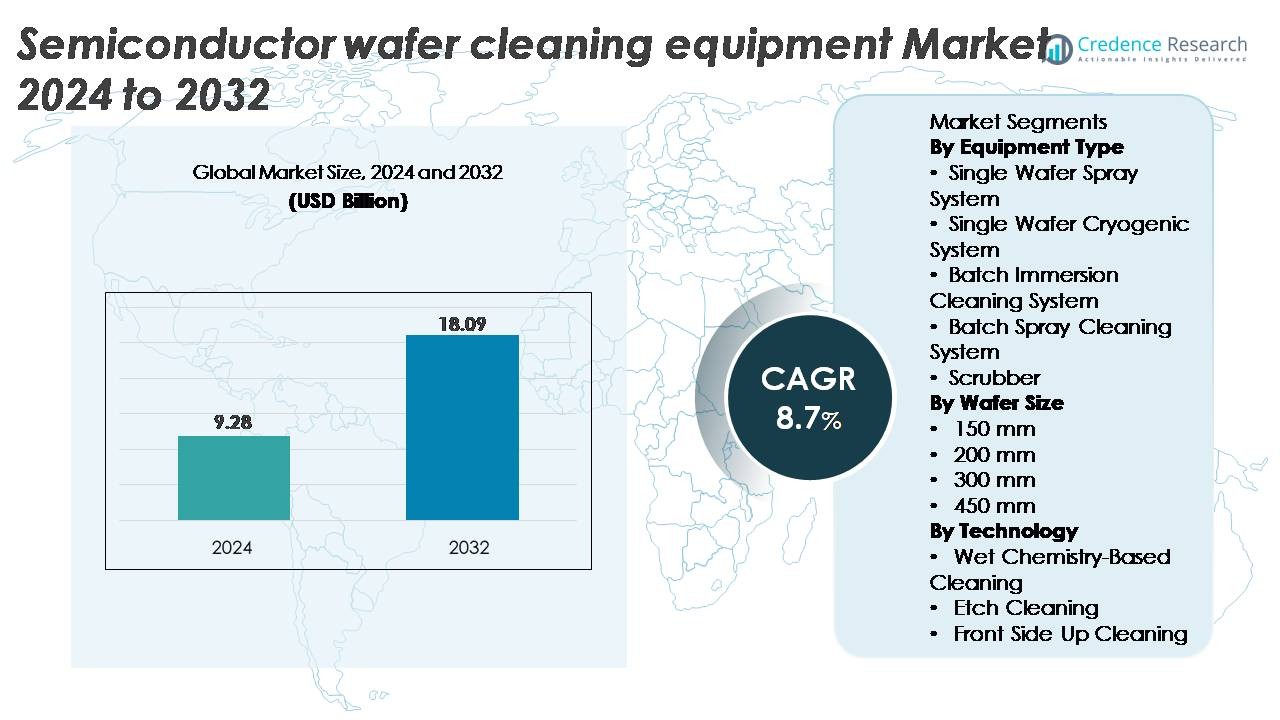

The semiconductor wafer cleaning equipment market was valued at USD 9.28 billion in 2024 and is projected to reach USD 18.09 billion by 2032, reflecting a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Wafer Cleaning Equipment Market Size 2024 |

USD 9.28 Billion |

| Semiconductor Wafer Cleaning Equipment Market, CAGR |

8.7% |

| Semiconductor Wafer Cleaning Equipment Market Size 2032 |

USD 18.09 Billion |

The semiconductor wafer cleaning equipment market is shaped by a group of dominant global players, including Tokyo Electron, Lam Research, SCREEN Holdings, KLA Corporation, Hitachi High-Tech, Semes, Shibaura Mechatronics, Entegris, and Modutek, each contributing advanced wet processing, single-wafer cleaning, and contamination-control technologies. These companies compete through innovations in megasonic cleaning, precise chemical management, and low-damage processes essential for sub-5 nm nodes. Asia-Pacific leads the market with approximately 44% share, driven by extensive wafer fabrication in Taiwan, South Korea, Japan, and China. North America follows with around 28%, supported by major fab expansions in the U.S., while Europe accounts for about 17%, anchored by strong automotive and power semiconductor manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The semiconductor wafer cleaning equipment market was valued at USD 9.28 billion in 2024 and is projected to reach USD 18.09 billion by 2032, registering a CAGR of 8.7% during the forecast period.

- Strong market growth is driven by advanced-node migration below 7 nm, increased EUV adoption, and rising wafer starts across logic, memory, and specialty semiconductor production.

- Key trends include the shift toward low-damage cryogenic cleaning, wet chemistry optimization, AI-enabled process control, and increasing demand from power electronics, MEMS, and advanced packaging segments.

- The competitive landscape is dominated by Tokyo Electron, Lam Research, SCREEN Holdings, KLA, Hitachi High-Tech, Semes, Shibaura Mechatronics, Entegris, and Modutek, with single-wafer spray systems holding the largest segment share due to high precision requirements.

- Regionally, Asia-Pacific leads with ~44%, followed by North America at ~28% and Europe at ~17%, supported by major fab expansions, government incentives, and strong specialty semiconductor manufacturing.

Market Segmentation Analysis:

By Equipment Type

Single wafer spray systems dominate the semiconductor wafer cleaning equipment market, accounting for the largest share due to their ability to support advanced nodes below 10 nm, where particle removal efficiency and uniformity are critical. Their high throughput, precise chemical delivery, and compatibility with megasonic and ultrasonics enhance yield in logic and memory production. Batch immersion and batch spray systems remain relevant for legacy nodes and high-volume manufacturing, while cryogenic systems and scrubbers gain adoption in niche processes requiring minimal chemical use and reduced pattern damage. The shift toward smaller geometries continues to strengthen demand for single wafer spray platforms.

- For instance, SCREEN’s SU-3400 single-wafer cleaning system delivers up to 1,200 wafers per hour, a figure confirmed in SCREEN’s official product documentation. The platform also uses SCREEN’s proprietary Nanocontrol™ nozzle technology, which enables precise control of chemical flow and dispense positioning to protect advanced patterned wafers during high-throughput cleaning.

By Wafer Size

300 mm wafers represent the dominant wafer size segment, holding the highest market share as major foundries and IDMs operate on 300 mm production lines for high-performance computing, advanced memory, and automotive-grade semiconductors. Their larger surface area and higher die count per wafer drive extensive use of advanced cleaning tools that ensure defect-free substrates. While 200 mm wafers maintain steady demand from power electronics and analog segments, the industry’s long-term transition toward 450 mm remains slow due to high capital costs and limited ecosystem readiness. The ongoing expansion of 300 mm fabs globally reinforces the segment’s leadership.

For instance, a 300 mm wafer has a surface area of about 70,685 mm², while a 200 mm wafer has about 31,416 mm² a ratio of roughly 2.25×. This larger area supports far higher die output, which pushes fabs to adopt high-throughput wafer cleaning systems to maintain overall line efficiency.

By Technology

Wet chemistry–based cleaning leads the technology segment with the largest market share, driven by its proven efficiency in removing organic, metallic, and particulate contaminants using chemistries such as SC-1, SC-2, SPM, and dilute HF. Its adaptability to both single-wafer and batch systems makes it essential across advanced and mature nodes. Etch cleaning plays a significant role in oxide removal and surface preparation, particularly in FEOL processes, while front-side-up cleaning supports sensitive layers that require minimal pattern disruption. Continued scaling to sub-7 nm processes sustains the dominance of wet chemical cleaning solutions due to their high process reliability and selectivity.

Key Growth Drivers

Advanced Node Shrink and Rising Sensitivity to Sub-Micron Defects

Scaling toward 7 nm, 5 nm, and 3 nm nodes is one of the strongest growth drivers for semiconductor wafer cleaning equipment, as shrinking geometries significantly heighten sensitivity to nanoscale contaminants. Even particles below 20 nm can cause line bridging, contact failure, and device yield reduction, prompting fabs to adopt high-precision single-wafer cleaning systems with advanced megasonic, spray, and cryogenic technologies. More complex multilayer architectures in logic, 3D NAND, and DRAM require repeated cleaning steps often more than 80 per wafer increasing the total process count. As EUV lithography becomes mainstream, residues from photoresist materials, metal oxides, and post-etch byproducts demand new chemistries and low-damage cleaning processes. These requirements drive investment in tools with enhanced selectivity, improved chemical uniformity, and better control of pattern collapse, reinforcing the critical role of wafer cleaning equipment in sustaining device performance and yield.

- For instance, Lam Research reports that defectivity control at advanced nodes requires removal of particles as small as 3–5 nm during FEOL cleaning to prevent pattern collapse in high-aspect-ratio features.

Expansion of Global Fab Capacity and Front-End Manufacturing Investments

A surge in investments by leading foundries and IDMs is rapidly expanding the demand for advanced wafer cleaning solutions across both established and emerging semiconductor hubs. New fabrication facilities in the U.S., Europe, Taiwan, South Korea, Japan, and China are accelerating procurement of high-throughput cleaning systems to support increased wafer starts per month. Government-backed semiconductor incentive programs, reshoring strategies, and supply-chain resilience initiatives further intensify the pace of fab construction. Each new 300 mm fab requires large fleets of wet benches, single-wafer spray tools, megasonic units, and particle control systems, making cleaning equipment among the highest-volume process tools purchased. Additionally, specialty fabs producing power devices, MEMS, sensors, and automotive chips continue to upgrade to advanced cleaning platforms to meet quality and reliability standards. This robust global manufacturing expansion underpins sustained, long-term growth in equipment demand.

- For instance, TSMC’s Arizona Fab (Fab 21 Phase 1) is designed for an initial capacity of 20,000 300-mm wafers per month, requiring large fleets of single-wafer cleaning, megasonic, and wet-bench platforms to support leading-edge logic production.

Increasing Use of Complex Materials and 3D Device Architectures

The shift toward 3D structures including 3D NAND, gate-all-around FETs (GAAFETs), FinFETs, and advanced packaging significantly increases the need for specialized wafer cleaning technologies. Complex materials such as high-k dielectrics, cobalt, ruthenium, and advanced photoresists introduce new contamination challenges requiring precise chemical formulations and delicate removal processes. As vertical stacking increases surface complexity, residues become harder to access, demanding tools with enhanced chemical penetration, uniformity, and damage-free particle removal. Advanced cleaning equipment must also handle fragile low-k films and sensitive patterns without causing collapse or delamination. In heterogeneous integration and chiplet packaging, ultra-clean surfaces are essential for reliable bonding, TSV formation, and warpage-free assembly. These evolving material and architecture requirements drive adoption of specialized wet chemistry tools, cryogenic CO₂ cleaning, and ultra-low-pressure megasonic systems optimized for next-generation nodes.

Key Trends & Opportunities

Adoption of Cryogenic and Low-Damage Cleaning Processes

A major trend shaping the market is the growing adoption of cryogenic and low-damage cleaning technologies designed for delicate device structures. Cryogenic CO₂ cleaning, dry ice blasting, and reduced-pressure megasonic systems provide effective contamination removal while minimizing pattern collapse and surface erosion issues increasingly prevalent at sub-5 nm nodes. These innovations cater to advanced lithography and FEOL processes where low mechanical stress is essential. The opportunity lies in replacing traditional chemical-intensive methods with environmentally friendly alternatives that reduce consumption of sulfuric acid, ammonia, and HF-based solutions. As regulatory pressure strengthens and fabs pursue sustainability initiatives, cryogenic and low-chemical cleaning solutions gain traction. Equipment suppliers offering scalable, modular systems with hybrid cryogenic-wet cleaning capabilities stand to benefit significantly, especially in fabs transitioning toward greener, low-damage wafer cleaning ecosystems.

· For instance, CO₂ snow-jet cleaning systems documented in semiconductor process engineering studies generate particle velocities above 200 m/s, created as solid CO₂ expands through a supersonic nozzle. These high-speed particles provide enough kinetic energy to lift organic films and particles while remaining gentle on low-k and other fragile dielectric layers.

Increasing Automation, AI-Based Process Control, and Smart Fab Integration

The integration of AI-driven analytics, real-time process monitoring, and advanced automation is creating new opportunities across semiconductor cleaning operations. AI-enabled control systems optimize chemical dosing, bath life, spray parameters, and megasonic frequencies to maintain consistent results across wafer lots. Smart sensors, digital twins, and predictive maintenance models further support defect reduction and tool uptime optimization. As fabs transition toward highly automated “lights-out” manufacturing environments, wafer cleaning equipment must integrate seamlessly with factory automation platforms, AMHS systems, and advanced metrology. This trend enables productivity gains, lower operational costs, and significantly improved contamination control. Vendors offering AI-enhanced, fully automated single-wafer cleaning systems with remote diagnostics and closed-loop process feedback become increasingly valuable partners to semiconductor manufacturers.

- For instance, Lam Research’s Sense.i® platform captures more than 1,000 tool-state signals per second and generates over 1 terabyte of equipment data per day, enabling machine-learning models to identify process drifts before they affect wafer quality.

Growth of Specialty Segments Power Electronics, MEMS, and Advanced Packaging

Beyond leading-edge logic and memory, rising demand from specialty semiconductor segments presents strong opportunities for equipment suppliers. Power electronics based on SiC and GaN require robust cleaning processes to handle harder, more abrasive materials and high-temperature etch residues. MEMS fabrication depends heavily on precise wet etching and cleaning cycles to ensure sensor accuracy and microstructure integrity. Advanced packaging such as fan-out, CoWoS, and chiplets relies on ultra-clean surfaces for bonding, plating, and through-silicon via processing. These segments demand both high-throughput batch systems and advanced single-wafer tools tailored to diverse substrate materials. As electrification, IoT, and automotive electronics grow, specialized wafer cleaning becomes a key enabler of quality, reliability, and device performance.

Key Challenges

Complexity of Cleaning Fragile Structures at Sub-5 nm Nodes

As semiconductor nodes continue to shrink, cleaning equipment faces increasing difficulty in maintaining structural integrity while removing contaminants. Ultra-thin films, narrow trenches, and delicate 3D architectures are highly susceptible to pattern collapse, watermark formation, surface roughness, and dielectric erosion. Traditional high-power megasonic systems and aggressive chemistries can damage sensitive materials such as low-k dielectrics and high-aspect ratio structures. Ensuring uniform chemical distribution across complex geometries becomes another major challenge. Equipment manufacturers must continuously innovate low-pressure, low-damage solutions with precise control over particle energy, chemical exposure, and mechanical forces. Balancing cleaning effectiveness with structural protection remains one of the most persistent technical obstacles for tool suppliers.

High Capital Costs and Complexity of Integration in Advanced Fabs

Deploying advanced wafer cleaning tools involves significant capital investment, complex installation requirements, and lengthy qualification cycles. Fabs operating at 300 mm scale require large fleets of single-wafer tools, wet benches, dilution systems, and chemical recycling infrastructure, contributing to high total cost of ownership. Integrating new cleaning platforms with existing fab automation, metrology systems, and safety protocols adds further complications. The cost and complexity are particularly challenging for emerging fabs, small foundries, and specialty device manufacturers with limited budgets. Additionally, fluctuations in semiconductor demand cycles delay procurement and extend payback periods. Overcoming these economic and operational barriers requires equipment vendors to provide modular, scalable, and energy-efficient tools that reduce footprint, chemical usage, and long-term operating costs.

Regional Analysis

North America

North America holds around 28% of the global market, supported by strong investments in advanced semiconductor manufacturing driven by U.S. CHIPS Act incentives. Major foundries, including Intel, TSMC Arizona, and Micron, continue expanding 300 mm fabrication capacity, creating sustained demand for high-precision single-wafer and cryogenic cleaning tools. The region’s strong focus on leading-edge nodes below 5 nm intensifies requirements for advanced wet chemistry systems and low-damage megasonic equipment. Growth is further supported by increased adoption of AI, HPC, and automotive chips manufactured in U.S.-based fabs, reinforcing the region’s high technology intensity and equipment procurement momentum.

Europe

Europe accounts for approximately 17% of the market, driven by robust activity in specialty semiconductor production across Germany, France, the Netherlands, and Italy. Regional fabrication strengths include power electronics, MEMS, automotive semiconductors, and advanced packaging, all of which require specialized wafer cleaning solutions tailored to SiC, GaN, and sensor substrates. EU-backed semiconductor sovereignty programs and investments from players such as STMicroelectronics, Infineon, and GlobalFoundries expand regional equipment demand. Europe’s strong environmental regulations also accelerate the shift toward chemical-efficient wet benches and low-emission cleaning systems, positioning the region as a growing adopter of sustainable wafer cleaning technologies

Asia-Pacific

Asia-Pacific leads the global market with an estimated 44% share, driven by extensive wafer manufacturing in Taiwan, South Korea, Japan, and China. Major fabs including TSMC, Samsung, SK Hynix, UMC, SMIC, and Kioxia collectively account for the majority of global 300 mm wafer starts, requiring large-scale deployment of single-wafer spray tools, immersion benches, and megasonic systems. The region’s rapid transition to EUV-enabled nodes below 5 nm further boosts demand for ultra-pure, damage-free cleaning platforms. Expanding DRAM, NAND, logic, and foundry capacities, along with aggressive government subsidies, reinforce Asia-Pacific’s dominant role in the semiconductor wafer cleaning equipment ecosystem.

Latin America

Latin America holds around 6% of the market, primarily supported by growing demand for semiconductor packaging, testing, and electronics assembly operations in Mexico and Brazil. While the region does not host major advanced-node fabs, increasing investments in automotive electronics, consumer device assembly, and industrial automation support the adoption of cleaning tools for backend and specialty semiconductor applications. Multinational OEMs operating in Mexico’s electronics clusters drive procurement of batch cleaning systems, scrubbers, and wet benches. As regional manufacturing diversifies and supply chains shift closer to North America, Latin America’s demand for wafer cleaning equipment continues to gradually expand.

Middle East & Africa

The Middle East & Africa region accounts for an estimated 5% share, with growth emerging from government-led technology investments particularly in Israel and the UAE. Israel’s advanced semiconductor ecosystem, anchored by Intel and local design-to-manufacturing partners, drives demand for high-precision cleaning solutions in R&D and pilot-scale production. GCC countries are increasingly investing in microelectronics research parks and semiconductor supply-chain localization initiatives, generating opportunities for wet chemistry and contamination-control equipment. While large-scale wafer fabrication is still limited, rising interest in semiconductor diversification and strategic alliances supports gradual market penetration of cleaning technologies across the region.

Market Segmentations:

By Equipment Type

- Single Wafer Spray System

- Single Wafer Cryogenic System

- Batch Immersion Cleaning System

- Batch Spray Cleaning System

- Scrubber

By Wafer Size

- 150 mm

- 200 mm

- 300 mm

- 450 mm

By Technology

- Wet Chemistry-Based Cleaning

- Etch Cleaning

- Front Side Up Cleaning

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the semiconductor wafer cleaning equipment market is characterized by a concentrated group of global players specializing in advanced wet processing, single-wafer cleaning, and cryogenic technologies. Leading companies such as Tokyo Electron (TEL), SCREEN Semiconductor Solutions, Lam Research, Applied Materials, DNS, and SEMES dominate the high-end segment through continuous innovation in megasonic systems, chemical distribution control, and EUV-compatible cleaning platforms. These vendors compete on process precision, throughput, low-damage capability, and integration with smart fab automation. Mid-tier players, including Modutek, ACM Research, Entegris, and Ultron Systems, strengthen their presence by offering cost-effective wet benches, batch immersion tools, and modular systems tailored to specialty device manufacturing. Strategic partnerships with major foundries and IDMs are critical, enabling co-development of cleaning chemistries and process recipes. Ongoing investments in R&D, sustainability-driven chemical reduction, and AI-enabled process optimization further define competition, as suppliers aim to meet the demands of sub-5 nm nodes and increasingly complex 3D device architectures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shibaura Mechatronics Corporation (Japan)

- Modutek Corporation (US)

- Semes Co., Ltd. (South Korea)

- Entegris, Inc. (US)

- Tokyo Electron Limited (Japan)

- KLA Corporation (US)

- SCREEN Holdings Co., Ltd. (Japan)

- Hitachi High-Tech Corporation (Japan)

- Lam Research Corporation (US)

Recent Developments

- In September 2025, Entegris held a “Clean & Sustainable Fluid Delivery Technology Day,” highlighting its latest innovations and commitment to sustainable fluid-management systems across semiconductor manufacturing processes. While not a pure “wafer cleaning tool” launch, this reflects Entegris’ broader emphasis on contamination control, chemical delivery, and yield-enhancement integral complements to wafer cleaning workflows.

- In March 2024, Hitachi High-Tech introduced the LS9300AD a wafer-inspection tool that incorporates a new Differential Interference Contrast (DIC) optical system enabling detection of “low-aspect microscopic defects” on wafer surfaces and backsides. The system retains a rotating-stage wafer edge-grip and supports high throughput front/backside inspection, thereby improving defect detection sensitivity and yield control on unpatterned wafers.

Report Coverage

The research report offers an in-depth analysis based on Equipment type, Wafer size, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced wafer cleaning tools will accelerate as fabs transition to sub-5 nm and future 2 nm nodes.

- Adoption of EUV lithography will increase the need for ultra-low-damage cleaning processes and new chemistries.

- Single-wafer spray systems will gain stronger dominance due to higher precision and compatibility with advanced device architectures.

- Cryogenic CO₂ and dry-clean technologies will expand as fabs prioritize reduced chemical usage and sustainability.

- AI-driven process control and automation will become standard in next-generation cleaning platforms.

- Growth in 3D NAND, GAAFETs, and chiplet-based packaging will drive demand for more complex, selective cleaning solutions.

- Regional fab expansions in Asia-Pacific and North America will significantly boost long-term equipment procurement.

- Power electronics, MEMS, and advanced packaging fabs will increase investments in specialized cleaning tools.

- Vendors will focus on energy-efficient, resource-optimized tools to reduce total cost of ownership.

- Collaborative process development between equipment makers and leading foundries will intensify to meet next-generation cleaning challenges.