Market overview

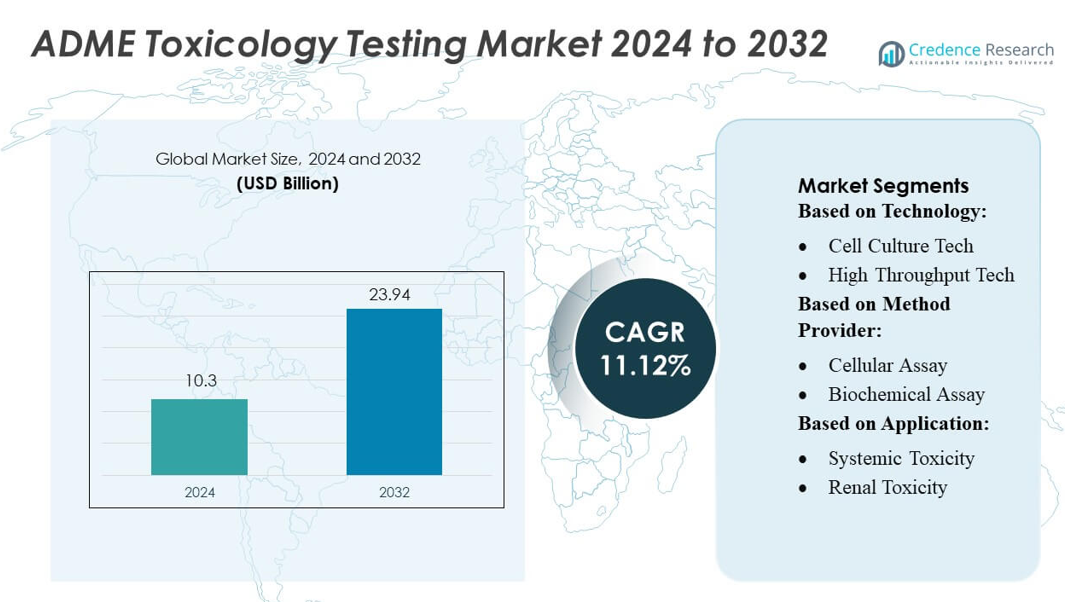

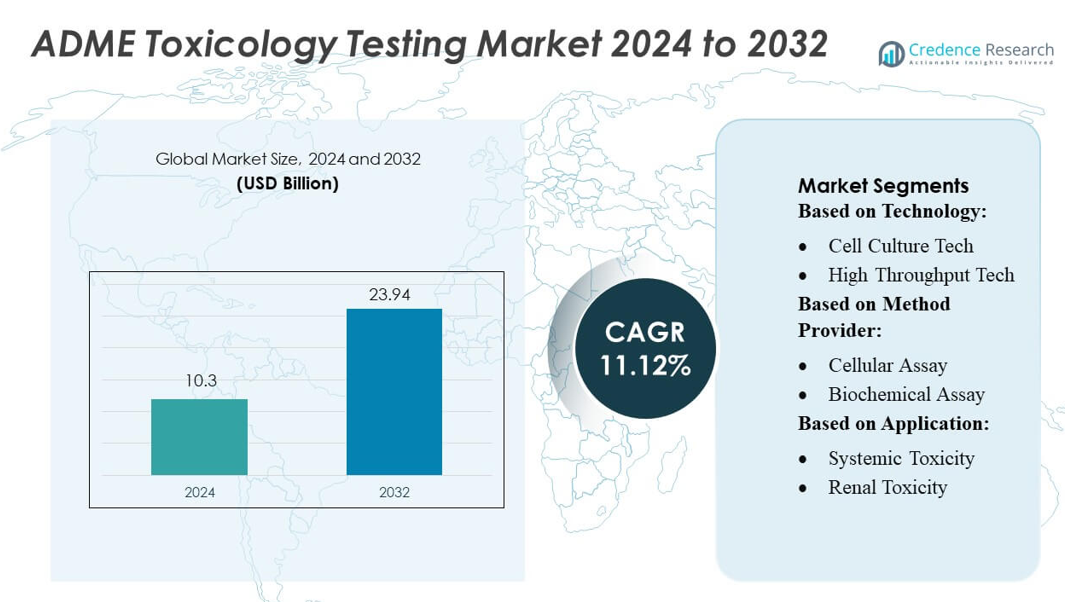

ADME Toxicology Testing Market size was valued USD 10.3 billion in 2024 and is anticipated to reach USD 23.94 billion by 2032, at a CAGR of 11.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ADME Toxicology Testing Market Size 2024 |

USD 10.3 billion |

| ADME Toxicology Testing Market, CAGR |

11.12% |

| ADME Toxicology Testing Market Size 2032 |

USD 23.94 billion |

The ADME toxicology testing market is highly competitive, driven by major players such as Eurofins Scientific, Promega Corporation, Catalent, Inc., Danaher, Labcorp, Thermo Fisher Scientific, Curia Global, Agilent Technologies, Charles River Laboratories, and Dassault Systèmes. These organizations differentiate themselves through broad service portfolios, cutting-edge ADME assay platforms, and strong investments in predictive toxicology and high-throughput screening. They also leverage partnerships and strategic acquisitions to enhance global reach and capacity. North America remains the leading region in this industry, commanding around 41.5% of the global market due to its advanced R&D infrastructure and stringent regulatory environment.

Market Insights

- The ADME toxicology testing market was valued at USD 10.3 billion in 2024 and is projected to reach USD 23.94 billion by 2032 at a CAGR of 11.12%, supported by rising demand for early-stage drug safety evaluation.

- Increasing use of advanced in vitro models, high-throughput screening, and AI-driven predictive tools continues to drive adoption as drug developers seek faster, more accurate toxicology insights.

- Competitive momentum remains strong as leading companies expand service portfolios, invest in innovative ADME platforms, and pursue strategic collaborations to enhance global capabilities.

- Market growth faces restraints such as high implementation costs of advanced analytical systems, limited standardization across regions, and the need for skilled expertise to manage complex testing technologies.

- North America maintains leadership with 41.5% market share, while in vitro ADME testing represents the dominant segment; Asia-Pacific shows the fastest growth due to expanding CRO networks and strengthening biopharmaceutical R&D investment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Within the ADME toxicology testing market, High-Throughput Technology leads the technology segment with an estimated 35–40% share, driven by its ability to automate, miniaturize, and accelerate compound screening across early-stage drug pipelines. Pharmaceutical companies increasingly prefer high-throughput platforms due to their compatibility with robotics, multi-well screening formats, and real-time analytics that reduce cycle time. Cell culture technology retains strong adoption for physiologically relevant modeling, while OMICS technologies and molecular imaging continue gaining traction as developers prioritize more predictive, multi-parameter toxicity assessment.

- For instance, Eurofins Scientific supports a portfolio of over 3,500 drug discovery services and 1,800 products—spanning ADME assays, in vitro phenotypic tests, and safety pharmacology—across its interconnected laboratories.

By Method Provider

Among method providers, Cellular Assays dominate with an estimated 40–45% share, supported by their high predictive accuracy for cytotoxicity, genotoxicity, and metabolism-related adverse effects. Their widespread integration into preclinical workflows stems from improved assay sensitivity, availability of stable cell lines, and compatibility with both 2D and emerging 3D culture formats. Biochemical assays maintain relevance for early mechanistic screening, while in-silico tools rapidly gain adoption for cost-efficient computational predictions. Ex-vivo methods serve niche applications requiring higher physiological fidelity but remain limited by scalability and cost.

- For instance, Promega Corporation demonstrated real-time toxicity profiling of 9,667 Tox21 compounds using two of its assays — the RealTime-Glo™ MT Cell Viability Assay and the CellTox™ Green Cytotoxicity Assay — achieving a signal-to-background ratio of 3–6×, coefficient of variance of 6–8%, and Z′ factor greater than 0.7.

By Application

In the application segment, Hepatotoxicity testing holds the largest share at 30–35%, reflecting the liver’s central role in drug metabolism and its frequent involvement in dose-limiting toxicities. Rising regulatory emphasis on early detection of liver liabilities drives demand for advanced hepatocyte models, 3D liver spheroids, and high-content imaging platforms. Systemic toxicity and renal toxicity follow as key focus areas due to their impact on clinical attrition. Neurotoxicity testing is expanding steadily as CNS-penetrant therapies increase, while other toxicity categories remain essential for comprehensive safety profiling across diverse therapeutic classes.

Key Growth Drivers

Rising Demand for Early-Stage Drug Safety Assessment

Pharmaceutical companies increasingly prioritize early ADME toxicology testing to reduce late-stage drug failures and development costs. As regulatory bodies emphasize robust preclinical safety validation, organizations integrate predictive ADME tools to identify pharmacokinetic issues at the discovery stage. This shift accelerates candidate screening, improves success rates, and reduces financial risks. High-throughput in vitro assays and advanced bioanalytical platforms enable faster, data-rich evaluations, driving broader adoption across drug discovery pipelines. The overall industry focus on efficiency and risk mitigation strongly supports market expansion.

- For instance, Catalent invested up to $40 million to establish its Durham biologics analytical lab, a new 80,000 sq ft facility announced in December 2022. This new center was designed to provide additional capacity for GLP and GMP method development, stability testing, and PK/PD sample analysis, complementing Catalent’s existing analytical capabilities by creating a second major US hub for standalone analytical testing.

Expansion of Biologics and Complex Modalities

The growing pipeline of biologics, cell therapies, nucleic acid drugs, and antibody–drug conjugates is generating demand for specialized ADME toxicology assessments. These modalities require sophisticated evaluation of metabolism, immunogenicity, biodistribution, and off-target toxicity. As developers explore novel drug mechanisms and targeted delivery platforms, testing frameworks must address complex interaction profiles. This trend has accelerated investment in advanced in vitro systems, bioanalytical technologies, and physiologically relevant models, positioning ADME testing as a critical component for ensuring safety, efficacy, and regulatory compliance for next-generation therapeutics.

- For instance, Cytiva division also supports a significant portion of biopharmaceutical production volumes, with their technologies used in the manufacture of 75% of FDA-approved biotherapeutics.

Advancements in High-Throughput and Predictive Technologies

Innovations in computational modeling, machine learning, organ-on-chip, and high-throughput screening systems are transforming ADME toxicology workflows. Predictive algorithms and physiologically based pharmacokinetic (PBPK) models provide more accurate safety forecasting and reduce reliance on animal studies. Microfluidic platforms replicate human organ physiology, enabling real-time assessment of toxicity and metabolism. These technologies significantly accelerate testing cycles, enhance precision, and streamline regulatory submissions. Their growing adoption across CROs and pharma R&D teams continues to push the market toward more automated, data-driven decision-making.

Key Trends & Opportunities

Growing Shift Toward In-Vitro and Alternative Testing Models

Ethical concerns and regulatory encouragement for reducing animal testing are accelerating the use of in vitro assays, 3D cell cultures, and organoid-based toxicology assessments. These platforms provide human-relevant insights, reduce variability, and improve predictive accuracy. As agencies endorse alternative testing methods, developers benefit from shorter timelines and cost-efficient workflows. Opportunities emerge for providers offering validated, scalable in vitro platforms that support early-stage screening and regulatory acceptance. This shift significantly increases the demand for human-centric toxicology solutions.

- For instance, Labcorp now runs approximately 400 in vitro toxicology studies per year, covering GLP- and non-GLP endpoints in both 2D and 3D models.

Increasing Adoption of AI-Enabled Predictive Toxicology

AI and machine learning are becoming essential tools for predicting drug metabolism, toxicity pathways, and pharmacokinetic behavior. These technologies enhance decision-making by analyzing large datasets and identifying patterns that traditional models often miss. Companies increasingly leverage AI-driven tools to optimize lead selection, reduce attrition, and design safer compounds. The continuous development of data-rich ADME databases and automated modeling systems presents strong opportunities for vendors offering interoperable, cloud-based predictive solutions that integrate seamlessly into R&D pipelines.

- For instance, Accelerator™ Drug Development platform—deployed across 700 programs in 14 therapeutic areas—leverages AI models in its OSDPredict™ toolbox to predict formulation behavior using multiple machine-learning algorithms.

Rising Outsourcing to Specialized CROs

Pharmaceutical and biotechnology companies are increasingly outsourcing ADME toxicology testing to contract research organizations to improve efficiency, access advanced technologies, and control operational costs. CROs offer specialized expertise, established workflows, and high-end analytical platforms that many companies prefer not to build internally. As drug pipelines expand, demand grows for CROs capable of high-throughput, complex toxicology studies. This trend creates significant opportunities for CROs to broaden service portfolios and invest in next-generation predictive and bioanalytical tools.

Key Challenges

High Cost and Technical Complexity of Advanced Platforms

Cutting-edge ADME toxicology tools—such as organ-on-chip systems, PBPK modeling, and AI-enabled predictive analytics—require substantial investment in infrastructure, validation, and skilled personnel. Smaller biotech firms often find these technologies financially prohibitive, limiting adoption and slowing market penetration. Additionally, integrating advanced systems into existing workflows can be technically challenging and necessitates continuous staff training. These cost and complexity barriers hinder uniform global adoption and restrict market growth in resource-constrained regions.

Variability in Regulatory Standards Across Regions

Diverse regulatory requirements for toxicology testing create challenges for companies operating across global markets. Differences in acceptance of alternative testing methods, data formats, and validation criteria complicate study design and extend approval timelines. Developers must frequently duplicate tests to satisfy multiple agency expectations, raising operational costs. The lack of harmonization slows the adoption of innovative models and hinders consistent global testing frameworks. Aligning regulatory expectations remains a significant challenge for industry stakeholders seeking streamlined development pathways.

Regional Analysis

North America

North America holds the largest share of the ADME toxicology testing market, accounting for 40–45% of global revenue. The region benefits from strong pharmaceutical and biotechnology industries, high R&D spending, and a large presence of advanced contract research organizations. The FDA’s strict safety requirements encourage companies to invest heavily in early toxicology testing to reduce development risks. The U.S. leads with widespread adoption of high-throughput screening, AI-based toxicity prediction, and in vitro models. Canada also contributes through growing biotech clusters and research funding. These factors make North America the most dominant and technologically advanced market.

Europe

Europe captures around 28–30% of the global market, supported by strong regulatory harmonization across the EU and active adoption of modern, non-animal testing approaches. Countries such as Germany, the U.K., Switzerland, and France host many certified laboratories that offer ADME, bioanalytical, and predictive toxicology services. The region is also a leader in expanding organ-on-chip systems and 3D cell culture models, driven by ethical guidelines encouraging alternatives to animal use. Pharmaceutical hubs and academic research centers across Europe continue to collaborate with CROs, strengthening the demand for comprehensive ADME toxicology solutions.

Asia-Pacific

Asia-Pacific accounts for approximately 20–25% of the market and is the fastest-growing region. China, India, Japan, and South Korea are major contributors, driven by rapid expansion in drug discovery and rising investment in preclinical testing. Many global pharmaceutical companies outsource ADME and toxicology studies to Asia-Pacific due to cost advantages and growing technical capabilities. Governments are also supporting biotech innovation through funding programs and partnerships, which further boosts the establishment of high-quality CROs. Increasing adoption of advanced in vitro testing methods and improved regulatory frameworks continue to accelerate market growth across the region.

Latin America

Latin America represents nearly 5% of the overall ADME toxicology testing market. Although smaller in scale, the region is steadily expanding due to increasing pharmaceutical manufacturing and better alignment with international safety standards. Brazil and Mexico lead market activity, supported by investments in biotechnology parks and emerging CRO infrastructure. More companies in the region are adopting in vitro toxicity methods to reduce development timelines and improve regulatory acceptance. However, limited advanced laboratory capabilities and slower adoption of new testing technologies continue to restrict faster market growth in Latin America.

Middle East & Africa

The Middle East & Africa region contributes about 5–8% to the global market. Growth is driven by increasing government initiatives to strengthen healthcare research capacity, particularly in Saudi Arabia, the UAE, and South Africa. These countries are investing in modern laboratory facilities and partnerships with international CROs to improve local testing capabilities. While adoption of advanced ADME technologies is still limited, the region is gradually increasing its focus on preclinical research, training programs, and regulatory improvements. Despite these developments, market expansion is slower due to gaps in infrastructure and limited R&D spending.

Market Segmentations:

By Technology:

- Cell Culture Tech

- High Throughput Tech

By Method Provider:

- Cellular Assay

- Biochemical Assay

By Application:

- Systemic Toxicity

- Renal Toxicity

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ADME toxicology testing market features a competitive landscape led by major players such as Eurofins Scientific, Promega Corporation, Catalent, Inc., Danaher, Labcorp, Thermo Fisher Scientific, Inc., Curia Global, Inc., Agilent Technologies, Inc., Charles River Laboratories, and Dassault Systèmes. The ADME toxicology testing market is characterized by strong innovation, expanding service capabilities, and increasing adoption of advanced predictive technologies. Companies focus on integrating high-throughput screening, in vitro assays, and computational toxicology tools to deliver faster and more accurate data for early drug development. The shift toward alternative testing methods, including organ-on-chip and 3D cell culture systems, is also shaping competition as providers invest in more human-relevant models. Collaboration with pharmaceutical firms, research institutions, and technology developers continues to rise, enabling broader access to specialized expertise and scalable testing platforms. Overall, competition centers on technological advancement, service quality, regulatory compliance support, and global reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eurofins Scientific

- Promega Corporation

- Catalent, Inc.

- Danaher

- Labcorp

- Thermo Fisher Scientific, Inc.

- Curia Global, Inc.

- Agilent Technologies, Inc.

- Charles River Laboratories

- Dassault Systèmes

Recent Developments

- In October 2025, Accenture announced the launch of its Physical AI Orchestrator platform for manufacturers to build software-defined facilities. The new cloud-based solution combines technologies like NVIDIA Omniverse and AI agents from Accenture’s AI Refinery platform to improve operational efficiency in factories and warehouses.

- In September 2024, Scientist.com partnered with Evotec SE to enhance drug discovery and development processes through its digital marketplace. The partnership incorporates ADME-PK services via Cyprotex, an Evotec company focusing on ADME studies.

- In August 2024, Recursion and Exscientia entered a definitive agreement to create a global leader in technology-enabled drug discovery. This collaboration will combine Recursion’s biology, chemistry, and machine learning expertise with Exscientia’s precision drug design capabilities.

Report Coverage

The research report offers an in-depth analysis based on Technology, Method Provider, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI and machine-learning tools to enhance predictive accuracy in early toxicology screening.

- In vitro and organ-on-chip models will continue to replace animal testing as regulatory bodies support alternative methods.

- High-throughput ADME platforms will expand as drug developers seek faster candidate screening and reduced development timelines.

- Cloud-based data integration and digital workflows will become standard across CROs and pharma R&D units.

- Demand for specialized ADME testing for biologics, RNA therapies, and cell-based drugs will grow steadily.

- Global outsourcing to CROs will rise as companies aim to optimize costs and access advanced technologies.

- harmonization of toxicology testing standards across regions will support smoother regulatory submissions.

- PBPK modeling and computational simulations will gain wider use for predicting human-relevant safety outcomes.

- Emerging markets in Asia-Pacific will see accelerated growth due to expanding biotech ecosystems.

- Investments in microfluidic and 3D culture systems will increase to improve physiological relevance in toxicity evaluation.