Market Overview

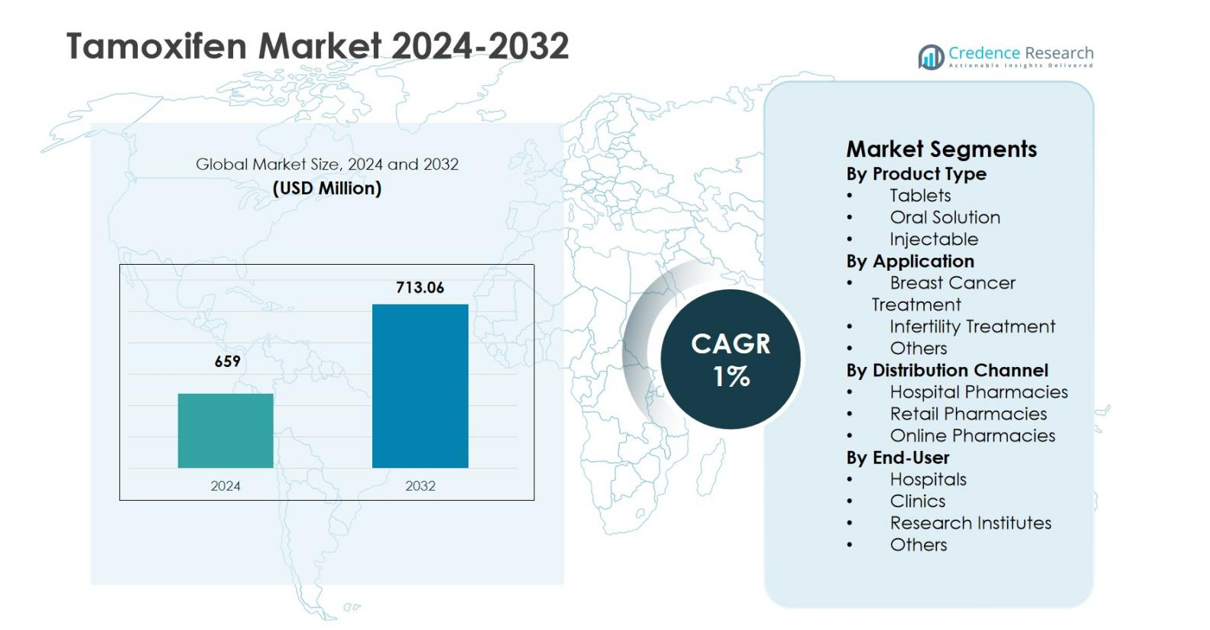

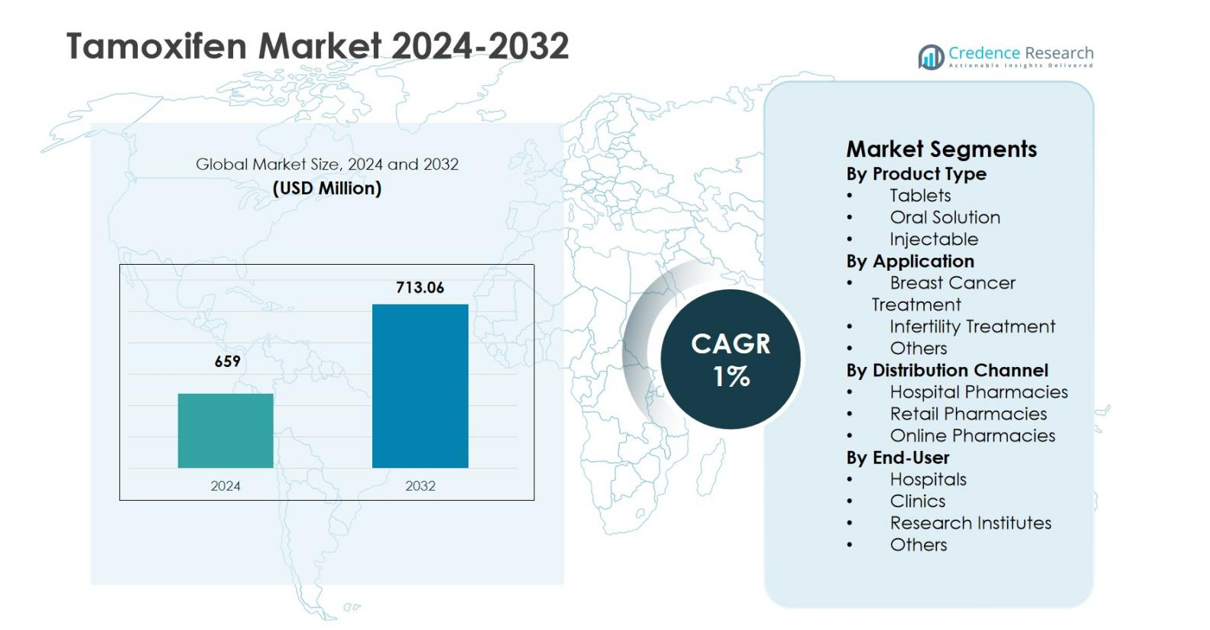

Tamoxifen Market size was valued at USD 659 Million in 2024 and is anticipated to reach USD 713.06 Million by 2032, at a CAGR of 1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tamoxifen Market Size 2024 |

USD 659 Million |

| Tamoxifen Market, CAGR |

1% |

| Tamoxifen Market Size 2032 |

USD 713.06 Million |

Tamoxifen Market is characterized by the strong presence of established pharmaceutical manufacturers including AstraZeneca, Novartis AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited, Dr. Reddy’s Laboratories Ltd., Mylan N.V., and Zydus Cadila, all of which focus on large-scale production and wide distribution of branded and generic formulations. These players benefit from robust manufacturing capabilities, regulatory expertise, and extensive hospital and retail pharmacy networks. Regionally, North America led the Tamoxifen Market with a 36.4% share in 2024, supported by advanced oncology infrastructure and high therapy adoption. Europe followed with 28.7%, driven by standardized treatment protocols, while Asia Pacific held 22.9%, supported by expanding healthcare access and growing generic penetration.

Market Insights

- Tamoxifen Market was valued at USD 659 Million in 2024 and is projected to reach USD 713.06 Million by 2032, growing at a CAGR of 1% during the forecast period, supported by steady long-term demand.

- Growth in the Tamoxifen Market is driven by rising hormone receptor-positive breast cancer cases and long-term endocrine therapy adoption, with the breast cancer treatment segment holding 68.9% share in 2024.

- Market trends indicate strong preference for oral dosage forms, with tablets accounting for 74.6% segment share in 2024, supported by cost efficiency, patient adherence, and wide generic availability.

- Market analysis shows leading participation from global and regional pharmaceutical manufacturers focusing on scale, supply continuity, and hospital and retail pharmacy penetration for sustained volumes.

- Regionally, North America led with 36.4% share in 2024, followed by Europe at 28.7%, Asia Pacific at 22.9%, Latin America at 7.1%, and Middle East & Africa at 4.9%, reflecting varied healthcare access and adoption levels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Tamoxifen Market, by product type, is dominated by tablets, which accounted for 74.6% of the market share in 2024, owing to their established clinical efficacy, ease of administration, and widespread prescription for long-term hormone therapy. Tablets remain the preferred option across oncology treatment protocols due to stable dosing, cost efficiency, and strong patient adherence. Oral solutions held 16.8% share, supported by demand among patients with swallowing difficulties, while injectables represented 8.6%, primarily used in limited clinical settings. Growth is driven by standardized treatment guidelines and broad availability of generic tablet formulations.

- For instance, Teva Pharmaceutical Industries Ltd. offers Tamoxifen Citrate Tablets USP in 10 mg and 20 mg strengths, approved as the AB-rated generic equivalent of AstraZeneca’s Nolvadex Tablets for breast cancer treatment.

By Application

By application, breast cancer treatment led the Tamoxifen Market with a 68.9% market share in 2024, supported by Tamoxifen’s critical role in estrogen receptor-positive breast cancer therapy across early and advanced stages. Strong clinical evidence, inclusion in global oncology protocols, and increasing breast cancer prevalence continue to reinforce dominance. Infertility treatment accounted for 21.4%, driven by off-label use in ovulation induction, particularly in emerging markets. The others segment captured 9.7%, supported by niche hormonal disorder treatments. Market growth is fueled by rising cancer incidence and sustained therapeutic relevance.

- For instance, AstraZeneca’s Nolvadex (10-20 mg twice daily) reduced gynecomastia size in 70% of patients after one month, with 78% complete resolution in series. In McCune-Albright syndrome, 20 mg daily halved vaginal bleeding frequency from 3.56 to 1.73 episodes/year.

By Distribution Channel

Based on distribution channel, hospital pharmacies dominated the Tamoxifen Market with a 52.3% share in 2024, supported by high prescription volumes, oncology-centered dispensing, and institutional treatment pathways. Hospitals remain the primary access point for cancer therapies, ensuring consistent demand. Retail pharmacies followed with a 34.1% share, driven by long-term outpatient therapy and repeat prescriptions. Online pharmacies held 13.6%, supported by digital health adoption and home-delivery convenience. Growth across channels is driven by chronic treatment duration, expanding generic availability, and improving pharmaceutical distribution infrastructure.

Key Growth Drivers

Rising Global Breast Cancer Incidence

The Tamoxifen Market continues to expand due to the increasing global incidence of hormone receptor-positive breast cancer. Tamoxifen remains a first-line endocrine therapy across early and advanced disease stages, reinforcing consistent prescription volumes. Growing awareness, early screening programs, and improving diagnostic rates are increasing patient inflow into long-term treatment regimens. Its proven efficacy, affordability, and inclusion in international oncology guidelines support sustained demand across both developed and emerging healthcare systems, making breast cancer prevalence a central driver of market growth.

- For instance, Teva Pharmaceuticals’ Tamoxifen Citrate Tablets USP, the generic equivalent of AstraZeneca’s Nolvadex, demonstrated proportional recurrence reductions of 47% in ER-positive breast cancer patients treated for about 5 years, based on clinical data from node-positive cases post-mastectomy.

Expanding Access to Cost-Effective Generic Therapies

The widespread availability of generic Tamoxifen significantly supports market expansion by improving affordability and accessibility. Generic formulations dominate prescriptions in public hospitals and retail pharmacies, particularly in price-sensitive regions. Reduced treatment costs enable prolonged therapy adherence, especially in adjuvant breast cancer care requiring multi-year administration. Government initiatives promoting generic drug utilization and expanding reimbursement coverage further strengthen adoption, driving volume growth despite the market’s modest overall pricing dynamics.

- For instance, Mamofen 20mg tablets, a generic Tamoxifen citrate formulation, are widely stocked in retail pharmacies across India at prices as low as ₹2.7 per tablet.

Growth in Off-Label and Adjunct Applications

The Tamoxifen Market benefits from expanding off-label use, particularly in infertility management and hormonal imbalance treatments. Physicians increasingly prescribe Tamoxifen for ovulation induction due to its favorable safety profile and oral administration. Growth in fertility clinics, delayed parenthood trends, and rising awareness of reproductive health treatments support broader application. This diversification beyond oncology enhances market stability and offsets slower growth in mature breast cancer treatment segments.

Key Trends & Opportunities

Shift Toward Long-Term Hormonal Therapy Adoption

A notable trend in the Tamoxifen Market is the growing emphasis on extended hormonal therapy durations. Clinical evidence supporting prolonged Tamoxifen use for recurrence prevention is influencing treatment protocols, increasing cumulative drug consumption per patient. This shift enhances prescription continuity and strengthens demand across hospital and retail channels. The trend creates opportunities for manufacturers to focus on patient-friendly formulations and adherence-support programs to sustain long-term therapy compliance.

- For instance, Soltamox offers a liquid Tamoxifen citrate formulation bioequivalent to tablets, with a CAPTURE survey of 626 patients showing 22% willingness to switch for better adherence during extended therapy. This patient-friendly option aids long-term compliance.

Expansion in Emerging Healthcare Markets

Emerging economies present significant growth opportunities for the Tamoxifen Market due to expanding oncology infrastructure and improving access to essential cancer drugs. Rising healthcare investments, increasing insurance penetration, and government-supported cancer care programs are improving treatment reach. Local manufacturing and favorable regulatory pathways for generics further support market penetration. These developments position emerging regions as key volume growth contributors over the forecast period.

- For instance, India’s Pradhan Mantri Jan Arogya Yojana (PMJAY) covers over 68 lakh cancer treatments worth ₹13,000 crore, enabling timely access to drugs like Tamoxifen within 30 days for beneficiaries, with a 90% rise in on-time treatment starts.

Key Challenges

Limited Innovation and Product Differentiation

The Tamoxifen Market faces challenges from limited innovation and minimal product differentiation. As a mature, off-patent drug, Tamoxifen lacks significant formulation advancements, restricting pricing flexibility and differentiation. Market participants primarily compete on cost and distribution reach, which compresses margins. This environment limits incentives for research investment and constrains opportunities for premium product positioning. Additionally, intense generic competition increases price erosion, pressures profitability, and forces manufacturers to prioritize operational efficiency and volume-driven strategies over innovation-focused development initiatives.

Side Effects and Availability of Alternative Therapies

Adverse effects associated with long-term Tamoxifen use, including thromboembolic risks and endometrial complications, pose challenges to sustained adoption. Additionally, the availability of alternative endocrine therapies, such as aromatase inhibitors, offers clinicians multiple treatment options. In certain patient populations, these alternatives are increasingly preferred, potentially limiting Tamoxifen prescription growth and creating pressure within hormone therapy regimens, particularly among postmenopausal patients and those with higher risk profiles requiring tailored treatment approaches.

Regional Analysis

North America

North America accounted for 36.4% of the Tamoxifen Market share in 2024, driven by a high prevalence of breast cancer, strong screening programs, and well-established oncology treatment protocols. The region benefits from early diagnosis, high therapy adherence, and widespread use of endocrine therapies across hospital and retail pharmacies. Favorable reimbursement frameworks and strong presence of branded and generic manufacturers support sustained demand. The United States remains the key contributor due to advanced healthcare infrastructure and long-term hormone therapy adoption, reinforcing North America’s leading position in the global Tamoxifen Market.

Europe

Europe held 28.7% of the Tamoxifen Market share in 2024, supported by comprehensive cancer care systems and strong adoption of standardized treatment guidelines. Countries such as Germany, the United Kingdom, and France drive regional demand through national breast cancer screening programs and broad access to generic medications. Government-funded healthcare and high prescription volumes in hospital pharmacies strengthen market stability. Long-term adjuvant therapy practices and increasing focus on cost-effective oncology drugs continue to sustain Tamoxifen utilization across both Western and Eastern European markets.

Asia Pacific

Asia Pacific captured 22.9% of the Tamoxifen Market share in 2024, driven by rising breast cancer incidence, expanding healthcare access, and growing adoption of generic drugs. Large patient populations in China and India, combined with improving diagnostic capabilities, significantly contribute to regional growth. Government initiatives to expand cancer treatment coverage and increased availability of low-cost formulations support wider adoption. Rapid growth in hospital infrastructure and retail pharmacy networks further strengthens demand, positioning Asia Pacific as a key volume-driven market.

Latin America

Latin America accounted for 7.1% of the Tamoxifen Market share in 2024, supported by improving access to oncology treatments and increasing awareness of breast cancer management. Countries such as Brazil and Mexico lead regional demand due to expanding public healthcare programs and rising use of essential cancer medicines. Growth is reinforced by the availability of affordable generics through hospital and retail pharmacies. Despite infrastructure limitations in some areas, ongoing healthcare investments and improving diagnostic reach continue to support steady market expansion.

Middle East & Africa

The Middle East & Africa region held 4.9% of the Tamoxifen Market share in 2024, driven by gradual improvements in cancer care infrastructure and increasing focus on women’s health. Urban centers in the Middle East show stronger adoption due to better access to oncology services and hospital pharmacies. In Africa, demand is supported by international health initiatives and expanding access to essential medicines. Although disparities in healthcare access persist, rising awareness and government-led cancer programs contribute to consistent regional demand growth.

Market Segmentations:

By Product Type

- Tablets

- Oral Solution

- Injectable

By Application

- Breast Cancer Treatment

- Infertility Treatment

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End-User

- Hospitals

- Clinics

- Research Institutes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape analysis of the Tamoxifen Market reflects a mature and highly genericized environment led by major pharmaceutical players such as AstraZeneca, Novartis AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited, Dr. Reddy’s Laboratories Ltd., Mylan N.V., and Zydus Cadila. These companies compete primarily on pricing, manufacturing scale, and distribution reach rather than product differentiation, as Tamoxifen is an off-patent therapy. Strong emphasis remains on ensuring consistent supply across hospital and retail pharmacies, particularly for long-term breast cancer treatment. Players with vertically integrated operations and broad geographic presence maintain advantages in cost efficiency and regulatory compliance. Expansion in emerging markets, strengthened generic portfolios, and optimized supply chains remain central strategies supporting sustained competition and stable market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Actinium Pharmaceuticals presented new preclinical data for its first-in-class targeted radiotherapy ATNM-400 showing potent activity in tamoxifen- and trastuzumab-resistant breast cancer models at the 2025 San Antonio Breast Cancer Symposium.

- In March 2025, Scotland’s National Cancer Medicines Advisory Group supported tamoxifen as a risk-reducing breast cancer treatment pathway update.

- In December 2024, Kwality Pharmaceuticals Ltd. (KPL) received approval from the South African Health Products Regulatory Authority (SAHPRA) for its Tamoxifen 20mg Tablet

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tamoxifen Market will continue to benefit from its established role in hormone receptor-positive breast cancer therapy.

- Long-term endocrine treatment protocols will support consistent prescription volumes across healthcare settings.

- Generic drug dominance will sustain affordability and broad patient access globally.

- Expanding breast cancer screening programs will increase early diagnosis and treatment initiation rates.

- Growing off-label use in infertility management will diversify application demand.

- Emerging markets will contribute higher patient volumes due to improving healthcare access.

- Hospital pharmacies will remain the primary distribution channel for oncology treatments.

- Retail and online pharmacies will gain traction through chronic therapy refills and convenience.

- Price competition will remain intense due to limited product differentiation.

- Continued inclusion in international treatment guidelines will reinforce long-term market stability.