Market Overview

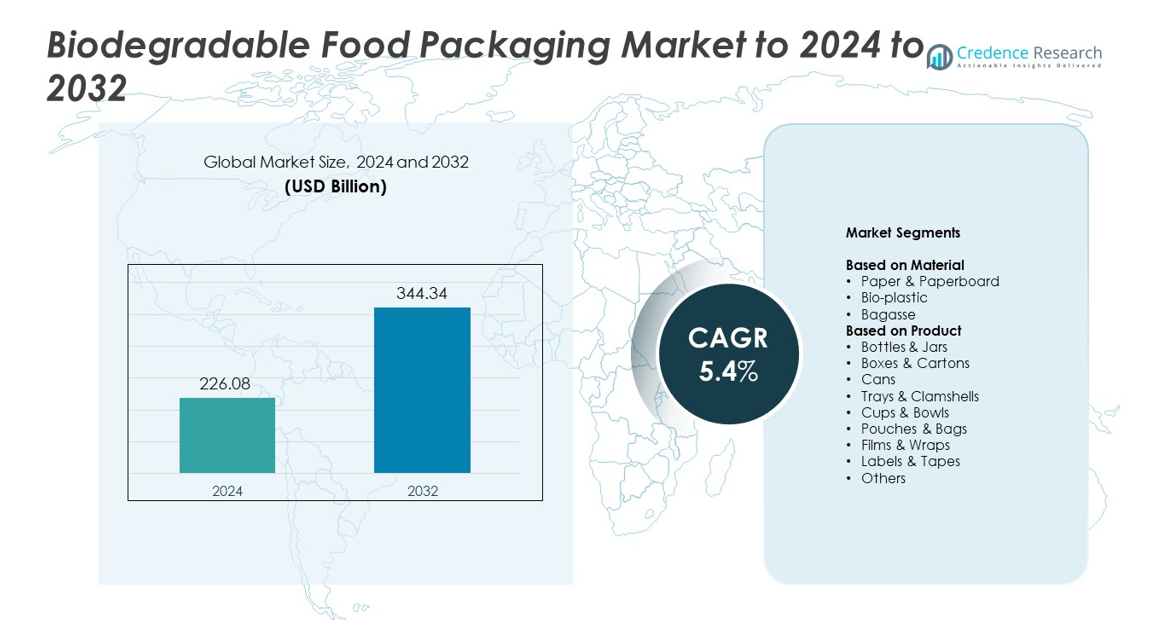

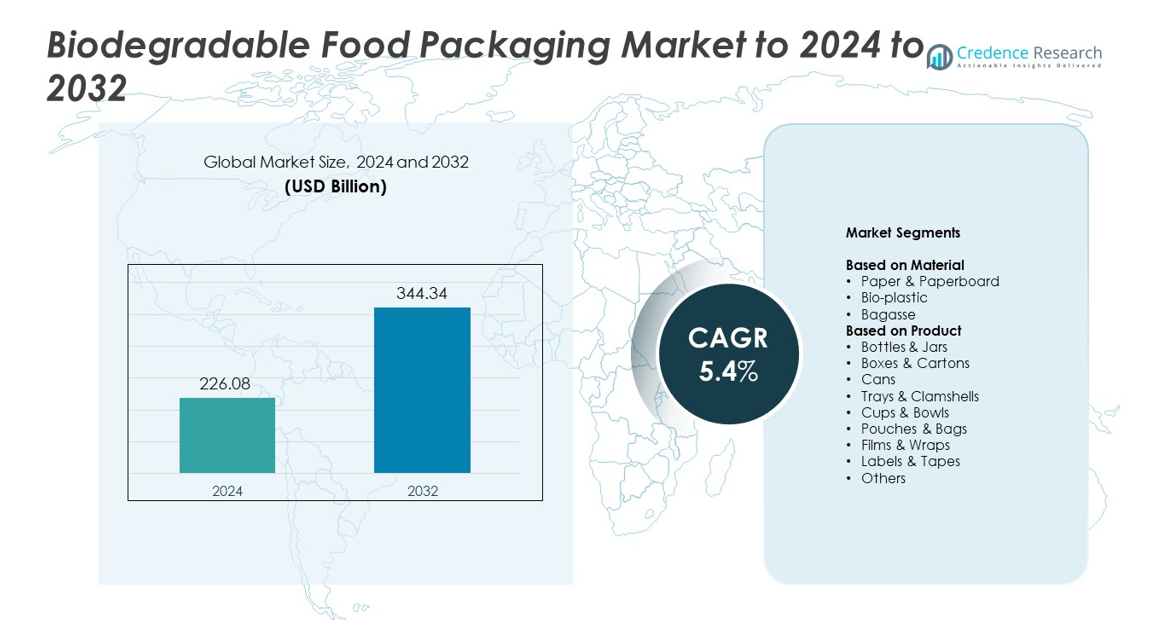

Biodegradable Food Packaging Market size was valued at USD 226.08 Billion in 2024 and is anticipated to reach USD 344.34 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodegradable Food Packaging Market Size 2024 |

USD 226.08 Billion |

| Biodegradable Food Packaging Market, CAGR |

5.4% |

| Biodegradable Food Packaging Market Size 2032 |

USD 344.34 Billion |

The biodegradable food packaging market includes leading companies such as Tetra Pak, Smurfit Westrock, Greenhope, Mondi, Notpla Limited, DS Smith, Amcor plc, Stora Enso, Elevate Packaging, and Sonoco Products Company. These players expand bio-based portfolios and invest in fiber, compostable film, and molded packaging technologies to meet rising sustainability demands from food manufacturers and retailers. They collaborate with foodservice chains and e-commerce platforms to scale recyclable and compostable formats across major applications. North America led the market in 2024 with about 34% share, followed by Europe with nearly 31%, supported by strong regulations, advanced recycling systems, and high consumer preference for eco-friendly packaging.

Market Insights

- The biodegradable food packaging market was valued at USD 226.08 Billion in 2024 and is projected to reach USD 344.34 Billion by 2032, growing at a CAGR of 5.4%.

- Strong market growth is driven by rising bans on single-use plastics and higher demand for safe, eco-friendly materials across foodservice, retail, and delivery sectors.

- Key trends include rapid expansion of molded fiber trays, coated paperboard, and high-barrier compostable films, with fiber-based products holding the largest material share at about 47%.

- Leading companies focus on recyclable designs, bio-based coatings, and circular packaging models to stay competitive as buyers demand low-carbon, compliant alternatives.

- North America led the market with about 34% share in 2024, followed by Europe at nearly 31% and Asia Pacific with about 26%, supported by strong regulatory pressure and fast adoption in takeaway, bakery, and ready-meal applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Paper and paperboard dominated the material segment in 2024 with about 47% share due to strong adoption across foodservice, bakery, and ready-to-eat products. Brands preferred these materials because they offer high printability, wide recycling access, and lower contamination risk for fresh foods. Governments also supported this shift through bans on single-use plastics and incentives for fiber-based packaging expansion. Bio-plastic gained steady traction as compostable grades improved performance, while bagasse advanced through rising demand for molded fiber trays and cutlery, yet paper and paperboard stayed in the lead due to mature supply chains and high consumer acceptance.

- For instance, Stora Enso is doubling formed-fiber capacity at its Hylte mill. Annual output is rising from about 50 million to around 115 million units for food bowls, trays, and lids.

By Product

Boxes and cartons led the product segment in 2024 with nearly 29% share, driven by growing demand for takeaway meals, bakery items, and online grocery shipments. Food brands used these formats because they provide strong structural rigidity and better protection during transport. Rising quick-service restaurant activity boosted the use of folding cartons made from recyclable kraft and coated boards. Cups and bowls gained momentum in ready-to-eat categories, while pouches, films, and wraps expanded with barrier-grade bio-material development. However, boxes and cartons maintained leadership due to large-scale conversion capacity and broad use across retail and foodservice channels.

- For instance, in their 2023/24 fiscal year, DS Smith produced approximately 4.1 million metric tons of containerboard material, the paper used to make corrugated boxes.

Key Growth Drivers

Rising Global Restrictions on Single-Use Plastics

Governments expanded bans and levies on single-use plastics, which pushed food brands toward biodegradable packaging as a primary replacement. These rules accelerated the shift in retail, foodservice, and delivery sectors, where compliance deadlines created rapid procurement changes. Producers increased output of compostable and fiber-based formats to match regulatory timelines. Retailers also adopted biodegradable solutions to strengthen sustainability credentials. This regulatory momentum became the strongest growth driver across emerging and developed markets.

- For instance, before switching to paper straws, McDonald’s in the UK used around 1.8 million plastic straws daily.

Growing Demand for Sustainable and Safe Food Packaging

Consumers preferred packaging made from natural, compostable, or plant-based inputs due to rising environmental and health awareness. Food brands responded by reformulating packaging to reduce chemical migration risk and improve end-of-life disposal. This shift supported strong adoption of biodegradable trays, bowls, and wraps in convenience foods. Companies used sustainability labeling to attract eco-focused buyers, which boosted replacement of conventional plastics. High visibility on e-commerce platforms further amplified demand and reinforced this driver.

- For instance, Tetra Pak estimates that about 1.2 million tonnes of beverage cartons were collected and sent for recycling in 2021.

Expansion of Quick-Service Restaurants and Online Food Delivery

The growth of quick-service restaurants and rapid expansion of app-based food delivery increased demand for biodegradable containers, cartons, cups, and bags. Food chains adopted fiber-based and compostable formats to meet rising takeaway volumes and lower their environmental footprint. Packaging suppliers scaled molded fiber and coated paperboard lines to support heavier loads and temperature variations. Growth in cloud kitchens and ready-meal brands also strengthened consistent procurement of biodegradable solutions, making this a major contributor to overall market expansion.

Key Trends and Opportunities

Advancements in Compostable and Bio-Based Materials

Producers accelerated development of high-barrier compostable films, heat-resistant biopolymers, and improved molded fiber designs. These upgrades allowed biodegradable packaging to replace synthetic plastics in fresh foods, sauces, frozen meals, and ready-to-eat products. Innovations in PLA blends, PHA resins, and water-based coatings opened new applications where durability and moisture resistance were earlier concerns. This trend created opportunities for brands to reduce plastic waste without sacrificing shelf life or product security.

- For instance, NatureWorks’ Blair, Nebraska plant has a nameplate capacity of about 150,000 metric tons of Ingeo PLA each year.

Growth of Circular Packaging and Closed-Loop Systems

Demand increased for packaging that fits into composting, recycling, or hybrid recovery systems. Retailers partnered with waste operators to expand organics collection and improve sorting for fiber-based materials. Food chains introduced take-back programs for compostable containers, while cities upgraded composting facilities to handle higher bioplastic volumes. These developments created strong opportunities for packaging firms that design materials aligned with circularity targets and municipal processing capabilities.

- For instance, the use of a Universal Bottle program in Brazil meant Coca-Cola produced approximately 1.8 billion fewer single-use bottles annually in the country as of 2019.

Rising Adoption of Eco-Friendly Branding Strategies

Food manufacturers used biodegradable packaging to strengthen brand image and meet corporate sustainability goals. Companies redesign packs with minimalist fiber materials, natural colors, and clear environmental claims. This trend offered opportunities for premium positioning, especially in organic, clean-label, and health-focused categories. Retailers promoted eco-friendly packaging as part of loyalty programs and private-label upgrades, increasing visibility for biodegradable formats across large retail chains.

Key Challenges

Limited Industrial Composting and Waste Processing Infrastructure

Many regions lacked adequate composting facilities that can handle biodegradable materials at large scale. This gap restricted proper end-of-life processing and reduced the environmental benefit of compostable formats. Some bioplastics require controlled conditions that municipal systems cannot yet support. As a result, packaging often ends up in landfills, limiting adoption among food producers who face stricter sustainability auditing. The slow pace of infrastructure expansion remained a major challenge for the market.

Higher Production Costs Compared to Conventional Plastics

Biodegradable packaging materials often cost more due to expensive feedstocks, complex processing, and lower economies of scale. These higher costs created barriers for small food businesses and price-sensitive markets. Fluctuations in agricultural raw materials also affected pricing stability for fiber-based and bioplastic grades. Manufacturers struggled to balance premium inputs with competitive pricing, especially in mass-market food categories. This challenge slowed faster substitution of traditional plastics in several regions.

Regional Analysis

North America

North America held about 34% share in 2024, driven by strong adoption of eco-friendly materials across packaged foods, beverages, and foodservice chains. Brands invested in compostable trays, fiber cartons, and bio-based films due to strict state-level plastic bans. Large retailers expanded private-label sustainable packaging programs, while quick-service restaurants shifted to biodegradable cups and clamshells. Growth in online grocery and meal-kit services increased demand for recyclable and compostable formats. Strong consumer preference for low-waste packaging and expansion of municipal composting facilities helped the region maintain its leading position.

Europe

Europe accounted for nearly 31% share in 2024, supported by advanced recycling frameworks and strict regulations targeting plastic reduction. Food manufacturers transitioned rapidly to biodegradable cartons, molded fiber products, and certified compostable films under extended producer responsibility rules. High adoption of sustainable labels encouraged retailers to expand fiber-based formats across fresh produce and bakery categories. Investment in circular systems and industrial composting enhanced material recovery, while regional sustainability goals accelerated innovation. The region’s strong regulatory push and consumer awareness kept Europe a major contributor to global biodegradable packaging growth.

Asia Pacific

Asia Pacific captured about 26% share in 2024, fueled by rising food delivery volumes, large urban populations, and increasing restrictions on single-use plastics across major economies. Restaurants and street-food operators adopted biodegradable containers, bowls, and cutlery to align with city-level waste rules. Expanding supermarket chains used fiber-based packaging to reduce plastic waste in fresh produce. Growth in e-commerce grocery and ready-meal categories increased demand for compostable films and paper-based pouches. Rapid industrialization and government-backed sustainability programs strengthened market penetration across emerging markets, making Asia Pacific one of the fastest-growing regions.

Latin America

Latin America held close to 6% share in 2024, supported by early-stage adoption of biodegradable cartons, bags, and molded fiber trays in foodservice and retail channels. Countries introduced plastic bag bans and producer responsibility rules that encouraged fiber and bagasse usage. Local food brands used compostable materials to differentiate in competitive categories such as snacks, bakery, and beverages. Growth in organic and natural food products also boosted demand for sustainable packaging solutions. Infrastructure gaps in composting limited wider uptake, yet regulatory momentum and rising consumer awareness sustained steady expansion.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share in 2024, driven by gradual policy shifts toward reducing plastic waste in urban centers. Food manufacturers explored biodegradable films and fiber-based trays to meet emerging sustainability requirements from retailers and hospitality groups. Growing quick-service restaurant networks increased demand for compostable cups and takeout packs. Adoption remained moderate due to limited waste-processing capacity, yet pilot composting projects and rising consumer interest in eco-friendly packaging supported early market growth. International brands operating in the region accelerated the shift toward biodegradable materials through regional sourcing partnerships.

Market Segmentations:

By Material

- Paper & Paperboard

- Bio-plastic

- Bagasse

By Product

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays & Clamshells

- Cups & Bowls

- Pouches & Bags

- Films & Wraps

- Labels & Tapes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The biodegradable food packaging market is shaped by major players such as Tetra Pak, Smurfit Westrock, Greenhope, Mondi, Notpla Limited, DS Smith, Amcor plc, Stora Enso, Elevate Packaging, and Sonoco Products Company. These companies expand bio-based portfolios by investing in molded fiber technology, compostable coatings, and recyclable paper-based formats to meet rising regulatory and consumer sustainability demands. Manufacturers focus on high-barrier solutions that support dairy, beverages, ready meals, and fresh produce without relying on traditional plastics. Many groups strengthen competitiveness through partnerships with foodservice chains aiming to reduce plastic waste and adopt circular materials. Production facilities increasingly use renewable feedstocks, lightweight designs, and water-based dispersion barriers to improve environmental performance. Several firms collaborate with recyclers and composting operators to ensure better end-of-life processing and compliance with global waste policies. Continuous innovation in plant-based films, pulp-based containers, and renewable fiber solutions supports wider adoption across retail, e-commerce, and quick-service channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tetra Pak

- Smurfit Westrock

- Greenhope

- Mondi

- Notpla Limited

- DS Smith

- Amcor plc

- Stora Enso

- Elevate Packaging

- Sonoco Products Company

Recent Developments

- In April 2025, Stora Enso launched Performa Nova, a high-yield folding boxboard designed for renewable, recyclable, and efficient food packaging including dry, frozen, and chilled foods.

- In 2024, Smurfit Kappa and WestRock combined to form Smurfit Westrock, a global leader in sustainable paper-based packaging.

- In 2023, Mondi and Veetee launched the first dry rice pack made from recyclable functional barrier paper, replacing plastic packaging.

Report Coverage

The research report offers an in-depth analysis based on Material, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more countries tighten rules on single-use plastics.

- Demand will rise with food brands adopting fiber-based and compostable packaging for sustainability goals.

- Bioplastic production capacity will increase as manufacturers invest in advanced PHA and PLA technologies.

- Quick-service restaurants and delivery platforms will accelerate the shift toward biodegradable takeaway solutions.

- Retailers will boost private-label products using eco-friendly packaging to strengthen brand reputation.

- Improvements in composting infrastructure will enhance recovery rates for biodegradable materials.

- Innovation in high-barrier compostable films will unlock new applications in frozen and ready-to-eat foods.

- Growth in organic and health-focused foods will support wider use of biodegradable formats.

- Circular packaging systems will expand as cities adopt composting and collection programs.

- Emerging markets will see faster adoption due to rising environmental awareness and regulatory reforms.