Market Overview

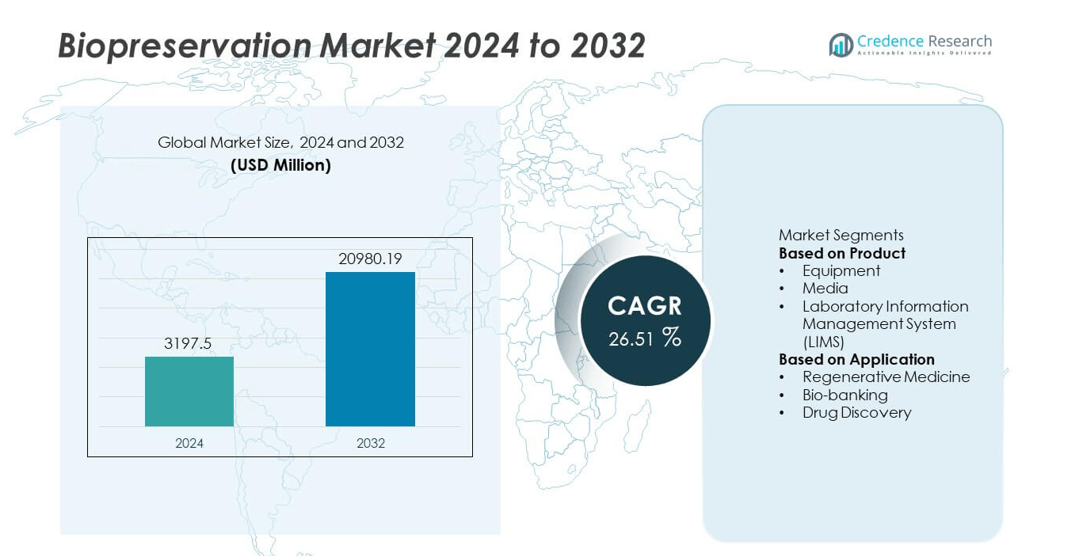

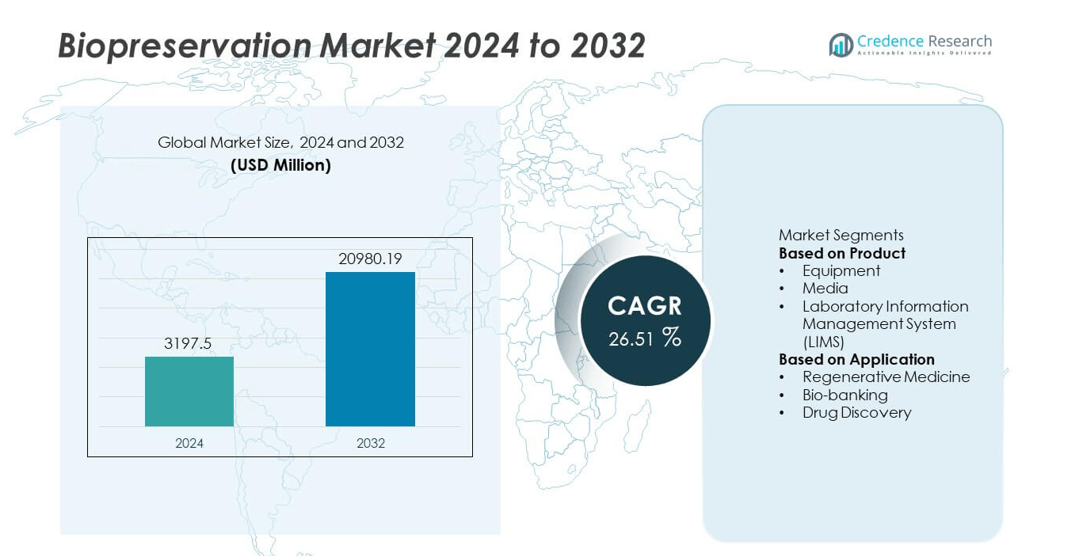

The Biopreservation market was valued at USD 3,197.5 million in 2024 and is projected to reach USD 20,980.19 million by 2032, expanding at a CAGR of 26.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biopreservation Market Size 2024 |

USD 3,197.5 million |

| Biopreservation Market, CAGR |

26.51% |

| Biopreservation Market Size 2032 |

USD 20,980.19 million |

The Biopreservation market is shaped by leading players such as Thermo Fisher Scientific, Inc., Panasonic Corporation, Azenta US, Inc., BioLife Solutions, MVE Biological Solutions, LabVantage Solutions, Inc., Taylor-Wharton, PrincetonCryo, X-Therma Inc., and Biomatrica, Inc. These companies provide cryogenic storage systems, advanced preservation media, and LIMS platforms that support long-term stability of cells, tissues, and genetic material. North America leads the market with a 41% share, driven by strong cell and gene therapy research and expanding biobanking networks. Europe holds 29% due to high pharmaceutical R&D investment, while Asia Pacific accounts for 22% as stem cell banking and regenerative medicine adoption grows across China, Japan, South Korea, and India.

Market Insights

- The Biopreservation market reached USD 3,197.5 million in 2024 and is projected to grow at a 26.51% CAGR through 2032, driven by rapid expansion in cell therapy, gene therapy, and long-term biological material storage.

- Growing demand for regenerative medicine, clinical biobanking, and personalized therapies accelerates adoption of preservation systems, with equipment holding a 61% segment share due to extensive use of cryogenic freezers and liquid nitrogen storage across research and clinical environments.

- Key trends include automation, AI-supported LIMS platforms, and next-generation cryoprotectants that enhance sample viability and reduce freeze–thaw degradation, supporting wider adoption in oncology, reproductive medicine, and population genomics programs.

- Competition intensifies as major companies invest in advanced cold-chain infrastructure, contamination-free storage systems, and validated logistics solutions, while high capital cost and strict regulatory compliance remain restraints for small laboratories and resource-limited healthcare settings.

- North America leads with 41% regional share, followed by Europe at 29% and Asia Pacific at 22%, reflecting strong investment in genomic research; Latin America holds 5% and Middle East & Africa 3%, supported by gradual expansion of biobanking and fertility preservation services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

Equipment dominates the Biopreservation market with a 61% share, supported by the rising demand for advanced cryogenic freezers, cold-chain storage units, and liquid nitrogen systems to preserve cells, tissues, and viral vectors. Pharmaceutical companies, biobanks, and stem cell research centers increasingly adopt automated storage and monitoring solutions to maintain sample integrity and traceability. The media segment continues to grow as cryoprotectants and specialized preservation solutions gain importance in maintaining cell viability for cell and gene therapy development. Laboratory Information Management Systems (LIMS) hold a smaller but expanding share as digital platforms streamline sample tracking, regulatory compliance, and data management across research and clinical environments.

- For instance, BioLife Solutions reported in peer-reviewed studies and company data sheets that its CryoStor CS10 solution generally results in superior post-thaw T-cell and stem cell recovery and viability compared to conventional home-brew formulations, often showing a 1.5 to 2.3-fold increase in the recovery of viable specific cell populations (such as viable CD34+ cells and granulocytes) and enhanced post-thaw functionality.

By Application:

Regenerative medicine leads with a 48% share, driven by rapid growth of stem cell therapies, CAR-T cell treatments, and personalized medicine, all of which require highly controlled preservation to maintain therapeutic potential. The biobanking segment shows strong expansion as public and private organizations store human biological samples for genomic, translational, and population health research. Drug discovery applications benefit from biopreservation systems that support high-throughput screening, cell-line preservation, and long-term storage of biomaterials used in therapeutic development. Advances in reproductive medicine, oncology, and precision therapies continue to reinforce market adoption across research and clinical applications.

- For instance, Panasonic Corporation deployed ultra-low temperature systems operating at –150°C that supported storage of 8,000 engineered cell lines for oncology drug screening studies.

Key Growth Drivers

Rising Demand for Cell and Gene Therapies

Growing adoption of cell and gene therapies accelerates the need for reliable biopreservation systems that maintain cell viability and functional stability. CAR-T therapy, stem cell treatments, and personalized immunotherapies rely on cryogenic preservation to support transportation, long-term storage, and clinical use. Pharmaceutical companies and research institutes expand biobanking capacities to store therapeutic cell lines and clinical-grade biomaterials. Increased FDA and EMA approvals for advanced therapies reinforce demand for next-generation freezers, cryoprotectants, and temperature-controlled logistics. This driver strongly supports market expansion across regenerative medicine, oncology, and rare disease treatment.

- For instance, MVE Biological Solutions manufactures high-efficiency cryogenic freezers, such as the MVE 1894R-190 model, capable of storing up to 94,500 1.2/2.0 mL clinical cell therapy vials at temperatures around –190°C. These systems are designed for reliable use in global logistics networks and life science applications.

Expansion of Biobanking and Genomic Research Programs

Rapid growth of biobanking initiatives enables long-term preservation of DNA, RNA, tissues, and biofluids for population health studies and precision medicine programs. Public health agencies and academic institutes invest in large-scale sample repositories to support biomarker discovery and disease surveillance. Pharmaceutical companies rely on preserved biological materials for high-throughput screening and preclinical research. Increasing funding for genomics and personalized medicine boosts adoption of liquid nitrogen storage systems and automated sample management platforms. This expansion strengthens commercial opportunities for media, cryogenic equipment, and LIMS software.

- For instance, Thermo Fisher Scientific provides equipment and infrastructure for the storage of biological and genomic samples at cryogenic temperatures, including in national research programs.

Increasing Focus on Cold-Chain and Temperature-Controlled Logistics

Global distribution of biological therapeutics, vaccines, and clinical trial specimens strengthens demand for advanced cold-chain biopreservation solutions. Ultra-low temperature freezers, portable cryogenic containers, and real-time monitoring systems ensure sample quality during long-distance transportation. Growth in decentralized clinical trials and cross-border research collaborations increases reliance on validated shipping protocols and insulated biologics containers. Pharmaceutical logistics providers integrate IoT-enabled tracking to prevent temperature excursions, reducing sample loss and regulatory risk. This trend reinforces equipment upgrades and logistics partnerships across biotechnology and healthcare networks.

Key Trends & Opportunities

Adoption of Automated and AI-Enabled Preservation Systems

Automation in storage, retrieval, and sample tracking reduces manual handling errors and enhances regulatory compliance. AI-driven LIMS platforms improve sample lifecycle management, integrity monitoring, and predictive maintenance of cryogenic systems. Robotic sample handling and barcode/RFID tracking support large biobanks and high-throughput research environments. Cloud-based data integration offers remote accessibility for distributed research teams. These advancements create strong opportunities for technology vendors focused on workflow optimization and digitalization of biological repositories.

- For instance, Azenta Life Sciences offers a range of automated cryogenic storage systems, such as the CryoArc Deca model, which is capable of rapid box-level retrieval in less than 60 seconds.

Growing Opportunity in Fertility Preservation and Reproductive Medicine

Demand for cryopreservation of embryos, oocytes, and reproductive tissues rises as fertility clinics expand treatment services and preservation programs. Cancer patients undergoing chemotherapy increasingly pursue cryopreservation for fertility protection. Advancements in vitrification media and closed-system freezing devices improve post-thaw success rates. Growth of elective egg freezing and third-party reproduction further strengthens adoption. This emerging segment supports broader use of biopreservation solutions in clinical practices beyond traditional biobanking and therapeutic research.

- For instance, PrincetonCryo supplies cryogenic equipment and storage systems that support the use of modern closed-chamber vitrification technology, which enables fertility centers to improve workflow throughput.

Key Challenges

High Cost of Cryogenic Storage and Infrastructure

Significant capital investment is required for ultra-low temperature freezers, liquid nitrogen systems, and specialized monitoring devices. Maintenance, energy consumption, and backup power needs increase operational costs, particularly for large biobanks. Small research labs and low-resource healthcare systems face affordability barriers that limit technology adoption. High insurance and regulatory compliance costs also challenge new entrants and emerging markets.

Regulatory Complexity and Sample Safety Concerns

Strict global regulations govern handling, transport, and storage of biological materials to ensure sample viability and patient safety. Variations in compliance standards across regions complicate international collaboration and cross-border sample sharing. Contamination risk, cold-chain failure, and labeling errors threaten sample integrity and research outcomes. Ensuring end-to-end traceability and data security remains a major challenge, especially for large-scale repositories and decentralized research networks.

Regional Analysis

North America

North America holds a 41% share of the Biopreservation market, driven by strong investment in cell and gene therapy development, well-established biobanking networks, and advanced cold-chain logistics. The United States leads regional demand due to a high number of clinical trials, FDA approvals for regenerative therapies, and growing adoption of cryogenic storage systems across research institutes and pharmaceutical companies. Expanding personalized medicine programs and large population genomic projects support continued infrastructure growth. Canada contributes through government-supported biobanking initiatives and increasing collaboration in precision medicine. Strong reimbursement pathways and digital LIMS integration further strengthen market leadership.

Europe

Europe accounts for a 29% share, supported by robust biomedical research, national biobank programs, and strict quality standards for biological material handling. The United Kingdom, Germany, and France lead market growth due to advanced stem cell research, fertility preservation services, and strong regulatory frameworks guiding biosample management. EU-funded genomics and rare disease research initiatives drive demand for cryogenic freezers and preservation media. Increasing pharmaceutical investment in cancer immunotherapy and cross-border research consortia enhances sample storage infrastructure. Rising interest in population health biorepositories and digital sample traceability platforms further supports adoption across leading healthcare systems.

Asia Pacific

Asia Pacific holds a 22% share and represents the fastest-growing region due to expanding biotechnology investment, growth in clinical stem cell applications, and increased demand for fertility preservation solutions. China, Japan, India, and South Korea demonstrate strong adoption of cryogenic biopreservation for regenerative medicine, oncology trials, and translational research. Government-supported genome projects and rising medical tourism for IVF enhance market expansion. Local manufacturing of biopreservation equipment and media contributes to cost-competitive availability. Growing partnerships between hospitals, research institutes, and biobanks strengthen infrastructure and support wider use of LIMS platforms for secure biospecimen management.

Latin America

Latin America holds a 5% share, driven by expanding research collaborations, growth in fertility cryopreservation, and development of public and private biobanks. Brazil and Mexico lead regional adoption as healthcare systems incorporate cryogenic storage for oncology, immunology, and population research programs. Economic constraints encourage demand for cost-efficient preservation media and controlled-temperature logistics solutions. Rising focus on personalized medicine and clinical trial participation supports gradual technology upgrades. Partnerships with global biotechnology suppliers and university-led research networks improve access to advanced storage systems and biospecimen tracking platforms throughout the region.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, supported by emerging cell therapy research, growing investment in precision medicine, and development of fertility preservation centers. The United Arab Emirates and Saudi Arabia lead adoption with increased funding for genomic medicine and hospital-based biobanking. Africa shows incremental progress, led by South Africa’s biorepository networks and international research partnerships focused on infectious disease and molecular epidemiology. Limited infrastructure and high equipment costs remain key barriers, yet government-led healthcare modernization, training initiatives, and expanding cold-chain logistics gradually improve access to advanced biopreservation technologies.

Market Segmentations:

By Product

- Equipment

- Media

- Laboratory Information Management System (LIMS)

By Application

- Regenerative Medicine

- Bio-banking

- Drug Discovery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Biopreservation market includes key players such as Panasonic Corporation, PrincetonCryo, Taylor-Wharton, LabVantage Solutions, Inc., X-Therma Inc., Thermo Fisher Scientific, Inc., MVE Biological Solutions, Azenta US, Inc., BioLife Solutions, and Biomatrica, Inc. The market remains highly competitive, driven by strong demand for cell and gene therapy storage, clinical biobanking, and advanced cold-chain solutions. Companies focus on cryogenic freezers, controlled-rate freezing systems, preservation media, and Laboratory Information Management Systems to support secure biological sample storage and transport. Leading vendors invest in R&D to improve viability rates, reduce freeze-thaw damage, and strengthen compliance with GMP and regulatory requirements. Strategic collaborations with biopharma companies and research institutes help expand global distribution and long-term storage capabilities. Digital sample tracking, automation, and AI-based temperature monitoring also shape differentiation as providers enhance data security and traceability. Continuous product innovation and capacity expansion support long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, X-Therma appointed Neil Warma to its Board of Directors to support its biopreservation technology growth.

- In May 2025, Azenta US, Inc. and Form Bio announced a strategic partnership to advance AAV gene-therapy development.

- In March 2024, X‑Therma Inc. completed a US $22.4 million Series B funding round to scale its platform for organ, tissue and cell preservation

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biopreservation systems will grow with expansion of cell and gene therapies.

- Automated cryogenic storage will enhance sample security and reduce handling errors.

- AI-enabled LIMS software will support large-scale biobank data management.

- New cryoprotectants will improve cell viability during long-term preservation.

- Personalized medicine programs will increase adoption of advanced preservation platforms.

- Growth in fertility preservation and stem cell banking will strengthen market usage.

- Cold-chain logistics innovation will improve safe transport of sensitive biological materials.

- Partnerships between drug developers and biobanks will expand long-term sample storage demand.

- Sustainability goals will drive energy-efficient cryogenic and ultra-low temperature systems.

- Regulatory harmonization will support international sharing of high-value biological samples.