Market Overview

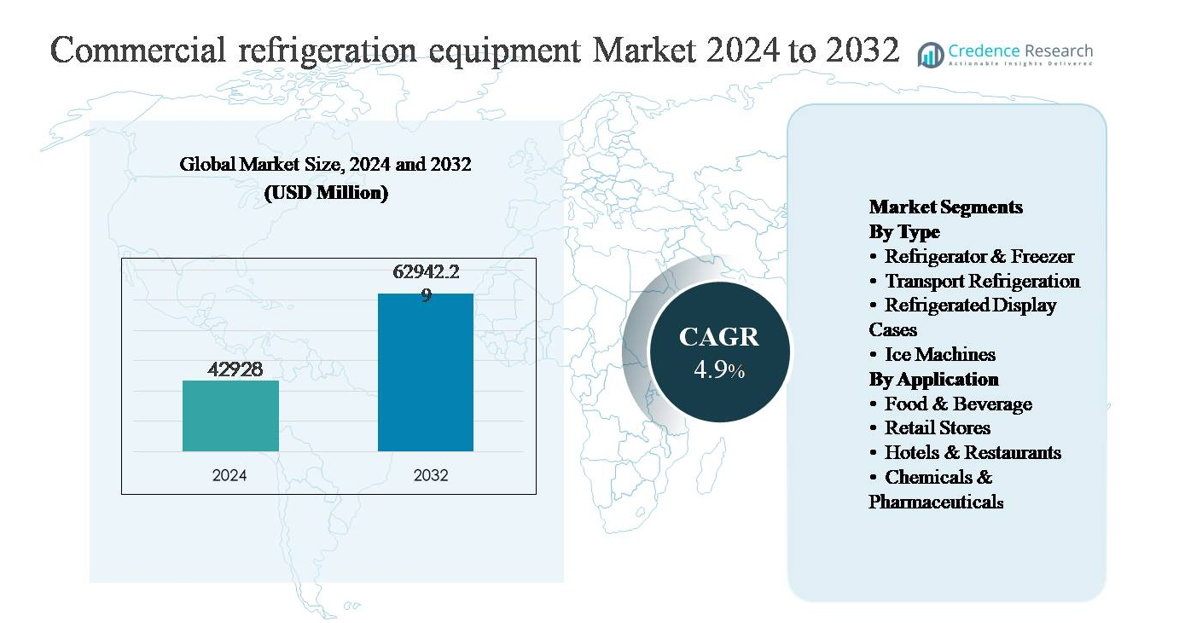

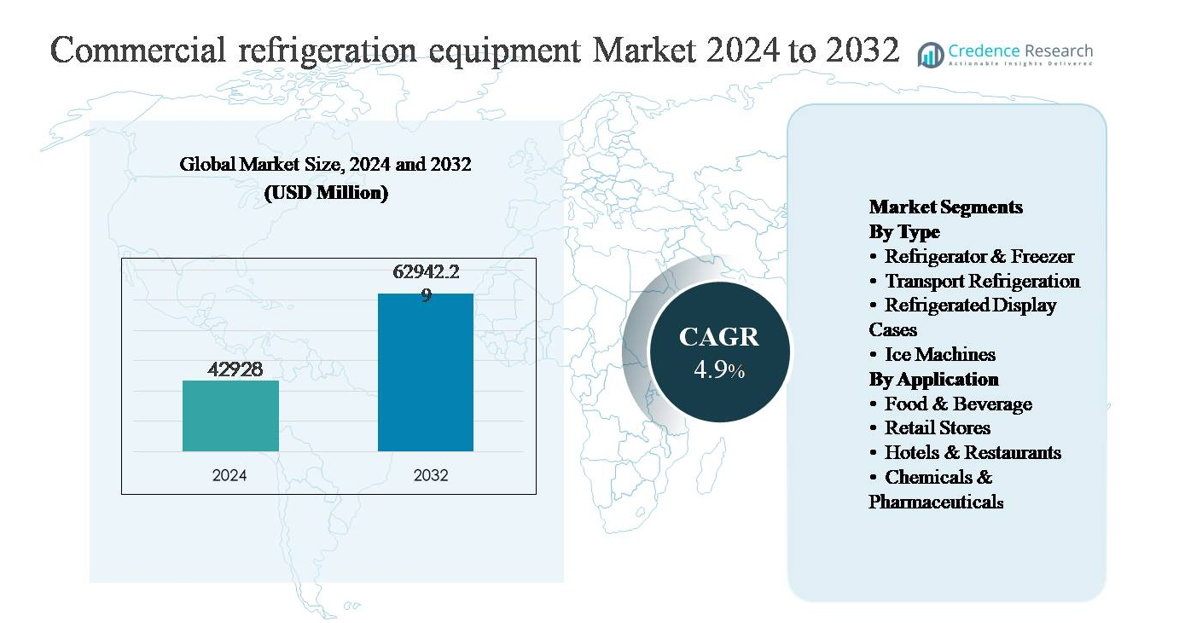

The commercial refrigeration equipment market was valued at USD 42,928 million in 2024 and is projected to reach USD 62,942.29 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Refrigeration Equipment Market Size 2024 |

USD 42,928 million |

| Commercial Refrigeration Equipment Market, CAGR |

4.9% |

| Commercial Refrigeration Equipment Market Size 2032 |

USD 62,942.29 million |

The commercial refrigeration equipment market is led by a mix of global conglomerates and specialized manufacturers, including Daikin Industries, Danfoss, GEA Group Aktiengesellschaft, Carrier Global Corporation, Johnson Controls, AB Electrolux, The Middleby Corporation, Welbilt, Nor-Lake, and Imbera. These players compete through energy-efficient system designs, low-GWP refrigerant adoption, digital monitoring capabilities, and application-specific solutions for food retail, foodservice, cold storage, and pharmaceuticals. Strategic portfolio optimization, technology upgrades, and service-led differentiation remain central to competition. North America is the leading regional market, accounting for approximately 32% of global market share, supported by a mature retail sector, advanced cold-chain infrastructure, and strict regulatory standards. Europe and Asia Pacific follow closely, driven by sustainability mandates and rapid retail and cold-chain expansion, respectively.

Market Insights

- The commercial refrigeration equipment market was valued at USD 42,928 million in 2024 and is projected to reach USD 62,942.29 million by 2032, expanding at a CAGR of 4.9% over the forecast period, driven by sustained demand across food retail, foodservice, cold storage, and pharmaceutical applications.

- Market growth is primarily driven by expansion of organized food retail, cold-chain logistics, and stricter food safety regulations, with refrigerators & freezers dominating by type at over 40% share due to widespread use in storage and back-of-house operations.

- Key trends include rising adoption of energy-efficient systems, low-GWP refrigerants, and smart refrigeration technologies, while competition centers on technology upgrades, portfolio optimization, and service differentiation among global and regional players.

- High initial equipment costs, maintenance expenses, and regulatory complexity related to refrigerant transitions act as key market restraints, particularly impacting small and medium-sized end users.

- Regionally, North America leads with ~32% market share, followed by Asia Pacific at ~29% driven by retail expansion, and Europe at ~27% supported by sustainability regulations, while Latin America and Middle East & Africa together account for the remaining share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

By type, the commercial refrigeration equipment market is led by Refrigerators & Freezers, which represent the dominant sub-segment with an estimated over 40% market share. Their leadership is driven by ubiquitous deployment across supermarkets, convenience stores, foodservice outlets, and institutional kitchens, where reliable chilled and frozen storage is essential. Demand is further supported by the replacement cycle for aging units, stricter food safety standards, and rapid adoption of energy-efficient compressors and natural refrigerants. Transport refrigeration follows as a fast-growing segment, supported by cold-chain expansion and growth in temperature-sensitive logistics.

- For instance, Emerson’s Copeland™ CO₂ transcritical compressors are engineered to operate at discharge pressures up to 130 bar and support medium-temperature applications down to -10 °C and low-temperature applications to -35 °C, enabling wide adoption in modern supermarket racks.

By Application:

By application, the Food & Beverage sector is the dominant sub-segment, accounting for more than 45% of total demand, driven by high refrigeration intensity across food processing, storage, and distribution environments. Continuous operation requirements, stringent hygiene regulations, and increasing consumption of frozen and ready-to-eat products underpin sustained equipment demand. Retail stores and hotels & restaurants contribute significantly through investments in modern display and back-of-house systems, while chemicals & pharmaceuticals represent a specialized, high-value segment driven by precise temperature control needs for drug storage and chemical stability.

- For instance, Carrier Commercial Refrigeration offers specialized industrial refrigeration solutions and modular cold rooms for food processing facilities. These systems are highly customizable and designed to maintain a range of stable product temperatures, including the low-temperature (LT) range down to −40 °C for freezing applications.

Key Growth Driver

Expansion of Food Retail and Cold-Chain Infrastructure

The rapid expansion of organized food retail and cold-chain infrastructure is a primary driver of the commercial refrigeration equipment market. Growth in supermarkets, hypermarkets, convenience stores, and online grocery fulfillment centers is increasing demand for reliable refrigeration across storage, display, and logistics stages. Rising consumption of frozen foods, dairy products, meat, and fresh produce requires continuous temperature control to maintain quality and comply with food safety regulations. Additionally, investments in cold storage warehouses and temperature-controlled transportation networks are accelerating in emerging economies to reduce post-harvest losses. As food supply chains become more complex and geographically extended, operators increasingly prioritize advanced refrigeration systems that offer durability, precise temperature management, and high uptime, reinforcing sustained equipment demand.

- For instance, Lineage Logistics has deployed large-scale automated cold storage facilities equipped with ammonia and CO₂-based refrigeration systems capable of maintaining storage temperatures as low as −30 °C across warehouse capacities exceeding 100,000 pallet positions per site.

Stringent Food Safety and Regulatory Compliance Requirements

Stricter food safety standards and regulatory oversight are significantly driving adoption of modern commercial refrigeration equipment. Governments and regulatory bodies worldwide enforce rigorous requirements for temperature monitoring, hygiene, and traceability across foodservice, retail, and pharmaceutical storage environments. Compliance with these regulations compels businesses to upgrade legacy systems with modern refrigeration units featuring digital controls, automated alarms, and real-time monitoring capabilities. In sectors such as meat processing, dairy handling, and vaccine storage, even minor temperature deviations can result in product spoilage or regulatory penalties. As a result, end users increasingly invest in high-performance refrigeration systems designed to deliver consistent cooling, regulatory compliance, and operational reliability, strengthening long-term market growth.

- For instance, Danfoss’ ADAP-KOOL® system managers deployed in food retail environments support temperature logging intervals as low as 10 seconds and alarm response times under 5 seconds, enabling rapid corrective action during deviations.

Rising Demand from Pharmaceutical and Healthcare Applications

Growing demand from pharmaceutical and healthcare sectors is emerging as a strong growth driver for commercial refrigeration equipment. Temperature-sensitive drugs, vaccines, biologics, and chemical reagents require tightly controlled storage conditions throughout manufacturing, distribution, and point-of-use stages. Expansion of pharmaceutical production capacity, increased vaccination programs, and growth in specialty drugs are driving investments in medical-grade refrigeration systems. These applications demand high precision, redundancy, and compliance with strict storage standards, favoring technologically advanced refrigeration solutions. As healthcare supply chains expand and diversify globally, especially in emerging markets, demand for reliable refrigeration infrastructure continues to rise, supporting sustained market expansion beyond traditional food-focused applications.

Key Trend & Opportunity

Shift Toward Energy-Efficient and Low-GWP Refrigeration Systems

A major trend shaping the commercial refrigeration equipment market is the transition toward energy-efficient systems using low global warming potential (GWP) refrigerants. Rising electricity costs and stricter environmental regulations are pushing end users to adopt equipment that minimizes energy consumption and refrigerant emissions. Manufacturers are increasingly integrating high-efficiency compressors, advanced insulation materials, and natural refrigerants such as CO₂ and hydrocarbons. This shift creates opportunities for equipment upgrades and retrofits, particularly in developed markets with aging infrastructure. Energy-efficient refrigeration not only reduces operating costs but also supports corporate sustainability goals, making it a key differentiator and long-term opportunity for technology-focused suppliers.

- For instance, Thermo Fisher Scientific’s TSX Universal Series ultra-low freezers, widely used in regulated pharmaceutical storage, maintain setpoints down to −80 °C with temperature uniformity of ±3 °C, while embedded controllers record continuous temperature histories compliant with regulatory audit requirements.

Digitalization and Smart Refrigeration Solutions

Digitalization is creating new opportunities within the commercial refrigeration equipment market through the adoption of smart and connected systems. Modern refrigeration units increasingly incorporate sensors, cloud-based monitoring, and data analytics to enable real-time temperature tracking, predictive maintenance, and remote diagnostics. These capabilities reduce downtime, prevent spoilage, and improve operational efficiency for retailers and foodservice operators. Smart refrigeration also supports compliance reporting and energy optimization, adding value beyond basic cooling functionality. As businesses adopt digital asset management strategies, demand is growing for refrigeration systems that integrate seamlessly with broader facility management and supply chain platforms, opening avenues for value-added services and long-term customer engagement.

- For instance, GEA Group Aktiengesellschaft deploys its GEA Omni™ control platform in industrial and commercial refrigeration systems, enabling continuous monitoring of compressor performance, suction pressure, and discharge temperatures across installations exceeding 20,000 I/O data points per plant.

Key Challenge

High Initial Capital and Maintenance Costs

High upfront capital investment and ongoing maintenance costs remain a significant challenge for the commercial refrigeration equipment market. Advanced refrigeration systems with energy-efficient components, digital controls, and low-GWP refrigerants often involve higher purchase and installation costs compared to conventional units. For small and medium-sized businesses, especially in cost-sensitive markets, these expenses can delay equipment upgrades or replacements. Additionally, specialized maintenance requirements and the need for trained technicians increase total cost of ownership. These financial barriers can slow adoption rates, particularly in developing regions, despite long-term operational savings and regulatory benefits offered by modern refrigeration technologies.

Regulatory Complexity and Refrigerant Transition Risks

Navigating evolving environmental regulations and refrigerant transition requirements poses a major challenge for market participants. Regulations targeting the phase-down of high-GWP refrigerants vary by region, creating compliance complexity for manufacturers and end users operating across multiple markets. Transitioning to alternative refrigerants may require system redesigns, safety considerations, and technician retraining. Improper handling or lack of infrastructure for new refrigerants can increase operational risk and implementation costs. These regulatory and technical uncertainties can delay purchasing decisions and complicate long-term planning, particularly for businesses managing large, geographically distributed refrigeration assets.

Regional Analysis

North America:

North America holds a leading position in the commercial refrigeration equipment market, accounting for approximately 32% of global market share. The region benefits from a highly developed food retail ecosystem, extensive cold-chain infrastructure, and strict food safety and energy-efficiency regulations. Strong demand from supermarkets, quick-service restaurants, and pharmaceutical storage facilities drives continuous equipment replacement and upgrades. Adoption of low-GWP refrigerants, smart refrigeration systems, and energy-efficient compressors is particularly high. The presence of major manufacturers, along with consistent investments in cold storage warehouses and last-mile refrigerated logistics, further reinforces North America’s dominant market position.

Europe:

Europe represents around 27% of the global commercial refrigeration equipment market, supported by stringent environmental regulations and aggressive refrigerant transition policies. The region is at the forefront of adopting natural refrigerants such as CO₂ and hydrocarbons, driving modernization of retail and foodservice refrigeration systems. High penetration of organized retail, strong hospitality activity, and well-established pharmaceutical manufacturing contribute to stable demand. Replacement of legacy systems to comply with energy efficiency directives remains a key growth factor. Western Europe leads regional consumption, while Central and Eastern Europe show steady growth driven by expanding retail and cold-chain infrastructure.

Asia Pacific:

Asia Pacific accounts for approximately 29% of the global market share, making it the fastest-growing regional market. Rapid urbanization, rising disposable incomes, and expansion of organized food retail are significantly boosting demand for commercial refrigeration equipment. Growth in food processing, cold storage facilities, and temperature-controlled logistics is particularly strong in China, India, and Southeast Asia. Increasing pharmaceutical manufacturing and vaccine distribution further support demand. While cost sensitivity remains a factor, governments and large retailers are increasingly investing in energy-efficient and compliant refrigeration systems, positioning Asia Pacific as a key long-term growth engine.

Latin America:

Latin America holds about 7% of the global commercial refrigeration equipment market, driven by gradual expansion of modern retail formats and foodservice chains. Countries such as Brazil and Mexico lead regional demand due to their large consumer bases and growing cold-chain investments. The food and beverage sector remains the primary application, particularly for refrigerated display cases and storage units. However, economic volatility and budget constraints can delay large-scale upgrades. Despite these challenges, increasing focus on reducing food waste and improving supply chain efficiency continues to support steady adoption of commercial refrigeration solutions.

Middle East & Africa:

The Middle East & Africa region accounts for roughly 5% of global market share, supported by growth in hospitality, food retail, and pharmaceutical distribution. Hot climatic conditions create strong dependence on reliable refrigeration systems across retail and foodservice environments. Gulf countries lead adoption due to large investments in supermarkets, hotels, and cold storage infrastructure, while Africa shows emerging demand driven by improving food security and healthcare logistics. Although market penetration remains lower compared to other regions, rising urban populations and infrastructure development are expected to support gradual long-term growth.

Market Segmentations:

By Type

- Refrigerator & Freezer

- Transport Refrigeration

- Refrigerated Display Cases

- Ice Machines

By Application

- Food & Beverage

- Retail Stores

- Hotels & Restaurants

- Chemicals & Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the commercial refrigeration equipment market is defined by intense rivalry among global and regional players focused on innovation, sustainability, and service differentiation. Key incumbents such as Carrier Global Corporation, Danfoss, GEA Group, Daikin Industries, Johnson Controls, and niche specialists like Nor-Lake and Imbera compete on product performance, energy efficiency, and regulatory compliance. Manufacturers are strategically responding to stringent environmental regulations by advancing low-GWP refrigerants, smart controls, and high-efficiency systems, which have become essential decision criteria for end users. Partnerships, mergers and acquisitions, and portfolio rationalization also shape competition; for example, divestitures and focus shifts among major conglomerates underscore the importance of core competencies in refrigeration technology. Regional diversification and tailored solutions for retail, foodservice, cold chain, and pharmaceutical applications further differentiate players. With rising demand for connected, digitally monitored systems, companies that integrate IoT capabilities and provide robust after-sales support stand to gain market share in an evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 26, 2025, Johnson Controls announced it would showcase advanced industrial refrigeration and digital solutions for the food & beverage sector at Gulfood Manufacturing 2025 in Dubai, highlighting energy-efficient modular refrigeration technologies and digital integration platforms tailored for operational performance and sustainability in manufacturing environments.

- In October 6, 2025, Johnson Controls announced a strategic investment in Accelsius, a firm specializing in two-phase, direct-to-chip liquid cooling technology for data centers. The collaboration supports scalable cooling platforms ranging from 500 kW to over 10 MW, underscoring technological breadth that overlaps data-center and high-performance refrigeration domains.

- In January 17, 2025, GEA AWP introduced the HSX high-pressure float valve tailored for industrial ammonia (NH₃) and CO₂ refrigeration systems, enabling improved energy efficiency by reducing pressure fluctuations and lowering compressor power consumption in large-scale refrigeration environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for commercial refrigeration equipment will continue to rise with the expansion of organized food retail and cold-chain logistics globally.

- Energy efficiency will remain a top priority, driving accelerated replacement of legacy systems with high-efficiency units.

- Adoption of low-GWP and natural refrigerants will increase as environmental regulations tighten across major regions.

- Smart and connected refrigeration systems will gain wider adoption for real-time monitoring and predictive maintenance.

- Growth in frozen and ready-to-eat food consumption will sustain demand for reliable refrigeration infrastructure.

- Pharmaceutical and healthcare applications will increasingly require precision refrigeration with strict compliance standards.

- Manufacturers will focus on modular and customizable designs to address diverse end-use requirements.

- After-sales services and lifecycle management offerings will become key competitive differentiators.

- Emerging markets will see rising investments in cold storage and temperature-controlled transportation.

- Strategic partnerships and technology-driven innovation will shape long-term competitive positioning.Top of FormBottom of Form