Market Overview

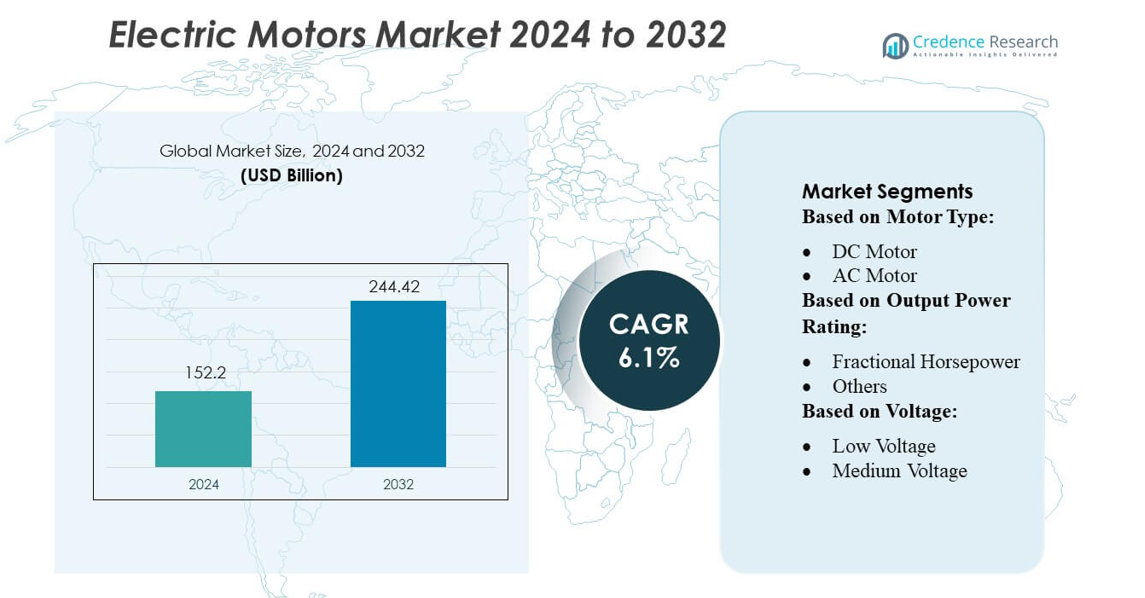

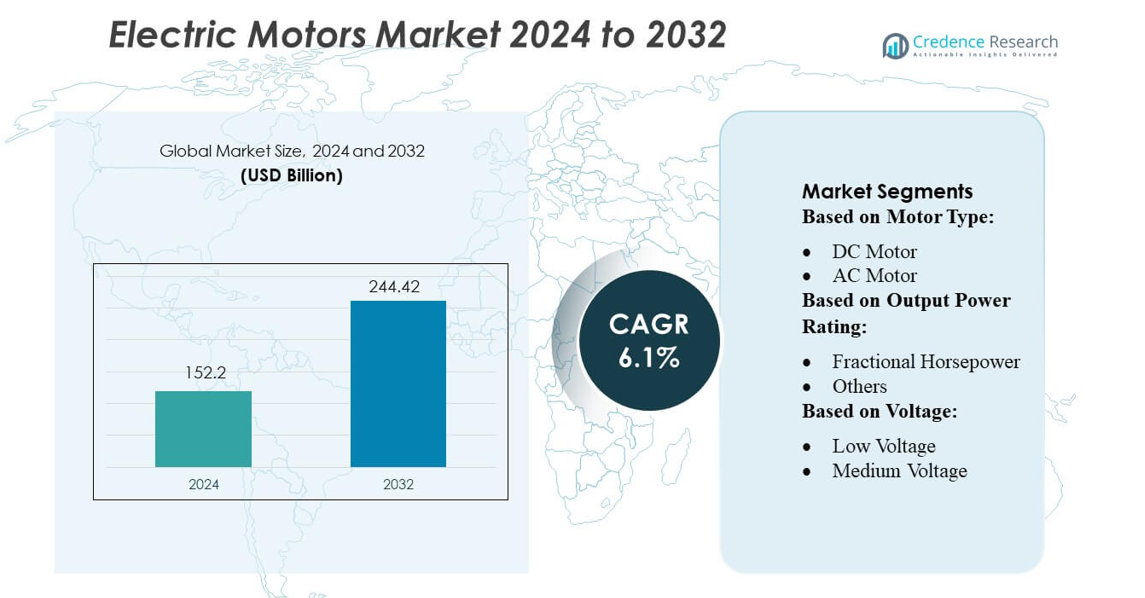

Electric Motors Market size was valued USD 152.2 billion in 2024 and is anticipated to reach USD 244.42 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Motors Market Size 2024 |

USD 152.2 billion |

| Electric Motors Market, CAGR |

6.1% |

| Electric Motors Market Size 2032 |

USD 244.42 billion |

The Electric Motors Market is shaped by several prominent players, including ABB, Siemens, Nidec Motor Corporation, Regal Rexnord Corporation, AMETEK, Inc., Johnson Electric Holdings Limited, Schneider Electric, Franklin Electric, Allied Motion, Inc., and ORIENTAL MOTOR USA CORP. These companies strengthen their competitive positions through advancements in high-efficiency motor technologies, smart control systems, and expanded production capabilities. Among all regions, Asia-Pacific leads the global market with an approximate over 45% share, driven by large-scale industrialization, strong electronics and automotive manufacturing bases, and rapid growth in electric mobility and automation initiatives across China, Japan, and South Korea.

Market Insights

- The Electric Motors Market was valued at USD 152.2 billion in 2024 and is projected to reach USD 244.42 billion by 2032, registering a 6.1% CAGR, driven by rising industrial automation, energy-efficiency regulations, and expanding application across automotive, HVAC, and manufacturing sectors.

- Market growth is strongly supported by increasing demand for high-efficiency AC motors, which hold the dominant segment share of over 70%, as industries adopt variable-speed drives and energy-optimized systems.

- Technological trends such as IoT-enabled smart motors, predictive maintenance features, miniaturized motor designs, and magnet-reduced technologies are transforming production and operational efficiency.

- Competitive intensity remains high, with key players advancing R&D, expanding global capacities, and integrating digital motor–drive systems to strengthen their portfolios across industrial, commercial, and mobility applications.

- Asia-Pacific leads the global market with over 45% regional share, followed by North America and Europe, supported by strong manufacturing ecosystems, rapid electrification, and large-scale deployment of EVs and automation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motor Type

The AC motor segment dominates the Electric Motors Market, accounting for an estimated over 70% share, driven by its high efficiency, lower maintenance needs, and strong adoption in industrial machinery, HVAC systems, EV powertrains, and household appliances. The scalability of AC induction and synchronous motors, combined with inverter-based variable-speed control, strengthens their suitability across light- and heavy-duty applications. DC motors retain niche demand in robotics and precision equipment due to superior speed control, while the “Others” category grows moderately with advancements in stepper and servo motors for automation and electronics.

- For instance, Schneider Electric’s Altivar 320 drive enables motor control up to 599 Hz and supports applications requiring high-torque performance, while its Lexium 32 servo system delivers positioning accuracy as fine as 1 μm, strengthening advanced motion-control capabilities in next-generation equipment.

By Output Power Rating

The Fractional Horsepower (FHP) motor segment leads the market with more than 55% share, supported by rising demand in consumer appliances, small pumps, fans, medical devices, and compact industrial equipment. Manufacturers increasingly prefer FHP motors for their compact size, reduced operating noise, and improved energy efficiency enabled by brushless DC (BLDC) designs. Growth is further reinforced by rapid expansion in residential construction, HVAC installations, and battery-powered smart devices. The “Others” category, consisting of integral horsepower motors, remains essential for heavy industries, but grows at a slower pace due to higher product costs and replacement cycles.

- For instance, Franklin MagForce 8-inch high-efficiency motor delivers up to 14% energy savings compared to traditional induction motors, enabling rapid payback through lower operating costs.

By Voltage

Low Voltage (LV) motors dominate the voltage segment with over 60% market share, primarily driven by their extensive deployment in commercial buildings, automotive systems, manufacturing lines, and small-to-medium industrial equipment. Their operational safety, compatibility with standard power systems, and cost-effective efficiency upgrades support continuous adoption. Medium Voltage motors gain traction in mining, metals, oil & gas, and large processing industries where higher torque is required, while High Voltage motors serve specialized heavy-duty applications. However, the LV segment remains the fastest-growing due to expanding automation and electrification across end-use sectors.

Key Growth Drivers

Rising Industrial Automation and Robotics Adoption

The rapid expansion of industrial automation, robotics, and smart manufacturing significantly drives demand for high-efficiency electric motors. Automated production systems rely on precise motion control, variable-speed functionalities, and compact motor designs, accelerating the adoption of servo, stepper, and high-performance AC motors. Industries such as automotive, electronics, logistics, and packaging increasingly deploy robotic arms and conveyor systems powered by advanced motor technologies. Additionally, strong integration of sensor-based monitoring and predictive maintenance solutions enhances operational reliability, making electric motors a core component in Industry 4.0 transformation.

- For instance, AMETEK’s Pittman® servo motors deliver continuous torque outputs up to 2.5 N·m and peak speeds exceeding 10,000 rpm, while its Haydon Kerk® linear actuators achieve resolution as fine as 0.0005 mm per step, enabling ultra-precise robotic positioning.

Electrification of Transportation Systems

The global shift toward electric mobility strengthens demand for traction motors used in EVs, e-buses, e-two-wheelers, and off-highway electric machinery. Governments worldwide promote electrification through subsidies, emission regulations, and infrastructure expansion, accelerating the need for efficient permanent magnet synchronous motors (PMSM) and induction motors. Automakers increasingly invest in in-house motor manufacturing to improve performance metrics such as torque density, thermal efficiency, and range optimization. With EV production scaling rapidly, electric motors become a foundational driver for transportation decarbonization and long-term market expansion.

- For instance, ORIENTAL MOTOR’s BMU Series brushless motors, used extensively in EV battery-module assembly and automated charging-station mechanisms, deliver rated outputs up to 400 W with speed control from 80 to 4,000 rpm, while their AZ Series positioning motors achieve step accuracy of ±0.05°, supporting high-precision automated EV manufacturing lines.

Growing Demand for Energy-Efficient Motors in Industrial and Commercial Sectors

Stricter global energy-efficiency regulations, such as IE3 and IE4 standards, push industries toward upgrading legacy motors with high-efficiency models. Demand rises for brushless DC motors, premium-efficiency induction motors, and smart motors equipped with IoT-enabled monitoring. Businesses prioritize reducing electricity costs and carbon footprints, resulting in accelerated retrofitting activities across HVAC systems, pumps, compressors, and manufacturing lines. Government incentives for energy-efficient equipment further amplify adoption, positioning efficiency improvements as a major growth catalyst across heavy industries, commercial infrastructure, and utilities.

Key Trends & Opportunities

Rapid Penetration of Smart Motors and IoT-Enabled Monitoring

Digitalization creates strong opportunities for smart electric motors integrated with IoT sensors, real-time diagnostics, and predictive maintenance capabilities. These motors support remote monitoring of vibration, temperature, load, and energy consumption, enabling operators to reduce downtime and improve operational transparency. Industries such as oil & gas, chemicals, and manufacturing increasingly adopt connected motor systems within digital twins and automated maintenance workflows. As enterprises shift toward data-driven asset management, smart motors represent a fast-growing trend and a high-value opportunity for motor manufacturers.

- For instance, Regal Rexnord’s Perceptiv™ Connected Services platform integrates wireless multi-axis vibration and temperature sensors. A common sensor model, the Sentry S2100, operates within a –20°C to 60°C range and supports long-life battery operation of up to 8 years.

Rising Use of High-Performance Motors in Renewable Energy Systems

The accelerating deployment of solar trackers, wind turbine systems, and energy storage technologies strengthens demand for durable, high-efficiency motors. Motors used in renewable applications require high torque, variable-speed operation, and robust resistance to harsh environmental conditions. Gearless permanent magnet motors and specialized pitch-control motors gain significant traction as renewable installations expand globally. Growing investment in decentralized energy systems and microgrids further opens opportunities for customized motor solutions that enhance energy conversion performance and system reliability.

- For instance, ABB’s IE5 SynRM motors reduce energy losses by up to 40% compared to standard IE3 motors and maintain peak efficiencies above 97%, while ABB’s wind-turbine pitch-control motors operate reliably in temperatures from –30°C to +60°C and deliver continuous torques exceeding 600 N·m, ensuring stable blade positioning in high-wind environments.

Expansion of Motor Miniaturization and Lightweight Designs

Advancements in materials engineering and electromagnetic optimization enable the development of compact, lightweight electric motors suitable for medical devices, drones, home appliances, and portable industrial tools. Miniaturization supports higher power density, improved thermal performance, and reduced energy use. Manufacturers increasingly adopt axial-flux designs, rare-earth magnet motors, and integrated motor-controller systems to meet the rising demand for compact, silent, and high-efficiency solutions. This trend creates strong opportunities in emerging markets such as robotics, consumer electronics, and micro-mobility.

Key Challenges

Volatility in Raw Material Prices, Especially Rare-Earth Elements

Fluctuating prices of rare-earth elements such as neodymium, dysprosium, and terbium pose significant challenges for motor manufacturers, particularly in producing high-performance permanent magnet motors. Supply chain uncertainties and geopolitical constraints intensify cost pressures, limiting scalability for manufacturers dependent on imported magnet materials. These fluctuations often lead companies to explore alternative motor technologies, recycling programs, or magnet-free designs. However, frequent cost instability remains a key barrier, impacting profitability, pricing strategies, and long-term procurement planning across the industry.

Technical Limitations and Efficiency Losses in High-Load Applications

Electric motors face performance constraints in demanding high-load, high-temperature, and continuous-duty environments, particularly within heavy industries such as mining, oil & gas, and steel processing. Efficiency losses due to heat generation, mechanical stress, and insulation degradation require costly system-level solutions like advanced cooling and specialized materials. Additionally, integrating variable-frequency drives (VFDs) with older motor systems remains complex and expensive. These technical limitations hinder seamless performance optimization, making it challenging for industries to achieve long-term reliability and operational efficiency in large-scale applications.

Regional Analysis

North America

North America holds approximately 22–24% of the Electric Motors Market, driven by strong adoption across industrial automation, HVAC systems, electric vehicles, and commercial infrastructure. The United States leads regional demand due to ongoing investments in robotics, data centers, and energy-efficient building systems. Growing EV manufacturing and supportive federal incentives for electrification further accelerate motor consumption, especially high-efficiency AC and traction motors. Modernization of legacy industrial equipment and the expansion of oil & gas upstream automation also strengthen market growth, positioning North America as a mature yet steadily expanding region.

Europe

Europe accounts for nearly 20–22% of the global market, supported by stringent energy-efficiency regulations, rapid EV penetration, and strong industrial automation deployment. Germany, the UK, and France lead adoption, with manufacturing, automotive production, and renewable energy systems driving sustained demand for high-efficiency and smart motors. The EU’s focus on carbon reduction encourages replacement of older motors with IE3 and IE4-rated systems. Additionally, the expansion of wind power installations and electric mobility infrastructure boosts consumption of specialized motors. Europe’s regulatory framework and advanced engineering capabilities position it as a high-value, innovation-driven regional market.

Asia-Pacific

Asia-Pacific dominates the Electric Motors Market with over 45% share, driven by large-scale industrialization, expanding manufacturing bases, and strong growth in EV production, especially in China, Japan, and South Korea. China remains the largest global consumer and producer of electric motors due to its extensive electronics, automotive, and industrial machinery sectors. The region benefits from cost-efficient production, rising residential construction, and rapid adoption of automation across automotive, electronics, and textiles. Government support for renewable energy and electrified transportation further accelerates demand, making Asia-Pacific the fastest-growing and most influential regional market.

Latin America

Latin America holds roughly 6–8% of the global market, with growth fueled by rising investments in mining, agriculture, food processing, and water treatment industries. Brazil and Mexico lead demand, supported by expanding manufacturing activity and modernization of industrial HVAC and pumping systems. Increasing adoption of energy-efficient motors, supported by regional efficiency standards and cost-saving initiatives, drives replacement of older equipment. Although economic volatility and fluctuating industrial output limit rapid expansion, rising automation adoption and infrastructure improvement projects are gradually strengthening the region’s role in the global electric motors landscape.

Middle East & Africa (MEA)

The Middle East & Africa region captures about 5–6% market share, supported by strong demand from oil & gas operations, power generation, water desalination, and construction projects. Gulf countries invest heavily in high-performance motors for industrial machinery, pumps, compressors, and HVAC systems used in large-scale infrastructure developments. Africa’s market grows steadily due to increasing electrification, agricultural mechanization, and expansion of small-scale manufacturing. Although dependency on imported equipment and limited local production pose challenges, ongoing industrial diversification initiatives across the GCC support long-term demand for efficient and durable electric motor systems.

Market Segmentations:

By Motor Type:

By Output Power Rating:

- Fractional Horsepower

- Others

By Voltage:

- Low Voltage

- Medium Voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Motors Market features a diverse mix of global leaders, including Schneider Electric, Franklin Electric, AMETEK, Inc., ORIENTAL MOTOR USA CORP., Regal Rexnord Corporation, ABB, Johnson Electric Holdings Limited, Siemens, Nidec Motor Corporation, and Allied Motion, Inc. The Electric Motors Market is characterized by strong technological advancement, increasing efficiency standards, and continuous product innovation across major application sectors. Companies compete by expanding their portfolios of high-performance AC, DC, and specialty motors designed for automation, electric mobility, HVAC, and renewable energy systems. The market shows a steady shift toward premium-efficiency models compliant with IE3, IE4, and emerging IE5 standards, supported by digital monitoring, predictive maintenance capabilities, and integrated motor–drive systems. Manufacturers also prioritize global expansion through modernized production facilities, strategic partnerships, and specialized solutions tailored for industrial machinery, consumer appliances, and precision equipment. As electrification and automation accelerate globally, competition intensifies around high-density designs, advanced materials, and smart motor technologies that improve reliability, reduce energy consumption, and support long-term operational sustainability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Franklin Electric

- AMETEK, Inc.

- ORIENTAL MOTOR USA CORP.

- Regal Rexnord Corporation

- ABB

- Johnson Electric Holdings Limited

- Siemens

- Nidec Motor Corporation

- Allied Motion, Inc.

Recent Developments

- In November 2024, ABB, a major market participant declared that the company had signed an agreement with Aurora Motors, one of the key companies in vertical pump motors. The acquisition is projected to enhance ABB’s existing portfolio and strengthen its global footprint.

- In September 2024, WEG, one of the key companies in the motors market announced that it had signed an agreement to acquire a Turkish manufacturing company of commercial and industrial electric motors, Volt Electric Motors (“Volt”).

- In May 2024, Lohia Auto introduced the ‘Humsafar IAQ,’ an electric three-wheeler for last-mile connectivity and short commutes. It offers a range of 185 km on a single charge, a top speed of 48 kmph, and can carry a driver plus four passengers.

- In April 2024, NexGen Energia, a Noida-based company, launched a new, cost-effective electric two-wheeler starting at Rs 36,990. The launch is considered a significant step toward making EVs more accessible and affordable for consumers.

Report Coverage

The research report offers an in-depth analysis based on Motor Type, Output Power Rating, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will accelerate with growing adoption of high-efficiency motors driven by stricter global energy-efficiency regulations.

- Electric vehicle expansion will significantly increase demand for advanced traction motors across passenger and commercial fleets.

- Smart and IoT-enabled motors will gain strong momentum as industries prioritize predictive maintenance and real-time monitoring.

- Industrial automation and robotics will continue to boost consumption of precision and variable-speed motor systems.

- Increased investment in renewable energy infrastructure will create opportunities for specialized motors used in wind, solar, and storage systems.

- Miniaturized and lightweight motors will see rising demand in medical devices, drones, and consumer electronics.

- Manufacturers will shift toward rare-earth-reduced and magnet-free motor technologies to address material cost volatility.

- Digital motor–drive integration will expand as industries adopt connected and energy-optimized systems.

- Emerging economies will drive new installations through industrialization, infrastructure growth, and electrification initiatives.

- Sustainability goals will push rapid replacement of legacy motors with next-generation, ultra-efficient models across all sectors.