Market Overview:

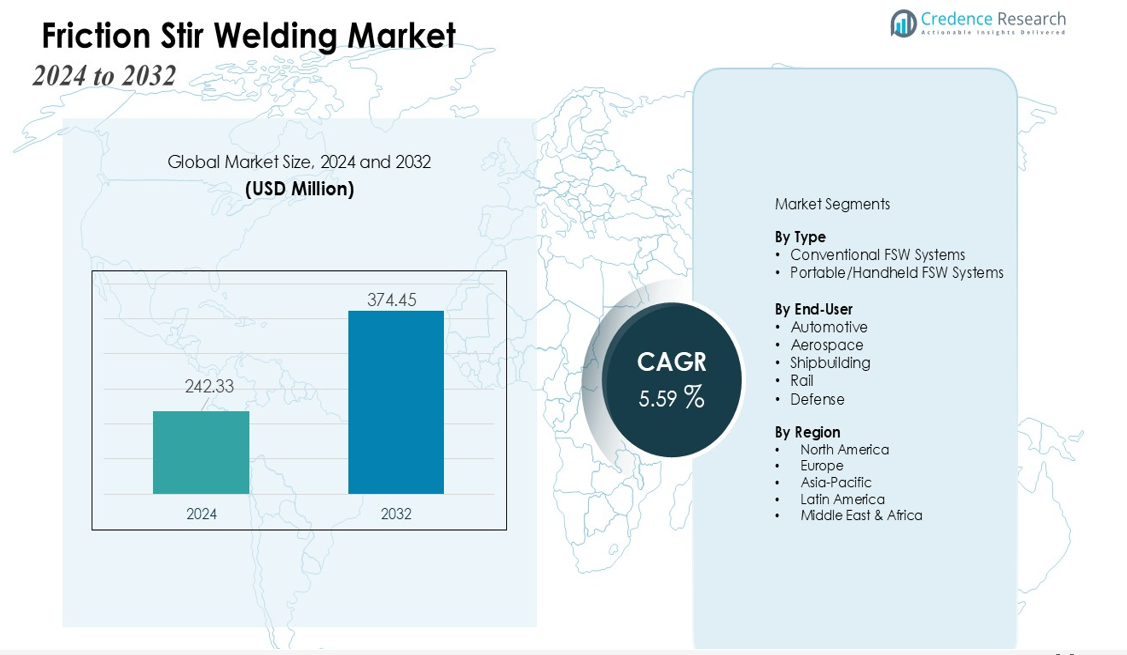

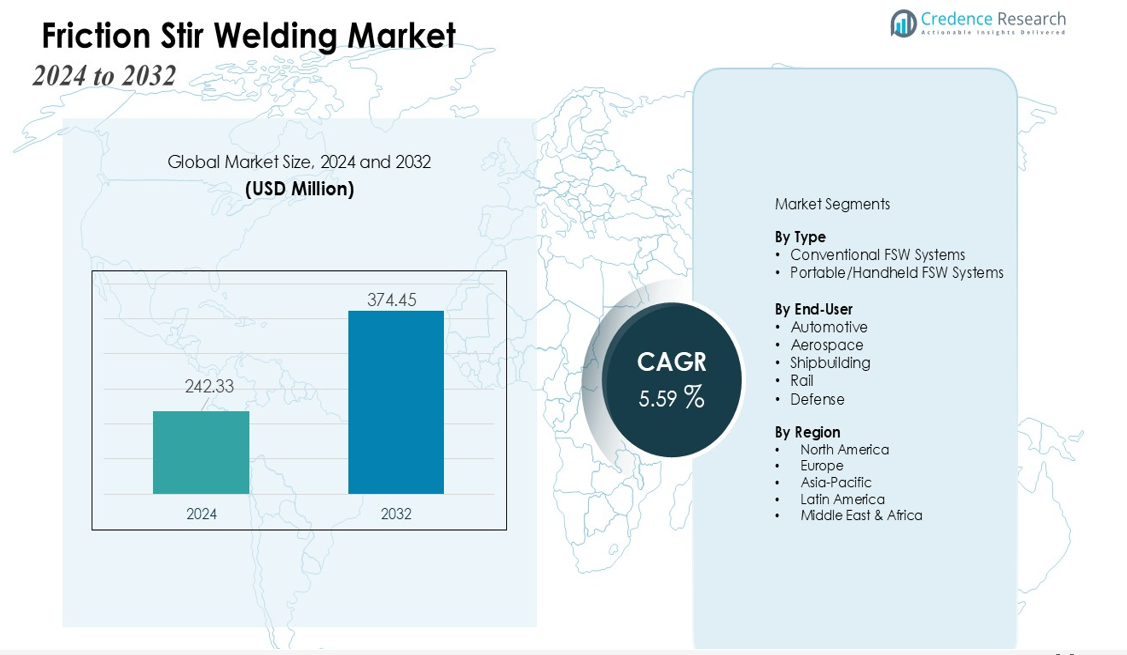

The Friction Stir Welding Market size was valued at USD 242.33 million in 2024 and is anticipated to reach USD 374.45 million by 2032, at a CAGR of 5.59% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Friction Stir Welding Market Size 2024 |

USD 242.33 million |

| Friction Stir Welding Market CAGR |

5.59% |

| Friction Stir Welding Market Size 2032 |

USD 374.45 million |

Key growth drivers include increasing demand for advanced welding solutions that enhance structural integrity while reducing production costs. The shift toward electric vehicles boosts the need for joining dissimilar materials such as aluminum, copper, and magnesium, where friction stir welding offers notable advantages. Expanding application in aerospace for lightweight airframes and fuel-efficient designs further accelerates adoption. Additionally, ongoing automation and integration of robotic FSW systems improve process precision and productivity, strengthening its market penetration.

Regionally, North America and Europe remain major contributors due to strong aerospace and automotive manufacturing bases and early technology adoption. Asia-Pacific is expected to record the fastest growth, driven by rapid industrialization, rising infrastructure projects, and expanding EV manufacturing in China, Japan, and India. Growing investments in high-performance fabrication technologies continue to reinforce the regional market outlook.

Market Insights:

- The Friction Stir Welding Market was valued at USD 242.33 million in 2024 and is projected to reach USD 374.45 million by 2032, reflecting steady growth during the forecast period.

- Rising demand for lightweight and high-strength materials in automotive, aerospace, and rail sectors drives adoption of friction stir welding for superior joint integrity and minimal defects.

- Expansion of electric vehicle manufacturing fuels market growth due to the need for joining dissimilar materials such as aluminum, copper, and magnesium in battery enclosures and structural components.

- North America accounts for 35% of the market, benefiting from established automotive, aerospace, and defense sectors, early technology adoption, and robust industrial infrastructure.

- Asia-Pacific captures 32% of the market, supported by rapid industrialization, expanding EV production, infrastructure projects, and growing adoption of modern fabrication technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Lightweight and High-Strength Materials

The Friction Stir Welding Market benefits from rising emphasis on lightweight components across automotive, aerospace, and rail sectors. Manufacturers seek welding solutions that ensure superior joint strength without compromising structural performance. It meets these requirements through solid-state joining that minimizes defects and distortion. The trend toward fuel efficiency and improved vehicle dynamics reinforces demand for advanced welding technologies.

- For instance, Ford Motor Company primarily integrated self-piercing rivets (SPR) and structural adhesives in their aluminum-intensive F-150 truck body panels.

Expansion of Electric Vehicle Manufacturing

Global EV production strengthens the growth trajectory of the Friction Stir Welding Market. EV platforms require reliable joining of dissimilar materials such as aluminum, copper, and magnesium to support battery enclosures and thermal management systems. It ensures strong, uniform welds that enhance safety and durability. Automakers adopt the process to improve energy efficiency and reduce vehicle weight.

- For instance, academic research has demonstrated that advanced solid-state joining techniques like friction stir welding (FSW) show potential for joining dissimilar materials such as aluminum and copper, offering improved weld consistency, structural integrity, and lower electrical resistance compared to traditional methods.

Rising Adoption of Automation and Robotic Welding Systems

Automation trends support the expansion of the Friction Stir Welding Market by improving consistency and productivity in high-volume manufacturing. Robotic FSW systems deliver precise control of tool movement and welding parameters. It enables manufacturers to increase output while maintaining strict quality standards. Industries adopt automated platforms to reduce operational costs and enhance process reliability.

Growing Application Across Aerospace and Defense

Aerospace and defense programs strengthen demand for the Friction Stir Welding Market due to the need for high-integrity joints in critical components. Aircraft structures, fuel tanks, and space vehicle panels require defect-free welds that withstand extreme conditions. It provides stable metallurgical properties that support long-term performance. Government investments in advanced manufacturing technologies enhance market adoption across strategic sectors.

Market Trends:

Increasing Adoption of Advanced Materials and Dissimilar Metal Joining

The Friction Stir Welding Market demonstrates significant momentum due to the growing need for joining advanced and lightweight materials. Industries increasingly work with aluminum alloys, copper, magnesium, and hybrid metal combinations to meet performance and weight reduction goals. It offers precise and reliable welds without compromising material properties or structural integrity. Manufacturers in automotive, aerospace, and shipbuilding sectors implement this technology to enhance fuel efficiency and reduce maintenance costs. Continuous improvements in tool design and process parameters expand its applicability across complex geometries. Rising demand for sustainable manufacturing practices further reinforces its relevance in modern production processes.

- For instance, TWI Ltd developed the MX-Triflute™ FSW tool probe, which enables welding speeds up to 50% faster while maintaining weld quality on aluminum panels less than 15mm thick.

Integration of Automation and Industry 4.0 Technologies

Automation and smart manufacturing trends drive key developments in the Friction Stir Welding Market. Robotic FSW systems deliver high precision, repeatability, and operational efficiency for large-scale industrial applications. It integrates with Industry 4.0 platforms to monitor welding quality, optimize process parameters, and reduce operational downtime. Companies leverage real-time data analytics to ensure consistent joint performance and minimize defects. The technology adoption is accelerating in high-volume production environments, including automotive assembly lines and aerospace component fabrication. Continuous innovation in sensor-based monitoring and adaptive control systems enhances process reliability and market growth potential.

- For instance, Stirweld’s FSW spindle for robots provides real-time feedback on torque, vibrations, and cooling control through an intelligent human-machine interface, enhancing welding quality and efficiency with precise monitoring data from multiple sensors, fully aligned with Industry 4.0 standards.

Market Challenges Analysis:

High Initial Investment and Equipment Costs

The Friction Stir Welding Market faces challenges due to significant initial investment and high equipment costs. Industrial-grade FSW machines require specialized tooling, precise control systems, and robust fixtures. It limits adoption among small and medium-sized manufacturers with constrained budgets. Maintenance and calibration of advanced machinery further increase operational expenses. Companies often need to justify the cost through long-term production efficiency and material savings. The financial barrier slows market penetration in emerging economies and smaller production facilities.

Technical Limitations and Material Constraints

Technical limitations pose another challenge for the Friction Stir Welding Market, particularly in joining certain thick or hard materials. It requires precise control of tool design, rotation speed, and welding parameters to avoid defects such as voids or surface irregularities. Material compatibility issues, especially with ferrous metals, restrict its broader application. Skilled operators and process expertise remain essential to ensure consistent quality. Ongoing research aims to expand material versatility, but current limitations affect widespread industrial adoption.

Market Opportunities:

Expansion in Automotive and Electric Vehicle Applications

The Friction Stir Welding Market presents significant opportunities due to the growing adoption of lightweight materials in automotive and electric vehicle manufacturing. It enables efficient joining of aluminum, copper, and hybrid materials, supporting energy-efficient and high-performance vehicle designs. Increasing production of electric vehicles drives demand for battery enclosures and structural components requiring strong, defect-free welds. Manufacturers seek solutions that reduce weight, improve safety, and enhance durability. The market can benefit from partnerships with OEMs and suppliers to integrate FSW technology into mass production lines. Rising investments in sustainable mobility solutions further support its adoption.

Growth Potential in Aerospace, Shipbuilding, and Defense Sectors

The aerospace, shipbuilding, and defense sectors provide substantial growth opportunities for the Friction Stir Welding Market. It ensures high-integrity joints for critical components, including aircraft panels, fuel tanks, and naval structures. Demand for lightweight, corrosion-resistant, and high-strength materials supports broader FSW integration. Advanced robotic systems and automation enable efficient fabrication of complex geometries while maintaining quality standards. Government initiatives and defense modernization programs stimulate technology adoption. Expansion into emerging markets with growing aerospace and naval infrastructure can further accelerate market growth.

Market Segmentation Analysis:

By Type

The Friction Stir Welding Market is categorized into conventional FSW systems and portable/handheld variants. Conventional systems dominate due to their high precision, consistency, and suitability for large-scale manufacturing in automotive, aerospace, and shipbuilding sectors. It ensures robust performance for joining thick and complex components while maintaining structural integrity. Portable FSW systems are gaining traction in on-site and maintenance applications, offering flexibility and ease of use for field operations. Technological improvements in both types continue to expand their industrial applicability.

- For Instance, Friction Stir Welding (FSW) systems have enabled aerospace companies to produce aluminum panels with significantly improved fatigue strength compared to traditional fusion welds.

By End-User

The market spans automotive, aerospace, shipbuilding, rail, and defense sectors. The automotive segment leads due to increasing production of electric and hybrid vehicles that require lightweight, high-strength material joining. It provides uniform welds for aluminum, copper, and magnesium components, enhancing energy efficiency and safety. The aerospace sector offers substantial opportunities, driven by demand for lightweight airframes and fuel-efficient designs. Shipbuilding and rail industries adopt FSW for durable structural components that reduce maintenance costs. Defense applications require high-integrity welds for naval and military vehicles, further supporting market growth.

- For instance, Boeing utilizes FSW to join over 4,000 meters of aluminum panels annually for its Delta IV launch vehicle cryogenic fuel tanks, enabling seamless welds without filler material.

Segmentations:

By Type

- Conventional FSW Systems

- Portable/Handheld FSW Systems

By End-User

- Automotive

- Aerospace

- Shipbuilding

- Rail

- Defense

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Advanced Manufacturing Adoption

North America accounts for 35% of the Friction Stir Welding Market, driven by well-established automotive, aerospace, and defense sectors. It benefits from early adoption of advanced welding solutions and strong industrial infrastructure. The demand for lightweight, high-strength materials in electric vehicles and aircraft fuels growth. Research institutions and industrial partnerships enhance innovation in robotic FSW systems and process optimization. The region’s focus on quality standards and precision manufacturing reinforces its leading position in the global market.

Europe Strengthens Growth Through Aerospace and Automotive Investments

Europe holds 28% of the Friction Stir Welding Market, supported by robust aerospace and automotive industries. It ensures high-performance applications with defect-free joints and minimal material distortion. Germany, France, and the UK drive adoption through automation and Industry 4.0 integration. Manufacturers implement FSW to meet strict environmental and safety regulations. The focus on lightweight materials and fuel-efficient vehicles continues to support regional expansion.

Asia-Pacific Expands Rapidly Through Industrial and Infrastructure Development

Asia-Pacific captures 32% of the Friction Stir Welding Market, fueled by rapid industrialization and large-scale manufacturing. It finds extensive use in automotive, shipbuilding, and rail sectors in China, Japan, and India. Growing electric vehicle production and demand for lightweight structural components enhance adoption. Investments in modern fabrication technologies and government initiatives strengthen market potential. Emerging economies contribute to global growth through increased production capacity and technology implementation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Friction Stir Welding Market features a competitive landscape with key players focusing on technological innovation, strategic partnerships, and global expansion. Leading companies invest in research and development to enhance tool designs, automation systems, and process efficiency. It emphasizes the adoption of robotic FSW systems and smart monitoring solutions to meet rising industrial demand. Strategic collaborations with automotive, aerospace, and shipbuilding manufacturers strengthen market presence and drive new project deployments. Companies also expand their production facilities and service networks to serve emerging markets in Asia-Pacific and Latin America. Continuous innovation in joining dissimilar and lightweight materials provides a competitive edge. Strong focus on customer support, training, and turnkey solutions enhances client retention and market positioning. The competitive dynamics encourage ongoing advancements, improving overall process reliability, productivity, and adoption of friction stir welding technology across high-performance applications globally.

Recent Developments:

- In July 2025, Nitto Denko Corporation formed a strategic partnership and made a strategic investment in Numat Technologies, Inc., aiming to accelerate the development of next-generation decarbonization technologies using metal-organic framework (MOF) materials for industrial sectors.

- In October 2025, Hitachi Power Solutions advanced a strategic alliance with Google Cloud to empower frontline workers through the deployment of field-specific AI agents, enhancing operational efficiency.

Report Coverage:

The research report offers an in-depth analysis based on Type, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Friction Stir Welding technology will witness increased adoption across automotive and aerospace sectors due to rising demand for lightweight, high-strength components.

- Expansion in electric vehicle production will drive the need for reliable joining of aluminum, copper, and hybrid materials.

- Automation and robotic integration will enhance process precision, repeatability, and operational efficiency in large-scale manufacturing.

- Emerging markets in Asia-Pacific and Latin America will contribute to significant growth through industrialization and infrastructure development.

- Development of advanced tool materials and optimized welding parameters will expand applicability to thicker and harder metals.

- Aerospace and defense applications will continue to prioritize FSW for critical components requiring defect-free, high-integrity joints.

- Adoption in shipbuilding and rail manufacturing will increase due to efficiency gains and superior metallurgical properties of welded joints.

- Integration with Industry 4.0 technologies will allow real-time monitoring, predictive maintenance, and quality assurance.

- Strategic collaborations between FSW equipment manufacturers and OEMs will accelerate technology deployment in high-volume production environments.

- Continuous innovation in joining dissimilar materials and complex geometries will strengthen FSW’s position as a preferred industrial welding solution.