Market Overview

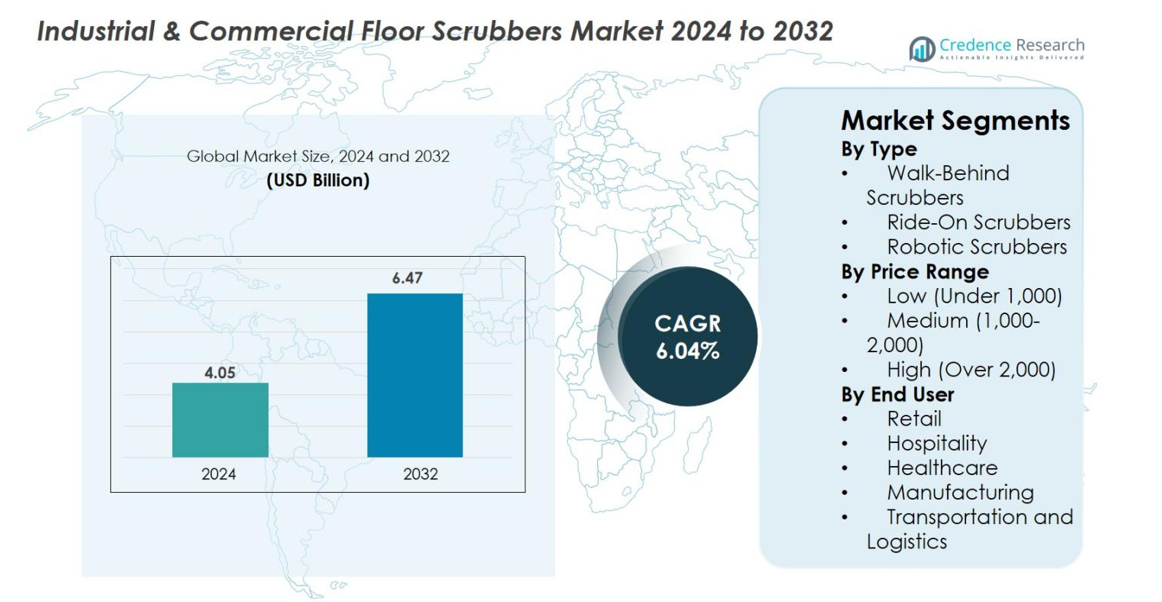

Industrial & Commercial Floor Scrubbers Market size was valued at USD 4.05 Billion in 2024 and is anticipated to reach USD 6.47 Billion by 2032, at a CAGR of 6.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial & Commercial Floor Scrubbers Market Size 2024 |

USD 4.05 Billion |

| Industrial & Commercial Floor Scrubbers Market , CAGR |

6.04% |

| Industrial & Commercial Floor Scrubbers Market Size 2032 |

USD 6.47 Billion |

Industrial & Commercial Floor Scrubbers Market features strong participation from leading players such as Tennant Company, Nilfisk Group, Hako GmbH, Diversey Inc., Numatic International, Dulevo S.p.A., Powr-Flite, Amano Corporation, Polivac International, and TRUVOX International, all of whom focus on advanced cleaning technologies, automation, and energy-efficient designs to strengthen their market presence. North America emerged as the leading region with a 34.2% share in 2024, driven by high adoption of automated cleaning solutions and strong facility-management standards. Europe followed with a 29.6% share, supported by stringent hygiene regulations and strong demand for sustainable cleaning equipment across commercial and industrial sectors.

Market Insights

- Industrial & Commercial Floor Scrubbers Market was valued at USD 4.05 Billion in 2024 and is projected to reach USD 6.47 Billion by 2032, growing at a CAGR of 6.04%.

- Strong demand is driven by rising hygiene standards, rapid facility modernization, and increasing adoption of automated scrubbers across retail, healthcare, hospitality, and industrial environments; walk-behind scrubbers led the market with a 46.8% share.

- Key trends include the expansion of autonomous and IoT-enabled scrubbers, sustainability-focused designs, and growing use of lithium-ion batteries to improve efficiency and reduce operating costs.

- Market competition is shaped by manufacturers such as Tennant Company, Nilfisk Group, Hako GmbH, and Diversey Inc., focusing on automation, product innovation, and expanded service networks to strengthen their presence.

- Regionally, North America held 34.2% share in 2024, followed by Europe at 29.6% and Asia-Pacific at 24.7%, supported by robust commercial infrastructure growth and rising adoption of advanced cleaning technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Walk-behind scrubbers dominated the Industrial & Commercial Floor Scrubbers Market in 2024 with an 46.8% share, driven by their affordability, ease of maneuverability, and suitability for small to medium commercial spaces. Ride-on scrubbers continue to gain traction as large industrial facilities prioritize higher cleaning productivity and reduced labor costs. Robotic scrubbers, though smaller in share, are expanding rapidly due to automation trends, labor shortages, and increased adoption in airports, warehouses, and modern retail environments. Advancements in sensors, AI navigation, and battery efficiency further accelerate demand across this segment.

- For instance, A walk-behind scrubber is often recommended for clinics, small retail shops, or narrow-corridor office buildings because of its “compact size and easy manoeuvrability.

By Price Range

The medium price range (USD 1,000–2,000) led the market with 42.5% share in 2024, supported by strong adoption from small and mid-sized businesses seeking durable and cost-effective cleaning solutions. This range offers an optimal balance between performance and affordability, making it popular across retail, hospitality, and healthcare facilities. Low-priced scrubbers attract budget-conscious buyers but offer limited durability, while high-priced scrubbers gain adoption in industrial and logistics spaces where advanced features, high-capacity tanks, and automation justify the premium investment.

- For instance, Budget scrubbers those well below the mid-price range tend to be limited in tank capacity, brush size, and battery life, making them less durable or effective for regular commercial use.

By End User

The retail segment held the largest share at 29.7% in 2024, driven by high footfall, strict cleanliness standards, and continuous demand for efficient floor maintenance. Hospitality and healthcare sectors also show strong adoption as they prioritize hygiene and operational efficiency. Manufacturing and logistics facilities increasingly invest in heavy-duty and automated scrubbers to meet regulatory standards and enhance productivity. Growth across all end-user categories is supported by rising facility management outsourcing, hygiene awareness, and expansion of commercial infrastructure.

Key Growth Drivers

Rising Hygiene Standards and Regulatory Compliance

Growing emphasis on hygiene, sanitation, and workplace safety remains a major force accelerating the adoption of industrial and commercial floor scrubbers. Industries such as healthcare, food processing, retail, and hospitality operate under stringent cleanliness regulations that require frequent and consistent floor sanitation. Traditional manual cleaning methods fail to meet modern standards for microbial control, efficiency, and uniformity, compelling organizations to invest in advanced scrubbers. Post-pandemic awareness has amplified expectations for clean public environments, driving demand for efficient, chemical-compatible, and quick-drying scrubber solutions. Regulatory frameworks around workplace safety also encourage mechanized cleaning to reduce slip hazards and cross-contamination risks. As facility sizes increase and maintenance budgets tighten, businesses prioritize equipment that enhances cleaning productivity while lowering long-term operational costs.

- For instance, in large facilities and warehouses, industrial floor scrubbers are more effective than mops in removing bacteria, grease, and allergens from floors combining cleaning solution, mechanical scrubbing, and vacuum extraction in one pass for deeper, more hygienic results.

Automation and Technological Advancements in Cleaning Equipment

Technological innovation plays a significant role in transforming the floor scrubber landscape, with automation, IoT integration, AI navigation, and energy-efficient designs reshaping user expectations. Modern scrubbers offer intelligent features such as route mapping, real-time performance monitoring, predictive maintenance alerts, and optimized water-detergent usage. Autonomous robotic scrubbers, equipped with sensors, LiDAR, and machine-learning algorithms, are increasingly deployed across airports, retail chains, and logistics centers to reduce labor dependence and improve cleaning consistency. Battery advancements extend run times and reduce downtime, enhancing efficiency in large facilities. Connected scrubbers that share usage data help facility managers optimize cleaning schedules and reduce resource waste. These technological shifts support sustainability goals while redefining operational efficiency across commercial environments.

- For instance, Tennant’s T7AMR robotic scrubber, powered by BrainOS, uses LiDAR and 3D sensors for autonomous navigation and has been deployed in airports and retail chains to improve consistency and reduce labor dependency.

Growth of Commercial Infrastructure and Facility Management Services

Rapid expansion of commercial establishments including supermarkets, malls, hotels, hospitals, warehouses, and manufacturing facilities continues to fuel strong demand for floor scrubbers. The rise of organized retail in developing economies boosts demand for efficient, large-scale cleaning operations as foot traffic intensifies. The global growth of facility management outsourcing further drives adoption, as service providers prioritize modern equipment that enhances productivity and reduces labor dependency. Industrial facilities increasingly rely on mechanized cleaning to support safety audits, reduce dust accumulation, and protect sensitive machinery. Urbanization trends add to the number of commercial spaces requiring frequent cleaning. Sustainability-focused facility models also encourage adoption of energy-efficient scrubbers with lower lifecycle costs, making mechanized cleaning a core component of operational excellence.

Key Trends & Opportunities

Rapid Adoption of Autonomous and Smart Scrubber Technologies

One of the most transformative trends in the market is the rapid adoption of autonomous and AI-enabled floor scrubbers. Organizations facing labor shortages or high cleaning labor costs increasingly turn to robotic solutions that operate independently and deliver consistent cleaning results. Smart scrubbers equipped with IoT sensors, telematics, and remote dashboards enable facility managers to track performance, optimize cleaning routes, and identify maintenance needs in real time. Integration with building management systems enhances automation and streamlines workflows. This trend opens opportunities for subscription-based services, remote diagnostics, and fleet-management software. Industries with large floor areas such as airports, distribution centers, and large retail formats are adopting smart scrubbers to improve efficiency and cleanliness. As robotics become more affordable and reliable, adoption is expected to accelerate globally.

- For instance, Tennant’s T7AMR, powered by BrainOS, is widely deployed in airports and retail chains, where its AI-based navigation and obstacle-detection sensors enable autonomous operation with minimal human intervention.

Sustainability and Energy-Efficient Cleaning Solutions

A strong shift toward environmentally responsible cleaning processes is creating substantial opportunities for manufacturers offering sustainable scrubber technologies. End users increasingly seek equipment that reduces water consumption, minimizes chemical usage, and delivers energy-efficient performance. Technologies such as water-recycling systems, chemical-free cleaning options, and lithium-ion batteries are gaining traction as organizations emphasize environmental compliance. Industries such as healthcare and hospitality prioritize green cleaning protocols to support indoor air quality and ESG objectives. Manufacturers with recyclable components, durable brush systems, and lower-noise operation align well with evolving buyer expectations. As sustainability becomes a central purchasing criterion, companies offering eco-certified products and transparent lifecycle assessments stand to capture significant market share.

- For instance, Tennant’s ec-H2O NanoClean® technology converts plain water into a cleaning solution eliminating the need for traditional chemicals and helping facilities reduce environmental impact.

Key Challenges

High Upfront Costs and Budget Constraints for Small Enterprises

Despite the long-term benefits of mechanized cleaning, high initial investment remains a major hurdle, especially for small and mid-sized businesses. Many organizations continue using manual cleaning methods due to lower upfront costs, even though long-term labor expenses are higher. Advanced scrubbers particularly robotic and ride-on models require substantial capital outlay, limiting adoption in cost-sensitive markets. Sectors such as small retail stores, local hospitality operators, and public facilities often face budget constraints that hinder technology adoption. Additional costs for maintenance, replacement parts, and periodic servicing further increase total cost of ownership. Financing, leasing, and rental programs can reduce barriers, but accessibility varies widely by region. To expand market penetration, manufacturers must balance innovation with affordability and offer flexible procurement options.

Operational Complexity and Need for Skilled Maintenance

Operational complexity associated with modern floor scrubbers presents another challenge, as these machines require skilled personnel for proper operation, troubleshooting, and maintenance. Robotic scrubbers rely on sophisticated navigation systems, sensors, and software that may overwhelm untrained staff, leading to improper use or reduced cleaning performance. Maintenance requirements for batteries, brushes, filters, and software updates can create additional operational burdens. Inadequate training often results in frequent downtime and higher repair costs. Availability of skilled technicians varies across regions, causing service delays. Facilities transitioning from manual to mechanized cleaning also face adoption resistance and workflow adjustments. Addressing these issues requires intuitive machine interfaces, comprehensive training programs, strong after-sales support, and simplified maintenance designs to ensure consistent and reliable performance.

Regional Analysis

North America

North America led the Industrial & Commercial Floor Scrubbers Market with an 34.2% share in 2024, driven by strong adoption of automated cleaning equipment across retail chains, airports, healthcare facilities, and large industrial complexes. The region benefits from advanced facility management practices, high labor costs encouraging mechanization, and rapid integration of robotic scrubbers in commercial spaces. Stringent hygiene regulations and strong replacement demand further strengthen market growth. Rising investment in smart buildings and IoT-enabled cleaning systems continues to accelerate uptake, positioning North America as a technology-driven and mature market for high-performance floor scrubbers.

Europe

Europe accounted for 29.6% share of the Industrial & Commercial Floor Scrubbers Market in 2024, supported by strict environmental regulations, widespread facility modernization, and demand for sustainable cleaning technologies. Industries such as hospitality, healthcare, manufacturing, and transportation prioritize high-efficiency scrubbers to meet hygiene and safety standards. The region’s strong presence of established cleaning equipment manufacturers further enhances product innovation and adoption. Growing interest in low-noise, energy-efficient, and eco-friendly models aligns with Europe’s sustainability agenda. Increased deployment of robotic scrubbers in airports, logistics hubs, and retail stores continues to advance the region’s market growth.

Asia-Pacific

Asia-Pacific captured 24.7% share in 2024 and represents the fastest-growing region, driven by rapid urbanization, expanding commercial infrastructure, and rising investments in modern facility management. Countries such as China, India, Japan, and South Korea are experiencing strong demand from retail malls, manufacturing facilities, hospitals, and transportation hubs. Labor shortages and rising wage levels in developed APAC markets further encourage adoption of automated scrubbers. Growing emphasis on workplace hygiene, driven by public-health awareness, fuels adoption across commercial sectors. Government initiatives supporting smart cities and digital infrastructure add momentum to advanced cleaning technology adoption.

Latin America

Latin America held an 7.4% share of the Industrial & Commercial Floor Scrubbers Market in 2024, with growth supported by expanding retail formats, rising hospitality investments, and modernization of industrial cleaning practices. Countries such as Brazil, Mexico, and Chile are increasingly adopting mechanized cleaning solutions to improve operational efficiency and hygiene compliance. Budget constraints continue to slow penetration of high-end robotic models, but demand for mid-range scrubbers remains strong. Strengthening facility management outsourcing and improved commercial infrastructure development contribute to steady market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for 4.1% share in 2024, driven by expanding commercial establishments, rapid development of hospitality and tourism infrastructure, and growth of large public facilities such as airports and healthcare centers. The Gulf countries, in particular, are investing heavily in automated cleaning technologies to maintain high cleanliness standards across premium commercial spaces. Industrial facilities in Africa are gradually transitioning toward mechanized cleaning as modernization accelerates. While adoption remains lower than other regions, increasing urban development and facility-management contracts support long-term market growth.

Market Segmentations

By Type

- Walk-Behind Scrubbers

- Ride-On Scrubbers

- Robotic Scrubbers

By Price Range

- Low (Under 1,000)

- Medium (1,000-2,000)

- High (Over 2,000)

By End User

- Retail

- Hospitality

- Healthcare

- Manufacturing

- Transportation and Logistics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Industrial & Commercial Floor Scrubbers Market is characterized by the presence of established global manufacturers alongside emerging automation-focused players, each striving to strengthen their market position through innovation, product diversification, and geographic expansion. Key companies such as Tennant Company, Nilfisk Group, Hako GmbH, Diversey Inc., Numatic International, Dulevo S.p.A., Powr-Flite, Amano Corporation, Polivac International, and TRUVOX International actively invest in technologies that enhance cleaning efficiency, reduce labor dependency, and support sustainability goals. Manufacturers increasingly focus on autonomous scrubbers, lithium-ion battery systems, low-noise operation, and IoT-enabled monitoring to meet evolving facility-management requirements. Strategic initiatives including mergers, partnerships, equipment leasing models, and after-sales service expansion play a crucial role in strengthening brand presence. Growing preference for robotic solutions is reshaping competition, encouraging players to integrate AI navigation, telematics, and real-time data analytics to differentiate offerings and capture emerging opportunities across commercial and industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nilfisk Group

- TRUVOX International

- Tennant Company

- Dulevo S.p.A.

- Powr-Flite

- Diversey, Inc

- Numatic International

- Hako GmbH

- Polivac International Company Ltd

- Amano Corporation

Recent Developments

- In September 2025, DAILIS announced a pre-sale program for new floor scrubbers and exhibited at the Russian International Cleaning Exhibition signaling its expansion efforts in the commercial scrubber space.

- In May 2024, Nilfisk Group partnered with LionsBot to launch an advanced autonomous cleaning machine for commercial/industrial cleaning

Report Coverage

The research report offers an in-depth analysis based on Type, Price Range, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as automation and smart cleaning technologies become widely adopted across commercial and industrial facilities.

- Robotic floor scrubbers will see rapid adoption driven by labor shortages and increasing demand for autonomous cleaning solutions.

- IoT-enabled scrubbers will expand as organizations prioritize real-time performance monitoring and predictive maintenance.

- Sustainability initiatives will boost demand for energy-efficient, low-water, and chemical-free cleaning systems.

- Lithium-ion battery technology will replace conventional power systems, enabling longer run times and faster charging cycles.

- Hygiene-focused sectors such as healthcare, hospitality, and retail will further increase investment in advanced cleaning equipment.

- Service-based and subscription models for equipment use and maintenance will gain popularity among end users.

- Rapid commercial infrastructure development in Asia-Pacific and the Middle East will significantly drive future demand.

- Manufacturers will focus on innovations that improve maneuverability, reduce noise, and enhance compact design efficiency.

- Integration of scrubbers with building management systems and automated facility platforms will become more widespread.